Global Seam Tape Market

Market Size in USD Million

CAGR :

%

USD

162.09 Million

USD

259.90 Million

2024

2032

USD

162.09 Million

USD

259.90 Million

2024

2032

| 2025 –2032 | |

| USD 162.09 Million | |

| USD 259.90 Million | |

|

|

|

|

Seam Tape Market Size

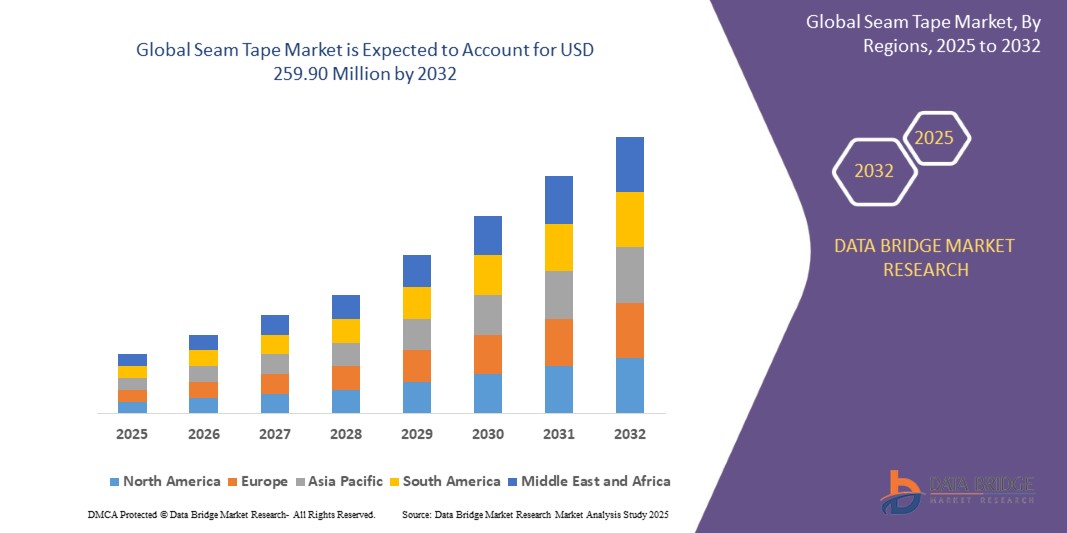

- The global Seam Tape market size was valued at USD 162.09 Million in 2024 and is expected to reach USD 259.90 Million by 2032, at a CAGR of 6.08% during the forecast period

- The market growth is largely fueled by the rising demand from the apparel, automotive, and construction industries, where seam tape is essential for enhancing waterproofing, durability, and overall product quality

- Furthermore, increasing environmental concerns and the push for eco-friendly and solvent-free adhesives are encouraging manufacturers to innovate and expand product offerings. These factors, coupled with growing awareness of product benefits and performance, are propelling the adoption of Seam Tape solutions, thereby contributing significantly to the market's expansion

Seam Tape Market Analysis

- Seam tapes, which are specialized adhesive tapes used to seal stitched seams in various products, are increasingly vital components in modern manufacturing processes across industries such as apparel, footwear, outdoor gear, automotive, and medical textiles. This is due to their ability to provide waterproofing, durability, and enhanced product performance.

- The escalating demand for seam tapes is primarily fueled by the growing production of technical textiles, rising consumer preference for high-performance and durable goods, and stringent quality standards in industries like automotive and healthcare that require reliable sealing solutions.

- North America dominates the Seam Tape market with the largest revenue share of 37.11% in 2025, characterized by its advanced manufacturing capabilities, high demand for premium apparel and gear, and the presence of leading seam tape manufacturers. The U.S. contributes significantly, with increased application in sportswear, military clothing, and protective medical equipment.

- Asia-Pacific is expected to be the fastest-growing region in the Seam Tape market during the forecast period, driven by increasing urbanization, rising disposable incomes, and booming textile and automotive sectors, especially in countries like China, India, and Vietnam.

