Global Sirolimus Market

Market Size in USD Million

CAGR :

%

USD

231.61 Million

USD

331.26 Million

2024

2032

USD

231.61 Million

USD

331.26 Million

2024

2032

| 2025 –2032 | |

| USD 231.61 Million | |

| USD 331.26 Million | |

|

|

|

|

Sirolimus Market Size

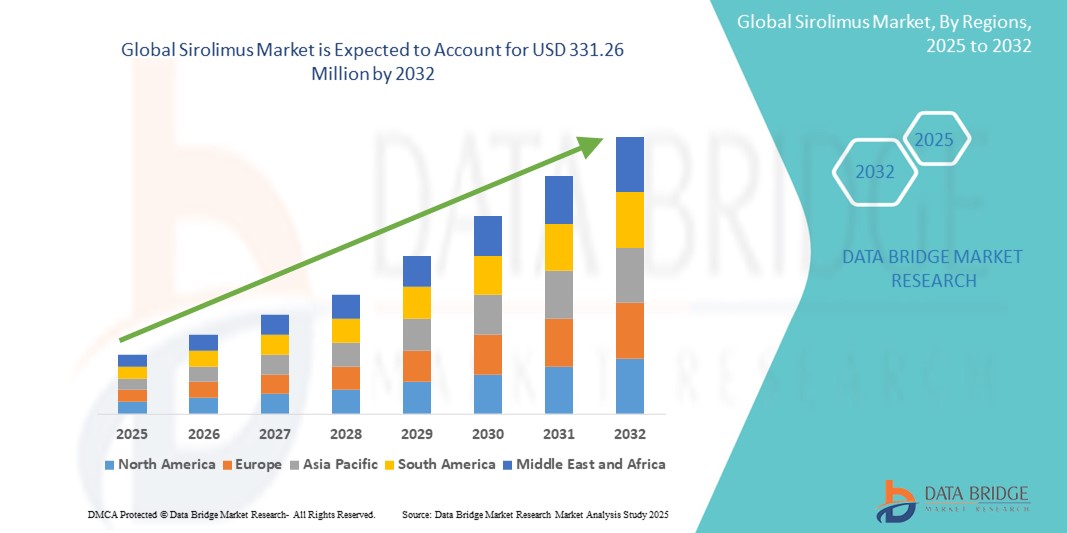

- The global sirolimus market size was valued at USD 231.16 Million in 2024 and is expected to reach USD 331.26 Million by 2032, at a CAGR of 4.6% during the forecast period

- The market growth is largely fuelled by the increasing prevalence of chronic conditions such as organ transplant rejection, lymphangioleiomyomatosis (LAM), and certain cancers, which has led to a surge in demand for effective immunosuppressive therapies such as sirolimus. The drug’s proven efficacy in preventing organ rejection and treating rare diseases is reinforcing its critical role in modern therapeutic regimens

- Furthermore, ongoing advancements in drug formulation and targeted drug delivery technologies, along with increasing R&D investments by pharmaceutical companies, are expanding the clinical applications of sirolimus beyond traditional organ transplantation. These converging factors are accelerating the adoption of sirolimus-based therapies, thereby significantly boosting the growth of the global sirolimus market

Sirolimus Market Analysis

- Sirolimus, a potent immunosuppressant and mTOR inhibitor, is increasingly vital in modern medicine, primarily for preventing organ transplant rejection and treating specific rare diseases such as Lymphangioleiomyomatosis (LAM). Its anti-proliferative properties also make it significant in cancer research and in drug-eluting devices

- The escalating demand for sirolimus is primarily fuelled by the rising global number of organ transplantation procedures, the expanding applications in oncology and rare diseases, and continuous advancements in drug delivery systems

- North America dominated the sirolimus market with the largest revenue share, accounting for 39% in 2024. This dominance is characterized by advanced healthcare infrastructure, a high volume of organ transplant procedures, favorable reimbursement policies, and a strong presence of key pharmaceutical companies engaged in Sirolimus research and development

- Asia-Pacific is expected to be the fastest-growing region in the sirolimus market during the forecast period, with a projected CAGR of 6.84%. This rapid growth is driven by increasing healthcare expenditure, improving healthcare infrastructure, a rising number of organ transplant procedures, and a growing patient pool for associated conditions in countries such as China and India

