Global Shale Gas Processing Equipment Market

Market Size in USD Billion

CAGR :

%

USD

6.11 Billion

USD

9.39 Billion

2024

2032

USD

6.11 Billion

USD

9.39 Billion

2024

2032

| 2025 –2032 | |

| USD 6.11 Billion | |

| USD 9.39 Billion | |

|

|

|

|

What is the Global Shale Gas Processing Equipment Market Size and Growth Rate?

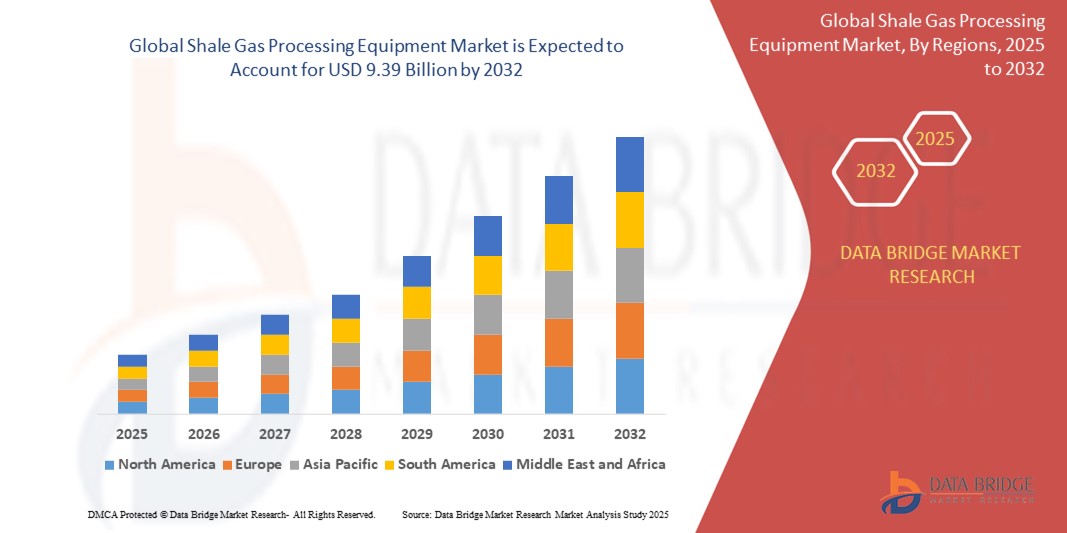

- The global shale gas processing equipment market size was valued at USD 6.11 billion in 2024 and is expected to reach USD 9.39 billion by 2032, at a CAGR of 5.50% during the forecast period

- The global shale gas processing equipment market is experiencing substantial growth, driven by the increasing production and utilization of shale gas as a key energy resource. As countries seek to enhance their energy security and reduce dependence on imported fossil fuels, shale gas has emerged as a viable alternative, leading to a surge in demand for processing equipment

- Technological advancements in hydraulic fracturing and horizontal drilling have significantly improved the efficiency and cost-effectiveness of shale gas extraction, further boosting market growth

- In addition, the need for sophisticated equipment to handle the unique challenges of shale gas, such as high-pressure and high-temperature conditions, is propelling investments in advanced processing technologies

What are the Major Takeaways of Shale Gas Processing Equipment Market?

- The increasing global demand for natural gas is propelled by a combination of factors, including rising energy consumption worldwide and a growing preference for cleaner energy sources amidst climate change concerns. Shale gas, extracted through advanced hydraulic fracturing techniques, has emerged as a significant contributor to meeting this demand

- Shale gas processing equipment plays a crucial role in extracting, refining, and transporting natural gas from shale formations. As countries seek to reduce their carbon footprint and diversify their energy mix, the demand for efficient shale gas processing equipment continues to grow, driven by its role in providing a cleaner alternative to traditional fossil fuels

- North America dominated the shale gas processing equipment market with the largest revenue share of 43.5% in 2024, driven by the region’s booming shale gas exploration activities, favorable regulatory environment, and advanced infrastructure for gas processing and transportation

- Asia-Pacific shale gas processing equipment market is poised to grow at the fastest CAGR of 6.6% during 2025 to 2032, fueled by increasing energy demand, large-scale shale gas reserves, and expanding gas infrastructure in countries such as China, India, and Australia

- The Compressors and Pumps segment dominated the shale gas processing equipment market with the largest revenue share of 38.5% in 2024, driven by the critical role these components play in transporting shale gas through pipelines and enhancing production efficiency

Report Scope and Shale Gas Processing Equipment Market Segmentation

|

Attributes |

Shale Gas Processing Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Shale Gas Processing Equipment Market?

