Global Shoe Care Market

Market Size in USD Billion

CAGR :

%

USD

4.47 Billion

USD

7.23 Billion

2024

2032

USD

4.47 Billion

USD

7.23 Billion

2024

2032

| 2025 –2032 | |

| USD 4.47 Billion | |

| USD 7.23 Billion | |

|

|

|

|

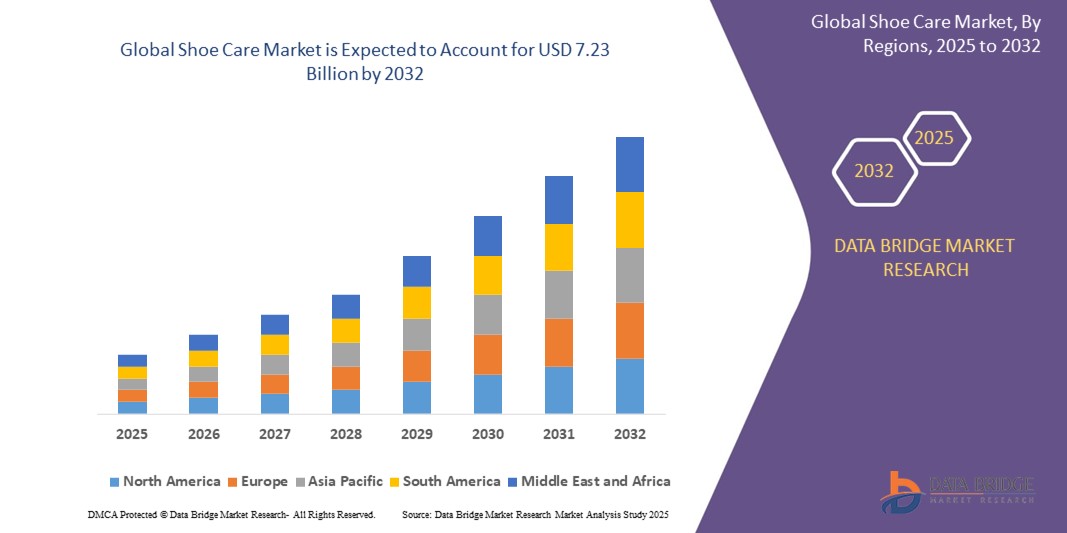

What is the Global Shoe Care Market Size and Growth Rate?

- The global shoe care market size was valued at USD 4.47 billion in 2024 and is expected to reach USD 7.23 billion by 2032, at a CAGR of 6.20% during the forecast period

- In the shoe care market, technological advancements have revolutionized products, offering benefits such as extended shoe lifespan and enhanced appearance. Innovative formulas and tools cater to diverse materials, ensuring comprehensive care

- Consumers enjoy convenience and efficiency, preserving their favorite footwear effortlessly. This progress fosters a thriving industry, meeting evolving needs while promoting sustainability and longevity.

What are the Major Takeaways of Shoe Care Market?

- The rise of sneaker culture has led to a niche market for premium shoe care products, catering specifically to sneaker enthusiasts and collectors, reflecting the growing demand within the sneaker and streetwear community

- These consumers, deeply invested in the aesthetics and upkeep of their footwear collections, fuel demand for premium cleaning and maintenance solutions. For instance, specialty sneaker cleaning kits have gained popularity, catering to the meticulous needs of this discerning demographic

- North America dominated the shoe care market with the largest revenue share of 44.25% in 2024, attributed to strong demand for footwear maintenance products across both urban and suburban populations

- Asia-Pacific region is projected to grow at the fastest CAGR of 12.56% from 2025 to 2032, driven by urbanization, growing middle-class income, and increasing fashion and sneaker trends. Rising footwear consumption across countries such as India, China, Indonesia, and Vietnam is expanding the need for basic and advanced shoe care solutions

- The polish segment dominated the shoe care market with the largest revenue share of 46.5% in 2024, driven by the widespread use of polish across both formal and casual footwear

Report Scope and Shoe Care Market Segmentation

|

Attributes |

Shoe Care Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Shoe Care Market?

