Global Security Monitoring Proactive Market

Market Size in USD Billion

CAGR :

%

USD

14.37 Billion

USD

48.11 Billion

2025

2033

USD

14.37 Billion

USD

48.11 Billion

2025

2033

| 2026 –2033 | |

| USD 14.37 Billion | |

| USD 48.11 Billion | |

|

|

|

|

Security Monitoring Proactive Market Size

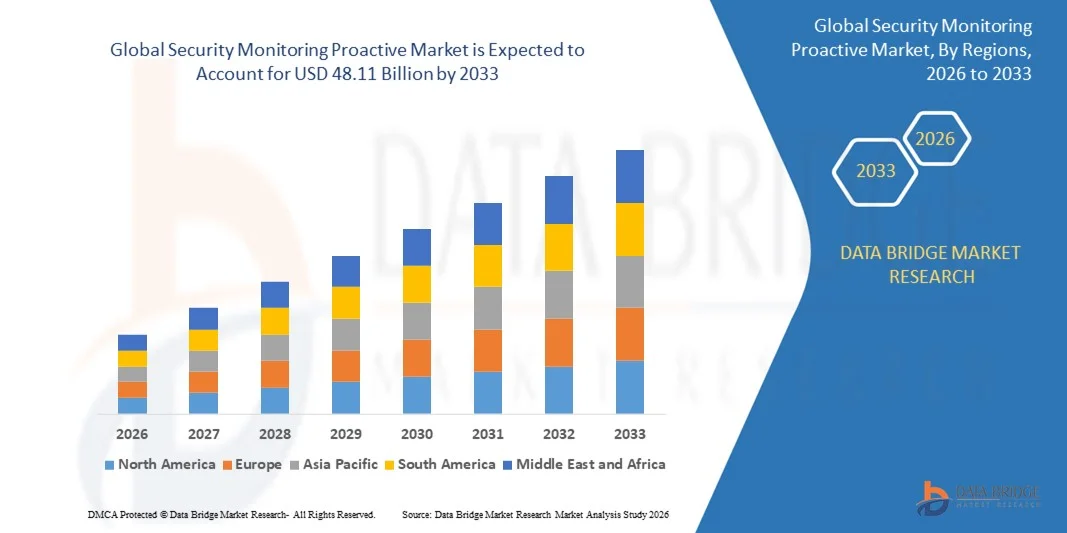

- The global security monitoring proactive market size was valued at USD 14.37 billion in 2025 and is expected to reach USD 48.11 billion by 2033, at a CAGR of 16.30% during the forecast period

- The market growth is primarily driven by the rising need for advanced threat prevention and real-time visibility as organizations face increasingly sophisticated cyberattacks, pushing businesses across sectors to adopt proactive security monitoring solutions that can detect, analyze, and mitigate threats before they escalate

- For instance, the increasing use of AI-enabled monitoring tools by companies such as Cisco is accelerating the shift from reactive to predictive security, strengthening early threat identification and supporting enterprises in safeguarding their expanding digital infrastructures

Security Monitoring Proactive Market Analysis

- Security monitoring proactive solutions, designed to continuously analyze networks, endpoints, cloud environments, and user behavior, are becoming indispensable for modern cybersecurity ecosystems due to their ability to prevent breaches, minimize operational disruptions, and provide timely insights into potential threats across critical infrastructures

- The demand for these solutions is growing rapidly due to the rising complexity of cyber threats, the expansion of cloud adoption, and the increasing need for predictive security technologies that help enterprises transition toward a prevention-first security model

- North America dominated the security monitoring proactive market with a share of over 35% in 2025, due to widespread adoption of real-time surveillance solutions, rising security threats, and strong penetration of advanced monitoring technologies across enterprises

- Asia-Pacific is expected to be the fastest growing region in the security monitoring proactive market during the forecast period due to rapid urban development, increasing disposable incomes, and expanding adoption of real-time security technologies in countries such as China, Japan, and India

