Global Secondary Lymphedema Treatment Market

Market Size in USD Million

CAGR :

%

USD

920.19 Million

USD

2,096.29 Million

2025

2033

USD

920.19 Million

USD

2,096.29 Million

2025

2033

| 2026 –2033 | |

| USD 920.19 Million | |

| USD 2,096.29 Million | |

|

|

|

|

Secondary Lymphedema Treatment Market Size

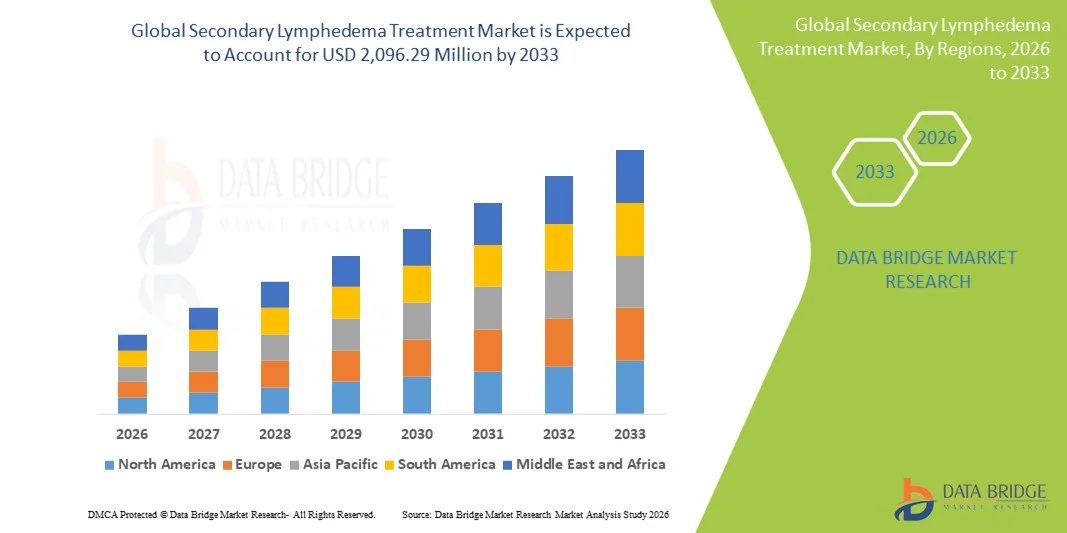

- The global secondary lymphedema treatment market size was valued at USD 920.19 million in 2025 and is expected to reach USD 2,096.29 million by 2033, at a CAGR of 10.84% during the forecast period

- The market growth is largely fueled by the rising incidence of cancer-related surgeries, radiation therapies, and lymph node dissections, which substantially increase the global burden of secondary lymphedema and drive sustained demand for treatment solutions

- Furthermore, increasing adoption of compression therapy, pneumatic devices, microsurgical techniques (LVA, VLNT), and improved reimbursement frameworks is accelerating clinical uptake, positioning secondary lymphedema treatments as essential components of long-term oncology rehabilitation. These converging factors are significantly boosting the industry’s growth

Secondary Lymphedema Treatment Market Analysis

- Secondary lymphedema, a chronic condition caused by damage to the lymphatic system commonly following cancer surgeries, radiation therapy, infections, or trauma has become a critical focus in global rehabilitation and oncology care, with rising adoption of advanced therapies including compression systems, pneumatic devices, and microsurgical procedures that improve long-term patient outcomes

- The escalating demand for secondary lymphedema treatments is primarily driven by the growing global cancer survivor population, increasing awareness of early diagnosis and management, and wider clinical acceptance of complete decongestive therapy (CDT) alongside innovative device-based and surgical interventions

- North America dominated the secondary lymphedema treatment market with the largest revenue share of 42.8% in 2025, supported by high cancer treatment volumes, strong reimbursement structures, early adoption of pneumatic compression devices, and a robust presence of specialized lymphedema clinics, with the U.S. witnessing rising uptake of advanced surgical options such as lymphaticovenous anastomosis (LVA) and vascularized lymph node transfer (VLNT)

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, fueled by rapid expansion of cancer care infrastructure, increasing awareness programs, improving access to compression products, and rising healthcare spending across developing economies

- The compression therapy segment dominated the secondary lymphedema treatment market with a market share of 55.8% in 2025, driven by its position as the gold-standard first-line treatment, widespread clinical acceptance, cost-effectiveness, and essential role across all disease stages, from early management through long-term maintenance

