Global Shoe Packaging Market

Market Size in USD Billion

CAGR :

%

USD

6.45 Billion

USD

8.56 Billion

2024

2032

USD

6.45 Billion

USD

8.56 Billion

2024

2032

| 2025 –2032 | |

| USD 6.45 Billion | |

| USD 8.56 Billion | |

|

|

|

|

Shoe Packaging Market Size

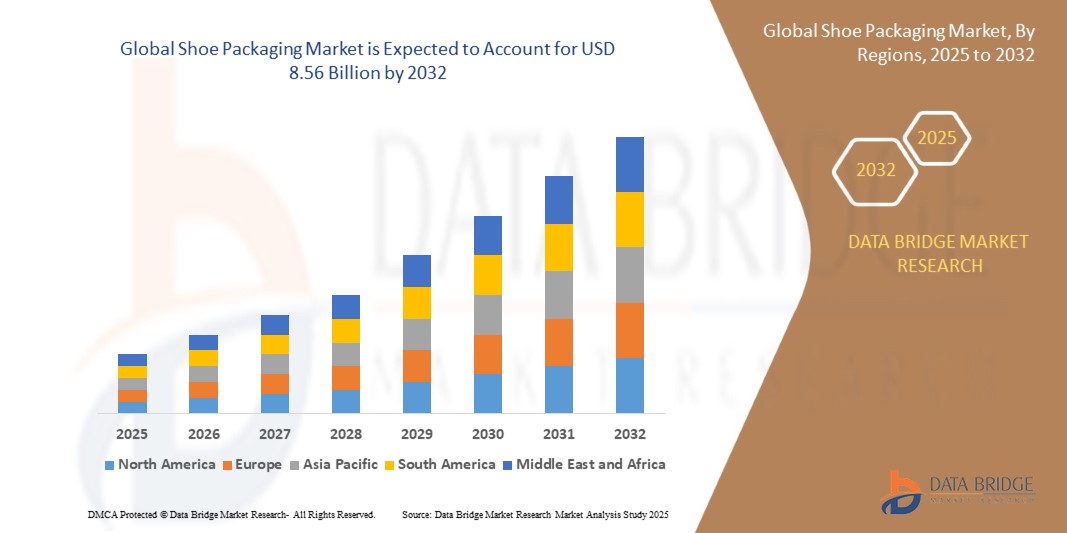

- The global shoe packaging market size was valued at USD 6.45 billion in 2024 and is expected to reach USD 8.56 billion by 2032, at a CAGR of 3.60% during the forecast period

- The market growth is largely fuelled by the increasing demand for eco-friendly and sustainable packaging, rising global footwear consumption, and the growing trend of premium and customized shoe packaging

- Expansion of retail infrastructure across emerging economies and increased consumer spending on fashion and lifestyle products are also contributing to the market’s growth

Shoe Packaging Market Analysis

- The rising focus on sustainability is prompting manufacturers to adopt recyclable and biodegradable materials for shoe packaging, appealing to environmentally conscious consumers

- Increasing e-commerce sales and direct-to-consumer footwear brands are accelerating the need for durable, protective, and aesthetically pleasing packaging solutions

- North America dominated the shoe packaging market with the largest revenue share of 37.42% in 2024, driven by the rising demand for branded footwear, robust e-commerce sales, and increased focus on sustainable packaging across the region

- Asia-Pacific region is expected to witness the highest growth rate in the global shoe packaging market, driven by growing urbanization, increasing online footwear sales in countries such as China, India, and Japan, and the availability of cost-effective packaging solutions catering to both domestic and international markets

- The rigid segment accounted for the largest market revenue share in 2024, driven by its durability, superior protection, and high-quality appeal. Rigid packaging is widely used by premium and branded shoe manufacturers to preserve product shape, resist compression during transportation, and enhance unboxing experience. Consumers often associate rigid packaging with quality, and brands leverage this to support premium positioning and ensure safe delivery of products during e-commerce shipments

Report Scope and Shoe Packaging Market Segmentation

|

Attributes |

Shoe Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Shoe Packaging Market Trends

Sustainability Driving Innovation in Shoe Packaging

- The global footwear industry is witnessing a significant shift toward eco-friendly packaging as brands respond to increasing consumer demand for sustainability. Biodegradable materials such as recycled paper, cardboard, and plant-based polymers are being adopted to reduce environmental impact and comply with evolving regulatory frameworks, particularly in regions such as Europe and North America

