Global Single Serve Packaging Market

Market Size in USD Billion

CAGR :

%

USD

20.28 Billion

USD

35.98 Billion

2024

2032

USD

20.28 Billion

USD

35.98 Billion

2024

2032

| 2025 –2032 | |

| USD 20.28 Billion | |

| USD 35.98 Billion | |

|

|

|

|

Single-Serve Packaging Market Size

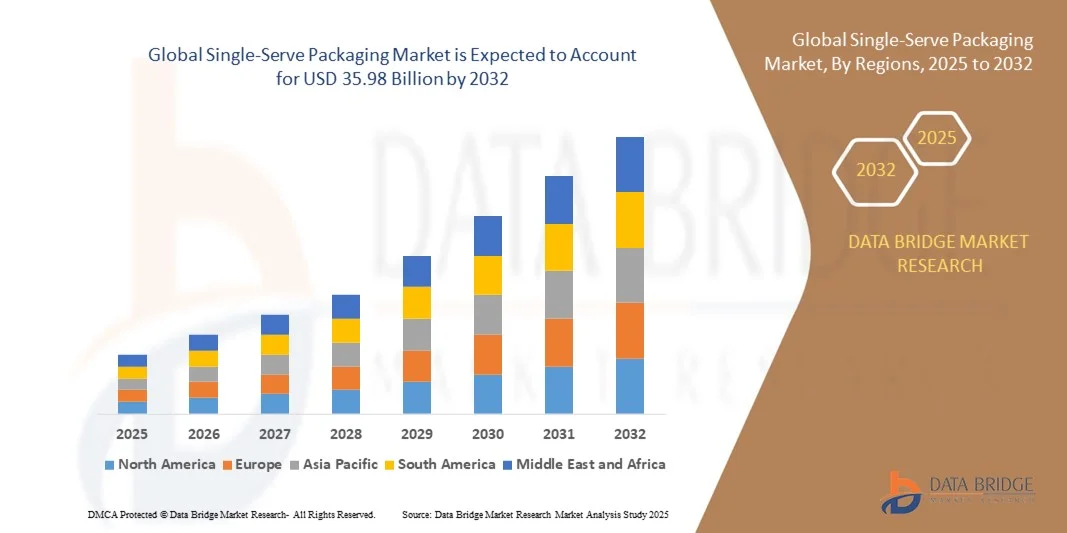

- The global single-serve packaging market size was valued at USD 20.28 billion in 2024 and is expected to reach USD 35.98 billion by 2032, at a CAGR of 7.43% during the forecast period

- The market growth is largely fueled by the rising demand for convenient, portable, and portion-controlled packaging solutions across food, beverage, and personal care industries, driven by changing consumer lifestyles and the growing trend of on-the-go consumption

- Furthermore, increasing adoption of single-serve formats by leading brands such as Nestlé and PepsiCo to cater to urban consumers seeking freshness, hygiene, and sustainability is accelerating market expansion and strengthening product innovation

Single-Serve Packaging Market Analysis

- Single-serve packaging, designed for individual consumption and convenience, is gaining significant traction across ready-to-drink beverages, dairy products, coffee pods, and snack segments as consumers prioritize portion control, mobility, and reduced food waste

- The growing demand for sustainable and recyclable materials, coupled with advancements in lightweight and flexible packaging technologies, is further shaping market development and driving manufacturers to invest in eco-friendly solutions to meet evolving consumer preferences

- North America dominated the single-serve packaging market with a share of 41.12% in 2024, due to the rising consumption of convenience foods, beverages, and ready-to-eat products

- Asia-Pacific is expected to be the fastest growing region in the single-serve packaging market during the forecast period due to rapid urbanization, rising disposable incomes, and the expansion of the food and beverage industry

