Global Sdn Market

Market Size in USD Billion

CAGR :

%

USD

35.22 Billion

USD

150.46 Billion

2025

2033

USD

35.22 Billion

USD

150.46 Billion

2025

2033

| 2026 –2033 | |

| USD 35.22 Billion | |

| USD 150.46 Billion | |

|

|

|

|

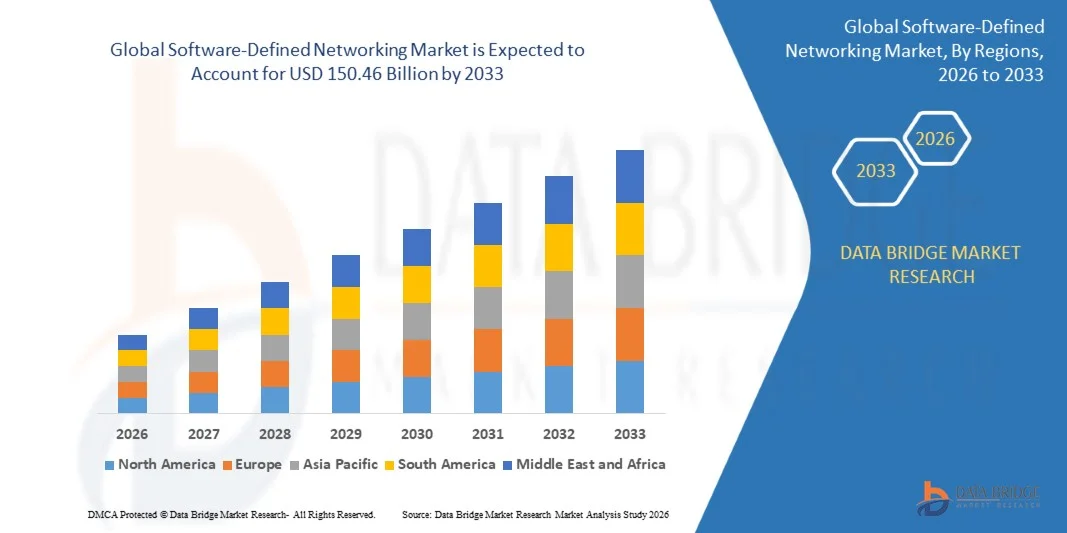

What is the Global Software-Defined Networking Market Size and Growth Rate?

- The global software-defined networking market size was valued at USD 35.22 billion in 2025 and is expected to reach USD 150.46 billion by 2033, at a CAGR of19.90% during the forecast period

- Increasing prevalence for network automation and virtualization among consumer is a crucial factor accelerating the market growth

What are the Major Takeaways of Software-Defined Networking Market?

- SDN stands for system defined networking which is designed to make the network limber and flexible. It helps the business to meet their requirement so that they can enhance their network control. These days they are extensively used in different sectors such as healthcare, education, banking, government among others

- Rising significant reduction in CAPEX and OPEX, rising demand for cloud services, data center consolidation, and server virtualization, rise in the demand for enterprise mobility to enhance productivity for field-based services, rise in the venture capital investment in SDN market space and rising benefits offered by SDN are the major factors among others boosting the software-defined networking (SDN) market

- North America dominates the Software-Defined Networking market with the largest revenue share of 46.01% in 2024, North America leads SDN adoption due to robust digital infrastructure, cloud expansion, and demand for agile network management

- The Asia-Pacific software-defined networking market is poised to grow at the fastest CAGR of over 28.1% in 2025, fueled by rapid urbanization, infrastructure expansion, and adoption across industries such as agriculture and mining

- The Open SDN segment dominated the market with a 46.2% share in 2025, owing to its controller-driven architecture, strong support from open-source communities, and high adoption across data centers and telecom networks

Report Scope and Software-Defined Networking Market Segmentation

|

Attributes |

Software-Defined Networking Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Software-Defined Networking Market?

“Increasing Shift Toward High-Speed, Automated, and Cloud-Integrated SDN Architectures”

- The software-defined networking market is experiencing rapid adoption of cloud-native, programmable, and high-speed SDN solutions that support real-time traffic steering, automation, and scalable network virtualization

- Vendors are introducing compact, high-performance, and AI-driven SDN controllers with enhanced orchestration, multi-cloud interoperability, and centralized policy management

- The rising need for cost-efficient, software-centric, and flexible networking infrastructure is accelerating SDN deployment across data centers, enterprises, telecom networks, and edge computing environments

- For instance, companies such as Cisco, VMware, Juniper Networks, Nokia, and Huawei have upgraded their SDN platforms with enhanced automation, cloud-based controller management, and advanced security capabilities

- Growing demand for faster provisioning, zero-touch configuration, and virtual network slicing is pushing organizations toward fully programmable and software-defined infrastructures

- As network traffic becomes more dynamic and application-intensive, SDN will remain crucial for enabling scalable, secure, and agile network operations across industries

What are the Key Drivers of Software-Defined Networking Market?