- Several leading shoe manufacturers are collaborating with packaging designers to develop reusable, foldable, and minimalistic shoe boxes that reduce waste while preserving aesthetic appeal. These innovations not only contribute to brand identity but also help reduce shipping volume and associated costs

- The trend is further supported by corporate environmental goals and carbon footprint reduction initiatives. Many brands are now incorporating environmental labeling on their packaging, detailing materials used, recyclability, and life cycle impact, enhancing consumer transparency and driving green purchasing decisions

- For instance, in 2023, Adidas introduced a 100% recycled shoe packaging line for select product categories, achieving a 45% reduction in packaging waste across its European distribution centers. This initiative is now being extended to global markets as part of its broader sustainability roadmap

- While the move toward sustainable packaging is reshaping the market, manufacturers must balance durability, protection, and aesthetics. Continued investment in bio-material research, cost-effective design, and supply chain adaptation is essential to meet growing eco-conscious expectations

Shoe Packaging Market Dynamics

Driver

Booming E-Commerce Footwear Sales and Need for Protective Packaging

- The rapid expansion of e-commerce in the footwear sector has created a growing demand for durable and protective shoe packaging solutions that ensure product integrity during shipping. As more consumers purchase shoes online, packaging must withstand long transit times and handling while maintaining brand appeal

- Footwear brands are investing in innovative packaging designs with cushioned inserts, tamper-evident features, and moisture-resistant materials. These enhancements not only reduce damage and returns but also improve customer satisfaction and unboxing experience

- In the age of social media, unboxing has become a key marketing moment. Custom-printed boxes with sleek designs and protective layering help brands make a lasting impression while maintaining product quality

- For instance, in 2022, Puma revamped its global e-commerce packaging with reinforced corrugated boxes and branded paper wraps to prevent damage during last-mile delivery. This strategy led to a noticeable decline in return rates across key online markets

- While e-commerce is driving packaging innovation, it also necessitates balance between sustainability and protection. Brands must navigate this challenge by adopting recyclable yet sturdy materials and optimizing box dimensions to cut excess waste and reduce shipping costs

Restraint/Challenge

High Production Costs and Supply Chain Volatility

- The cost of raw materials used in quality shoe packaging—such as coated paperboard, sustainable polymers, and custom printing inks—has risen significantly due to global supply chain disruptions. This has impacted packaging manufacturers and footwear brands seeking cost-effective yet premium solutions

- Small and medium-sized brands often struggle to afford high-end packaging options, which can limit their branding potential and customer experience. In addition, the price gap between traditional and sustainable materials remains a concern for mass adoption

- Logistics and procurement challenges, particularly in Asia-Pacific and Latin America, are adding further stress. Fluctuating transportation costs, material shortages, and lead time variability hinder timely packaging delivery and production planning

- For instance, in 2023, several shoe exporters in Vietnam and Indonesia reported delays in fulfilling orders due to unavailability of recyclable packaging boards, citing supply chain bottlenecks and rising input costs as major setbacks

- To overcome these challenges, industry players must focus on localized sourcing, automation in packaging processes, and diversified supplier networks to manage risk and reduce cost pressures while maintaining quality standards

Shoe Packaging Market Scope

The market is segmented on the basis of type, material, product, application, and shoe type.

• By Type

On the basis of type, the shoe packaging market is segmented into flexible and rigid. The rigid segment accounted for the largest market revenue share in 2024, driven by its durability, superior protection, and high-quality appeal. Rigid packaging is widely used by premium and branded shoe manufacturers to preserve product shape, resist compression during transportation, and enhance unboxing experience. Consumers often associate rigid packaging with quality, and brands leverage this to support premium positioning and ensure safe delivery of products during e-commerce shipments.

The flexible segment is expected to witness the fastest growth rate from 2025 to 2032, due to its lightweight structure, space-saving benefits, and lower production cost. Flexible packaging appeals to manufacturers looking to optimize packaging expenses and reduce material usage, especially for lower-cost or mass-produced footwear. Its growing use in casual and sports shoe categories, along with improved printing and branding capabilities, is accelerating segment adoption globally.

