Global Shortenings Market

Market Size in USD Billion

CAGR :

%

USD

5.23 Billion

USD

7.53 Billion

2024

2032

USD

5.23 Billion

USD

7.53 Billion

2024

2032

| 2025 –2032 | |

| USD 5.23 Billion | |

| USD 7.53 Billion | |

|

|

|

|

Shortenings Market Size

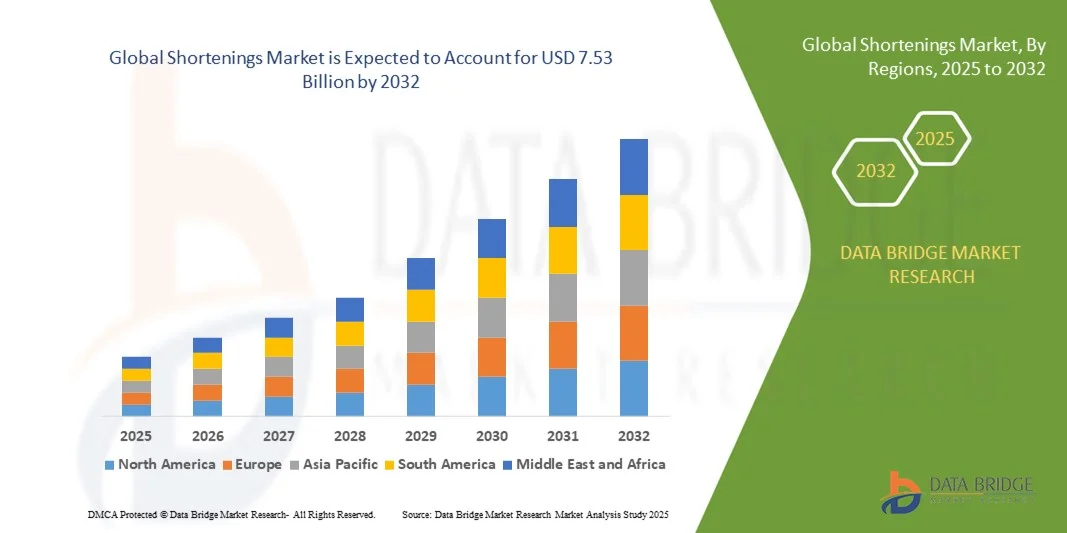

- The global shortenings market size was valued at USD 5.23 billion in 2024 and is expected to reach USD 7.53 billion by 2032, at a CAGR of 4.67% during the forecast period

- The market growth is largely fueled by the increasing demand from industrial and commercial bakery, confectionery, and snack production sectors, where functional fats play a crucial role in ensuring texture, aeration, and stability of products

- Furthermore, rising consumer preference for processed, convenience, and ready-to-eat foods, along with the growing trend of clean-label, non-GMO, and plant-based ingredients, is establishing shortenings as a key functional ingredient in modern food manufacturing. These converging factors are accelerating product adoption, thereby significantly boosting the industry's growth

Shortenings Market Analysis

- Shortenings, including solid and liquid fats derived from vegetable and animal sources, are increasingly essential for bakery, confectionery, frying, and snack applications due to their ability to enhance texture, stability, and shelf life

- The escalating demand for shortenings is primarily fueled by the expansion of industrial food processing, growing consumer awareness of functional and specialty fats, and the rising preference for convenience foods across both retail and commercial segments

- North America dominated the shortenings market with a share of over 40% in 2024, due to the high demand from industrial bakery, confectionery, and food processing sectors

- Asia-Pacific is expected to be the fastest growing region in the shortenings market during the forecast period due to rapid urbanization, rising disposable incomes, and growth in bakery, confectionery, and snack industries in countries such as China, Japan, and India

- Vegetable segment dominated the market with a market share of 68.5% in 2024, due to growing consumer preference for plant-based products and their perception as healthier alternatives to animal fats. Vegetable shortenings are widely used in bakery, confectionery, and frying applications due to their consistent quality and functional reliability. They offer ease of processing, smooth texture, and longer shelf life compared to animal fats. Sustainability concerns and the clean-label trend further strengthen their adoption. Manufacturers also prefer vegetable sources for cost-effectiveness and availability. The segment benefits from compatibility with modern industrial baking equipment and mass production

Report Scope and Shortenings Market Segmentation

|

Attributes |

Shortenings Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Shortenings Market Trends

