Global Single Use Bioreactors Market

Market Size in USD Billion

CAGR :

%

USD

3.54 Billion

USD

8.64 Billion

2025

2033

USD

3.54 Billion

USD

8.64 Billion

2025

2033

| 2026 –2033 | |

| USD 3.54 Billion | |

| USD 8.64 Billion | |

|

|

|

|

Single-Use Bioreactors Market Size

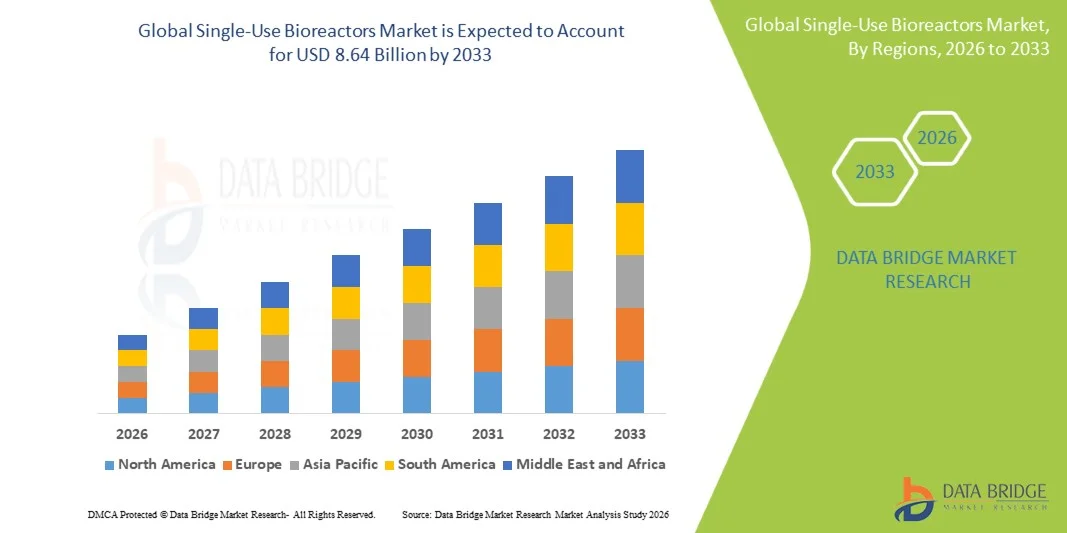

- The global single-use bioreactors market size was valued at USD 3.54 billion in 2025 and is expected to reach USD 8.64 billion by 2033, at a CAGR of 11.80% during the forecast period

- The market growth is largely fueled by rising demand for biologics, including monoclonal antibodies, vaccines, and gene- and cell-based therapies, coupled with the operational advantages of single-use systems such as flexibility, lower contamination risk, and reduced cleaning and validation costs

- Furthermore, increasing adoption by contract manufacturing organizations (CMOs), expanding applications in cell and gene therapy production, and continuous technological innovations in bioreactor bags, integrated sensors, and process monitoring systems are establishing single-use bioreactors as the modern choice for biomanufacturing

Single-Use Bioreactors Market Analysis

- Single‑use bioreactors, providing disposable, pre-sterilized systems for cell culture and bioprocessing, are increasingly critical components in modern biologics and vaccine production due to their operational flexibility, reduced contamination risk, and seamless integration with automated manufacturing workflows

- The escalating demand for single‑use bioreactors is primarily fueled by the growing production of monoclonal antibodies, vaccines, and gene- and cell-based therapies, increasing adoption by contract manufacturing organizations (CMOs), and a rising preference for scalable, cost-efficient, and low-maintenance bioprocessing solutions

- North America dominated the single‑use bioreactors market with the largest revenue share of 43% in 2025, characterized by early adoption of advanced bioprocessing technologies, strong R&D infrastructure, and the presence of key industry players, particularly in the U.S., where innovations in stirred-tank single-use bioreactors are driving substantial deployment

- Asia-Pacific is expected to be the fastest-growing region in the single-use bioreactors market during the forecast period due to increasing biologics manufacturing capacity, favorable regulatory support, and rising investments in contract biomanufacturing infrastructure in China and India

