Global Self Adhesive Vinyl Films Market

Market Size in USD Billion

CAGR :

%

USD

3.90 Billion

USD

5.61 Billion

2024

2032

USD

3.90 Billion

USD

5.61 Billion

2024

2032

| 2025 –2032 | |

| USD 3.90 Billion | |

| USD 5.61 Billion | |

|

|

|

|

Self-Adhesive Vinyl Films Market Size

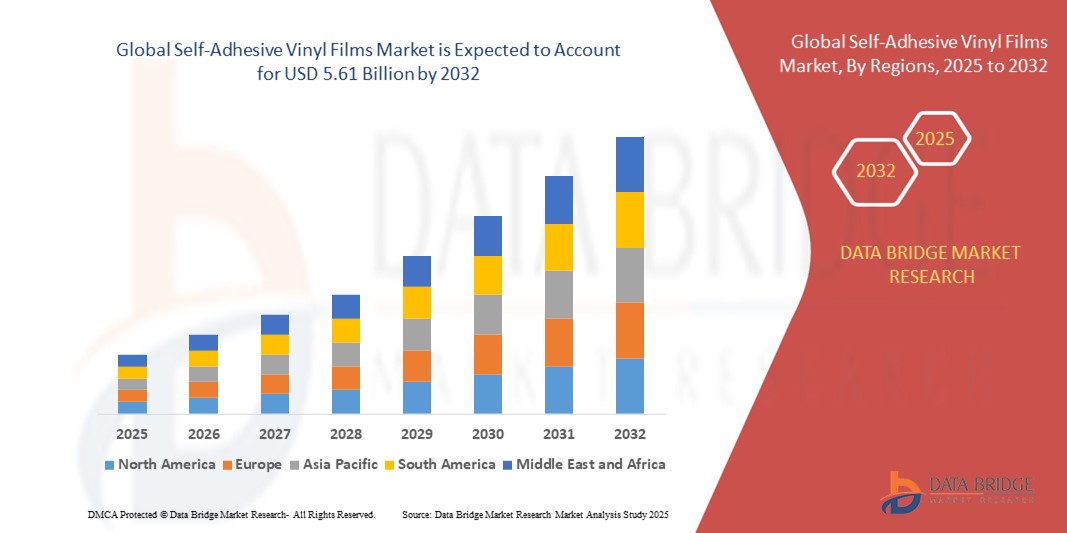

- The global self-adhesive vinyl films market size was valued at USD 3.90 billion in 2024 and is projected to reach USD 5.61 billion by 2032, with a CAGR of 4.65% during the forecast period

- Market expansion is driven by increasing demand across sectors such as advertising, automotive, and construction, where vinyl films are utilized for signage, vehicle wraps, and decorative applications, owing to their durability and ease of application

- In addition, the rising emphasis on visually appealing branding and cost-effective promotional materials is propelling the adoption of self-adhesive vinyl films globally. This growing usage, coupled with innovations in printing and adhesive technologies, continues to fuel the market’s steady growth trajectory

Self-Adhesive Vinyl Films Market Analysis

- Self-adhesive vinyl films, known for their pressure-sensitive adhesive backing, are widely used in signage, vehicle wraps, interior décor, and industrial labeling due to their durability, ease of application, and compatibility with various surfaces and printing technologies

- The growing demand is largely driven by expanding advertising and branding needs, rapid urbanization, and increased investments in infrastructure and automotive customization, as businesses seek cost-effective, visually impactful display and promotional solutions

- Asia-Pacific dominated the self-adhesive vinyl films market with the largest revenue share of 38.6% in 2023, driven by strong demand across the advertising, automotive, and construction industries, along with rapid urbanization and infrastructure development

- The North America self-adhesive vinyl films market is projected to grow at the fastest CAGR of 14.56% during the forecast period, supported by high advertising spend, advanced printing technologies, and widespread demand in the automotive and construction sectors

- The opaque segment dominated the market with the largest market revenue share of 46.3% in 2024, primarily due to its extensive application in outdoor advertising, vehicle graphics, and signage where strong color contrast and UV resistance are required

Report Scope and Market Segmentation

|

Attributes |

Self-Adhesive Vinyl Films Ingredients Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Self-Adhesive Vinyl Films Market Trends