Report Scope and Secondary Lymphedema Treatment Market Segmentation

|

Attributes |

Secondary Lymphedema Treatment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Secondary Lymphedema Treatment Market Trends

Integration of Advanced Imaging, Wearables, and AI-Driven Monitoring

- A significant and accelerating trend in the global secondary lymphedema treatment market is the growing integration of advanced imaging tools, wearable monitoring devices, and AI-supported assessment platforms that enhance early detection, support personalized therapy, and improve long-term disease management outcomes

- For instance, companies are increasingly incorporating portable diagnostic ultrasound and bioimpedance spectroscopy (BIS) into routine evaluations, allowing clinicians to detect subtle lymphatic changes earlier and intervene proactively to prevent disease progression

- AI-enabled systems are improving clinical decision-making by analyzing limb-volume trends, predicting exacerbations, and optimizing compression therapy plans, while smart wearables provide real-time monitoring of swelling, treatment adherence, and tissue-fluid fluctuations to support precision care

- The integration of wearable compression systems with mobile health apps enables patients to track therapy sessions, receive adaptive treatment suggestions, and share data with healthcare providers, enhancing engagement and improving continuity of care

- This trend toward digitally enhanced, connected, and data-driven lymphedema management is reshaping clinical expectations for comprehensive rehabilitation, prompting innovations from companies developing intelligent compression pumps, monitoring sensors, and advanced therapeutic platforms

- The demand for technology-enabled lymphedema management solutions is rapidly increasing across hospitals, specialty clinics, and home-care environments as clinicians and patients prioritize accuracy, convenience, and personalized treatment approaches

Secondary Lymphedema Treatment Market Dynamics

Driver

Rising Incidence of Cancer-Related Surgeries and Growing Adoption of Advanced Therapies

- The increasing prevalence of cancer surgeries, lymph node dissections, and radiation therapy major causes of secondary lymphedema combined with stronger awareness of early rehabilitation, is significantly driving the demand for comprehensive lymphedema treatment solutions

- For instance, in 2025 several cancer centers expanded their lymphedema prevention programs by adopting early-detection tools such as BIS scanners and standardized post-surgical pathways, reinforcing the importance of structured lymphedema care across oncology departments

- As patients and clinicians become more aware of chronic swelling risks and long-term complications, treatments such as compression garments, pneumatic pumps, and manual lymphatic drainage (MLD) offer clear clinical benefits over delayed or reactive care approaches

- Furthermore, the increasing recognition of microsurgical interventions such as lymphaticovenous anastomosis (LVA) and vascularized lymph node transfer (VLNT) is making surgical care an important growth driver, supported by advancements in supermicrosurgery and expanding surgeon training programs

- The shift toward proactive surveillance, personalized rehabilitation strategies, and integrated device-based care approaches is accelerating adoption across hospitals and specialty clinics, strengthening the market footprint of advanced lymphedema solutions

- The convenience and clinical effectiveness of home-based compression therapy, remote monitoring tools, and app-connected treatment devices are key factors propelling the widespread adoption of secondary lymphedema therapies in both developed and emerging healthcare systems

Restraint/Challenge

Limited Awareness, High Treatment Costs, and Regulatory Compliance Barriers

- Concerns surrounding limited patient awareness, insufficient early diagnosis, and challenges in accessing specialized lymphedema care pose significant hurdles to widespread adoption of evidence-based treatment pathways, especially in low-resource settings

- For instance, reports of delayed lymphedema identification in post-cancer patients have highlighted gaps in care coordination, making many individuals hesitant or unable to seek timely treatment, which reduces therapeutic effectiveness and increases long-term disease burden

- Addressing these challenges through standardized screening protocols, broader clinician training, and improved patient education is crucial for expanding access to effective treatment, while companies emphasize clinical validation and outcome data to support broader acceptance of advanced solutions

- In addition, high treatment and device costs especially for pneumatic compression pumps, surgical procedures, and wearable monitoring technologies create financial barriers for uninsured or underinsured patients, limiting access to optimal care options in many markets

- While prices and reimbursement coverage are gradually improving, the perceived financial burden associated with lifelong therapy requirements continues to hinder broad adoption, particularly in regions with limited insurance support or fragmented healthcare infrastructure

- Overcoming these challenges through stronger reimbursement frameworks, clinician education initiatives, regulatory-standard adherence, and cost-optimized treatment offerings will be essential for sustained global market expansion

Secondary Lymphedema Treatment Market Scope

The market is segmented on the basis of cause, treatment, end user, and distribution channel.

