Global Shoe Insoles Market

Market Size in USD Billion

CAGR :

%

USD

4.20 Billion

USD

6.55 Billion

2024

2032

USD

4.20 Billion

USD

6.55 Billion

2024

2032

| 2025 –2032 | |

| USD 4.20 Billion | |

| USD 6.55 Billion | |

|

|

|

|

Shoe Insole Market Size

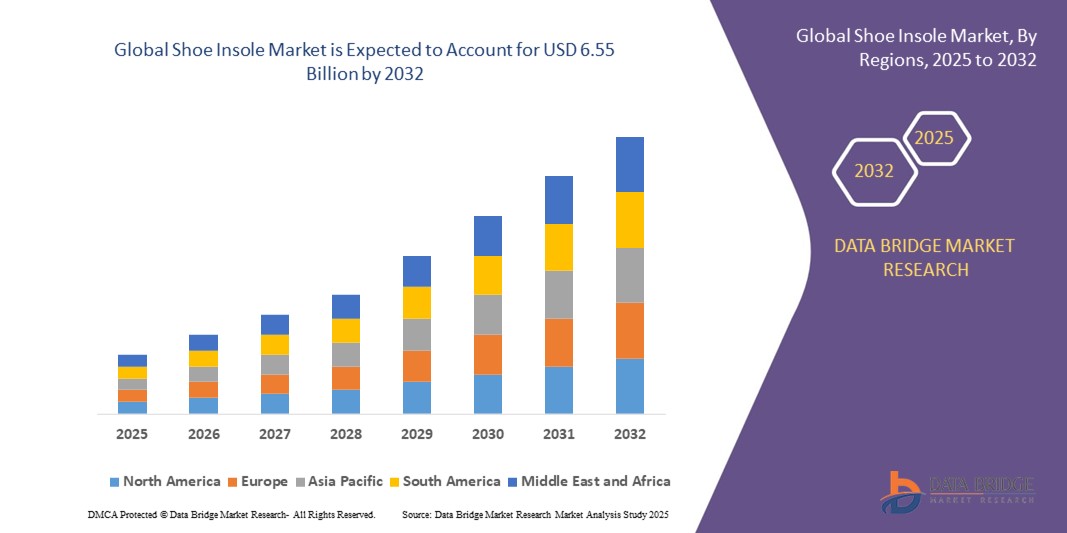

- The global shoe insole market size was valued at USD 4.20 billion in 2024 and is expected to reach USD 6.55 billion by 2032, at a CAGR of 5.7% during the forecast period

- The market growth is largely fueled by rising awareness about foot health, increasing prevalence of foot-related conditions such as plantar fasciitis and flat feet, and growing demand for personalized comfort in daily footwear across age groups

- Furthermore, the expansion of the athletic and fitness industry, coupled with rising demand for performance-enhancing footwear solutions, is accelerating the adoption of insoles among athletes and active consumers, thereby driving substantial growth in the shoe insole market

Shoe Insole Market Analysis

- Shoe insoles are footbed inserts designed to provide support, comfort, and pain relief by improving foot alignment and redistributing pressure. They are used in a wide range of footwear including athletic, casual, safety, and orthopedic shoes

- The increasing use of shoe insoles is driven by growing consumer focus on preventive foot care, rising cases of chronic foot ailments, and the need for enhanced mobility and comfort, especially among seniors and working professionals who stand or walk for extended hours

- Asia-Pacific dominated shoe insole market with a share of 41.3% in 2024, due to growing health awareness, rapid urbanization, and increasing demand for orthopedic products across emerging economies

- North America is expected to be the fastest growing region in the shoe insole market during the forecast period due to a strong focus on preventive healthcare, rising foot-related ailments, and increasing awareness of ergonomic wellness

