Global Shortwave Infrared Swir Market

Market Size in USD Million

CAGR :

%

USD

230.51 Million

USD

403.52 Million

2024

2032

USD

230.51 Million

USD

403.52 Million

2024

2032

| 2025 –2032 | |

| USD 230.51 Million | |

| USD 403.52 Million | |

|

|

|

|

SWIR Market Size

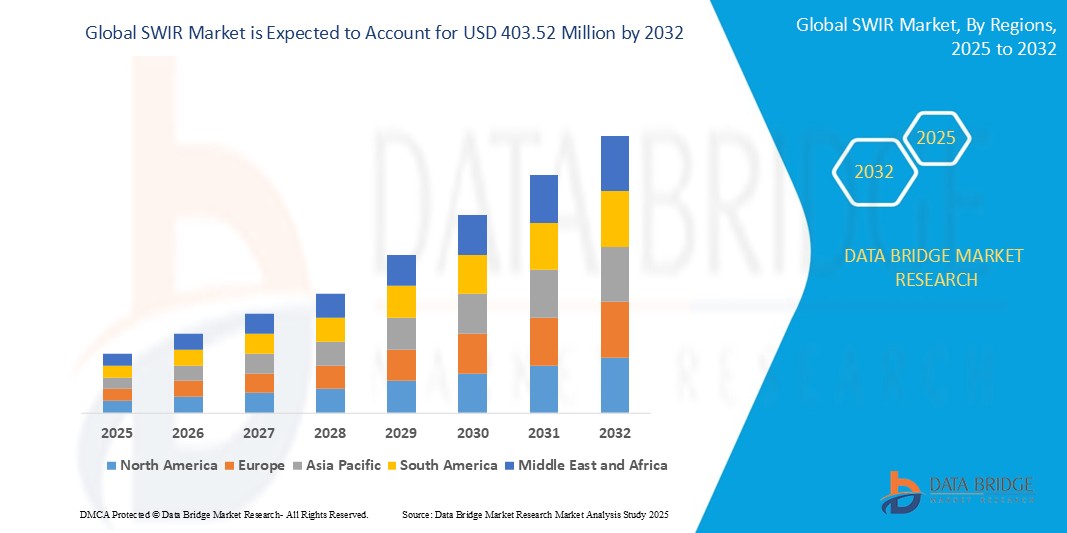

- The global SWIR market size was valued at USD 230.51 million in 2024 and is expected to reach USD 403.52 million by 2032, at a CAGR of 7.25% during the forecast period

- The market growth is largely fueled by the increasing adoption of SWIR technology in diverse industries requiring enhanced imaging capabilities beyond the visible spectrum

SWIR Market Analysis

- Short-wave infrared (SWIR) refers to electromagnetic radiation with wavelengths ranging from approximately 1 to 3 micrometres

- SWIR imaging technology captures light beyond the visible spectrum, enabling applications such as night vision, material analysis, and moisture detection. It offers advantages in penetrating certain materials and atmospheric conditions compared to visible or thermal imaging

- North America dominates the SWIR market with the largest revenue share of 38.5% in 2025, characterized by high adoption rate of advanced imaging technologies in sectors such as military and defense, industrial automation, and scientific research

- Asia-Pacific is expected to be the fastest growing region in the SWIR market during the forecast period due to increasing industrial automation across various sectors,

- Area Scan segment is expected to dominate the SWIR market with a market share in 2025, driven by its ability to capture a two-dimensional image in a single acquisition makes them versatile for a wide range of applications, including machine vision, surveillance, and various inspection tasks

Report Scope and SWIR Market Segmentation

|

Attributes |

SWIR Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand |

SWIR Market Trends

“Miniaturization and Cost Reduction of SWIR Sensors”

- A significant trend in the global SWIR market, as of May 2025, is the ongoing miniaturization and cost reduction of SWIR sensors

- This trend is making SWIR technology more accessible and integrable into a wider range of applications Previously, SWIR cameras and sensors were often bulky and expensive, limiting their adoption to specialized fields

- However, advancements in semiconductor technology and manufacturing processes are leading to smaller, lighter, and more affordable SWIR components

- For instance, we are seeing the integration of smaller SWIR sensors into handheld devices for industrial inspection and even potential future integration into advanced driver-assistance systems (ADAS) in vehicles

- This increased accessibility is expanding the potential use cases and driving higher volumes, further contributing to cost reductions, creating a positive feedback loop for market growth