- By Cause

On the basis of cause, the secondary lymphedema treatment market is segmented into cancer-related secondary lymphedema, infection-related, and surgical-related (non-cancer). The cancer-related secondary lymphedema segment dominated the market with the largest revenue share in 2025, driven by the high global incidence of breast cancer, gynecologic malignancies, melanoma, and prostate cancer that often require lymph node removal or radiation. Patients undergoing cancer therapies frequently develop lymphatic impairment, resulting in lifelong reliance on compression garments, physiotherapy, and pneumatic compression devices. Hospitals and oncology centers routinely monitor and manage cancer-survivors, further increasing the treatment volume for this segment. Clinical guidelines from global oncology societies also recommend standardized lymphedema management, supporting high adoption rates of evidence-based treatments. Reimbursement policies for cancer-related secondary lymphedema in many countries play a significant role in maintaining its market leadership. This population’s high recurrence risk and ongoing need for maintenance therapies reinforce the dominant position of this segment.

The infection-related secondary lymphedema segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing cases of cellulitis, lymphangitis, and filariasis-associated lymphatic damage in emerging markets. For instance, countries in Asia-Pacific and Africa observe rising numbers of filarial infections that lead to chronic swelling, substantially expanding the demand for compression therapy and physiotherapy. Public health campaigns focused on early identification and management of post-infectious lymphedema are improving patient awareness and diagnosis rates. Infection-related cases are also benefitting from expanded community care programs and improved access to low-cost compression solutions. As preventative care for recurrent cellulitis improves, the need for structured lymphedema treatment is growing rapidly. These factors collectively position infection-related lymphedema as the fastest expanding cause-based segment.

- By Treatment

On the basis of treatment, the secondary lymphedema treatment market is segmented into compression therapy, manual lymphatic drainage, complete decongestive therapy, intermittent pneumatic compression devices, surgical treatment, adjunctive therapies, and emerging therapies. The compression therapy segment dominated the market with the largest revenue share 55.8% in 2025 due to its universal role as the frontline management modality for all stages of lymphedema. Compression garments, wraps, and bandaging are clinically validated for reducing swelling, improving lymphatic flow, and preventing progression, making them essential for long-term patient care. Hospitals and physiotherapy centers rely extensively on compression therapy as the most accessible and clinically accepted treatment. Reimbursement support for medical-grade garments in many countries further strengthens adoption. Replacement cycles for compression garments also create recurring revenue, reinforcing its dominance. Compression therapy’s non-invasive nature and broad global availability make it the most consistently prescribed and widely used treatment option.

The intermittent pneumatic compression (IPC) devices segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing adoption of smart, portable, and home-based compression systems. For instance, advanced IPC devices with Bluetooth connectivity, real-time pressure optimization, and adherence-tracking applications are gaining rapid acceptance among both patients and clinicians. Rising healthcare costs and a shift toward remote therapeutic monitoring are encouraging patients to choose IPC devices as an alternative to frequent clinic visits. Technological innovations that enable personalized pressure settings and AI-driven therapy adjustments are further enhancing clinical outcomes. IPC devices are also gaining traction among early-stage patients who prefer home-based care. These factors collectively make IPC devices the fastest growing treatment segment.

- By End User

On the basis of end user, the secondary lymphedema treatment market is segmented into hospitals, specialty clinics, ambulatory surgical centers, homecare settings, and physiotherapy centers. The hospitals segment dominated the market with the largest revenue share in 2025, supported by their central role in diagnosing, initiating, and managing secondary lymphedema in cancer and post-surgical patients. Hospitals house multidisciplinary teams including oncologists, surgeons, and certified lymphedema therapists, enabling comprehensive treatment planning. They perform advanced procedures such as lymphovenous bypass and vascularized lymph node transfer, increasing the share of hospital-based care. Hospitals also procure large volumes of compression garments, manual lymphatic drainage services, and IPC devices, strengthening their purchasing contribution. They often act as referral centers, ensuring continuous inflow of new patients. These factors collectively reinforce hospitals as the dominant end-user segment.