- The Multi-Layered segment is expected to dominate the Seam Tape market with a market share of 69.81% in 2025, due to its cost-effectiveness, ease of application, and widespread usage in consumer apparel and rainwear, making it the preferred choice among manufacturers for large-scale applications.

Report Scope and Seam Tape Market Segmentation

|

Attributes |

Seam Tape Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Seam Tape Market Trends

“Rising Preference for Lightweight, Durable, and Eco-Friendly Seam Tapes”

- A significant and accelerating trend in the global Seam Tape market is the increasing demand for lightweight, durable, and environmentally sustainable seam tape solutions across key industries such as apparel, automotive, and healthcare. Manufacturers and end-users alike are prioritizing materials that not only enhance product performance but also align with global sustainability initiatives.

- For instance, leading brands like Framis Italia and Bemis Associates have launched eco-conscious seam tape lines that use solvent-free adhesives and recyclable polymers, catering to global apparel brands that seek sustainable sourcing and reduced carbon footprints. These products are designed to meet strict performance and environmental compliance standards.

- Innovation in material science is enabling the production of multi-layered and polyurethane-based seam tapes that offer superior waterproofing, flexibility, and breathability while being lighter than traditional alternatives. This is particularly valuable in sectors like sportswear and outdoor gear, where weight reduction and wearer comfort are critical.

- Additionally, regulatory pressures and ESG (Environmental, Social, Governance) goals are compelling both manufacturers and end-users to adopt greener alternatives. Seam tape producers are responding by developing biodegradable options and closed-loop manufacturing processes.

- This trend is reshaping procurement strategies, especially in fashion and technical apparel industries, where companies are actively seeking sustainable innovations without compromising performance. The shift toward green manufacturing and product design is becoming a competitive differentiator in the seam tape market.

- As a result, the demand for lightweight, high-performance, and eco-friendly seam tapes is gaining momentum across global markets, presenting new opportunities for product innovation and differentiation.

Seam Tape Market Dynamics

Driver

“Rising Demand for Functional Apparel and Technical Textiles”

- The growing demand for functional apparel and technical textiles across industries such as sportswear, outdoor gear, military clothing, and medical textiles is a significant driver for the rising use of seam tapes.

- For instance, in March 2024, Bemis Associates Inc. launched a new line of sustainable seam tapes designed specifically for high-performance outerwear and protective garments. This product line addresses the need for both durability and eco-responsibility, catering to global apparel brands.

- As consumers increasingly seek clothing that offers weather resistance, breathability, and enhanced comfort, seam tapes are becoming essential for achieving waterproofing and structural integrity in garments. This is especially relevant in outdoor and performance wear where environmental exposure is high.

- Additionally, the rapid expansion of the global sportswear market and rising popularity of fitness and adventure sports are fueling demand for lightweight and flexible seam tapes that enhance garment performance without adding bulk.

- In the healthcare sector, stringent hygiene standards and the increased use of PPE and medical apparel are also driving the adoption of seam-sealed products that protect against fluids and contaminants.

- The integration of seam tapes into technical and protective textiles is thus gaining momentum, as manufacturers look to meet industry-specific performance criteria while also complying with evolving environmental and safety regulations.

Restraint/Challenge

“High Production Costs and Complex Application Processes”

- The high production costs of advanced seam tapes, especially those utilizing thermoplastic polyurethane (TPU), polyamide, or eco-friendly materials, present a significant challenge to broader market adoption. These premium materials and the specialized manufacturing technologies required to produce them increase overall product costs.

- For instance, multi-layer seam tapes and those used in medical or military-grade applications require strict quality control, precision engineering, and heat-sealing expertise, all of which contribute to elevated operational expenses for manufacturers and end-users.

- In addition, seam tape application often demands skilled labor and advanced equipment, such as heat-bonding machines and laser sealing systems, making integration more complex and cost-intensive for manufacturers, particularly in low-cost production settings.

- These factors can be particularly prohibitive for small and medium-sized enterprises (SMEs) and manufacturers in developing regions, where access to high-end equipment and trained labor is limited, and cost sensitivity is high.