Sustainable and Customizable Solutions Driving Demand

- A prominent and growing trend in the global self-adhesive vinyl films market is the shift toward sustainable, eco-friendly, and customizable film solutions, fueled by environmental regulations, changing consumer preferences, and the need for high-impact visual communication in branding and décor

- Manufacturers are increasingly introducing PVC-free and recyclable self-adhesive vinyl films, reducing environmental impact while maintaining the durability and printability that brands and designers rely on. For instance, 3M and Avery Dennison have developed eco-conscious product lines that meet both performance and sustainability standards

- Customization is also playing a key role in market growth, with advancements in digital printing technology allowing for precise, vibrant, and personalized designs for everything from vehicle wraps and window graphics to interior décor. These customizable films are in high demand in retail, hospitality, and automotive sectors where visual identity and aesthetics are crucial

- Innovations in adhesive technology have led to the development of repositionable, bubble-free, and residue-free adhesives, enhancing ease of application and removal particularly valuable in temporary promotional campaigns or seasonal décor changes. This user-friendly approach broadens the appeal across both commercial and consumer segments

- The rise of interior design trends emphasizing quick aesthetic updates has also driven increased usage of self-adhesive vinyl films in home and office spaces for walls, furniture, and glass surfaces. Companies such as ORAFOL and Hexis offer a wide range of textures and finishes that replicate materials such as wood, metal, and marble

- Overall, the convergence of sustainability, advanced printing capabilities, and consumer demand for flexible, on-demand customization is redefining the market landscape. As a result, key players are prioritizing R&D to create more eco-efficient and design-forward solutions, positioning the industry for continued innovation and growth

Self-Adhesive Vinyl Films Market Dynamics

Driver

Rising Demand for Visual Branding and Interior Aesthetics

- The growing emphasis on impactful visual communication and interior customization across industries such as retail, automotive, and construction is a key driver for the increasing demand for self-adhesive vinyl films. Businesses are investing in eye-catching signage, vehicle wraps, and promotional graphics to enhance brand visibility and consumer engagement

- For instance, major retail chains and automotive service providers are increasingly using high-resolution printed vinyl films for storefronts and fleet branding, owing to their durability, easy application, and cost-efficiency. This widespread commercial adoption is propelling market growth globally

- In the interior décor segment, the surge in demand for DIY-friendly, customizable, and removable design solutions is driving consumers toward self-adhesive vinyl films for wall coverings, furniture wraps, and glass decoration. Products offering aesthetic variety—such as wood grain, marble, or metallic textures—are especially popular for temporary or seasonal interior makeovers

- In addition, advancements in digital printing technologies and adhesive formulations are enabling faster, more flexible production, supporting on-demand customization and reducing installation time. This is further expanding usage in events, exhibitions, and hospitality settings, where speed and visual appeal are critical

- The combination of creative flexibility, cost-effectiveness, and ease of use makes self-adhesive vinyl films a preferred choice in both commercial and residential sectors, with the trend toward short-term promotional and aesthetic applications continuing to fuel steady market growth

Restraint/Challenge

Environmental Concerns and Raw Material Volatility

- A key challenge facing the self-adhesive vinyl films market is growing environmental scrutiny over the use of PVC-based products and the associated challenges in recycling these materials. Traditional vinyl films, particularly those with solvent-based adhesives, pose sustainability concerns, potentially limiting their appeal amid rising global emphasis on eco-friendly alternatives

- Government regulations in regions such as the EU are tightening restrictions on single-use plastics and VOC emissions, pushing manufacturers to invest in greener alternatives. However, the transition to sustainable materials such as PVC-free or biodegradable films often comes with higher production costs, which may deter adoption, especially in price-sensitive markets

- For instance, while companies such as Avery Dennison and 3M have introduced environmentally friendly product lines, their higher price points compared to conventional vinyl options can be a barrier for small businesses or budget-conscious consumers

- Another ongoing challenge is the volatility in raw material prices, particularly petroleum-based resins and adhesives, which can significantly impact production costs and pricing stability for manufacturers. This unpredictability may disrupt supply chains and reduce profit margins, especially in regions with limited local manufacturing

- Addressing these restraints requires continuous innovation in sustainable product development, investment in recycling infrastructure, and the adoption of cost-effective, eco-friendly materials to align with evolving regulatory and consumer expectations

Self-Adhesive Vinyl Films Market Scope

The market is segmented on the basis of type, category, width, manufacturing process, adhesive type, substrate, thickness, and application.

