Global Sensor Fusion Market

Market Size in USD Million

CAGR :

%

USD

430.00 Million

USD

7,393.67 Million

2024

2032

USD

430.00 Million

USD

7,393.67 Million

2024

2032

| 2025 –2032 | |

| USD 430.00 Million | |

| USD 7,393.67 Million | |

|

|

|

|

What is the Global Sensor Fusion Market Size and Growth Rate?

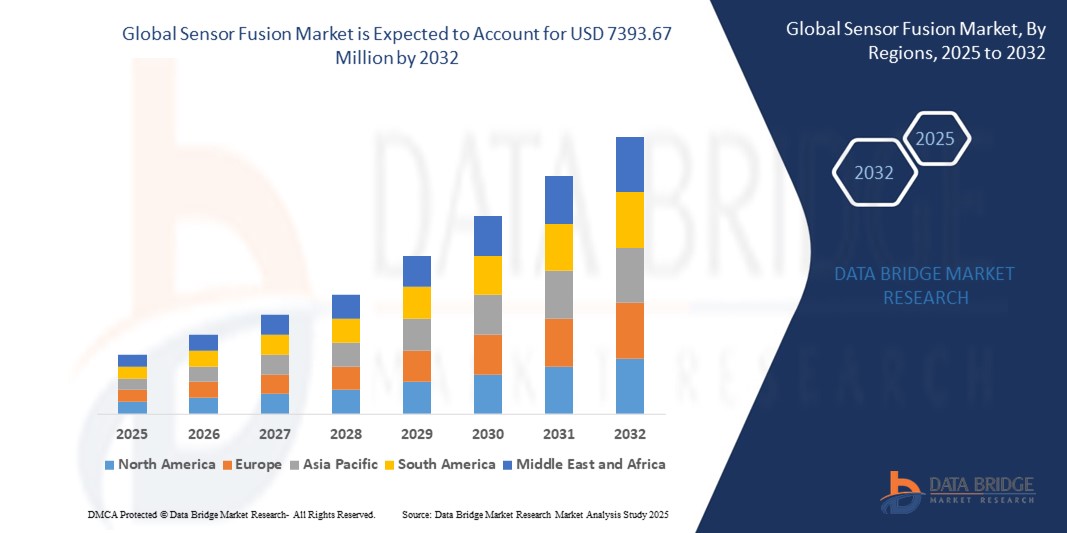

- The global sensor fusion market size was valued at USD 430 million in 2024 and is expected to reach USD 7393.67 million by 2032, at a CAGR of 42.70% during the forecast period

- The sensor fusion market is rapidly expanding due to increased demand for advanced driver assistance systems (ADAS), autonomous vehicles, and IoT devices. Integration of data from multiple sensors such as accelerometers, gyroscopes, magnetometers, and GPS enhances real-time decision-making and system accuracy, making it a cornerstone in automotive, consumer electronics, and industrial automation sectors

What are the Major Takeaways of Sensor Fusion Market?

- Major technological trends include the combination of AI with sensor fusion for improved pattern recognition and predictive analytics. The use of 3D vision and LiDAR-based sensor fusion is also gaining traction in autonomous mobility and robotics applications

- Consumer electronics are embracing sensor fusion to enhance AR/VR experiences, motion tracking, and wearable performance. In addition, MEMS-based sensor fusion modules are gaining popularity due to their compact size and power efficiency

- The market is expected to witness strong momentum as demand surges for smart, efficient, and real-time sensing solutions, particularly in connected and automated environments

- Asia-Pacific dominated the sensor fusion market with the largest revenue share of 38.74% in 2024, driven by surging demand for smart devices, ADAS-enabled vehicles, and growing integration of AI-powered sensors across consumer electronics and automotive sectors

- North America is projected to grow at the fastest CAGR of 13.41% from 2025 to 2032, driven by the surge in autonomous driving R&D, increasing demand for smart medical devices, and strong government backing for AI and defense modernization

- The MEMS segment dominated the market with the largest revenue share of 61.3% in 2024, attributed to its compact size, low power consumption, and cost-effectiveness

Report Scope and Sensor Fusion Market Segmentation

|

Attributes |

Sensor Fusion Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Sensor Fusion Market?

