Global Simulators Market

Market Size in USD Billion

CAGR :

%

USD

19.54 Billion

USD

31.61 Billion

2024

2032

USD

19.54 Billion

USD

31.61 Billion

2024

2032

| 2025 –2032 | |

| USD 19.54 Billion | |

| USD 31.61 Billion | |

|

|

|

|

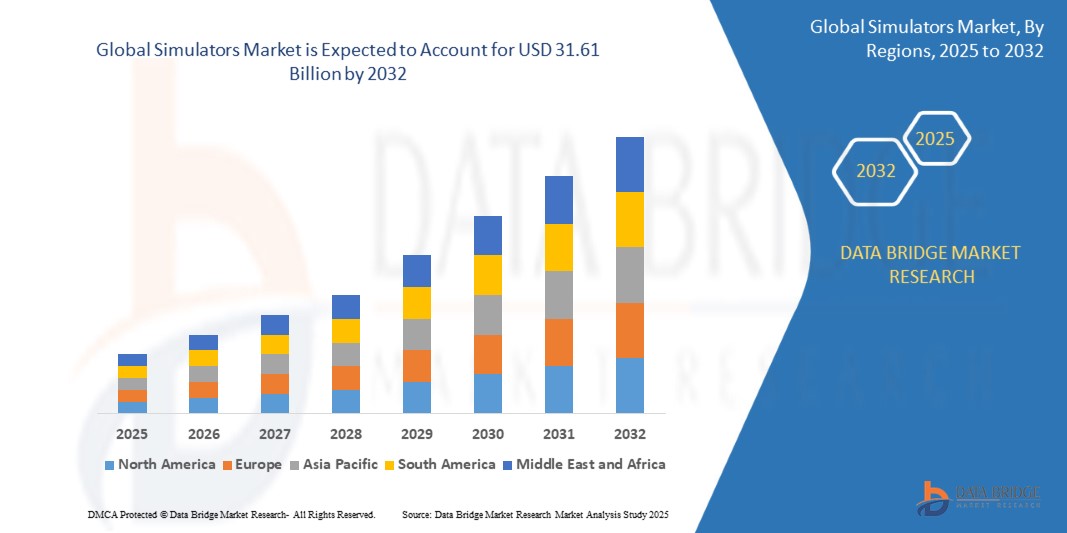

What is the Global Simulators Market Size and Growth Rate?

- The global simulators market size was valued at USD 19.54 billion in 2024 and is expected to reach USD 31.61 billion by 2032, at a CAGR of 6.20% during the forecast period

- A simulator is a device or system that replicates the operation or features of one system through the operation of another. Simulators are widely used in various industries for training, testing, research, and entertainment purposes. They provide a realistic and immersive experience that mimics real-world scenarios, allowing users to acquire skills, practice procedures, and conduct simulations in a controlled environment

What are the Major Takeaways of Simulators Market?

- With rapid technological advancements and evolving job requirements, there's a growing need for effective training and skill development across various industries. Simulators provide a realistic and immersive environment for hands-on training, allowing individuals to acquire and refine skills in a safe and controlled setting. As organizations prioritize employee development to meet changing demands, the demand for simulators as training tools continues to rise

- Continuous innovations in simulation technologies, such as improved graphics, enhanced sensory feedback, and advanced hardware capabilities, have significantly enhanced the realism and effectiveness of simulators. These advancements enable more accurate replication of real-world scenarios, leading to better training outcomes and increased user engagement. As technology continues to evolve, simulators become more sophisticated, offering enhanced training experiences across various industries

- Asia-Pacific dominated the simulators market with the largest revenue share of 42.3% in 2024, fueled by increasing investments in defense training, aviation, automotive testing, and medical education

- North America simulators market is poised to grow at the fastest CAGR of 13.5% from 2025 to 2032, driven by cutting-edge technological advancements and growing demand across defense, aerospace, and healthcare

- The Flight Simulators segment dominated the market with the largest revenue share of 41.3% in 2024, driven by their extensive use in aviation training, defense pilot programs, and commercial airline operations

Report Scope and Simulators Market Segmentation

|

Attributes |

Simulators Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Simulators Market?

AI-Powered Training and Realistic Immersion

- A major trend in the global Simulators market is the integration of artificial intelligence (AI) with advanced immersive technologies to enhance training effectiveness, decision-making, and operational efficiency

- AI-powered simulators analyze trainee performance in real time, provide adaptive learning paths, and deliver predictive insights to improve skill acquisition

- For instance, CAE Inc. is developing AI-enabled aviation simulators that adapt training modules based on pilot performance, while Thales Group integrates AI with VR/AR for defense training to enhance situational awareness

- The growing demand for realistic, data-driven, and intelligent training environments is reshaping how industries approach simulation, driving adoption across defense, aviation, healthcare, and industrial sectors

What are the Key Drivers of Simulators Market?

