Global Security Paper Market

Market Size in USD Billion

CAGR :

%

USD

18.50 Billion

USD

36.70 Billion

2024

2032

USD

18.50 Billion

USD

36.70 Billion

2024

2032

| 2025 –2032 | |

| USD 18.50 Billion | |

| USD 36.70 Billion | |

|

|

|

|

Global Security Paper Market Size

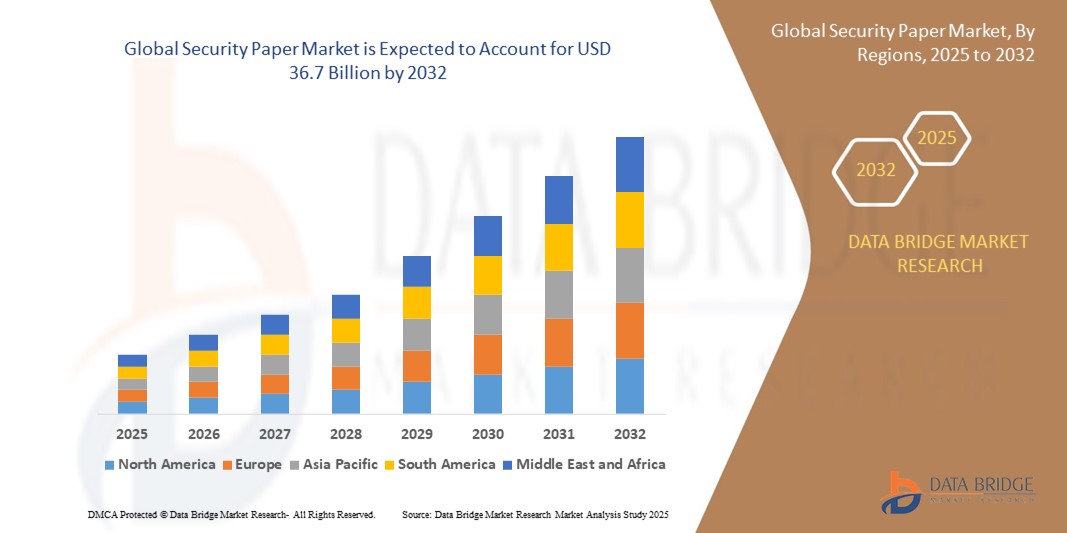

- The Global Security Paper Market size was valued at USD 18.5 billion in 2024 and is expected to reach USD 36.7 billion by 2032, at a CAGR of 8.95 % during the forecast period

- Market growth is primarily driven by increasing concerns over document authenticity, rising incidences of counterfeiting, and growing demand for tamper-evident and fraud-resistant paper-based solutions across sectors such as banking, government, and education

- Furthermore, regulatory mandates and the need for secure printing of documents like passports, certificates, currency, and legal papers are further strengthening the demand for security paper globally. These dynamics are accelerating the integration of advanced technologies like watermarks, holograms, and embedded fibers, thereby propelling market expansion

Global Security Paper Market Analysis

- Security paper, designed with embedded features to prevent counterfeiting, tampering, and forgery, plays a crucial role in securing sensitive and high-value documents such as currency, passports, certificates, legal documents, and checks. Its importance is growing across government, financial, and educational sectors due to the increasing need for document authentication and verification

- The rising demand for security paper is primarily driven by increasing incidents of document fraud, regulatory pressures to enhance document security, and growing global trade and mobility requiring secure documentation such as visas and ID cards

- Asia-Pacific leads the global security paper market with the largest revenue share of 38.7% in 2024, owing to robust production and consumption of banknotes, increasing government investments in secure documentation infrastructure, and the presence of major paper manufacturing hubs in countries such as China and India

- Europe is expected to be the fastest-growing region during the forecast period, fueled by stringent anti-counterfeiting regulations, rising adoption of e-passports, and strong demand for tamper-evident documents across public and private institutions

- The banknotes segment dominates the security paper market with a market share of 41.5% in 2024, supported by the continued circulation of physical currency in emerging and developing economies and the need for highly secure substrates in financial applications

Report Scope and Global Security Paper Market Segmentation

|

Attributes |

Smart Lock Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

Global Security Paper Market Trends

“Technological Advancements in Anti-Counterfeiting Features and Hybrid Security Solutions”

