Global Set Top Box Market

Market Size in USD Billion

CAGR :

%

USD

46.18 Billion

USD

81.75 Billion

2025

2033

USD

46.18 Billion

USD

81.75 Billion

2025

2033

| 2026 –2033 | |

| USD 46.18 Billion | |

| USD 81.75 Billion | |

|

|

|

|

Set Top Box Market Size

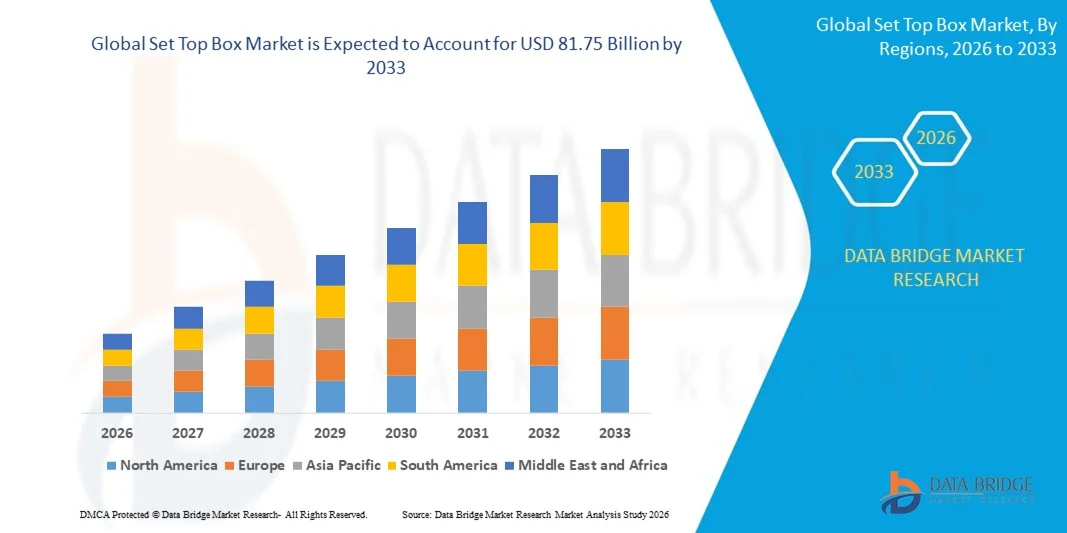

- The global set top box market size was valued at USD 46.18 billion in 2025 and is expected to reach USD 81.75 billion by 2033, at a CAGR of 7.40% during the forecast period

- The market growth is largely fueled by increasing broadband penetration, rising smart TV adoption, and the rapid expansion of OTT and IPTV services, leading to greater digital content consumption in both residential and commercial settings

- Furthermore, growing consumer demand for high-definition, interactive, and on-demand content is positioning set-top boxes as a central gateway for home entertainment and business content delivery. These converging factors are accelerating the adoption of advanced set-top box solutions, thereby significantly boosting the industry's growth

Set Top Box Market Analysis

- Set-top boxes are electronic devices that enable users to receive, decode, and stream digital television and internet-based content. These devices support multiple technologies, including IPTV, OTT, and hybrid systems, providing high-definition content, interactive services, and multi-device integration for residential and commercial applications

- The escalating demand for set-top boxes is primarily fueled by the growing adoption of smart TVs, increased consumption of on-demand and streaming content, and consumer preference for personalized, user-friendly entertainment experiences. Rising investments by service providers and content platforms to enhance interactive features and UHD/HD content delivery are further driving market growth

- Asia-Pacific dominated the set top box market with a share of 43% in 2025, due to rising broadband penetration, growing smart TV adoption, and increasing demand for internet-based television services

- North America is expected to be the fastest growing region in the set top box market during the forecast period due to increasing demand for OTT and IPTV services, premium content consumption, and rising smart TV adoption

- Internet protocol segment dominated the market with a market share of 38.5% in 2025, due to increasing broadband penetration and the growing adoption of internet-based television services. IP set-top boxes offer users interactive features, on-demand streaming, and seamless integration with smart TVs, making them a preferred choice for tech-savvy households

Report Scope and Set Top Box Market Segmentation

|

Attributes |

Set Top Box Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Set Top Box Market Trends

