Global Seed Coating Market

Market Size in USD Billion

CAGR :

%

USD

2.71 Billion

USD

5.16 Billion

2024

2032

USD

2.71 Billion

USD

5.16 Billion

2024

2032

| 2025 –2032 | |

| USD 2.71 Billion | |

| USD 5.16 Billion | |

|

|

|

|

Seed Coating Market Size

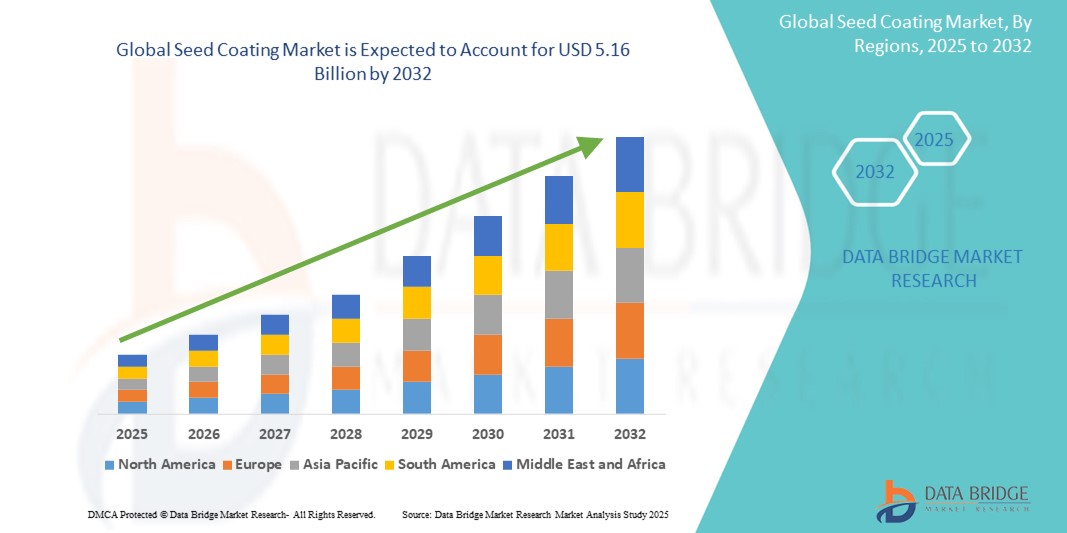

- The global seed coating market size was valued at USD 2.71 billion in 2024 and is expected to reach USD 5.16 billion by 2032, at a CAGR of 8.40% during the forecast period

- The market growth is largely fuelled by the rising demand for high-yielding crops, increasing adoption of modern agricultural practices, and the growing need for crop protection against pests and diseases

- Expansion of commercial farming and precision agriculture, coupled with advancements in coating technologies that enhance seed performance and germination, is also contributing significantly to market growth

Seed Coating Market Analysis

- The seed coating market is witnessing steady expansion driven by a growing emphasis on improving seed quality and uniformity in crop emergence

- In addition, the demand for sustainable and eco-friendly agricultural solutions is encouraging the development of biodegradable and water-based coatings

- North America dominated the global seed coating market with the largest revenue share in 2024, driven by the widespread adoption of advanced agricultural practices and increasing demand for enhanced seed performance and crop yield

- Asia-Pacific region is expected to witness the highest growth rate in the global seed coating market, driven by rapid advancements in agricultural practices, rising demand for high-yield crops, and increasing adoption of advanced seed technologies in emerging economies such as India, China, and Indonesia

- The polymers segment dominated the market with the largest revenue share in 2024, driven by their superior binding properties, controlled release potential, and ability to enhance seed durability. Polymers also improve seed flowability, reduce dust-off during handling, and support precision planting operations, making them a widely adopted coating component across large-scale farming operations

Report Scope and Seed Coating Market Segmentation

|

Attributes |

Seed Coating Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Expansion Of Bio-Based and Eco-Friendly Seed Coating Solutions • Rising Adoption of Precision Agriculture Technologies |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Seed Coating Market Trends

“Increasing Shift toward Biological Seed Coatings for Sustainable Agriculture”

- Growing environmental awareness is encouraging farmers to adopt biological coatings over synthetic chemicals

- Biological coatings are compatible with organic farming practices, making them ideal for high-value crop segments

- In India, several seed companies are incorporating Trichoderma- and Bacillus-based coatings to support root development and stress tolerance

- European countries such as Germany and the Netherlands are supporting biologicals through subsidy programs and sustainability incentives

- Biological coatings offer long-term benefits such as improved soil health and reduced chemical dependency

Seed Coating Market Dynamics

Driver

“Rising Demand for Seed Enhancement Technologies to Improve Crop Yield”