- Stirred-tank single-use bioreactors segment dominated the market with a market share of 79.6% in 2025, driven by their versatility, efficient mixing, and oxygen transfer capabilities, making them the preferred choice across applications including research & development, process development, and commercial manufacturing

Report Scope and Single-Use Bioreactors Market Segmentation

|

Attributes |

Single-Use Bioreactors Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Single-Use Bioreactors Market Trends

“Accelerated Adoption Through Automation and Advanced Sensor Integration”

- A significant and accelerating trend in the global single-use bioreactors market is the deeper integration of advanced sensors, automation software, and real-time analytics, enabling higher precision, consistency, and efficiency across both upstream and downstream bioprocessing workflows

- For instance, Thermo Fisher Scientific’s HyPerforma DynaDrive SUB integrates advanced single-use sensors that monitor pH, dissolved oxygen, and pressure in real time, improving control during complex biologics production cycles

- Automation in single-use bioreactors enables features such as adaptive process control, predictive monitoring, and automated feeding strategies, improving culture performance and reducing operator intervention. For instance, Sartorius’ BIOSTAT STR system uses digital twins and automated feedback loops to optimize cell growth parameters

- The seamless integration of single-use bioreactors with digital bioprocessing platforms facilitates centralized process oversight, allowing users to monitor parameters, run analytics, and adjust operational settings through unified interfaces across multiple production units

- This trend toward more intelligent, intuitive, and connected bioprocessing systems is reshaping expectations for modern biologics manufacturing, driving demand for systems capable of scalable and automated high-performance production

- Consequently, companies such as Cytiva are developing next-generation single-use bioreactors featuring enhanced automation, advanced control software, and interconnected sensor technologies to support high-efficiency manufacturing environments

- The demand for bioreactor systems offering seamless automation and advanced data connectivity is rising rapidly across biopharmaceutical and contract manufacturing sectors, as producers increasingly prioritize reliability, sterility assurance, and real-time process optimization

Single-Use Bioreactors Market Dynamics

Driver

“Growing Need Due to Rising Biologics Demand and Flexible Manufacturing Adoption ”

- The increasing prevalence of biologics demand including monoclonal antibodies, vaccines, and cell- and gene-based therapies combined with the accelerating adoption of flexible manufacturing facilities, is a significant driver for the rapid growth of single-use bioreactors

- For instance, in March 2025, Cytiva announced an expansion of its single-use manufacturing capacity to support higher global demand for disposable bioprocessing solutions, reinforcing the industry's shift toward flexible and rapid-deployment facilities

- As biopharmaceutical companies seek scalable, contamination-resistant, and cost-efficient production systems, single-use bioreactors offer strong advantages such as reduced cleaning, lower validation requirements, and faster changeover times compared to stainless-steel systems

- Furthermore, the rising popularity of modular and multi-product biomanufacturing facilities is making single-use bioreactors an essential technology, enabling seamless integration with other disposable components across upstream and downstream processes

- The convenience of rapid setup, reduced downtime, and simplified workflow management is propelling adoption in both clinical and commercial settings, with growing utilization across pharmaceutical, biopharmaceutical, and CMO/CDMO segments worldwide

- The ability to maintain high cell viability, reproducibility, and lot-to-lot consistency makes these media solutions critical for achieving high yields, especially in mammalian cell-based production

- The widespread growth of CDMOs and the increase in multi-product manufacturing facilities further contribute to the rapid adoption of single-use media formats optimized for quick turnaround and diversified therapeutic pipelines

Restraint/Challenge

“Material Compatibility Issues and Regulatory Compliance Hurdles”

- Concerns surrounding material-extractables and leachables in polymer-based components of single-use systems pose a significant challenge to broader market penetration, especially for regulatory-sensitive applications in commercial biologics manufacturing

- For instance, reports of variability in material composition across certain single-use bioprocessing films have made some producers cautious about adopting disposable systems for high-potency biologics or long-duration culture processes

- Addressing these risks through consistent film formulation, validated compatibility studies, and stringent supplier qualification is crucial for building confidence among regulatory bodies and manufacturers seeking long-term reliability

- In addition, the relatively higher recurring cost of disposable bags, components, and specialized sensors compared to reusable stainless-steel systems can be a barrier for cost-sensitive facilities or emerging-market biomanufacturers with tight operational budgets

- While manufacturers are increasingly offering more robust film technologies and cost-optimized SUB platforms, the perception of material limitations and long-term regulatory scrutiny continues to hinder accelerated adoption in certain large-scale production environments

- Overcoming these challenges through improved raw-material traceability, diversified supply partnerships, and scale-driven cost reductions will be vital for expanding the global uptake of high-performance single-use bioreactor media solutions

Single-Use Bioreactors Market Scope

The market is segmented on the basis of type, cell type, molecule type, application, and end user.