- A prominent and accelerating trend in the global security paper market is the adoption of advanced anti-counterfeiting technologies and hybrid security features to combat the growing sophistication of document fraud and forgery. Manufacturers are increasingly integrating physical and digital security elements to provide multi-layered protection for high-value and sensitive documents

- For example, security papers are now embedded with overt, covert, and forensic features such as color-shifting inks, holographic threads, microtext, ultraviolet fibers, and watermarks, while also incorporating machine-readable elements like QR codes and RFID chips for digital traceability. This evolution enables secure document verification not only through manual inspection but also via automated systems

- Companies like Giesecke+Devrient and Crane Co. are pioneering hybrid security solutions that merge traditional paper-based features with digital enhancements, such as secure cloud-linked authentication for high-security applications like e-passports and tax stamps

- The demand for security paper with integrated digital verification capabilities is especially increasing in government, banking, and educational sectors. For instance, several countries are transitioning to e-document systems backed by tamper-evident physical documents, especially for certificates, ID cards, and border control documents

- This trend is also being driven by regulatory mandates and international standards that require higher levels of document security, encouraging innovation in customizable, scalable, and eco-friendly security paper solutions. As a result, companies like Pura Group and Drewsen Spezialpapiere are investing in sustainable yet highly secure substrates that support both print and digital verification

- Overall, the fusion of physical security features with digital authentication and traceability is reshaping the expectations for document integrity and trust, creating vast opportunities for innovation and expansion in the global security paper market

Global Security Paper Market Dynamics

Driver

“Heightened Counterfeiting Threats and Regulatory Demand for Secure Documentation”

- The increasing sophistication and frequency of counterfeiting, forgery, and document fraud are key drivers for the global security paper market. Governments, financial institutions, and educational bodies are under growing pressure to safeguard the authenticity and integrity of vital documents, such as banknotes, passports, ID cards, tax stamps, and academic certificates

- For instance, recent global efforts to modernize currency and official document systems such as the rollout of polymer-based banknotes and biometric passports are fueling the demand for high-quality security paper with embedded anti-counterfeiting features.

- Regulatory mandates across regions are also driving adoption. Many countries have introduced legal requirements for secure substrates in official documentation, prompting significant investments in advanced security paper solutions

- The increasing emphasis on secure borders, transparent financial systems, and trustworthy public records is leading to the widespread implementation of multi-layered document security, making security paper indispensable across public and private sectors

- Additionally, as international travel and trade resume post-pandemic, the demand for verifiable and tamper-proof documents is expected to grow substantially, further boosting the security paper market

Restraint/Challenge

“Digital Alternatives and High Production Costs”

- The rising adoption of digital documentation and electronic verification systems presents a major challenge to the traditional security paper market. As institutions increasingly shift toward paperless operations and e-documents driven by cost-saving measures and sustainability goals the demand for physical secure paper may experience gradual erosion in some segments

- For example, e-passports, digital ID cards, and blockchain-based certifications offer enhanced security and convenience without the need for physical substrates. This transition poses a competitive threat to traditional security paper manufacturers, especially in digitally advanced regions such as North America and Western Europe

- Furthermore, the production of high-grade security paper involves specialized materials, technologies, and labor-intensive processes, resulting in relatively high manufacturing costs. Incorporating advanced features like holograms, watermarks, and embedded threads increases complexity and capital investment

- These high production costs can deter adoption, particularly in price-sensitive developing economies where governments and institutions may lack the budget to invest in premium security paper solutions

- To mitigate this restraint, companies must focus on cost-efficient production, invest in hybrid solutions that complement digital verification, and promote the value of physical authenticity in sectors where digital systems are not yet fully secure or accessible

Global Security Paper Market Scope

The market is segmented on the basis of type, security feature, end-use application, and region

- By Type

On the basis of type, the security paper market is segmented into banknotes, passports, certificates, identity cards, checks, and others. The banknotes segment dominates the largest market revenue share of 41.5% in 2024, driven by the continued use of physical currency in emerging and developing economies. Governments and central banks are investing in high-security banknote paper embedded with features such as watermarks, security threads, and color-shifting inks to deter counterfeiting

The passport segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by rising global travel, e-passport issuance, and heightened border security regulations. The integration of biometric and machine-readable elements is creating demand for next-generation security paper substrates that meet international travel document standards