SWIR Market Dynamics

Driver

“Increasing Adoption in Industrial Automation and Quality Control”

- A key driver for the global SWIR market is its increasing adoption in industrial automation and quality control processes SWIR imaging offers significant advantages in non-destructive testing and defect detection across various manufacturing sectors

- For Instance, in the food and beverage industry, SWIR cameras can inspect packaging seals and detect foreign materials In electronics manufacturing, they can identify micro-cracks in silicon wafers or inspect solder joints

- With the growing emphasis on automation and stringent quality standards, industries are increasingly integrating SWIR technology to enhance efficiency, reduce waste, and improve product reliability

- This demand for advanced inspection capabilities is a strong impetus for the growth of the SWIR market

Restraint/Challenge

“High Cost Compared to Visible Imaging”

- A notable restraint and challenge for the global SWIR market remains the relatively higher cost of SWIR cameras and sensors compared to their visible light counterparts

- While costs are decreasing, the price differential can still be a significant barrier to adoption, particularly in price-sensitive applications

- This cost factor can limit the uptake of SWIR technology, especially in high-volume, cost-conscious industries where visible imaging might suffice for certain tasks

- For instance, while SWIR offers superior performance in certain surveillance scenarios, the higher initial investment might lead some users to opt for less expensive visible or thermal cameras unless the specific advantages of SWIR are critical

- Overcoming this cost barrier through further technological advancements and economies of scale will be crucial for broader market penetration

SWIR Market Scope

The market is segmented on the basis of scanning type, detector type, chemical composition, application, component, and industry.

- By Scanning Type

On the basis of scanning type, the SWIR market is segmented into line scan and area scan. The area scan segment dominates the largest market revenue share of 43.2% in 2025, driven by its ability to capture a two-dimensional image in a single acquisition makes them versatile for a wide range of applications, including machine vision, surveillance, and various inspection tasks .

The line scan segment is anticipated to witness the fastest growth rate of 21.7% from 2025 to 2032, fueled by increasing demand for high-resolution and high-speed imaging in emerging applications such as advanced manufacturing quality control, autonomous vehicles (for enhanced perception), and sophisticated surveillance systems.

- By Detector Type

On the basis of detector type, the SWIR market is segmented into cooled and uncooled. The cooled held the largest market revenue share in 2025 of, driven by the higher sensitivity and lower noise compared to uncooled detectors, which is crucial for applications requiring high image quality and the detection of subtle differences, such as scientific research, certain medical imaging, and long-range surveillance.

The uncooled segment is expected to witness the fastest CAGR from 2025 to 2032, driven by its their lower cost, smaller size, and reduced power consumption, making them increasingly attractive for integration into a broader range of commercial and industrial applications where extremely high sensitivity might not be paramount.

- By Chemical composition

On the basis of chemical composition, the SWIR market is segmented into indium gallium arsenide, mercury cadmium telluride, indium antimonide (INSB), lead sulfide quantum dots, and others. The indium gallium arsenide (INGAAS) held the largest market revenue share in 2025, driven as they offer a good balance of performance, cost, and operating temperature, making them suitable for a wide variety of applications, including machine vision, surveillance, and some thermal imaging .

The lead sulfide quantum dot segment held a significant market share in 2025, favored for its potential for lower manufacturing costs and integration with silicon-based platforms, which could open up new high-volume applications .

- By Application

On the basis of application, the SWIR market is segmented into machine vision, thermal imaging, hyperspectral imaging, security and surveillance, monitoring and inspection, photovoltaics, and others. The machine vision segment accounted for the largest market revenue share in 2024, driven by the ability to see beyond the visible spectrum allows for enhanced inspection and quality control in various manufacturing processes, including food sorting, electronics inspection, and pharmaceutical quality assurance.

The Hyperspectral Imaging segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the increasing use in diverse fields such as agriculture (for crop health monitoring), environmental monitoring, and scientific research, where the detailed spectral information provided by SWIR hyperspectral imaging offers significant advantages.

- By Component

On the basis of component, the SWIR market is segmented into hardware, software, and services. The hardware segment accounted for the largest market revenue share in 2024, driven by the hardware component, which includes SWIR cameras, detectors, and light sources, currently holds the largest market share This is because the fundamental requirement for any SWIR application is the physical hardware needed to capture and process the SWIR radiation.

