Global Sheet Metal Fabrication Services Market

Market Size in USD Billion

CAGR :

%

USD

12.69 Billion

USD

17.50 Billion

2024

2032

USD

12.69 Billion

USD

17.50 Billion

2024

2032

| 2025 –2032 | |

| USD 12.69 Billion | |

| USD 17.50 Billion | |

|

|

|

|

Sheet Metal Fabrication Services Market Size

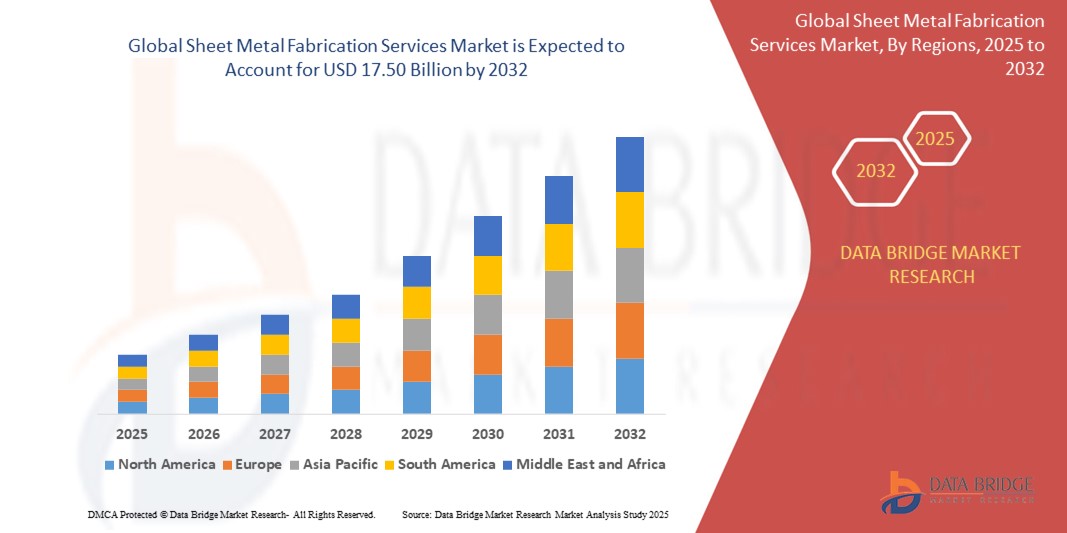

- The global sheet metal fabrication services market size was valued at USD 12.69 billion in 2024 and is expected to reach USD 17.50 billion by 2032, at a CAGR of 4.1% during the forecast period

- The market growth is largely driven by the rising demand for precision-engineered components across industries such as automotive, aerospace, construction, and electronics, where sheet metal fabrication is essential for high-quality structural and functional parts

- Furthermore, advancements in fabrication technologies, including CNC machining, laser cutting, and automated welding, are improving production efficiency and accuracy, thereby encouraging widespread adoption and significantly propelling the growth of the sheet metal fabrication services market

Sheet Metal Fabrication Services Market Analysis

- Sheet metal fabrication services, involving processes such as cutting, bending, and assembling metal structures, are increasingly critical across diverse industries including automotive, construction, aerospace, and electronics due to their ability to deliver durable, customized, and high-precision components

- The escalating demand for sheet metal fabrication is primarily fueled by rapid industrialization, rising adoption of advanced manufacturing technologies, and growing requirements for lightweight, high-strength materials in both consumer and industrial applications

- North America dominated the sheet metal fabrication services market in 2024, due to robust manufacturing activity across automotive, aerospace, and industrial machinery sectors

- Asia-Pacific is expected to be the fastest growing region in the sheet metal fabrication services market during the forecast period due to rapid industrialization, urban development, and rising investments in automotive and electronics manufacturing across China, India, and Southeast Asia

- Steel segment dominated the market with a market share of 60.5% in 2024, due to its strength, affordability, and extensive use in heavy-duty applications such as construction, automotive, and industrial machinery. Steel’s weldability and structural integrity make it a go-to material for load-bearing components

Report Scope and Sheet Metal Fabrication Services Market Segmentation

|

Attributes |

Sheet Metal Fabrication Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Sheet Metal Fabrication Services Market Trends

“Rising Adoption of Automation Integration for Precision and Efficiency”

- A prominent trend in the sheet metal fabrication services market is the rising adoption of advanced automation technologies such as CNC machines, robotic welding, and laser cutting systems. These innovations are significantly enhancing production speed, precision, and consistency, allowing manufacturers to meet high-volume and high-complexity demands efficiently.

