Global Sensing Labels Market

Market Size in USD Billion

CAGR :

%

USD

13.34 Billion

USD

47.19 Billion

2025

2033

USD

13.34 Billion

USD

47.19 Billion

2025

2033

| 2026 –2033 | |

| USD 13.34 Billion | |

| USD 47.19 Billion | |

|

|

|

|

Sensing Labels Market Size

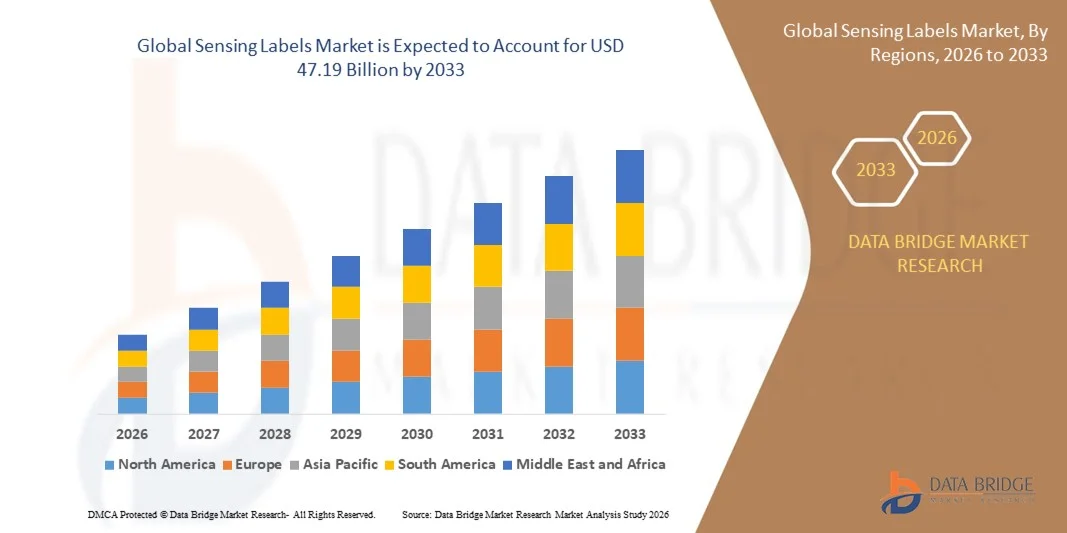

- The global sensing labels market size was valued at USD 13.34 billion in 2025 and is expected to reach USD 47.19 billion by 2033, at a CAGR of 17.10% during the forecast period

- The market growth is largely fuelled by the increasing adoption of smart packaging solutions across food, pharmaceutical, and logistics sectors, enabling real-time monitoring of product conditions and enhancing supply chain transparency

- Rising demand for temperature-sensitive and perishable goods, coupled with regulatory compliance requirements for quality and safety, is driving the integration of sensing labels into packaging

Sensing Labels Market Analysis

- The market is witnessing growth due to the rising need for efficient inventory management, quality assurance, and counterfeit prevention across industries such as healthcare, food & beverages, and logistics

- Increasing awareness among consumers and manufacturers regarding product safety, shelf-life monitoring, and smart packaging innovations is boosting the demand for sensing labels across regions

- North America dominated the sensing labels market with the largest revenue share of XX% in 2025, driven by increasing demand for product safety, traceability, and quality assurance across industries such as food, pharmaceuticals, and logistics

- Asia-Pacific region is expected to witness the highest growth rate in the global sensing labels market, driven by rapid urbanization, expanding FMCG and healthcare sectors, increased adoption of automated and smart packaging solutions, and supportive government initiatives for technological advancement

- The Temperature Sensing Labels segment held the largest market revenue share in 2025, driven by the widespread need to monitor perishable goods and pharmaceuticals throughout the supply chain. Temperature-sensitive labels provide real-time alerts and help prevent spoilage, making them essential for cold chain logistics and high-value product transportation

