Global Seed Coating Polymers Market

Market Size in USD Billion

CAGR :

%

USD

12.88 Billion

USD

24.02 Billion

2024

2032

USD

12.88 Billion

USD

24.02 Billion

2024

2032

| 2025 –2032 | |

| USD 12.88 Billion | |

| USD 24.02 Billion | |

|

|

|

|

Seed Coating Polymers Market Size

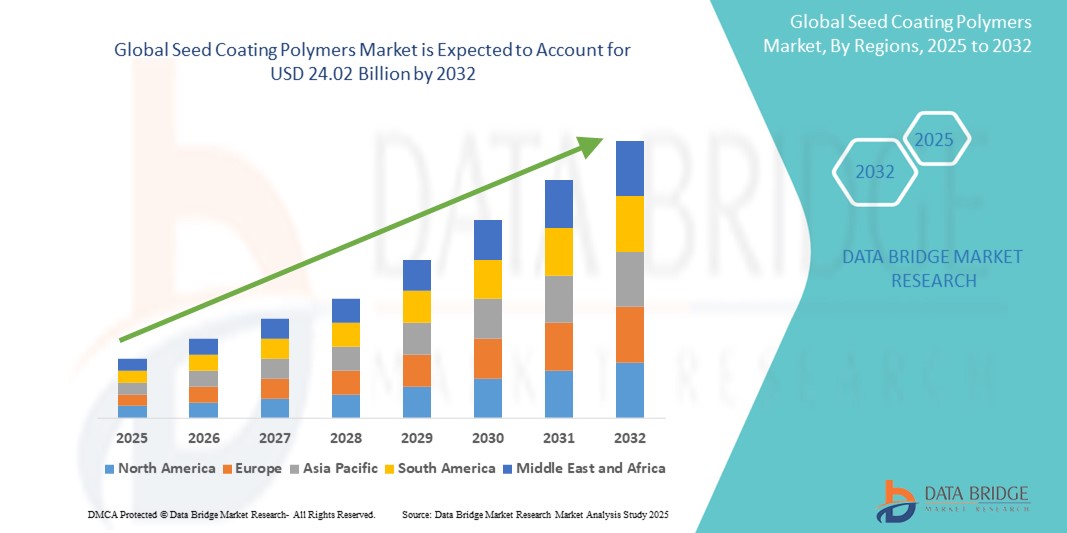

- The global seed coating polymers market size was valued at USD 12.88 billion in 2024 and is expected to reach USD 24.02 billion by 2032, at a CAGR of 8.10% during the forecast period

- The market growth is largely fueled by the increasing demand for high-performance seeds and the rising adoption of sustainable agricultural practices, prompting the use of seed coating polymers to enhance germination, protect against pests and diseases, and support precision planting across diverse crop types

- Furthermore, growing concerns regarding microplastic pollution, regulatory pressures in regions such as Europe, and advancements in biodegradable and biologically active coating technologies are accelerating innovation and uptake of eco-friendly seed coating polymers, thereby significantly boosting the industry's growth

Seed Coating Polymers Market Analysis

- Seed coating polymers are specialized formulations applied to seeds to improve handling, uniformity, protection, and planting performance. These polymers serve as carriers for active ingredients such as fungicides, nutrients, and growth promoters, while also enhancing the physical properties of seeds

- The growing popularity of precision agriculture, combined with increasing investment in high-yield seed technologies and the development of microplastic-free, biodegradable coatings, is driving the adoption of seed coating polymers across cereals, oilseeds, vegetables, and specialty crops

- North America dominated the seed coating polymers market with a share of 40.3% in 2024, due to the widespread adoption of advanced agricultural practices and a strong focus on crop yield optimization

- Asia-Pacific is expected to be the fastest growing region in the seed coating polymers market during the forecast period due to rising food demand, expanding arable land, and the growing adoption of high-yield seeds in countries such as China and India

- Film coating segment dominated the market with a market share of 52.2% in 2024, due to its widespread adoption due to its simplicity, cost-effectiveness, and ability to apply a uniform layer of polymer with minimal impact on seed size and shape. Film coating is particularly suited for smaller seeds and offers benefits such as improved flowability, reduced dust-off, and better appearance without impairing germination performance

Report Scope and Seed Coating Polymers Market Segmentation

|

Attributes |

Seed Coating Polymers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Seed Coating Polymers Market Trends

“Rising Adoption of Precision Agriculture”

- The seed coating polymers market is experiencing robust growth as precision agriculture becomes more prevalent, enabling farmers to optimize resource use and enhance crop performance through targeted seed treatments

- For instance, leading companies such as BASF SE, Bayer CropScience, Croda International, and Syngenta are investing in advanced polymer-based seed coatings that improve seed flowability, enable controlled release of nutrients and protectants, and support higher germination rates in diverse field conditions

- The integration of biodegradable and water-based polymers is gaining traction, aligning with sustainability goals and regulatory requirements for environmentally friendly agricultural inputs

- Film coating technology, which provides a thin, uniform layer of polymer on seeds, is widely adopted for its ability to enhance seed handling, reduce dust-off, and facilitate precise mechanical sowing