- Video surveillance segment dominated the market with a market share of 46.6% in 2025, due to its critical role in delivering real-time situational awareness across commercial, industrial, and public environments. AI-powered analytics enhance video feeds by identifying abnormal activities, enabling faster incident prevention. Businesses prefer centrally managed surveillance networks that integrate with alarms and access systems to create cohesive security frameworks. Large-scale infrastructure projects and smart city initiatives continue to expand the use of high-resolution cameras and intelligent monitoring systems, ensuring the dominance of video surveillance

Report Scope and Security Monitoring Proactive Market Segmentation

|

Attributes |

Security Monitoring Proactive Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Security Monitoring Proactive Market Trends

Rising Integration of AI and Automation in Proactive Security Monitoring

- A prominent trend in the security monitoring proactive market is the accelerating integration of AI and automation that enables continuous analysis of large-scale threat data, thereby enhancing detection accuracy and reducing human dependency in complex security environments through intelligent processing

- For instance, Cisco Systems, Inc. integrates AI-powered automation within its SecureX platform, enabling automated threat correlation, faster anomaly investigation, and reduced response time, illustrating how organizations are adopting automated security ecosystems to strengthen proactive threat defence

- AI-enabled monitoring solutions support advanced capabilities such as behavioural analytics, contextual intelligence, and adaptive alerting, helping security teams detect subtle deviations that may indicate early signs of cyberattacks while improving overall operational efficiency

- Automation-driven frameworks are increasingly being adopted to eliminate repetitive manual tasks, streamline monitoring across cloud, on-premises, and hybrid infrastructures, and maintain continuous visibility into rapidly evolving digital environments

- Real-time automation is also improving the capability of security systems to perform predictive modelling and early anomaly identification, enabling organizations to counter emerging threats before they escalate into active breaches

- This trend is expected to shape the future of proactive monitoring as enterprises continue prioritizing intelligent, autonomous, and resilient security layers that can evolve with threat complexity while ensuring stronger and more responsive protection architectures

Security Monitoring Proactive Market Dynamics

Driver

Increasing Demand for Predictive Threat Intelligence Solutions

- The increasing demand for predictive threat intelligence solutions is a major driver of market growth as organizations seek mechanisms that can forecast cyber risks, identify hidden attack vectors, and prevent breaches before they impact mission-critical operations

- For instance, IBM Corporation strengthens predictive threat intelligence through its QRadar Suite, which leverages machine learning and automated correlation to identify emerging attack behaviours, enabling enterprises to act on potential threats with greater speed and precision

- Security teams are adopting predictive tools that evaluate historical threat data, user activity trends, and indicators of compromise to deliver forward-looking insights that enhance preparedness across complex digital infrastructures

- With the growing sophistication of cyberattacks, enterprises are prioritizing intelligence-driven monitoring strategies that support continuous threat hunting, real-time risk scoring, and deeper investigative capabilities

- The demand for pre-emptive protection is rapidly rising across industries where uninterrupted operations are crucial, reinforcing the long-term importance of predictive intelligence as an essential pillar of proactive security monitoring

Restraint/Challenge

High Implementation Costs and Complex Integration Requirements

- High implementation costs represent a major challenge for organizations deploying proactive monitoring systems, as these solutions often require investment in advanced technologies, skilled personnel, and infrastructure upgrades that many companies find financially burdensome

- For instance, small and mid-sized enterprises frequently face difficulty implementing platforms such as Palo Alto Networks Cortex XDR due to the need for extensive system integration, specialized expertise, and additional backend resources

- Complex integration requirements further intensify this challenge because proactive monitoring platforms must be aligned with multiple layers of existing infrastructure such as legacy systems, cloud workloads, and diverse endpoint environments

- Ensuring compatibility demands time-consuming configuration, continuous optimization, and technical knowledge, which can increase deployment timelines and create operational disruption during migration processes

- These financial and integration-related constraints continue to restrict adoption among cost-sensitive sectors, highlighting the need for flexible pricing models, simplified deployment strategies, and easily scalable solutions to overcome the barriers and support long-term market expansion

Security Monitoring Proactive Market Scope

The market is segmented on the basis of organization size, industry vertical, and application.

