Global Shrink Films Market

Market Size in USD Billion

CAGR :

%

USD

18.07 Billion

USD

25.69 Billion

2024

2032

USD

18.07 Billion

USD

25.69 Billion

2024

2032

| 2025 –2032 | |

| USD 18.07 Billion | |

| USD 25.69 Billion | |

|

|

|

|

Shrink Films Market Size

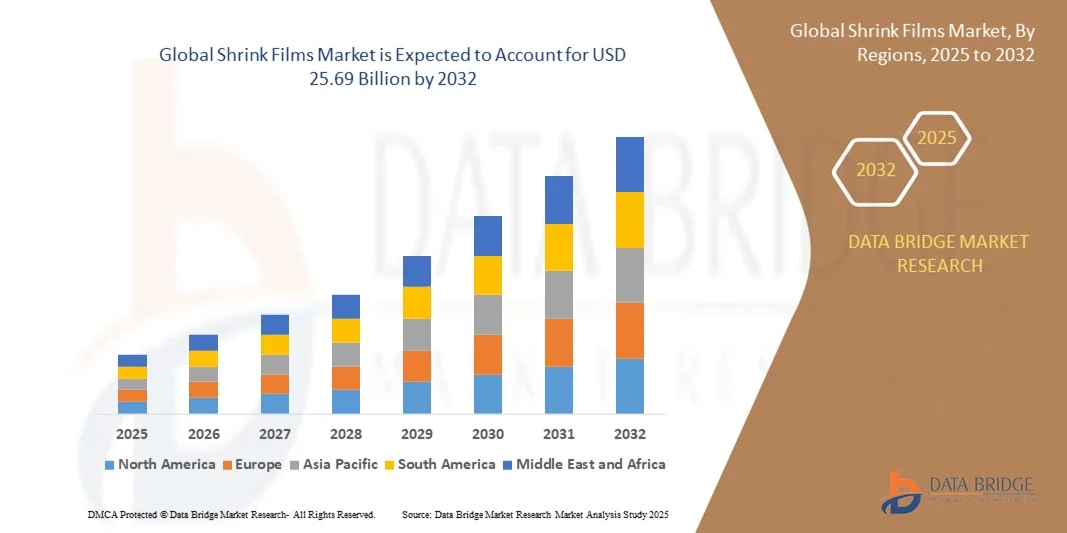

- The global shrink films market size was valued at USD 18.07 billion in 2024 and is expected to reach USD 25.69 billion by 2032, at a CAGR of 4.5% during the forecast period

- The market growth is largely fueled by the increasing demand for packaged beverages and consumer goods, driving the adoption of shrink films for multipack bundling, tamper-evident protection, and shelf-ready packaging

- Furthermore, rising focus on sustainability, brand differentiation, and visually appealing packaging solutions is encouraging manufacturers to adopt both printed and eco-friendly shrink films. These factors are accelerating the uptake of advanced shrink film solutions, significantly boosting the industry’s growth

Shrink Films Market Analysis

- Shrink films are polymer-based packaging materials used to wrap individual products or multipacks, offering protection, product integrity, and marketing appeal. They are widely applied across beverages, food, personal care, and household sectors, providing both functional and promotional benefits

- The escalating demand for shrink films is primarily fueled by growth in the global beverage and retail sectors, increasing preference for convenient and attractive packaging, and rising adoption of sustainable and recyclable film materials to meet environmental regulations and consumer expectations

- Asia-Pacific dominated the shrink films market with a share of 45.4% in 2024, due to high consumption of packaged beverages, growing retail and e-commerce sectors, and increasing use of multipack and printed shrink films

- North America is expected to be the fastest growing region in the shrink films market during the forecast period due to rising beverage consumption, adoption of advanced packaging technologies, and increasing demand for multipack shrink films