- Rising demand for safe, cost-effective, and risk-free training environments across aviation, defense, and healthcare is fueling market growth

- For instance, in May 2024, Boeing expanded its digital flight training solutions with advanced simulators to reduce operational risks and improve pilot readiness

- Growing complexity in defense systems, aviation operations, and medical procedures is accelerating simulator adoption for skill development and compliance

- Expanding applications in industrial and automotive sectors, where simulation reduces downtime and enhances worker training, further strengthen demand

- The increasing shift towards remote and digital learning platforms post-pandemic is also boosting investment in cloud-based and networked simulation systems

Which Factor is Challenging the Growth of the Simulators Market?

- High development and procurement costs of advanced simulators limit adoption, especially for small institutions and emerging economies

- For instance, Saab AB highlighted the high capital requirements of military simulators as a barrier for smaller defense forces in budget-constrained nations

- Concerns around technological obsolescence, with rapid advances in AI, VR, and AR, make continuous upgrades necessary, adding cost pressures for buyers

- Data privacy and cybersecurity vulnerabilities in connected simulators pose risks, particularly in defense and healthcare applications

- Addressing these challenges through scalable, modular, and cost-efficient simulation solutions will be key to ensuring sustained market growth

How is the Simulators Market Segmented?

The market is segmented on the basis of type, technique, platform, and applications.

• By Type

On the basis of type, the simulators market is segmented into Flight Simulators, Driving Simulators, Train Simulators, Surgical Simulators, and Other Simulators. The Flight Simulators segment dominated the market with the largest revenue share of 41.3% in 2024, driven by their extensive use in aviation training, defense pilot programs, and commercial airline operations. Their ability to replicate real-world scenarios reduces operational risks and training costs while enhancing pilot competency. The adoption of advanced motion platforms, immersive visuals, and AI integration continues to push this segment forward.

The Surgical Simulators segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the rising need for minimally invasive surgeries, increased medical training, and the global focus on patient safety. Medical institutions and training centers are increasingly deploying surgical simulators for skill development, thereby creating strong growth potential.

• By Technique

On the basis of technique, the simulators market is segmented into Live, Virtual, and Constructive (LvVC Simulator, Synthetic Environment Simulator, and Gaming Simulator). The Live simulation segment accounted for the largest revenue share of 44.8% in 2024, as it provides hands-on experience for military drills, aviation practices, and tactical training. Live simulations are highly valued for their ability to replicate real-life operational environments with high accuracy, making them indispensable for defense forces worldwide.

The Virtual simulation segment is anticipated to register the fastest growth from 2025 to 2032, driven by technological advancements in VR/AR and cost-effectiveness compared to live setups. Virtual simulators are being increasingly adopted across aviation, healthcare, and gaming sectors to provide immersive, scalable, and safe training environments. The integration of VR goggles, motion tracking, and cloud-based systems further enhances adoption in education and enterprise training.

• By Platform

On the basis of platform, the simulators market is segmented into Air, Land, and Sea. The Air platform segment dominated the market with a share of 47.6% in 2024, owing to the high demand for pilot training in commercial aviation, military air forces, and aerospace research institutions. Flight safety requirements, stringent aviation regulations, and the rising number of air passengers continue to drive adoption of air-based simulators globally.

The Land platform segment is projected to grow at the fastest CAGR from 2025 to 2032, fueled by the adoption of driving simulators for automotive R&D, driver training schools, and defense vehicle operations. The push towards autonomous vehicles, electric mobility, and military ground training is accelerating demand for advanced land-based simulation solutions.

• By Application

On the basis of application, the simulators market is segmented into Military & Defense, Aviation, Healthcare, Entertainment, and Other Applications. The Military & Defense segment held the largest market revenue share of 45.2% in 2024, driven by increasing investments in defense modernization, mission rehearsal programs, and tactical training to minimize real-life risks. Defense organizations extensively use simulators for combat readiness, weapon systems training, and battlefield scenario planning.

The Healthcare segment is expected to grow at the fastest CAGR from 2025 to 2032, as the demand for surgical training, patient safety, and skill-based learning increases. Medical schools and hospitals are adopting simulators for training in complex procedures, reducing medical errors, and enhancing learning outcomes. This growth is further supported by rising global healthcare investments and technology integration in medical education.

Which Region Holds the Largest Share of the Simulators Market?