“Eco-Friendly and Sustainable Formulations”

- A major trend shaping the global Shoe Care market is the growing consumer preference for eco-friendly, biodegradable, and non-toxic products, driven by rising environmental consciousness and regulatory pressure against harsh chemicals

- Companies are increasingly offering shoe polishes, cleaners, and sprays that are plant-based, free from aerosols and silicones, and packaged in recyclable or reusable containers. For instance, brands The Polish segment dominated the Shoe Care market with the largest revenue share of 46.5% in 2024, driven by the widespread use of polish across both formal and casual footwear Jason Markk and Saphir promote natural ingredients and sustainable packaging in their premium shoe care lines

- The shift is evident in innovations such as water-based cleaning solutions and solvent-free polishes, which are safer for users, shoes, and the environment. Retailers are also prioritizing eco-certifications on shelves to influence purchase decisions

- In addition, the demand for vegan leather care solutions has risen in parallel with the growth of synthetic and cruelty-free footwear. These products require specially formulated conditioners and cleaners, sparking further innovation in sustainable formulations

- As consumers increasingly align their purchases with environmental values, eco-friendly shoe care products are gaining shelf space in both physical and online retail, influencing the broader industry toward greener alternatives

- This trend is expected to remain a long-term growth driver, encouraging product innovation and brand differentiation in an increasingly sustainability-driven consumer market

What are the Key Drivers of Shoe Care Market?

- Rising consumer spending on premium footwear and growing sneaker culture worldwide are propelling demand for complementary shoe care products to prolong product life and maintain appearance

- For instance, in June 2024, Crep Protect launched a global campaign showcasing its full product range, from waterproofing sprays to sneaker cleaning kits, targeting youth audiences through social media influencers and e-commerce channels

- Increased awareness of proper footwear maintenance—driven by lifestyle bloggers, influencers, and fashion-forward consumers—has led to a surge in demand for multi-step shoe care routines, especially in the U.S., U.K., and Japan

- Footwear brands and luxury retailers are also offering bundled shoe care kits or co-branded products at the point of sale, encouraging consumers to invest in aftercare from the moment of purchase

- In addition, the rising adoption of online channels and growing DIY culture have made shoe care kits more accessible to the average consumer, further fueling sales and category awareness across both casual and formal footwear segments

Which Factor is challenging the Growth of the Shoe Care Market?

- A key challenge in the shoe care market is the low frequency of purchase and replacement cycles, as most products such as polishes, creams, and brushes tend to last several months or longer, limiting repeat sales

- For instance, many consumers in emerging markets still rely on traditional home remedies or cheaper local alternatives, reducing the market potential for premium or branded shoe care products

- In addition, limited consumer awareness about specialized products—such as suede-specific cleaners, odor neutralizers, or water-resistant sprays—can restrict market penetration, especially in lower-tier cities and rural areas

- Seasonal demand variations also affect sales; waterproof sprays and deodorizers, for instance, see higher sales in monsoon and summer, while usage drops significantly in other periods

- Moreover, lack of standardization in packaging and labelling across regions often leads to confusion among first-time users, hindering their willingness to invest

- To overcome these challenges, brands must focus on consumer education, product bundling, and targeting fast-fashion and sneaker audiences with more frequent launches, smaller pack sizes, and convenient kits to boost purchase frequency

How is the Shoe Care Market Segmented?

The market is segmented on the basis of product, application, and distribution channel.

• By Product

On the basis of product, the shoe care market is segmented into Polish, Cleaning, and Accessories. The Polish segment dominated the Shoe Care market with the largest revenue share of 46.5% in 2024, driven by the widespread use of polish across both formal and casual footwear. Polish products enhance the visual appeal, durability, and longevity of shoes, making them a staple in household and commercial shoe care routines. The availability of a wide range of colors and formats further fuels market dominance.

The Cleaning segment is expected to grow at the fastest CAGR from 2025 to 2032, owing to increasing consumer interest in sneaker maintenance, eco-friendly cleaning agents, and water-repellent sprays. As sneaker culture and casual footwear continue to gain popularity, consumers are investing more in maintaining the cleanliness and freshness of their footwear.

• By Application

On the basis of application, the shoe care market is segmented into Formal, Casual, Sports, and Others. The Formal segment accounted for the largest revenue share of 39.7% in 2024, primarily due to the consistent demand for polish and maintenance of leather shoes worn in corporate, official, and ceremonial settings. Professionals continue to prioritize clean, well-maintained footwear to complement their attire and maintain a polished appearance.

The Sports segment is projected to witness the fastest CAGR from 2025 to 2032, driven by the global rise in athletic footwear usage and the growing need for sneaker cleaning solutions. Active lifestyles and performance-oriented shoes are driving higher usage of protective and cleaning products designed specifically for sports shoes.

• By Distribution Channel

On the basis of distribution channel, the shoe care market is segmented into Online and Offline. The Offline segment held the highest revenue share of 58.3% in 2024, led by strong consumer preference for retail stores, footwear outlets, and departmental stores where products can be physically inspected before purchase. The trust in in-store purchases and immediate product availability remains a key driver.