- For instance, companies are increasingly investing in Industry 4.0 practices, integrating real-time monitoring systems and intelligent controls to streamline workflows. Trumpf and Amada have introduced automated bending cells and self-adjusting laser systems to reduce manual labor and improve throughput.

- Automation in fabrication processes reduces human error and operational downtime while optimizing material utilization. This leads to higher cost-effectiveness, making it easier to serve industries with stringent quality standards such as automotive, aerospace, and electronics.

- By adopting automation, manufacturers are better equipped to address labor shortages, meet tight delivery timelines, and offer customized solutions at scale. As demand for complex and lightweight metal components grows, the reliance on automation will continue to shape the market's evolution.

- This trend is also driving the development of integrated fabrication platforms that combine multiple processes—cutting, forming, welding—within a single automated system, fostering a shift toward smarter, more connected fabrication environments

- The continuous innovation in automated solutions is expected to remain a key differentiator for market leaders, supporting faster, more precise, and sustainable sheet metal production

Sheet Metal Fabrication Services Market Dynamics

Driver

“Surging Demand for Lightweight and Durable Components”

- The increasing need for lightweight, durable, and precision-engineered components across automotive, aerospace, and construction sectors is a key driver fueling the growth of the sheet metal fabrication services market

- For instance, the automotive industry’s shift toward electric vehicles has amplified the demand for lightweight yet strong metal parts to improve energy efficiency and performance. Sheet metal fabrication plays a critical role in producing these structural and functional components

- The aerospace and defense sectors are also seeking advanced sheet metal solutions to meet safety and weight requirements, leading to increased outsourcing to specialized fabrication service providers

- In the construction industry, customized architectural metal structures and HVAC components are becoming more prevalent, requiring highly precise sheet metal fabrication

- This broad and rising demand across diverse sectors ensures consistent market expansion, encouraging investment in capacity enhancement and technological upgrades by service providers

Restraint/Challenge

“High Capital Investment and Skilled Labor Shortage”

- A significant challenge in the sheet metal fabrication services market is the high initial capital required for advanced fabrication machinery and technology integration. Equipment such as CNC laser cutters, robotic welders, and bending machines come with substantial costs, limiting entry for small and medium-sized players

- For instance, manufacturers looking to scale operations or adopt automation face financial barriers in procuring and maintaining high-end systems, which can impede overall productivity and profitability

- Moreover, the industry continues to struggle with a shortage of skilled labor capable of operating sophisticated machinery and managing digital fabrication workflows. This labor gap affects turnaround time, quality control, and scalability

- Addressing this challenge requires continuous workforce training, partnerships with vocational institutions, and the development of user-friendly, semi-automated systems to bridge the skills gap. Companies such as SafanDarley and Durma Machine Tools are introducing intuitive interfaces and modular machines to reduce training time, but widespread implementation remains limited

- Mitigating these challenges through financial assistance programs, leasing models, and training initiatives will be crucial for fostering broader industry participation and sustainable market growth

Sheet Metal Fabrication Services Market Scope

The market is segmented on the basis of industry, process, material, application, and volume.

• By Industry

On the basis of industry, the sheet metal fabrication service market is segmented into automotive, construction, aerospace and defense, electronics, healthcare, and energy. The automotive segment accounted for the largest market revenue share in 2024, driven by consistent demand for lightweight and durable sheet metal parts used in vehicle bodies, engine components, and structural reinforcements. Automotive OEMs and suppliers heavily rely on fabrication services for customized parts and rapid prototyping, enhancing production efficiency.

