Global Seed Testing Services Market

Market Size in USD Billion

CAGR :

%

USD

1.70 Billion

USD

2.72 Billion

2024

2032

USD

1.70 Billion

USD

2.72 Billion

2024

2032

| 2025 –2032 | |

| USD 1.70 Billion | |

| USD 2.72 Billion | |

|

|

|

|

Seed Testing Services Market Size

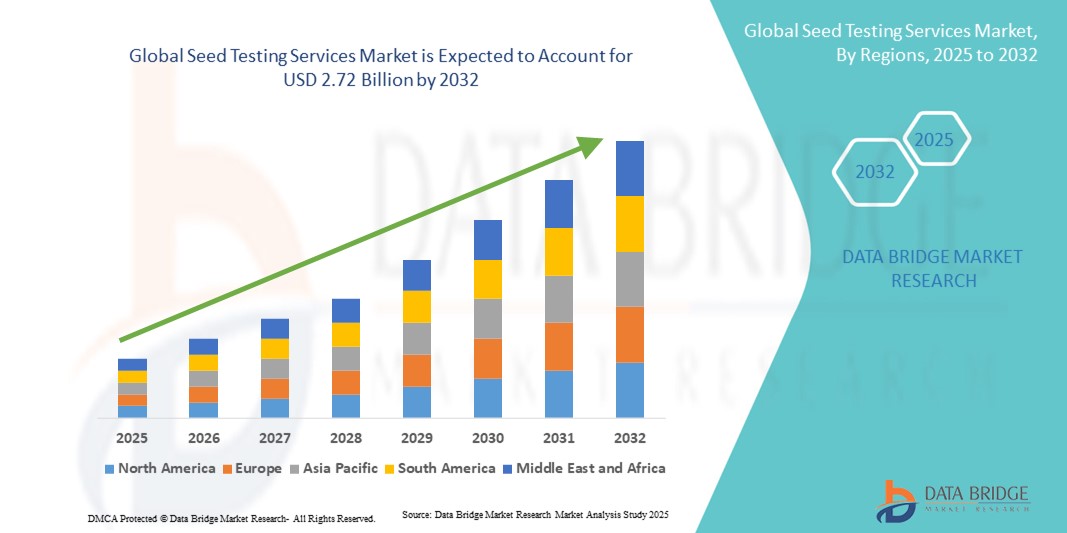

- The global seed testing services market size was valued at USD 1.7 billion in 2024 and is expected to reach USD 2.72 billion by 2032, at a CAGR of 6.09% during the forecast period

- The market growth is largely fuelled by the increasing emphasis on seed quality certification, rising demand for high-yield and disease-resistant crops, and the growing role of seed testing in supporting sustainable agriculture

- Expanding global food demand and stricter regulatory standards for seed trade are further accelerating the adoption of professional seed testing services

Seed Testing Services Market Analysis

- The market is witnessing robust growth as governments, agricultural institutions, and private seed companies increasingly prioritize reliable testing solutions to ensure seed quality, safety, and compliance

- Growing awareness among farmers about the benefits of certified seeds in achieving higher crop productivity is creating strong demand for testing services worldwide

- North America dominated the seed testing services market with the largest revenue share of 38.5% in 2024, driven by a strong presence of certified seed companies, stringent quality regulations, and the rising demand for high-yield crop varieties

- Asia-Pacific region is expected to witness the highest growth rate in the global seed testing services market, driven by expanding food demand, urbanization, growing seed production, and adoption of advanced testing services in countries such as China, India, and Japan

- The germination test segment held the largest market revenue share in 2024, driven by its critical role in determining seed viability and ensuring compliance with international trade and certification standards. Germination testing remains a core requirement for both domestic and export markets, making it the most widely used service among seed companies

Report Scope and Seed Testing Services Market Segmentation

|

Attributes |

Seed Testing Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Seed Testing Services Market Trends

Integration Of Digital Technologies In Seed Testing

- The adoption of digital and automated technologies is reshaping the seed testing services market by enhancing precision, speed, and scalability in quality assessment. Digital imaging systems, AI-based analysis, and automated germination testing platforms allow laboratories to deliver highly accurate results with reduced manual errors. This shift is especially valuable in large-scale seed production where consistency is critical

- The growing demand for traceability and certification in global seed trade is accelerating the use of blockchain-enabled platforms and cloud-based data systems. These solutions streamline recordkeeping and ensure transparent communication across supply chains, building trust among farmers, regulators, and consumers

- Automation and digitization are also reducing turnaround times and operational costs, making testing services more accessible to seed companies and agricultural cooperatives. This supports compliance with international quality standards while strengthening competitiveness in global markets