The Online segment is projected to expand at the fastest CAGR from 2025 to 2032, fueled by growing e-commerce penetration, convenience, and the availability of bundled kits and exclusive products. Online platforms also benefit from detailed product descriptions, user reviews, and frequent promotional discounts, encouraging more digital-savvy consumers to shop online.

Which Region Holds the Largest Share of the Shoe Care Maret?

- North America dominated the shoe care market with the largest revenue share of 44.25% in 2024, attributed to strong demand for footwear maintenance products across both urban and suburban populations

- Consumers in this region value product aesthetics and longevity, which drives the consistent use of polish, cleaners, and protective sprays for formal, casual, and sports shoes

- The market is supported by high footwear consumption, increased fashion consciousness, and growing sneaker culture, particularly among millennials and Gen Z demographics

U.S. Shoe Care Market Insight

The U.S. dominated the North American shoe care market in 2024, driven by high per capita footwear ownership and robust retail infrastructure. Increasing awareness about shoe hygiene, especially post-pandemic, has fueled demand for cleaning kits and sanitizing sprays. Popularity of luxury and limited-edition footwear has also contributed to the growing use of premium shoe care accessories.

Europe Shoe Care Market Insight

The Europe shoe care market is projected to grow at a significant CAGR through 2032, led by a strong tradition of leather footwear use and high consumer preference for premium shoe polish and protection products. Countries such as Italy, Germany, and France have a well-established footwear craftsmanship culture, promoting ongoing demand for maintenance and conditioning solutions.

U.K. Shoe Care Market Insight

The U.K. market is expected to register robust growth through the forecast period, supported by rising demand for formal and casual footwear in work and lifestyle contexts. The growing influence of fashion-forward consumers and online footwear sales has increased the consumption of shoe care products such as waterproof sprays, deodorizing solutions, and multi-purpose cleaning wipes.

Germany Shoe Care Market Insight

The Germany shoe care market is growing steadily, bolstered by high awareness around sustainability and product lifecycle extension. German consumers are increasingly seeking eco-friendly and biodegradable shoe care solutions, particularly in urban areas. The preference for leather and business footwear supports continuous demand for polishing and conditioning products.

Which Region is the Fastest Growing in the Shoe Care Market?

Asia-Pacific region is projected to grow at the fastest CAGR of 12.56% from 2025 to 2032, driven by urbanization, growing middle-class income, and increasing fashion and sneaker trends. Rising footwear consumption across countries such as India, China, Indonesia, and Vietnam is expanding the need for basic and advanced shoe care solutions. The growth of e-commerce and local manufacturing of affordable shoe care products has improved accessibility and affordability across diverse consumer groups.

Japan Shoe Care Market Insight

The Japan market is witnessing growth due to a strong preference for cleanliness, quality footwear, and organized lifestyle habits. Shoe polishing and maintenance are considered part of personal grooming culture, especially among professionals. The popularity of branded sneakers and formal footwear further fuels demand for specialized cleaning and care kits.

China Shoe Care Market Insight

China held the largest revenue share in Asia-Pacific in 2024, owing to rapid urbanization, expanding fashion influence, and widespread footwear purchases. With strong domestic production of both shoes and care products, China’s market benefits from local innovation and wide distribution networks. As sneaker and luxury shoe markets grow, so does the consumer appetite for high-quality cleaning, shining, and odor-control products.

Which are the Top Companies in Shoe Care Market?

The Shoe Care industry is primarily led by well-established companies, including:

- C. Johnson & Son, Inc. (U.S.)

- Caleres (U.S.)

- Payless ShoeSource, Inc. (U.S.)

- SHINOLA (U.S.)

- Charles Clinkard (U.K.)

- Salamander (Germany)

- Implus Footcare, LLC (U.S.)

- GRANGERS (U.K.)

- Angelus Shoe Polish (U.S.)

- Griffin Shoe Care (U.S.)

- U.S. CONTINENTAL (U.S.)

- Salzenbrodt GmbH & Co. KG (Germany)

- Allen Edmonds Corporation (U.S.)

What are the Recent Developments in Global Shoe Care Market?