- By Type

On the basis of type, the market is segmented into stirred-tank single-use bioreactors, wave-induced single-use bioreactors, bubble-column single-use bioreactors, and others. The stirred-tank single-use bioreactors segment dominated the market with the largest revenue share of 79.6% in 2025, driven by its strong suitability for monoclonal antibody production and large-scale biologics manufacturing. Manufacturers prefer stirred-tank systems due to their efficient mixing capabilities, robust oxygen transfer, and similarity to stainless-steel bioreactors, enabling easier process transfer. Their scalability from small developmental volumes to commercial capacities strengthens adoption across the biopharmaceutical sector. The ability to integrate advanced sensors and automation controls further enhances process consistency and yield reliability. Growing use in multiproduct facilities and increased adoption by global CDMOs In addition contribute to segment dominance.

The wave-induced single-use bioreactors segment is anticipated to witness the fastest growth rate from 2026 to 2033, driven by rising adoption in seed train expansion, viral vector production, and cell and gene therapy workflows. These systems offer gentle mixing environment ideal for shear-sensitive cell lines such as stem cells and gene-modified cells, making them highly valuable in next-generation biologics manufacturing. The ease of setup, rapid batch turnover, and lower operational costs make wave-induced systems attractive to emerging biotech firms. Their flexibility supports accelerated development cycles in early-stage programs and small-batch clinical production. Increasing investments in cell therapy infrastructure across Asia-Pacific and Europe further boost demand for these reactors. As personalized medicine continues to evolve, wave-based systems are expected to become increasingly integral to advanced therapy production.

- By Cell Type

On the basis of cell type, the market is segmented into mammalian cells, bacterial cells, yeast cells, and others. The mammalian cells segment dominated the market with the largest share in 2025, driven by the widespread use of mammalian expression systems for monoclonal antibodies, vaccines, and therapeutic proteins. Mammalian cell lines such as CHO and HEK293 require specialized, controlled environments, making single-use systems ideal due to their sterility and reduced contamination risk. Biopharmaceutical companies increasingly rely on disposable bioreactors to support rapid scale-up of mammalian-based biologics. The alignment of single-use platforms with regulatory expectations for consistent and contamination-free production further strengthens adoption. Strong growth in biosimilars and next-generation biologics continues to reinforce segment leadership.

The others segment, particularly stem cells and gene-modified cells, is expected to witness the fastest growth from 2026 to 2033, driven by rapid expansion of cell and gene therapy development. These cell types require closed-system, sterile, and flexible culture environments, making single-use bioreactors well-suited for maintaining viability and product quality. Increasing pipeline activities in autologous and allogeneic therapies create strong demand for small-to-medium volume disposable systems. The rise of specialized CGT manufacturing facilities globally also supports the accelerated uptake of advanced single-use platforms. As more personalized treatments move into clinical and commercial phases, bioreactors optimized for stem and genetically modified cells are expected to see substantial growth. Growing investments by biotech companies into regenerative medicine further drive this expansion.

- By Molecule Type

On the basis of molecule type, the market is segmented into monoclonal antibodies, vaccines, stem cells, gene-modified cells, and other recombinant proteins. The monoclonal antibodies segment dominated the market with the largest revenue share in 2025, supported by growing global demand for MAb therapeutics targeting oncology, autoimmune disorders, and chronic diseases. Single-use bioreactors are widely adopted for mAb manufacturing due to their scalability, sterility, and ability to support high-density mammalian cell culture. Biopharmaceutical companies benefit from reduced cleaning, faster turnaround, and flexible facility layouts enabled by disposable systems. The increasing number of biosimilar approvals worldwide continues to fuel demand for cost-effective, multiproduct biomanufacturing. Strong adoption by CDMOs producing diverse mAb portfolios further contributes to segment dominance.