- A major emerging trend in the global shale gas processing equipment market is the increasing incorporation of advanced technologies aimed at boosting efficiency, reliability, and safety across processing operations. Innovations such as AI-based monitoring systems, predictive maintenance tools, and automation solutions are reshaping how shale gas processing equipment functions, reducing downtime and improving throughput

- For instance, companies are deploying smart compression and dehydration units equipped with real-time diagnostics and automated controls to optimize gas processing operations and reduce environmental emissions

- AI integration in shale gas processing enables predictive analytics for equipment failures, performance optimization based on real-time data, and enhanced operational safety. This allows processing plants to lower operating costs while maintaining high output efficiency

- The integration of remote monitoring, data analytics platforms, and digital twins in gas processing equipment is enhancing process transparency and asset management. Operators can now access critical performance data remotely, make informed decisions, and quickly respond to potential issues

- Leading players such as Burckhardt Compression AG and Enerflex Ltd. are actively developing AI-enabled compressors, separation units, and other gas processing technologies to meet growing demands for efficiency and environmental compliance

- The need for enhanced operational control, coupled with the push for low-emission and energy-efficient shale gas production, is significantly accelerating the adoption of technologically advanced processing equipment across the global market

What are the Key Drivers of Shale Gas Processing Equipment Market?

- The rising global demand for natural gas, driven by its role as a cleaner transition fuel compared to coal and oil, is a primary growth driver for the shale gas processing equipment market. As countries strive to reduce carbon emissions, shale gas production is expected to play a critical role

- For instance, in March 2024, Linde plc announced new shale gas processing projects in North America aimed at expanding low-carbon energy supply and meeting increasing natural gas demand. Such initiatives are anticipated to fuel market growth

- In addition, the growing number of shale gas exploration and production activities, particularly in the U.S., China, and Argentina, is creating robust demand for advanced processing equipment such as compressors, dehydrators, separators, and heat exchangers

- Stringent environmental regulations and the need to reduce flaring, methane leaks, and emissions have further driven the adoption of advanced, eco-friendly shale gas processing equipment

- The shale gas industry's increasing emphasis on cost optimization, improved recovery rates, and operational efficiency continues to accelerate equipment upgrades and new deployments, supporting overall market expansion globally

Which Factor is challenging the Growth of the Shale Gas Processing Equipment Market?

- Volatility in global oil and gas prices presents a significant challenge to the shale gas processing equipment market. Price fluctuations impact investment decisions, leading to delays or cancellations of new processing projects, especially in emerging markets

- For instance, during the global energy market downturn in 2020, numerous shale gas projects were stalled or postponed due to financial uncertainties, negatively affecting equipment demand

- Moreover, high capital costs associated with installing advanced shale gas processing equipment, particularly for small-scale producers, can limit market penetration in price-sensitive regions. This is particularly evident in developing countries where infrastructure investment budgets are often constrained

- Technical complexities and operational challenges in shale gas extraction, such as handling high-pressure, high-temperature conditions and sour gas compositions, require highly specialized equipment, increasing overall project costs

- To overcome these barriers, companies are focusing on innovations that lower the total cost of ownership, such as modular and skid-mounted processing systems, while governments continue to provide incentives for environmentally sustainable energy projects

How is the Shale Gas Processing Equipment Market Segmented?

The market is segmented on the basis of component and application.