- In September 2023, Astromueller AG, a prominent shoe company, completed the acquisition of Schuhhaus Klauser GmbH & Co. KG (Salamander), a historic European footwear brand with a 120-year legacy. The acquisition is aimed at revitalizing the Salamander brand and expanding its offerings in the modern comfort footwear segment. This strategic move is expected to enhance brand value and boost the demand for complementary shoe care products

- In February 2023, Shoe Park, a leading footwear retailer, launched a new retail outlet introducing 15 fresh footwear brands designed to cater to consumers of all age groups. This initiative is set to fuel the demand for shoe care essentials, including polish and cleaning products, in the Maldives but across the Asia-Pacific region as well. The expansion is likely to positively influence the regional shoe care market

- In August 2022, Philips introduced the Philips Sneaker Cleaner GCA1000/60, a product specifically developed for the growing global sneaker enthusiast community. With sneaker culture gaining momentum worldwide, this device addresses the need for easy-to-use and affordable sneaker maintenance solutions. The launch is anticipated to drive demand for smart and efficient shoe care technologies globally

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL SHOE CARE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL SHOE CARE MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 LIFE LINE CURVE ANALYSIS

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 SECONDARY SOURCES

2.15 IMPORT AND EXPORT DATA

2.16 GLOBAL SHOE CARE MARKET: RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 RAW MATERIAL PRODUCTION COVERAGE

5.2 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

5.3 PORTER’S FIVE FORCES

5.4 VENDOR SELECTION CRITERIA

5.5 PESTEL ANALYSIS

5.6 REGULATORY OVERVIEW

6 SUPPLY CHAIN ANALYSIS

6.1 OVERVIEW

6.2 LOGISTIC COST SCENARIO

6.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

7 CLIMATE CHANGE SCENARIO

7.1 ENVIRONMENTAL CONCERNS

7.2 INDUSTRY RESPONSE

7.3 GOVERNMENT’S ROLE

7.4 ANALYST RECOMMENDATIONS

8 GLOBAL SHOE CARE MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

8.1 OVERVIEW

8.2 SHOE POLISH

8.2.1 SHOE POLISH, BY TYPE

8.2.1.1. WAX BASED SHOE POLISH

8.2.1.2. CREAM-EMULSION SHOE POLISH

8.2.1.3. LIQUID SHOE POLISH

8.2.1.4. OTHERS

8.3 SHOE CLEAN

8.3.1 SHOE CLEAN, BY TYPE

8.3.1.1. BRUSHES

8.3.1.2. TOWELS

8.3.1.3. SPONGE

8.3.1.4. SOAPS

8.3.1.5. BUFFING CLOTH

8.3.1.6. CLEANING WIPES

8.3.1.7. WATER REPALLANT SPRAYS

8.3.1.8. CONDITIONING CREAM

8.3.1.9. OTHERS

8.4 SHOE CARE ACCESSORIES

8.4.1 SHOE CARE ACCESSORIES, BY TYPE

8.4.1.1. INSOLES

8.4.1.2. SHOE LACES

8.4.1.3. OVERSHOES

8.4.1.4. SHOE HORNS

8.4.1.5. SHOE TREES

8.4.1.6. COLOURS & DYES

8.4.1.7. DECORATION CHARMS

8.4.1.8. OTHERS

8.5 SHOE SHINER

8.6 OTHERS

9 GLOBAL SHOE CARE MARKET, BY FORM, 2022-2031 (USD MILLION)

9.1 OVERVIEW

9.2 WAXY PASTE

9.3 LIQUID

9.4 CREAM

9.5 AEROSOLS

9.6 OTHERS

10 GLOBAL SHOE CARE MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

10.1 OVERVIEW

10.2 FORMAL SHOE

10.2.1 FORMAL SHOE, BY TYPE

10.2.1.1. LACED SHOES

10.2.1.2. MONK SHOES

10.2.1.3. BOOTS

10.2.1.4. OTHERS

10.3 CASUAL SHOE

10.3.1 CASUAL SHOE, BY TYPE

10.3.1.1. LOAFERS

10.3.1.2. SNEAKERS

10.3.1.3. ANKLE BOOTS

10.3.1.4. CANVAS

10.3.1.5. OTHERS

10.4 SPORTS SHOE

10.4.1 SPORTS SHOE, BY TYPE

10.4.1.1. CLEATS

10.4.1.1.1. SOCCER CLEATS

10.4.1.1.2. LACROSSE CLEATS

10.4.1.1.3. FOOTBALL CLEATS

10.4.1.1.4. BASEBALL CLEATS

10.4.1.2. RUNNING SHOES

10.4.1.3. COURT SHOES

10.4.1.4. HIKING SHOES

10.4.1.5. CYCLING SHOES

10.4.1.6. SKATES

10.4.1.7. OTHERS

10.5 OTHERS

11 GLOBAL SHOE CARE MARKET, BY END-USER, 2022-2031 (USD MILLION)

11.1 OVERVIEW