- Full length segment dominated the market with a market share of 85.3% in 2024, due to it provides support across the entire footbed, improving weight distribution and posture. These insoles are commonly used for comprehensive foot alignment, arch support, and shock absorption. They are suitable for those with chronic conditions, long working hours, or active routines. Full-length insoles are ideal for sneakers, work boots, and orthopedic footwear. They reduce stress on ankles and knees by promoting better gait alignment. Brands offer full-length options in multiple materials and densities, enhancing fit and user experience. As long-term foot comfort becomes a priority, demand for full-length insoles continues to rise

Report Scope and Shoe Insole Market Segmentation

|

Attributes |

Shoe Insole Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Shoe Insole Market Trends

Rising Demand for Sustainable and Eco-Friendly Insoles

- The shoe insole market is increasingly driven by consumer and regulatory demands for sustainable and eco-friendly materials, promoting the use of biodegradable, recycled, and plant-based components to reduce environmental impact while maintaining comfort and durability

- For instance, manufacturers such as Superfeet and Dr. Scholl’s are innovating with eco-conscious insoles made from recycled foam, cork, and natural rubber that appeal to environmentally aware consumers and align with global sustainability goals

- The trend toward sustainability is supported by growing health and wellness awareness, where consumers prefer insoles that are both comfortable and contribute to reducing their carbon footprint

- Advances in bio-material technology and green manufacturing processes enable production of high-performance insoles that incorporate natural antibacterial and moisture-wicking properties, enhancing hygiene and longevity

- Retailers and brands are increasingly marketing sustainable insoles as part of their corporate social responsibility programs, strengthening brand loyalty among eco-conscious buyers

- The rise of online sales channels and direct-to-consumer models facilitates wider distribution of specialized sustainable insoles, expanding accessibility globally and supporting niche market growth

Shoe Insole Market Dynamics

Driver

Rapidly Expanding Sports and Fitness Activities

- The shoe insole market is significantly fueled by the growing participation in sports, fitness, and outdoor recreational activities, where performance-enhancing and injury-preventing insoles are in high demand to improve comfort and reduce stress on joints and muscles

- For instance, major brands such as ASICS and Nike have introduced insoles integrated with shock-absorbing gels and ergonomic designs tailored for runners, athletes, and fitness enthusiasts, boosting market adoption

- Increasing global health awareness and fitness-oriented lifestyles encourage consumers to invest in specialized insoles that enhance athletic performance and provide preventive support for common foot and leg ailments

- The expanding fitness center industry and proliferation of sports events worldwide create consistent demand for comfortable and technologically advanced insoles

- Collaboration between sportswear companies and podiatric experts drives innovation in customized insoles designed to address sport-specific biomechanical needs, further expanding market opportunities

Restraint/Challenge

Environmental Impact of Insole Production and Disposal

- Despite growing demand for sustainable products, the production processes of many shoe insoles still involve the use of non-renewable resources, synthetic materials, and energy-intensive manufacturing, contributing to environmental concerns

- For instance, traditional foam and gel insoles, widely used by many manufacturers, pose challenges in recycling and disposal due to their composite and non-biodegradable nature, leading to accumulation in landfills

- The lack of standardized recycling infrastructure and consumer awareness limits the effectiveness of recycling programs for shoe insoles, creating environmental waste management challenges

- Balancing the performance attributes of insoles, such as durability and cushioning, with eco-friendly materials remains technically complex and often increases production costs

- Regulatory pressures and evolving environmental standards compel manufacturers to invest heavily in research for greener materials and circular economy models, which may slow down production scale and market pricing competitiveness

Shoe Insole Market Scope

The market is segmented on the basis of type, material, price range, customization, prescription, length, insole thickness, end user, and distribution channel.

- By Type

On the basis of type, the shoe insole market is segmented into casual insole, sports/athletic insole, orthotics insole, safety insole, and others. The orthotics insole segment dominated the largest market revenue share in 2024, owing to the increasing prevalence of foot-related issues such as plantar fasciitis, flat feet, and diabetic foot complications. These insoles are designed to offer biomechanical correction, alleviate foot pain, and improve posture. Their demand is also boosted by rising awareness of long-term foot health and ergonomic support. Orthotic insoles are widely prescribed by podiatrists and physical therapists for therapeutic benefits. In addition, they are often used by the elderly and people with active jobs who need prolonged foot comfort. Availability in both OTC and custom formats makes them suitable for diverse consumer needs. Their long lifespan and compatibility with most footwear types further contribute to their dominance.