- Plastics segment dominated the market with a market share of 44.78% in 2024, due to its versatility, strength, and ability to create lightweight, tamper-resistant packaging solutions. Plastics enable superior barrier properties against moisture and oxygen, ensuring product preservation across food and beverage applications. The development of recyclable and bio-based plastic materials has further driven adoption among eco-conscious brands. Manufacturers also favor plastic for its molding flexibility and cost efficiency in mass production of portion-controlled packages

Report Scope and Single-Serve Packaging Market Segmentation

|

Attributes |

Single-Serve Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Single-Serve Packaging Market Trends

Shift Toward Sustainable and Biodegradable Packaging

- The single-serve packaging market is witnessing a rapid transition toward sustainable and biodegradable materials as brands respond to growing environmental awareness and regulatory pressure against single-use plastics. Manufacturers are actively adopting plant-based films, paper-based laminates, and compostable materials to reduce the ecological footprint of portion-sized packaging formats used in beverages, snacks, and condiments

- For instance, Amcor plc and Huhtamaki Oyj have introduced fully recyclable and biodegradable single-serve packaging for food and beverage applications, incorporating fiber-based and bio-polymer alternatives. These innovations cater to consumer preferences for convenience without compromising environmental responsibility, offering packaging options that align with circular economy goals

- Consumer demand for eco-conscious packaging is driving research into new material technologies such as polylactic acid (PLA) and molded fiber, which provide durability while supporting biodegradability. Such materials ensure product safety and shelf life required for single-serve applications in dairy, coffee, and ready-to-eat meals while minimizing waste generation

- In addition, many global consumer goods companies are pledging net-zero packaging goals by adopting materials that can be fully recycled or composted within existing waste management infrastructures. This shift supports a balance between on-the-go consumption convenience and sustainability expectations from environmentally aware consumers

- The move toward bioplastics and paper-based single portions is further supported by technological advancements in barrier coatings that enhance moisture and oxygen resistance. This progress allows packaging to maintain product freshness while being environmentally compatible and lightweight

- The growing focus on sustainability, resource efficiency, and responsible consumption is positioning biodegradable single-serve packaging as an essential component of the industry’s future, ensuring long-term alignment with global environmental targets and consumer trust in sustainable brands

Single-Serve Packaging Market Dynamics

Driver

Rising Demand for Convenient Portion-Controlled Solutions

- The increasing urbanization, busy lifestyles, and evolving consumption habits are fueling the demand for single-serve packaging formats across food, beverage, and personal care industries. Consumers seeking on-the-go convenience prefer compact, ready-to-use portions that deliver freshness, hygiene, and precise serving sizes without the need for storage or preparation

- For instance, Mondelez International and Nestlé have expanded their portion-controlled packaging lines across snack bars, coffee pods, and confectionery segments. These single-serve innovations allow brands to meet both convenience-driven and portion-aware consumer needs, offering a measure of indulgence with controlled calorie intake and minimal waste

- The growing trend of individual consumption among younger demographics and smaller households has amplified the need for compact and portable packaging formats. Single-serve solutions cater to such preferences by offering freshness retention, ease of carrying, and reduced product wastage compared to larger packaging units

- In addition, the rising popularity of food delivery services and vending systems has boosted the adoption of single-serve containers that support quick distribution and consumption. These formats improve operational efficiency for businesses, enabling portion standardization and improved product quality consistency

- The preference for ready-to-eat, single-use, and portable options continues to shape packaging innovations that combine convenience with safety assurance. As a result, single-serve packaging is poised to remain a key enabler of modern consumption trends, supporting the expansion of packaged and processed food categories worldwide

Restraint/Challenge

High Cost of Eco-Friendly Material Production

- The shift toward sustainable single-serve packaging faces challenges due to the high cost of producing biodegradable and compostable materials compared to conventional plastics. Raw materials derived from renewable sources such as starch, sugarcane, or cellulose generally involve complex production processes that raise overall manufacturing expenses

- For instance, Tetra Pak and Sealed Air Corporation have reported increased operational costs while transitioning toward paper and bio-based polymers for their single-portion packaging lines. These costs stem from intensive R&D efforts, specialized equipment, and supply chain adaptation necessary for sustainable material implementation at scale

