Global Single Use Bioprocessing Probes And Sensors Market

Market Size in USD Billion

CAGR :

%

USD

3.54 Billion

USD

9.55 Billion

2024

2032

USD

3.54 Billion

USD

9.55 Billion

2024

2032

| 2025 –2032 | |

| USD 3.54 Billion | |

| USD 9.55 Billion | |

|

|

|

|

Single-Use Bioprocessing Probes and Sensors Market Size

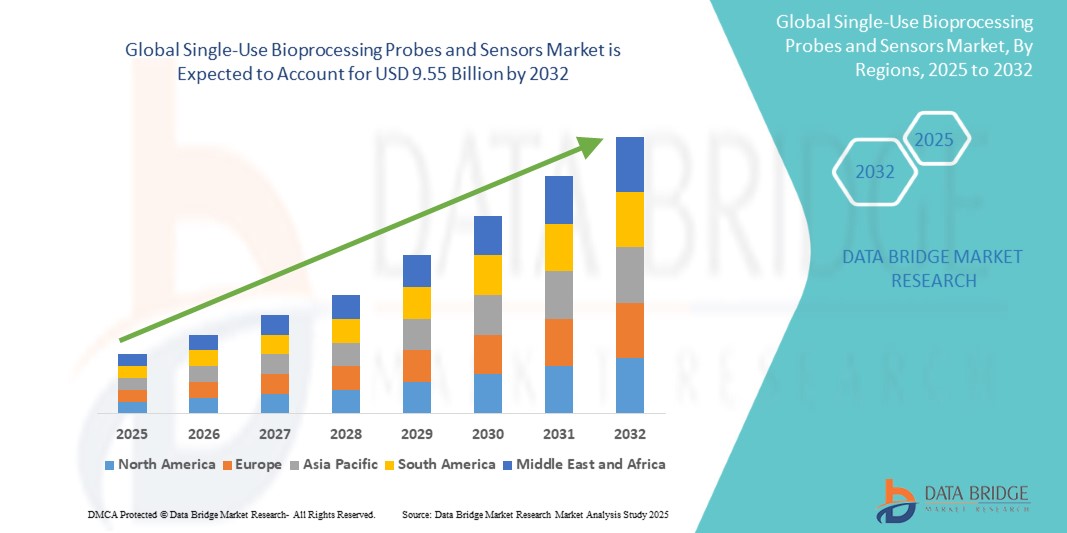

- The global single-use bioprocessing probes and sensors market size was valued at USD 3.54 billion in 2024 and is expected to reach USD 9.55 billion by 2032, at a CAGR of 13.2% during the forecast period

- The market growth is largely fueled by the growing adoption and technological progress within biopharmaceutical manufacturing and single-use technologies, leading to increased digitalization and efficiency across upstream and downstream processes

- Furthermore, rising demand for secure, user-friendly, and contamination-free monitoring solutions in bioprocessing is establishing Single-Use Bioprocessing Probes and Sensors as the preferred alternative to traditional reusable counterparts. These converging factors are accelerating the uptake of Single-Use Bioprocessing Probes and Sensors solutions, thereby significantly boosting the industry's growth

Single-Use Bioprocessing Probes and Sensors Market Analysis

- Single-use bioprocessing probes and sensors, which offer disposable, contamination-free solutions for monitoring critical parameters such as pH, dissolved oxygen, and pressure, are increasingly becoming indispensable in the biopharmaceutical manufacturing process due to their sterility, reduced turnaround time, and cost-effectiveness

- The growing shift toward personalized medicine, the rising number of biologics and biosimilars in development, and the increasing adoption of disposable technologies by contract manufacturing organizations (CMOs) are major drivers propelling the demand for single-use sensors in upstream and downstream processing

- North America dominated the single-use bioprocessing probes and sensors market with the largest revenue share of 41.88% in 2024, supported by the region’s mature biopharmaceutical industry, strong presence of leading biomanufacturers, and rising demand for cost-efficient, scalable bioproduction systems

- Asia-Pacific is expected to witness the fastest growth in the single-use bioprocessing probes and sensors market during the forecast period, driven by expanding biopharma infrastructure, favorable government initiatives, and increased investment in biotech R&D across countries such as China, India, and South Korea