Rising Adoption of OTT and IPTV Services

- A significant trend in the set-top box market is the increasing adoption of OTT and IPTV services, driven by the growing demand for flexible, on-demand, and high-quality content across residential and commercial segments. Consumers are increasingly shifting from traditional DTH and cable subscriptions to internet-based streaming platforms, which offer personalized viewing experiences and multi-device compatibility

- For instance, Tata Play and Airtel Digital TV are expanding their hybrid IPTV offerings to integrate OTT apps, enhancing content accessibility for subscribers. This integration allows users to access live TV, catch-up services, and streaming platforms through a single device, strengthening customer engagement and retention

- The trend is further reinforced by the proliferation of smart TVs and high-speed broadband networks, which facilitate seamless content streaming and high-definition video delivery. Companies such as Reliance Jio with its Jio Set Top Box are leveraging this trend by combining OTT content, gaming, and interactive apps under one platform

- In addition, the growing preference for interactive and personalized content is encouraging operators to bundle advanced features such as voice search, recommendation engines, and multi-screen viewing. This positions set-top boxes as central hubs for digital entertainment, enhancing overall user experience

- The expansion of global OTT platforms including Netflix, Disney+, and Amazon Prime Video is accelerating the adoption of compatible set-top boxes. Consumers benefit from access to international content, premium shows, and on-demand services, contributing to higher market penetration

- The market is witnessing robust growth in hybrid and IP-enabled set-top boxes where high-definition and ultra-high-definition content delivery, coupled with interactive and cloud-based features, is redefining the traditional television viewing experience. These converging developments are reinforcing the role of set-top boxes as critical devices in modern digital ecosystems

Set Top Box Market Dynamics

Driver

Increasing Smart TV Penetration and Broadband Availability

- The rising penetration of smart TVs, combined with widespread broadband availability, is a key driver for the set-top box market. Consumers increasingly prefer integrated solutions that allow access to live TV, OTT content, and interactive features, making set-top boxes a preferred gateway for home entertainment

- For instance, EchoStar and Dish TV are leveraging high-speed broadband networks to deliver IP and OTT-based set-top box solutions that provide seamless streaming, on-demand content, and multi-device support. These offerings cater to consumer demand for high-quality viewing experiences and convenience

- The expansion of high-speed internet infrastructure in emerging markets is further fueling the adoption of IPTV and OTT-compatible set-top boxes. Companies such as Huawei Technologies and HUMAX Electronics are introducing devices optimized for HD and UHD content streaming, supporting growth in regions with improved connectivity

- The driver is reinforced by the rising adoption of cloud-based and interactive services that allow users to personalize viewing experiences, record content, and access additional apps. This integration of digital services is creating opportunities for service providers to differentiate offerings and retain subscribers

- Increasing consumer awareness and preference for high-definition and ultra-high-definition content, supported by broadband penetration, is accelerating market demand. The combination of smart TV compatibility, broadband access, and interactive services is driving sustained growth in the set-top box market

Restraint/Challenge

Intense Competition from Streaming Platforms and Digital Content Providers

- The set-top box market faces challenges due to intense competition from OTT streaming platforms and digital content providers, which often allow direct access to content without requiring a dedicated device. Consumers can bypass traditional set-top boxes, opting instead for smart TVs or mobile devices with built-in streaming apps

- For instance, platforms such as Netflix, Amazon Prime Video, and Disney+ offer content directly via smart TVs or mobile applications, reducing dependency on traditional or hybrid set-top boxes. This is limiting market penetration and exerting pressure on set-top box manufacturers to innovate continuously

- High competition also drives price sensitivity among consumers, compelling manufacturers to balance advanced features with cost-effective solutions. Companies such as Arris International and ADB face pressure to provide high-quality devices at competitive prices while maintaining profitability

- The challenge is compounded by the rapid evolution of content delivery technologies, including cloud streaming, mobile-first applications, and adaptive bitrate streaming. This requires continuous investment in research, development, and device compatibility to keep pace with consumer expectations

- Scaling operations in regions with emerging digital infrastructure is difficult as service providers must invest heavily in distribution, partnerships, and local content integration. These market pressures collectively challenge the ability of set-top box companies to maintain growth and secure long-term consumer loyalty

Set Top Box Market Scope

The market is segmented on the basis of product type, content quality, services, end-user, and technology.