Shift Toward Plant-Based and Trans-Fat-Free Shortenings

- The global shortenings market is witnessing a clear transformation driven by the shift toward plant-based and trans-fat-free formulations. Health-conscious consumers and food manufacturers are increasingly prioritizing safer and cleaner fat alternatives as awareness about cardiovascular health and dietary sustainability continues to grow

- For instance, Cargill, Incorporated has expanded its range of non-hydrogenated and palm-based shortenings under its Clear Valley brand, offering trans-fat-free options designed for bakery and confectionery applications. The company’s innovation strategy reflects the intensifying industry focus on replacing traditional hydrogenated fats with healthier, plant-derived substitutes without compromising texture or functionality

- Plant-based shortenings derived from sources such as palm, coconut, soybean, and sunflower oils are becoming widely used across processed food categories including bakery, snacks, and ready meals. These shortenings offer desirable attributes such as stability, creaming ability, and extended shelf life while aligning with vegan and clean-label product trends

- In addition, advances in fat crystallization technology and enzyme interesterification have enabled producers to create shortenings with improved melting profiles and desirable mouthfeel, comparable to traditional animal-based or hydrogenated products. Such technological innovations are driving adoption by large-scale bakeries and food processors aiming for health-conscious product lines

- Manufacturers are reformulating existing products by combining sustainability and functionality, focusing on responsibly sourced oils and reduced saturated fat blends. This transition supports both environmental goals and compliance with stringent health-related labeling regulations in major consumer markets

- The ongoing preference for natural, trans-fat-free, and plant-based shortenings underscores the broader evolution of the global fats and oils industry. As food sectors align with consumer wellness and sustainability demands, the shift toward reformulated shortenings is expected to define the next phase of innovation and market growth across food processing applications

Shortenings Market Dynamics

Driver

Strong Demand from Industrial Food Processing for Functional Fats

- The growing need for functional fats that enhance product texture, stability, and shelf life is driving demand for shortenings in industrial food processing. Shortenings are essential for achieving consistent quality in bakery, confectionery, and snack applications, offering benefits in aeration, flakiness, and moisture retention

- For instance, Bunge Limited has developed specialized shortenings designed for large-scale bakery operations, providing improved plasticity and temperature stability ideal for laminated pastries, pies, and cookies. This product innovation demonstrates how tailored fat solutions are addressing diverse industrial processing requirements where consistency and functionality are paramount

- The versatility of shortenings in influencing dough handling, crumb structure, and flavor distribution makes them indispensable in food manufacturing. Industrial processors value shortenings for their ability to maintain stable performance under high-temperature and extended production environments, supporting high-volume output with minimal variation

- In addition, the rising popularity of baked snacks and pastries globally has encouraged manufacturers to enhance their product offerings through shortenings that combine performance with health attributes. Blends using palm-free or low-saturated formulations are gaining momentum as consumers demand better-for-you bakery products

- The continued integration of shortenings in large-scale automated food systems highlights their enduring role in manufacturing flexibility and product optimization. As demand for processed and convenience foods expands, functional fats such as shortenings will remain a vital ingredient category supporting innovation, efficiency, and product differentiation

Restraint/Challenge

Regulatory Restrictions on Hydrogenated and Trans Fats

- Stringent health regulations targeting hydrogenated oils and trans fats represent one of the most significant challenges facing the shortenings market. Governments and health organizations worldwide have imposed strict limits on industrially produced trans fats due to their link to cardiovascular and metabolic diseases, compelling reformulation across food sectors

- For instance, the U.S. Food and Drug Administration’s ban on partially hydrogenated oils and the European Union’s restrictions have prompted global manufacturers such as Archer Daniels Midland Company to reformulate shortening products to meet regulatory and nutritional standards. These changes have required major investments in R&D and process innovation to maintain product performance while ensuring compliance

- The regulatory phase-out of trans fats has intensified the need for alternative formulations using interesterified and natural fat blends. However, adjusting existing production processes and achieving desired melting characteristics without using hydrogenated fats remain complex and cost-intensive challenges for producers

- In addition, varying global standards for permissible fat compositions complicate export operations for multinational food manufacturers. The need to adapt to multiple regional regulations increases supply chain complexity and quality assurance costs, impacting profitability and production timelines

- As regulatory scrutiny continues to expand across emerging markets, the shift toward compliant, trans-fat-free shortenings will demand ongoing innovation in lipid chemistry. Producers investing in cleaner production methods, sustainable sourcing, and health-aligned formulations will be best positioned to overcome these regulatory barriers and maintain competitiveness in the evolving global shortenings market

Shortenings Market Scope

The market is segmented on the basis of source, raw materials, process, form, certifications, nature, ingredients, variant, distribution channel, application, and end use.