- Unprinted segment dominated the market with a market share of 62.5% in 2024, due to its versatility, cost-effectiveness, and widespread use across various packaging applications. Unprinted shrink films are preferred for their ease of processing and adaptability to automated packaging lines, making them suitable for high-volume production. Their compatibility with diverse product types, including beverages and multipacks, further reinforces their dominance. Moreover, unprinted films allow manufacturers to focus on functional benefits such as product protection, tamper evidence, and bundle integrity without incurring additional printing costs

Report Scope and Shrink Films Market Segmentation

|

Attributes |

Shrink Films Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Shrink Films Market Trends

Increasing Use of Printed Shrink Films for Branding

- The shrink films market is witnessing growing adoption of digitally printed and customizable shrink films as companies increasingly leverage packaging for branding and differentiation. These films serve as a cost-effective medium to enhance visual appeal, product information, and shelf presence, making them key in competitive retail environments

- For instance, Avery Dennison and UPM Raflatac have introduced advanced shrink film solutions that allow high-resolution printing and extended design flexibility, supporting brand owners in creating visually appealing packaging formats. These offerings demonstrate the role of printed shrink films in elevating branding and consumer engagement at the point of sale

- Printed shrink films allow for 360-degree coverage of bottles, cans, and containers, which enables companies to highlight brand identity, nutritional details, and compliance information seamlessly. This extensive space utilization attracts customer attention and provides a modern alternative to traditional labels

- In addition, innovations in high-quality inks and digital printing enable sharp, durable, and multi-color designs while ensuring recyclability in line with sustainability needs. Printed shrink films are also being optimized for tamper-evidence, enhancing both branding and product safety functions

- The beverage, food, and personal care sectors increasingly rely on printed shrink films to combine attractive designs with functional protection. Brands are deploying them to capture consumer attention while maintaining product integrity through robust barrier properties

- The increasing use of printed shrink films highlights the dual role of packaging as both a protective shield and a storytelling medium. This trend reflects the growing importance of visual identity and branding in influencing purchasing decisions, thereby making printed shrink films a strategic tool in modern packaging solutions

Shrink Films Market Dynamics

Driver

Rising Demand for Sustainable, Recyclable Packaging

- The rising demand for sustainable and recyclable packaging is a major driver shaping the shrink films market. Growing environmental concerns and regulations are encouraging companies to adopt eco-friendly shrink films made from recyclable polymers and bio-based materials

- For instance, Amcor has launched recyclable shrink film packaging designed for beverages and multipacks, while Berry Global has expanded its sustainable shrink films portfolio by using post-consumer recycled resins. These initiatives reflect how leading firms are innovating to align packaging with circular economy principles

- Manufacturers are adopting low-density polyethylene (LDPE) and polyolefin-based shrink films that are widely recyclable and compatible with modern waste management systems. This adoption ensures compliance with extended producer responsibility regulations across multiple regions

- The integration of renewable raw materials into shrink films and innovation in lightweight films further reduce carbon footprints. These efforts provide brands with the ability to achieve sustainability targets while reinforcing product appeal through green packaging

- The increasing shift toward sustainable shrink films underscores a long-term market transformation. The convergence of regulatory compliance, consumer preference, and corporate sustainability goals ensures that recyclable shrink films will remain a crucial growth driver for the industry in the years ahead

Restraint/Challenge

High Cost of Advanced Shrink Films

- The high production costs of advanced shrink films, which incorporate features such as high-barrier protection, recyclability, and premium printing, impose a significant challenge for manufacturers and end users. Companies face difficulty balancing affordability with technology-driven upgrades to packaging

- For instance, Klöckner Pentaplast’s advanced recyclable shrink films offer enhanced barrier properties but come at higher production costs compared to conventional alternatives, impacting adoption in price-sensitive markets. These increases reduce accessibility and limit penetration among smaller brands and budget segments

- Achieving high-quality printing combined with recycling compatibility requires complex manufacturing processes. Investments in specialized extrusion technologies, advanced ink systems, and upgraded machinery drive up the capital and operational expenses for producers

