Global Sewing Machines Market

Market Size in USD Billion

CAGR :

%

USD

4.56 Billion

USD

7.54 Billion

2024

2032

USD

4.56 Billion

USD

7.54 Billion

2024

2032

| 2025 –2032 | |

| USD 4.56 Billion | |

| USD 7.54 Billion | |

|

|

|

|

Global Sewing Machines Market Size

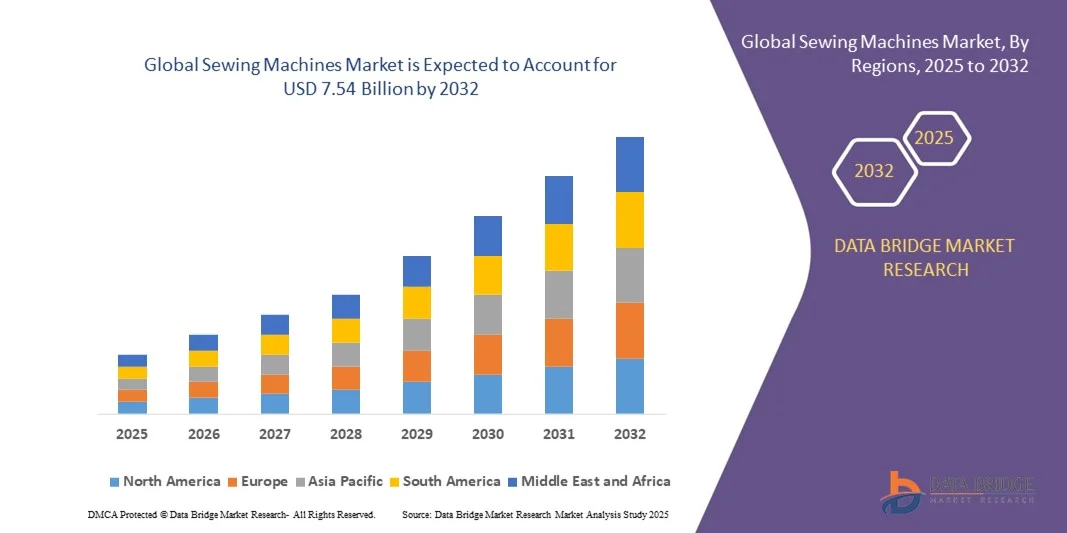

- The global Sewing Machines Market size was valued at USD 4.56 billion in 2024 and is expected to reach USD 7.54 billion by 2032, growing at a CAGR of 6.50% during the forecast period

- The market growth is primarily driven by rising demand for advanced, efficient, and automated sewing solutions across both industrial and domestic sectors, supporting greater productivity and precision

- Additionally, increasing interest in DIY fashion, home tailoring, and sustainable clothing practices is encouraging the adoption of modern sewing machines, significantly propelling the market's expansion

Global Sewing Machines Market Analysis

- Sewing machines, essential tools for fabric stitching and garment creation, are becoming increasingly advanced in both industrial and domestic applications due to automation, digital interfaces, and integration with design software, enhancing efficiency and precision in sewing operations

- The growing demand for sewing machines is primarily driven by the rising popularity of DIY fashion, increasing garment production, and the adoption of smart and computerized machines that support customization and improved stitching quality

- North America dominated the sewing machines market with the largest revenue share of 39.6% in 2024, attributed to the region's strong textile manufacturing base, cost-effective labor, and increasing investments in automation technologies, particularly in countries like China, India, and Bangladesh

- Asia-Pacific is expected to witness significant growth in the sewing machines market during the forecast period, driven by a growing trend of home-based tailoring, increased interest in sustainable fashion, and innovations in user-friendly, compact machines

- The electric segment dominated the market with the largest revenue share of 45.6% in 2024, owing to its wide usage in both domestic and semi-industrial applications

Report Scope and Global Sewing Machines Market Segmentation

|

Attributes |

Sewing Machines Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Sewing Machines Market Trends

Enhanced Convenience Through AI and Digital Integration

- A significant and rapidly evolving trend in the global Sewing Machines Market is the integration of artificial intelligence (AI), smart sensors, and digital technologies into modern sewing machines. These advancements are transforming traditional sewing into a more automated, intuitive, and user-friendly process, catering to both industrial manufacturers and home-based users.

- For Instance, Janome’s Continental M17 combines AI with advanced sensors to provide real-time feedback on fabric handling, stitch quality, and tension control, significantly reducing manual adjustments and improving output consistency. Similarly, Brother’s Luminaire series uses built-in cameras and projection technology to assist users with real-time stitch guidance and pattern alignment.