- The upstream segment dominated the single-use bioprocessing probes and sensors market, with a market revenue share of 62.3% in 2024, driven by the widespread adoption of single-use technologies in cell culture, fermentation, and media preparation processes. These systems offer operational flexibility, reduced contamination risks, and faster batch turnovers

Report Scope and Single-Use Bioprocessing Probes and Sensors Market Segmentation

|

Attributes |

Single-Use Bioprocessing Probes and Sensors Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Single-Use Bioprocessing Probes and Sensors Market Trends

“Technological Advancements and Intelligent Monitoring Systems Driving Market Growth”

- A significant and accelerating trend in the global single-use bioprocessing probes and sensors market is the increasing integration of advanced technologies designed to enhance process control, data accuracy, and operational efficiency in biopharmaceutical manufacturing environments

- Innovations in sensor technologies are enabling real-time, non-invasive monitoring of critical process parameters such as pH, dissolved oxygen, temperature, pressure, and conductivity. For instance, single-use pH and DO sensors are being increasingly adopted for upstream bioprocessing to reduce contamination risks and ensure data integrity

- Advanced probes and sensors are now capable of self-calibration and error diagnostics, minimizing downtime and manual intervention. These features contribute significantly to maintaining sterility and compliance in GMP manufacturing facilities

- Integration with digital platforms and bioprocess management systems allows for seamless data logging and predictive analytics. Manufacturers can now track trends, detect anomalies early, and optimize yield and quality in real time using advanced process analytical technology (PAT) frameworks

- Furthermore, the increased use of modular, flexible biomanufacturing setups is propelling demand for plug-and-play single-use probes and sensors that support faster batch turnover and scale-up/down processes.

- Companies such as Sartorius, Thermo Fisher Scientific, and Hamilton Company are at the forefront of developing next-generation single-use sensor solutions tailored for upstream and downstream bioprocess workflows. These solutions align with the growing need for flexibility, reduced risk of contamination, and faster time-to-market for biologics and personalized medicines

- As the biopharmaceutical industry continues its transition toward continuous manufacturing and automation, the demand for intelligent, pre-calibrated, and disposable sensors is expected to rise sharply, making them an integral component of future-ready bioprocessing systems

Single-Use Bioprocessing Probes and Sensors Market Dynamics

Driver

“Growing Need Due to Bioprocess Efficiency and Demand for Contamination-Free Monitoring”

- The increasing demand for biologics, vaccines, and cell therapies, coupled with the rise of modular and continuous manufacturing facilities, is significantly driving the adoption of single-use bioprocessing probes and sensors

- For instance, in April 2024, Sartorius launched its new integrated single-use sensor suite for upstream applications, enabling precise, real-time monitoring of critical process parameters such as pH, dissolved oxygen, and conductivity without compromising sterility. Such advancements by leading players are expected to drive the Single-Use Bioprocessing Probes and Sensors industry growth throughout the forecast period

- As manufacturers prioritize sterility assurance and quick turnaround times, single-use sensors eliminate the need for cleaning and validation, offering improved safety and cost-efficiency. These probes also reduce the risk of cross-contamination in multi-product manufacturing environments

- In addition, the growing prevalence of decentralized manufacturing and mobile bioprocessing units necessitates flexible, scalable, and disposable monitoring solutions, making single-use sensors a critical component of modern biopharmaceutical setups

- The convenience of pre-calibrated, plug-and-play sensor modules and their compatibility with automated control systems are key drivers boosting adoption. Increasing demand from CMOs and CROs further amplifies the market as they seek rapid deployment solutions with reduced downtime

Restraint/Challenge

“Concerns Regarding Measurement Accuracy and High Implementation Costs”

- Despite the growing popularity of single-use technologies, concerns persist regarding the long-term accuracy, reliability, and durability of disposable probes compared to traditional reusable sensors

- For instance, high-precision applications in downstream purification or final fill-finish processes demand tight tolerances and real-time quality control, where any sensor failure could risk batch integrity or regulatory non-complianc

- Addressing these challenges requires significant R&D investment from manufacturers to improve sensor calibration, response times, and robustness. Companies such as Thermo Fisher Scientific and Hamilton are actively developing next-gen sensor solutions with enhanced stability and longer shelf lives to build industry confidence

- In addition, the initial cost of transitioning to single-use bioprocessing infrastructure, including compatible sensor systems and connectors, remains a barrier for small- to mid-sized manufacturers. Integration challenges with legacy control platforms also limit immediate adoption

- However, increasing regulatory support for single-use technology, growing demand for flexible biomanufacturing, and innovations aimed at improving sensor precision and lifecycle are expected to overcome these hurdles and foster long-term growth in the market

Single-Use Bioprocessing Probes and Sensors Market Scope

The market is segmented on the basis of type, workflow, and end user.