- Furthermore, the lack of standardization in application processes across industries (e.g., apparel vs. automotive) can lead to inconsistencies in product performance and higher wastage, further discouraging widespread usage.

- Overcoming these challenges will require continued innovation in cost-effective materials, simplified application technologies, and training initiatives that can democratize access to seam tape solutions across all scales of production.

Seam Tape Market Scope

The market is segmented on the basis of type, backing material, and application.

- By Type

On the basis of type, the Seam Tape market is segmented into Single-Layered and Multi-Layered seam tapes. The Multi-Layered segment dominates the largest market revenue share of 69.81% in 2025, owing to its superior waterproofing, durability, and performance in high-demand applications such as outdoor gear, military uniforms, and medical PPE. These tapes provide enhanced protection and are preferred in environments requiring robust seam sealing under extreme conditions.

The Single-Layered segment is expected to witness steady growth, driven by its cost-effectiveness and ease of application, particularly in casual apparel and basic consumer goods. Single-layered tapes are widely adopted in low to medium-performance requirements where moisture protection and seam reinforcement are necessary but not critical.

- By Backing Material

On the basis of backing material, the Seam Tape market is segmented into Polyurethane (PU), Polyvinyl Chloride (PVC), and Others. The Polyurethane segment leads the market in 2025 due to its flexibility, lightweight properties, and strong bonding characteristics. PU seam tapes are widely used in sportswear, intimate apparel, and outdoor gear due to their superior comfort and elasticity.

The Polyvinyl Chloride (PVC) segment is expected to grow steadily, favored for its durability and cost-efficiency, particularly in industrial applications. However, environmental concerns around PVC may limit its long-term adoption, pushing demand toward more sustainable alternatives.

- By Application

On the basis of application, the Seam Tape market is segmented into Casual Apparel, Surgical, Sportswear, Industrial, Sports Innerwear, Shoes, Military, Intimate Apparel, and Other Applications. The Sportswear segment accounts for the largest market share in 2025, driven by the growing demand for lightweight, breathable, and waterproof performance apparel. Seam tapes are critical in sports garments for maintaining comfort and function during intense physical activity.

The Surgical segment is projected to witness the fastest growth from 2025 to 2032 due to increasing global healthcare needs, demand for protective medical clothing, and stringent infection control standards that require highly sealed garments.

Seam Tape Market Regional Analysis

- North America dominates the Seam Tape market with the largest revenue share of 37.11% in 2024, driven by strong demand from industries such as sportswear, medical textiles, and outdoor apparel. The region benefits from an established manufacturing infrastructure, high consumer awareness, and stringent product performance standards that require durable and waterproof solutions.

- The widespread use of technical textiles in the U.S. and Canada, especially in healthcare and military applications, supports increased demand for high-performance seam tapes.

- Innovation, coupled with environmentally sustainable product development by key players in the region, further bolsters market growth.

U.S. Seam Tape Market Insight

The U.S. Seam Tape market captured the largest revenue share of 81% within North America in 2025, driven by advancements in textile engineering and growing applications in the sports, medical, and industrial sectors. The demand for waterproof, windproof, and durable garments—especially in outdoor recreation and defense—is accelerating seam tape usage. The U.S. is also witnessing a rising trend of sustainable fashion, leading to increased adoption of eco-friendly seam tapes among manufacturers.

Europe Seam Tape Market Insight

The European Seam Tape market is projected to expand at a substantial CAGR throughout the forecast period, supported by stringent environmental regulations and increasing adoption of functional apparel. The growing popularity of outdoor activities and demand for weather-resistant clothing are key contributors to the regional market. Europe is also at the forefront of sustainable manufacturing practices, which is boosting demand for solvent-free and recyclable seam tapes.

U.K. Seam Tape Market Insight

The U.K. Seam Tape market is anticipated to grow at a noteworthy CAGR, driven by increasing investments in technical textiles and high-performance fashion. Rising consumer awareness of product durability, quality, and sustainability in clothing and accessories has spurred demand for advanced seam tape solutions. The defense and healthcare sectors are also emerging as significant contributors to growth, especially for protective and surgical gear.