The electronics segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising global demand for consumer electronics, server enclosures, and compact housing solutions. Sheet metal fabrication supports miniaturization and precise thermal management needs in electronics, making it an essential process for electronics manufacturers seeking both scale and accuracy.

• By Process

On the basis of process, the market is segmented into stamping, laser cutting, welding, bending, and finishing. Stamping held the largest revenue share in 2024 due to its high-speed production capabilities and cost efficiency in mass production. Widely adopted across industries such as automotive and appliance manufacturing, stamping enables consistent shaping and forming of metal parts with minimal material waste.

Laser cutting is projected to experience the fastest CAGR through 2032, driven by its precision, automation compatibility, and suitability for complex geometries. The increasing adoption of laser technology in aerospace, electronics, and medical equipment manufacturing is also accelerating the segment’s growth, especially in high-tolerance applications.

• By Material

On the basis of material, the market is segmented into steel, aluminum, stainless steel, titanium, brass, and copper. Steel dominated the market with the largest revenue share of 60.5% in 2024 owing to its strength, affordability, and extensive use in heavy-duty applications such as construction, automotive, and industrial machinery. Steel’s weldability and structural integrity make it a go-to material for load-bearing components.

Aluminum is expected to register the fastest growth rate from 2025 to 2032 due to its lightweight, corrosion resistance, and increasing preference in electric vehicles, aerospace, and consumer electronics. The shift toward fuel efficiency and lightweight materials in transportation sectors further supports aluminum’s rapid adoption in fabrication services.

• By Application

On the basis of application, the sheet metal fabrication service market is segmented into structural components, enclosures and housings, vehicle parts, industrial machinery, and consumer products. Structural components accounted for the largest market share in 2024, supported by sustained demand from infrastructure development, machinery frameworks, and building systems. Their critical role in providing strength and stability across sectors positions them as a high-volume application area.

The enclosures and housings segment is anticipated to grow at the fastest pace during 2025–2032 due to increasing use in electronics, telecommunications, and automation systems. Precision and protection offered by fabricated enclosures are vital in safeguarding internal components from environmental exposure and mechanical damage.

• By Volume

On the basis of volume, the market is segmented into low volume (1–100 units), medium volume (101–1,000 units), and high volume (1,000+ units). High-volume production held the largest market share in 2024, driven by large-scale manufacturing needs in the automotive, appliance, and heavy machinery industries. Economies of scale, automated processes, and long-term contracts with OEMs support this segment's strength.

Low-volume production is projected to witness the highest growth from 2025 to 2032, propelled by increasing demand for custom prototypes, small-batch production in medical devices, and specialized parts in aerospace and defense. This segment benefits from flexible manufacturing, quick turnaround, and innovation-led product development cycles.

Sheet Metal Fabrication Services Market Regional Analysis

- North America dominated the sheet metal fabrication services market with the largest revenue share in 2024, driven by robust manufacturing activity across automotive, aerospace, and industrial machinery sectors

- The region's mature industrial base, high demand for customized metal components, and advanced adoption of automation in fabrication processes contribute to sustained growth

- Technological advancements, availability of skilled labor, and strong investments in defense and infrastructure projects continue to reinforce the dominance of the North American market

U.S. Sheet Metal Fabrication Services Market Insight

The U.S. sheet metal fabrication services market captured the largest revenue share within North America in 2024, fueled by increased production in aerospace, automotive, and consumer electronics. Strong domestic demand, rising military and infrastructure investments, and the early adoption of advanced fabrication technologies such as CNC machining and laser cutting have supported this growth. The presence of a large number of fabricators offering both low- and high-volume services strengthens the U.S. position in the global market.

Europe Sheet Metal Fabrication Services Market Insight

The Europe sheet metal fabrication services market is projected to register a significant CAGR over the forecast period, driven by growth in automotive, electronics, and construction sectors. Stringent EU regulations around material sustainability and energy efficiency are promoting the adoption of lightweight metals and precision fabrication. European industries are increasingly relying on automation and smart manufacturing techniques to improve productivity and reduce turnaround time.