- AI-powered sewing machines are capable of recognizing fabric types, recommending optimal settings, and learning from user behavior to suggest improvements or preferred stitching patterns. Some models even feature voice-guided tutorials and touchscreen interfaces that streamline complex sewing tasks for beginners and professionals alike.

- The integration of sewing machines with digital design software and cloud connectivity enables users to import, customize, and execute embroidery and stitching patterns directly from online platforms. This creates a seamless design-to-production workflow, especially beneficial for small businesses and independent designers.

- This trend is not only boosting user convenience but also driving efficiency and precision across the sewing value chain. Companies like Juki and Bernina are increasingly launching smart sewing systems equipped with wireless connectivity, machine learning capabilities, and IoT-based performance monitoring to meet rising demands for intelligent textile production.

- The growing preference for AI-enhanced, connected sewing machines reflects a broader market shift towards automation and personalization, particularly in fashion, upholstery, and custom embroidery sectors, reshaping user expectations and driving innovation across both domestic and industrial segments.

Global Sewing Machines Market Dynamics

Driver

Growing Demand Driven by DIY Trends and Textile Industry Expansion

-

The rising global interest in do-it-yourself (DIY) fashion, home tailoring, and sustainable clothing practices is significantly boosting demand for sewing machines across both residential and commercial segments. Consumers are increasingly investing in sewing equipment to repair, customize, or create garments and home textiles, driven by cost-saving motives and creative expression.

- For instance, during and post-pandemic, brands like Singer and Brother reported a surge in domestic sewing machine sales as hobbyists and small-scale entrepreneurs embraced sewing as a craft and business opportunity. This trend continues with the growing availability of beginner-friendly, feature-rich machines.

- In the industrial sector, rapid growth in apparel manufacturing, especially in Asia-Pacific regions like Bangladesh, India, and Vietnam, is fueling the demand for advanced industrial sewing machines. These machines offer high-speed operation, automation, and precision stitching—ideal for mass production.

- Additionally, the integration of digital design platforms with sewing machines enables small businesses and fashion designers to easily prototype and produce high-quality customized apparel, driving adoption in creative industries.

- The expansion of the global textile and garment industry, combined with increasing interest in sustainability and local production, positions sewing machines as vital tools across various applications. Brands are responding with machines that support a wide range of materials and functions, from embroidery and quilting to heavy-duty industrial stitching.

Restraint/Challenge

High Cost of Advanced Machines and Skill Barriers

- The high upfront cost of technologically advanced sewing machines—particularly computerized and industrial models—remains a key restraint, especially for small businesses, independent creators, and users in developing regions. These machines, while offering enhanced performance, often come with premium pricing due to automation, software integration, and specialized features.

- For Instance, models such as the Bernina 880 Plus or Janome Horizon Memory Craft series can cost several thousand dollars, making them inaccessible for many entry-level users or hobbyists. This cost barrier may limit adoption in price-sensitive markets despite growing interest.

- Furthermore, the learning curve associated with operating modern sewing machines—especially computerized models with touchscreen controls, design software, and AI-assisted functions—can discourage new users unfamiliar with sewing technology.

- The lack of formal training, especially in emerging economies, further limits the effective use of these machines in both domestic and small industrial settings. Without adequate skill development, users may struggle to unlock the full potential of high-end devices.

- To overcome these challenges, manufacturers are focusing on developing more affordable, user-friendly models and offering online tutorials, training programs, and simplified interfaces. Expanding access to financing options, warranty support, and after-sales service is also critical for promoting adoption in lower-income and under-served markets.

Global Sewing Machines Market Scope

The market is segmented on the basis of type, use case, and application.

- By Type

On the basis of type, the sewing machines market is segmented into electric, computerized, and manual machines. The electric segment dominated the market with the largest revenue share of 45.6% in 2024, owing to its wide usage in both domestic and semi-industrial applications. These machines provide a balance between functionality and affordability, offering enhanced stitching speed, ease of use, and compatibility with multiple fabric types. They are particularly popular among hobbyists, small tailoring businesses, and educational institutions.

The computerized segment is expected to witness the fastest CAGR from 2025 to 2032, driven by rising demand for automation, customization, and precision. These machines feature programmable stitch patterns, touchscreen displays, and integration with embroidery software, appealing to both advanced hobbyists and commercial users. Their ability to handle complex designs with minimal user intervention makes them increasingly favored in high-value garment production and small-scale fashion businesses.