- Farmers are increasingly adopting biological seed coatings made from beneficial microbes and biostimulants to promote sustainable crop production

- These coatings enhance nutrient absorption, improve root health, and strengthen plants' resistance to pests and environmental stress

- The trend aligns with global efforts to reduce synthetic pesticide use and transition toward eco-friendly farming solutions

- In India, seed producers have started integrating Trichoderma-based coatings for cotton and rice to improve root growth and early vigor under low-fertility conditions

- European markets such as Germany and the Netherlands are offering regulatory and financial support for biologically treated seeds to promote soil and environmental health

Restraint/Challenge

“Fluctuating Raw Material Costs and Compatibility Issues with Active Ingredients”

- Prices of polymers, binders, and colorants used in seed coatings are subject to oil price fluctuations, increasing manufacturing costs for producers

- Small and medium seed companies in emerging economies face difficulty in adopting advanced coatings due to these high and unstable input costs

- Compatibility issues between certain active ingredients and seed types can negatively impact germination, storage, and field performance

- In Southeast Asia, vegetable seed suppliers reported challenges when applying pesticide-heavy coatings to spinach seeds, which led to reduced germination and poor emergence

- The need for specialized storage conditions and shorter shelf life of biologically coated seeds also adds logistical and cost barriers for large-scale adoption

Seed Coating Market Scope

The seed coating market is segmented into four notable segments based on additive, process, active ingredient, and crop type.

• By Additive

On the basis of additive, the seed coating market is segmented into polymers, colorants, pellets, minerals/pumice, active ingredients, and others. The polymers segment dominated the market with the largest revenue share in 2024, driven by their superior binding properties, controlled release potential, and ability to enhance seed durability. Polymers also improve seed flowability, reduce dust-off during handling, and support precision planting operations, making them a widely adopted coating component across large-scale farming operations.

The active ingredients segment is expected to witness the fastest growth rate from 2025 to 2032 due to the increasing demand for value-added coatings that include fungicides, insecticides, and micronutrients. These additives provide seeds with early protection against pests and diseases while promoting healthy root development. Farmers in emerging economies such as India and Brazil are increasingly opting for such enhanced formulations to maximize germination success under sub-optimal conditions.

• By Process

On the basis of process, the seed coating market is segmented into film coating, encrusting, and pelleting. The film coating segment accounted for the largest market revenue share in 2024, owing to its cost-effectiveness, minimal impact on seed size, and suitability for a wide range of crops. Film coatings are favored in commercial seed treatment facilities for their ability to evenly distribute additives while preserving seed integrity.

The pelleting segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its growing use in vegetable and flower seeds that require precise sowing. Pelleting significantly alters the size, shape, and weight of seeds, making them easier to plant using automated systems. This is particularly important in countries such as the Netherlands and Japan, where high-value horticultural crops are cultivated with mechanized sowing technologies.

• By Active Ingredient

On the basis of active ingredient, the market is segmented into protectants, phytoactive promoters, and others. The protectants segment led the market in 2024, supported by increasing applications of fungicides and insecticides to ensure disease-free seed germination and early plant development. These coatings help reduce seedling mortality and are widely used across cereals and oilseed crops.

Phytoactive promoters is expected to witness the fastest growth rate from 2025 to 2032 due to their role in enhancing root growth, nutrient uptake, and abiotic stress tolerance. The growing shift toward sustainable farming practices and the preference for residue-free produce are prompting manufacturers to develop biostimulant-based coatings for row crops and specialty segments.

• By Crop Type

On the basis of crop type, the seed coating market is segmented into cereals and grains, oilseeds and pulses, vegetables, flowers and ornamentals, and others. The cereals and grains segment dominated the global market in 2024, largely driven by the widespread use of coated maize, wheat, and rice seeds across North America, Asia-Pacific, and Latin America.

The vegetables segment is expected to witness the fastest growth rate from 2025 to 2032, due to rising demand for high-value crops and the need for uniform germination in controlled growing environments. Coated vegetable seeds are increasingly adopted by growers in countries such as China and the U.S., where precision planting and enhanced seedling vigor are critical for productivity and profit margins.