The gene-modified cells segment is anticipated to witness the fastest CAGR from 2026 to 2033, driven by rising development of CAR-T and other engineered cell-based therapies. These therapies require highly controlled production environments, making single-use systems the preferred choice for ensuring aseptic processing. The small-batch, patient-specific nature of advanced therapies aligns well with the flexibility and rapid changeover capabilities of disposable bioreactors. Growing clinical success of engineered cell therapies has prompted large-scale investments in dedicated manufacturing facilities globally. As regulatory frameworks become more standardized for cell-based therapies, demand for GMP-compliant single-use systems is expected to surge. Increasing focus on scalable, closed bioprocessing technologies further accelerates growth in this segment.

- By Application

On the basis of application, the market is segmented into research & development, process development, and commercial manufacturing. The commercial manufacturing segment dominated the market with the largest revenue share in 2025, driven by increasing adoption of single-use technologies for full-scale biologics production. Pharmaceutical and biopharmaceutical companies utilize single-use bioreactors to achieve faster batch turnover and reduced contamination risk in multiproduct environments. Disposable systems minimize cleaning and validation requirements, making them ideal for flexible manufacturing strategies. The rise of biosimilars and new biologic modalities has prompted investment in single-use–enabled commercial facilities. Growing reliance on CDMOs that prefer disposable systems for cost-efficiency further strengthens this segment. Regulatory acceptance of SUS-based commercial processes continues to support widespread deployment.

The process development segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by the expanding development pipelines for biologics, vaccines, and advanced cell therapies. Researchers favor single-use bioreactors for their ability to rapidly test multiple process conditions without the constraints of cleaning or sterilization. These systems enable seamless scalability from laboratory to pilot-scale operations, improving efficiency in early-stage development. The rising need to accelerate time-to-clinic and time-to-market for emerging therapeutics supports the shift toward flexible disposable technologies. Adoption is further driven by increasing R&D spending in biopharmaceuticals and the rise of modular labs using SUS platforms. Growing complexity in biologics development reinforces demand for highly adaptable process development tools.

- By End User

On the basis of end user, the market is segmented into pharmaceutical & biopharmaceutical companies, CROs & CMOs, and academic & research institutes. The pharmaceutical & biopharmaceutical companies segment dominated the market with the largest revenue share in 2025, supported by widespread adoption of single-use systems across commercial and clinical manufacturing. These companies benefit from the operational flexibility, reduced contamination risk, and cost efficiencies associated with disposable bioreactors. The increasing number of biologics approvals has driven major investments in single-use–enabled facilities across North America, Europe, and Asia-Pacific. Large biopharma manufacturers prioritize single-use technologies for multiproduct operations and rapid capacity expansion. Ongoing advancements in continuous bioprocessing also enhance the utility of disposable bioreactors.

The CROs & CMOs segment is anticipated to witness the fastest growth rate from 2026 to 2033, driven by accelerating outsourcing trends across biologics development and production. Contract organizations rely heavily on flexible, scalable systems that can accommodate diverse client requirements. Single-use bioreactors enable rapid changeover between different projects and reduce downtime in multiproduct facilities. Growing demand for outsourced manufacturing of mAbs, vaccines, and cell and gene therapies is increasing investments in disposable systems among CMOs. These organizations also favor single-use platforms due to cost savings in facility design and operational workflows. As biotech startups increasingly depend on outsourcing, the CRO/CMO segment is expected to expand rapidly.

