Global Sensor Bearings Market

Market Size in USD Million

CAGR :

%

USD

745.10 Million

USD

1,109.27 Million

2024

2032

USD

745.10 Million

USD

1,109.27 Million

2024

2032

| 2025 –2032 | |

| USD 745.10 Million | |

| USD 1,109.27 Million | |

|

|

|

|

Sensor Bearings Market Size

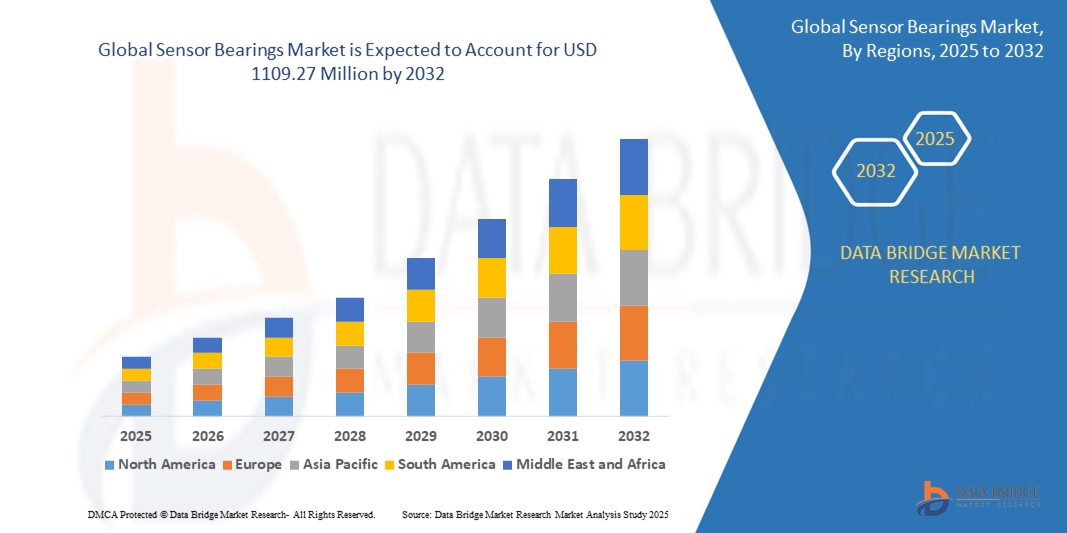

- The global sensor bearings market size was valued at USD 745.1 million in 2024 and is expected to reach USD 1109.27 million by 2032, at a CAGR of 5.10% during the forecast period

- The market growth is largely fuelled by the increasing integration of sensors into automotive and industrial machinery to enhance performance monitoring, predictive maintenance, and operational efficiency

Sensor Bearings Market Analysis

- Rising demand for smart bearings in electric vehicles (EVs), wind turbines, and industrial automation is contributing to market expansion

- Technological advancements such as embedded speed and temperature sensors are supporting smarter machine applications

- North America dominated the sensor bearings market with the largest revenue share in 2024, driven by advanced manufacturing capabilities, widespread adoption of Industry 4.0 practices, and a strong automotive and aerospace sector

- Asia-Pacific region is expected to witness the highest growth rate in the global sensor bearings market, driven by rapid industrialization, expanding automotive production, and the integration of smart sensor technologies across various sectors such as transportation, mining, and energy

- The speed segment dominated the market with the largest revenue share in 2024, driven by its widespread application in automotive systems such as anti-lock braking systems (ABS) and electric motors. Speed detection plays a critical role in ensuring optimal safety, control, and energy efficiency in dynamic environments. The adoption of speed sensor bearings is further supported by their integration in smart systems requiring real-time feedback and precision control across various industries

Report Scope and Sensor Bearings Market Segmentation

|

Attributes |

Sensor Bearings Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• SKF Group (Sweden) |

|

Market Opportunities |

• Integration Of IoT And Predictive Maintenance In Industrial Applications |

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Sensor Bearings Market Trends

“Growing Integration of Sensor Bearings in Automotive Safety and Electrification Systems”

- Sensor bearings are increasingly embedded in electric motors, gearboxes, and anti-lock braking systems to support vehicle safety and performance