The sports/athletic insole segment is projected to witness the fastest growth rate from 2025 to 2032, driven by increasing participation in sports, fitness activities, and gym routines. These insoles are engineered to absorb high-impact forces and reduce the risk of stress injuries. They offer specialized arch support, heel cushioning, and moisture-wicking properties that enhance athletic performance. Growing interest in wellness and personal fitness among youth and working adults is a major growth driver. Brands are focusing on athlete-specific designs tailored for running, hiking, and court sports, expanding product variety. Technological innovations such as energy return foams and breathable layers are increasing product differentiation. Endorsements by sports personalities and fitness influencers are also improving consumer acceptance. As consumers become more health-conscious, demand for high-performance insoles will continue to surge.

- By Material

On the basis of material, the shoe insole market is segmented into foam, gel, plastic/polymer, silicone, polyurethane, carbon fiber, and others. The foam segment captured the largest revenue share in 2024, attributed to its excellent cushioning, cost efficiency, and broad application across footwear categories. Foam insoles provide soft support, shock absorption, and arch comfort for daily use. Their lightweight structure makes them easy to insert into most shoe types, increasing usability. They are widely used in casual, work, and school shoes due to affordability and comfort. The versatility of foam allows for modifications in density and contouring, improving ergonomics. The material is also easily available and manufacturable, supporting bulk production. Consumers seeking basic comfort without a high price tag are increasingly opting for foam-based insoles.

The gel segment is expected to witness the fastest growth from 2025 to 2032, as users seek high-impact shock absorption and all-day foot fatigue relief. Gel insoles conform to foot shape and distribute pressure evenly, making them ideal for people who stand or walk for long durations. The cooling effect of gel and its anti-microbial properties enhance comfort in warm or humid conditions. Demand is rising among fitness enthusiasts, healthcare workers, and industrial employees. Advancements in gel technology such as dual-density layering and perforated air channels are improving breathability and performance. As consumers associate gel with premium cushioning, willingness to spend on this material is increasing. Marketing campaigns highlighting therapeutic benefits are further driving adoption in this segment.

- By Price Range

On the basis of price range, the market is segmented into low, medium, and high. The medium price range segment held the highest market share in 2024, as it offers a balanced mix of comfort, quality, and affordability. These insoles generally feature good durability, ergonomic design, and moderate customization without the premium costs of high-end products. They are ideal for general foot fatigue, minor arch support, and everyday walking or standing. The growing middle-class population globally prefers value-for-money products, fueling this segment’s growth. Retailers often position medium-priced insoles as the optimal choice for people seeking reliable comfort. This category also includes a wide variety of foam, gel, and blended materials, increasing consumer choices. Their availability in both online and offline channels has widened market access.

The high price range segment is anticipated to grow at the fastest pace through 2032, driven by rising demand for advanced orthopedic support and performance-oriented solutions. These insoles often feature custom-fitted designs, premium materials such as carbon fiber or silicone, and precision engineering. Increasing disposable income, especially in urban areas, is making consumers more willing to invest in foot wellness. High-end insoles are popular among athletes, the elderly, and people with chronic conditions requiring superior cushioning and correction. Technologies such as 3D scanning and gait analysis are enabling precise customizations, elevating perceived value. The market is also seeing growth in designer insoles targeting the fashion-conscious demographic. As awareness of long-term foot care increases, premium insoles are expected to witness sustained demand.