“AI-Augmented Sensor Fusion for Enhanced Perception and Real-Time Decision-Making”

- A key trend driving the sensor fusion market is the integration of artificial intelligence (AI) and machine learning (ML) to enhance data interpretation, situational awareness, and real-time decision-making in autonomous systems, especially in automotive and robotics applications

- AI-powered fusion engines can dynamically prioritize sensor inputs (e.g., radar, LiDAR, cameras) based on environmental context, improving accuracy in poor visibility or complex conditions

- For instance, NXP Semiconductors and BASELABS are collaborating on AI-integrated Sensor Fusion software that enables Level 3+ autonomous driving, using probabilistic modeling to enhance lane, object, and path detection

- This trend is especially vital in ADAS and autonomous vehicles, where accurate perception and prediction are critical for safety. AI-driven fusion reduces false positives and supports adaptive control strategies

- Beyond automotive, AI-fusion systems are being developed for wearables, smart home devices, and medical monitoring to intelligently filter sensor noise and recognize complex user behaviors

- As edge computing evolves, expect widespread deployment of AI-augmented sensor fusion chips in decentralized devices, pushing the boundary of low-latency intelligent sensing

What are the Key Drivers of Sensor Fusion Market?

- Proliferation of sensors in consumer electronics, automotive, and industrial IoT is fueling demand for efficient fusion systems that combine multiple data streams into unified insights, enabling smarter, faster responses

- For instance, in February 2025, Bosch Sensortec launched a 9-axis sensor fusion solution tailored for AR/VR and gaming applications, offering sub-millisecond latency and reduced power draw

- The rise of ADAS, electric vehicles (EVs), and autonomous platforms is increasing reliance on sensor fusion to synthesize data from LiDAR, cameras, radar, and IMUs for accurate environmental mapping

- Governments are mandating the inclusion of ADAS features (e.g., automatic braking, lane keeping), driving OEMs to integrate advanced sensor fusion units for compliance and safety

- The growing adoption of wearables and health-monitoring devices is another driver; fusion enhances motion tracking, fall detection, and biometric analysis with greater reliability and battery efficiency

Which Factor is challenging the Growth of the Sensor Fusion Market?

- One of the major challenges is the increasing complexity of sensor integration, especially when dealing with heterogeneous sensor types operating at different sampling rates, data resolutions, and latency constraints

- For instance, while STMicroelectronics is developing multi-sensor ICs for real-time fusion, integrating these into systems with constrained compute and thermal budgets remains technically demanding

- High-performance sensor fusion algorithms demand significant computational power, often requiring dedicated fusion processors or neural network accelerators—raising device costs and power consumption

- A lack of standardized software frameworks and reference architectures for fusion hinders rapid development and scalability, forcing OEMs to develop custom stacks for each platform

- In safety-critical applications (e.g., ADAS or surgical robotics), ensuring low latency, redundancy, and fail-safes in sensor fusion is essential but difficult to validate under diverse real-world conditions

- Addressing these barriers will require continued investment in low-power AI cores, modular sensor packages, and open-source fusion libraries to accelerate adoption across mass-market devices

How is the Sensor Fusion Market Segmented?

The market is segmented on the basis of technology, product type, and end user.

- By Technology

On the basis of technology, the sensor fusion market is segmented into MEMS and Non-MEMS. The MEMS segment dominated the market with the largest revenue share of 61.3% in 2024, attributed to its compact size, low power consumption, and cost-effectiveness. MEMS-based sensor fusion solutions are widely used in smartphones, wearables, and automotive applications, where space and energy efficiency are critical.