- Automakers are adopting sensor bearings to enable real-time diagnostics and predictive maintenance in EVs and hybrid vehicles

- The demand is driven by the push toward ADAS and EV systems that rely on sensor feedback for efficient control

- Lightweight and compact design makes them ideal for space-constrained automotive applications

- For instance, BMW uses sensor bearings in its regenerative braking systems to precisely monitor wheel speed and enhance energy recovery

Sensor Bearings Market Dynamics

Driver

“Rising Demand for Condition Monitoring Across Industrial and Manufacturing Sectors”

- Sensor bearings enable early detection of equipment issues such as misalignment, imbalance, or lubrication failure

- Adoption is growing in manufacturing, mining, and energy industries where machine uptime is critical to output

- Integration with Industry 4.0 and IoT platforms allows remote diagnostics and reduces manual inspection requirements

- Manufacturers are prioritizing smart maintenance strategies to minimize downtime and optimize productivity

- For instance, Siemens equips its high-end conveyor systems in mining operations with sensor bearings to monitor vibration and prevent catastrophic failures

Restraint/Challenge

“High Initial Cost and Complex Integration With Existing Systems”

- Sensor bearings cost significantly more than standard bearings due to advanced sensing elements and circuitry

- Retrofitting existing equipment may require significant adjustments to accommodate power, signal output, and system integration

- Companies in harsh operating environments (e.g., oil rigs or chemical plants) need additional sealing or protective solutions, increasing costs

- Limited standardization and compatibility across manufacturers add complexity in choosing the right sensor-bearing solution

- For instance, integrating sensor bearings into older production lines in legacy automotive factories often requires upgrading the entire control system to enable real-time data processing

Sensor Bearings Market Scope

The market is segmented on the basis of functionality, application, and end-use.

• By Functionality

On the basis of functionality, the sensor bearings market is segmented into speed, temperature, vibration, displacement, and others. The speed segment dominated the market with the largest revenue share in 2024, driven by its widespread application in automotive systems such as anti-lock braking systems (ABS) and electric motors. Speed detection plays a critical role in ensuring optimal safety, control, and energy efficiency in dynamic environments. The adoption of speed sensor bearings is further supported by their integration in smart systems requiring real-time feedback and precision control across various industries.

The temperature segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the increasing demand for monitoring bearing health in high-heat applications. Industries such as metal & mining and oil & gas rely on accurate thermal data to prevent overheating and mechanical failure, positioning temperature sensor bearings as an essential predictive maintenance solution in critical operations.

• By Application

On the basis of application, the sensor bearings market is segmented into anti-lock braking system, material handling equipment, electric motors, and others. The anti-lock braking system (ABS) segment held the largest market share in 2024 due to the high penetration of ABS in modern vehicles, where sensor bearings are essential for wheel speed detection and brake modulation. ABS technology mandates the use of robust and precise speed sensors integrated with bearings to ensure smooth vehicle operation during emergency braking.

The electric motors segment is expected to witness the fastest growth rate from 2025 to 2032, as sensor bearings play an increasingly vital role in improving energy efficiency and monitoring performance. With the growth in electric vehicles and industrial automation, real-time monitoring using integrated bearing sensors is gaining momentum to enhance operational uptime and prevent equipment failures.

• By End-Use

On the basis of end-use, the sensor bearings market is segmented into automotive, transportation, metal & mining, oil & gas, aerospace & defense, and others. The automotive segment dominated the market in 2024 owing to the increasing implementation of sensor-based safety systems and energy-efficient technologies in vehicles. Automakers are investing heavily in smart components that offer improved reliability, real-time diagnostics, and cost-efficiency.

The aerospace & defense segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the need for advanced monitoring systems in mission-critical environments. Sensor bearings in aerospace applications are instrumental for vibration detection, structural integrity analysis, and thermal monitoring, ensuring both operational safety and predictive maintenance of flight systems.