The homecare settings segment is anticipated to witness the fastest growth rate from 2026 to 2033, driven by rising preference for convenient, economical, and continuous management of chronic lymphedema at home. For instance, portable IPC devices, wearable compression systems, and telehealth rehabilitation programs are making home-based care more accessible. Aging populations and the rise of post-cancer survivorship programs are further boosting home-care adoption. Patients increasingly prefer managing their swelling without frequent hospital visits, especially those with stable or moderate-stage disease. Homecare also supports better adherence due to greater comfort and convenience. As digital monitoring and remote support expand, homecare settings are becoming the fastest-growing end-user category.

- By Distribution Channel

On the basis of distribution channel, the secondary lymphedema treatment market is segmented into hospital procurement, specialty medical suppliers, retail & e-commerce, and direct-to-consumer. The hospital procurement segment dominated the market with the largest revenue share in 2025, driven by bulk purchasing of compression garments, physiotherapy supplies, and advanced IPC devices by hospitals and oncology departments. Hospitals prefer centralized procurement to standardize product quality and ensure timely availability for newly diagnosed patients. Strong relationships between manufacturers and hospital purchasing teams also streamline long-term contracts and supply-chain consistency. Hospital-driven treatment initiation contributes significantly to product utilization, reinforcing its dominant market role. Reimbursement claims are commonly processed through hospitals, further supporting this channel. As a result, hospital procurement remains the primary driver of institutional sales volumes.

The retail & e-commerce segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by rising patient awareness, growing digital retail adoption, and increasing comfort with purchasing compression garments and adjunctive devices online. For instance, online medical supply platforms now offer size-measurement tools, virtual fitting guides, subscription-based replacements, and rapid delivery options. Patients managing chronic lymphedema often require frequent garment replacement, making e-commerce a convenient and cost-effective choice. Direct access to home-use devices has also energized online demand. As consumers increasingly seek autonomy and product variety, retail & e-commerce continues to expand at an accelerated pace, making it the fastest-growing distribution channel.

Secondary Lymphedema Treatment Market Regional Analysis

- North America dominated the secondary lymphedema treatment market with the largest revenue share of 42.8% in 2025, supported by high cancer treatment volumes, strong reimbursement structures, early adoption of pneumatic compression devices

- The region’s growing adoption of compression therapies, surgical interventions, and innovative physiotherapy equipment is supported by well-established reimbursement policies and an increasing number of cancer survivors at risk of developing secondary lymphedema

- Rising clinical research activity, availability of specialized lymphedema management centers, and strong patient preference for early diagnosis and long-term management continue to solidify North America’s lead in the global market

U.S. Secondary Lymphedema Treatment Market Insight

The U.S. secondary lymphedema treatment market captured the largest revenue share of 82% in 2025 within North America, driven by the growing number of cancer survivors and strong clinical emphasis on early lymphedema management. Demand for compression devices, manual lymph drainage (MLD), and advanced imaging tools continues to rise as providers prioritize long-term patient outcomes. Increasing adoption of home-based therapy systems, alongside expanding reimbursement support for lymphedema-related services, is further accelerating market growth. Moreover, the advancement of digital therapeutic platforms and wearable monitoring technologies is strengthening the U.S. market’s leadership.

Europe Secondary Lymphedema Treatment Market Insight

The Europe secondary lymphedema treatment market is projected to expand at a substantial CAGR throughout the forecast period, supported by stringent healthcare policies and rising awareness of post-cancer lymphatic complications. Increasing adoption of physiotherapy interventions, compression garments, and surgical procedures is driven by strong public healthcare systems and structured reimbursement models. European patients are also drawn to enhanced comfort, durability, and compliance offered by newer therapy products. The region is experiencing notable uptake across hospitals, specialty clinics, and home-care settings, with lymphedema care being integrated into routine oncology follow-up.

U.K. Secondary Lymphedema Treatment Market Insight

The U.K. secondary lymphedema treatment market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by rising investments in cancer care pathways and emphasis on early diagnosis. Increasing awareness of chronic swelling and its long-term impact on quality of life is driving hospitals and community care providers to adopt advanced therapeutic tools. In addition, rising concerns regarding infection risks and mobility impairment are encouraging both clinicians and patients to prioritize structured lymphedema management. The U.K.’s strong digital health infrastructure and expanding tele-rehabilitation services are expected to support the market’s continued expansion.

Germany Secondary Lymphedema Treatment Market Insight

The Germany secondary lymphedema treatment market is expected to expand at a considerable CAGR, supported by high awareness of chronic lymphatic disorders and strong demand for advanced, clinically validated treatment solutions. Germany’s emphasis on technological innovation, precision healthcare, and integrated therapy models promotes adoption of modern lymphatic drainage systems and compression technologies. The market benefits from well-developed rehabilitation centers and widespread insurance coverage, enabling greater access to preventive and therapeutic care. Integration of lymphedema treatment with digital monitoring and home-care assistance is becoming increasingly prevalent in the country.