- The use of seed coating polymers is expanding beyond row crops to specialty crops, vegetables, and greenhouse farming, driven by the need for consistent seed performance across various agricultural systems

- In conclusion, the convergence of precision agriculture, sustainability initiatives, and technological innovation is positioning seed coating polymers as a critical enabler of modern, high-efficiency farming practices worldwide

Seed Coating Polymers Market Dynamics

Driver

“Increasing Emphasis on Crop Efficiency”

- The growing need to maximize crop yields and resource efficiency is a primary driver for the seed coating polymers market, as farmers seek to improve germination rates, plant vigor, and early-stage crop establishment

- For instance, polymer coatings are widely used in crops such as wheat, corn, and soybeans to enhance seed adhesion, reduce mechanical damage during sowing, and enable the integration of nutrients, pesticides, and growth stimulants for tailored crop solutions

- Advances in polymer chemistry and formulation are enabling the development of coatings that provide protection against environmental stresses such as moisture fluctuations, pests, and diseases, supporting resilient crop production

- The adoption of genetically engineered and high-value seeds is fueling demand for sophisticated seed coatings that protect seed investments and promote uniform crop emergence

- Regulatory encouragement for green agrochemicals and the need for sustainable, cost-effective inputs in large agricultural economies are further accelerating the adoption of seed coating polymers

Restraint/Challenge

“Limited Adoption in Traditional Farming Practices”

- The uptake of seed coating polymers remains limited among small-scale and traditional farmers, particularly in regions where awareness, technical expertise, or access to advanced inputs is low

- For instance, in developing agricultural markets, many growers continue to rely on conventional seed treatments or untreated seeds due to cost concerns, lack of training, or limited distribution of coated seed products

- The initial investment required for coated seeds and specialized sowing equipment can be a barrier for resource-constrained farmers, slowing broader market penetration

- Cultural preferences and skepticism toward new agricultural technologies may also hinder adoption, especially in areas with established traditional farming practices

- Regulatory uncertainties, especially regarding the environmental impact of synthetic polymers and microplastics, can affect market growth and require ongoing innovation in biodegradable and bio-based coating formulations

Seed Coating Polymers Market Scope

The market is segmented on the basis of crop type, process, and active ingredient.

- By Crop Type

On the basis of crop type, the seed coating polymers market is segmented into cereals and grains, oilseeds and pulses, vegetables, flowers and ornamentals, and others. The cereals and grains segment dominated the largest market revenue share in 2024, owing to the widespread global cultivation of crops such as wheat, rice, corn, and barley, which are central to food security and commercial agriculture. These crops are often treated with seed coating polymers to improve germination rates, protect against pests and diseases, and ensure uniform seed size for precision planting. The demand is further supported by government initiatives promoting high-yield varieties and sustainable farming practices.

The vegetables segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by the rising global demand for nutrient-rich food, increased commercial vegetable farming, and the need for high-quality planting materials. Seed coating polymers provide vegetable seeds with enhanced shelf life, resistance to microbial threats, and optimized emergence, which are critical for high-value crops cultivated under tight production cycles and often in controlled environments.

- By Process

On the basis of process, the market is segmented into film coating, encrusting, and pelleting. The film coating segment held the largest market revenue share of 52.2% in 2024, owing to its widespread adoption due to its simplicity, cost-effectiveness, and ability to apply a uniform layer of polymer with minimal impact on seed size and shape. Film coating is particularly suited for smaller seeds and offers benefits such as improved flowability, reduced dust-off, and better appearance without impairing germination performance.

The pelleting segment is projected to witness the fastest CAGR from 2025 to 2032, supported by the increasing mechanization of agriculture and the demand for precision planting. Pelleting transforms irregularly shaped seeds into spherical, size-graded units that are easier to handle and sow with automated equipment. This process is gaining traction in high-value crops where planting accuracy and uniform seedling emergence are critical, such as in vegetables, herbs, and flowers.

- By Active Ingredient

On the basis of active ingredient, the market is segmented into protectants and phytoactive promoters, and others. The protectants and phytoactive promoters segment accounted for the largest market revenue share in 2024, driven by the growing emphasis on early-stage plant protection and improved seedling vigor. Protectants such as fungicides, insecticides, and antimicrobials are commonly incorporated into coatings to shield seeds from soil-borne pathogens and pests, while phytoactive promoters include biostimulants and growth enhancers that support root development and stress tolerance.

The others segment is expected to grow at the fastest CAGR from 2025 to 2032, fueled by ongoing innovations in polymer chemistry and the integration of novel functional ingredients such as micronutrients, biofertilizers, and moisture-retentive agents. These advanced formulations aim to deliver multifunctional benefits in a single coating layer, aligning with the evolving needs of sustainable and resource-efficient farming systems.