• By Type

On the basis of type, the Single-Use Bioprocessing Probes and Sensors market is segmented into pH sensors, oxygen sensors, pressure sensors, temperature sensors, conductivity sensors, flow meters and sensors, and others. The pH sensors segment dominated the largest market revenue share of 27.4% in 2024, driven by their critical role in real-time monitoring of cell culture environments and maintaining process stability in upstream bioprocessing applications. These sensors are essential for ensuring optimal growth conditions and maintaining product quality.

The oxygen sensors segment is anticipated to witness the fastest growth rate of 21.3% from 2025 to 2032, owing to the rising demand for precise monitoring of dissolved oxygen levels in bioreactors. Enhanced oxygen control helps improve product yield and ensures regulatory compliance, particularly in large-scale biologics manufacturing.

• By Workflow

On the basis of workflow, the Single-Use Bioprocessing Probes and Sensors market is segmented into upstream and downstream. The upstream segment accounted for the largest market revenue share of 62.3% in 2024, driven by widespread adoption of single-use technologies in cell culture, fermentation, and media preparation processes. These systems offer operational flexibility, reduced contamination risks, and faster batch turnovers.

The downstream segment is expected to witness the fastest CAGR of 19.8% from 2025 to 2032, attributed to the increased use of disposable sensors and probes in chromatography and filtration steps. The push for closed and continuous downstream processing is also driving demand for single-use sensors that enhance process control and data accuracy.

• By End User

On the basis of end user, the Single-Use Bioprocessing Probes and Sensors market is segmented into biopharmaceutical manufacturers, CMOs and CROs, and others. The biopharmaceutical manufacturers segment held the largest market revenue share of 58.6% in 2024, due to increasing in-house production of biologics, mAbs, and vaccines. These companies prefer integrated single-use systems to streamline operations, reduce validation time, and meet stringent regulatory standards.

The CMOs and CROs segment is projected to witness the fastest CAGR of 20.7% from 2025 to 2032, driven by the rising trend of outsourcing bioprocessing operations to contract organizations for cost-efficiency and scalability. These service providers are rapidly adopting single-use sensors to meet client needs for flexibility and compliance.

Single-Use Bioprocessing Probes and Sensors Market Regional Analysis

- North America dominated the single-use bioprocessing probes and sensors market with the largest revenue share of 41.88% in 2024, driven by the rising adoption of disposable bioprocessing technologies, increased biologics production, and the presence of leading biopharmaceutical companies utilizing advanced monitoring tools

- Biopharmaceutical manufacturers in the region prioritize process efficiency, contamination control, and real-time data collection—factors that single-use sensors deliver effectively, especially in upstream and downstream bioproduction

- This strong uptake is supported by a well-established healthcare infrastructure, favorable regulatory frameworks, and high investment in biologics R&D, making single-use probes and sensors critical in ensuring GMP compliance across North American facilities

U.S. Single-Use Bioprocessing Probes and Sensors Market Insight

The U.S. single-use bioprocessing probes and sensors market captured the largest revenue share of 88% in 2024 within North America, driven by a rapidly expanding biopharmaceutical manufacturing base and increasing shift towards flexible, single-use systems. Growing demand for biologics, vaccines, and personalized medicines has prompted major manufacturers to implement advanced sensor solutions for real-time monitoring of critical parameters such as pH, dissolved oxygen (DO), and pressure. Moreover, government funding for innovative biomanufacturing technologies is further propelling market growth.

Europe Single-Use Bioprocessing Probes and Sensors Market Insight

The Europe single-use bioprocessing probes and sensors market is projected to expand at a robust CAGR during the forecast period, supported by strict quality assurance norms, increased biopharmaceutical activity, and regional initiatives promoting sustainable manufacturing. Countries such as Germany, France, and the U.K. are witnessing a surge in demand for single-use probes, especially in contract manufacturing and biosimilar production. The European Medicines Agency’s stringent quality guidelines also reinforce the demand for accurate, single-use monitoring solutions.