- Rising demand for programmable, flexible, and cost-efficient networking solutions to support high data traffic, bandwidth-intensive applications, and multi-cloud workflows

- For instance, in 2025, industry leaders such as Cisco, VMware, Ciena, and Arista Networks expanded their SDN portfolios to enhance automation, network visibility, and controller-based security enforcement

- Growing adoption of IoT devices, 5G infrastructure, edge computing, and digital transformation initiatives is increasing the need for intelligent and scalable SDN deployments across the U.S., Europe, and Asia-Pacific

- Advancements in virtualization, NFV, intent-based networking, AI-driven policy automation, and centralized management architectures strengthen network efficiency and performance

- Rising use of cloud services, virtual machines, container platforms, and distributed applications is creating demand for agile and programmable network environments

- Supported by strong investments in data centers, telecom modernization, and enterprise IT upgrades, the SDN market is expected to see sustained and robust growth

Which Factor is Challenging the Growth of the Software-Defined Networking Market?

- High initial costs related to SDN controllers, orchestration platforms, and advanced automation tools limit adoption among small enterprises and budget-constrained organizations

- For instance, during 2024–2025, fluctuations in IT infrastructure spending, supply chain constraints, and increased hardware component costs affected SDN deployment cycles for several global enterprises

- Complexity in integrating SDN with legacy networking systems, along with the need for skilled professionals in virtualization and controller-based networking, acts as a major adoption barrier

- Limited awareness in emerging markets regarding SDN capabilities, automation benefits, and virtual network management slows implementation, especially in SMEs

- Competition from traditional networking solutions, hybrid networks, and vendor-specific proprietary architectures creates pricing pressure and reduces standardization

- To overcome these challenges, companies are focusing on cost-optimized SDN solutions, AI-driven orchestration, training programs, cloud-based controller platforms, and open-source collaboration to boost global adoption

How is the Software-Defined Networking Market Segmented?

The market is segmented on the basis of type, component, end-user.

• By Type

The software-defined networking market is segmented into Open SDN, SDN via API, and SDN via Overlay. The Open SDN segment dominated the market with a 46.2% share in 2025, owing to its controller-driven architecture, strong support from open-source communities, and high adoption across data centers and telecom networks. Open SDN enables centralized traffic management, improves network agility, and reduces operational complexity. Its compatibility with multi-vendor environments and orchestration tools makes it highly preferred among enterprises undergoing digital transformation.

The SDN via API segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising adoption of programmable networks, intent-based networking, and automated service provisioning. As enterprises and cloud providers increasingly prioritize network automation, API-based SDN offers improved flexibility, faster deployment, and seamless integration with cloud-native applications and DevOps workflows.

• By Component

The market is segmented into Solutions and Services. The Solutions segment dominated the market with a 58.7% share in 2025, supported by strong deployment of SDN controllers, orchestration platforms, virtualized network functions (VNFs), and programmable switching systems. Organizations are shifting from hardware-centric to software-centric infrastructures to enhance network agility, reduce costs, and support multi-cloud connectivity. SDN solutions enable centralized policy control, network slicing, bandwidth allocation, and real-time traffic optimization.

The Services segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by rising demand for consulting, integration, managed services, and lifecycle support. As networks become more complex due to 5G rollout, IoT expansion, and data center upgrades, enterprises increasingly rely on managed SDN services for configuration management, automation, security monitoring, and continuous optimization.

• By End Users

The software-defined networking market is segmented into Data Centers, Service Providers, and Enterprises. The Data Centers segment dominated the market with a 49.3% share in 2025, owing to large-scale deployment of virtualized infrastructures, cloud environments, hyperscale architectures, and storage networks. SDN enables efficient traffic management, network automation, and scalable resource allocation, making it essential for modern data center operations. The rise of multi-cloud computing, AI-driven workloads, and containerized applications further accelerates adoption.

The Service Providers segment is projected to grow at the fastest CAGR from 2026 to 2033, fueled by increasing rollout of 5G networks, edge computing infrastructure, and network virtualization technologies such as NFV. Telecom operators use SDN to optimize bandwidth, automate service provisioning, and support dynamic network slicing for enterprise and consumer services.

Which Region Holds the Largest Share of the Software-Defined Networking Market?

