Global Shipbuilding Market

Market Size in USD Billion

CAGR :

%

USD

145.65 Billion

USD

212.75 Billion

2024

2032

USD

145.65 Billion

USD

212.75 Billion

2024

2032

| 2025 –2032 | |

| USD 145.65 Billion | |

| USD 212.75 Billion | |

|

|

|

|

Shipbuilding Market Analysis

The global shipbuilding market is witnessing significant growth, driven by increasing demand for commercial vessels, naval ships, and technologically advanced ships for energy transportation. Advancements in shipbuilding technology, such as automation, digital twin technology, and AI-driven design optimization, are transforming the industry by enhancing efficiency and reducing construction costs. The growing adoption of LNG-powered and hybrid propulsion systems is also contributing to market expansion, as shipping companies focus on reducing carbon emissions and complying with stringent environmental regulations. Asia-Pacific dominates the market, with countries such as China, South Korea, and Japan leading in ship production due to strong government support, advanced infrastructure, and a skilled workforce. The defense sector is also fueling demand, with nations investing in modern naval fleets for maritime security. In addition, the rise of smart ship solutions, including IoT-enabled fleet management and real-time monitoring, is revolutionizing vessel operations. With increasing global trade, offshore oil and gas exploration, and sustainability-driven innovations, the shipbuilding market is poised for continued expansion in the coming years.

Shipbuilding Market Size

The global shipbuilding market size was valued at USD 145.65 billion in 2024 and is projected to reach USD 212.75 billion by 2032, with a CAGR of 4.85% during the forecast period of 2025 to 2032. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Shipbuilding Market Trends

“Increasing Adoption of LNG-Powered and Hybrid Propulsion Systems”

One prominent trend in the shipbuilding market is the increasing adoption of LNG-powered and hybrid propulsion systems to meet stringent environmental regulations and reduce carbon emissions. With global efforts to decarbonize the maritime industry, shipbuilders are integrating dual-fuel engines, battery storage systems, and energy-efficient designs to comply with IMO 2023 emission standards. For instance, South Korea’s Samsung Heavy Industries and Hyundai Heavy Industries have been leading in developing LNG-fueled container ships and bulk carriers, significantly lowering greenhouse gas emissions compared to traditional diesel-powered vessels. In addition, China Merchants Energy Shipping has recently placed orders for several Newcastlemax bulk carriers equipped with low-emission fuel systems, reinforcing the industry's shift towards sustainable shipping. As governments and maritime organizations push for green shipbuilding solutions, the demand for next-generation fuel-efficient vessels is expected to rise, reshaping the global shipbuilding market towards cleaner and more sustainable maritime operations.

Report Scope and Shipbuilding Market Segmentation

|

Attributes |

Shipbuilding Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Hyundai Heavy Industries Co., Ltd. (South Korea), Hanwha Group (South Korea), SAMSUNG HEAVY INDUSTRIES (South Korea), MITSUBISHI HEAVY INDUSTRY, LTD. (Japan), TSUNEISHI SHIPBUILDING Co. Ltd. (Japan), IMABARI SHIPBUILDING CO., LTD. (Japan), Northstar Ship Chandler Inc. (U.S.), LARSEN & TOUBRO LIMITED. (India), JSC United Shipbuilding Corporation (Russia), Sumitomo Heavy Industries, Ltd. (Japan), Hanjin Heavy Industries and Construction Holdings Co. Ltd. (South Korea), and Jiangsu New Yangzi Shipbuilding Co., Ltd. (China) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Shipbuilding Market Definition

Shipbuilding is the process of designing, constructing, and assembling various types of marine vessels, including cargo ships, passenger ships, military vessels, fishing boats, and tankers, for commercial, defense, and industrial purposes. It involves multiple stages, such as hull fabrication, outfitting, welding, propulsion system installation, and final testing, to ensure seaworthiness and compliance with international maritime regulations.

Shipbuilding Market Dynamics

Drivers

- Increasing Demand for Commercial Ships

The surge in global trade and maritime transportation has significantly fueled the demand for cargo ships, container vessels, and bulk carriers. With over 80% of global trade conducted via seaborne routes, the need for high-capacity, fuel-efficient vessels is at an all-time high. Shipping companies are increasingly placing orders for larger and technologically advanced vessels to optimize freight transport and reduce costs. For instance, Maersk and MSC have recently invested in next-generation container ships equipped with smart logistics technology to improve cargo handling and fuel efficiency. This rising demand for modernized commercial vessels positions shipbuilding as a crucial industry, driving the need for continuous innovation and production expansion.

- Adoption of Green Shipbuilding Technologies

With stringent environmental regulations and increasing focus on sustainable maritime practices, the shipbuilding industry is witnessing a shift towards green technologies. The International Maritime Organization (IMO) 2023 regulations emphasize reducing carbon emissions, leading shipbuilders to develop LNG-powered, hydrogen-fueled, and electric ships. Companies such as Hyundai Heavy Industries and Mitsubishi Heavy Industries are investing in energy-efficient hull designs, wind-assisted propulsion systems, and low-emission engines to comply with these regulations. For instance, Maersk has launched its first carbon-neutral methanol-powered container ship, setting a benchmark for sustainable shipping. This growing emphasis on eco-friendly shipbuilding serves as a major driver in reshaping the future of maritime transportation.