Single-Use Bioreactors Market Regional Analysis

- North America dominated the single‑use bioreactors market with the largest revenue share of 43% in 2025, characterized by early adoption of advanced bioprocessing technologies, strong R&D infrastructure, and the presence of key industry players, particularly in the U.S., where innovations in stirred-tank single-use bioreactors are driving substantial deployment

- The region benefits from a highly mature bioprocessing infrastructure, early integration of single-use technologies, and strong investments by leading biotech firms focused on monoclonal antibodies, cell therapies, and vaccines

- Increasing demand for flexible, scalable, and contamination-free production platforms continues to drive widespread preference for single-use bioreactors across both commercial manufacturing and development pipelines

U.S. Single-Use Bioreactors Market Insight

The U.S. single-use bioreactors market captured the largest revenue share within North America in 2025, driven by the rapid scale-up of biologics, vaccines, and advanced therapies requiring flexible and contamination-resistant production platforms. Biopharmaceutical companies are increasingly prioritizing disposable bioprocessing systems to reduce cleaning validation, accelerate batch changeovers, and support multiproduct manufacturing. Strong adoption of gene and cell therapy pipelines, paired with a substantial presence of CDMOs, further boosts demand for single-use stirred-tank and wave-induced systems across both R&D and commercial sites. The U.S. market also benefits from a robust regulatory push toward innovative bioprocessing technologies, encouraging modernization of production facilities. In addition, high capital investments in biologics expansions and a strong ecosystem of suppliers and integrators continue to reinforce the U.S. as the leading hub for single-use bioreactor adoption.

Europe Single-Use Bioreactors Market Insight

The Europe single-use bioreactors market is projected to grow at a substantial CAGR throughout the forecast period, supported by stringent environmental and operational standards that favor disposable, low-contamination manufacturing solutions. The region’s large biologics and biosimilars industry is accelerating the transition from stainless-steel to flexible single-use production to increase efficiency and reduce utility consumption. Rising adoption of continuous bioprocessing and intensified upstream workflows is also amplifying the demand for scalable, ready-to-use bioreactor platforms across both Western and Eastern Europe. Growing investment in localized biologics manufacturing capacities, particularly in Germany, France, and the U.K., further supports widespread implementation of single-use technologies. In addition, strong government and regulatory support for biopharma innovation is encouraging modernization and expansion of GMP facilities equipped with flexible bioreactor systems.

U.K. Single-Use Bioreactors Market Insight

The U.K. single-use bioreactors market is anticipated to expand at a noteworthy CAGR during the forecast period, driven by the country’s rapidly advancing biopharmaceutical and cell therapy sectors. The growing emphasis on flexible, modular manufacturing environments is pushing companies to transition toward disposable bioreactors that minimize downtime and boost throughput. Increased funding for life sciences innovation, coupled with the expansion of research institutes and CDMOs, is fueling adoption across development and clinical-scale manufacturing. In addition, heightened focus on biosafety, contamination control, and accelerated product development timelines is encouraging the use of single-use systems across early-stage and commercial pipelines. The U.K.’s strong collaborative ecosystem between academia and industry further enhances the long-term demand for these technologies.

Germany Single-Use Bioreactors Market Insight

The Germany single-use bioreactors market is expected to grow at a considerable CAGR during the forecast period, supported by a strong culture of technological innovation and precision biomanufacturing. German biopharma companies are increasingly integrating single-use systems to improve production flexibility, scale-out capabilities, and operational sustainability. Growing demand for biosimilars and biologics manufacturing is contributing to widespread adoption of high-performance single-use stirred-tank and wave-induced bioreactors. Sustainability-driven initiatives promoting reduced water and energy usage are also pushing companies to replace stainless-steel systems with closed, disposable units. Furthermore, Germany’s well-established automation and digitalization environment strengthens the deployment of smart, sensor-integrated single-use bioprocessing platforms.

Asia-Pacific Single-Use Bioreactors Market Insight

The Asia-Pacific single-use bioreactors market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, supported by rapid biopharmaceutical expansion in countries such as China, India, South Korea, and Japan. Growing investment in biologics manufacturing, biosimilars development, and vaccine production is driving strong demand for scalable and cost-efficient disposable bioreactor systems. Government initiatives supporting biotech infrastructure development and GMP modernization are further accelerating adoption across both local manufacturers and global CDMOs operating in the region. The rise of single-use system manufacturing hubs in APAC is also improving affordability and accessibility, enabling smaller firms and start-ups to adopt advanced bioprocessing technologies. Increasing interest in cell therapy manufacturing is In addition contributing to robust market growth.