- In addition, the incorporation of bio-based or recycled resins often comes with higher raw material costs, which further elevate final product pricing. This discourages broader adoption in regions where cost remains the primary factor driving purchasing decisions

- While demand for high-performance and sustainable films is increasing, affordable scalability continues to be a bottleneck. Innovations in cost-efficient raw materials, streamlined production methods, and economies of scale will be critical in addressing the high cost challenge and ensuring wider adoption of advanced shrink films across diverse markets

Shrink Films Market Scope

The market is segmented on the basis of type, application, container type, multipack size, and application packaging.

- By Type

On the basis of type, the shrink films market is segmented into printed and unprinted. The unprinted segment dominated the largest market revenue share of 62.5% in 2024, driven by its versatility, cost-effectiveness, and widespread use across various packaging applications. Unprinted shrink films are preferred for their ease of processing and adaptability to automated packaging lines, making them suitable for high-volume production. Their compatibility with diverse product types, including beverages and multipacks, further reinforces their dominance. Moreover, unprinted films allow manufacturers to focus on functional benefits such as product protection, tamper evidence, and bundle integrity without incurring additional printing costs.

The printed segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising demand for brand visibility and product differentiation. Printed shrink films allow companies to communicate branding, nutritional information, and promotional messages directly on the packaging, enhancing consumer engagement. Technological advances in printing techniques have improved print quality on shrink films, encouraging adoption across beverage, food, and consumer goods sectors. In addition, the increasing trend of customization in limited edition and seasonal packaging contributes to the growth of printed shrink films.

- By Application

On the basis of application, the shrink films market is segmented into alcoholic beverages, water, carbonated soft drinks, and other drinks. The carbonated soft drinks segment dominated the largest market revenue share in 2024, supported by high global consumption and the need for multipack bundling and tamper-evident packaging. Carbonated beverages often require robust shrink films that maintain integrity under storage and transportation conditions, preventing leaks and preserving carbonation. The packaging also provides branding space, enhancing product visibility on retail shelves. Growing urbanization and the convenience-oriented culture further reinforce the use of shrink films in soft drink packaging.

The water segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by increasing bottled water consumption and the expansion of retail channels in emerging markets. Multipack water bottles frequently rely on shrink films for bundle stability, protection, and easy handling during transport. Rising health consciousness and the demand for premium, branded bottled water encourage the use of printed shrink films to differentiate products and provide informative labeling. Manufacturers are also adopting lightweight and sustainable shrink film materials to cater to environmentally conscious consumers, boosting market growth in this segment.

- By Container Type

On the basis of container type, the shrink films market is segmented into can, bottle, and brick. The bottle segment dominated the largest market revenue share in 2024, driven by high consumption of bottled beverages such as water, soft drinks, and alcoholic drinks. Bottles require shrink films for multipack bundling, tamper evidence, and shelf-ready presentation, ensuring both safety and visual appeal. The segment’s growth is supported by modern retail formats and e-commerce channels that prioritize convenient, well-packaged bottles for consumers. Flexibility in film types, including printed and unprinted, allows manufacturers to meet diverse branding and functional requirements.

The can segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the rising popularity of canned beverages across both alcoholic and non-alcoholic categories. Cans are increasingly used for craft drinks, energy drinks, and ready-to-drink beverages, driving demand for shrink films for bundling and promotional packaging. Cans’ lightweight nature and recyclability complement sustainability trends, encouraging the adoption of high-quality shrink films for multipacks.

- By Multipack Size

On the basis of multipack size, the shrink films market is segmented into 3x2, 4x2, 4x3, 6x3, and other multipack sizes. The 6x3 multipack segment dominated the largest market revenue share in 2024, driven by its popularity in carbonated soft drinks and water multipacks. This size offers an optimal balance between convenience for consumers and efficiency for retailers and distributors. Shrink films provide secure bundling, tamper evidence, and ease of handling, making it ideal for high-volume sales channels. The segment’s dominance is reinforced by consistent demand in supermarkets, convenience stores, and vending machines, where pre-bundled packs simplify stocking and display.