- By Organization Size

On the basis of organization size, the Security Monitoring Proactive Market is segmented into large enterprises and small and medium-sized enterprises. The large enterprises segment dominated the market in 2025 due to their extensive security requirements across complex infrastructures that demand constant monitoring and rapid threat detection. These organizations deploy integrated platforms that combine surveillance, intrusion alerts, access control, and automated analytics to prevent operational disruptions. Their high exposure to data breaches and compliance-driven environments compels them to invest in advanced proactive monitoring solutions. Large enterprises also rely on centralized command systems that support real-time security orchestration across multiple locations, reinforcing their dominant position.

The small and medium-sized enterprises segment is anticipated to witness the fastest growth rate from 2026 to 2033 driven by the increasing adoption of cloud-based monitoring systems offering affordability and ease of deployment. SMEs are transitioning to digital operations, increasing their vulnerability to security risks and heightening the need for proactive detection capabilities. Subscription-based and scalable security services are enabling faster adoption among smaller businesses seeking continuous monitoring without heavy infrastructure investments. Growing awareness of cyber and physical threats is encouraging SMEs to integrate surveillance, intrusion detection, and automated alerts into their daily operations, supporting the segment’s rapid expansion.

- By Industry Vertical

On the basis of industry vertical, the Security Monitoring Proactive Market is segmented into banking, financial services, and insurance (BFSI), government and defence, retail and e-commerce, IT and telecom, healthcare and life sciences, energy and utilities, manufacturing, and others. The BFSI segment dominated the market in 2025 owing to its stringent security requirements across digital payment channels, customer data systems, ATM networks, and physical branches. Financial institutions depend on real-time monitoring tools that detect fraud patterns, unusual activities, and external intrusions to ensure uninterrupted banking operations. Regulatory frameworks drive major investments in automated surveillance and anomaly analytics, ensuring compliance and operational safety. The rising adoption of digital banking and remote financial services further strengthens the need for advanced proactive monitoring, maintaining BFSI as the dominant vertical.

The retail and e-commerce segment is expected to witness the fastest growth rate from 2026 to 2033 supported by rising demand for centralized monitoring across stores, warehouses, and distribution hubs. Retailers are deploying intelligent surveillance platforms that track customer movement, prevent shrinkage, and support loss prevention strategies. E-commerce companies prioritize intrusion alerts, access control, and automated alarms to secure high-volume logistics systems. Cloud-enabled monitoring solutions allow retailers to manage multi-location security from unified dashboards. The rapid expansion of digital transactions and omnichannel operations further accelerates the need for proactive monitoring technologies in this segment.

- By Application

On the basis of application, the Security Monitoring Proactive Market is segmented into video surveillance, intrusion detection, access control, fire detection, and alarm monitoring. The video surveillance segment held the largest market share of 46.6% in 2025 driven by its critical role in delivering real-time situational awareness across commercial, industrial, and public environments. AI-powered analytics enhance video feeds by identifying abnormal activities, enabling faster incident prevention. Businesses prefer centrally managed surveillance networks that integrate with alarms and access systems to create cohesive security frameworks. Large-scale infrastructure projects and smart city initiatives continue to expand the use of high-resolution cameras and intelligent monitoring systems, ensuring the dominance of video surveillance.

The intrusion detection segment is projected to witness the fastest CAGR from 2026 to 2033 fueled by rising threats targeting physical perimeters and sensitive operational spaces. Organizations are increasingly adopting motion sensors, behavioral detectors, and automated alarms to identify unauthorized entry in real time. Modern intrusion detection systems integrate seamlessly with video analytics and access control platforms, enabling faster incident response. Cloud-based monitoring tools allow businesses to manage multi-site intrusion data from remote dashboards. Growing concerns over asset protection and operational continuity strengthen the demand for proactive intrusion solutions, supporting this segment’s rapid growth.