- For instance, in 2023, several seed testing laboratories in Europe introduced AI-driven germination analysis tools that delivered faster and more reliable results compared to traditional manual counting. This enabled seed producers to meet export timelines and improve certification efficiency

- While digital technologies are driving accuracy and scalability, their adoption requires significant investment, staff training, and regulatory alignment. Service providers must adapt localized strategies to expand adoption in developing regions and balance innovation with affordability

Seed Testing Services Market Dynamics

Driver

Growing Demand For High-Quality Seeds To Enhance Crop Yields

- The rising global population and increasing food demand are pushing farmers and governments to focus on high-yield, disease-resistant crop varieties. Certified seed testing ensures better germination rates, purity, and vigor, positioning it as a cornerstone of modern agriculture

- Farmers and agribusinesses are increasingly aware of the risks associated with poor-quality seeds, including low yields, pest susceptibility, and wasted inputs. This awareness has led to higher reliance on formal testing services, even among small and mid-sized seed producers

- Government-backed certification programs and international quality frameworks are strengthening the adoption of professional seed testing services. Subsidies, training initiatives, and stricter seed trade regulations are supporting the industry’s expansion

- For instance, in 2022, India’s Ministry of Agriculture rolled out a nationwide initiative mandating seed certification for hybrid varieties, which boosted demand for germination and purity testing services across multiple states

- While awareness and regulatory support are driving market growth, there remains a need to expand laboratory networks, standardize testing methods globally, and ensure affordable access for small-scale producers

Restraint/Challenge

High Cost Of Advanced Testing Equipment And Limited Availability In Developing Regions

- The high price of advanced seed testing technologies, such as genetic purity analyzers and high-throughput germination systems, creates entry barriers for smaller testing laboratories and local cooperatives. This limits access to professional testing services in resource-constrained regions

- Many developing countries face a shortage of trained personnel capable of handling complex testing equipment and interpreting advanced results. Infrastructure gaps and logistical hurdles further delay timely testing and certification

- Supply chain disruptions and inconsistent reagent availability in rural areas often force farmers to depend on uncertified seeds, leading to compromised yields and higher production risks

- For instance, in 2023, seed cooperatives across Sub-Saharan Africa reported that over 60% of smallholder farmers lacked access to certified seed testing facilities, citing high costs and inadequate infrastructure as key barriers

- While technological innovations are expanding service capabilities, overcoming cost and accessibility issues will be crucial. Stakeholders must prioritize decentralized testing labs, portable kits, and scalable digital solutions to close the quality gap and unlock growth in underserved markets

Seed Testing Services Market Scope

The market is segmented on the basis of test type, service type, seed type, and end user.

- By Test Type

On the basis of test type, the seed testing services market is segmented into purity test, moisture test, vigour test, germination test, and others. The germination test segment held the largest market revenue share in 2024, driven by its critical role in determining seed viability and ensuring compliance with international trade and certification standards. Germination testing remains a core requirement for both domestic and export markets, making it the most widely used service among seed companies.

The vigour test segment is expected to witness the fastest growth rate from 2025 to 2032, owing to rising demand for high-performance seeds capable of withstanding variable climatic conditions. Vigour testing provides valuable insights into seed strength and resilience, making it increasingly popular among commercial seed producers and large-scale farmers.

- By Service Type

On the basis of service type, the seed testing services market is segmented into off-site and on-site. The off-site segment accounted for the largest share in 2024, supported by the widespread use of accredited laboratory facilities equipped with advanced testing instruments and certified procedures. Off-site testing ensures standardized results that meet global benchmarks, appealing to seed exporters and large agricultural enterprises.

The on-site segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the rising adoption of portable testing kits and mobile laboratories that bring seed quality checks directly to farms and cooperatives. On-site services are particularly effective in reducing delays and enhancing accessibility for small and mid-sized farmers.

- By Seed Type

On the basis of seed type, the seed testing services market is segmented into cereal seeds, vegetable seeds, and flower seeds. The cereal seeds segment dominated the market in 2024, attributed to the high demand for staple crops such as wheat, rice, and maize, which require strict quality control to maintain food security and productivity levels.

The vegetable seeds segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the growing popularity of high-value horticultural crops and the rising focus on hybrid varieties that require frequent testing for purity and performance.

- By End User

On the basis of end user, the seed testing services market is segmented into seed manufacturers, farmers, agriculture consultants, research bodies, and others. The seed manufacturers segment held the largest share in 2024, driven by the increasing need for compliance with quality standards, certification processes, and international trade regulations. Seed manufacturers rely heavily on testing services to maintain brand reputation and market competitiveness.