Report Scope and Sensing Labels Market Segmentation

|

Attributes |

Sensing Labels Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Sensing Labels Market Trends

Rise of Smart and Intelligent Packaging

- The growing adoption of smart and intelligent packaging is transforming the sensing labels market by enabling real-time monitoring of product conditions such as temperature, humidity, and freshness. These labels enhance supply chain transparency, reduce spoilage, and improve product safety, which is critical for perishable goods and pharmaceuticals. In addition, manufacturers can gain actionable insights on product handling and storage conditions, improving overall operational efficiency

- The rising demand for traceability and anti-counterfeit solutions is accelerating the integration of sensing labels in food, beverage, and pharmaceutical industries. Smart labels equipped with RFID, NFC, or QR code technologies provide end-to-end visibility, ensuring product authenticity and regulatory compliance. These technologies also help reduce losses from fraud, tampering, and counterfeiting, strengthening brand reputation and customer trust

- The ease of integration and decreasing costs of sensor technologies are making sensing labels attractive for both manufacturers and retailers. The labels can be embedded in packaging without altering the product form factor, allowing for wide adoption across various industries. Furthermore, improved durability and compatibility with automated packaging lines support large-scale deployment

- For instance, in 2023, several European food packaging companies implemented temperature-sensitive sensing labels for dairy and meat products, resulting in improved product quality and consumer trust, while reducing waste and recalls. These labels also allowed better tracking of product conditions during transport and storage, helping businesses optimize inventory management

- While smart and intelligent labels are driving market growth, sustained expansion depends on continuous innovation, cost reduction, and effective deployment across global supply chains. Market players must also invest in training and customer awareness programs to fully capitalize on the benefits of smart labeling technology

Sensing Labels Market Dynamics

Driver

Increasing Demand for Product Safety, Traceability, and Quality Assurance

- Growing awareness among manufacturers and consumers regarding product safety and quality is driving the demand for sensing labels. These labels provide accurate information on storage conditions and detect potential product tampering, boosting confidence in supply chains. In addition, real-time monitoring allows early detection of spoilage or contamination, minimizing product losses and recalls

- The surge in regulatory requirements for traceability, particularly in food, pharmaceuticals, and healthcare sectors, is compelling companies to adopt sensing labels for compliance. This includes monitoring temperature-sensitive vaccines, perishable foods, and sensitive chemicals. Adoption is further accelerated by governments and international agencies mandating stricter labeling standards to ensure public safety and consumer protection

- Technological advancements in printed electronics, IoT, and smart sensors are enhancing the functionality and affordability of sensing labels. This allows for widespread adoption across retail, logistics, and industrial applications. Advanced analytics capabilities integrated with labels enable predictive monitoring, inventory optimization, and improved supply chain decision-making

- For instance, in 2022, leading pharmaceutical distributors in North America adopted RFID-enabled sensing labels for cold chain management, improving monitoring efficiency and reducing spoilage-related losses. The implementation also reduced manual inspection efforts and improved compliance reporting for regulatory audits

- While awareness and technology are fueling market growth, manufacturers must focus on improving label durability, sensor accuracy, and seamless integration with existing packaging systems. Collaborative efforts with packaging and logistics partners can enhance adoption and unlock new revenue streams

Restraint/Challenge

High Cost of Advanced Sensing Labels and Limited Adoption in Emerging Markets

- The high price point of advanced sensing labels, including RFID, NFC, and temperature-sensitive variants, limits adoption among small and mid-sized manufacturers, particularly in emerging regions. Cost constraints remain a significant barrier for widespread deployment. Moreover, high initial investment for equipment and software integration can discourage first-time users from adopting the technology

- In many regions, lack of awareness about the benefits and functionalities of sensing labels restricts market penetration. Companies often continue using conventional labels, missing the advantages of smart monitoring and traceability. Educational initiatives and industry workshops are needed to showcase ROI and operational benefits to potential adopters

