Global Silo Bags Market

Market Size in USD Million

CAGR :

%

USD

661.22 Million

USD

1,081.23 Million

2024

2032

USD

661.22 Million

USD

1,081.23 Million

2024

2032

| 2025 –2032 | |

| USD 661.22 Million | |

| USD 1,081.23 Million | |

|

|

|

|

Global Silo Bags Market Size

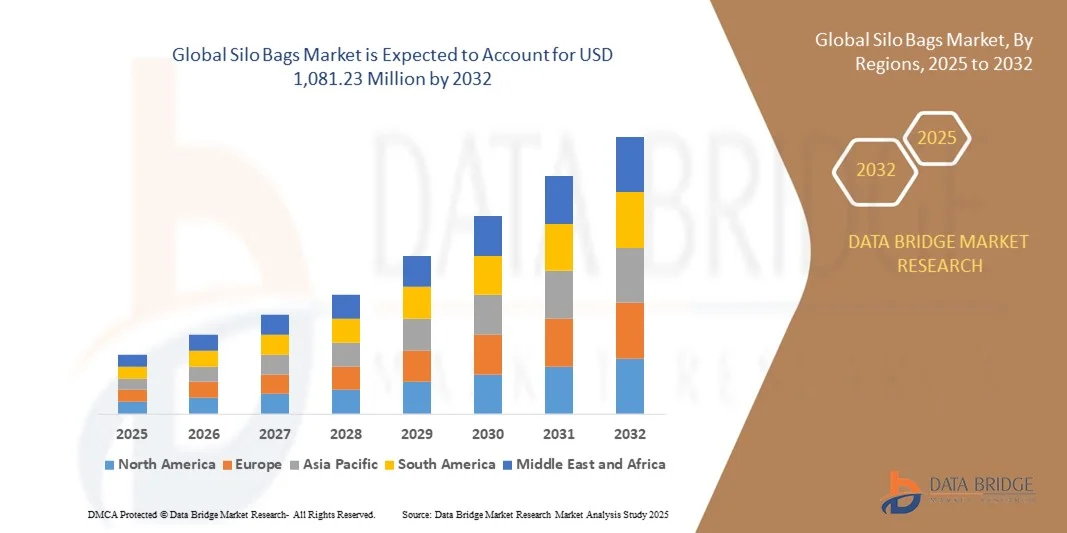

- The global Silo Bags Market size was valued at USD 661.22 million in 2024 and is expected to reach USD 1,081.23 million by 2032, at a CAGR of 6.34% during the forecast period.

- The market growth is primarily driven by increasing demand for efficient and cost-effective grain storage solutions in agriculture, coupled with rising awareness about reducing post-harvest losses.

- Additionally, advancements in durable and eco-friendly materials used in silo bags, along with expanding adoption in emerging economies, are further propelling market expansion and solidifying silo bags as a preferred storage method worldwide.

Global Silo Bags Market Analysis

- Silo bags, used for on-farm storage of grains and fodder, are increasingly essential in modern agricultural practices due to their cost-effectiveness, ease of installation, and ability to preserve crop quality over extended periods.

- The rising demand for silo bags is mainly driven by the need to reduce post-harvest losses, improve storage efficiency, and support growing agricultural production worldwide.

- North America dominated the Global Silo Bags Market with the largest revenue share of 35% in 2024, attributed to advanced farming practices, high mechanization levels, and strong adoption of innovative storage solutions, particularly in the U.S. and Canada where large-scale grain production and export activities prevail.

- Asia-Pacific is expected to be the fastest-growing region in the Global Silo Bags Market during the forecast period due to rapid agricultural modernization, increasing crop production, and expanding farmer awareness in countries such as India, China, and Australia.

- The Up to 200 MT segment dominated the market with the largest revenue share of 55.4% in 2024, primarily driven by its suitability for small to medium-sized farms and regional agribusinesses

Report Scope and Global Silo Bags Market Segmentation

|

Attributes |

Silo Bags Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Silo Bags Market Trends

Enhanced Convenience Through Smart Monitoring and Automation

- A significant and accelerating trend in the global Silo Bags Market is the growing integration of smart monitoring systems and automated technologies, enabling farmers and agribusinesses to efficiently manage stored produce remotely. These innovations are transforming traditional storage methods by providing real-time insights and improving operational convenience.

- For instance, IoT-enabled silo bags equipped with sensors continuously monitor parameters such as temperature, humidity, and grain condition, sending alerts directly to users’ mobile devices. This allows for proactive management of storage conditions, minimizing spoilage and loss. Similarly, automated inflation systems help maintain optimal bag pressure, adapting to environmental changes without manual intervention.