The software segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the increasing need for sophisticated image processing, analysis, and integration tools to extract meaningful information from SWIR data, particularly in applications such as machine vision, hyperspectral imaging, and security.

- By Industry

On the basis of industry, the SWIR market is segmented into commercial, industrial, medical, military and defense, scientific research, and others. The industrial segment accounted for the largest market revenue share in 2024, driven by the widespread use of SWIR technology for quality control, inspection, and process monitoring across various manufacturing industries, including food and beverage, electronics, and pharmaceuticals.

The medical segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the emerging applications in areas such as surgical imaging, dermatology, and ophthalmology, where SWIR'S ability to penetrate tissue and provide subsurface information offers significant diagnostic and therapeutic potential.

SWIR Market Regional Analysis

- North America dominates the SWIR market with the largest revenue share of 38.5% in 2024, driven by a high adoption rate of advanced imaging technologies in sectors such as military and defense, industrial automation, and scientific research

- Furthermore, substantial investments in research and development activities related to SWIR technology, coupled with favorable government initiatives in defense and security, further solidify North America's leading position in the global SWIR market.

- This dominance is primarily due to the strong presence of key market players and a well-established technological infrastructure in the region

U.S. SWIR Market Insight

The U.S. SWIR market captured the largest revenue share within North America in 2025, fueled by the substantial defense and military sector which utilizes SWIR for surveillance, night vision, and target identification The strong presence of key SWIR technology providers and the increasing adoption in industrial automation and quality control further contribute to the market size.

Europe SWIR Market Insight

The European SWIR market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the demand is propelled by the growing use of SWIR in industrial inspection, particularly in the automotive and pharmaceutical sectors, along with increasing applications in scientific research and environmental monitoring residential, commercial, and multi-family housing applications, with SWIRs being incorporated into both new constructions and renovation projects.

U.K. SWIR Market Insight

The U.K. SWIR market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by its application in defense, security, and industrial quality control The increasing focus on advanced imaging technologies for various industrial and surveillance purposes supports market expansion.

Germany SWIR Market Insight

The German SWIR market is expected to expand at a considerable CAGR during the forecast period, fueled with significant adoption in manufacturing for quality inspection and process control. The country's emphasis on industrial automation and technological advancement makes it a key consumer of SWIR technology.

Asia-Pacific SWIR Market Insight

The Asia-Pacific SWIR market is poised to grow at the fastest CAGR in 2025, driven by fastest-growing region in the global SWIR market, with China and Japan leading the way The rapid industrialization, increasing investments in automation, and rising demand in consumer electronics (such as facial recognition) and automotive (ADAS) are fueling this growth.

Japan SWIR Market Insight

The Japan SWIR market is gaining momentum due to the country’s high-tech culture, rapid urbanization, and demand for convenience. The Japanese market places a significant security, and the adoption of SWIRs is driven by with strong applications in industrial automation, quality control in electronics manufacturing, and growing adoption in automotive safety systems and advanced driver assistance.

China SWIR Market Insight

The China SWIR market accounted for the largest market revenue share in Asia Pacific in 2025, attributed to the country's expanding middle class, rapid urbanization, and high rates of technological adoption. China is experiencing rapid expansion in its SWIR market, driven by its massive manufacturing sector demanding advanced inspection technologies The increasing use of SWIR in consumer electronics, surveillance, and agriculture also contributes to its high growth rate.

SWIR Market Share

The SWIR industry is primarily led by well-established companies, including:

- Teledyne Digital Imaging Inc (U.S.)

- Exosens (France)

- Lynred (France)

- Allied Vision Technologies GmbH (Germany)

- Hamamatsu Photonics K.K. (Japan)

- New Imaging Technologies (NIT) (France)

- Photon Etc. (Canada)

- Princeton Infrared Technologies, Inc. (U.S.)

- Raptor Photonics (U.K.)

- IRCameras LLC (U.S.)

- Intevac, Inc. (U.S.)

- Opgal Ltd (Canada)

- InfraTec GmbH (Germany)

- TTP plc. (U.K.)

- Photonic Science and Engineering Limited (U.K.)

- SWIR Vision Systems (Belgium)

- Edmund Optics Inc. (U.S.)

- Silent Sentinel (U.K.)