- Supply chain and infrastructure challenges, such as limited integration with existing packaging lines or inadequate data management systems, can impede the effective implementation of sensing labels. Poor connectivity in remote areas and inconsistent IT capabilities can further delay adoption and limit real-time monitoring effectiveness

- For instance, in 2023, several food producers in Southeast Asia reported low adoption of intelligent labels due to high costs and lack of technical expertise, impacting market growth. Companies also cited difficulties in sourcing compatible sensors and integrating them into automated packaging lines as additional barriers

- While technological advancements are improving label performance, addressing cost barriers, enhancing awareness, and providing integration support are critical for long-term market expansion. Strategic partnerships with technology providers and government incentives can further accelerate adoption and market penetration

Sensing Labels Market Scope

The sensing labels market is segmented into four notable segments based on type and application.

- By Type

On the basis of type, the market is segmented into Position/Tilt Sensing Labels, Chemical Sensing Labels, Humidity Sensing Labels, and Temperature Sensing Labels. The Temperature Sensing Labels segment held the largest market revenue share in 2025, driven by the widespread need to monitor perishable goods and pharmaceuticals throughout the supply chain. Temperature-sensitive labels provide real-time alerts and help prevent spoilage, making them essential for cold chain logistics and high-value product transportation.

The Humidity Sensing Labels segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by the increasing demand for moisture monitoring in food, electronics, and packaging industries. These labels ensure product quality, reduce waste, and enhance compliance with industry standards, supporting broader adoption across multiple sectors.

- By Application

On the basis of application, the market is segmented into Automotive, Fast Moving Consumer Goods, Healthcare & Pharmaceutical, Logistic, and Retail. The Healthcare & Pharmaceutical segment held the largest market revenue share in 2025, driven by stringent regulations for drug storage and transport, where accurate monitoring of temperature and environmental conditions is critical.

The Fast Moving Consumer Goods segment is expected to witness the fastest growth rate from 2026 to 2033, attributed to the rising focus on product freshness, quality assurance, and traceability. FMCG manufacturers are increasingly implementing sensing labels to improve inventory management, enhance consumer trust, and reduce product recalls across global retail channels.

Sensing Labels Market Regional Analysis

- North America dominated the sensing labels market with the largest revenue share of XX% in 2025, driven by increasing demand for product safety, traceability, and quality assurance across industries such as food, pharmaceuticals, and logistics

- Consumers and businesses in the region highly value the enhanced monitoring capabilities, reduced spoilage, and compliance benefits offered by smart and intelligent sensing labels

- This widespread adoption is further supported by robust infrastructure, high awareness of supply chain optimization, and the integration of IoT and smart packaging technologies, making sensing labels a preferred choice for manufacturers and distributors

U.S. Sensing Labels Market Insight

The U.S. sensing labels market captured the largest revenue share in 2025 within North America, fueled by the rising emphasis on product quality and safety standards. Companies are increasingly adopting temperature, humidity, and chemical sensing labels to ensure compliance with stringent food and pharmaceutical regulations. The growing integration of smart packaging solutions with IoT and cloud-based monitoring platforms further propels market growth. Moreover, initiatives supporting supply chain transparency and anti-counterfeit measures are significantly contributing to the expansion of the sensing labels market.

Europe Sensing Labels Market Insight

The Europe sensing labels market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by regulatory compliance requirements and the increasing demand for traceable and tamper-evident packaging solutions. Growing urbanization and the adoption of advanced logistics systems are fostering the use of sensing labels. European manufacturers are also investing in smart packaging technologies to meet consumer expectations for quality, safety, and sustainability, resulting in widespread adoption across food, beverage, and pharmaceutical sectors.

U.K. Sensing Labels Market Insight

The U.K. sensing labels market is expected to witness the fastest growth rate from 2026 to 2033, driven by the increasing focus on food safety, cold chain management, and anti-counterfeit solutions. Rising awareness among manufacturers regarding regulatory compliance and consumer protection is encouraging the adoption of intelligent labels. The U.K.’s robust logistics and e-commerce infrastructure further facilitates the implementation of smart sensing labels in retail and pharmaceutical applications, boosting market expansion.