- By Use Case

On the basis of use case, the sewing machines market is segmented into apparel, shoes, bags, and others. The apparel segment held the largest market revenue share of 58.9% in 2024, driven by the global expansion of the textile and clothing industry. The growing trend of fast fashion, sustainable clothing, and custom apparel has led to a surge in demand for efficient and flexible sewing machines capable of handling various fabric types and designs. The rise of home tailoring and small fashion startups also contributes to the segment’s dominance.

The bags segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing demand for customized, durable, and designer bags, including backpacks, handbags, and travel accessories. Heavy-duty sewing machines that support thick materials like leather and canvas are increasingly being adopted by small workshops and independent designers catering to niche markets and premium craftsmanship.

- By Application

On the basis of application, the sewing machines market is segmented into commercial, industrial, and residential categories. The industrial segment dominated the market with the largest share of 56.4% in 2024, primarily due to high adoption in large-scale apparel manufacturing facilities across Asia-Pacific. Industrial sewing machines offer high-speed stitching, long operational life, and compatibility with automation systems—making them essential for mass production in textile, footwear, and upholstery industries.

The residential segment is projected to register the fastest CAGR from 2025 to 2032, driven by the rise in DIY culture, hobby sewing, and the growing interest in sustainable living through self-made clothing and repairs. Compact, user-friendly machines with beginner features and digital enhancements are particularly appealing to hobbyists and first-time users. Furthermore, online tutorials and digital sewing communities are fueling growth in this segment by lowering skill barriers and encouraging new entrants into the home sewing space.

Global Sewing Machines Market Regional Analysis

- North America dominated the global sewing machines market with the largest revenue share of 39.6% in 2024, driven by the region’s expansive textile and garment manufacturing sector, particularly in countries like China, India, Bangladesh, and Vietnam. These nations serve as key global hubs for apparel production, supported by favorable labor costs and large-scale industrial infrastructure.

- Manufacturers in the region are increasingly adopting advanced, high-speed, and automated sewing machines to enhance efficiency and meet growing global demand for ready-made garments. Additionally, rising investments in smart factories and Industry 4.0 integration are further accelerating machine upgrades in the industrial segment.

- On the domestic front, the growing popularity of home tailoring, DIY fashion, and sustainable living—coupled with rising disposable incomes—is encouraging more consumers to purchase electric and computerized sewing machines. This combination of strong industrial demand and expanding consumer interest positions Asia-Pacific as the dominant force in the global sewing machines market.

U.S. Sewing Machines Market Insight

The U.S. sewing machines market captured the largest revenue share of 37% in North America in 2024, driven by a growing interest in home sewing, DIY fashion, and customization. Consumers are increasingly adopting computerized and electric sewing machines due to their advanced features and ease of use. The rising trend of sustainable fashion and garment upcycling further fuels demand. Additionally, strong retail infrastructure, access to innovative sewing technologies, and increasing hobbyist communities contribute to steady market growth. The industrial segment also benefits from high demand in apparel manufacturing and technical textiles.

Europe Sewing Machines Market Insight

The Europe sewing machines market is projected to expand steadily over the forecast period, supported by stringent quality standards and the region’s established textile industry. Countries such as Italy and Germany are known for their high-end fashion manufacturing, driving demand for advanced industrial sewing machines. Rising awareness around sustainable textile production and home sewing is boosting residential segment growth, especially in Western Europe. The demand for computerized and multi-functional sewing machines is increasing as consumers look for innovation, customization, and ease of use in both home and commercial environments.

U.K. Sewing Machines Market Insight

The U.K. sewing machines market is expected to witness notable growth, propelled by the popularity of DIY fashion, craft culture, and upcycling trends. Increasing interest in home-based tailoring and small-scale entrepreneurship is driving adoption of electric and computerized machines. Moreover, the country’s strong e-commerce presence makes advanced sewing machines more accessible to consumers. Demand is also rising in the commercial segment, where independent designers and boutique manufacturers seek precision and automation to enhance production efficiency and quality.

Germany Sewing Machines Market Insight

Germany’s sewing machines market is anticipated to grow at a considerable pace, fueled by its strong textile and automotive upholstery sectors. The country’s focus on innovation, precision engineering, and sustainable manufacturing drives adoption of high-end industrial and computerized sewing machines. Residential consumers are increasingly attracted to multifunctional machines that combine embroidery, quilting, and stitching capabilities. Germany’s robust infrastructure and skilled workforce further support growth in both industrial and home sewing segments, aligning with consumer preferences for quality and technological advancement.