- By Product Type

On the basis of product type, the set-top boxes market is segmented into Internet Protocol (IP), Digital Terrestrial Television (DTT), Satellite, Cable, Over-The-Top (OTT) content, and Others. The IP segment dominated the largest market revenue share of 38.5% in 2025, driven by increasing broadband penetration and the growing adoption of internet-based television services. IP set-top boxes offer users interactive features, on-demand streaming, and seamless integration with smart TVs, making them a preferred choice for tech-savvy households. Consumers increasingly value personalized viewing experiences, and IP set-top boxes support content recommendation engines and multi-device streaming, boosting their market share. Compatibility with advanced middleware platforms and regional content partnerships further reinforces the dominance of IP set-top boxes in the global market.

The OTT content segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by the rising popularity of streaming platforms such as Netflix, Disney+, and Amazon Prime Video. OTT set-top boxes allow users to access content directly over the internet without traditional cable subscriptions, offering convenience and flexibility. The proliferation of smart TVs, mobile devices, and high-speed internet infrastructure accelerates the adoption of OTT-enabled devices. Interactive features such as voice search, personalized recommendations, and multi-language support enhance user experience, driving rapid growth. The segment also benefits from increasing investments by content providers and device manufacturers to expand compatibility and user engagement.

- By Content Quality

On the basis of content quality, the set-top boxes market is segmented into High Definition (HD), Standard Definition (SD), and Ultra-High Definition (UHD). The HD segment held the largest market revenue share in 2025 due to its balance between affordability and superior viewing experience compared with standard definition. HD set-top boxes support popular streaming apps and broadcasting platforms, making them widely adopted in residential households and commercial setups. The segment’s compatibility with mid-range TVs and moderate internet speeds makes HD content the default choice for many users globally. In addition, manufacturers continue to enhance HD boxes with smart features such as recording, pause, and multi-screen capabilities, strengthening market dominance.

The UHD segment is expected to witness the fastest CAGR from 2026 to 2033, driven by rising consumer preference for immersive viewing experiences and next-generation display technologies. UHD set-top boxes provide ultra-high-resolution content, HDR support, and superior color reproduction, appealing to premium segments. Adoption is particularly high among 4K and 8K TV owners who seek cinematic-quality content at home. OTT platforms and premium broadcasters increasingly offer UHD streaming, accelerating adoption. Enhanced processing power, storage, and network optimization further fuel the rapid growth of UHD set-top boxes.

- By Services

On the basis of services, the set-top boxes market is segmented into Managed Services and Interactive Services. The Managed Services segment dominated the largest market revenue share in 2025 due to widespread operator-led subscription models and end-to-end support offerings. Managed service set-top boxes provide users with streamlined installation, content aggregation, and technical support, ensuring minimal operational hassle. Service providers benefit from recurring revenue streams and improved customer retention through bundled packages. In addition, managed services enable integration with regional content providers and advanced analytics, enhancing personalized recommendations. The segment remains dominant as operators increasingly leverage smart set-top boxes to deliver differentiated service offerings.

Interactive Services are anticipated to witness the fastest growth from 2026 to 2033, fueled by rising consumer demand for on-demand content, gaming, and multi-screen functionality. For instance, platforms such as Tata Sky and Comcast offer interactive features including video-on-demand, pause/rewind live TV, and interactive advertisements. The growth is supported by increasing broadband penetration and smart TV adoption, which allow seamless access to interactive services. Features such as voice control, apps, and integration with OTT platforms further drive user engagement. Enhanced analytics and targeted content delivery enhance personalization, propelling the rapid expansion of interactive services.

- By End-User

On the basis of end-user, the set-top boxes market is segmented into Commercial and Residential. The residential segment held the largest market revenue share in 2025 due to the high adoption of pay-TV subscriptions, OTT content, and smart home integrations. Residential users increasingly prefer advanced set-top boxes that support multi-device streaming, parental controls, and content recommendation engines. Affordable subscription plans and regional content availability make residential deployments the dominant segment. Manufacturers continue to innovate with compact, energy-efficient designs and improved user interfaces, further boosting market share. In addition, rising internet penetration in emerging economies drives demand for residential set-top boxes across urban and semi-urban regions.