- By Customization

On the basis of customization, the market is segmented into standard and customized. The standard segment dominated in 2024, owing to its mass-market appeal, affordability, and widespread availability. Standard insoles are pre-molded to fit general foot shapes and shoe types, making them convenient for everyday use. These products are typically available at pharmacies, supermarkets, and footwear stores, increasing accessibility. They serve well for users with common foot discomfort who don’t require medical-grade correction. With improving designs, many standard insoles now offer moderate arch support and pressure distribution. Consumers appreciate the ease of use and no-wait purchase experience. Their compatibility with a broad range of footwear styles also boosts sales volume in this segment.

The customized segment is projected to grow at the highest rate through 2032, driven by increased demand for personalized comfort and medical precision. Customized insoles are designed based on individual foot measurements, pressure points, and gait patterns. These are often prescribed by orthopedic specialists or podiatrists for specific foot conditions such as flat feet, bunions, or pronation issues. The rise of technologies such as 3D scanning, mobile gait analysis, and CAD modeling has made customization more accurate and accessible. Consumers with chronic pain or performance needs are increasingly opting for tailored solutions. The premium pricing of custom insoles is offset by long-term health benefits and satisfaction. Growing awareness of preventative foot care among young adults is also contributing to demand.

- By Prescription

On the basis of prescription, the shoe insole market is segmented into OTC (Over-the-Counter) and prescribed. The OTC segment led the market in 2024 due to its widespread availability, ease of purchase, and affordability. These insoles cater to general issues such as mild arch discomfort, heel pain, and fatigue, and can be bought without a doctor’s prescription. Retailers offer a broad range of OTC options across foam, gel, and composite materials, enhancing consumer accessibility. Their quick availability and simple use make them highly preferred for immediate relief. Health-conscious individuals often choose OTC insoles for preventive care and daily comfort. The rise of online platforms offering detailed product reviews has also boosted confidence in OTC purchases. These insoles serve as an entry point for foot care, especially among first-time buyers.

The prescribed segment is expected to register the fastest growth from 2025 to 2032, driven by increasing medical diagnosis of foot abnormalities and chronic conditions. Prescribed insoles are tailored by medical professionals based on patient-specific gait and pressure analysis. They offer targeted correction for issues such as flat feet, plantar fasciitis, and diabetic neuropathy. The segment is also supported by rising insurance coverage for orthotic products in many regions. Medical professionals increasingly recommend prescribed insoles as part of long-term treatment plans. Advancements in digital foot scanning and 3D-printed customization are improving clinical outcomes. As awareness grows around professional foot health intervention, more consumers are turning to prescribed insoles for optimal results.

- By Length

On the basis of length, the market is segmented into full length, 3/4th length, and heel cup. The full-length segment held the highest share of 85.3% in 2024 as it provides support across the entire footbed, improving weight distribution and posture. These insoles are commonly used for comprehensive foot alignment, arch support, and shock absorption. They are suitable for those with chronic conditions, long working hours, or active routines. Full-length insoles are ideal for sneakers, work boots, and orthopedic footwear. They reduce stress on ankles and knees by promoting better gait alignment. Brands offer full-length options in multiple materials and densities, enhancing fit and user experience. As long-term foot comfort becomes a priority, demand for full-length insoles continues to rise.

The heel cup segment is projected to grow at the fastest pace, primarily due to its targeted support and compact design. Heel cups are popular among individuals with plantar fasciitis, heel spurs, and Achilles tendon issues. These insoles focus on absorbing heel shock and stabilizing the rearfoot area. Their compact size makes them compatible with various shoe types, including dress shoes and sandals. Heel cups are easy to insert and remove, offering convenient pain management. The market benefits from rising awareness of early intervention in heel pain. As consumers seek minimalist yet effective solutions, heel cups are becoming a preferred choice for localized relief and lightweight comfort.

