Global Ship Repair And Maintenance Services Market

Market Size in USD Billion

CAGR :

%

USD

29.16 Billion

USD

51.61 Billion

2024

2032

USD

29.16 Billion

USD

51.61 Billion

2024

2032

| 2025 –2032 | |

| USD 29.16 Billion | |

| USD 51.61 Billion | |

|

|

|

|

Ship Repair and Maintenance Services Market Size

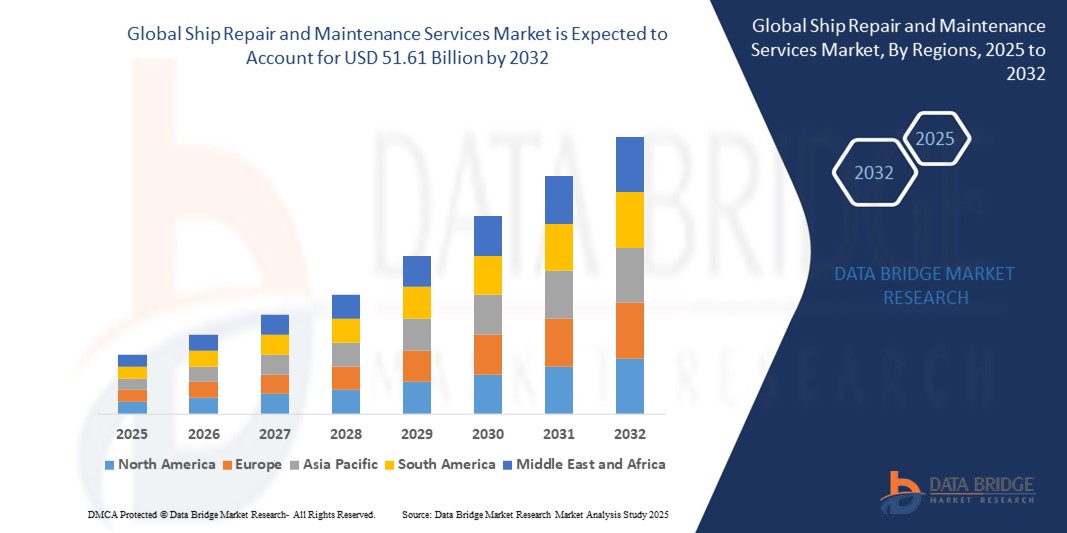

- The global ship repair and maintenance services market was valued at USD 29.16 billion in 2024 and is expected to reach USD 51.61 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 7.5%, primarily driven by the aging global fleet

- This growth is driven by factors such as the rise in global maritime trade increasing demand for vessel upkeep, and the adoption of advanced technologies like AI, IoT, and predictive analytics enhancing maintenance efficiency and reducing downtime

Ship Repair and Maintenance Services Market Analysis

- Ship repair and maintenance services are essential for ensuring the operational efficiency and safety of maritime vessels, encompassing activities like dry-docking, engine overhauls, hull repairs, and system upgrades

- The market's growth is significantly driven by factors such as the aging global fleet requiring more frequent maintenance, stringent environmental regulations necessitating eco-friendly retrofitting, and the adoption of advanced technologies like AI, IoT, and predictive analytics

- The Asia-Pacific region stands out as a dominant market for ship repair and maintenance services with market share 36.89%, attributed to its extensive shipbuilding industry, significant trade activities, and well-established shipyards in countries such as China, South Korea, and Japan

- For instance, On November 15, 2024, South Korea's Hanwha Ocean secured a contract with the U.S. Navy to provide maintenance, repair, and overhaul (MRO) services for the 31,000-ton replenishment vessel, USNS Yukon (T-AO-202). This agreement highlights Hanwha’s expanding role in global naval support and strengthens defense ties between South Korea and the U.S.

