Global Shale Gas Market

Market Size in USD Billion

CAGR :

%

USD

101.55 Billion

USD

191.62 Billion

2024

2032

USD

101.55 Billion

USD

191.62 Billion

2024

2032

| 2025 –2032 | |

| USD 101.55 Billion | |

| USD 191.62 Billion | |

|

|

|

|

Shale Gas Market Size

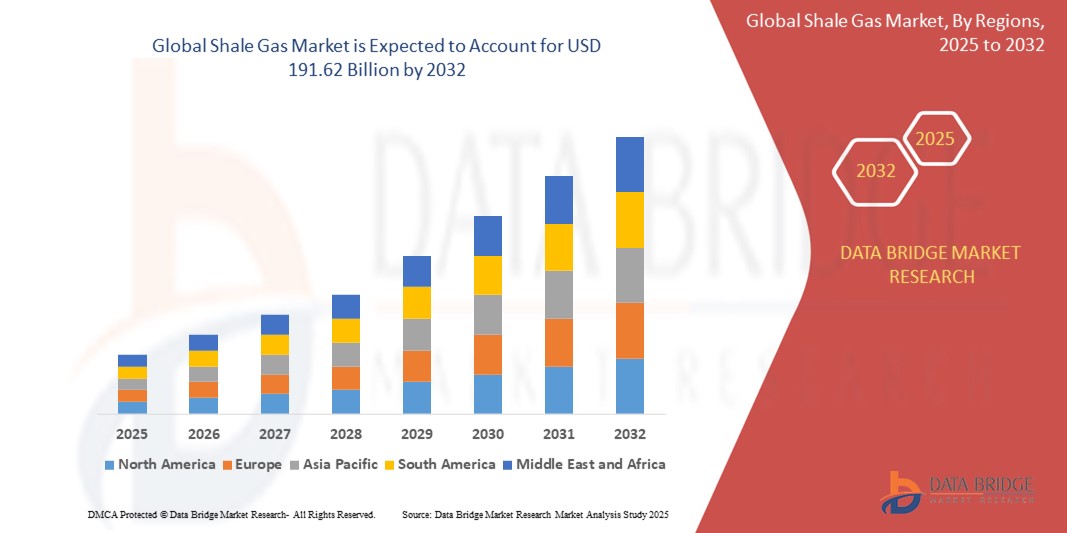

- The global shale gas market size was valued at USD 101.55 billion in 2024 and is expected to reach USD 191.62 billion by 2032, at a CAGR of 8.26% during the forecast period

- The market growth is largely fuelled by the rising demand for cleaner energy alternatives and the increasing adoption of hydraulic fracturing and horizontal drilling technologies across key economies

- Growing energy independence initiatives in countries such as the U.S. and China are further accelerating shale gas exploration and production activities across the globe

Shale Gas Market Analysis

- The shale gas market is witnessing steady growth due to technological advancements in extraction processes and increasing energy demand across industrial sectors

- Companies are focusing on improving efficiency and output through innovations in drilling techniques and well optimization strategies

- North America dominated the shale gas market with the largest revenue share in 2024, driven by advanced extraction technologies and significant proven reserves, particularly in the U.S. The region benefits from well-established infrastructure, favorable regulatory support, and a mature energy market that encourages investment and exploration

- The Asia-Pacific region is expected to witness the highest growth rate in the global shale gas market, driven by increasing energy demand, supportive government policies, and rising investments in exploration across countries such as China, India, and Australia

- The power generation segment held the largest market revenue share in 2024, driven by the growing demand for low-emission energy sources and the replacement of coal-fired plants. Shale gas provides a cleaner alternative for electricity generation and helps reduce carbon footprints, aligning with international climate commitments. The sector benefits from stable supply and pricing, making it an attractive option for energy providers aiming to meet rising consumption needs

Report Scope and Shale Gas Market Segmentation

|

Attributes |

Shale Gas Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Rising Demand for Cleaner Energy Alternatives to Reduce Carbon Emissions • Technological Advancements Enabling Cost-Effective Shale Gas Extraction |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Shale Gas Market Trends

“Rising Focus on Hydraulic Fracturing and Horizontal Drilling Technologies”

- Hydraulic fracturing and horizontal drilling are gaining prominence for improving the efficiency of shale gas extraction

- These advanced techniques allow companies to access unconventional reserves more economically and with greater output

- In the U.S., for instance, horizontal drilling has played a pivotal role in making shale gas a dominant part of its energy portfolio

- China is also ramping up investments in hydraulic fracturing to tap into its large but previously inaccessible shale reserves

- Energy firms are increasingly adopting these technologies to reduce operational costs while aligning with global sustainability initiatives

Shale Gas Market Dynamics

Driver

“Rising Global Energy Demand and the Shift Toward Cleaner Fossil Fuels”