Sensor Bearings Market Regional Analysis

• North America dominated the sensor bearings market with the largest revenue share in 2024, driven by advanced manufacturing capabilities, widespread adoption of Industry 4.0 practices, and a strong automotive and aerospace sector

• The region's established infrastructure in smart manufacturing, coupled with significant investments in automation and predictive maintenance, has propelled the demand for sensor-integrated bearing systems

• High adoption of electric vehicles (EVs), growth in the oil & gas sector, and increasing integration of smart sensors in rotating equipment across industrial operations have made North America a key market for sensor bearings

U.S. Sensor Bearings Market Insight

The U.S. sensor bearings market accounted for the largest share within North America in 2024, driven by technological innovation and increased deployment of industrial IoT solutions. The country’s dominant automotive manufacturing base and robust R&D investments in motion control and robotics are significantly boosting demand. In particular, major automotive OEMs and component manufacturers are integrating sensor bearings to monitor real-time vibration, temperature, and rotational speed—critical for performance and safety. These advancements, along with growing demand from the aerospace and oilfield services sector, are solidifying the U.S. position in the market.

Europe Sensor Bearings Market Insight

The Europe sensor bearings market is expected to witness the fastest growth rate from 2025 to 2032, supported by stringent emission regulations and the continent’s strong foothold in precision engineering. The demand is particularly high in Germany, France, and Italy, where automotive, railways, and metal & mining industries are leveraging sensor bearings to enhance operational efficiency. The increasing electrification of vehicles, adoption of smart factory solutions, and support for sustainability initiatives through energy-efficient components are further fueling market growth.

U.K. Sensor Bearings Market Insight

The U.K. sensor bearings market is expected to witness the fastest growth rate from 2025 to 2032, driven by innovation in the transportation and defense sectors. The expansion of electric mobility and government-led infrastructure projects are accelerating the integration of smart components in vehicles and industrial machines. Furthermore, the country’s focus on increasing domestic production and adoption of predictive maintenance technologies in rail networks and industrial facilities are key growth enablers.

Germany Sensor Bearings Market Insight

The Germany sensor bearings market continues to lead within Europe, backed by its reputation as an engineering and manufacturing powerhouse. The country’s automotive giants and industrial machinery firms are early adopters of advanced sensor technologies for real-time diagnostics. This trend, combined with the government’s push towards smart factory transitions under the “Industrie 4.0” strategy, supports sustained demand. Germany also benefits from strong academic-industry collaborations that further advance product innovation in sensor-integrated bearings.

Asia-Pacific Sensor Bearings Market Insight

The Asia-Pacific sensor bearings market is expected to witness the fastest growth rate from 2025 to 2032, fueled by rapid industrialization, expanding automotive production, and infrastructure modernization across nations such as China, Japan, and India. Regional growth is driven by low manufacturing costs, a rising demand for energy-efficient solutions, and increased investments in mining, steel, and heavy machinery sectors. Moreover, governments in APAC are promoting smart factory frameworks and electric vehicle adoption, which necessitate reliable sensor technologies in bearings.

Japan Sensor Bearings Market Insight

Japan’s sensor bearings market is expected to witness the fastest growth rate from 2025 to 2032 owing to its advanced robotics, automation, and automotive landscape. Japanese companies are integrating sensor bearings in next-generation electric vehicles and industrial robotics to enhance precision, safety, and energy efficiency. In addition, the country's leadership in high-speed rail and infrastructure modernization makes it a strong contributor to the regional market.

China Sensor Bearings Market Insight

China holds the largest market revenue share in Asia-Pacific in 2024, driven by a thriving manufacturing sector, government initiatives supporting smart machinery, and strong exports of industrial equipment. As the country continues to invest in clean energy, transportation, and heavy industries, the need for smart and durable components such as sensor bearings grows significantly. The presence of domestic manufacturers and cost-effective production capabilities further amplify China’s influence in the global sensor bearings market.

Sensor Bearings Market Share

The Sensor Bearings industry is primarily led by well-established companies, including:

• SKF Group (Sweden)

• Schaeffler AG (Germany)

• NSK Ltd. (Japan)

• NTN Corporation (Japan)

• The Timken Company (U.S.)

• JTEKT Corporation (Japan)

• MinebeaMitsumi Inc. (Japan)

• Brtec (China)

• RBC Bearings Incorporated (U.S.)

• RHP Bearings Ltd. (U.K.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.