- Limited availability of cost-effective biodegradable feedstocks and established recycling infrastructures in developing regions further constrains adoption. This imbalance makes sustainable single-serve packaging less accessible to small and mid-sized producers lacking investment capacity for green material conversion

- Production stability and mechanical performance of alternative materials such as bioplastics also present challenges, as they must maintain heat, moisture, and puncture resistance similar to petroleum-based options. Meeting these performance expectations while preserving eco-friendly attributes increases formulation complexity and expenses

- Addressing these cost and scalability factors through technological innovation, improved raw material supply chains, and collaborative industry initiatives will be essential to reduce manufacturing barriers, supporting the long-term viability and affordability of eco-conscious single-serve packaging solutions

Single-Serve Packaging Market Scope

The market is segmented on the basis of product, material, and application.

- By Product

On the basis of product, the single-serve packaging market is segmented into cans, bottles, pouches, and others. The pouches segment dominated the market with the largest revenue share in 2024, driven by its lightweight nature, portability, and cost-effective production. Pouches are widely used for snacks, ready-to-drink beverages, and instant meals, appealing to consumers seeking convenience and portion control. Their flexible structure allows easy storage and reduced material use, aligning with sustainability goals. The growing popularity of resealable and stand-up pouch formats further enhances their appeal among food and beverage manufacturers aiming to extend product freshness and shelf life.

The bottles segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising demand in the beverage industry and innovations in recyclable and biodegradable bottle materials. Single-serve bottles provide durability and user-friendly handling, especially for on-the-go consumers in urban environments. Manufacturers are increasingly adopting PET and bio-based plastics to improve sustainability while maintaining product safety and visual appeal. The segment’s expansion is also supported by increased consumption of functional drinks, dairy products, and cold brews, where bottle-based single servings ensure controlled portions and freshness.

- By Material

On the basis of material, the single-serve packaging market is segmented into paper and paperboard, wood, plastics, and metals. The plastics segment dominated the market with a share of 44.78% in 2024 due to its versatility, strength, and ability to create lightweight, tamper-resistant packaging solutions. Plastics enable superior barrier properties against moisture and oxygen, ensuring product preservation across food and beverage applications. The development of recyclable and bio-based plastic materials has further driven adoption among eco-conscious brands. Manufacturers also favor plastic for its molding flexibility and cost efficiency in mass production of portion-controlled packages.

The paper and paperboard segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by growing environmental awareness and demand for sustainable packaging alternatives. Paper-based single-serve packs are gaining traction due to their biodegradability and ease of printing for branding purposes. The food and beverage industries increasingly prefer paperboard cartons and cups to replace plastic-based formats, particularly for ready-to-eat and drink products. Technological advancements in barrier coatings have enhanced the functionality of paper materials, making them suitable for liquid packaging without compromising product integrity.

- By Application

On the basis of application, the single-serve packaging market is segmented into food, beverages, healthcare, and personal care. The food segment dominated the market with the largest revenue share in 2024, driven by the rising preference for portion-controlled snacks, ready meals, and convenience foods. Urbanization, busy lifestyles, and the increasing number of single-person households have fueled demand for compact and easy-to-carry food packaging. Food manufacturers leverage single-serve formats to minimize waste, ensure freshness, and meet hygienic standards. The trend of healthy snacking and meal replacement products further boosts this segment’s dominance.

The beverages segment is projected to register the fastest growth from 2025 to 2032, propelled by the surge in consumption of energy drinks, cold brews, and nutritional beverages. Single-serve packaging in this segment ensures portion consistency, extended shelf life, and portability, catering to active consumers. Innovations in recyclable bottles, aluminum cans, and flexible pouch designs enhance sustainability and appeal. The growing preference for on-the-go hydration and functional drinks among health-conscious consumers continues to create lucrative opportunities for beverage packaging manufacturers.