Latest Developments in Global SWIR Market

- In July 2024, onsemi (Semiconductor Components Industries, LLC) acquired SWIR VISION SYSTEMS, INC., a company known for its advanced SWIR technology based on colloidal quantum dots (CQD). This technology allows sensors to capture images beyond the typical visible spectrum, enhancing imaging in areas such as industrial automation, surveillance, and autonomous vehicles. By integrating SWIR with its CMOS sensors, onsemi aims to provide more cost-effective, high-performance imaging solutions for various sectors, including automotive and defense

- In May 2024, Teledyne FLIR LLC announced a partnership with UE Systems Inc. (U.S.) through which the company aims to provide industrial customers with advanced predictive maintenance solutions. This collaboration will combine Teledyne's thermal imaging systems with UE system's ultrasonic technology

- In April 2024, New Imaging Technologies (NIT) launched its latest advancement in SWIR imaging technology: the high-resolution SWIR InGaAs sensor precisely engineered to tackle the industry's toughest challenges. NSC2101, the new SWIR, features a high-performance InGaAs sensor with an 8µm pixel pitch, offering an impressive resolution of 2 MPIX at 1920x1080px. With an ultra-low noise level of just 25e-, it ensures outstanding image clarity even in demanding conditions

- In September 2023, Leonardo DRS (U.S.) launched Small Unmanned Aircraft System Tactical Agile Gimbal (STAG)-5 LLD gimbal which offers high-definition day and night imaging for small, unmanned aircraft. It is lightweight, highly stable, and integrates advanced sensors for superior performance in military operations

- In October 2023, Omron Corporation launched a new line of SWIR cameras aimed at enhancing precision inspection in manufacturing. These cameras enable visibility beyond the capabilities of standard vision systems, making them ideal for detecting defects in materials such as glass, silicon, and plastics. The SWIR technology allows for higher accuracy in inspecting products during various manufacturing stages, improving quality control and reducing waste

- In December 2021, Allied Vision Technologies GmbH (Germany) launched Alvium 1800 (SWIR Camera), which was made available with Sony's innovate InGaAs SWIR sensors

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL SWIR MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL SWIR MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 STANDARDS OF MEASUREMENT

2.2.9 VENDOR SHARE ANALYSIS

2.2.10 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.11 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL SWIR MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHT

5.1 PORTERS FIVE FORCES

5.2 REGULATORY STANDARDS

5.3 TECHNOLOGICAL TRENDS

5.4 PATENT ANALYSIS

5.5 CASE STUDY

5.6 VALUE CHAIN ANALYSIS

5.7 COMPANY COMPARITIVE ANALYSIS

6 GLOBAL SWIR MARKET, BY SCANNING TYPE

6.1 OVERVIEW

6.2 AREA SCAN

6.2.1 CMOS

6.2.2 CCD

6.3 LINE SCAN

6.3.1 CAMERA LINK

6.3.2 GIGE/10GIGE

7 GLOBAL SWIR MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 COOLED INFRARED IMAGING

7.2.1 BY COMPONENTS

7.2.1.1. SENSORS

7.2.1.2. ENCLOSURES

7.2.1.3. LENSES

7.2.1.4. OTHERS

7.3 UNCOOLED IINFRARED IMAGING

8 GLOBAL SWIR MARKET, BY COMPONENTS

8.1 OVERVIEW

8.2 GLASS

8.3 LENSES

8.4 OPTICAL COMPONENTS

8.4.1 OPTICAL FILTERS

8.4.2 WINDOWS

8.5 SENSORS

8.6 CAMERA

8.7 OTHERS

9 GLOBAL SWIR MARKET, BY RANGE

9.1 OVERVIEW

9.2 LESS THAN 700 NM

9.3 700 TO 2,000 NM

9.4 MORE THAN 2,000 NM

10 GLOBAL SWIR MARKET, BY SPECTRUM RANGE

10.1 OVERVIEW

10.2 SHORT RANGE

10.3 MEDIUM WAVE

10.4 LONG WAVE

11 GLOBAL SWIR MARKET, BY LENS RANGE

11.1 OVERVIEW

11.2 8MM

11.3 12.5 MM

11.4 16 MM

11.5 25 MM

11.6 35 MM

11.7 50 MM

11.8 OTHERS

12 GLOBAL SWIR MARKET, BY MATERIAL

12.1 OVERVIEW

12.2 INDIUM GALLIUM ARSENIDE

12.3 INDIUM ANTIMONIDE

12.4 LEAD SULFIDE

12.5 MERCURY CADMIUM TELLURIDE (MCT)

13 GLOBAL SWIR MARKET, BY IMAGE FORMAT

13.1 OVERVIEW

13.2 VGA

13.3 XGA

13.4 SXGA

13.5 QXGA

13.6 QSXGA

13.7 OTHERS

14 GLOBAL SWIR MARKET, BY DYNAMIC RANGE

14.1 OVERVIEW

14.2 UP TO 56 DB

14.3 UP TO 60 DB

14.4 UP TO 67 DB

14.5 UP TO 69 DB

14.6 UP TO 70 DB

15 GLOBAL SWIR MARKET, BY NOISE

15.1 OVERVIEW

15.2 45 E-

15.3 80 E-

15.4 110 E-

15.5 120 E-

15.6 170 E-

15.7 200 E-

15.8 350 E-

16 GLOBAL SWIR MARKET, BY APPLICATION

16.1 OVERVIEW

16.2 MACHINE VISION

16.3 THERMAL IMAGING

16.4 HYPERSPECTRAL IMAGING

16.5 VEHICLE NAVIGATION

16.6 MATERIAL PROCESSING

16.7 SECURITY & SURVEILLANCE

16.8 MONITORING & INSPECTION

16.9 DETECTION

16.1 MATERIAL IDENTIFICATION

16.11 VEGETATION

16.12 SNOW AND ICE DISCRIMINATION

16.13 DISASTER MANAGEMENT (OIL SPILL)

16.14 SOLAR CELL INSPECTION

16.15 IDENTIFYING AND SORTING

16.16 ANTI-COUNTERFEITING

16.17 OTHERS

17 GLOBAL SWIR MARKET, BY INDUSTRY

17.1 OVERVIEW

17.2 INDUSTRIAL

17.2.1 INDUSTRIAL, BY TYPE

17.2.1.1. AUTOMOTIVE

17.2.1.2. AEROSPACE

17.2.1.3. ELECTRONICS & SEMI-CONDUCTORS

17.2.1.4. OIL & GAS

17.2.1.5. FOOD & BEVERAGES

17.2.1.6. GLASS

17.2.1.7. OTHERS

17.2.2 BY SCANNING TYPE

17.2.2.1. AREA SCAN

17.2.2.1.1. CMOS

17.2.2.1.2. CCD

17.2.2.2. LINE SCAN

17.2.2.2.1. CAMERA LINK

17.2.2.2.2. GIGE/10GIGE

17.3 NON-INDUSTRIAL

17.3.1 NON-INDUSTRIAL, BY TYPE

17.3.1.1. MILITARY & DEFENSE

17.3.1.2. MEDICAL

17.3.1.3. SCIENTIFIC RESEARCH

17.3.1.4. OTHERS

17.3.2 BY SCANNING TYPE

17.3.2.1. AREA SCAN

17.3.2.1.1. CMOS

17.3.2.1.2. CCD

17.3.2.2. LINE SCAN

17.3.2.2.1. CAMERA LINK

17.3.2.2.2. GIGE/10GIGE

18 GLOBAL SWIR MARKET, BY GEOGRAPHY

GLOBAL SWIR MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