- Smart monitoring solutions are increasingly using AI to analyze data patterns, predicting risks like moisture buildup or pest infestation and suggesting timely preventive measures. This level of automation reduces the need for constant manual checks and enables better decision-making, saving both time and resources.

- The seamless integration of silo bag monitoring with farm management platforms facilitates centralized control over multiple storage units, allowing users to oversee entire storage networks through a single interface. This unified approach enhances operational efficiency and supports scalable farm management.

- This trend towards intelligent, automated, and connected storage solutions is redefining expectations in agricultural storage, driving demand for more advanced and user-friendly products. Leading companies such as Poly-Ag and Berry Global are at the forefront, developing smart silo bag systems that combine durability with digital innovation.

- The demand for silo bags with integrated smart monitoring and automation features is rapidly increasing worldwide, fueled by farmers’ need to improve storage reliability, reduce losses, and support sustainable agricultural practices.

Global Silo Bags Market Dynamics

Driver

Growing Need Due to Increasing Post-Harvest Losses and Demand for Efficient Storage Solutions

-

The rising concerns over significant post-harvest losses among farmers and agribusinesses, combined with increasing demand for efficient and cost-effective grain storage solutions, are key drivers propelling growth in the global Silo Bags Market.

- For Instance, companies such as Poly-Ag and Berry Global are investing in innovations such as durable, UV-resistant materials and improved sealing technologies to enhance the protection and longevity of stored crops. Such advancements are expected to further boost market expansion during the forecast period.

- As awareness grows around the economic impact of spoilage and contamination, silo bags offer an attractive alternative to traditional storage methods by providing secure, weather-resistant, and pest-proof storage options that help maintain grain quality.

- Moreover, the expanding adoption of modern farming practices and increased mechanization are driving demand for silo bags as they offer flexible, on-site storage without the need for costly infrastructure.

- The convenience of easy installation, scalability for different farm sizes, and the ability to store diverse crops safely are critical factors encouraging widespread use of silo bags across both smallholder farms and large commercial operations. Growing government initiatives promoting sustainable agriculture and reducing food waste also support the adoption of silo bag technology globally.

Restraint/Challenge

Concerns Regarding Durability, Environmental Impact, and Initial Investment Costs

- Concerns related to the physical durability of silo bags, potential environmental impact due to plastic waste, and relatively high upfront costs pose challenges to broader market adoption. While silo bags offer cost savings over traditional storage, the initial investment can be a barrier, especially for small-scale farmers in developing regions.

- For instance, exposure to extreme weather conditions or improper handling can lead to tears or punctures, compromising stored produce and causing financial losses. Environmental concerns regarding disposal and recycling of used plastic bags also affect consumer perception.

- Addressing these challenges through the development of more robust, biodegradable materials and improving recycling programs is essential to increase market acceptance. Leading manufacturers like Pacifil Brasil and Agroflex are exploring eco-friendly alternatives and promoting best practices for reuse and disposal.

- Additionally, educating farmers on proper installation and maintenance techniques can mitigate damage risks and extend the lifespan of silo bags, thereby improving cost-effectiveness.

- Although costs are gradually declining due to technological advancements and economies of scale, the initial premium compared to traditional storage solutions remains a hurdle for some users, particularly in price-sensitive markets. Overcoming these barriers through innovation, sustainability initiatives, and financial support programs will be critical for sustained growth in the global Silo Bags Market.

Global Silo Bags Market Scope

Global silo bags market is segmented on the basis of capacity, length type, material type, and application.

- By Capacity

On the basis of capacity, the global silo bags market is segmented into Up to 200 MT and Above 200 MT. The Up to 200 MT segment dominated the market with the largest revenue share of 55.4% in 2024, primarily driven by its suitability for small to medium-sized farms and regional agribusinesses. This segment appeals to farmers looking for flexible, cost-effective storage options that do not require large-scale infrastructure investments. Its manageable size also supports easier handling and transport, which is crucial in regions with limited mechanization.

The Above 200 MT segment is anticipated to witness the fastest growth rate of 23.1% from 2025 to 2032, propelled by the increasing adoption of silo bags in large commercial farms and agribusinesses that require bulk storage solutions. Growing grain production, export activities, and investments in large-scale agricultural operations, especially in emerging economies, are fueling demand for higher-capacity storage bags, making this segment a key driver of market expansion.

- By Length Type

On the basis of length, the global silo bags market is segmented into 60 Meter, 75 Meter, and 90 Meter bags. The 75 Meter length segment held the largest market revenue share of 47.8% in 2024, favored for its optimal balance between storage capacity and ease of installation. This length size is widely preferred by both smallholder farmers and mid-sized agricultural enterprises for storing various types of grains and forages efficiently.