Germany Sheet Metal Fabrication Services Market Insight

Germany leads the European market, supported by a highly industrialized economy and strong automotive and machinery manufacturing sectors. In 2024, Germany accounted for the largest revenue share within Europe due to its emphasis on engineering excellence and innovation. Integration of Industry 4.0 practices, coupled with government support for advanced manufacturing technologies, is accelerating the adoption of automated sheet metal fabrication processes.

U.K. Sheet Metal Fabrication Services Market Insight

The U.K. sheet metal fabrication market is expected to grow at a healthy CAGR through 2032, driven by increasing demand from aerospace, defense, and construction industries. Post-Brexit investments in domestic manufacturing and the push for resilient supply chains are further boosting the need for localized and custom sheet metal services. Advanced CNC fabrication and a shift toward digital design in the U.K. are also enhancing market competitiveness.

Asia-Pacific Sheet Metal Fabrication Services Market Insight

The Asia-Pacific sheet metal fabrication services market is poised to grow at the fastest CAGR from 2025 to 2032, driven by rapid industrialization, urban development, and rising investments in automotive and electronics manufacturing across China, India, and Southeast Asia. Cost-effective production, a large skilled workforce, and expanding infrastructure projects are fueling regional demand for fabrication services.

China Sheet Metal Fabrication Services Market Insight

China accounted for the largest revenue share in the Asia-Pacific region in 2024, bolstered by massive domestic manufacturing, government-backed industrial expansion, and high-volume demand for consumer electronics and vehicles. China's established fabrication ecosystem, with thousands of small and large-scale service providers, supports both domestic consumption and exports.

Japan Sheet Metal Fabrication Services Market Insight

Japan’s sheet metal fabrication services market is experiencing steady growth, driven by demand from its high-tech industries, precision machinery manufacturing, and the automotive sector. Emphasis on ultra-precision, miniaturization, and material efficiency is driving adoption of advanced laser cutting and forming techniques. The aging workforce is also pushing demand for increased automation and AI-driven fabrication systems.

Sheet Metal Fabrication Services Market Share

The sheet metal fabrication services industry is primarily led by well-established companies, including:

- Trumpf GmbH + Co. KG (Germany)

- SafanDarley B.V. (Netherlands)

- Durma Machine Tools (Turkey)

- Mate Precision Technologies (U.S.)

- Mitsubishi Electric Corporation (Japan)

- Wilamowski S.A. (Poland)

- Mazak Corporation (Japan)

- Bystronic Laser AG (Switzerland)

- Murata Machinery, Ltd. (Japan)

- Amada Co., Ltd. (Japan)

- BLM Group S.p.A. (Italy)

- LVD Company NV (Belgium)

- Haco Group (Belgium)

- Komatsu Ltd. (Japan)

- Prima Industrie S.p.A (Italy)

Latest Developments in Global Sheet Metal Fabrication Services Market

- In July 2023, ArcelorMittal Nippon Steel India, a joint venture of global steel leaders ArcelorMittal and Nippon Steel, signed a Memorandum of Understanding (MoU) with Festo India at the Festo Corporate Center in Stuttgart, Germany. This collaboration is expected to strengthen automation and skill development within the sheet metal fabrication industry, enhancing production efficiency and supporting the adoption of advanced technologies across fabrication facilities in India

- In March 2022, Vulcan Industries plc expanded its capabilities by acquiring Aptec Ltd., a company specializing in metal forming, bending, and laser cutting. This acquisition is likely to boost Vulcan’s service portfolio and geographic reach, contributing to increased consolidation and capacity expansion in the sheet metal fabrication services market

- In February, CGI Automated Manufacturing’s acquisition of Richlind Metal Fabricators, a precision sheet metal and machining service provider, underscores the trend of strategic mergers to improve technical expertise and service offerings. This move supports market growth by enabling companies to meet rising demand for high-precision, value-added fabrication services

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Sheet Metal Fabrication Services Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Sheet Metal Fabrication Services Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Sheet Metal Fabrication Services Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.