- The organ transplant rejection segment dominated the sirolimus market, holding a market share of 52.7% in 2024. This is driven by its critical role as a key immunosuppressant to ensure successful patient outcomes post-transplantation, particularly in kidney and liver transplants. The drug’s well-established efficacy with minimal nephrotoxicity makes it a preferred choice among healthcare providers

Report Scope and Sirolimus Market Segmentation

|

Attributes |

Sirolimus Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Sirolimus Market Trends

“Enhanced Efficacy and Patient Management Through AI and Data Analytics”

- A significant and accelerating trend impacting the global sirolimus market is the deepening integration of artificial intelligence (AI) and advanced data analytics. This fusion of technologies is significantly enhancing drug discovery, personalized dosing, and patient management, ultimately improving therapeutic outcomes for patients on Sirolimus

- For instance, in 2024-2025, academic and pharmaceutical research is leveraging AI-powered models to personalize immunosuppressant drug dosing, including Sirolimus. Projects, such as those at Carleton University, are developing AI-based models to predict individual patient responses to drugs such as Sirolimus and tacrolimus, optimizing dosage and reducing risks of rejection or toxicity. This aims to move beyond trial-and-error, improving patient safety and treatment effectiveness

- AI integration in the Sirolimus market enables features such as predicting patient response to therapy, identifying optimal dosing regimens, and analyzing vast genomic and clinical datasets to uncover new indications or biomarkers. For instance, AI algorithms can analyze complex biological data to predict which patients with certain cancers or rare diseases are most likely to respond to Sirolimus. Furthermore, AI can aid in monitoring potential drug interactions and side effects by analyzing real-world patient data, enhancing safety

- The seamless integration of AI and data analytics in the drug development pipeline facilitates more efficient and targeted research. Through sophisticated algorithms, researchers can analyze patient data and preclinical models to streamline drug discovery processes, potentially reducing development costs and timelines for new Sirolimus formulations or applications by an estimated 25-50%

- This trend towards more intelligent, data-driven, and personalized therapeutic approaches is fundamentally reshaping expectations for how drugs such as Sirolimus are discovered, prescribed, and managed. Consequently, pharmaceutical companies and research institutions are investing heavily in AI platforms to accelerate clinical trials and refine treatment protocols

- The demand for AI-driven solutions that offer enhanced therapeutic efficacy and patient safety for drugs such as Sirolimus is growing rapidly across both clinical and research sectors, as healthcare providers increasingly prioritize personalized medicine and optimized patient outcomes

Sirolimus Market Dynamics

Driver

“Growing Incidence of Chronic Diseases, Organ Transplants, and Expanding Therapeutic Applications”

- The increasing global incidence of chronic diseases requiring immunosuppression, coupled with the accelerating number of organ transplantation procedures and the expansion of Sirolimus's therapeutic applications into new areas such as oncology and rare diseases, is a significant driver for the heightened demand in the Sirolimus market

- For instance, the rising burden of end-stage organ diseases, such as kidney, liver, and heart failure, directly translates into a greater need for immunosuppressants such as Sirolimus post-transplant. Furthermore, the growing recognition of Sirolimus's efficacy in treating rare conditions such as Lymphangioleiomyomatosis (LAM) and its exploration in various cancer therapies are opening new avenues for market growth. Such advancements and expanding clinical utility are expected to drive the Sirolimus industry growth in the forecast period

- As healthcare providers and patients become more aware of Sirolimus's multifaceted benefits – from effective immunosuppression with a favorable side effect profile in some cases, to its anti-proliferative effects – it offers a compelling therapeutic option over traditional mechanical approaches or less targeted drugs

- Furthermore, the continuous research and development into novel formulations and drug delivery systems for Sirolimus are making it an integral component of modern medical interventions, offering seamless integration with other treatment protocols and devices

- The convenience of a proven therapeutic agent for long-term management of chronic conditions, its potential in preventing graft-versus-host disease, and the ability to manage complex disease states through targeted mTOR inhibition are key factors propelling the adoption of Sirolimus in both hospital and outpatient settings. The trend towards personalized medicine and the increasing availability of generic Sirolimus options further contribute to market growth

Restraint/Challenge

“Concerns Regarding Side Effects, Drug Interactions, and High Treatment Costs”