- By Insole Thickness

On the basis of insole thickness, the market is segmented into thin, medium, and thick. The medium thickness segment held the largest revenue share in 2024, as it offers an ideal balance between cushioning and space efficiency. These insoles provide adequate support without making shoes feel tight, making them suitable for daily use. Medium insoles can be found in work shoes, casual footwear, and even athletic gear. They often feature multiple layers for enhanced comfort and sweat control. Consumers prefer them for their versatility across a range of activities and foot types. This segment appeals to users looking for moderate support at a reasonable price point. Their adaptability has made them the go-to solution for general foot care.

The thick segment is anticipated to witness the highest CAGR through 2032, driven by growing demand for enhanced cushioning and pressure relief. Thick insoles are essential for individuals with high-impact lifestyles, such as construction workers, nurses, and athletes. They offer superior shock absorption, reducing strain on the heel and forefoot. Patients with diabetic foot issues or arthritis also benefit from their added protection. Despite their bulk, innovations in lightweight foams and breathable layers have improved comfort. Many brands now design thick insoles that don’t compromise shoe fit, increasing their appeal. The trend toward therapeutic and comfort-focused footwear is expected to further boost this segment.

- By End User

On the basis of end user, the market is segmented into seniors (above 50 years), adults (25–50 years), teenagers (15–24 years), and kids (under 14 years). The adults segment dominated the market in 2024, supported by rising foot stress due to work-related standing, long commutes, and increased fitness activity. Adults are the largest consumer group actively seeking ergonomic insoles for daily comfort and pain prevention. This segment includes professionals, parents, athletes, and commuters who prioritize wellness. Lifestyle-related foot problems such as plantar fasciitis and arch collapse are common in this group. The availability of stylish and discreet insoles tailored for adult shoes further supports market share. As more adults focus on maintaining foot health and posture, demand continues to grow.

The seniors segment is expected to grow at the fastest rate through 2032, as aging populations are more prone to foot pain, balance issues, and chronic conditions. Seniors often require insoles that provide arch support, cushioning, and alignment to reduce strain. Medical-grade and orthotic insoles are popular in this segment to manage conditions such as arthritis and neuropathy. Seniors are increasingly encouraged by healthcare providers to use insoles as a preventive tool for falls and mobility decline. Customization options and soft materials are enhancing comfort and compliance among elderly users. The growing senior population globally, particularly in developed nations, is a key driver. Brands are focusing on ease of use and orthotic quality to cater to this age group effectively.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into online and offline. The offline segment accounted for the largest market share in 2024, as physical stores provide hands-on fitting, personal consultation, and immediate purchase. Pharmacies, orthopedic clinics, and specialty footwear retailers remain dominant sales points, especially for prescribed and custom insoles. Consumers often prefer trying insoles for fit and comfort before buying, which offline channels facilitate. Health practitioners and trained staff assist customers in selecting the right insole based on their foot condition. The ability to physically feel product texture and material also influences purchasing decisions. Offline channels enjoy consumer trust for high-value and health-related purchases, reinforcing their market lead.

The online segment is anticipated to register the fastest growth rate from 2025 to 2032, driven by growing e-commerce adoption, convenience, and expanded product variety. Online platforms allow consumers to compare prices, read reviews, and access a wide selection of brands from any location. The rise of direct-to-consumer insole brands is disrupting traditional retail by offering affordable, quality products with doorstep delivery. Digital tools such as virtual fitting guides and AI-driven foot assessments are improving user confidence. Subscription models and bulk offers are further enhancing customer retention. As mobile commerce grows and logistics improve, more consumers are shifting to online channels for both OTC and specialty insoles.