The 4x2 multipack segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing demand for smaller, convenient pack sizes among urban consumers. These packs are preferred for single-use consumption or on-the-go purchases, particularly in ready-to-drink beverages. Printed shrink films in this size are increasingly adopted for branding, promotions, and limited edition packaging, supporting market expansion. Rising retail promotions and e-commerce sales further drive the growth of 4x2 multipacks.

- By Application Packaging

On the basis of application packaging, the shrink films market is segmented into can, bottle, and brick. The bottle application packaging segment dominated the largest market revenue share in 2024, driven by the high consumption of bottled beverages and the need for protective, visually appealing multipack packaging. Bottles benefit from shrink films for securing multipacks, providing tamper evidence, and offering a surface for branding and promotional messaging. The segment’s dominance is reinforced by the adoption of automated packaging lines that enhance operational efficiency and maintain consistent quality.

The can application packaging segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing global preference for canned beverages in ready-to-drink and alcoholic beverage categories. Cans often require shrink films for bundling into multipacks, protecting products during transport, and providing space for printed promotional designs. Sustainability considerations and lightweight packaging trends further drive the adoption of shrink films in can packaging applications.

Shrink Films Market Regional Analysis

- Asia-Pacific dominated the shrink films market with the largest revenue share of 45.4% in 2024, driven by high consumption of packaged beverages, growing retail and e-commerce sectors, and increasing use of multipack and printed shrink films

- The region’s cost-effective manufacturing landscape, rising investments in packaging solutions, and expanding beverage production facilities are accelerating market expansion

- The availability of skilled labor, supportive government policies, and rapid industrialization across developing economies are contributing to increased adoption of shrink films in both beverage and consumer goods packaging

China Shrink Films Market Insight

China held the largest share in the Asia-Pacific shrink films market in 2024, owing to its strong beverage manufacturing base and status as a global packaging hub. The country’s advanced production capabilities, adoption of modern packaging technologies, and extensive export networks are key growth drivers. Rising demand for branded multipacks, innovative packaging designs, and both printed and unprinted shrink films for retail-ready products further support market expansion.

India Shrink Films Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by expanding beverage production, rising consumption of bottled water and carbonated drinks, and increasing investments in modern packaging infrastructure. Government initiatives promoting “Make in India” and self-reliance in packaging solutions are strengthening demand. In addition, the growing retail and e-commerce penetration and focus on sustainable and high-quality shrink films are contributing to robust market growth.

Europe Shrink Films Market Insight

The Europe shrink films market is expanding steadily, supported by high demand for premium beverages, strict packaging quality standards, and investments in sustainable and recyclable packaging solutions. The region emphasizes environmental compliance, branding appeal, and advanced multipack designs, particularly in carbonated drinks and bottled beverages. Adoption of innovative printed shrink films for marketing and product differentiation is further enhancing market growth.

Germany Shrink Films Market Insight

Germany’s shrink films market is driven by its leadership in beverage manufacturing, strong focus on sustainable packaging, and advanced packaging technology adoption. The country has well-established R&D networks for innovative packaging solutions and high-quality shrink films. Demand is particularly strong for multipacks, premium bottled beverages, and customized printed shrink films catering to both domestic and export markets.

U.K. Shrink Films Market Insight

The U.K. market is supported by a mature beverage industry, growing retail modernization, and increasing demand for visually appealing and tamper-evident packaging. Rising focus on sustainability, recyclable shrink films, and innovative printed solutions is driving adoption. The market also benefits from collaborations between packaging solution providers and beverage manufacturers for specialized multipack and promotional packaging.