- Concerns surrounding the significant side effects associated with Sirolimus, its complex drug interaction profile, and the relatively high initial and long-term treatment costs pose a significant challenge to broader market penetration and patient adherence. As Sirolimus relies on careful patient monitoring and management to balance efficacy with safety, its adverse event profile raises anxieties among potential prescribers and patients

- For instance, high-profile reports of potential side effects such as hyperlipidemia, proteinuria, delayed wound healing, and lung toxicity can make some physicians hesitant to prescribe Sirolimus as a first-line agent, particularly in certain patient populations. In addition, its narrow therapeutic window necessitates rigorous therapeutic drug monitoring, adding to healthcare costs and patient burden

- Addressing these safety and management concerns through robust patient education, pharmacogenomic testing to personalize dosing, and the development of formulations with improved side effect profiles is crucial for building prescriber and patient trust. Companies are investing in research to mitigate these issues and improve patient outcomes.In addition, the relatively high initial cost of Sirolimus (especially branded versions) and the ongoing costs of monitoring can be a barrier to adoption for price-sensitive healthcare systems and patients, particularly in developing regions or for those with limited insurance coverage. While generic versions of Sirolimus have become more affordable, the overall cost of complex treatment regimens and associated monitoring can still be substantial.

- While research is gradually leading to better management strategies for side effects and a better understanding of drug interactions, the perceived complexity of management can still hinder widespread adoption, especially for those healthcare providers who do not have immediate access to specialized monitoring facilities or expertise

Sirolimus Market Scope

The market is segmented on the basis of strength, application, drug class, dosage, route of administration and end user.

• By Strength

On the basis of strength, the sirolimus market is segmented into 0.5 mg, 1 mg, 2 mg, and 1 mg/mL. The 1 mg segment dominated the market with the largest revenue share of 48.5% in 2024, attributed to its standard dosing in maintenance immunosuppressive therapy following organ transplantation. Its widespread availability in tablet form and established efficacy contribute to its dominance.

The 1 mg/mL formulation is expected to witness the fastest CAGR of 20.4% from 2025 to 2032, driven by growing demand for intravenous delivery in cases requiring precise titration and pediatric use, as well as increasing adoption in hospital and critical care settings.

• By Application

On the basis of application, the sirolimus market is segmented into organ transplant rejection, sirolimus catheter device, sirolimus coated balloons, and others. The organ transplant rejection segment held the largest market revenue share of 52.7% in 2024, owing to the drug’s well-established role in preventing rejection in kidney and liver transplants. It is favored for its immunosuppressive efficacy with minimal nephrotoxicity.

The sirolimus coated balloons segment is expected to register the fastest CAGR of 18.9% from 2025 to 2032, driven by increasing clinical research and commercialization efforts in cardiovascular interventions for peripheral artery disease and in-stent restenosis.

• By Drug Class

On the basis of drug class, the sirolimus market is segmented into mTOR Inhibitors and selective immunosuppressants. The mTOR inhibitors segment accounted for the largest revenue share of 69.1% in 2024, as Sirolimus is primarily classified under this class, recognized for inhibiting T-cell proliferation and aiding long-term graft survival.

The selective immunosuppressants segment is anticipated to witness the fastest CAGR of 15.6% from 2025 to 2032, due to increasing interest in targeted immunomodulation with fewer systemic side effects, supporting broader applications in autoimmune and inflammatory conditions.

• By Dosage

On the basis of dosage, the sirolimus market is segmented into injection, tablet, and others. The tablet segment dominated the market with a share of 63.4% in 2024, driven by patient convenience, ease of dosing, and long-term maintenance therapy for transplant patients.

The injection segment is projected to grow at the fastest CAGR of 17.3% from 2025 to 2032, due to its rising use in acute care settings and precision dosing in specific clinical scenarios.

• By Route of Administration

On the basis of route of administration, the sirolimus market is segmented into oral, intravenous, and others. The oral route held the highest share of 67.8% in 2024, supported by the dominance of oral tablet formulations used in outpatient transplant care and long-term therapy.

The intravenous segment is expected to register the fastest CAGR of 16.4% from 2025 to 2032, reflecting increased hospital use, faster onset of action in emergencies, and new drug delivery advancements.