• By Component

On the basis of component, the shale gas processing equipment market is segmented into Compressors and Pumps, Electrical Machinery, Heat Exchangers, Internal Combustion Engines, Measuring and Controlling Devices, and Others. The Compressors and Pumps segment dominated the shale gas processing equipment market with the largest revenue share of 38.5% in 2024, driven by the critical role these components play in transporting shale gas through pipelines and enhancing production efficiency. High demand for reliable compression units to handle fluctuating pressures and volumes, combined with growing shale gas extraction activities in North America and Asia-Pacific, is fueling this segment’s dominance. In addition, technological advancements such as AI-based monitoring in compressors are further enhancing operational efficiency, supporting market growth.

The Heat Exchangers segment is anticipated to witness the fastest growth rate of 22.4% from 2025 to 2032, propelled by the increasing focus on energy efficiency and optimized thermal management in gas processing operations. Heat exchangers play a vital role in minimizing energy consumption and emissions, aligning with the global push for environmentally sustainable processing solutions. Their application in both upstream and downstream shale gas operations is expanding rapidly across emerging markets.

• By Process

On the basis of process, the shale gas processing equipment market is segmented into Distillation, Pyrolysis, Reheating, Cracking, and Chemical Treatment. The Distillation segment accounted for the largest market revenue share of 41.7% in 2024, owing to its widespread use in separating impurities and extracting valuable hydrocarbons from shale gas. Distillation remains a fundamental step in shale gas processing, ensuring product purity and meeting industry standards for downstream applications such as LNG production and petrochemical feedstock supply. The scalability and proven efficiency of distillation processes make them the backbone of both small and large-scale shale gas facilities.

The Cracking segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the growing demand for ethane and other valuable by-products derived from shale gas. Cracking processes are being increasingly adopted to maximize hydrocarbon recovery and produce high-value derivatives used in chemicals and plastics industries. Technological advancements in catalytic cracking and thermal cracking methods are enhancing process efficiency, contributing to the segment’s rapid growth.

Which Region Holds the Largest Share of the Shale Gas Processing Equipment Market?

- North America dominated the shale gas processing equipment market with the largest revenue share of 43.5% in 2024, driven by the region’s booming shale gas exploration activities, favorable regulatory environment, and advanced infrastructure for gas processing and transportation

- The U.S. and Canada have significantly expanded shale gas extraction, supported by technological advancements such as horizontal drilling and hydraulic fracturing, fueling demand for efficient gas processing equipment

- In addition, the region benefits from the presence of leading equipment manufacturers, a mature oil & gas industry, and growing export opportunities for liquefied natural gas (LNG), collectively driving market growth

U.S. Shale Gas Processing Equipment Market Insight

The U.S. shale gas processing equipment market captured the largest revenue share of 79% within North America in 2024, propelled by record-breaking shale gas output from plays such as the Permian Basin, Marcellus, and Haynesville. The nation’s focus on energy independence, coupled with growing investments in processing infrastructure, including compression, heat exchangers, and separation systems, is fueling market expansion. The increasing export of LNG and the modernization of existing gas processing plants with advanced, energy-efficient equipment further support the sector's growth trajectory.

Europe Shale Gas Processing Equipment Market Insight

The Europe shale gas processing equipment market is projected to grow steadily during the forecast period, driven by increasing efforts to reduce energy dependence and diversify gas supplies. While Europe’s shale gas production remains limited, countries such as the U.K. and Poland are exploring potential reserves, and demand for processing equipment is rising, particularly for import terminals, gas storage, and LNG regasification facilities. The region’s strong emphasis on sustainable technologies and energy efficiency is also fostering innovation and adoption of advanced gas processing solutions.

U.K. Shale Gas Processing Equipment Market Insight

The U.K. shale gas processing equipment market is anticipated to expand at a notable CAGR during the forecast period, supported by strategic efforts to develop domestic shale gas resources and enhance energy security. While regulatory challenges persist, investments in gas processing infrastructure for potential shale projects, along with upgrades to existing facilities, are contributing to market growth. Moreover, the U.K.’s focus on reducing carbon emissions is encouraging the adoption of energy-efficient processing equipment across the oil & gas value chain.