Germany Seam Tape Market Insight

The German Seam Tape market is expected to expand considerably, propelled by the country’s leadership in automotive textiles, industrial fabrics, and innovation-focused manufacturing. Seam tapes are increasingly used in automotive interiors for waterproofing and acoustic insulation. Germany’s emphasis on sustainable production and high safety standards further accelerates the shift towards premium, high-performance seam tapes.

Asia-Pacific Seam Tape Market Insight

The Asia-Pacific Seam Tape market is poised to grow at the fastest CAGR of over 24% in 2025, fueled by rising disposable incomes, increasing urbanization, and the expanding textile industry in China, India, Japan, and Southeast Asia. The region is also becoming a global manufacturing hub for garments and shoes, creating a massive demand for reliable seam sealing materials. Governments' support for smart textile innovations and eco-friendly products is fostering significant growth across multiple verticals.

Japan Seam Tape Market Insight

The Japan Seam Tape market is gaining momentum due to its focus on precision manufacturing and premium textile products. Applications in high-end apparel, wearable tech, and medical garments are growing steadily. Seam tape innovations catering to lightweight, breathable, and waterproof performance are especially popular in Japan's aging population and health-conscious demographics.

China Seam Tape Market Insight

The China Seam Tape market accounted for the largest revenue share in Asia-Pacific in 2025, driven by rapid industrialization, urban expansion, and the presence of major textile and apparel manufacturers. Seam tape adoption is high in sportswear, footwear, and outerwear, reflecting China's growing domestic consumption and strong export capabilities. China's government policies promoting green manufacturing and smart textiles are also driving innovation and domestic production of sustainable seam tape solutions.

Seam Tape Market Share

The Seam Tape industry is primarily led by well-established companies, including:

- Bemis Associates Inc. (U.S.)

- TORAY INDUSTRIES INC. (Japan)

- HiMEL (South Korea)

- SEALON (South Korea)

- LOXY AS. (Norway)

- DingZing Advanced Material Inc. (Taiwan)

- SAN CHEMICALS, LTD. (Japan)

- Essentra plc (United Kingdom)

- Sattler AG (Austria)

- KSAPOLYMER.COM (South Korea)

- GCP Applied Technologies Inc. (U.S.)

- Framis Italia S.p.A (Italy)

- TAIWAN HIPSTER ENTERPRISE CO., LTD. (Taiwan)

- Adhesive Films, Inc. (U.S.)

- E. TEXTINT CORP. (Taiwan)

- 3M (U.S.)

- Sika AG (Switzerland)

- Duraco Specialty Tapes LLC. (U.S.)

- YETOM (China)

Latest Developments in Global Seam Tape Market

- In February 2023, Toray Industries, Inc. announced the development of a rapid integrated molding process for mobility components made from carbon fiber reinforced plastic (CFRP). This material features a thermosetting prepreg skin with outstanding mechanical properties, layered over a lightweight, porous carbon fiber-reinforced foam (CFRF) core. As part of the New Energy and Industrial Technology Development Organization’s novel structural materials research project, Toray achieved several key advancements with this innovation

- In April 2022, 3M partnered with Innovative Automation Inc., a leading provider of high-quality integrator automation systems. The collaboration aimed to deliver automated tape application solutions for industrial manufacturers, emphasizing precision, high output, and consistency. Following this partnership, manufacturers leveraged the 3M Tape through the RoboTape System in their assembly lines, resulting in improved quality, increased production efficiency, reduced manual labor, and minimized rework

- In August 2020, Bemis Associates Inc. acquired Safe Reflections International LLC, a Taiwan-based company, along with the “play” product line of Safe Reflections Inc., a textile firm specializing in solutions that improve the safety and visibility of apparel.

- In May 2020, Framis Italia introduced “ProTape 1000,” a protective coverall suit designed to guard against infectious agents and low-pressure liquids. Earlier, in October 2018, the company launched “Ecolife,” a thermos-adhesive product used for reinforcing and covering seams in outerwear, swimwear, fashion garments, sportswear, and underwear

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.