Single-Serve Packaging Market Regional Analysis

- North America dominated the single-serve packaging market with the largest revenue share of 41.12% in 2024, driven by the rising consumption of convenience foods, beverages, and ready-to-eat products

- The region’s consumers increasingly prefer on-the-go meal solutions and portion-controlled packaging formats that align with fast-paced lifestyles

- The growing demand for sustainable and recyclable materials is also reshaping packaging strategies among key players. Strong presence of established food and beverage brands, coupled with technological advancements in packaging machinery, continues to boost market growth

U.S. Single-Serve Packaging Market Insight

The U.S. single-serve packaging market captured the largest revenue share within North America in 2024, supported by the widespread adoption of convenience-oriented and eco-friendly packaging formats. The growing trend toward portion control and waste reduction has fueled demand for single-serve packs in snacks, dairy, and beverage segments. Consumers are increasingly drawn to resealable pouches and recyclable bottles, aligning with sustainability goals. The strong presence of multinational food and drink companies, alongside innovation in lightweight and biodegradable packaging materials, is further accelerating market expansion.

Europe Single-Serve Packaging Market Insight

The Europe single-serve packaging market is projected to grow at a steady CAGR during the forecast period, driven by stringent sustainability regulations and growing consumer preference for recyclable packaging. European consumers increasingly favor portion-controlled packs that promote convenience while minimizing food waste. The market benefits from the adoption of paper-based and compostable materials, supported by initiatives promoting circular economy practices. Growth is prominent in food and beverage sectors, particularly among ready meals, dairy, and personal care applications across the region.

U.K. Single-Serve Packaging Market Insight

The U.K. single-serve packaging market is expected to record notable growth during the forecast period, fueled by the increasing demand for portable food and beverage solutions. The shift toward sustainable packaging materials such as paperboard and bio-based plastics is gaining momentum among manufacturers. Rising consumer awareness about eco-friendly consumption and government efforts to curb single-use plastics are reshaping packaging strategies. The robust retail and e-commerce infrastructure in the U.K. further supports the uptake of compact, easy-to-handle packaging formats.

Germany Single-Serve Packaging Market Insight

The Germany single-serve packaging market is anticipated to expand steadily, driven by the country’s focus on sustainability, innovation, and efficient resource utilization. German consumers prioritize environmentally responsible packaging, prompting manufacturers to invest in recyclable and reusable materials. The growing popularity of single-serve dairy products, ready-to-drink beverages, and portioned condiments contributes to the segment’s strength. Technological advancements in automated filling and sealing systems further enhance the efficiency and precision of single-serve production lines.

Asia-Pacific Single-Serve Packaging Market Insight

The Asia-Pacific single-serve packaging market is expected to grow at the fastest CAGR during 2025–2032, supported by rapid urbanization, rising disposable incomes, and the expansion of the food and beverage industry. Consumers in emerging economies such as China, India, and Indonesia are increasingly opting for convenient and hygienic packaging solutions suitable for on-the-go consumption. Government initiatives promoting sustainable materials and domestic manufacturing capacity are also driving regional growth. Expanding retail networks and growing online food delivery services further boost the adoption of single-serve formats.

China Single-Serve Packaging Market Insight

China dominated the Asia-Pacific market in 2024, attributed to its massive food processing industry, expanding urban population, and growing demand for portioned meal and drink options. The country’s packaging sector is undergoing rapid transformation, with increasing investment in recyclable and biodegradable materials. Rising adoption of modern retail formats and e-commerce platforms supports higher consumption of packaged goods. The strong presence of domestic packaging manufacturers offering cost-effective solutions continues to strengthen China’s leadership in the regional market.