- By Security Feature

On the basis of security feature, the market is segmented into watermarks, holograms, UV fibers, security threads, color-shifting inks, and others. The watermarks segment held the largest market share in 2024 due to its long-standing effectiveness and wide adoption across currency and legal document printing. Watermarks are difficult to duplicate and easily verified without special equipment, making them a foundational feature in security paper

The hologram segment is expected to witness the fastest CAGR from 2025 to 2032, driven by technological innovations and rising demand for visually verifiable anti-counterfeit features. Holograms offer strong resistance against digital and photocopy-based forgery, making them ideal for government IDs, visas, and branded certificates

- By Application

On the basis of application, the security paper market is segmented into government documents, banknotes, certificates, legal & commercial documents, and others. The government documents segment held the largest market revenue share in 2024, driven by the surge in demand for secure paper for national identity cards, voter IDs, passports, and tax stamps. Increasing digitization is also prompting governments to pair physical documentation with embedded digital verification features

The legal & commercial documents segment is projected to witness the fastest CAGR from 2025 to 2032, supported by the need to secure confidential contracts, financial checks, and official correspondence in both private and public sectors. Security paper helps prevent tampering, duplication, and unauthorized alterations in legal and business processes

Global Security Paper Market Regional Analysis

- North America is a significant market for security paper, holding a substantial revenue share in 2024. This is driven by the escalating need for secure documents across various sectors

- The increasing cases of financial fraud, identity theft, and unauthorized duplication are compelling governments and financial institutions to implement stricter security measures, boosting the demand for security paper in currency, passports, certificates, and legal documents

- This widespread adoption is further supported by technological advancements in security features and a growing adoption in packaging and labeling, particularly for luxury goods and pharmaceuticals, to combat product counterfeiting

North America Security Paper Market Insight

North America is a significant market for security paper, driven by the strong demand for secure documents across various sectors. The region's security market, which includes security paper, was valued at approximately USD 46.85 billion in 2024. The escalating cases of financial fraud, identity theft, and unauthorized duplication are compelling governments and financial institutions to implement stricter security measures, boosting the demand for security paper in currency, passports, certificates, and legal documents. The market also benefits from technological advancements in security features and a growing adoption in packaging and labeling, particularly for luxury goods and pharmaceuticals, to combat product counterfeiting

U.S. Security Paper Market Insight

The U.S. security paper market is a key contributor to North America's dominance, fueled by the persistent threat of counterfeiting and the ongoing need for secure identification and financial instruments. The demand for highly secure documents, including banknotes, passports, and various government-issued certificates, drives growth. Innovations in security features like embedded fibers and advanced inks are crucial in combating sophisticated counterfeiting techniques. The emphasis on data integrity and anti-fraud measures across banking, legal, and government sectors further propels the market in the U.S

Europe Security Paper Market Insight

The Europe security paper market is projected to expand at a substantial CAGR throughout the forecast period. This growth is primarily driven by stringent security regulations and the continuous need for enhanced security in financial transactions and official documents. While some European countries are rapidly adopting digital identity systems, there remains a significant demand for secure physical documents. The increasing awareness regarding document security and the focus on preventing fraud in both public and private sectors contribute to the steady adoption of security papers across applications like banknotes, passports, and legal documents. The market is also seeing investments in new production technologies to create more advanced paper grades

U.K. Security Paper Market Insight

The U.K. security paper market is anticipated to grow at a noteworthy CAGR during the forecast period, spurred by the continuous fight against counterfeiting and the need for high-security physical documents. Concerns about financial fraud and identity theft are encouraging the adoption of advanced security paper solutions in currency, identity cards, and certificates. The U.K.'s robust regulatory framework for secure documentation, coupled with ongoing efforts to upgrade existing security features in banknotes and other official papers, contributes to sustained market demand

Germany Security Paper Market Insight

The Germany security paper market is expected to expand at a considerable CAGR during the forecast period, fueled by a strong emphasis on digital security awareness and the demand for technologically advanced, eco-conscious solutions. Germany's well-developed infrastructure and its focus on innovation and sustainability promote the adoption of high-quality security papers, particularly for official documents and currency. The country's prominent players in the security printing industry, such as Giesecke+Devrient, are at the forefront of developing innovative security features, aligning with local consumer and institutional expectations for secure and privacy-focused solutions