Security Monitoring Proactive Market Regional Analysis

- North America dominated the security monitoring proactive market with the largest revenue share of over 35% in 2025, driven by widespread adoption of real-time surveillance solutions, rising security threats, and strong penetration of advanced monitoring technologies across enterprises

- Organizations in the region prioritize integrated monitoring platforms that combine video analytics, intrusion detection, and automated alerts, ensuring seamless threat prevention across commercial and residential environments

- Growing investments in digital transformation, the rise in smart infrastructure, and heightened awareness of proactive security measures continue to reinforce the region’s leadership, establishing security monitoring systems as an essential component across multiple industries

U.S. Security Monitoring Proactive Market Insight

The U.S. security monitoring proactive market captured the largest revenue share in 2025 within North America, fueled by the rapid adoption of AI-driven monitoring tools and increasing reliance on analytics-based threat detection. Businesses across sectors are prioritizing round-the-clock monitoring to safeguard data, infrastructure, and operational continuity. The growing demand for integrated platforms enabling remote supervision, real-time alerts, and automated risk assessment further accelerates market expansion. Strong investments in digital security modernization and a high rate of technological adoption contribute substantially to the U.S. market’s dominance

Europe Security Monitoring Proactive Market Insight

The Europe security monitoring proactive market is projected to expand at a substantial CAGR throughout the forecast period, driven by stringent security compliance requirements and increasing emphasis on safeguarding physical and digital assets. Rapid urbanization and the rising number of connected buildings are encouraging the adoption of proactive monitoring solutions across commercial and residential settings. European consumers and businesses are increasingly valuing integrated systems offering automation, energy efficiency, and enhanced security visibility. The region is experiencing steady growth across infrastructure, corporate environments, and multi-dwelling units, with monitoring solutions being implemented in both new developments and renovation projects

U.K. Security Monitoring Proactive Market Insight

The U.K. security monitoring proactive market is anticipated to grow at a noteworthy CAGR during the forecast period owing to rising adoption of advanced monitoring systems and growing awareness of threat prevention. Security concerns surrounding commercial and residential properties are boosting demand for real-time video analytics, intrusion alerts, and centralized monitoring tools. The market is further supported by the country’s rapid shift toward connected solutions and digitally managed infrastructure. Increasing integration of IoT devices within homes, offices, and industrial spaces is expected to sustain strong growth across the U.K.

Germany Security Monitoring Proactive Market Insight

The Germany security monitoring proactive market is expected to expand at a considerable CAGR during the forecast period, strengthened by rising attention to digital protection and demand for technologically advanced monitoring tools. Germany’s emphasis on innovation, sustainability, and privacy-conscious solutions is accelerating the adoption of intelligent surveillance and automated alerts. Strong infrastructure and growing interest in secure smart building systems are promoting widespread integration of proactive monitoring technologies. Both residential and enterprise sectors are increasingly implementing unified monitoring platforms to ensure efficient security management

Asia-Pacific Security Monitoring Proactive Market Insight

The Asia-Pacific security monitoring proactive market is poised to grow at the fastest CAGR from 2026 to 2033, driven by rapid urban development, increasing disposable incomes, and expanding adoption of real-time security technologies in countries such as China, Japan, and India. The region’s push toward digitalization, coupled with rising security concerns in densely populated cities, is accelerating demand for proactive surveillance solutions. Growing local manufacturing capabilities and availability of cost-effective systems are making monitoring technologies accessible to a broader consumer base. Expansion of smart home applications, commercial infrastructure, and industrial automation continues to support market growth

Japan Security Monitoring Proactive Market Insight

The Japan security monitoring proactive market is gaining momentum supported by the nation’s strong technology culture, urban density, and rising demand for convenience-focused security solutions. Japan’s growing number of smart homes and connected buildings is driving adoption of monitoring systems integrated with IoT platforms. Enhanced focus on safeguarding property and ensuring smooth access control in residential and commercial settings contributes to increasing market traction. The aging population also supports demand for simplified, reliable, and secure monitoring solutions across households

