Global Servers Technology Market

Market Size in USD Billion

CAGR :

%

USD

108.99 Billion

USD

173.72 Billion

2024

2032

USD

108.99 Billion

USD

173.72 Billion

2024

2032

| 2025 –2032 | |

| USD 108.99 Billion | |

| USD 173.72 Billion | |

|

|

|

|

Servers Technology Market Size

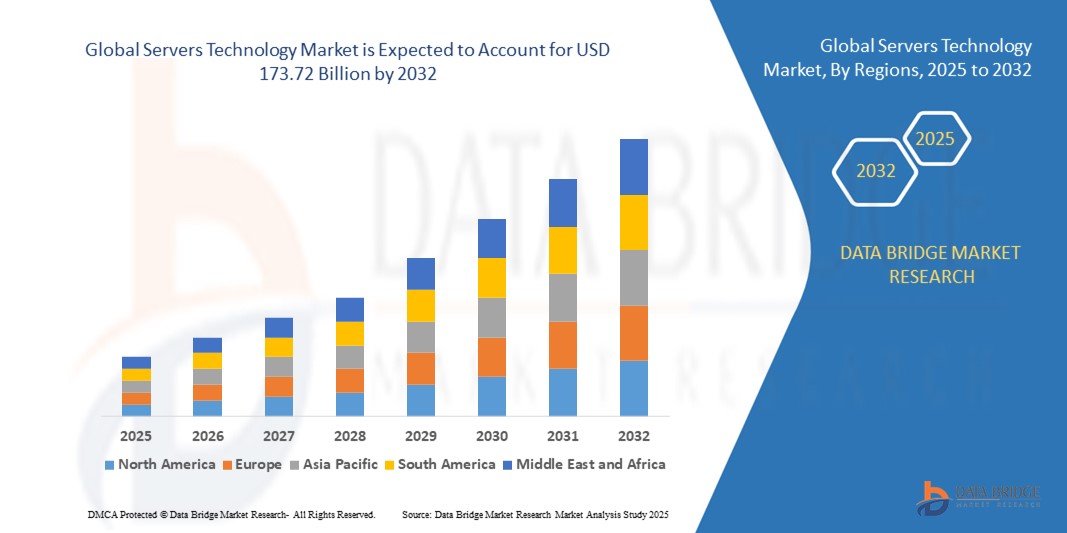

- The global servers technology market size was valued at USD 108.99 billion in 2024 and is expected to reach USD 173.72 billion by 2032, at a CAGR of 6.0% during the forecast period

- The market growth is largely fueled by the growing adoption and technological advancements in cloud computing, data centers, and enterprise IT infrastructure, leading to increased digitalization across industries and organizations

- Furthermore, rising enterprise demand for high-performance, scalable, and energy-efficient server solutions is establishing advanced servers as the backbone of modern IT operations. These converging factors are accelerating the deployment of servers, thereby significantly boosting the industry’s growth

Servers Technology Market Analysis

- Servers are high-performance computing systems that manage, store, and process data for enterprise applications, cloud services, and large-scale IT operations. These systems include blade, rack and tower, micro, and Open Compute Project (OCP) servers, supporting virtualization, AI workloads, and hybrid IT environments

- The escalating demand for servers is primarily fueled by the widespread adoption of cloud computing, AI and machine learning applications, big data analytics, and enterprise digital transformation initiatives, coupled with the need for secure, reliable, and scalable IT infrastructure across industries

- North America dominated the servers technology market with a share of 44.04% in 2024, due to high adoption of cloud computing, data center expansions, and digital transformation initiatives across enterprises

- Asia-Pacific is expected to be the fastest growing region in the servers technology market during the forecast period due to rapid urbanization, digitalization initiatives, and expansion of IT and telecom infrastructure in countries such as China, Japan, and India

- Rack and tower segment dominated the market with a market share of 43% in 2024, due to their versatility and widespread deployment across diverse IT infrastructures. These servers are favored for their scalability, ease of maintenance, and compatibility with both enterprise and small business applications. Organizations often prioritize rack and tower servers for their robust performance, reliability, and support for virtualization and high-density workloads. The segment also benefits from extensive vendor support and a wide range of configurable options, enabling tailored solutions for computing, storage, and networking needs