• By End Users

On the basis of end users, the sirolimus market is segmented into hospitals, specialty clinics, homecare, and others. The hospitals segment accounted for the largest market share of 55.6% in 2024, owing to the high volume of transplant surgeries, immediate postoperative care, and availability of infusion therapy.

The homecare segment is expected to grow at the fastest CAGR of 19.1% from 2025 to 2032, driven by the increasing use of oral therapies, telemedicine support, and preference for at-home monitoring in chronic transplant maintenance therapy.

• By Distribution Channel

On the basis of distribution channel, the sirolimus market is segmented into hospital pharmacy, retail pharmacy, online pharmacy, and others. The hospital pharmacy segment held the largest market revenue share of 46.9% in 2024, as it remains the primary distribution point for transplant-related medications during inpatient stays.

The online pharmacy segment is projected to experience the fastest CAGR of 21.5% from 2025 to 2032, driven by the rise in e-prescriptions, convenience in medication delivery, and the expanding digital health ecosystem supporting remote patient care.

Sirolimus Market Regional Analysis

- North America dominated the sirolimus market with the largest revenue share of 39% in 2024, driven by a high prevalence of organ transplant surgeries, strong healthcare infrastructure, and early adoption of advanced immunosuppressive therapies

- The region benefits from well-established pharmaceutical distribution networks and ongoing clinical trials focusing on mTOR inhibitors for various applications, including cardiovascular and oncology

- High healthcare spending, favorable reimbursement policies, and FDA approvals for Sirolimus-based drug-eluting devices contribute to continued market leadership

U.S. Sirolimus Market Insight

The U.S. sirolimus market captured 81.02% of the North America sirolimus market in 2024, owing to the high rate of organ transplants, advanced hospital facilities, and increasing off-label use of Sirolimus in oncology and dermatology. Strong R&D presence, particularly among major pharmaceutical companies and academic institutions, is propelling innovation in Sirolimus formulations. In addition, rising demand for personalized medicine, an aging population, and an increasing focus on biologics and targeted therapies fuel continued market expansion in the U.S.

Europe Sirolimus Market Insight

The Europe sirolimus market is projected to grow at a robust CAGR from 2025 to 2032, driven by the growing number of renal transplants, high awareness of immunosuppressive therapy, and support from centralized healthcare systems. The implementation of EU regulations encouraging drug safety, along with investments in drug-coated devices, enhances the growth outlook. European countries are also embracing Sirolimus in cardiovascular therapies, especially in stent coatings and drug-eluting balloons for peripheral arterial disease.

U.K. Sirolimus Market Insight

The U.K. sirolimus market is expected to grow at a noteworthy CAGR during the forecast period, supported by the NHS’s increasing procurement of immunosuppressants and ongoing initiatives to improve transplant outcomes. Rising concern for graft survival and cost-effectiveness has made Sirolimus an appealing alternative to calcineurin inhibitors. Furthermore, the expansion of clinical trials and fast-track approvals for orphan indications are accelerating the market trajectory.

Germany Sirolimus Market Insight

The Germany sirolimus market is projected to expand at a considerable CAGR from 2025 to 2032, due to increasing prevalence of chronic kidney and heart conditions, and a steady rise in transplant procedures. Germany’s strong pharmaceutical manufacturing base and emphasis on biosimilar development are facilitating access to Sirolimus-based therapies. Patient preference for oral formulations and rising demand for outpatient immunosuppressive therapy further fuel market demand.

Asia-Pacific Sirolimus Market Insight

The Asia-Pacific sirolimus market is poised to grow at the fastest CAGR of 6.84% during the forecast period, fueled by rising healthcare expenditure, expanding transplant programs, and increasing awareness of immunosuppressive drugs. Countries such as China and India are witnessing growing demand due to large patient pools, improving access to healthcare, and an expanding pharmaceutical manufacturing sector. In addition, government support for generic production and clinical research programs is boosting the availability of cost-effective Sirolimus formulations.

Japan Sirolimus Market Insight

The Japan sirolimus market is gaining significant momentum from 2025 to 2032, owing to the country’s advanced healthcare infrastructure and high incidence of chronic diseases requiring immunosuppression. Japan has also seen a rise in the use of Sirolimus in drug-eluting devices and ophthalmic applications. The government's push toward aging population care, personalized therapies, and targeted drug delivery is further stimulating market growth.