Shoe Insole Market Regional Analysis

- Asia-Pacific dominated the shoe insole market with the largest revenue share of 41.3% in 2024, driven by growing health awareness, rapid urbanization, and increasing demand for orthopedic products across emerging economies

- Rising incidence of foot-related disorders, expanding middle-class population, and growing participation in sports and fitness activities are fueling product adoption across the region

- A strong manufacturing base, availability of cost-effective raw materials, and increasing e-commerce penetration are accelerating market expansion in both standard and custom insole segments

China Shoe Insole Market Insight

China held the largest share in the Asia-Pacific shoe insole market in 2024, supported by its dominance in global footwear manufacturing and increasing domestic demand for comfort and health-oriented products. Urban professionals and factory workers are actively seeking insoles that offer fatigue reduction and posture support, driving high-volume sales. Rising disposable income and the growing senior population are contributing to the uptake of orthotic and therapeutic insoles. With a strong e-commerce infrastructure, insole manufacturers are rapidly expanding their online presence and diversifying product portfolios. China is also investing in technology-driven insoles such as smart and pressure-mapped variants, further enhancing its market leadership across both standard and customized product categories.

India Shoe Insole Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by increasing foot health awareness, rising chronic conditions such as diabetes, and growing emphasis on active lifestyles. Consumers are increasingly turning to insoles for posture correction, foot pain relief, and preventive orthopedic care. Government initiatives such as “Make in India” are promoting domestic manufacturing, encouraging local players to scale up production and innovation. The expansion of retail pharmacies and online platforms is improving product accessibility, even in Tier 2 and Tier 3 cities. A young, fitness-conscious population and growing engagement in sports and gym activities are further boosting demand for athletic and gel-based insoles. With rising investments in healthcare and wellness infrastructure, India’s insole market is poised for sustained growth.

Europe Shoe Insole Market Insight

Europe is a key contributor to the shoe insole market, underpinned by strong demand for orthopedic and therapeutic products, high consumer awareness, and a well-established healthcare ecosystem. The region is home to leading manufacturers specializing in custom-fit, medical-grade, and sustainable insole solutions. Aging populations across countries such as Germany, Italy, and France are increasingly turning to orthotic insoles to improve mobility, comfort, and foot alignment. The market is also being shaped by environmental concerns, with consumers favoring eco-friendly materials and biodegradable products. Technological advancements in foot scanning, gait analysis, and biomechanical engineering are driving growth in both standard and custom categories. Europe’s balanced mix of clinical, retail, and e-commerce channels is further supporting widespread adoption of shoe insoles.

Germany Shoe Insole Market Insight

Germany’s shoe insole market is driven by its advanced orthopedic manufacturing base, strong R&D infrastructure, and a high rate of insole usage among aging and health-conscious populations. Consumers prioritize quality and functionality, leading to high demand for both off-the-shelf and prescription insoles designed to address chronic foot issues. Collaboration between medical institutions, physiotherapists, and insole producers is facilitating innovation in customized solutions. Germany’s leadership in biomechanical research and foot pressure analysis tools is enabling more precise and effective product development. The market is particularly strong in therapeutic, diabetic, and ergonomic insole segments, with premium products gaining traction among professionals and senior users.

U.K. Shoe Insole Market Insight

The U.K. market is supported by a robust life sciences sector, a strong culture of wellness, and increasing consumer demand for orthopedic comfort in both casual and work footwear. Post-Brexit localization efforts are encouraging domestic brands to innovate and reduce reliance on imports. A well-developed healthcare system, including NHS recommendations for orthotic solutions, is supporting the uptake of prescribed and semi-custom insoles. Consumers are also responding positively to sustainability trends, with growing interest in vegan, recycled, and eco-conscious materials. The rise of boutique and online brands offering stylish yet supportive insole solutions is further enhancing product diversity. In both sports and clinical contexts, the U.K. continues to see growing preference for quality foot support solutions.

North America Shoe Insole Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, driven by a strong focus on preventive healthcare, rising foot-related ailments, and increasing awareness of ergonomic wellness. The region benefits from a large population with high disposable income, a widespread culture of fitness, and easy access to advanced medical products. Rising rates of obesity, diabetes, and orthopedic issues are driving demand for both OTC and prescribed insole products. The trend toward performance optimization in sports and workplace comfort is further fueling growth in athletic and occupational insoles. Innovations in 3D-printed, sensor-equipped, and app-integrated smart insoles are gaining traction among tech-savvy consumers. With a highly developed distribution infrastructure and strong brand presence, North America is becoming a key market for premium and custom-fit solutions.