• By Material

On the basis of material, the shoe packaging market is segmented into paper, plastic, and others. The paper segment dominated the market in 2024, supported by strong global sustainability initiatives and increasing demand for recyclable and biodegradable packaging solutions. Paper-based shoe boxes, inserts, and wraps are preferred by environmentally conscious brands and consumers aiming to reduce carbon footprints. The shift toward eco-friendly materials has encouraged manufacturers to redesign packaging using kraft paper and corrugated cardboard.

The plastic segment is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by its water resistance, durability, and versatility. Plastic packaging, including transparent boxes and zipper bags, is commonly used for premium or specialty shoes where visibility and presentation are key. However, regulatory pressure on single-use plastics may limit long-term plastic adoption unless recyclable or bio-based alternatives gain traction.

• By Product

On the basis of product, the market is segmented into corrugated shoe packaging, reusable shoe packaging, tubular shoe packaging, and others. The corrugated shoe packaging segment led the market in 2024 due to its robustness, cost-efficiency, and suitability for bulk shipping and storage. Corrugated boxes are highly customizable, recyclable, and widely adopted by brands across various price tiers for their ability to protect products through distribution channels.

The reusable shoe packaging segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising consumer inclination toward sustainability and multifunctional packaging. These include zippered pouches, fabric bags, or designer boxes intended for secondary use. Brands use reusable packaging to enhance perceived value and improve environmental credentials, particularly in online retail and luxury shoe segments.

• By Application

On the basis of application, the market is segmented into commercial and individual. The commercial segment held the largest revenue share in 2024, led by high-volume packaging demands from footwear manufacturers, distributors, and retailers. Bulk ordering, brand customization, and product safety during transport are the key factors supporting commercial segment growth.

The individual segment is expected to witness the fastest growth rate from 2025 to 2032, fuelled by a growing do-it-yourself (DIY) trend in shoe care, storage, and gifting. Consumers purchasing specialty packaging for personal use or resale, especially through online platforms, are driving this segment. Increased personalization options and availability of aesthetic packaging formats are also boosting demand among individual buyers.

• By Shoe Type

On the basis of shoe type, the shoe packaging market is segmented into running shoes, loafers, leather shoes, short shoes, long boots, and casual shoes. The running shoes segment led the market in 2024, attributed to the booming demand for athletic footwear and frequent new product launches in this category. The need for functional, protective, and visually appealing packaging is high among sportswear brands seeking differentiation.

The long boots segment is expected to witness the fastest growth rate from 2025 to 2032, due to increased fashion trends, rising boot purchases in colder regions, and the necessity for tailored packaging designs to protect elongated structures. Custom-fit packaging and premium-grade materials are becoming common in this segment to ensure minimal product damage and enhanced shelf appeal.

Shoe Packaging Market Regional Analysis

- North America dominated the shoe packaging market with the largest revenue share of 37.42% in 2024, driven by the rising demand for branded footwear, robust e-commerce sales, and increased focus on sustainable packaging across the region

- Consumers in the region prioritize durable, visually appealing, and eco-friendly packaging that enhances both product protection and brand experience. The adoption of advanced printing techniques and personalization is further transforming packaging strategies

- The market is also supported by high purchasing power, growing inclination towards online shopping, and rising popularity of subscription-based shoe delivery services, positioning North America as a key contributor to global shoe packaging innovation and consumption

U.S. Shoe Packaging Market Insight

The U.S. shoe packaging market captured the largest revenue share in 2024 within North America, driven by the country’s large footwear consumer base and strong retail infrastructure. The proliferation of premium and customized packaging, fueled by consumer demand for luxury and eco-conscious alternatives, is accelerating growth. Major brands are increasingly adopting recyclable materials, biodegradable components, and creative box structures to align with environmental goals and consumer expectations.

Europe Shoe Packaging Market Insight

The Europe shoe packaging market is expected to witness the fastest growth rate from 2025 to 2032, supported by rising sustainability regulations and growing consumer awareness around eco-friendly materials. Countries such as Germany, France, and the United Kingdom are leading innovation through the use of recycled paper, corrugated cardboard, and minimalist designs. The market benefits from strong domestic footwear production and increasing brand initiatives focused on low-impact packaging.