The commercial segment is expected to witness the fastest CAGR from 2026 to 2033, driven by the increasing deployment of set-top boxes in hotels, offices, and entertainment venues. For instance, hospitality chains such as Marriott and Hilton deploy interactive set-top boxes to provide guests with personalized content, room controls, and on-demand services. Commercial set-top boxes enhance customer experience while enabling operators to deliver customized content packages. The adoption is further supported by technological advancements such as cloud-based content management and multi-language support. Growing demand for digital signage, video conferencing, and IPTV in commercial setups also fuels rapid market expansion.

- By Technology

On the basis of technology, the set-top boxes market is segmented into OTT, IPTV, and Hybrid. The IPTV segment dominated the largest market revenue share in 2025 due to established broadband networks and widespread adoption of operator-led streaming services. IPTV set-top boxes allow seamless integration with on-demand and live content services while providing interactive features, parental controls, and multi-screen support. The segment benefits from high-quality video streaming and stable network connectivity, making it a preferred choice for households and businesses. In addition, IPTV technology enables analytics, content monetization, and regional content customization, strengthening market leadership. Providers continue to invest in enhancing middleware platforms and expanding service offerings, reinforcing IPTV dominance.

The OTT segment is anticipated to witness the fastest growth from 2026 to 2033, driven by increasing consumer preference for internet-based streaming services and flexible content consumption. For instance, Netflix, Amazon Prime Video, and Disney+ are driving OTT adoption by offering extensive content libraries and multi-device support. OTT set-top boxes allow users to bypass traditional broadcasting infrastructure while providing high-quality streaming, personalized recommendations, and easy access to global content. Growth is accelerated by rising smart TV penetration and high-speed internet availability. Innovative features such as voice search, app stores, and cross-platform compatibility further fuel rapid adoption of OTT set-top boxes.

Set Top Box Market Regional Analysis

- Asia-Pacific dominated the set top box market with the largest revenue share of 43% in 2025, driven by rising broadband penetration, growing smart TV adoption, and increasing demand for internet-based television services

- The region’s cost-effective manufacturing landscape, rising investments in consumer electronics, and expanding OTT and IPTV infrastructure are accelerating market expansion

- Availability of skilled labor, favorable government policies, and rapid digitalization across developing economies are contributing to increased consumption of set-top boxes in both residential and commercial sectors

China Set-Top Box Market Insight

China held the largest share in the Asia-Pacific set-top box market in 2025, owing to its status as a global leader in electronics manufacturing and home entertainment solutions. The country’s strong industrial base, government initiatives promoting digital infrastructure, and extensive domestic and international distribution channels are major growth drivers. Demand is also bolstered by ongoing investments in smart TV integration, OTT platforms, and high-definition content delivery.

India Set-Top Box Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by rising internet penetration, growing OTT content consumption, and increasing adoption of smart TVs. Government initiatives such as Digital India and expansion of broadband networks are strengthening demand for set-top boxes. In addition, growing investment by content providers and device manufacturers in interactive services and HD/UHD technology is contributing to robust market expansion.

Europe Set-Top Box Market Insight

The Europe set-top box market is expanding steadily, supported by high adoption of advanced television services, strong consumer preference for high-definition content, and increasing investments in OTT and IPTV solutions. The region emphasizes quality, regulatory compliance, and environmentally sustainable production practices in consumer electronics. Growing integration of interactive services, smart home ecosystems, and multi-device connectivity is further enhancing market growth.

Germany Set-Top Box Market Insight

Germany’s set-top box market is driven by its leadership in high-quality consumer electronics manufacturing, strong R&D capabilities, and high household adoption of smart TVs. The country has well-established partnerships between technology providers and content platforms, fostering innovation in set-top box solutions. Demand is particularly strong for IP and hybrid set-top boxes offering advanced features, high-definition content, and interactive services.

U.K. Set-Top Box Market Insight

The U.K. market is supported by a mature television and broadcasting industry, growing efforts to expand OTT and IPTV services, and increasing consumer preference for high-quality content delivery. Rising focus on innovation, interactive features, and integration with smart home ecosystems is driving adoption. Investments in local manufacturing, content partnerships, and digital infrastructure continue to strengthen the U.K.'s position in the set-top box market.

North America Set-Top Box Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing demand for OTT and IPTV services, premium content consumption, and rising smart TV adoption. Strong investments in broadband infrastructure, technological advancements in interactive set-top boxes, and growing preference for UHD content are boosting market growth. In addition, collaborations between content providers, device manufacturers, and service operators are accelerating market expansion.