The 90 Meter length segment is expected to witness the fastest CAGR of 22.5% from 2025 to 2032, driven by the need for maximizing storage volume in large-scale farms and commercial agricultural settings. Its extended length reduces the number of bags required on expansive farms, streamlining storage management and reducing costs, especially in regions with high grain production. The 60 Meter bags continue to see steady demand in smaller operations due to their ease of handling and installation.

- By Material Type

On the basis of material type, the global silo bags market is segmented into Polyethylene (PE) and Polypropylene (PP). The Polyethylene (PE) segment dominated the market with the largest revenue share of 62.3% in 2024, attributed to its superior durability, UV resistance, and flexibility. PE bags provide excellent protection against environmental factors such as moisture, pests, and sunlight, making them the preferred choice for long-term grain storage.

The Polypropylene (PP) segment is projected to witness the fastest growth rate of 19.8% during the forecast period, fueled by growing innovation in biodegradable and recycled polypropylene materials. This segment is gaining traction due to increasing environmental concerns and regulations promoting sustainable packaging solutions. Advances in PP manufacturing also enhance strength and resistance, making it an attractive alternative for eco-conscious farmers and agribusinesses.

- By Application

On the basis of application, the global silo bags market is segmented into Grain Storage, Forages Storage, Fertilizers Storage, Dried Fruits Storage, Wood Chips, and Others. The Grain Storage segment accounted for the largest market revenue share of 58.7% in 2024, driven by the critical need for efficient post-harvest management in staple crops like wheat, maize, and rice. The ability of silo bags to preserve grain quality and reduce losses makes this segment dominant globally.

The Forages Storage segment is expected to witness the fastest CAGR of 21.4% from 2025 to 2032, supported by the rising demand for quality fodder preservation in livestock farming. Increasing livestock production and the need to maintain nutritional value of forages during off-seasons are key factors driving this segment’s growth. Other applications such as fertilizers and dried fruits storage are also contributing to market diversification, reflecting expanding use cases for silo bag technology.

Global Silo Bags Market Regional Analysis

- North America dominated the global silo bags market with the largest revenue share of 35% in 2024, driven by the region’s well-established agricultural infrastructure and high adoption of advanced storage solutions

- Farmers and agribusinesses in North America increasingly rely on silo bags for their cost-effectiveness, ease of use, and ability to preserve large quantities of grain and forage efficiently throughout varying climatic conditions

- This dominance is supported by strong government initiatives promoting modern farming practices, extensive grain production, and high investment in post-harvest technology, making silo bags a preferred storage solution across both small and large-scale farming operations in the region

U.S. Silo Bags Market Insight

The U.S. silo bags market captured the largest revenue share of 81% within North America in 2024, driven by extensive grain production and the need for efficient post-harvest storage solutions. Farmers increasingly prefer silo bags due to their cost-effectiveness, ease of use, and ability to preserve large quantities of grain and forage with minimal infrastructure investment. The growing focus on reducing post-harvest losses and increasing demand for flexible storage options are further propelling market growth. Additionally, advancements in material technology improving durability and pest resistance are boosting adoption across small to large-scale farms.

Europe Silo Bags Market Insight

The Europe silo bags market is projected to expand at a substantial CAGR during the forecast period, driven by increasing awareness about food security, waste reduction, and sustainable agricultural practices. Stringent regulations on grain storage and quality, alongside rising demand for efficient, on-farm storage solutions, are encouraging silo bag adoption. The market is also supported by the growth in livestock farming and forage production, where silo bags serve as an effective preservation method. Western Europe, particularly countries like France and Germany, is seeing strong demand due to modernization in farming and agro-industrial sectors.

U.K. Silo Bags Market Insight

The U.K. silo bags market is anticipated to grow steadily throughout the forecast period, fueled by the increasing emphasis on efficient grain and forage storage among both commercial farmers and agribusinesses. The rise in organic farming and sustainability initiatives in the country is encouraging the use of silo bags for their environmental benefits and reduction in spoilage. Additionally, the growing livestock industry and the need for quality forage preservation are further contributing to market expansion. The adoption of silo bags in the U.K. is also supported by government subsidies and increasing investment in farm infrastructure.

Germany Silo Bags Market Insight

The Germany silo bags market is expected to witness considerable growth during the forecast period, driven by a focus on reducing post-harvest losses and enhancing the quality of stored crops. Germany’s advanced agricultural technology adoption and strong environmental regulations promote the use of high-quality silo bags made from durable and recyclable materials. The country’s significant grain production and forage farming sectors demand reliable storage solutions, positioning silo bags as a preferred option. Integration of sustainable practices and demand for eco-friendly materials also boost the market in Germany.