- Rising global energy demand is increasing the need for stable and scalable energy sources, pushing countries to explore alternative fossil fuels such as shale gas

- Shale gas emits fewer pollutants than coal or oil, making it a preferred transitional fuel in global strategies aimed at reducing greenhouse gas emissions

- Countries such as India and China are actively developing shale gas to diversify their energy portfolios and decrease dependence on high-emission coal

- Technological advances such as hydraulic fracturing and horizontal drilling have improved extraction efficiency, attracting investments in regions with untapped reserves

- For instance, the shale gas boom in the U.S. has stabilized energy prices domestically and boosted liquefied natural gas exports, reinforcing shale gas’s role in global energy security

Restraint/Challenge

“Environmental Concerns and Regulatory Hurdles”

- Growing environmental concerns surrounding hydraulic fracturing, such as groundwater contamination and seismic activity, are limiting shale gas exploration efforts

- Public opposition and environmental activism have led to bans or moratoriums on fracking in several countries and regions

- For instance, France and Germany have restricted shale gas development due to ecological and social risks associated with extraction

- Stringent and inconsistent regulatory frameworks increase compliance costs and delay project approvals, especially impacting small and mid-sized energy firms

- Rising global focus on climate change is prompting stricter rules, which may deter investments and reduce the long-term viability of shale gas projects

Shale Gas Market Scope

The market is segmented on the basis of application type and technique type.

- By Application Type

On the basis of application type, the shale gas market is segmented into power generation, industrial and manufacturing applications, residential applications, commercial applications, and transportation. The power generation segment held the largest market revenue share in 2024, driven by the growing demand for low-emission energy sources and the replacement of coal-fired plants. Shale gas provides a cleaner alternative for electricity generation and helps reduce carbon footprints, aligning with international climate commitments. The sector benefits from stable supply and pricing, making it an attractive option for energy providers aiming to meet rising consumption needs.

The industrial and manufacturing applications segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by its role in heating processes, feedstock for chemicals, and reliable energy source for operational continuity. Shale gas enables cost-effective fuel alternatives for various industries such as steel, cement, and petrochemicals, where consistent energy availability is critical for productivity and competitiveness.

- By Technique Type

On the basis of technique type, the shale gas market is segmented into horizontal drilling, rotary fracking, and hydraulic fracturing. The hydraulic fracturing segment dominated the market with the largest revenue share in 2024, owing to its proven effectiveness in unlocking trapped gas in shale formations. This method enables high recovery rates and supports large-scale production, particularly in countries such as the U.S. and China where extensive reserves exist. Its scalability and continuous technological improvements further enhance its role in commercial shale gas development.

The horizontal drilling segment is expected to witness the fastest growth rate from 2025 to 2032, due to its efficiency in accessing vast lateral reserves and reducing surface disruption. Horizontal drilling allows operators to extract more gas from a single site, making it a preferred option for maximizing output and minimizing environmental impact. This technique is gaining prominence in emerging markets where exploration and production activity is intensifying.

Shale Gas Market Regional Analysis

- North America dominated the shale gas market with the largest revenue share in 2024, driven by advanced extraction technologies and significant proven reserves, particularly in the U.S. The region benefits from well-established infrastructure, favorable regulatory support, and a mature energy market that encourages investment and exploration

- The widespread availability of shale formations, such as the Marcellus and Barnett shales, supports high production levels and contributes to energy independence

- Continued innovation and supportive energy policies are likely to maintain North America’s leadership in shale gas production across residential, commercial, and industrial sector

U.S. Shale Gas Market Insight

The U.S. shale gas market accounted for the largest share in North America in 2024, primarily due to extensive resource availability and large-scale adoption of hydraulic fracturing and horizontal drilling. These technologies have significantly lowered production costs and increased extraction efficiency.

With strong export capabilities and domestic demand for cleaner fuels, the U.S. has emerged as a major player in the global energy trade. Government incentives and the shift away from coal are also accelerating shale gas investments across multiple applications, from power generation to transportation.

Europe Shale Gas Market Insight

The Europe shale gas market is expected to expand at a moderate pace during the forecast period, driven by the region’s energy diversification strategies and interest in reducing dependency on imported gas. While environmental regulations and public resistance have limited large-scale production, countries are exploring options for safe and sustainable development.

Advancements in extraction technology and rising geopolitical concerns around energy security are pushing several European nations to reassess their shale gas policies. Ongoing research and pilot projects are focused on balancing energy needs with environmental protection.

U.K. Shale Gas Market Insight

The U.K. shale gas market is experiencing renewed attention following government-backed initiatives introduced in 2023 to support exploration. These efforts include establishing a Shale Environmental Regulator and a Planning Brokerage Service aimed at simplifying approval processes and boosting investor confidence. The U.K. sees shale gas as a potential domestic energy source that can enhance supply security and reduce reliance on imports. However, public concern over environmental impacts remains a barrier, and further technological and regulatory developments will influence future growth.