Asia-Pacific Security Paper Market Insight

The Asia-Pacific security paper market is poised to grow at the fastest CAGR during the forecast period, driven by increasing urbanization, rising disposable incomes, and rapid technological advancements in countries such as China, Japan, and India. The region's large population base, high inclination towards cash transactions, and government initiatives promoting digitalization and secure identification programs are significantly fueling the adoption of security papers. As APAC emerges as a major manufacturing hub for security paper components and systems, the affordability and accessibility of security papers are expanding to a wider consumer base, particularly in applications like currency printing, passports, and certificates

Japan Security Paper Market Insight

The Japan security paper market is gaining momentum due to the country's high-tech culture and strong emphasis on security and integrity in documentation. The demand for security paper is driven by the need for secure banknotes, passports, and various official certificates. The integration of advanced security features and continued innovation in paper technology is crucial in Japan. The market also sees opportunities from the country's commitment to robust identification systems and the careful management of physical currency

China Security Paper Market Insight

The China security paper market accounted for the largest market revenue share in Asia Pacific, attributed to the country's expanding middle class, rapid urbanization, and high rates of technological adoption. China is a massive market for secure documents, with a significant demand for security paper in banknote printing, identity cards, and legal documents. The government's push towards enhanced security and the availability of advanced, yet affordable, security paper options from strong domestic manufacturers are key factors propelling the market in China. The continuous efforts to combat counterfeiting across various sectors further solidify the demand for high-quality security paper

Global Security Paper Market Share

The Global Security Paper industry is primarily led by well-established companies, including:

- GOZNAK (Russia)

- China Banknote Printing and Minting Corporation (China)

- Drewsen SPEZIALPAPIERE GmbH & Co. KG (Germany)

- Crane Co. (US)

- Giesecke+Devrient GmbH (Germany)

- Document Security Systems, Inc. (US)

- Simpson Security Papers (US)

- CIOTOLA SRL (Italy)

- Pura Group (Indonesia)

- EPLHOUSE (Malaysia)

- SPM - Security Paper Mill, Inc. (Philippines)

- HG Technology Sdn Bhd (Malaysia)

- Security Papers Limited (Pakistan)

- Sequana (France)

- Fedrigoni (Italy)

Latest Developments in Global Security Paper Market

- In April 2024, Drewsen Spezialpapiere GmbH & Co. KG announced a significant investment of USD 2.05 Million in a new film press for its Paper Machine 1 (PM1). This strategic upgrade aims to replace existing equipment and facilitate the production of more sophisticated paper grades, strengthening Drewsen's market share and global position as a leading manufacturer of security papers

- In March 2024, Korea Minting, Security Printing & ID Card Operating Corp. (KOMSCO) announced a collaboration with the Costa Rican government. This partnership aims to share KOMSCO's expertise and provide assistance for the implementation of digital identification initiatives in Costa Rica, including the concept of Korea's digital government and K-DID, a blockchain-based mobile ID system. While focusing on digital, this move also highlights the broader evolution of secure identification solutions which can influence demand for physical security papers

- In January 2024, the International Hologram Manufacturers Association (IHMA) launched the Security Image Register (SIR). This secure registry of holographic images is designed to safeguard hologram copyright and reinforce the use of holograms in authentication and security printing. The SIR provides a global database to protect security images by recording and identifying all copyrights associated with every design of a security image, enhancing the overall integrity of security paper features

- In November 2022, Louisenthal, a prominent banknote paper manufacturing company, unveiled a new house note called "The Dancer." This new note showcases fascinating, forgery-proof features. It incorporates the JUMP technology, which can be utilized on both paper and polymer substrates, and includes two advanced security features: the RollingStar LEAD foil and the company's proprietary SPARK technology, demonstrating continuous innovation in banknote security

- In April 2022, the state-owned Korea Minting, Security Printing, and ID Card Operating Corporation (KOMSCO) signed a memorandum of understanding with Kyrgyzstan's Ministry of Digital Development. The agreement focused on digitizing government-issued documents, such as identification cards and tax payment certificates, and expanding KOMSCO's export areas from security papers and inks to comprehensive digital security solutions. This highlights a broader trend of integrating traditional security paper with digital solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Security Paper Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Security Paper Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Security Paper Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.