India Single-Serve Packaging Market Insight

India is anticipated to witness the fastest growth rate within Asia-Pacific, driven by shifting consumer preferences toward convenience food, single-use beverages, and affordable portion packs. The growing working-class population and expansion of quick-service restaurants are major factors fueling demand. Government efforts to promote eco-friendly packaging and waste management are encouraging manufacturers to adopt sustainable materials. Moreover, the increasing influence of organized retail and online grocery platforms further accelerates the penetration of single-serve packaging solutions.

Single-Serve Packaging Market Share

The single-serve packaging industry is primarily led by well-established companies, including:

- T.H.E.M. (U.S.)

- Sonic Packaging (U.S.)

- JHS PACKAGING (U.S.)

- Amcor plc (Switzerland)

- Transcontinental Inc. (Canada)

- Tetra Pak (Switzerland)

- American Beverage Corporation (U.S.)

- SNAPSIL (Australia)

- Sealed Air (U.S.)

- Aranow Packaging Machinery (Spain)

- American FlexPack (U.S.)

- Elis Packaging Solutions, Inc. (U.S.)

- MattPak (U.S.)

- LIQUIPAK CORPORATION (U.S.)

- Assemblies Unlimited, Inc. (U.S.)

- M.J. Rapoport & Company, Inc. (U.S.)

- The Box Co-Op (U.S.)

Latest Developments in Global Single-Serve Packaging Market

- In October 2025, Amcor plc introduced a new portfolio of fully recyclable mono-material pouches specifically designed for single-serve food and beverage packaging, marking a significant step toward a circular packaging economy. The innovation replaces traditional multi-layer plastic structures with high-barrier recyclable films, improving both sustainability and performance. This advancement allows manufacturers to reduce material waste while maintaining product integrity, freshness, and visual appeal. The initiative is expected to accelerate the shift toward environmentally responsible single-serve solutions, particularly in snack foods, coffee, and dairy-based beverages, reinforcing Amcor’s leadership in sustainable packaging innovation

- In August 2025, Tetra Pak launched its next-generation plant-based single-serve carton packaging made entirely from renewable materials, featuring advanced barrier coatings that extend product shelf life without compromising recyclability. The company’s development aims to meet the rising demand for sustainable, lightweight, and portable beverage packaging. This initiative directly supports Tetra Pak’s long-term sustainability vision of net-zero emissions and reduced dependence on fossil-based materials. The innovation is projected to transform the beverage industry by encouraging a large-scale transition to renewable, eco-efficient single-serve packaging options

- In May 2025, Nestlé unveiled a comprehensive initiative to expand the use of paper-based single-serve packaging across its coffee, confectionery, and dairy product portfolios. This move replaces conventional plastic formats with recyclable and compostable paper materials that align with Nestlé’s goal of achieving 100% recyclable or reusable packaging by 2025. The company’s large-scale adoption is expected to set a benchmark for the industry, prompting other major brands to accelerate similar sustainability transitions. This development is poised to drive innovation in fiber-based packaging and strengthen consumer trust in eco-conscious single-serve products

- In November 2024, Lactips and Walki Group entered into a joint development agreement to produce fully biodegradable, plastic-free food packaging using natural polymers recyclable within the paper stream. By combining Lactips’ expertise in natural polymer formulation with Walki’s advanced production technologies, the collaboration aims to offer a sustainable alternative to conventional plastic films. This partnership supports the growing consumer and regulatory demand for environmentally friendly packaging, positioning both companies at the forefront of the shift toward circular single-serve packaging solutions

- In July 2024, the U.S. government announced a comprehensive strategy to combat plastic pollution, targeting the entire lifecycle of plastic products through federal policy reforms. A key focus of the strategy is the phased elimination of single-use plastics in federal procurement, with specific milestones set for 2027 and 2035. This initiative is expected to catalyze widespread adoption of reusable, compostable, and recyclable materials in single-serve packaging. It will also stimulate innovation among manufacturers seeking to comply with new sustainability standards, reinforcing the shift toward an eco-conscious packaging ecosystem across multiple industries

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Single Serve Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Single Serve Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Single Serve Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.