- North America dominates the software-defined networking market with the largest revenue share of 46.01% in 2024, North America leads SDN adoption due to robust digital infrastructure, cloud expansion, and demand for agile network management

- Enterprises and service providers are leveraging SDN for improved scalability, security, and automation.

- In addition, the region benefits from strong R&D investment, widespread 5G rollout, and a mature IT ecosystem, accelerating the integration of SDN across diverse industries, including finance, healthcare, and telecommunications

U.S. Software-Defined Networking Market Insight

The U.S. software-defined networking market captured the largest revenue share of 71.2% within North America in 2025, The U.S. SDN market is driven by large-scale cloud deployments, high data traffic, and the need for real-time network responsiveness. Businesses are embracing SDN to enhance data center efficiency, reduce operational costs, and support digital transformation. Government initiatives supporting IT modernization and growing investments in cybersecurity and automation further boost SDN demand across sectors.

Europe Software-Defined Networking Market Insight

The Europe software-defined networking market is projected to expand at a substantial CAGR throughout the forecast period, Europe SDN market is driven by increasing demand for network agility and automation in cloud computing and 5G deployments. Strong regulatory support, digital transformation initiatives, and emphasis on cybersecurity are pushing enterprises toward adopting programmable and scalable networking solutions.

Germany Software-Defined Networking Market Insight

The Germany software-defined networking market is anticipated to grow at a noteworthy CAGR during the forecast period, Germany’s SDN market benefits from Industry 4.0 advancements and the need for flexible, intelligent networks. Enterprises are leveraging SDN to optimize industrial automation, cloud integration, and IoT connectivity, while ensuring efficient resource management and high-performance data transmission.

France Software-Defined Networking Market Insight

The France software-defined networking market is expected to expand at a considerable CAGR during the forecast period, France’s SDN growth is fueled by digital innovation in public infrastructure, telecom, and cloud services. Government-backed modernization efforts and increasing data privacy requirements encourage organizations to adopt SDN for enhanced control, automation, and secure, scalable networking architectures.

Asia-Pacific Intelligence Systems Market Insight

The Asia-Pacific software-defined networking market is poised to grow at the fastest CAGR of over 28.1% in 2025, fueled by rapid urbanization, infrastructure expansion, and adoption across industries such as agriculture and mining. Government investments in smart city projects and favorable regulatory frameworks are accelerating drone and SDN integration, enhancing real-time data processing and operational efficiency.

Japan Software-Defined Networking Market Insight

The Japan software-defined networking market is a strong emphasis on innovation, robotics, and AI. Applications in disaster management, agriculture, and infrastructure inspection are supported by government policies promoting smart technologies. These initiatives are helping industries modernize operations and improve responsiveness to environmental and logistical challenges.

China Software-Defined Networking Market Insight

The China software-defined networking market accounted for the largest market revenue share in Asia Pacific in 2025 driven by massive infrastructure projects and robust governmental support. High demand from sectors such as logistics, urban planning, and precision agriculture, alongside advances in drone hardware and analytics, is accelerating SDN deployment. This combination is propelling China to the forefront of technological advancement in the region.

Which are the Top Companies in Software-Defined Networking Market?

The software-defined networking industry is primarily led by well-established companies, including:

- Cisco Systems (U.S.)

- VMware, Inc. (U.S.)

- Huawei Technologies Co., Ltd. (China)

- Ciena Corporation (U.S.)

- Hewlett Packard Enterprise Development LP (U.S.)

- Juniper Networks, Inc. (U.S.)

- NEC Technologies India Private Limited (India)

- Extreme Networks (U.S.)

- Big Switch Networks, Inc. (U.S.)

- Pluribus Networks (U.S.)

- Nokia (Finland)

- Oracle (U.S.)

- Cumulus Networks (U.S.)

- Arista Networks, Inc. (U.S.)

- Pica8 Inc. (U.S.)

- Broadcom (U.S.)

What are the Recent Developments in Global Software-Defined Networking Market?

- In October 3, 2024, Cisco announced its intent to acquire Isovalent, a company specializing in multicloud networking and security solutions. This move aims to enhance Cisco's capabilities in modern network architectures and security.

- In May 2025, Intel explored the sale of its networking and edge business unit, previously known as NEX. This strategic consideration reflects Intel's focus on its core strengths in PC and data center chips.

- In August 2022, Arista Networks completed the acquisition of Pluribus Networks, a move aimed at bolstering its presence in the cloud networking space and advancing its unified cloud fabric solution.

- In March 2024, Juniper Networks launched Contrail Cloud Edition 3.0, integrating Kubernetes-native network policies and supporting 40 cloud regions out-of-the-box. This development enhances Juniper's SDN offerings for cloud environments.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.