Asia-Pacific Sewing Machines Market Insight

The Asia-Pacific sewing machines market is poised to grow at the fastest CAGR of 22% during 2025 to 2032, led by booming textile and garment manufacturing hubs such as China, India, Bangladesh, and Vietnam. Rising urbanization, increased disposable incomes, and government initiatives to modernize manufacturing facilities are key drivers. The region also sees strong demand for electric and computerized sewing machines in both industrial and domestic segments. Expansion of small and medium enterprises in fashion, along with growing interest in DIY sewing, supports widespread market growth.

Japan Sewing Machines Market Insight

Japan’s sewing machines market is growing steadily, driven by the country’s advanced technology ecosystem and strong domestic manufacturers like Brother and Juki. The emphasis on precision, automation, and compact design appeals to both industrial users and home sewing enthusiasts. Japan’s aging population and interest in crafting as a leisure activity also contribute to demand for user-friendly computerized machines. Integration with digital design software and IoT connectivity is further enhancing market growth, particularly in high-value embroidery and fashion applications.

China Sewing Machines Market Insight

China accounted for the largest market revenue share in Asia-Pacific in 2024, fueled by its dominant role as a global manufacturing hub for apparel and textiles. The country’s vast industrial base continually upgrades to high-speed, automated sewing machines to meet global demand for fast fashion and technical textiles. Increasing disposable incomes and rising interest in home sewing also stimulate demand for electric and computerized machines among domestic consumers. Strong local manufacturers and government support for industrial modernization further boost the sewing machines market in China.

Global Sewing Machines Market Share

The Sewing Machines industry is primarily led by well-established companies, including:

- Brother Industries, Ltd. (Japan)

- Singer Corporation (U.S.)

- Juki Corporation (Japan)

- Bernina International AG (Switzerland)

- Janome Sewing Machine Co., Ltd. (Japan)

- Pfaff (Germany)

- Husqvarna Viking (Sweden)

- Merrow Inc. (U.S.)

- Aisin Seiki Co., Ltd. (Japan)

- Pegasus Sewing Machine Mfg. Co., Ltd. (Japan)

- Usha International Limited (India)

- SEIKO Sewing Machine Co., Ltd. (Japan)

- SVP Holdings Ltd. (U.S.)

- China Feiyue USA Inc. (U.S.)

- Kaulin Manufacturing Co., Ltd. (Taiwan)

- Tacony Corporation (U.S.)

- Rimoldi & CF srl (Italy)

- Jack Sewing Machine Co., Ltd. (China)

- Shang Gong Group Co., Ltd. (China)

- Toyota Home Sewing (Japan)

What are the Recent Developments in Global Sewing Machines Market?

- In April 2023, Brother Industries, Ltd., a global leader in sewing machine manufacturing, launched a strategic initiative in South Africa aimed at expanding access to advanced sewing technologies for both industrial and domestic users. This initiative focuses on providing innovative, reliable, and efficient sewing solutions tailored to meet the unique needs of local textile and garment manufacturers. By leveraging its global expertise and cutting-edge product lineup, Brother is strengthening its foothold in the rapidly growing global sewing machines market.

- In March 2023, Janome Sewing Machine Co., Ltd., a renowned Japanese brand, introduced a new line of computerized sewing machines specifically designed for small businesses and home-based fashion entrepreneurs. The innovative models emphasize ease of use, precision stitching, and connectivity features, catering to growing demand in the DIY and custom tailoring segments. This advancement reflects Janome’s commitment to supporting creative communities and driving growth in both residential and commercial markets.

- In March 2023, Juki Corporation successfully partnered with leading apparel manufacturers in Bangladesh to implement automated industrial sewing systems aimed at improving production efficiency and garment quality. This collaboration highlights Juki’s dedication to advancing manufacturing technologies in key textile hubs, helping to modernize facilities and boost global competitiveness. The initiative underscores the increasing role of smart automation in the textile industry’s evolution.

- In February 2023, Pfaff, a German sewing machine manufacturer known for precision and innovation, announced a strategic partnership with several European fashion institutes to provide students and professionals with access to high-end computerized sewing and embroidery machines. This collaboration aims to foster innovation and craftsmanship within the fashion design community, supporting skill development and creativity while expanding Pfaff’s presence in educational markets.

- In January 2023, Singer Corporation, a leading global brand, unveiled the Singer Quantum Stylist Pro at the International Sewing Expo 2023. This state-of-the-art electric sewing machine features advanced stitching patterns, touchscreen controls, and enhanced durability tailored for both hobbyists and small-scale manufacturers. The launch reinforces Singer’s commitment to blending tradition with innovation, offering consumers versatile, high-performance machines that meet evolving market demands.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.