Germany Shoe Packaging Market Insight

The Germany shoe packaging market is expected to witness the fastest growth rate from 2025 to 2032, driven by the country’s advanced manufacturing capabilities and focus on green packaging solutions. German brands and consumers alike are pushing for alternatives to plastic-based packaging, promoting paper-based boxes and reusable designs. The market also benefits from a well-established logistics network, enabling efficient distribution and adoption of high-quality, protective packaging formats across the footwear industry.

U.K. Shoe Packaging Market Insight

The U.K. shoe packaging market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing consumer demand for sustainable and aesthetically appealing packaging solutions. The region’s strong retail and e-commerce infrastructure, coupled with rising environmental awareness, is encouraging footwear brands to adopt recyclable and biodegradable packaging. Government regulations and consumer preferences for minimalistic, premium-quality designs are also pushing manufacturers to innovate in materials and structure.

Asia-Pacific Shoe Packaging Market Insight

The Asia-Pacific shoe packaging market is expected to witness the fastest growth rate from 2025 to 2032, supported by expanding footwear production, rising disposable incomes, and growing export activities across countries such as China, India, and Vietnam. Manufacturers are increasingly investing in cost-effective, attractive, and protective packaging that appeals to global brands. The region’s transition toward sustainable materials is also gaining traction, particularly in response to international environmental standards.

China Shoe Packaging Market Insight

The China shoe packaging market accounted for the largest revenue share in Asia-Pacific in 2024, driven by the country’s dominant role in global footwear manufacturing and the rapid expansion of e-commerce platforms. Chinese packaging providers are innovating with lightweight, customizable, and eco-conscious solutions tailored for both domestic and export markets. Moreover, the growing focus on brand differentiation is encouraging the adoption of advanced printing technologies and creative packaging formats.

Japan Shoe Packaging Market Insight

The Japan shoe packaging market is expected to witness the fastest growth rate from 2025 to 2032, fueled by the country’s commitment to sustainability, precision in design, and premium retail standards. Japanese consumers place high importance on packaging quality and environmental impact, driving demand for compact, durable, and recyclable packaging solutions. Footwear brands are increasingly integrating minimalist aesthetics and eco-friendly materials such as molded pulp and recycled cardboard to align with both cultural preferences and regulatory requirements.

Packaging Market Share

The shoe packaging industry is primarily led by well-established companies, including:

- M. K. Packaging (India)

- Packman Packaging Private Limited (India)

- Precious Packaging (U.K.)

- Royal Packers (India)

- Cross Country Box Company (U.S.)

- Packtek (India)

- Great Little Box Company Ltd. (Canada)

- Marber Ltd. (U.K.)

- Merrypak (Australia)

- Pack Now (U.S.)

- Packqueen (Australia)

- Samrat Box Mfg. Co. Pvt. Ltd (India)

- Taizhou Forest Color Printing Packing (China)

Latest Developments in Global Shoe Packaging Market

- In April 2024, Adidas introduced an innovative product concept called the Box Shoe, unveiled as an April Fool’s Day campaign. This design turned traditional shoeboxes into wearable sneakers, featuring perforations, thick shoelaces, and a midfoot flap for secure wear. While playful, it emphasized the brand’s focus on creative, eco-friendly product design, highlighting the potential for sustainable, multifunctional packaging in the footwear market

- In January 2024, Yonex Co. Ltd launched new shoe boxes made entirely from 100% recycled materials, reducing material weight by 20%. By integrating instruction manuals into shoe tags and using single-color printing, the initiative promotes resource efficiency and eco-conscious packaging. This development strengthens the company’s sustainability credentials and sets a precedent for greener packaging within the footwear industry

- In September 2023, Nike introduced fully circular shoes under its ISPA platform, designed for easy disassembly and recyclability. This product not only advances Nike’s sustainability goals but also supports the broader shift toward closed-loop systems in footwear production. It enhances environmental responsibility while encouraging innovative packaging that complements product recyclability

- In October 2022, Under Armour launched the UA SlipSpeed, a versatile training shoe tailored for athletes. This launch signified the growing demand for customized packaging solutions that reflect the uniqueness and functionality of performance footwear. It also encouraged packaging manufacturers to innovate around branding, durability, and adaptability

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Shoe Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Shoe Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Shoe Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.