U.S. Set-Top Box Market Insight

The U.S. accounted for the largest share in the North America set-top box market in 2025, underpinned by its expansive media and entertainment industry, strong digital infrastructure, and high consumer demand for IP- and OTT-enabled devices. The country’s focus on innovation, interactive services, and multi-device compatibility is encouraging adoption of advanced set-top boxes. Presence of key players, widespread content availability, and mature distribution networks further solidify the U.S.'s leading position in the region.

Set Top Box Market Share

The set top box industry is primarily led by well-established companies, including:

- Arris International (U.S.)

- ADB (Switzerland)

- EchoStar Corporation (U.S.)

- Huawei Technologies Co., Ltd. (China)

- HUMAX Electronics Co., Ltd. (South Korea)

- Sichuan Jiuzhou Electronic Technology Co., Ltd. (China)

- Kaonmedia Co., Ltd. (South Korea)

- LG CNS (South Korea)

- Netgem Group (France)

- SAGEMCOM (France)

- Samsung (South Korea)

- Sky (U.K.)

- Skyworth India Electronics Pvt Ltd. (India)

- Technicolor (France)

- TechniSat Digital GmbH (Germany)

- TOPFIELD CO., LTD. (South Korea)

- Zinwell Corporation (Taiwan)

Latest Developments in Global Set Top Box Market

- In August 2025, Dish TV India reported a consolidated net loss of ₹94.53 crore, highlighting the company’s ongoing financial pressures amid rising competition in the Indian DTH and OTT market. Despite this, the company’s OTT platform Watcho surpassed 10 million paid subscriptions, indicating strong consumer adoption and engagement with its digital content offerings. This mixed outcome reflects a transitional phase where traditional broadcasting struggles with profitability, while digital and OTT services emerge as key growth drivers. The milestone achieved by Watcho underscores the increasing shift of Indian consumers toward on-demand streaming and the monetization potential of digital platforms within the company’s broader ecosystem

- In June 2025, Qatar Airways partnered with Panasonic to implement Converix systems across 60 Boeing 777X aircraft, significantly enhancing in-flight entertainment and connectivity services for passengers. This strategic deployment enables Qatar Airways to offer a more seamless and interactive passenger experience, including personalized media, live content streaming, and improved connectivity. For Panasonic, the partnership strengthens its presence in the global aviation technology market, demonstrating its ability to deliver advanced hardware and software solutions that meet the evolving demands of airlines for premium in-flight services. The collaboration highlights the growing importance of integrated digital platforms in airline customer experience strategies

- In May 2025, EchoStar announced Q1 2025 revenue of USD 3.87 billion, achieving record-low DISH churn during the period, which indicates strong customer retention in a highly competitive broadcasting environment. The results reflect EchoStar’s operational resilience and effective management of subscriber loyalty despite pressures from emerging OTT platforms and alternative content providers. The company’s performance also demonstrates its ability to balance traditional DTH services with digital innovations, ensuring continuity in revenue streams while adapting to changing consumer viewing preferences. Low churn rates reinforce EchoStar’s position as a stable service provider in the North American and global markets

- In February 2025, Tata Play and Airtel Digital TV entered advanced merger discussions through a share swap arrangement, signaling a potential major consolidation in the Indian DTH sector. If completed, this merger could reshape the competitive landscape by combining subscriber bases, expanding content offerings, and creating operational efficiencies. The strategic alignment aims to strengthen market positioning against both traditional rivals and growing OTT platforms, potentially leading to improved pricing power and service innovation. This move also reflects the trend of consolidation within the Indian broadcasting market as companies seek scale and digital integration to maintain profitability

- In August 2023, Reliance Jio unveiled its Jio Set Top Box (STB) along with Jio Smart Home Services and Jio Router during the company’s 46th Annual General Meeting (AGM). The STB offering is designed to integrate television streaming, gaming, and applications such as JioCinema and JioTV+, creating a comprehensive digital ecosystem for Indian consumers. By bundling entertainment, connectivity, and smart home services, Reliance Jio aims to strengthen customer engagement, expand its digital footprint, and compete effectively with other DTH providers and OTT platforms. The launch exemplifies Jio’s strategy of converging multiple digital services under a single ecosystem, enhancing convenience and value for subscribers

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.