Report Scope and Servers Technology Market Segmentation

|

Attributes |

Servers Technology Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Servers Technology Market Trends

Growing Cloud Computing Adoption

- Rapid growth in cloud computing services is driving demand for advanced server technologies that deliver high performance, scalability, and energy efficiency to support diverse workloads in public, private, and hybrid cloud environments

- For instance, tech giants such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud are continuously upgrading server infrastructure with cutting-edge processors, storage solutions, and networking components to meet soaring data and application demands

- Expansion of edge computing and distributed cloud architectures requires specialized server designs optimized for low latency, compact form factors, and localized data processing capabilities

- Increasing adoption of containerization, microservices, and artificial intelligence workloads drives innovation in server hardware for optimized compute, memory, and GPU capabilities

- Focus on energy-efficient and green data centers accelerates investment in servers with improved power management and cooling technologies to reduce carbon footprints and operational costs

- Growth of Software as a Service (SaaS), platform services, and digital transformation initiatives further propel server technology upgrades across enterprises and cloud providers

Servers Technology Market Dynamics

Driver

Data Center Expansion and Modernization

- Continuous expansion and technological modernization of data centers worldwide underpin the demand for high-performance, scalable server infrastructure to handle increasing volumes of digital data and applications

- For instance, hyperscale data center operators such as Equinix, Digital Realty, and China Telecom are investing in new facilities and retrofitting existing ones with next-generation servers to improve compute density, operational efficiency, and service reliability

- Rising adoption of virtualization and software-defined data centers stimulates demand for flexible and powerful server configurations capable of dynamic resource allocation

- Increased cloud migration by enterprises across industries requires data center upgrades to support hybrid cloud and multi-cloud strategies

- Focus on reducing total cost of ownership (TCO) and improving system uptime drives investments in advanced server management, monitoring, and automation tools. Growth in data-intensive applications such as big data analytics, machine learning, and video streaming escalates server performance and capacity requirements

Restraint/Challenge

Rising Supply Chain Disruptions

- Ongoing global supply chain challenges—including semiconductor shortages, component delays, and logistics constraints—pose significant risks to timely server technology availability and cost stability

- For instance, disruptions in sourcing processors, memory chips, and high-speed networking parts from key suppliers such as Intel, AMD, and Nvidia have led to extended lead times and pricing pressures for server manufacturers and data center operators

- Geopolitical tensions and trade restrictions exacerbate supply risks, especially for industry-critical raw materials and semiconductor fabrication capacity concentrated in select regions

- Fluctuating transportation costs and port congestions increase overall delivery expenses and complicate inventory management

- Delays in hardware availability can affect data center deployment schedules, cloud service expansions, and enterprise IT modernization projects. Manufacturing capacity limitations and fluctuating demand patterns contribute to market volatility, impacting procurement strategies and technology refresh cycles

Servers Technology Market Scope

The market is segmented on the basis of product, enterprise size, and end use.

- By Product

On the basis of product, the servers technology market is segmented into blade, micro, Open Compute Project (OCP), and rack and tower servers. The rack and tower servers segment dominated the largest market revenue share of 43% in 2024, driven by their versatility and widespread deployment across diverse IT infrastructures. These servers are favored for their scalability, ease of maintenance, and compatibility with both enterprise and small business applications. Organizations often prioritize rack and tower servers for their robust performance, reliability, and support for virtualization and high-density workloads. The segment also benefits from extensive vendor support and a wide range of configurable options, enabling tailored solutions for computing, storage, and networking needs.

The blade servers segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the rising adoption in data centers and cloud computing environments. Blade servers offer high-density computing within minimal space, enhancing energy efficiency and reducing operational costs. Their modular architecture allows businesses to scale efficiently while supporting heavy workloads and virtualization requirements. Growing demand from hyperscale data centers, coupled with advances in cooling and power management technologies, is driving the accelerated adoption of blade servers globally.