The Non-MEMS segment is projected to witness the fastest growth from 2025 to 2032, driven by increasing demand for high-performance sensing in military, industrial automation, and autonomous systems where precision and durability are key.

- By Product Type

On the basis of product type, the sensor fusion market is segmented into Radar Sensors, Image Sensors, IMU, and Temperature Sensors. The IMU (Inertial Measurement Unit) segment held the largest market share of 47.6% in 2024, driven by its essential role in motion tracking, navigation, and stability control across smartphones, drones, and automotive safety systems.

The Radar Sensors segment is expected to grow at the highest CAGR over the forecast period due to their increasing adoption in advanced driver-assistance systems (ADAS), particularly for object detection, collision avoidance, and blind-spot monitoring.

- By End User

On the basis of end user, the sensor fusion market is segmented into Consumer Electronics, Automotive, Home Automation, Medical, Military, and Industrial. The Automotive segment dominated the market with the largest revenue share of 54.2% in 2024, supported by the integration of sensor fusion in ADAS, autonomous driving, and safety systems. Automakers are increasingly relying on multi-sensor data integration to deliver improved driving experience, vehicle intelligence, and compliance with safety standards.

The Medical segment is expected to witness the fastest growth from 2025 to 2032, fueled by the rising adoption of wearable health monitors, remote diagnostics, and precision surgery tools that rely on accurate real-time data from multiple sensor types.

Which Region Holds the Largest Share of the Sensor Fusion Market?

- Asia-Pacific dominated the sensor fusion market with the largest revenue share of 38.74% in 2024, driven by surging demand for smart devices, ADAS-enabled vehicles, and growing integration of AI-powered sensors across consumer electronics and automotive sectors

- The region benefits from robust domestic manufacturing, cost-effective sensor technologies, and large-scale government investments in smart mobility and digital infrastructure. Countries such as China, Japan, and South Korea are leading innovation in MEMS and non-MEMS technologies, establishing Asia-Pacific as the global hub for sensor fusion R&D and deployment

- Strategic support through initiatives such as China’s “New Infrastructure Plan” and India’s “Make in India” campaign has further accelerated adoption across industries, solidifying Asia-Pacific’s position at the forefront of the global sensor fusion market

China Sensor Fusion Market Insight

China held the largest share of Asia-Pacific’s sensor fusion revenue in 2024, driven by its dominance in consumer electronics and EV production. Major OEMs such as Huawei, Xiaomi, and BYD are integrating advanced sensor fusion systems for autonomous navigation and smart wearables. The government’s emphasis on AI and autonomous mobility is also catalyzing innovation and sensor integration across the transportation and industrial sectors.

Japan Sensor Fusion Market Insight

Japan’s sensor fusion market is growing rapidly, backed by the nation’s legacy in electronics and robotics. Companies such as Sony, Panasonic, and Renesas are leading advancements in MEMS sensors and IMUs for medical and consumer applications. Government programs supporting smart city development and automotive autonomy are enhancing the demand for sensor fusion platforms across both urban and rural landscapes.

India Sensor Fusion Market Insight

India is emerging as a strong growth region, driven by rapid urbanization, expanding IoT adoption, and rising demand for safety features in mid-range vehicles. Government policies such as the Production Linked Incentive (PLI) scheme are encouraging domestic sensor manufacturing. In addition, the growing smartphone and wearable market is pushing local startups and global tech giants to invest in low-cost sensor fusion solutions.

Which Region is the Fastest Growing in the Sensor Fusion Market?

North America is projected to grow at the fastest CAGR of 13.41% from 2025 to 2032, driven by the surge in autonomous driving R&D, increasing demand for smart medical devices, and strong government backing for AI and defense modernization. The region benefits from a mature ecosystem of tech innovators, sensor manufacturers, and Tier-1 automotive suppliers. Enhanced deployment of radar, image, and IMU sensors in advanced driver-assistance systems (ADAS) and military applications is significantly driving demand for sensor fusion modules. Initiatives such as the U.S. CHIPS Act and Canada's AI research funding are empowering local production and innovation, while collaborations between automotive OEMs and semiconductor firms are fostering widespread technology adoption.