- By Source

On the basis of source, the shortenings market is segmented into vegetable and animal. The vegetable segment dominated the market with the largest revenue share of 68.5% in 2024, driven by growing consumer preference for plant-based products and their perception as healthier alternatives to animal fats. Vegetable shortenings are widely used in bakery, confectionery, and frying applications due to their consistent quality and functional reliability. They offer ease of processing, smooth texture, and longer shelf life compared to animal fats. Sustainability concerns and the clean-label trend further strengthen their adoption. Manufacturers also prefer vegetable sources for cost-effectiveness and availability. The segment benefits from compatibility with modern industrial baking equipment and mass production.

The animal segment is expected to witness the fastest growth from 2025 to 2032, fueled by demand in traditional food preparations and specialty bakery products. Animal shortenings provide superior aeration, flakiness, and mouthfeel in pastries and baked goods. Their unique taste profile is preferred in certain confectionery items and traditional recipes. High-temperature stability makes them suitable for frying and industrial processes. The segment also benefits from niche applications in gourmet and artisanal food products. Rising interest in authentic flavors supports the adoption of animal-based shortenings.

- By Raw Materials

On the basis of raw materials, the market is segmented into soybeans, rapeseeds, sunflower seeds, palm and palm kernel, maize, coconut, castor, linseed, groundnut, cotton, and sesame. Palm and palm kernel-based shortenings dominated the market with a share of 54.5% in 2024 due to their wide availability and cost-effectiveness. They offer high oxidative stability, semi-solid consistency at room temperature, and superior functional properties for baking and frying. The consistent performance and long shelf life make them ideal for industrial-scale production. Palm-based shortenings are also compatible with various processing techniques, including hydrogenation and fractionation. The segment benefits from large-scale cultivation and global supply chains. Their versatility across bakery, confectionery, and snack products reinforces market dominance.

Soybean-based shortenings are projected to witness the fastest growth from 2025 to 2032, driven by health awareness and adaptability to heart-healthy formulations. Soybean fats are preferred for low trans-fat and cholesterol-reduced products. Their neutral flavor and light texture make them suitable for bakery and frying applications. High versatility in blending with other oils supports innovation in specialty shortenings. Rising cultivation in key regions ensures a stable supply. Manufacturers are increasingly adopting soybean shortenings for functional and nutritional labeling.

- By Process

On the basis of process, the market is segmented into fractionisation, hydrogenation, interesterification, and edible oil production process. Fractionisation dominated the market in 2024 due to its ability to produce high-purity solid and liquid fractions with precise melting points. This ensures reliable functional properties for bakery and confectionery products. Fractionised shortenings provide consistent texture, aeration, and stability in large-scale production. Their compatibility with industrial machinery and reduced processing variability support widespread adoption. Fractionisation is preferred for creating specialty fats and blends with targeted performance. Manufacturers value its efficiency in producing consistent product quality.

Interesterification is expected to witness the fastest growth from 2025 to 2032, driven by the demand for trans-fat-free and healthier shortenings. This process allows customization of fat blends for texture, stability, and melting characteristics. Interesterified shortenings are suitable for clean-label and health-conscious products. They support innovation in bakery, confectionery, and frying applications. Rising regulatory restrictions on trans fats are encouraging adoption. Their functional versatility and improved nutritional profile appeal to manufacturers and consumers alike.

- By Form

On the basis of form, the market is segmented into solid and liquid. Solid shortenings dominated the market in 2024 due to their broad use in bakery, confectionery, and frying applications. They provide structural support, aeration, and stability during high-temperature processes. Solid shortenings are preferred for industrial-scale and artisanal baking. Their ability to maintain product shape and texture enhances end-product quality. They also offer longer shelf life and consistency in processing. The segment benefits from widespread familiarity among manufacturers and chefs.

Liquid shortenings are anticipated to witness the fastest growth from 2025 to 2032 due to ease of handling and uniform blending properties. Liquid forms are suitable for automated food processing lines and high-volume production. They reduce processing time and minimize waste in industrial operations. Their adaptability supports a wide range of formulations in bakery, confectionery, and frying. Liquid shortenings are increasingly preferred for premium and health-oriented products. Rising demand from industrial users seeking efficiency and consistency drives growth.