- By Enterprise Size

On the basis of enterprise size, the servers technology market is segmented into micro, small and medium, and large enterprises. The large enterprise segment dominated the largest market revenue share in 2024, driven by the increasing need for high-performance computing, data storage, and secure infrastructure. Large enterprises often deploy advanced server solutions to support mission-critical applications, cloud services, and enterprise-wide IT operations. Their investments in robust IT infrastructure, combined with the growing focus on digital transformation, enhance the demand for reliable and scalable server technologies. Large enterprises also prefer servers that support virtualization, analytics, and AI workloads, making them the leading segment in revenue generation.

The small and medium enterprise (SME) segment is expected to witness the fastest growth from 2025 to 2032, fueled by rising digital adoption and cloud-based server solutions tailored to SMEs. These enterprises are increasingly seeking cost-effective and scalable server options that provide enterprise-grade performance without heavy capital investment. The flexibility to deploy hybrid server environments and integrate with managed IT services further drives the uptake. Government incentives for digitalization and growing awareness about data security are also accelerating SME adoption of advanced server technologies.

- By End Use

On the basis of end use, the servers technology market is segmented into BFSI, energy, government and defense, healthcare, IT and telecom, and others. The IT and telecom segment dominated the largest market revenue share in 2024, driven by the need to support high-speed data processing, cloud computing, and network infrastructure. Telecom and IT companies increasingly rely on advanced servers to handle large-scale traffic, ensure low latency, and provide reliable services for consumers and enterprises alike. The segment also benefits from continuous innovation in server technologies, including edge computing and AI integration, which further strengthen its market position.

The healthcare segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the rising demand for digitization, electronic medical records, and telemedicine services. Healthcare providers require secure, high-performance servers to manage sensitive patient data, support real-time analytics, and integrate AI-driven diagnostic tools. Increasing adoption of cloud-based hospital management systems and growing investments in healthcare IT infrastructure are further accelerating server deployment in this sector. The need for regulatory compliance, data security, and scalable infrastructure also contributes to the rapid growth of this segment.

Servers Technology Market Regional Analysis

- North America dominated the servers technology market with the largest revenue share of 44.04% in 2024, driven by high adoption of cloud computing, data center expansions, and digital transformation initiatives across enterprises

- Organizations in the region are increasingly investing in high-performance server infrastructure to support AI, analytics, and large-scale IT operations. The widespread presence of leading technology vendors and strong IT services ecosystems further strengthens market growth

- Enterprises prioritize scalable and reliable servers, enabling enhanced operational efficiency, secure data handling, and seamless integration with existing IT environments

U.S. Servers Technology Market Insight

The U.S. servers technology market captured the largest revenue share within North America in 2024, fueled by rapid adoption of cloud and hybrid server deployments. Businesses are focusing on upgrading legacy systems to handle high-density workloads, virtualization, and edge computing applications. The preference for energy-efficient and modular server solutions, along with a robust IT infrastructure and technological awareness, drives market expansion. Moreover, the strong presence of hyperscale data centers and investment in digital transformation across sectors supports sustained demand for advanced server technologies.

Europe Servers Technology Market Insight

The Europe servers technology market is projected to grow steadily during the forecast period, supported by increasing IT modernization initiatives, government digitalization programs, and stringent data security requirements. Enterprises are investing in high-performance servers to support cloud adoption, virtualization, and business continuity. The rise in digital services, e-commerce, and connected infrastructure drives the adoption of servers across commercial and public sectors. European organizations also prioritize energy-efficient and sustainable server solutions, boosting market expansion across the region.

U.K. Servers Technology Market Insight

The U.K. servers technology market is expected to expand at a notable CAGR, driven by enterprise demand for advanced IT infrastructure and digital transformation initiatives. The growing reliance on cloud computing, hybrid IT models, and data-intensive applications encourages adoption of high-performance server systems. Enterprises are increasingly deploying scalable and secure server solutions to manage workloads efficiently, support analytics, and maintain compliance with local and international data regulations.