- By Type

On the basis of type, the self-adhesive vinyl film market is segmented into opaque, transparent, and translucent. The opaque segment dominated the market with the largest market revenue share of 46.3% in 2024, primarily due to its extensive application in outdoor advertising, vehicle graphics, and signage where strong color contrast and UV resistance are required. Opaque films are valued for their durability and ability to conceal underlying surfaces, making them a preferred choice for branding and promotional campaigns.

The transparent segment is anticipated to witness the fastest CAGR from 2025 to 2032, driven by growing demand in window graphics, decorative applications, and promotional displays. Transparent films offer clarity, allow visibility of underlying surfaces, and are widely adopted in retail environments for glass-front displays. The versatility and design flexibility of transparent vinyl films are expected to accelerate their adoption across commercial advertising and architectural applications.

- By Category

On the basis of category, the market is segmented into printable and non-printable self-adhesive vinyl films. The printable segment dominated the market with a revenue share of 58.7% in 2024, supported by its wide use in digital printing for advertising, exhibition graphics, and custom signage. Printable vinyl films are compatible with inkjet and solvent printers, offering high-quality image reproduction, flexibility in design, and long-term durability. The rising trend of personalized branding and event promotion further enhances demand for printable films.

The non-printable segment is expected to register the fastest CAGR from 2025 to 2032, as these films are increasingly adopted for interior decoration, protective coverings, and functional applications where no customization is needed. Non-printable vinyl films provide cost-effectiveness and simplicity, making them suitable for large-scale use in furniture lamination, surface protection, and wallcovering applications, especially in commercial and residential spaces.

- By Width

On the basis of width, the market is segmented into middle size width (approx. 137 cm), big size width (152–160 cm), and small size width (below 110 cm). The middle size width segment held the largest revenue share of 41.5% in 2024, as it is the most versatile option preferred for vehicle wraps, window graphics, and retail advertising. Its balanced size makes it compatible with standard printing equipment while offering flexibility for medium-to-large-scale installations.

The big size width segment is projected to grow at the fastest CAGR during 2025–2032, fueled by increasing demand in large-scale outdoor advertising, billboards, and fleet graphics that require broader coverage without joints. Advancements in printing technology and growing urbanization, particularly in Asia-Pacific, are driving adoption of wide-format advertising materials. The growing preference for impactful visual marketing will continue to strengthen demand for big size vinyl films in the coming years.

- By Manufacturing Process

On the basis of manufacturing process, the market is segmented into calendered films and cast films. The calendered films segment dominated the market with a revenue share of 63.8% in 2024, owing to their cost-effectiveness, durability, and suitability for short- to medium-term applications such as promotional graphics and wall decals. These films are widely adopted in both indoor and outdoor advertising due to their balance between affordability and performance.

The cast films segment is expected to witness the fastest CAGR from 2025 to 2032, driven by their premium quality, high conformability, and superior durability, making them ideal for vehicle wraps and long-term branding projects. Cast films can stretch and adhere to complex surfaces without shrinking, offering higher performance in harsh weather conditions. Their increasing adoption in automotive, fleet, and architectural applications is expected to fuel strong growth over the forecast period.

- By Adhesive Type

On the basis of adhesive type, the market is segmented into removable self-adhesive vinyl film and permanent self-adhesive vinyl film. The permanent adhesive segment dominated the market with 55.9% revenue share in 2024, driven by its reliability and strong bonding properties, making it a popular choice for long-term branding, outdoor signage, and industrial uses. Permanent adhesives are valued for their ability to withstand environmental stress and resist peeling, ensuring durability.

The removable adhesive segment is projected to grow at the fastest CAGR between 2025 and 2032, supported by increasing demand for temporary graphics, promotional campaigns, and seasonal displays. Businesses prefer removable adhesives for flexibility in advertising, as they can be easily replaced without damaging the surface. This segment is also gaining popularity in exhibitions and event-based branding where short-term application is essential.

- By Substrate

On the basis of substrate, the market is segmented into plastics, glass, floor, and others. The plastic substrate segment held the largest revenue share of 48.6% in 2024, supported by its wide applicability in retail displays, labels, and packaging. Plastic substrates offer durability, light weight, and flexibility, making them highly compatible with vinyl films.