- By Certifications

On the basis of certifications, the market is segmented into organic, non-GMO, vegan, kosher, and gluten-free. Non-GMO shortenings dominated the market in 2024 due to rising consumer awareness and preference for transparency in ingredients. Non-GMO certified fats are widely accepted in mainstream bakery, confectionery, and snack production. They ensure regulatory compliance and maintain product integrity across global markets. Manufacturers value their versatility, stability, and wide functional performance. The segment benefits from growing consumer trust and strong retail presence. Non-GMO shortenings are increasingly used in packaged and processed food products.

Organic shortenings are expected to witness the fastest growth from 2025 to 2032, fueled by clean-label trends and sustainability concerns. Organic-certified shortenings appeal to health-conscious consumers and premium food segments. They support artisanal bakery, specialty confectionery, and natural product formulations. Rising demand for chemical-free and naturally sourced fats enhances adoption. Manufacturers leverage organic certification for brand differentiation and market expansion. The segment growth is also supported by increased retail and online availability.

- By Nature

On the basis of nature, the market is segmented into organic and conventional. Conventional shortenings dominated the market in 2024 due to their cost-effectiveness, widespread availability, and established use across industrial and retail sectors. They offer reliable functional properties for diverse applications in bakery, confectionery, and frying. Conventional fats are compatible with large-scale production and various processing techniques. The segment benefits from supply chain stability and economies of scale. Manufacturers rely on them for standard product lines and mass-market applications.

Organic shortenings are projected to witness the fastest growth from 2025 to 2032, driven by consumer preference for natural and sustainably produced products. They are increasingly adopted in premium bakery, confectionery, and health-oriented products. Organic shortenings support clean-label initiatives and cater to lifestyle-focused consumers. Rising awareness of chemical-free and environmentally friendly ingredients fuels growth. Retail and e-commerce channels expand accessibility to organic products. The segment also benefits from regulatory support and certification standards.

- By Ingredients

On the basis of ingredients, the market is segmented into oil, lard, tallow, butter, and others. Oil-based shortenings dominated the market in 2024 due to versatility, cost-effectiveness, and functional reliability. They are widely used in bakery, confectionery, and frying processes. Oil-based fats offer consistent texture, aeration, and melting characteristics suitable for industrial production. Their stability and shelf life make them ideal for mass manufacturing. Manufacturers benefit from easier handling, blending, and process optimization. The segment supports a broad range of applications and product innovation.

Butter-based shortenings are anticipated to witness the fastest growth from 2025 to 2032, driven by rising demand for premium and artisanal bakery products. Butter imparts superior flavor, texture, and mouthfeel compared to other fats. It is preferred in cakes, pastries, and specialty confectionery. The segment benefits from growing gourmet and indulgent product trends. Butter-based shortenings align with consumer preference for natural and traditional ingredients. Manufacturers leverage butter for premium positioning and enhanced product quality.

- By Variant

On the basis of variant, the market is segmented into liquid, solid, all-purpose, cake/icing, emulsified, high-stability, and others. All-purpose shortenings dominated the market in 2024 due to multifunctionality across bakery, frying, and confectionery applications. They provide consistent performance, aeration, and texture. All-purpose fats are preferred by industrial and retail manufacturers for flexibility. Their ease of processing and reliable quality reinforce adoption. The segment supports large-scale production and versatile recipes. They are widely available in bulk and packaged formats.

Cake/icing shortenings are expected to witness the fastest growth from 2025 to 2032, fueled by specialty bakery and confectionery demand. These variants provide superior aeration, smooth texture, and stability in frostings and cakes. They support high-end product innovation and artisanal recipes. The segment benefits from rising premium bakery consumption and gourmet trends. Cake/icing shortenings are increasingly preferred in HoReCa and retail segments. Manufacturers use them to enhance product aesthetics and sensory quality.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct/B2B and indirect/B2C. B2B dominated the market in 2024 due to industrial-scale use in bakery, confectionery, and snack production. Bulk procurement and long-term supply contracts support stable revenue streams. B2B buyers benefit from consistent quality, cost efficiency, and supply chain reliability. The segment ensures manufacturers’ access to specialized fats and custom formulations. Large-scale food processors drive high-volume demand. The channel also facilitates innovation through tailored product solutions.