18.1 NORTH AMERICA

18.1.1 U.S.

18.1.2 CANADA

18.1.3 MEXICO

18.2 EUROPE

18.2.1 GERMANY

18.2.2 FRANCE

18.2.3 U.K.

18.2.4 ITALY

18.2.5 SPAIN

18.2.6 RUSSIA

18.2.7 TURKEY

18.2.8 BELGIUM

18.2.9 NETHERLANDS

18.2.10 NORWAY

18.2.11 FINLAND

18.2.12 SWITZERLAND

18.2.13 DENMARK

18.2.14 SWEDEN

18.2.15 POLAND

18.2.16 REST OF EUROPE

18.3 ASIA PACIFIC

18.3.1 JAPAN

18.3.2 CHINA

18.3.3 SOUTH KOREA

18.3.4 INDIA

18.3.5 AUSTRALIA

18.3.6 NEW ZEALAND

18.3.7 SINGAPORE

18.3.8 THAILAND

18.3.9 MALAYSIA

18.3.10 INDONESIA

18.3.11 PHILIPPINES

18.3.12 TAIWAN

18.3.13 VIETNAM

18.3.14 REST OF ASIA PACIFIC

18.4 SOUTH AMERICA

18.4.1 BRAZIL

18.4.2 ARGENTINA

18.4.3 REST OF SOUTH AMERICA

18.5 MIDDLE EAST AND AFRICA

18.5.1 SOUTH AFRICA

18.5.2 EGYPT

18.5.3 SAUDI ARABIA

18.5.4 U.A.E

18.5.5 OMAN

18.5.6 BAHRAIN

18.5.7 ISRAEL

18.5.8 KUWAIT

18.5.9 QATAR

18.5.10 REST OF MIDDLE EAST AND AFRICA

18.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

19 GLOBAL SWIR MARKET,COMPANY LANDSCAPE

19.1 COMPANY SHARE ANALYSIS: GLOBAL

19.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

19.3 COMPANY SHARE ANALYSIS: EUROPE

19.4 COMPANY SHARE ANALYSIS: ASIA PACIFIC

19.5 MERGERS & ACQUISITIONS

19.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

19.7 EXPANSIONS

19.8 REGULATORY CHANGES

19.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

20 GLOBAL SWIR MARKET, SWOT & DBMR ANALYSIS

21 GLOBAL SWIR MARKET, COMPANY PROFILE

21.1 SWIR VISION SYSTEMS, INC.

21.1.1 COMPANY SNAPSHOT

21.1.2 REVENUE ANALYSIS

21.1.3 GEOGRAPHIC PRESENCE

21.1.4 PRODUCT PORTFOLIO

21.1.5 RECENT DEVELOPMENT

21.2 COLLINS AEROSPACE

21.2.1 COMPANY SNAPSHOT

21.2.2 REVENUE ANALYSIS

21.2.3 GEOGRAPHIC PRESENCE

21.2.4 PRODUCT PORTFOLIO

21.2.5 RECENT DEVELOPMENT

21.3 NEW IMAGING TECHNOLOGIES (NIT)

21.3.1 COMPANY SNAPSHOT

21.3.2 REVENUE ANALYSIS

21.3.3 GEOGRAPHIC PRESENCE

21.3.4 PRODUCT PORTFOLIO

21.3.5 RECENT DEVELOPMENT

21.4 SONY SEMICONDUCTOR SOLUTIONS CORPORATION (A PART OF SONY CORPORATION)

21.4.1 COMPANY SNAPSHOT

21.4.2 REVENUE ANALYSIS

21.4.3 GEOGRAPHIC PRESENCE

21.4.4 PRODUCT PORTFOLIO

21.4.5 RECENT DEVELOPMENT

21.5 HAMAMATSU PHOTONICS K.K

21.5.1 COMPANY SNAPSHOT

21.5.2 REVENUE ANALYSIS

21.5.3 GEOGRAPHIC PRESENCE

21.5.4 PRODUCT PORTFOLIO

21.5.5 RECENT DEVELOPMENT

21.6 L3HARRIS TECHNOLOGIES, INC.

21.6.1 COMPANY SNAPSHOT

21.6.2 REVENUE ANALYSIS

21.6.3 GEOGRAPHIC PRESENCE

21.6.4 PRODUCT PORTFOLIO

21.6.5 RECENT DEVELOPMENT

21.7 ALLIED VISION TECHNOLOGIES GMBH

21.7.1 COMPANY SNAPSHOT

21.7.2 REVENUE ANALYSIS

21.7.3 GEOGRAPHIC PRESENCE

21.7.4 PRODUCT PORTFOLIO

21.7.5 RECENT DEVELOPMENT

21.8 XENICS NV

21.8.1 COMPANY SNAPSHOT

21.8.2 REVENUE ANALYSIS

21.8.3 GEOGRAPHIC PRESENCE

21.8.4 PRODUCT PORTFOLIO

21.8.5 RECENT DEVELOPMENT

21.9 SILENT SENTINEL

21.9.1 COMPANY SNAPSHOT

21.9.2 REVENUE ANALYSIS