Seed Coating Market Regional Analysis

• North America dominated the global seed coating market with the largest revenue share in 2024, driven by the widespread adoption of advanced agricultural practices and increasing demand for enhanced seed performance and crop yield

• Farmers and agribusinesses in the region are embracing coated seeds for their ability to improve germination rates, protect against pests, and deliver micronutrients directly to crops during early growth stages

• The presence of leading agrochemical companies, coupled with strong investment in precision farming and biotechnology, is contributing to the region’s dominance in the seed coating market

• Technological advancements in formulation and growing awareness about seed treatment benefits are further accelerating market penetration across major farming belts in the U.S. and Canada

U.S. Seed Coating Market Insight

The U.S. seed coating market held the largest share in North America in 2024, supported by the country's expansive row crop production and adoption of innovative agricultural inputs. Coated seeds are increasingly used in corn, soybeans, and cotton farming due to their ability to enhance disease resistance and enable uniform seed placement. The U.S. Department of Agriculture’s emphasis on sustainable agriculture and yield optimization is encouraging farmers to utilize bio-based and multi-functional seed coatings. Moreover, U.S.-based agri-tech firms are actively developing advanced formulations that combine polymers, micronutrients, and active ingredients to improve early-stage crop establishment.

Europe Seed Coating Market Insight

The Europe seed coating market is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising demand for eco-friendly and sustainable agricultural practices. Strict EU regulations on agrochemicals are propelling the adoption of biological seed coatings that offer protection without compromising environmental safety. European farmers are increasingly turning to encrusting and film-coating techniques to improve seed handling and reduce waste during sowing. Demand is especially robust in countries such as Germany and France, where modern farming methods and high-value crops dominate the agricultural landscape.

U.K. Seed Coating Market Insight

The U.K. seed coating market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing consumer demand for high-quality, residue-free produce and regulatory support for sustainable farming solutions. British farmers are showing rising interest in polymer-based and organic seed coatings that aid in disease control and moisture retention. The expansion of greenhouse cultivation and urban farming in the U.K. also supports the adoption of precision seed technologies to maximize space and resources effectively.

Germany Seed Coating Market Insight

The Germany is expected to witness the fastest growth rate from 2025 to 2032, supported by its advanced agricultural sector, research institutions, and strong demand for high-yielding seeds. The market benefits from widespread awareness about crop protection, climate adaptation, and efficient fertilizer delivery via coated seeds. With the country focusing on reducing pesticide usage, seed coatings incorporating biostimulants and natural active ingredients are gaining considerable traction in cereals, vegetables, and oilseeds.

Asia-Pacific Seed Coating Market Insight

The Asia-Pacific seed coating market is expected to witness the fastest growth rate from 2025 to 2032, driven by growing agricultural output, increasing population, and rising demand for high-yield crops in countries such as China, India, and Japan. Governments in the region are investing in modernizing farming practices and improving food security, creating fertile ground for seed coating technologies. The market is also supported by expanding awareness of seed treatment benefits, particularly among smallholder farmers. Moreover, domestic agrochemical manufacturers are introducing affordable and region-specific coating formulations to penetrate rural markets.

China Seed Coating Market Insight

The China accounted for the largest market share in the Asia-Pacific seed coating market in 2024, attributed to the country's vast agricultural base and government support for modern farming methods. Coated seeds are being widely adopted in rice, wheat, and corn cultivation, enhancing plant vigor and pest resistance. With a strong domestic manufacturing base and rising investments in sustainable agri-inputs, the seed coating industry in China is expected to witness robust growth across both food and cash crops.

Japan Seed Coating Market Insight

The Japan seed coating market is expected to witness the fastest growth rate from 2025 to 2032, supported by the country's strong focus on agricultural innovation, food quality, and sustainability. Japanese farmers are increasingly adopting advanced seed technologies such as film coating and pelleting to improve seed handling, uniformity in sowing, and early-stage crop performance—particularly in high-value crops such as vegetables and horticultural plants. The country’s emphasis on reducing chemical inputs and promoting precision farming practices also contributes to the rising use of seed coatings that incorporate bioactive and environmentally friendly additives. With ongoing investments in smart agriculture and automation, Japan continues to drive demand for coated seeds that align with its efficiency and quality-oriented cultivation systems.

Seed Coating Market Share

The Seed Coating industry is primarily led by well-established companies, including:

- Germain Seed Technology, Inc. (U.S.)

- Bayer AG (Germany)

- BASF SE (Germany)

- Clariant AG (Switzerland)

- Croda International PLC (U.K.)

- BrettYoung Seeds Limited (Canada)

- Sensient Technologies (U.S.)

- Precision Laboratories LLC (U.S.)

- Centor Oceania (Australia)

Latest Developments in Global Seed Coating Market

- In February 2022, Croda International joined forces with Xampla to develop a seed coating that is entirely biodegradable and free from microplastics. This partnership positions Croda International at the forefront of the seed coating materials market, enabling the company to provide sustainable solutions in compliance with microplastic bans in certain countries

- In July 2021, Solvay, a company specializing in seed and grain solutions, acquired the Bayer Seed coating business. This acquisition is set to strengthen Solvay's product portfolio and enhance its research and development capabilities for seed-related products

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.