B2C channels are projected to witness the fastest growth from 2025 to 2032, fueled by home baking trends and rising e-commerce penetration. Retail consumers increasingly prefer packaged and convenient shortenings. Online and supermarket availability enhances accessibility. The segment benefits from consumer interest in specialty, organic, and functional fats. B2C adoption is supported by lifestyle-focused marketing and DIY baking trends. Growth is driven by rising urbanization and disposable income.

- By Application

On the basis of application, the market is segmented into bakery, confectionery, ice cream, dairy, snacks and savoury, animal feed, non-edible hard fats, frying, and others. Bakery dominated the market in 2024 due to the widespread use of shortenings for dough handling, aeration, and product texture. Growing packaged and artisanal bakery consumption supports demand. Functional performance, consistency, and cost-effectiveness make bakery applications central to market growth. Manufacturers rely on shortenings for mass production and premium product lines. The segment benefits from both retail and industrial consumption.

Confectionery applications are expected to witness the fastest growth from 2025 to 2032, driven by premium chocolates, frostings, and specialty products. Shortenings support aeration, melting behavior, and structural stability. Rising consumer interest in indulgent and gourmet confectionery fuels demand. The segment benefits from innovations in product formulation and flavors. Specialty shortenings enhance shelf life and quality of chocolates and frostings. Confectionery applications are expanding in emerging markets due to rising disposable incomes.

- By End Use

On the basis of end use, the market is segmented into retail/household, food service/HoReCa, and food processor. Food processors dominated the market in 2024 due to large-scale industrial usage and long-term procurement contracts. High-volume production requires consistent functional fats and quality control. Food processors benefit from bulk availability, process optimization, and reliable supply chains. The segment covers bakery, snack, and confectionery production extensively. Manufacturers prioritize cost-effective and versatile shortenings. Industrial applications drive stable market revenue.

Retail/household applications are anticipated to witness the fastest growth from 2025 to 2032, fueled by increasing home baking trends and awareness of functional shortenings. Convenient packaging and availability through supermarkets and online channels support adoption. Rising consumer interest in baking and cooking at home drives demand for solid and liquid shortenings. Specialty and organic variants gain popularity among urban households. DIY baking trends and culinary experimentation enhance growth. The segment benefits from lifestyle-oriented marketing and accessibility.

Shortenings Market Regional Analysis

- North America dominated the shortenings market with the largest revenue share of over 40% in 2024, driven by the high demand from industrial bakery, confectionery, and food processing sectors

- Consumers and manufacturers in the region highly value consistent product quality, functional performance, and regulatory compliance

- The widespread adoption is further supported by advanced manufacturing infrastructure, high disposable incomes, and the growing preference for processed and convenience foods, establishing shortenings as an essential ingredient for both commercial and household use

U.S. Shortenings Market Insight

The U.S. shortenings market captured the largest revenue share in North America in 2024, fueled by strong demand from industrial and retail bakeries, snack producers, and confectionery manufacturers. The market is driven by the need for functional fats that ensure consistent texture, aeration, and stability in baked goods. The growing popularity of processed and ready-to-eat foods, coupled with stringent food safety standards, further propels the market. In addition, increasing adoption of specialty and organic shortenings is supporting product diversification and premium offerings.

Europe Shortenings Market Insight

The Europe shortenings market is projected to expand at a steady CAGR during the forecast period, primarily driven by high consumption in bakery, confectionery, and snack applications, along with evolving consumer preferences for healthier and sustainable ingredients. Rising urbanization and increasing demand for packaged foods are encouraging the adoption of functional shortenings. European manufacturers are focusing on non-GMO, organic, and trans-fat-free products to meet regulatory standards and consumer expectations. The region is experiencing significant growth across industrial and retail segments, with emphasis on quality and compliance.

U.K. Shortenings Market Insight

The U.K. shortenings market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising demand for bakery, confectionery, and home baking products. Consumers increasingly prefer functional and specialty fats that ensure product consistency and taste. The growing awareness of clean-label, non-GMO, and trans-fat-free products, alongside an established retail and e-commerce infrastructure, continues to stimulate market growth. The market is also supported by the trend of premiumization and artisanal bakery products.

Germany Shortenings Market Insight

The Germany shortenings market is expected to expand at a considerable CAGR during the forecast period, fueled by strong industrial bakery and snack manufacturing demand. Germany’s well-developed infrastructure, emphasis on food safety, and preference for high-quality, sustainable ingredients promote adoption. Functional fats that offer aeration, stability, and texture consistency are in high demand. In addition, increasing awareness of health-conscious alternatives and organic options is contributing to market expansion, especially in premium and specialty bakery segments.