Germany Sensing Labels Market Insight

The Germany sensing labels market is expected to witness the fastest growth rate from 2026 to 2033, fueled by advancements in smart packaging technologies and stringent quality control regulations. Germany’s emphasis on innovation, industrial automation, and sustainability promotes the adoption of sensing labels, particularly in the food, healthcare, and logistics sectors. Integration with IoT-based monitoring systems and focus on reducing spoilage and product recalls are key factors driving market growth in the region.

Asia-Pacific Sensing Labels Market Insight

The Asia-Pacific sensing labels market is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing industrialization, technological advancements, and rising awareness regarding product safety and quality in countries such as China, Japan, and India. The growing adoption of smart packaging solutions, supported by government initiatives promoting digitalization and supply chain efficiency, is accelerating market penetration. Furthermore, as APAC becomes a hub for manufacturing smart labels and sensors, affordability and accessibility are improving, enabling broader adoption across industries.

Japan Sensing Labels Market Insight

The Japan sensing labels market is expected to witness the fastest growth rate from 2026 to 2033 due to the country’s technologically advanced manufacturing sector, focus on product quality, and stringent regulatory standards. Japanese companies are increasingly implementing temperature, humidity, and chemical sensing labels to enhance product monitoring and supply chain efficiency. The integration of intelligent labels with IoT and smart packaging solutions, coupled with high consumer expectations for safety and traceability, is propelling market growth.

China Sensing Labels Market Insight

The China sensing labels market accounted for the largest revenue share in Asia Pacific in 2025, attributed to rapid urbanization, technological adoption, and increasing demand for product traceability and safety in food, pharmaceuticals, and logistics. China is a leading market for smart packaging technologies, and sensing labels are becoming a standard solution for monitoring storage conditions and preventing counterfeiting. Government initiatives supporting smart supply chains and the presence of strong domestic manufacturers are further driving the growth of the sensing labels market in the country.

Sensing Labels Market Share

The Sensing Labels industry is primarily led by well-established companies, including:

• Advantech Co., Ltd. (Taiwan)

• Alien Technology, LLC (U.S.)

• Avery Dennison Corporation (U.S.)

• CCL Industries (Canada)

• GLI, LLC (U.S.)

• Invengo Technology Pte. Ltd (Singapore)

• Mühlbauer Group (Germany)

• SATO Holdings Corporation (Japan)

• Checkpoint Systems, Inc. (U.S.)

• Smartrac Technology GmbH (Germany)

• METRA BLANSKO s.r.o. (Czech Republic)

• William Frick & Company (U.S.)

• Thin Film Electronics ASA (Norway)

• Zebra Technologies Corp. and/or its affiliates (U.S.)

• Toshiba Global Commerce Solutions (Japan)

Latest Developments in Global Sensing Labels Market

- In October 2024, Avery Dennison Corporation launched an expansion of its AD TexTrace portfolio with the introduction of heat-seal and durable printed fabric label solutions, aimed at enhancing product traceability and durability. This development is expected to strengthen the company’s position in the smart labeling market and cater to growing demand for robust, long-lasting label solutions

- In October 2024, TOPPAN Holdings Inc. completed the acquisition of 100% ownership of Selinko SA, a company specializing in ID authentication platforms in Europe. This strategic move enables TOPPAN to enhance its digital authentication capabilities, expand its footprint in the European market, and provide advanced anti-counterfeit solutions

- In August 2023, CCL Industries announced a partnership with Imprint Energy to develop thin, flexible, rechargeable batteries for smart labels. This collaboration focuses on creating environmentally friendly, high-performance power solutions, supporting the next generation of sensing and smart packaging technologies, and driving innovation in the global smart labeling market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Sensing Labels Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Sensing Labels Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Sensing Labels Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.