Asia-Pacific Silo Bags Market Insight

The Asia-Pacific silo bags market is poised to grow at the fastest CAGR of 24% from 2025 to 2032, fueled by rapid urbanization, rising disposable incomes, and government initiatives supporting modern agricultural practices. Countries such as China, India, and Australia are leading the demand for cost-efficient, scalable grain storage solutions to reduce post-harvest losses. Increasing awareness about food security, expansion of commercial farming, and the shift towards mechanized agriculture contribute to market growth. Furthermore, the availability of locally manufactured silo bags at competitive prices is accelerating adoption across the region.

Japan Silo Bags Market Insight

The Japan silo bags market is gaining momentum due to the country’s emphasis on technological innovation and precision agriculture. Japanese farmers seek effective storage solutions that preserve crop quality while minimizing space requirements. The aging farming population and increasing mechanization are encouraging the use of silo bags for ease of handling and efficiency. Moreover, integration with smart farming practices and government support for reducing food waste further enhance the market outlook in Japan. The demand is also driven by the need to store various crops and forage for livestock farming.

China Silo Bags Market Insight

The China silo bags market accounted for the largest revenue share in Asia-Pacific in 2024, driven by the country’s expanding agricultural sector and the urgent need to tackle post-harvest losses. Rapid urbanization, government subsidies for modern farming infrastructure, and increased focus on food security have accelerated silo bag adoption. The presence of strong domestic manufacturers offering affordable and high-quality silo bags supports widespread market penetration. Additionally, growth in grain exports and rising commercial farming activities fuel demand, making China a pivotal market in the global silo bags industry.

Global Silo Bags Market Share

The Silo Bags industry is primarily led by well-established companies, including:

- Berry Global Inc. (U.S.)

- IG Industrial Plastics, LLC (U.S.)

- Canadian Tarpaulin Manufacturers Ltd. (Canada)

- Poly-Ag Corp. (U.S.)

- Pacifil Brasil (Brazil)

- Agroflex (Brazil)

- Planet Plastic LLC (U.S.)

- ARGSELMASH (Russia)

- Up North Plastics, Inc. (U.S.)

- Seed & Forage Bags Australia Pty Ltd. (Australia)

- Polypropylene Products (U.S.)

- Polypropylene Bags (USA)

- Shanghai HiTeC Plastics Co., Ltd. (China)

- Shandong Longxing Plastic Film Technology Corp. Ltd. (China)

- Rishi FIBC Solutions Pvt. Ltd. (India)

- IPESA USA LLC (U.S.)

- RKW Group (Germany)

- PLASTAR (Turkey)

- GEM Silage Products (U.S.)

- Blue Lake Plastics, LLC (U.S.)

What are the Recent Developments in Global Silo Bags Market?

- In April 2023, Berry Global Inc., a leading manufacturer of flexible packaging solutions, launched a new line of high-durability silo bags in South America designed to withstand extreme weather conditions and improve grain preservation. This initiative demonstrates Berry Global’s commitment to innovation and sustainability, addressing the specific storage challenges faced by farmers in the region while strengthening its presence in the expanding global silo bags market.

- In March 2023, IG Industrial Plastics, LLC, a key player in agricultural film production, introduced advanced polyethylene (PE) silo bags with enhanced UV resistance and oxygen barrier technology. Targeted for commercial grain storage applications, this product advancement aims to reduce post-harvest losses and extend storage life. The launch highlights IG Industrial Plastics’ focus on delivering cutting-edge solutions that meet the evolving needs of modern agriculture.

- In March 2023, Canadian Tarpaulin Manufacturers Ltd. successfully partnered with several large-scale farms in Canada to implement their eco-friendly polypropylene (PP) silo bags as part of a government-backed initiative to promote sustainable agricultural practices. This collaboration underscores the company’s dedication to environmental stewardship while boosting the adoption of silo bag technology in the region.

- In February 2023, Poly-Ag Corp., a global supplier of agricultural storage solutions, announced a strategic alliance with major grain exporters to expand the use of silo bags for safe and efficient grain handling in export terminals. This partnership is aimed at improving the quality of stored commodities and reducing spoilage during transit, reinforcing Poly-Ag’s role as a market innovator.

- In January 2023, Pacifil Brasil unveiled its latest range of silo bags designed specifically for tropical climates, featuring enhanced durability against moisture and pests. Introduced at the Agrishow 2023 event, these silo bags provide Brazilian farmers with effective grain and forage storage options, reflecting Pacifil’s commitment to regional agricultural advancement and strengthening its footprint in the global silo bags market.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Silo Bags Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Silo Bags Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Silo Bags Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.