U.K. Single-Use Bioprocessing Probes and Sensors Market Insight

The U.K. single-use bioprocessing probes and sensors market is anticipated to grow at a noteworthy CAGR over the forecast period, owing to its strong presence of biotech startups, expanding clinical trials landscape, and government incentives supporting life sciences R&D. The country is adopting advanced sensor technologies to support cell and gene therapy production, with rising demand for single-use sensors capable of maintaining sterility and precision across closed systems.

Germany Single-Use Bioprocessing Probes and Sensors Market Insight

The Germany single-use bioprocessing probes and sensors market is expected to grow significantly, driven by its leadership in industrial automation, pharmaceutical innovation, and biologics manufacturing. German manufacturers are increasingly deploying single-use sensors to enhance production flexibility, minimize contamination, and meet evolving GMP standards. Investments in modular biomanufacturing facilities are further encouraging the integration of disposable, real-time sensing technologies.

Asia-Pacific Single-Use Bioprocessing Probes and Sensors Market Insight

The Asia-Pacific single-use bioprocessing probes and sensors market is projected to grow at the fastest CAGR of 24% from 2025 to 2032, fueled by rising biologics manufacturing in China, India, South Korea, and Japan. Government support for biotech infrastructure development, along with cost-effective contract development and manufacturing organizations (CDMOs), is driving strong demand for disposable bioprocessing tools. The ability of single-use sensors to reduce cleaning validation costs and shorten production cycles aligns well with the APAC market’s scalability requirements.

Japan Single-Use Bioprocessing Probes and Sensors Market Insight

The Japan single-use bioprocessing probes and sensors market is experiencing a steady rise in demand for single-use sensors, largely due to the country’s expanding regenerative medicine sector, adoption of closed-loop manufacturing, and focus on high-precision therapeutic development. As Japanese firms seek greater efficiency in producing high-value biologics, disposable probes for pH, conductivity, and DO monitoring are becoming standard in next-gen bioprocessing systems.

China Single-Use Bioprocessing Probes and Sensors Market Insight

The China single-use bioprocessing probes and sensors market held the largest market share in Asia-Pacific in 2024, attributed to growing domestic biologics production, aggressive investment in life sciences, and the expansion of local CDMOs. The government's "Made in China 2025" policy emphasizes biopharma as a key sector, encouraging adoption of disposable systems, including single-use probes and sensors. Local innovation, combined with international partnerships, is making China a leading market for scalable bioproduction solutions.

Single-Use Bioprocessing Probes and Sensors Market Share

The single-use bioprocessing probes and sensors industry is primarily led by well-established companies, including:

- Sartorius AG (Germany)

- Thermo Fisher Scientific (U.S.)

- Danaher Corporation (U.S.)

- PreSens Precision Sensing GmbH (Germany)

- ABEC (U.S.)

- Hamilton Company (U.S.)

- PendoTECH LLC (U.S.)

- Equflow (Netherlands)

- Parker Hannifin Corporation (U.S.)

- Malema Engineering Corporation (U.S.)

- Dover Corporation (U.S.)

- Broadley-James Corporation (U.S.)

- High Purity New England, Inc. (U.S.)

- Cole-Parmer Instrument Company, LLC. (U.S.)

- ESI Ultrapure (U.S.)

Latest Developments in Global Single-Use Bioprocessing Probes and Sensors Market

- In April 2025, Sartorius Stedim Biotech established a strategic partnership with Tulip Interfaces to launch Biobrain Operate powered by Tulip, a no-code, digital manufacturing platform supporting single-use bioreactors. This solution enhances data integration, operational visibility, and error reduction in single-use workflows

- In April 2025, AGC Biologics expanded its single-use production capabilities by integrating two Thermo Scientific DynaDrive 5,000 L single-use bioreactors at its Yokohama, Japan facility. This move positions the site among the most advanced in Japan for large-scale biologics production using single-use systems

- In March 2022, ABEC collaborated with EKF Life Science for expanding its Biomanufacturing operations in U.S. market

- In November 2021, Sartorius AG announced that it will expand its operation, production, innovation and storage facilities in France by investing 100 million Euros by 2025

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.