North America Shrink Films Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, driven by rising beverage consumption, adoption of advanced packaging technologies, and increasing demand for multipack shrink films. Growth is supported by innovation in printed shrink films for branding and marketing, sustainability initiatives, and the expansion of e-commerce and retail-ready packaging.

U.S. Shrink Films Market Insight

The U.S. accounted for the largest share in the North America market in 2024, underpinned by a strong beverage industry, high R&D investment in packaging solutions, and widespread adoption of multipack and printed shrink films. Focus on sustainability, premium packaging, and product differentiation, along with the presence of key players and established distribution networks, further solidifies the country’s leading position in the region.

Shrink Films Market Share

The shrink films industry is primarily led by well-established companies, including:

- Sealed Air (U.S.)

- KUREHA CORPORATION (Japan)

- WINPAK LTD. (Canada)

- Flexopack (Greece)

- Bonset America Corporation (U.S.)

- Coveris (Austria)

- PREMIUMPACK GmbH (Germany)

- Schur Flexibles Holding GesmbH (Austria)

- Buergofol GmbH (Germany)

- Allfo (Germany)

- Atlantis-Pak (Russia)

- XtraPlast (U.S.)

- Transcontinental Inc. (Canada)

- BP Plastics Holding Bhd (Malaysia)

- Crawford Packaging (Canada)

- SYFAN USA (U.S.)

- Idemitsu Kosan Co.,Ltd. (Japan)

- Vijay Packaging System (India)

- NPF.com (U.S.)

- Akar Shrink Packs (India)

- Alpha Plastomers (India)

- MANOJ PLASTICS (India)

- Vishakha Polyfab Pvt Ltd (India)

- Gupta Package Industries (India)

- International Plastics Inc. (U.S.)

- Shri Balaji Packers (India)

- Global Polyfilms (India)

- Rishba Poly Product (India)

- 3D Plast (U.S.)

- Eminent Solution (U.K.)

- modwrap.com (India)

- Bagla Group (India)

Latest Developments in Global Shrink Films Market

- In February 2025, Innovia Films introduced a next-generation RayoFloat high-shrink polyolefin shrink sleeve, offering up to 73% shrinkage and automatic detachment during recycling. This innovation improves compatibility with various packaging formats, particularly bottles, and supports PET recycling by ensuring the sleeve separates during processing. Its high shrinkage capability enhances product fit and visual appeal, addressing growing demand for sustainable and attractive packaging in the beverage and personal care sectors

- In February 2024, Innovia Films launched floatable polyolefin shrink films, RayoFloat White APO, a low-density white polyolefin that maintains floatability even when printed. The film’s opacity improves light-blocking, making it ideal for shrink sleeves in light-sensitive industries such as dairy, nutritional products, supplements, and cosmetics. This development strengthens packaging protection while supporting sustainability and recycling efforts

- In February 2024, IPG introduced ExlfilmPlus PCR, a polyolefin shrink film containing 35% recycled content, including at least 10% certified post-consumer recycled (PCR) and 25% certified post-industrial recycled (PIR) content. The film utilizes mechanically recycled consumer plastic waste, aligning with increasing demand for eco-friendly packaging that maintains high quality and performance. This launch emphasizes the market shift toward sustainable and circular packaging solutions

- In May 2023, Innovia Films introduced APO45, a floatable and sustainable shrink sleeve material aimed at improving PET recycling rates and supporting a circular economy for packaging. Suitable for household, personal care, food, dairy, and beverage applications, APO45 reduces carbon emissions during transport and ensures floatable separation from PET flakes, improving recycled PET quality and contributing to efficient recycling practices

- In May 2023, a leading manufacturer (Amcor) launched a bio-based shrink film made from renewable sources for multipack beverage applications. The film provides comparable durability and shrink performance to conventional polyolefins while reducing reliance on fossil-based plastics. This initiative supports sustainability goals in the beverage packaging market and encourages adoption of environmentally responsible materials by large-scale manufacturers

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Shrink Films Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Shrink Films Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Shrink Films Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.