- Globally, ship repair and maintenance services are recognized as critical components in the maritime industry, playing a pivotal role in maintaining the longevity and performance of vessels, second only to shipbuilding in importance

Report Scope and Ship Repair and Maintenance Services Market Segmentation

|

Attributes |

Ship Repair and Maintenance Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ship Repair and Maintenance Services Market Trends

“Increased Adoption of 3D Imaging and Digital Integration in Ship Diagnostics and Repair”

- One prominent trend in the global Ship Repair and Maintenance Services market is the growing adoption of 3D imaging and digital integration

- These advanced tools enhance accuracy and efficiency by enabling shipyards to capture detailed 3D models of damaged or aging ship components for precise diagnostics and repair planning

- For instance, HMM, a South Korean shipping company, is trialing onboard 3D printing aboard its containership, HMM GREEN, to produce maintenance parts on-demand. This initiative aims to reduce downtime, cut inventory costs, and improve operational efficiency. Similarly, companies like Wilhelmsen and Immensa are leveraging 3D printing to streamline maritime supply chains and enhance spare parts availability, revolutionizing ship repair and maintenance.

- Digital integration enables real-time collaboration between onsite technicians and remote experts through connected devices, ensuring faster decision-making and documentation during maintenance operations

- This trend is transforming the ship repair ecosystem by improving diagnostic accuracy, reducing manual errors, and increasing the demand for digital solutions in ship maintenance

Ship Repair and Maintenance Services Market Dynamics

Driver

“Aging Global Fleet Necessitating Frequent Repairs”

- The increasing age of commercial and naval vessels is a primary driver for the ship repair and maintenance services market

- Vessels older than 15–20 years experience structural fatigue, system inefficiencies, and frequent breakdowns that necessitate dry-docking, retrofitting, and component replacements

- Aging ships must comply with stricter international safety, emissions, and maintenance regulations, prompting regular servicing to remain operational

For instance,

- In August 2024, A.P. Moller - Maersk is advancing its fleet renewal program by placing orders for 20 dual-fuel vessels, totaling 300,000 TEU. These vessels, equipped with liquefied gas dual-fuel engines, will replace older ships, maintaining the fleet size at 4.3 million TEU. The initiative aligns with Maersk’s decarbonization goals, aiming for net-zero emissions by 2040.

- As fleets continue to age, ship owners are investing more in preventive maintenance to avoid costly breakdowns, which in turn drives consistent market growth

Opportunity

“Sustainable Retrofitting and Green Repair Services”

- Environmental regulations such as IMO 2023 and EU Fit for 55 are pushing ship operators to adopt green technologies, opening up opportunities in eco-friendly retrofitting and upgrades.

- Services like scrubber installations, ballast water treatment system retrofits, and alternative fuel conversions (LNG, methanol) are becoming high-demand segments

- This shift supports sustainability goals while extending the life of vessels through regulatory-compliant upgrades

For instance,

- Goltens is advancing maritime sustainability through its Green Technologies division, helping shipowners cut emissions, boost fuel efficiency, and meet evolving regulations. With over 1,000 successful retrofits for sulphur emission control and ballast water treatment, Goltens offers global expertise and efficient project coordination. Its commitment positions the company as a trusted partner in driving a greener, compliant shipping industry.

- The transition toward greener fleets provides shipyards with new revenue streams, especially in offering carbon-reduction solutions through strategic repair and retrofit services

Restraint/Challenge

“High Operational and Infrastructure Costs”

- The ship repair industry faces significant cost-related barriers, particularly in establishing and maintaining advanced dry-docking, lifting systems, and automation facilities

- Costs associated with acquiring skilled labor, complying with environmental regulations, and maintaining global-class certification standards are often prohibitively high

- Small and medium-sized yards, especially in developing regions, struggle to stay competitive due to lack of automation and limited capital

For instance,

- In February 2025, according to the news by ShipUniverse.com, the ship repair industry faces rising costs due to labor and material price hikes, regulatory pressures, and supply chain disruptions. Major contracts like Wärtsilä’s deal with CMA CGM highlight growing demand for fleet maintenance, while financial challenges, such as the U.S. Navy’s $17B budget overrun and Meyer Werft’s financial troubles, reflect industry strain. Geopolitical tensions also impact repair decisions.