Asia-Pacific Shortenings Market Insight

The Asia-Pacific shortenings market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and growth in bakery, confectionery, and snack industries in countries such as China, Japan, and India. Government initiatives promoting food processing and modernization of manufacturing facilities are supporting market adoption. The availability of cost-effective shortenings and growing industrial and retail demand is enabling wider penetration across urban and semi-urban markets.

Japan Shortenings Market Insight

The Japan shortenings market is gaining momentum due to strong demand from industrial bakeries, confectionery producers, and growing home baking trends. Japanese manufacturers and consumers prioritize functional fats that ensure texture, stability, and flavor consistency. The market is further driven by the preference for high-quality, specialty, and trans-fat-free shortenings. Rising urbanization, aging population, and interest in convenience foods are supporting demand for premium and easy-to-use products in both residential and commercial sectors.

China Shortenings Market Insight

The China shortenings market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, growth in bakery and confectionery industries, and increasing processed food consumption. The expanding middle class and rising demand for packaged and convenience foods are key growth drivers. Domestic production capabilities and cost-effective shortenings support market expansion. Moreover, increasing awareness of functional fats for consistent baking performance and growing adoption of industrial bakery practices contribute to strong market growth.

Shortenings Market Share

The shortenings industry is primarily led by well-established companies, including:

- Namchow Chemical Industrial Co., Ltd. (Taiwan)

- Cargill, Incorporated (U.S.)

- «NMGK» Group (Russia)

- FUJI OIL CO., LTD. (Japan)

- Yildiz Holding Inc. (Turkey)

- Conagra Brands, Inc. (U.S.)

- ADM (U.S.)

- Bunge Limited (U.S.)

- Wilmar International Ltd (Singapore)

- Ventura Foods (U.S.)

- IFFCO (U.S.)

- AAK AB (Sweden)

- Associated British Foods plc (U.K.)

- The J.M. Smucker Company (U.S.)

- Nutiva Inc. (U.S.)

- Premium Vegetable Oils Sdn Bhd (Malaysia)

- FEDIOL aisbl (Belgium)

- INTERCONTINENTAL SPECIALTY FATS SDN. BHD. (Malaysia)

- Manildra Group (Australia)

- Natu'oil Services Inc (Canada)

Latest Developments in Global Shortenings Market

- In February 2025, Bunge and Viterra completed their merger to form a leading global agribusiness solutions company. This strategic consolidation strengthens their capabilities in oilseed processing and specialty plant-based oils and fats. The merger is expected to generate annual operational synergies of USD 250 million within three years, enhancing efficiency and scale. It positions the combined entity to better meet the rising demand for functional shortenings and plant-based alternatives, reinforcing its competitive standing in the global market

- In October 2024, Stratas Foods announced the acquisition of AAK Foodservice in Hillside, New Jersey, for approximately USD 56.55 million. This acquisition expanded Stratas Foods’ manufacturing footprint from eight to nine locations in the U.S., boosting production capacity and operational flexibility. The move strengthens the company’s ability to supply shortenings to industrial and commercial customers, supporting faster delivery, localized production, and greater market penetration in the North American shortenings segment

- In May 2024, Wilmar International completed the acquisition of a majority stake in the shortening business of Bunge Limited. This strategic investment enabled Wilmar to expand its footprint in the global shortenings market and diversify its product portfolio. The acquisition supports the company’s growth in industrial bakery, confectionery, and snack applications, enhancing its ability to serve large-scale processors and respond to evolving market demands for functional fats

- In March 2024, Archer Daniels Midland Company (ADM) and Cargill formed a strategic partnership to expand their offerings in the plant-based food sector. By combining resources and expertise, the collaboration strengthens both companies’ positions in the rapidly growing market for plant-based shortenings. This alliance enables accelerated innovation, improved product quality, and broader distribution, catering to increasing consumer demand for sustainable and healthier functional fats in bakery and confectionery applications

- In January 2024, Tate & Lyle launched its new texturizing system, "SweetenMax Shortening," designed to replace hydrogenated oils in baked goods. Using plant-based ingredients, the product received positive feedback for improved taste and functionality. This launch addresses the market’s growing preference for healthier, trans-fat-free shortenings and positions Tate & Lyle as an innovator in clean-label and sustainable fat solutions, strengthening its presence in industrial and retail baking applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Shortenings Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Shortenings Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Shortenings Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.