Opportunities

- Growth in Naval and Defense Shipbuilding

The rising geopolitical tensions and increasing defense budgets worldwide have led to significant growth in naval and defense shipbuilding. Governments are investing in advanced warships, submarines, and patrol vessels to enhance their maritime security and strategic presence. For instance, the U.S. and U.K. have ramped up their naval ship procurement efforts, with the U.S. Navy planning to expand its fleet of nuclear submarines and guided-missile destroyers. Similarly, China and India are heavily investing in domestic shipbuilding programs, such as India's Project 75 for indigenous submarines and China's Type 055 destroyers. This expansion presents a lucrative market opportunity for shipbuilders, as defense contracts often lead to long-term collaborations and technological advancements in naval engineering.

- Increasing Advancements in Smart Ship Technology

The shipbuilding industry is witnessing a digital transformation with the integration of AI, IoT, and digital twin technology, enabling the development of smart ships. These technologies allow for autonomous navigation, predictive maintenance, real-time performance monitoring, and enhanced fuel efficiency, significantly reducing operational costs and human errors. Leading industry players such as Rolls-Royce and Samsung Heavy Industries are investing in AI-powered smart ships, with Rolls-Royce unveiling its concept for autonomous cargo vessels that operate without onboard crews. In addition, Samsung Heavy Industries is developing next-generation vessels with IoT-based monitoring systems, improving ship performance and reducing downtime. The growing demand for digitized and AI-driven ships presents a major market opportunity for shipbuilders to pioneer smart maritime solutions and gain a competitive edge in the industry.

Restraints/Challenges

- High Production Costs

The shipbuilding industry faces significant challenges due to rising production costs, primarily driven by the increasing prices of raw materials such as steel and aluminum. As shipbuilders aim to produce high-capacity and fuel-efficient vessels, the demand for specialized alloys and corrosion-resistant materials has surged, further escalating expenses. In addition, the integration of advanced automation and digital shipbuilding technologies, such as AI-driven design systems and robotic welding, has increased upfront investment costs. Labor costs have also risen, as the industry requires highly skilled workers to operate and maintain these sophisticated systems. For instance, in South Korea, shipbuilders such as Hyundai Heavy Industries are investing heavily in automation to reduce labor dependence, but the transition remains costly. These financial burdens make it difficult for small and mid-sized shipyards to compete, limiting market expansion.

- Stringent Environmental Regulations

The shipbuilding sector is under immense pressure to comply with stringent environmental regulations, particularly those imposed by the International Maritime Organization (IMO) to reduce greenhouse gas emissions. The transition to eco-friendly propulsion systems, such as LNG, hydrogen, and ammonia-based fuels, requires substantial investment in research and retrofitting existing fleets, adding to production costs. Shipbuilders are also required to integrate energy-efficient hull designs, exhaust gas cleaning systems, and hybrid propulsion technologies to meet sustainability targets. For instance, Mitsubishi Heavy Industries is investing in ammonia-fueled ship designs to align with the IMO 2050 decarbonization goals, but the adoption of such technologies remains expensive and logistically complex. This regulatory burden increases operational costs, making it challenging for traditional shipbuilders to stay competitive while ensuring compliance with evolving global environmental standards.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Shipbuilding Market Scope

The market is segmented on the basis of type and end user. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Cruise Ships