- These high overhead and infrastructure costs hinder service scalability, reduce profit margins, and limit the industry's ability to adopt advanced tools and techniques globally

Ship Repair and Maintenance Services Market Scope

The market is segmented on the basis of vessel type, product type, application, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Vessel type |

|

|

By Product Type |

|

|

By Application |

|

|

By end user |

|

Ship Repair and Maintenance Services Market Regional Analysis

“Asia-Pacific is the Dominant Region in the Ship Repair and Maintenance Services Market”

- Asia-Pacific (APAC) dominates the ship repair and maintenance services market with a market share of 36.89% because of the increased sea-borne trade activities within the region and the strong presence of key market players.

- The region benefits from extensive maritime infrastructure, with countries like China, South Korea, and Japan housing some of the world’s largest and most advanced shipyards.

- Leadership in research and development further drives the adoption of cutting-edge technologies that enhance operational efficiency and promote environmentally sustainable practices across ship maintenance operations.

- In addition, government support and growing private investments contribute to the region’s dominance, fostering innovation and enabling shipyards to maintain global competitiveness in repair and maintenance services.

“Europe is Projected to Register the Highest Growth Rate”

- The Europe region is expected to witness the highest growth rate in the Ship Repair and Maintenance Services market with market share 29.68%, driven by the region’s strong regulatory framework, focus on environmental sustainability, and modernization of existing fleets. These factors are creating significant opportunities for advanced and eco-friendly repair and maintenance services

- Countries such as Germany, the Netherlands, Norway, and Italy have made substantial investments in maritime infrastructure, establishing state-of-the-art shipyards that are increasingly adopting green technologies and digital solutions

- Germany plays a pivotal role in the global ship repair and maintenance services market, underpinned by its engineering excellence, innovation in sustainable maritime practices, and highly skilled workforce

- The Netherlands and Norway have established themselves as leading hubs in Europe, with a strong emphasis on digital shipyard transformation and green retrofitting, while Italy continues to grow its footprint through strategic modernization efforts and improved service offerings

Ship Repair and Maintenance Services Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Sembcorp Industries (Singapore)

- China Shipbuilding Industry Corporation (China)

- Damen Shipyards Group (Netherlands)

- Hyundai Mipo Dockyard Co, ltd (South Korea)

- DAE SUN Shipbuilding & Engineering Co, Ltd (South Korea)

- Cochin Shipyard Limited (Kochi)

- Dundee Marine & Industrial Services Pte Ltd (Singapore)

- Tsuneishi Shipbuiding Co, Ltd, HOSEI Co, LTD (South Korea)

- Keppel Corporation Limited (Singapore)

- Swissco Holdings Limited (Singapore)

- Egyptian Ship Repair & Building Company (Egypt)

- Sembcorp Marine LTD (Singapore)

- Hanjin Heavy Industry Co.Ltd (South Korea)

- Desan Shipyard (Turkey)

Latest Developments in Global Ship Repair and Maintenance Services Market

- In January 2025, Wärtsilä renewed its Operation & Maintenance agreement with Caparo Power Ltd (CPL) for its 36 MW power plant in Bawal, Haryana. The extension, effective for five years, includes maintenance, spare parts, operational support, and Wärtsilä’s Expert Insight solution, ensuring plant efficiency and reliability. This renewal highlights the strong partnership between Wärtsilä and CPL since 2010

- In July 2024, Seatrium Limited, headquartered in Singapore, secured ship repair and upgrade contracts worth SGD $180 million (US$140 million) in July 2024. The projects include repairs and upgrades on offshore vessels, naval vessels, ferries, LNG carriers, and tankers. Seatrium continues to strengthen Singapore’s position as a hub for vessel repairs, emphasizing its expertise in complex projects and adherence to safety standards

- In February 2025, Weser Maritim, a leading ship repair company in Istanbul, announced eco-friendly solutions to make ship repairs more sustainable. The company introduced biodegradable cleaning agents, energy-efficient technologies, and optimized procedures to reduce environmental impact. These measures align with evolving IMO regulations and global sustainability goals, helping shipowners cut costs and enhance their green credentials

- In January 2025, Russian Arc7-class LNG tankers underwent repairs at European Union shipyards, including Damen (France) and Fayard (Denmark), enabling Russia to maintain Arctic gas transport despite sanctions. The Yamal LNG plant's operations depend on these services, with 14 out of 15 tankers serviced at these yards. EU sanctions have yet to target natural gas, though measures to limit LNG imports are forthcoming

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.