Germany Shale Gas Market Insight

The Germany shale gas market is restrained by stringent environmental policies and strong public opposition to hydraulic fracturing, limiting commercial viability. Despite having potential reserves, Germany has placed a moratorium on shale gas extraction due to sustainability concerns and its commitment to transitioning toward renewable energy. However, energy supply uncertainties have sparked discussions around reevaluating the role of domestic shale gas. Any policy shift will likely focus on strict environmental safeguards and innovative, low-impact extraction technologies.

Asia-Pacific Shale Gas Market Insight

The Asia-Pacific shale gas market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising energy demand and efforts to diversify energy portfolios. Countries such as China and India are making substantial investments in shale gas exploration to reduce dependency on imports.

Technological collaborations and supportive government initiatives are enabling access to unconventional resources, while urbanization and industrialization are boosting energy consumption. The region is also focusing on sustainability, making shale gas an appealing transitional fuel.

China Shale Gas Market Insight

China held the largest share in the Asia-Pacific shale gas market in 2024, attributed to aggressive development plans and strong policy support. With vast shale reserves, particularly in the Sichuan Basin, the country is scaling production to meet its domestic energy needs. The government’s push toward cleaner fuels to reduce air pollution, coupled with investments in hydraulic fracturing technology, is accelerating the shale gas sector. Domestic companies are also collaborating with international firms to enhance technical expertise and improve extraction efficiency.

Japan Shale Gas Market Insight

The Japan shale gas market is still in a nascent stage, with limited domestic production capacity but growing strategic interest in unconventional gas resources. Due to its heavy reliance on energy imports, Japan is investing in overseas shale gas assets and collaborating with other nations for supply security. Japanese energy companies are also exploring advanced extraction techniques and forming partnerships to evaluate potential reserves. While domestic shale production remains limited, Japan’s demand for cleaner energy alternatives supports its involvement in global shale gas development.

Shale Gas Market Share

The Shale Gas industry is primarily led by well-established companies, including:

- Occidental Petroleum Corporation (U.S.)

- Antero Resources Corporation (U.S.)

- Chesapeake Energy Corporation (U.S.)

- Chevron Corporation (U.S.)

- EQT (Sweden)

- Pioneer Natural Resources Company (U.S.)

- Range Resources Corporation (U.S.)

- Shell International B.V. (Netherlands)

- SM Energy (U.S.)

- Equinor ASA (Norway)

- Repsol (Spain)

- MARATHON OIL COMPANY (U.S.)

- Mitsubishi Corporation (Japan)

- Quicksilver Resources (U.S.)

- Exxon Mobil Corporation (U.S.)

- Reliance Industries Limited (India)

Latest Developments in Global Shale Gas Market

- In December 2023, the U.K. government introduced new initiatives to boost shale gas development by establishing a Shale Environmental Regulator and a Planning Brokerage Service. These measures are designed to streamline the approval process for shale gas projects, improve regulatory coordination, and accelerate project timelines, potentially enhancing domestic energy production and reducing reliance on imports

- In August 2023, Falcon Oil & Gas, in partnership with Tamboran Resources, reported a significant dry gas discovery at the Shenandoah South 1H (SS1H) well in Australia’s Beetaloo sub-basin. This development signals strong shale gas potential in the region and is expected to drive further exploration and investment in Australia’s unconventional gas sector

- In October 2022, Sinopec announced a major shale gas find in the Sichuan basin in southwest China. With plans to reach a production target of 100 billion cubic meters annually, the discovery is likely to bolster China’s domestic gas supply, reduce energy imports, and support the nation’s cleaner energy transition strategy

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL SHALE GAS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL SHALE GAS MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 IMPORT AND EXPORT DATA