Seed Coating Polymers Market Regional Analysis

- North America dominated the seed coating polymers market with the largest revenue share of 40.3% in 2024, driven by the widespread adoption of advanced agricultural practices and a strong focus on crop yield optimization

- Farmers across the region increasingly rely on seed coating polymers to enhance seed performance, protect against early-stage pests and diseases, and ensure uniform germination under varying climatic conditions

- The market is further supported by the presence of leading agrochemical companies, robust investment in agricultural R&D, and government initiatives promoting sustainable and precision farming practices

U.S. Seed Coating Polymers Market Insight

The U.S. seed coating polymers market captured the largest revenue share within North America in 2024, fueled by the country’s highly mechanized agriculture sector and large-scale cultivation of cereals, grains, and oilseeds. The demand for seed coating technologies is rising as farmers seek to maximize crop productivity and input efficiency. Increasing awareness about the environmental benefits of polymer coatings, including reduced pesticide leaching and improved seed handling, further supports market expansion.

Europe Seed Coating Polymers Market Insight

The Europe seed coating polymers market is projected to grow at a significant CAGR during the forecast period, supported by stringent environmental regulations and a growing emphasis on sustainable agriculture. The adoption of coated seeds is rising in response to EU mandates that encourage reduced chemical usage and enhanced seed treatment precision. The region benefits from strong institutional support for agricultural innovation and rising demand for high-quality horticultural and vegetable crops across countries such as Germany, France, and the Netherlands.

Germany Seed Coating Polymers Market Insight

Germany is expected to witness considerable growth in the seed coating polymers market due to its technologically advanced farming sector and focus on eco-friendly agricultural inputs. Farmers in Germany are progressively adopting coated seeds for cereals and vegetables to improve germination rates and ensure efficient sowing. The country’s leadership in agricultural engineering and sustainability initiatives further reinforces demand for polymer-based seed enhancement technologies.

Asia-Pacific Seed Coating Polymers Market Insight

The Asia-Pacific seed coating polymers market is anticipated to grow at the fastest CAGR from 2025 to 2032, driven by rising food demand, expanding arable land, and the growing adoption of high-yield seeds in countries such as China and India. Government subsidies, agricultural modernization programs, and growing awareness of the benefits of seed treatment technologies are accelerating regional market growth. In addition, local manufacturing of coating materials and increasing foreign investment in the agri-inputs sector are boosting availability and affordability.

China Seed Coating Polymers Market Insight

China held the largest revenue share in the Asia-Pacific seed coating polymers market in 2024, attributed to the rapid transformation of its agricultural sector, high population pressure on food production, and growing demand for crop enhancement inputs. The widespread cultivation of rice, corn, and vegetables is driving the need for coated seeds that improve crop uniformity and resilience. China’s strong domestic production capabilities and government support for agricultural innovation further propel market momentum.

India Seed Coating Polymers Market Insight

India is projected to experience robust growth in the seed coating polymers market over the forecast period, driven by increased investment in agricultural infrastructure, the shift toward high-quality hybrid seeds, and rising demand for cost-effective farming solutions. Farmers are adopting coated seeds to improve drought resistance, pest tolerance, and early-stage seed vigor. The government's emphasis on doubling farmer income and sustainable crop production is expected to support long-term growth in seed enhancement technologies.

Seed Coating Polymers Market Share

The seed coating polymers industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Bayer AG (Germany)

- Clariant (Switzerland)

- Croda International Plc (U.K.)

- Sensient Colors LLC (U.S.)

- BRETTYOUNG (China)

- Precision Laboratories, LLC (U.S.)

- Germains Seed Technology (U.K.)

- Organic Dyes and Pigments (U.S.)

- Element Solutions Inc (U.S.)

- CISTRONICS TECHNOVATIONS PVT. LTD (India)

- Prebbles Turf World (New Zealand)

- Smith Seed Services (U.S.)

- Michelman, Inc. (U.S.)

- Centor Oceania (Australia)

- Universal Coating Systems, LLC(U.S.)

Latest Developments in Global Seed Coating Polymers Market

- In November 2024, Milliken launched a microplastic-free (MPF) polymer technology in Brazil, integrated into its Milli Fusion product line. This innovation is expected to strengthen the market by addressing rising environmental concerns and regulatory pressures through sustainable seed pigmentation, improving seed performance without contributing to microplastic pollution

- In November 2024, GROWMARK and Indigo Ag announced a strategic partnership to increase the availability of powder-based biological seed coatings, enabled by Indigo’s new CLIPS flowable powder application system. This development reflects a broader market trend toward eco-friendly and biologically driven seed solutions, promoting both environmental sustainability and improved economic returns for farmers

- In January 2024, Lucent BioSciences introduced Nutreos, a biodegradable seed coating designed to eliminate microplastics from agricultural inputs. This launch aligns with recent European Union regulations phasing out microplastics and is expected to accelerate market demand for compliant, environmentally responsible seed coating alternatives

- In November 2023, BASF Agricultural Solutions introduced Flo Rite® Pro 02, an advanced plantability polymer that enhances seed flow and adhesion. This innovation supports market growth by improving sowing precision and maximizing yield potential, addressing growers' needs for performance-driven seed treatment technologies

- In October 2021, BASF SE launched the trinamiX mobile Near Infrared (NIR) spectroscopy solution for the feed industry, streamlining on-site analysis of animal feed and ingredients. This innovation eliminates the need for customers to send samples to laboratories, providing a faster and more convenient testing process, consequently attracting more customers across the value chain

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.