The glass substrate segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the rising use of window graphics, decorative films, and architectural branding in commercial and residential spaces. Transparent and frosted self-adhesive vinyl films on glass surfaces offer both functional and aesthetic benefits, such as privacy, branding, and energy efficiency. The growing adoption of glass façades and interiors in modern architecture further supports demand for vinyl films on glass substrates.

- By Thickness

On the basis of thickness, the market is segmented into thin (2–3 mils) and thick (more than 3 mils). The thin films segment dominated the market with 57.2% revenue share in 2024, as they are lightweight, flexible, and easier to handle during printing and application. Thin films are widely used in advertising and promotional graphics due to their affordability and adaptability across diverse surfaces.

The thick films segment is anticipated to grow at the fastest CAGR from 2025 to 2032, owing to their higher durability, resistance to wear, and suitability for heavy-duty applications such as floor graphics and long-term outdoor advertising. Their strength and extended lifespan make them increasingly attractive for industries requiring robust and long-lasting branding solutions.

- By Application

On the basis of application, the market is segmented into fleet graphics, floor graphics, window graphics, car wrapping, labels & stickers, exhibition & stickers, outdoor advertising, furniture decoration, advertising & branding, wallcovering, and others. The outdoor advertising segment dominated the market with a revenue share of 33.4% in 2024, owing to growing demand for cost-effective, durable, and impactful branding solutions in billboards, hoardings, and public spaces. Self-adhesive vinyl films provide weather resistance and vibrant image quality, making them ideal for large-scale visibility.

The car wrapping segment is expected to register the fastest CAGR from 2025 to 2032, supported by increasing automotive personalization trends, fleet branding requirements, and advancements in cast vinyl film technology. Car wrapping offers businesses and individuals a versatile, removable, and cost-efficient alternative to paint, making it one of the most dynamic growth areas in the market.

Self-Adhesive Vinyl Films Market Regional Analysis

- Asia-Pacific dominated the self-adhesive vinyl films market with the largest revenue share of 38.6% in 2023, driven by strong demand across the advertising, automotive, and construction industries, along with rapid urbanization and infrastructure development

- Businesses in the region increasingly use vinyl films for promotional graphics, vehicle wraps, and interior décor due to their versatility, durability, and cost-efficiency

- The market benefits from a large manufacturing base, rising consumer interest in DIY interior upgrades, and the widespread adoption of digitally printed signage, especially in countries such as China, India, and Southeast Asia. These factors are positioning Asia-Pacific as a key hub for both production and consumption of vinyl film products across multiple sectors

China Self-Adhesive Vinyl Films Market Insight

The China self-adhesive vinyl films market held the largest revenue share within Asia-Pacific in 2023, attributed to the country’s strong advertising sector, large-scale urban development, and rapid automotive production. China's position as a global manufacturing hub enables cost-effective production, making vinyl films widely accessible. In addition, the adoption of digitally printed vinyl films in commercial and residential décor is rising steadily, supported by expanding e-commerce platforms and consumer DIY trends.

India Self-Adhesive Vinyl Films Market Insight

India’s self-adhesive vinyl films market is projected to grow at the fastest CAGR during the forecast period, supported by growing retail activity, infrastructure modernization, and the increasing use of vinyl films in vehicle graphics and signage. The rising popularity of personalized interior décor and branding in small and medium businesses is boosting demand. In addition, the government's push for smart cities and urban beautification initiatives is increasing the use of vinyl films in public and commercial spaces.

North America Self-Adhesive Vinyl Films Market Insight

The North America self-adhesive vinyl films market is projected to grow at the fastest CAGR of 14.56% during the forecast period, supported by high advertising spend, advanced printing technologies, and widespread demand in the automotive and construction sectors. Consumers and businesses in the region favor eco-friendly and digitally printable vinyl solutions, with increasing emphasis on recyclable materials. The use of vinyl films in home improvement projects and retail displays further supports consistent demand across the U.S. and Canada.

U.S. Self-Adhesive Vinyl Films Market Insight

The U.S. self-adhesive vinyl films market accounted for the largest revenue share in North America in 2023, driven by strong demand in advertising, automotive wraps, and interior decoration. The country’s developed infrastructure, mature retail sector, and focus on sustainable branding materials are driving the adoption of innovative vinyl solutions. Moreover, growing interest in customized, short-term promotional graphics supports the usage of repositionable and easy-to-apply vinyl products.