2.15 SECONDARY SOURCES

2.16 GLOBAL SHALE GAS MARKET: RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PRODUCTION CONSUMPTION ANALYSIS

5.2 IMPORT EXPORT SCENARIO

5.3 RAW MATERIAL PRODUCTION COVERAGE

5.4 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

5.5 LIST OF KEY BUYERS, BY REGION

5.5.1 NORTH AMERICA

5.5.2 EUROPE

5.5.3 ASIA PACIFIC

5.5.4 SOUTH AMERICA

5.5.5 MIDDLE EAST & AFRICA

5.6 PORTER’S FIVE FORCES

5.7 VENDOR SELECTION CRITERIA

5.8 PESTEL ANALYSIS

5.9 REGULATION COVERAGE

6 SUPPLY CHAIN ANALYSIS

6.1 OVERVIEW

6.2 LOGISTIC COST SCENARIO

6.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

7 CLIMATE CHANGE SCENARIO

7.1 ENVIRONMENTAL CONCERNS

7.2 INDUSTRY RESPONSE

7.3 GOVERNMENT’S ROLE

7.4 ANALYST RECOMMENDATIONS

7.5 CONCLUSION

8 GLOBAL SHALE GAS MARKET, BY APPLICATION TYPE, 2018-2032, USD MILLION, BCM

8.1 OVERVIEW

8.2 POWER GENERATION

8.3 INDUSTRIAL AND MANUFACTURING APPLICATIONS

8.4 RESIDENTIAL APPLICATIONS

8.5 COMMERCIAL APPLICATIONS

8.6 TRANSPORTATION

9 GLOBAL SHALE GAS MARKET, BY COMPONENT, 2018-2032, USD MILLION

9.1 OVERVIEW

9.2 COMPRESSORS & PUMPS

9.3 ELECTRICAL MACHINERY

9.4 HEAT EXCHANGERS

9.5 INTERNAL COMBUSTION ENGINES

9.6 MEASURING & CONTROLLING DEVICES

9.7 OTHERS

10 GLOBAL SHALE GAS MARKET, BY TECHNIQUE TYPE, 2018-2032, USD MILLION

10.1 OVERVIEW

10.2 HORIZONTAL DRILLING

10.3 ROTARY FRACKING

10.4 HYDRAULIC FRACTURING

11 GLOBAL SHALE GAS MARKET, BY UTILITY, 2018-2032, USD MILLION

11.1 OVERVIEW

11.2 ONSHORE

11.3 OFFSHORE

12 GLOBAL SHALE GAS MARKET, BY GEOGRAPHY, 2018-2032, USD MILLION

GLOBAL SHALE GAS MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

12.2 EUROPE

12.2.1 GERMANY

12.2.2 U.K.

12.2.3 ITALY

12.2.4 FRANCE

12.2.5 SPAIN

12.2.6 RUSSIA

12.2.7 SWITZERLAND

12.2.8 TURKEY

12.2.9 BELGIUM

12.2.10 NETHERLANDS

12.2.11 LUXEMBURG

12.2.12 REST OF EUROPE

12.3 ASIA-PACIFIC

12.3.1 JAPAN

12.3.2 CHINA

12.3.3 SOUTH KOREA

12.3.4 INDIA

12.3.5 SINGAPORE

12.3.6 THAILAND

12.3.7 INDONESIA

12.3.8 MALAYSIA

12.3.9 PHILIPPINES

12.3.10 AUSTRALIA & NEW ZEALAND

12.3.11 REST OF ASIA-PACIFIC

12.4 SOUTH AMERICA

12.4.1 BRAZIL

12.4.2 ARGENTINA

12.4.3 REST OF SOUTH AMERICA

12.5 MIDDLE EAST AND AFRICA

12.5.1 SOUTH AFRICA

12.5.2 EGYPT

12.5.3 SAUDI ARABIA

12.5.4 UNITED ARAB EMIRATES

12.5.5 ISRAEL

12.5.6 REST OF MIDDLE EAST AND AFRICA

13 GLOBAL SHALE GAS MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: GLOBAL

13.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

13.3 COMPANY SHARE ANALYSIS: EUROPE

13.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

13.5 MERGERS AND ACQUISITIONS

13.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

13.7 EXPANSIONS

13.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

14 SWOT AND DATA BRIDGE MARKET RESEARCH ANALYSIS

15 GLOBAL SHALE GAS MARKET - COMPANY PROFILES

15.1 OCCIDENTAL PETROLEUM CORPORATION

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT UPDATES

15.2 ANTERO RESOURCES CORPORATION

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT UPDATES

15.3 CHEVRON CORPORATION

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT UPDATES

15.4 EQT

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT UPDATES

15.5 EXXON MOBIL CORPORATION.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT UPDATES

15.6 RANGE RESOURCES CORPORATION

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT UPDATES

15.7 SHELL INTERNATIONAL B.V.

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT UPDATES

15.8 SM ENERGY

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT UPDATES

15.9 EQUINOR ASA

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT UPDATES

15.1 REPSOL

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT UPDATES

15.11 MARATHON OIL COMPANY

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT UPDATES

15.12 MITSUBISHI CORPORATION

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT UPDATES

15.13 QUICKSILVER RESOURCES

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT UPDATES

15.14 EXXON MOBIL CORPORATION

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT UPDATES

15.15 RELIANCE INDUSTRIES LIMITED

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT UPDATES

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

16 RELATED REPORTS

17 QUESTIONNAIRE

18 CONCLUSION

19 ABOUT DATA BRIDGE MARKET RESEARCH

Global Shale Gas Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Shale Gas Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Shale Gas Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.