The farmers segment is expected to witness the fastest growth rate from 2025 to 2032, due to increasing awareness of the benefits of certified seeds in boosting yield and reducing crop failure risks. Affordable access to seed testing is making such services more attractive to smallholder and mid-sized farmers across emerging economies.

Seed Testing Services Market Regional Analysis

- North America dominated the seed testing services market with the largest revenue share of 38.5% in 2024, driven by a strong presence of certified seed companies, stringent quality regulations, and the rising demand for high-yield crop varieties

- Farmers and seed producers in the region increasingly value the role of seed testing in ensuring productivity, disease resistance, and export compliance

- This adoption is further supported by advanced agricultural practices, strong institutional frameworks, and a technologically aware farming community, positioning seed testing services as an essential part of modern agribusiness

U.S. Seed Testing Services Market Insight

The U.S. seed testing services market captured the largest revenue share in 2024 within North America, fueled by the expansion of genetically modified crops and the growing emphasis on seed certification for both domestic and export markets. Farmers are prioritizing testing for purity, germination, and vigor to ensure consistency in yields. The adoption of DNA-based diagnostics and government-supported quality programs is further driving market growth. Additionally, increasing collaborations between seed companies and research institutes are reinforcing the market’s expansion.

Europe Seed Testing Services Market Insight

The Europe seed testing services market is expected to witness the fastest growth rate from 2025 to 2032, driven by strict EU regulations on seed trade and the demand for high-quality, certified seeds across multiple crops. The adoption of sustainable farming practices, combined with rising consumer demand for non-GMO and organic seeds, is boosting the need for advanced testing services. Seed laboratories and certification bodies across the region are investing in innovative technologies to support large-scale testing and cross-border trade compliance.

U.K. Seed Testing Services Market Insight

The U.K. seed testing services market is expected to witness the fastest growth rate from 2025 to 2032, supported by the increasing adoption of certified seeds to meet domestic food security needs and export requirements. Rising awareness among farmers about the benefits of seed quality testing, coupled with government-backed seed certification schemes, is fostering growth. The demand for hybrid seeds and innovations in plant breeding further support the adoption of seed testing services across the country.

Germany Seed Testing Services Market Insight

The Germany seed testing services market is expected to witness the fastest growth rate from 2025 to 2032, fueled by the country’s advanced agricultural infrastructure and emphasis on precision farming. German farmers and seed companies prioritize high-quality seeds to maximize crop efficiency and reduce risks of disease outbreaks. The adoption of technologically advanced testing methods, including molecular diagnostics, is becoming more prevalent, aligning with Germany’s focus on sustainability and innovation in agriculture.

Asia-Pacific Seed Testing Services Market Insight

The Asia-Pacific seed testing services market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising food demand, expanding agricultural activities, and supportive government programs in countries such as China, India, and Japan. Increasing awareness of the importance of certified seeds in enhancing yields is accelerating the adoption of testing services. Additionally, the emergence of APAC as a hub for seed production and trade is expanding the demand for large-scale and cost-effective testing solutions.

Japan Seed Testing Services Market Insight

The Japan seed testing services market is expected to witness the fastest growth rate from 2025 to 2032 due to the country’s focus on high-value crops, advanced agricultural technologies, and the need for consistent seed quality in both domestic and export markets. The market is being shaped by strict quality standards and rising interest in innovative seed testing methods. Moreover, Japan’s aging farming population is increasing reliance on certified seeds and professional testing services to ensure productivity and efficiency.

China Seed Testing Services Market Insight

The China seed testing services market accounted for the largest market revenue share in Asia Pacific in 2024, attributed to the country’s massive agricultural base, rapid modernization of farming practices, and strong government regulations on seed certification. China’s push for food security and high-yield crop production has increased the demand for quality-assured seeds. The expansion of domestic seed companies, along with affordable testing solutions and large-scale breeding programs, is propelling the growth of the seed testing services market in the country.

Seed Testing Services Market Share

The Seed Testing Services industry is primarily led by well-established companies, including:

- DuPont (U.S.)

- Intertek Group plc (U.K.)

- Bureau Veritas (France)

- Syngenta Crop Protection AG (Switzerland)

- Bayer AG (Germany)

- Land O'Lakes, Inc. (U.S.)

- DLF Seeds A/S (Denmark)

- Sakata Seed America (U.S.)

- TAKII & CO., LTD. (Japan)

- Adama Agricultural Solutions Ltd. (Israel)

- ALS Limited (Australia)

- KWS SAAT SE & Co. KGaA (Germany)

- Rijk Zwaan Zaadteelt en Zaadhandel B.V. (Netherlands)

- R J Hill Laboratories Limited (New Zealand)

- SGS SA (Switzerland)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.