Germany Servers Technology Market Insight

The Germany servers technology market is anticipated to witness substantial growth, fueled by strong industrial and commercial IT investment. The country’s emphasis on innovation, sustainability, and digital security promotes the adoption of modular, high-density, and energy-efficient servers. Enterprises in Germany are leveraging servers to enhance business processes, enable automation, and integrate AI and IoT-driven applications, reinforcing the market’s growth trajectory.

Asia-Pacific Servers Technology Market Insight

The Asia-Pacific servers technology market is poised to grow at the fastest CAGR during the forecast period, driven by rapid urbanization, digitalization initiatives, and expansion of IT and telecom infrastructure in countries such as China, Japan, and India. The region is witnessing strong adoption of cloud computing, hyperscale data centers, and edge computing solutions, fueling demand for high-performance servers. Government support for smart city projects, combined with an expanding enterprise base and increasing investments in digital infrastructure, further accelerates market growth.

Japan Servers Technology Market Insight

The Japan servers technology market is gaining traction due to high technological adoption, the need for reliable enterprise IT infrastructure, and advanced cloud computing deployments. Enterprises focus on energy-efficient, modular, and AI-compatible server solutions to manage large-scale operations and enhance digital services. In addition, Japan’s demand for smart infrastructure and IoT-enabled applications drives consistent server adoption across commercial and industrial sectors.

China Servers Technology Market Insight

The China servers technology market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by rapid enterprise digitalization, cloud adoption, and investment in hyperscale data centers. The country’s expanding industrial base and IT infrastructure modernization fuel strong server demand. Domestic server manufacturers, coupled with competitive pricing and scalable solutions, are enabling widespread deployment across commercial, government, and residential sectors, positioning China as a key growth hub in the region.

Servers Technology Market Share

The servers technology industry is primarily led by well-established companies, including:

- ASUSTeK Computer Inc. (Taiwan)

- Cisco Systems, Inc. (U.S.)

- Dell Inc. (U.S.)

- Fujitsu (Japan)

- Hewlett Packard Enterprise Development LP (U.S.)

- Huawei Technologies Co., Ltd. (China)

- IBM (U.S.)

- Inspur (China)

- Intel Corporation (U.S.)

- SMART Global Holdings, Inc. (U.S.)

Latest Developments in Global Servers Technology Market

- In September 2023, Microsoft and AMD collaborated to develop optimized cloud solutions for Azure, leveraging AMD’s latest EPYC processors. This partnership strengthened Microsoft’s position in the servers technology market by enabling high-performance computing workloads, including AI and machine learning, to run more efficiently on Azure. The collaboration enhanced Azure’s competitiveness by offering innovative, scalable, and energy-efficient server solutions, attracting enterprise customers seeking robust cloud infrastructure and advanced computing capabilities

- In May 2023, Intel and Alibaba Cloud partnered to develop optimized server platforms for cloud workloads, combining Intel’s latest processors and technologies with Alibaba’s cloud expertise. This collaboration expanded Alibaba Cloud’s ability to deliver high-performance, cost-effective, and scalable solutions for cloud-native applications. It reinforced both companies’ market presence by addressing the growing demand for efficient cloud infrastructure across enterprises and data centers in Asia-Pacific and globally

- In May 2023, Broadcom Inc. acquired VMware in a landmark $61 billion deal, positioning Broadcom as a major player in the cloud computing and servers technology market. The acquisition allowed Broadcom to integrate its infrastructure solutions with VMware’s cloud management software, enhancing its ability to offer comprehensive, enterprise-grade server and virtualization solutions. This move strengthened Broadcom’s competitive edge and market influence in providing end-to-end infrastructure and cloud services

- In June 2022, HPE announced the availability of the HPE ProLiant RL300 Gen11, a cloud-native server designed for social platforms, cloud-based services, e-commerce, and media streaming. Featuring a 1-socket, 1U configuration supporting up to 16 DIMMs and 4TB maximum memory, the server enhanced HPE’s market positioning by addressing the growing need for high-density, scalable, and energy-efficient server solutions. This launch enabled enterprises to deploy advanced computing infrastructure optimized for modern workloads and cloud-native applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.