- Asia-Pacific dominated the simulators market with the largest revenue share of 42.3% in 2024, fueled by increasing investments in defense training, aviation, automotive testing, and medical education. The region’s expanding focus on safety, efficiency, and cost-effective training solutions is driving strong adoption

- Countries such as China, Japan, and India are at the forefront, with government initiatives, industrial growth, and rapid digitalization accelerating demand for simulators in both civil and military applications

- The presence of a robust manufacturing ecosystem, coupled with growing R&D expenditure and rising demand for pilot and driver training programs, has positioned Asia-Pacific as the global leader in the simulators market

China Simulators Market Insight

China simulators market captured the largest revenue share in Asia-Pacific in 2024, supported by extensive government investments in defense modernization and civil aviation expansion. Rising demand for automotive simulation technologies, coupled with smart manufacturing initiatives, further strengthens the market. Local companies are also innovating aggressively, enhancing affordability and accessibility.

Japan Simulators Market Insight

Japan simulators market is witnessing strong growth driven by the country’s high-tech infrastructure, automotive sector advancements, and defense training requirements. The integration of simulators in healthcare for surgical training and education is also accelerating adoption. Moreover, Japan’s commitment to safety and precision is fueling consistent simulator demand across industries.

India Simulators Market Insight

India simulators market is projected to grow significantly due to rising investments in aviation training, increasing road safety programs, and the adoption of digital education tools. The government’s focus on skill development, along with the rapid growth of the defense sector, is further boosting demand. Growing partnerships with global simulator manufacturers are strengthening India’s position as a key emerging market.

Which Region is the Fastest Growing Region in the Simulators Market?

North America simulators market is poised to grow at the fastest CAGR of 13.5% from 2025 to 2032, driven by cutting-edge technological advancements and growing demand across defense, aerospace, and healthcare. The region’s strong focus on immersive training, AI-driven simulation, and virtual reality applications is accelerating growth.

U.S. Simulators Market Insight

U.S. simulators market dominates the regional share, driven by high defense budgets, aviation training requirements, and strong adoption in healthcare education. Advanced R&D capabilities, combined with the presence of leading players such as Boeing, Lockheed Martin, and L3Harris, reinforce the U.S. leadership position. The rising use of AI and VR-based training is further shaping market expansion.

Canada Simulators Market Insight

Canada simulators market is expanding steadily, supported by growing investments in pilot training, automotive safety, and healthcare simulation. The country’s increasing emphasis on digital learning platforms and defense collaborations with NATO allies are fueling demand. Canada is also fostering partnerships with simulator manufacturers to strengthen its domestic training infrastructure.

Mexico Simulators Market Insight

Mexico simulators market is gaining traction due to the expansion of the aviation and automotive industries, alongside the growing adoption of simulators in education and vocational training. The government’s focus on modernizing infrastructure and workforce skills is driving simulator integration in training facilities across the country.

Which are the Top Companies in Simulators Market?

The simulators industry is primarily led by well-established companies, including:

- Assa Abloy (Sweden)

- Allegion (Ireland)

- Kwikset (U.S.)

- Yale (Sweden)

- August Home (U.S.)

- Schlage (U.S.)

- Level Lock (U.S.)

- Lockly (U.S.)

- U-tec (U.S.)

- TP-Link (China)

- Eufy Security (China)

- Aqara (China)

- Nuki (Austria)

- Danalock (Denmark)

- Samsung SmartThings (South Korea)

- Honeywell (U.S.)

- Brinks Home (U.S.)

- Vivint (U.S.)

- ZKTeco (China)

- Tesa (Spain)

What are the Recent Developments in Global Simulators Market?

- In July 2023, Iran showcased the successful demonstration of its MiG-29 simulator, designed to strengthen the combat capabilities of its armed forces, while also developing electronic warfare simulations for Su-24 and F-4 fighter jets at Shahid Sattari Aeronautical University. This initiative highlights the country’s growing emphasis on indigenous simulation technologies for military preparedness

- In April 2023, VirtaMed AG launched an innovative surgical simulator equipped with advanced haptic feedback, providing medical professionals with a highly realistic training experience. This development marks a significant step in improving surgical training outcomes through cutting-edge simulation solutions

- In March 2023, CAE Inc. introduced a new series of flight simulators featuring enhanced technologies aimed at advancing pilot training efficiency and realism. This launch strengthens CAE’s leadership position in aviation simulation and expands training opportunities globally

- In February 2023, BAE Systems and FSTC unveiled plans to co-develop a state-of-the-art twin-dome full-mission simulation system for the Indian Defense Force, integrating realistic synthetic environments for pilot training. This collaboration is set to enhance India’s defense training infrastructure with next-generation simulation capabilities

- In November 2022, the U.S. Air Force awarded SimX a research and development contract to create an advanced Virtual Reality (VR) medical simulation training program, enhancing tactical combat casualty care. This project underscores the role of VR-based simulation in revolutionizing medical training for military operations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.