Asia-Pacific Secondary Lymphedema Treatment Market Insight

The Asia-Pacific secondary lymphedema treatment market is poised to grow at the fastest CAGR of 24% during 2026–2033, driven by rapid expansion of cancer treatment facilities, increasing awareness programs, and rising disposable incomes in emerging countries. Growing attention to post-surgical care, combined with large patient pools in China, India, and Southeast Asia, is accelerating adoption of compression therapies and physiotherapy-based management. APAC is also becoming a competitive manufacturing hub for cost-effective lymphedema treatment products, improving affordability and access for a broader population.

Japan Secondary Lymphedema Treatment Market Insight

The Japan secondary lymphedema treatment market is gaining momentum owing to the country’s advanced healthcare culture, aging population, and strong focus on patient-centered rehabilitation. The market is driven by widespread adoption of compression technologies, modern diagnostic methods, and clinic-based therapeutic protocols. Integration of lymphedema management into oncology care plans is expanding rapidly. In addition, Japan’s high interest in smart medical devices and IoT-enabled monitoring tools is contributing to increased acceptance of digital and home-use solutions.

India Secondary Lymphedema Treatment Market Insight

The India secondary lymphedema treatment market accounted for the largest revenue share in Asia Pacific in 2025, supported by the rapidly expanding cancer patient base, growing hospital infrastructure, and rising demand for rehabilitation services. Increased public health initiatives and awareness campaigns are strengthening early recognition and treatment uptake. India’s position as a major producer of affordable compression garments and therapy devices is expanding accessibility among both urban and semi-urban populations. Moreover, the push toward digital healthcare and wider availability of physiotherapy services is significantly advancing market penetration.

Secondary Lymphedema Treatment Market Share

The Secondary Lymphedema Treatment industry is primarily led by well-established companies, including:

- 3M (U.S.)

- Tactile Medical (U.S.)

- AIROS Medical Inc. (U.S.)

- Bio Compression Systems Inc. (U.S.)

- Essity AB (Sweden)

- Lohmann & Rauscher GmbH & Co. KG (Germany)

- medi GmbH & Co. KG (Germany)

- Huntleigh Healthcare Ltd. (U.K.)

- SIGVARIS GROUP (Switzerland)

- Smith & Nephew plc (U.K.)

- PAUL HARTMANN AG (Germany)

- Convatec Group (U.K.)

- Julius Zorn GmbH (Germany)

- Mego Afek Ltd. (Israel)

- ThermoTek Inc. (U.S.)

- Lympha Press (U.S.)

- KOYA Medical (U.S.)

- Riancorp Pty Ltd (Australia)

- BiaCare Medical LLC (U.S.)

- Compression Dynamics LLC (U.S.)

What are the Recent Developments in Global Secondary Lymphedema Treatment Market?

- In May 2025, Tactile Medical reported that alongside its Nimbl expansion, it had optimized its sales organization and launched a new customer‑relationship management (CRM) tool — efforts aimed at scaling patient reach, improving service delivery, and strengthening long-term growth in the lymphedema treatment market

- In February 2025, Tactile Medical expanded the commercial availability of Nimbl to include treatment for lower‑extremity lymphedema (phlebolymphedema), thereby broadening the addressable patient base well beyond upper‑limb cancer‑related swelling and targeting chronic leg/foot edema populations

- In October 2024, Tactile Medical launched its next‑generation pneumatic compression platform Nimbl for upper‑extremity lymphedema, offering a significantly smaller, lighter, and more portable option than prior devices making home‑ or travel‑friendly therapy more feasible for patients

- In September 2024, Tactile Medical received approval from the U.S. Centers for Medicare & Medicaid Services (CMS) contractor for the HCPCS billing code for Nimbl, facilitating reimbursement and increasing access to lymphedema patients across Medicare/Medicaid a crucial step for adoption by older or insured patient populations

- In February 2024, Lymphatica Medtech SA announced that its implantable lymphedema treatment technology LymphoDrain received a “Breakthrough Device Designation” from the U.S. Food and Drug Administration (FDA), highlighting potential for a paradigm‑shifting, minimally invasive fluid‑drainage solution for chronic lymphedema patients globally

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.