U.S. Sensor Fusion Market Insight

The U.S. led North America’s revenue share in 2024, fueled by a high penetration of autonomous and connected vehicles. Companies such as Tesla, Apple, and Qualcomm are actively deploying multi-sensor systems to support navigation, environmental monitoring, and augmented reality (AR). The country’s defense sector is also a key adopter, with growing integration in unmanned vehicles and wearable battlefield tech.

Canada Sensor Fusion Market Insight

Canada’s sensor fusion market is witnessing notable growth, supported by rising investments in smart manufacturing, automotive electrification, and healthcare innovation. Universities and tech hubs in Ontario and British Columbia are fostering R&D in sensor technologies, while public-private collaborations are promoting sensor deployment in climate monitoring and sustainable transportation.

Which are the Top Companies in Sensor Fusion Market?

The sensor fusion industry is primarily led by well-established companies, including:

- Robert Bosch GmbH (Germany)

- Continental AG (Germany)

- ZF Friedrichshafen AG (Germany)

- NXP Semiconductors (Netherlands)

- Allegro MicroSystems, Inc. (U.S.)

- Valeo SA (France)

- Aptiv PLC (Ireland)

- DENSO CORPORATION (Japan)

- PANASONIC CORPORATION (Japan)

- Magna International (Canada)

- Hillcrest (U.S.)

- Analog Devices Inc. (U.S.)

- Fullpower Technologies (U.S.)

- QuickLogic (U.S.)

- Asahi Kasei Microdevices (Japan)

- PNI Corp (U.S.)

- Freescale Semiconductor (U.S.)

- Bosch Sensortec (Germany)

- Qualcomm (U.S.)

- CyweeMotion Ltd. (Taiwan)

What are the Recent Developments in Global Sensor Fusion Market?

- In May 2023, Arbe Robotics Ltd., a global leader in perception radar technology, introduced its groundbreaking 4D Imaging Radar Chipset Solutions, marking a significant leap in sensor capabilities. This next-gen radar system offers 100 times more detail than existing radar technologies, positioning itself as a crucial sensor for L2+ and higher levels of autonomous driving. This innovation strengthens Arbe’s role in making autonomous vehicles safer and more reliable

- In April 2023, Cepton Inc. unveiled Komodo, its proprietary LiDAR point cloud processor Application-Specific Integrated Circuit (ASIC) chip, aimed at enhancing LiDAR performance while cutting down production costs. The chip is designed to support widespread adoption by enabling cost-effective deployment in mass-market applications. This development is expected to accelerate the accessibility of advanced LiDAR across automotive platforms

- In February 2023, Bosch and Nokia announced the expansion of their strategic partnership, originally formed in 2017, to include research and development in 6G technologies alongside automotive IoT and 5G. The announcement was made during Mobile World Congress 2023 in Barcelona, highlighting 6G’s potential to dramatically enhance autonomous driving, smart cities, and connected ecosystems. This collaboration signifies a step toward a hyper-connected future powered by next-generation wireless innovation

- In January 2023, SAT and emotion3D introduced a collaborative sensor fusion driver monitoring system at CES 2023, featuring drowsiness detection using both cameras and vital sign sensors. The system, developed in partnership with Garmin, aims to improve road safety by monitoring driver fatigue and responsiveness in real time. This advancement marks a critical move toward integrating health and safety metrics into next-gen in-vehicle monitoring systems

- In November 2022, STMicroelectronics (ST) launched a new six-axis Inertial Measurement Unit (IMU) equipped with integrated sensor fusion blocks and machine learning (ML) cores. The device is tailored for advanced 3D mapping and context-aware applications, supporting more intelligent and responsive embedded systems. This release reinforces ST's commitment to enabling smarter motion tracking and real-time environmental awareness across industries

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.