China Security Monitoring Proactive Market Insight

The China security monitoring proactive market accounted for the largest revenue share in Asia-Pacific in 2025, driven by rapid urban expansion, high digital adoption rates, and increasing installation of surveillance and monitoring systems across multiple sectors. China stands as one of the leading markets for smart and connected security technologies, with strong participation from domestic manufacturers enhancing market affordability and penetration. Growing smart city initiatives, coupled with widespread deployment of monitoring systems in residential, commercial, and industrial settings, continue to propel market growth in the country

Security Monitoring Proactive Market Share

The security monitoring proactive industry is primarily led by well-established companies, including:

- IBM Corporation (U.S.)

- Cisco (U.S.)

- Broadcom (U.S.)

- FireEye, Inc. (U.S.)

- McAfee, LLC (U.S.)

- Palo Alto Networks, Inc. (U.S.)

- Securonix, Inc. (U.S.)

- LogRhythm, Inc. (U.S.)

- Rapid7 (U.S.)

- Qualys, Inc. (U.S.)

- AT&T Intellectual Property (U.S.)

- Trustwave Holdings, Inc. (U.S.)

- CyberSponse, Inc. (U.S.)

- FireMon, LLC (U.S.)

- RSA Security LLC (U.S.)

- ThreatConnect, Inc. (U.S.)

- Centrify Corporation (U.S.)

- Oracle (U.S.)

- Swimlane (U.S.)

- Skybox Security, Inc. (U.S.)

Latest Developments in Global Security Monitoring Proactive Market

- In October 2025, Bosch Security Systems (Germany) introduced an upgraded AI-enabled command-and-control platform designed to unify physical surveillance, intrusion analytics, and automated incident reporting across enterprise environments. This enhancement strengthens Bosch’s competitive position by enabling customers to transition toward centralized, data-driven security ecosystems. The rollout of this platform accelerates market momentum toward intelligent, scalable monitoring solutions and reinforces the industry’s shift from reactive to predictive security models, significantly influencing buyer expectations across Europe and Asia-Pacific

- In September 2025, Securitas AB (SE) launched a new digital platform designed to streamline its security services across Europe. This platform utilizes machine learning algorithms to optimize resource allocation, reduce operational inefficiencies, and improve real-time incident response. By deploying a unified digital ecosystem, Securitas accelerates the regional transition toward proactive, intelligence-led security management. This development positions the company as a pioneer in digital transformation and raises the industry benchmark for operational automation in security systems

- In August 2025, ADT Inc. (US) announced a strategic partnership with a leading technology firm to integrate advanced AI-driven analytics into its security monitoring architecture. This collaboration reinforces ADT’s competitive strength by elevating its threat detection accuracy, reducing false alarms, and enabling faster response times. The move underscores the increasing importance of AI-powered security intelligence and signals a clear shift in the market toward automated, analytics-based monitoring frameworks that enhance protection for residential and commercial customers

- In July 2025, Honeywell International Inc. (US) unveiled a comprehensive suite of integrated security solutions combining physical surveillance with cybersecurity protection. This advancement addresses growing concerns about cyber intrusions within physical security networks and strengthens Honeywell’s leadership in hybrid security offerings. By providing end-to-end protection, the company aligns with evolving customer expectations for unified defense mechanisms and contributes to expanding industry adoption of dual-layered physical–digital security infrastructures

- In June 2025, Johnson Controls International (Ireland/US) introduced a cloud-native security monitoring module that enables organizations to consolidate access control, video analytics, and alarm management on a single digital interface. This innovation enhances operational visibility, reduces on-premises infrastructure dependence, and supports scalable deployment across multi-site enterprises. By pushing cloud-first monitoring capabilities into mainstream adoption, Johnson Controls significantly influences market evolution toward flexible, subscription-based security ecosystems preferred by modern businesses

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.