21.9.3 GEOGRAPHIC PRESENCE

21.9.4 PRODUCT PORTFOLIO

21.9.5 RECENT DEVELOPMENT

21.1 OMRON CORPORATION

21.10.1 COMPANY SNAPSHOT

21.10.2 REVENUE ANALYSIS

21.10.3 GEOGRAPHIC PRESENCE

21.10.4 PRODUCT PORTFOLIO

21.10.5 RECENT DEVELOPMENT

21.11 JAI

21.11.1 COMPANY SNAPSHOT

21.11.2 REVENUE ANALYSIS

21.11.3 GEOGRAPHIC PRESENCE

21.11.4 PRODUCT PORTFOLIO

21.11.5 RECENT DEVELOPMENT

21.12 RAPTOR PHOTONICS

21.12.1 COMPANY SNAPSHOT

21.12.2 REVENUE ANALYSIS

21.12.3 GEOGRAPHIC PRESENCE

21.12.4 PRODUCT PORTFOLIO

21.12.5 RECENT DEVELOPMENT

21.13 TELEDYNE DIGITAL IMAGING INC ( A TELEDYNE TECHNOLOGIES COMPANY)

21.13.1 COMPANY SNAPSHOT

21.13.2 REVENUE ANALYSIS

21.13.3 GEOGRAPHIC PRESENCE

21.13.4 PRODUCT PORTFOLIO

21.13.5 RECENT DEVELOPMENT

21.14 NEDINSCO

21.14.1 COMPANY SNAPSHOT

21.14.2 REVENUE ANALYSIS

21.14.3 GEOGRAPHIC PRESENCE

21.14.4 PRODUCT PORTFOLIO

21.14.5 RECENT DEVELOPMENT

21.15 LYTID

21.15.1 COMPANY SNAPSHOT

21.15.2 REVENUE ANALYSIS

21.15.3 GEOGRAPHIC PRESENCE

21.15.4 PRODUCT PORTFOLIO

21.15.5 RECENT DEVELOPMENT

21.16 LYNRED (SOFRADIR) (A PART OF THALES GROUP AND OTHERS)

21.16.1 COMPANY SNAPSHOT

21.16.2 REVENUE ANALYSIS

21.16.3 GEOGRAPHIC PRESENCE

21.16.4 PRODUCT PORTFOLIO

21.16.5 RECENT DEVELOPMENT

21.17 PHOTON ETC

21.17.1 COMPANY SNAPSHOT

21.17.2 REVENUE ANALYSIS

21.17.3 GEOGRAPHIC PRESENCE

21.17.4 PRODUCT PORTFOLIO

21.17.5 RECENT DEVELOPMENT

21.18 INTEVAC, INC

21.18.1 COMPANY SNAPSHOT

21.18.2 REVENUE ANALYSIS

21.18.3 GEOGRAPHIC PRESENCE

21.18.4 PRODUCT PORTFOLIO

21.18.5 RECENT DEVELOPMENT

21.19 SIERRA-OLYMPIA TECH.

21.19.1 COMPANY SNAPSHOT

21.19.2 REVENUE ANALYSIS

21.19.3 GEOGRAPHIC PRESENCE

21.19.4 PRODUCT PORTFOLIO

21.19.5 RECENT DEVELOPMENT

21.2 IRCAMERAS LLC

21.20.1 COMPANY SNAPSHOT

21.20.2 REVENUE ANALYSIS

21.20.3 GEOGRAPHIC PRESENCE

21.20.4 PRODUCT PORTFOLIO

21.20.5 RECENT DEVELOPMENT

21.21 EPISENSORS

21.21.1 COMPANY SNAPSHOT

21.21.2 REVENUE ANALYSIS

21.21.3 GEOGRAPHIC PRESENCE

21.21.4 PRODUCT PORTFOLIO

21.21.5 RECENT DEVELOPMENT

21.22 PRINCETON INFRARED TECHNOLOGIES, INC.

21.22.1 COMPANY SNAPSHOT

21.22.2 REVENUE ANALYSIS

21.22.3 GEOGRAPHIC PRESENCE

21.22.4 PRODUCT PORTFOLIO

21.22.5 RECENT DEVELOPMENT

21.23 INFRATEC GMBH

21.23.1 COMPANY SNAPSHOT

21.23.2 REVENUE ANALYSIS

21.23.3 GEOGRAPHIC PRESENCE

21.23.4 PRODUCT PORTFOLIO

21.23.5 RECENT DEVELOPMENT

21.24 LEONARDO DRS

21.24.1 COMPANY SNAPSHOT

21.24.2 REVENUE ANALYSIS

21.24.3 GEOGRAPHIC PRESENCE

21.24.4 PRODUCT PORTFOLIO

21.24.5 RECENT DEVELOPMENT

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

22 CONCLUSION

23 QUESTIONNAIRE

24 RELATED REPORTS

25 ABOUT DATA BRIDGE MARKET RESEARCH

Global Shortwave Infrared Swir Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Shortwave Infrared Swir Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Shortwave Infrared Swir Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.