Japan Single-Use Bioreactors Market Insight

The Japan single-use bioreactors market is gaining momentum as the country advances its leadership in high-technology biomanufacturing and precision medicine. Strong demand for stem cell, regenerative medicine, and vaccine production is driving accelerated adoption of single-use systems across both research and commercial setups. Japanese manufacturers value the high sterility assurance, reduced cleaning burden, and rapid batch-to-batch transitions offered by disposable bioreactors. The integration of IoT-enabled sensors, automated controls, and digital monitoring in upstream workflows is further strengthening Japan’s adoption of advanced single-use bioprocessing platforms. In addition, aging population-driven healthcare needs are amplifying investments in biologics and cell-based therapies, reinforcing long-term market expansion.

India Single-Use Bioreactors Market Insight

The India single-use bioreactors market accounted for one of the largest revenue shares in Asia-Pacific in 2025, supported by strong growth in domestic biologics production, biosimilars manufacturing, and vaccine development. India’s rapidly expanding biopharma ecosystem is increasingly adopting disposable bioreactor systems to reduce operational costs, improve facility agility, and accelerate product development timelines. The country’s push toward self-reliance in biologics manufacturing and its significant CDMO capacity are key factors driving widespread implementation of flexible single-use platforms. Growing investment in biotech parks, innovation hubs, and R&D facilities is also fueling demand across early-stage and scale-up applications. In addition, the availability of competitively priced single-use technologies and expanding local manufacturing capabilities are making India a central growth engine for the regional market.

Single-Use Bioreactors Market Share

The Single-Use Bioreactors industry is primarily led by well-established companies, including:

- Sartorius AG (Germany)

- Thermo Fisher Scientific Inc. (U.S.)

- Danaher (U.S.)

- Merck KGaA (Germany)

- Getinge AB (Sweden)

- Eppendorf SE (Germany)

- Repligen Corporation (U.S.)

- Corning Incorporated (U.S.)

- Lonza (Switzerland)

- Avantor, Inc. (U.S.)

- PBS Biotech, Inc. (U.S.)

- ABEC, Inc. (U.S.)

- Cellexus Ltd (U.K.)

- Applikon Biotechnology (Getinge) (Netherlands)

- Infors AG (Switzerland)

- Meissner Filtration Products, Inc. (U.S.)

- PARKER HANNIFIN CORPORATION (U.S.)

- Entegris (U.S.)

- Kuhner AG (Switzerland)

- Saint-Gobain (France)

What are the Recent Developments in Global Single-Use Bioreactors Market?

- In April 2025, Thermo Fisher Scientific introduced a 5 L DynaDrive single-use bioreactor, designed to bridge bench-scale development and large-scale manufacturing, with seamless scale-up from 1 L to 5,000 L and enhanced productivity

- In March 2025, Cytiva broadened its Xcellerex X-platform by introducing 500 L and 2,000 L single-use bioreactors, strengthening scalability for biopharma companies moving from pilot to commercial production. These new systems feature an integrated infrared camera for enhanced foam detection, improved filter design for simplified handling, and advanced automation to reduce operator workload

- In March 2025, ABEC unveiled its new Advanced Therapy Bioreactor (ATB™), designed specifically for cell- and gene-therapy workflows that require precise nutrient exchange and closed-system sterility. The ATB™ platform integrates hollow-fiber membrane networks for optimized mass transfer, oscillation-based mixing for gentler shear conditions, and automated processing from 0.2 L to 10 L. This launch significantly enhances manufacturing efficiency for ATMP developers seeking scalable and consistent early-stage production

- In June 2024, WuXi Biologics boosted its manufacturing capabilities by installing three 5,000 L single-use bioreactors at its Hangzhou MFG20 facility, marking one of the industry’s largest deployments of SUBs at this scale. This expansion increased total capacity from 8,000 L to 23,000 L, reinforcing WuXi’s position in large-scale, flexible, disposable-based biologics production

- In March 2024, Cytiva introduced the Xcellerex XDR-50 MO, a modular single-use bioreactor tailored for vaccine development and early GMP production. The system offers enhanced automation, configurable process control modules, and a flexible design suitable for viral vector, protein-based, and mRNA vaccine workflows. This launch addresses rising global demand for rapid, scalable vaccine manufacturing infrastructure following the expansion of pandemic preparedness programs

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.