U.S. Shoe Insole Market Insight

The U.S. accounted for the largest share in the North America shoe insole market in 2024, supported by its large aging population, high prevalence of chronic foot conditions, and well-established medical and retail ecosystem. The country’s orthopedic and podiatric care network plays a crucial role in promoting the use of insoles for both treatment and prevention. Consumers are increasingly seeking insoles tailored to specific needs such as plantar fasciitis, flat feet, sports recovery, or long work hours. Retailers and online platforms offer a vast selection of materials, thickness levels, and customization options to suit diverse lifestyles. Innovations in smart insoles capable of tracking pressure, posture, and activity levels are also seeing growing consumer interest. Strong domestic manufacturing, insurance support for prescribed insoles, and high investment in wellness technologies are reinforcing the U.S.'s market dominance.

Shoe Insole Market Share

The shoe insole industry is primarily led by well-established companies, including:

- Texon International Group (U.K.)

- Bauerfeind USA Inc (U.S.)

- SUPERFEET WORLDWIDE, LLC (U.S.)

- SPENCO (A Brand of Implus Footcare LLC) (U.S.)

- Scholl's Wellness Company Limited (U.K.)

- SOLO Laboratories, Inc. (U.S.)

- PROFOOT INC. (U.S.)

- Foot Science International (New Zealand)

- PowerStep (U.S.)

- Li Ning (China) Sports Goods Co., Ltd. (China)

- YONEX Co., Ltd. (Japan)

- SIDAS (France)

- ENERTOR (U.K.)

- MYFRIDO (India)

- FOOTBALANCE SYSTEM LTD. (Finland)

- Helios India (India)

- Rehband Limited (Sweden)

Latest Developments in Global Shoe Insole Market

- In March 2024, Frido launched its Arch Support Insoles, designed specifically for individuals with flat feet, enhancing both comfort and structural support. Made in India with durable foam and breathable fabric, this product reinforces the company’s focus on foot health and domestic innovation. By addressing pain relief and stability, especially for sports enthusiasts and professionals on their feet for long durations, the launch expanded Frido’s portfolio and also strengthened its position in the performance and orthotic insole segments within the Indian market

- In 2023, Frido acquired CURREX, a well-established brand known for its independent running shoe insoles in the U.S. and Germany. This strategic acquisition allowed Frido to significantly broaden its geographic footprint and diversify its customer base across two major global markets. The integration of CURREX’s product line into Frido’s offerings enhances its brand value in the premium insole segment and is expected to drive revenue growth through cross-market penetration and expanded distribution

- In March 2023, Dr. Scholl’s introduced a new line of foot care products, including insoles, foot masks, and a foot file, targeting consumers experiencing pain due to joint stiffness, posture-related strain, and physical activity. The new insoles were especially crafted to support users dealing with flat feet, uneven pressure distribution, or increased body weight. This product expansion enabled Dr. Scholl’s to reinforce its reputation in holistic foot wellness while tapping into growing demand for multi-functional, preventive foot care solutions

- In October 2022, Superfeet Worldwide launched two specialized categories of removable insoles tailored for snowboarders and skiers, incorporating thermal top covers and moisture-wicking layers alongside its proprietary cushioning system. This product innovation addressed the specific performance and comfort needs of winter sports athletes, helping the brand carve a niche in the seasonal and sports-specific insole segment. The move reflected Superfeet’s strategy to diversify its offerings by targeting sport-specific markets with tailored ergonomic support

- In September 2022, Texon introduced Ecostrobe, a fully sustainable insole developed from 100% recycled PET using a fusion-bonding technology that avoids the use of chemicals and water. The insole is 20% lighter and consumes 50% less energy during production. This eco-conscious innovation positioned Texon as a leader in sustainable insole manufacturing, aligning with rising consumer and industry demand for green products while contributing to environmental goals and ESG compliance within the footwear component sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.