Europe Self-Adhesive Vinyl Films Market Insight

Europe’s self-adhesive vinyl films market is expected to expand at a substantial CAGR during the forecast period, driven by increasing environmental regulations and growing demand for PVC-free and sustainable vinyl films. The region’s well-established automotive and construction industries are key consumers of high-performance vinyl products. In addition, the popularity of creative advertising formats and demand for quick-installation décor solutions are propelling market growth across both Western and Eastern Europe.

Germany Self-Adhesive Vinyl Films Market Insight

Germany’s self-adhesive vinyl films market is growing steadily, supported by the country’s leadership in engineering and manufacturing. High standards in building aesthetics, combined with a preference for eco-conscious materials, are influencing adoption across the architectural and automotive sectors. The use of self-adhesive films in window graphics, fleet branding, and product labeling continues to expand, with sustainability and precision printing quality being key purchase drivers.

U.K. Self-Adhesive Vinyl Films Market Insight

The U.K. self-adhesive vinyl films market is projected to grow at a notable CAGR, driven by increasing investment in outdoor advertising, retail branding, and event marketing. The demand for digitally printed, easy-to-install vinyl solutions is rising among businesses looking for flexible, short-term promotional displays. In addition, the trend toward creative home renovations and the use of decorative vinyl in furniture and wall applications is supporting residential segment growth.

Global Self Adhesive Vinyl Films Market Share

Global Self Adhesive Vinyl Films Market Leaders Operating in the Market Are:

- 3M (U.S.)

- Avery Dennison Corporation (U.S.)

- LX HAUSYS (South Korea)

- ORAFOL Europe GmbH.(Germany)

- Metamark (U.K.)

- DRYTAC (U.S.)

- Achilles USA Inc. (U.S.)

- Navratan LLP. (India)

- Brite Coatings Private Limited(India)

- Shanghai Hanker Industrial Co., Ltd. (China)

- Shawei Digital (China)

- ATP adhesive systems AG (Switzerland)

- Eikon Ltd. a Spandex Group Company (U.K.)

- Grafityp (Belgium)

- General Formulations (U.S.)

- POLI-TAPE Holding GmbH (Germany)

- LINTEC Corporation (Japan)

- UPM (Finland)

- Fedrigoni S.P.A. (Italy)

- HEXIS S.A.S. (France)

- KPMF (Netherlands)

- Flexcon Company, Inc. (U.S.)

- Aquabond Ltd. (U.S.)

- Gardiner Graphics Supplies Europe (U.K.)

- Decal Adhesive (U.S.)

- A.P.A. S.p.A (Italy)

- Great K2 Industry Co., Ltd. (China)

- Nekoosa (U.S.)

Recent Developments in Global Self-Adhesive Vinyl Films Market in the same format and word limit:

- In April 2024, 3M Company launched a new line of eco-friendly self-adhesive vinyl films designed for automotive and architectural applications. These films offer improved durability and UV resistance while meeting stringent environmental regulations, reinforcing 3M’s commitment to sustainability and innovation in high-performance vinyl products. This development aims to cater to growing demand for green materials in vehicle wraps and building graphics globally

- In March 2024, Avery Dennison Corporation introduced its advanced digital printable vinyl film series featuring enhanced adhesion and faster drying times, targeting commercial signage and advertising sectors. The new product range supports vibrant color output and long-term outdoor durability, addressing the rising needs of retail and event marketing industries for flexible and high-quality visual communication solutions

- In February 2024, Orafol Europe GmbH expanded its portfolio by launching a premium cast vinyl film optimized for large-format vehicle graphics and marine applications. The product features superior conformability and chemical resistance, appealing to automotive and transportation businesses seeking durable and customizable branding solutions. This move strengthens Orafol’s presence in the competitive European vinyl films market

- In January 2024, Hexis S.A. announced a strategic partnership with a leading digital print technology provider to co-develop next-generation self-adhesive vinyl films tailored for indoor décor and point-of-sale displays. The collaboration aims to accelerate innovation in printable films that combine aesthetics with easy application, enabling retailers to create immersive brand experiences

- In January 2024, Mactac Europe, part of Avery Dennison, launched a new line of repositionable self-adhesive vinyl films designed for temporary signage and promotional campaigns. These films offer clean removability without residue, meeting the growing demand from the retail and event sectors for flexible, short-term graphic solutions that simplify installation and removal

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Self Adhesive Vinyl Films Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Self Adhesive Vinyl Films Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Self Adhesive Vinyl Films Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.