11.2 GENERAL CONSUMERS

11.3 PROFESSIONALS

11.4 SHOE REPAIR PROFESSIONALS

11.5 TRAVELERS

11.6 OTHERS

12 GLOBAL SHOE CARE MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

12.1 OVERVIEW

12.2 ONLINE

12.2.1 COMPANY OWNED

12.2.2 THIRD PARTY

12.3 OFFLINE

12.3.1 SHOE STORES

12.3.2 RETAIL OUTLETS

12.3.3 DISTRIBUTORS / WHOLESALERS

12.3.4 SUPERMARKETS / HYPERMARKETS

12.3.5 SPECIALTY STORES

12.3.6 CONVENIENCE STORES

12.3.7 OTHERS

13 GLOBAL SHOE CARE MARKET, BY GEOGRAPHY, 2022-2031 (USD MILLION)

GLOBAL SHOE CARE MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

13.1 OVERVIEW

13.2 NORTH AMERICA

13.2.1 U.S.

13.2.2 CANADA

13.2.3 MEXICO

13.3 EUROPE

13.3.1 GERMANY

13.3.2 U.K.

13.3.3 ITALY

13.3.4 FRANCE

13.3.5 SPAIN

13.3.6 SWITZERLAND

13.3.7 RUSSIA

13.3.8 TURKEY

13.3.9 BELGIUM

13.3.10 NETHERLANDS

13.3.11 REST OF EUROPE

13.4 ASIA-PACIFIC

13.4.1 JAPAN

13.4.2 CHINA

13.4.3 SOUTH KOREA

13.4.4 INDIA

13.4.5 AUSTRALIA

13.4.6 NEW ZEALAND

13.4.7 SINGAPORE

13.4.8 THAILAND

13.4.9 INDONESIA

13.4.10 MALAYSIA

13.4.11 PHILIPPINES

13.4.12 REST OF ASIA-PACIFIC

13.5 SOUTH AMERICA

13.5.1 BRAZIL

13.5.2 ARGENTINA

13.5.3 REST OF SOUTH AMERICA

13.6 MIDDLE EAST AND AFRICA

13.6.1 SOUTH AFRICA

13.6.2 EGYPT

13.6.3 SAUDI ARABIA

13.6.4 UNITED ARAB EMIRATES

13.6.5 ISRAEL

13.6.6 REST OF MIDDLE EAST AND AMERICA

14 GLOBAL SHOE CARE MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

14.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

14.3 COMPANY SHARE ANALYSIS: EUROPE

14.4 COMPANY SHARE ANALYSIS: ASIA PACIFIC

14.5 MERGERS & ACQUISITIONS

14.6 NEW PRODUCT DEVELOPMENT & APPROVALS

14.7 EXPANSIONS

14.8 REGULATORY CHANGES

14.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

15 GLOBAL SHOE CARE MARKET, DBMR AND SWOT ANALYSIS

16 GLOBAL SHOE CARE MARKET – COMPANY PROFILES

16.1 ABC GROUP

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT UPDATES

16.2 S. C. JOHNSON & SON, INC.

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT UPDATES

16.3 THE CLINKARD GROUP

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT UPDATES

16.4 IMPLUS CORPORATION

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT UPDATES

16.5 TARRAGO

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT UPDATES

16.6 MONEYSWORTH & BEST

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT UPDATES

16.7 CHERRY BLOSSOM

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT UPDATES

16.8 CLARKS

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT UPDATES

16.9 GRIFFIN BRANDS, INC.

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT UPDATES

16.1 ADIDAS AG

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCT PORTFOLIO

16.10.4 RECENT UPDATES

16.11 ALLEN EDMONDS CORPORATION

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT UPDATES

16.12 HARRI HOFFMAN CO DIVISION

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT UPDATES

16.13 ABBEYHORN

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT UPDATES

16.14 SALAMANDER

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT UPDATES

16.15 JASON MARKK UK, INC

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT UPDATES

16.16 CALERES INC

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT UPDATES

16.17 GRANGERS INTERNATIONAL

16.17.1 COMPANY SNAPSHOT

16.17.2 REVENUE ANALYSIS

16.17.3 PRODUCT PORTFOLIO

16.17.4 RECENT UPDATES

16.18 C.A. ZOES MFG CO.

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT UPDATES

16.19 FIEBING’S

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 PRODUCT PORTFOLIO

16.19.4 RECENT UPDATES

16.2 COLLONIL COMPANY

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 PRODUCT PORTFOLIO

16.20.4 RECENT UPDATES

17 QUESTIONNAIRE

18 RELATED REPORTS

19 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.