- Cargo Ships

- Military Vessels

- Tugs

- Fishing Vessels

- Bunker Tankers

- Small Passenger Ships

- Small General Cargo Carriers

End User

- Transport

- Military

Shipbuilding Market Regional Analysis

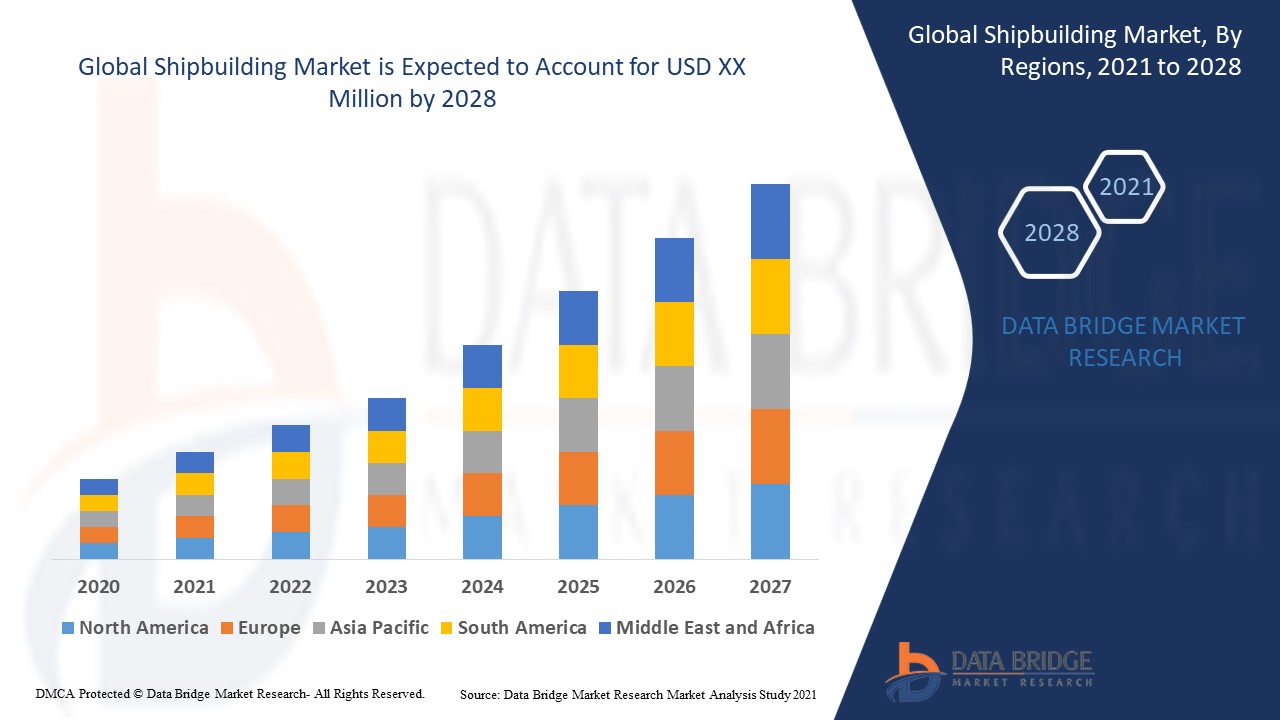

The market is analysed and market size insights and trends are provided by country, type, and end user as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

Asia-Pacific dominates the shipbuilding market due to various government initiatives aimed at strengthening the shipbuilding industry and increasing domestic production capabilities. In addition, the rising demand for LNG-fueled engines is driving the adoption of environmentally friendly and fuel-efficient vessels across the region. The increasing use of shipbuilding in passenger transportation, cargo shipping, and other industrial applications is further contributing to market expansion. With rapid economic growth, expanding trade routes, and technological advancements in ship construction, the shipbuilding market in Asia-Pacific is expected to witness significant growth during the forecast period.

North America is projected to experience fastest growth in the global shipbuilding market during the forecast period. This growth is driven by increasing investments in naval defense, rising demand for commercial vessels, and advancements in shipbuilding technologies. In addition, government initiatives and collaborations with private firms are expected to enhance regional production capabilities. The expansion of port infrastructure and a focus on sustainable shipbuilding practices further contribute to market growth.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Shipbuilding Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Shipbuilding Market Leaders Operating in the Market Are:

- Hyundai Heavy Industries Co., Ltd. (South Korea)

- Hanwha Group (South Korea)

- SAMSUNG HEAVY INDUSTRIES (South Korea)

- MITSUBISHI HEAVY INDUSTRY, LTD. (Japan)

- TSUNEISHI SHIPBUILDING Co. Ltd. (Japan)

- IMABARI SHIPBUILDING CO., LTD. (Japan)

- Northstar Ship Chandler Inc. (U.S.)

- LARSEN & TOUBRO LIMITED. (India)

- JSC United Shipbuilding Corporation (Russia)

- Sumitomo Heavy Industries, Ltd. (Japan)

- Hanjin Heavy Industries and Construction Holdings Co. Ltd. (South Korea)

- Jiangsu New Yangzi Shipbuilding Co., Ltd. (China)

Latest Developments in Shipbuilding Market

- In June 2024, China Merchants Energy Shipping placed an order with New Times Shipbuilding for multiple newcastlemax bulk carriers. The Hong Kong-based company has contracted the Jiangsu-based shipyard to build eight conventional marine fuel 210,000-dwt vessels, with delivery scheduled for 2028

- In June 2024, Damen Shipyards signed an agreement with the Portland Harbour Authority (PHA) in the U.K. to deliver the Damen ASD Tug 2111, one of its latest tugboat models. The 21-meter-long ASD Tug 2111 is highly maneuverable and capable of producing a 50-ton bollard pull

- In August 2023, the Canadian government announced an investment of CAD 463 million (USD 345 million) in shipbuilding infrastructure to advance the Surface Combatant (CSC) program. The funding will support the construction of 15 new warships for the Royal Canadian Navy and will be used to prepare Irving Shipyard and adjacent facilities in Nova Scotia for construction, set to begin next year

- In May 2023, Vard Marine Inc., along with Team Vigilance partners Heddle Shipyards, Thales Canada, SH Defence, and Fincantieri, unveiled the Vigilance Offshore Patrol Vessel at CANSEC 2023. These partners bring significant expertise in naval ship design, construction, combat and offboard system integration, modular payload systems, and life-cycle solutions

- In May 2023, Garden Reach Shipbuilders and Engineers Ltd launched the GRSE Accelerated Innovation Nurturing Scheme (GAINS) to drive technological advancements in ship design and construction. This initiative aims to tackle current and emerging challenges in shipbuilding while aligning with the objectives of Atmanirbhar Bharat

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.