Germany Shale Gas Processing Equipment Market Insight

The Germany shale gas processing equipment market is expected to witness moderate growth, primarily driven by the nation’s commitment to transitioning towards cleaner energy sources while ensuring energy security. Though Germany has limited shale gas extraction activities, the demand for advanced gas processing equipment is rising in LNG import terminals, biogas upgrading, and industrial gas processing applications. The country’s technological leadership and strong manufacturing base for high-precision equipment also support market development.

Which Region is the Fastest Growing Region in the Shale Gas Processing Equipment Market?

Asia-Pacific shale gas processing equipment market is poised to grow at the fastest CAGR of 6.6% during 2025 to 2032, fueled by increasing energy demand, large-scale shale gas reserves, and expanding gas infrastructure in countries such as China, India, and Australia. Government initiatives to boost domestic gas production and reduce reliance on coal are driving investments in shale gas exploration and processing technologies across the region. In addition, Asia-Pacific’s growing manufacturing capabilities, competitive equipment pricing, and strategic focus on energy diversification are accelerating market growth.

Japan Shale Gas Processing Equipment Market Insight

The Japan shale gas processing equipment market is gaining momentum due to the nation’s significant LNG import activities and emphasis on energy efficiency. While Japan lacks substantial domestic shale gas reserves, its heavy reliance on imported natural gas necessitates advanced processing equipment at regasification terminals and storage facilities. Ongoing technological advancements and the integration of environmentally friendly equipment are enhancing Japan’s role in the regional gas processing landscape.

China Shale Gas Processing Equipment Market Insight

The China shale gas processing equipment market accounted for the largest revenue share within Asia-Pacific in 2024, driven by the country’s aggressive shale gas development initiatives, particularly in the Sichuan Basin and other resource-rich regions. China’s focus on boosting domestic gas output to meet rising energy demands and reduce carbon emissions is fueling significant investments in gas processing infrastructure. The presence of strong local manufacturers, supportive government policies, and the expansion of gas pipelines and LNG facilities are collectively propelling the shale gas processing equipment market in China.

Which are the Top Companies in Shale Gas Processing Equipment Market?

The shale gas processing equipment industry is primarily led by well-established companies, including:

- Burckhardt Compression AG (Switzerland)

- Croft Production Systems, Inc. (U.S.)

- Enerflex Ltd. (U.S.)

- Gas Processing (India)

- Gastech Engineering LLC (U.S.)

- Honeywell International Inc. (U.S.)

- Koch Industries Inc. (U.S.)

- Linde plc (U.K.)

- Newpoint Gas LLC (U.S.)

- SLB (U.S.)

- Van Air Systems (U.S.)

What are the Recent Developments in Global Shale Gas Processing Equipment Market?

- In April 2025, ExxonMobil and Chevron announced plans to significantly expand the use of simultaneous fracturing (simul-frac) technology across their U.S. shale operations. This technique allows for multiple wells to be fractured at the same time, resulting in substantial reductions in pumping duration, water consumption, and overall resource use. Both companies anticipate that this move will deliver considerable savings in production costs while boosting operational efficiency across shale fields

- In March 2025, Argentina witnessed a surge in foreign and domestic investments in the Vaca Muerta shale formation, following favorable government policy reforms supporting energy development. Increased drilling activity, coupled with the expansion of supporting infrastructure, is attracting global energy companies eager to tap into Argentina’s shale potential. These developments are positioning Argentina as a key player in the global energy market by 2030 and are expected to fuel regional demand for advanced shale gas processing equipment

- In February 2025, a survey revealed that approximately 20% of U.S. oil and gas executives have transitioned to fully electric drilling rigs and hydraulic fracturing systems as part of a broader shift away from diesel-powered operations. The move toward electrification aims to reduce greenhouse gas emissions, lower operational noise levels, and enhance compliance with environmental regulations. This growing preference for electrified equipment is expected to accelerate demand for innovative, low-emission shale gas processing technologies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Shale Gas Processing Equipment Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Shale Gas Processing Equipment Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Shale Gas Processing Equipment Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.