China Sirolimus Market Insight

The China sirolimus market held the largest revenue share in the Asia-Pacific sirolimus market in 2024, accounting for 38.5% of the regional market, driven by an expanding middle class, large transplant patient base, and government support for generic production. Rapid urbanization, high disease burden, and increasing penetration of Sirolimus in cardiovascular and oncology applications are key contributors. The rise of domestic pharmaceutical companies and export-oriented manufacturing enhances China’s position in both local and global Sirolimus supply chains.

Sirolimus Market Share

The sirolimus industry is primarily led by well-established companies, including:

- Accord Healthcare (U.S.)

- Apotex Inc. (Canada)

- Amneal Pharmaceuticals LLC. (U.S.)

- Pfizer Inc. (U.S.)

- Zydus Cadila (India)

- Dr. Reddy's Laboratories Ltd. (India)

- Torrent Pharmaceuticals Ltd. (India)

- Biocon (India)

- Concept Medical (U.S.)

- Intas Pharmaceuticals Ltd (India)

- Concord Biotech (India)

- Livzon (China)

- Actiza Pharmaceutical Private Limited (India)

- Tiefenbacher API + Ingredients GmbH & Co. KG (Germany)

- Delphis Pharmaceutical (India)

Latest Developments in Global Sirolimus Market

- In February 2023, Zydus Group obtained final approval from the U.S. Food and Drug Administration (FDA) for Sirolimus Tablets, 1 mg, and 2 mg (generic for Rapamune Tablets). This approval reinforced Zydus's product portfolio and market position, enabling the company to provide a vital medication for preventing organ rejection in kidney transplant recipients, enhancing affordability and access

- In January 2024 (published February 2024), a prospective clinical trial demonstrated the efficacy of Sirolimus in treating intractable lymphatic anomalies (LAs). This open-label, single-arm, multicenter study conducted in Japan showed that Sirolimus can reduce lymphatic tissue volume in LAs and may lead to improvements in clinical symptoms and quality of life. This highlights the ongoing expansion of Sirolimus's applications in rare and complex diseases beyond its traditional uses

- In April 2022 (with ongoing impact into 2023-2024), the FDA approved topical Sirolimus (HYFTOR) for facial angiofibroma associated with tuberous sclerosis complex. This marked the first topical treatment approved in the US for this specific manifestation. While the approval was earlier, its market adoption and the ongoing clinical experience continue to shape the Sirolimus landscape, highlighting the potential for localized formulations.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL SIROLIMUS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE SIROLIMUS MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL TRANSDERMAL PATCHE MARKET : RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES MODEL

5 INDUSTRY INSIGHTS

5.1 PATENT ANALYSIS

5.1.1 PATENT STRENGTH AND QUALITY

5.1.2 PATENT LITIGATION AND LICENSING

5.2 DRUG TREATMENT RATE BY MATURED MARKETS

5.3 DEMOGRAPHIC TRENDS

5.4 KEY PRICING STRATEGIES

5.5 KEY PATIENT ENROLLMENT STRATEGIES

5.6 INTERVIEWS WITH SPECIALIST

5.7 OTHER KOL SNAPSHOTS

6 EPIDEMIOLOGY

7 MERGERS AND ACQUISITION

7.1 LICENSING

7.2 COMMERCIALIZATION AGREEMENTS

8 REGULATORY FRAMEWORK

8.1 REGULATORY APPROVAL PROCESS

8.2 GEOGRAPHIES’ EASE OF REGULATORY APPROVAL

8.3 REGULATORY APPROVAL PATHWAYS

8.4 LICENSING AND REGISTRATION

8.5 POST-MARKETING SURVEILLANCE

8.6 GOOD MANUFACTURING PRACTICES (GMPS) GUIDELINES

9 PIPELINE ANALYSIS

9.1 CLINICAL TRIALS AND PHASE ANALYSIS

9.2 DRUG THERAPY PIPELINE

9.3 PHASE III CANDIDATES

9.4 PHASE II CANDIDATES

9.5 PHASE I CANDIDATES

9.6 OTHERS (PRE-CLINICAL AND RESEARCH)

10 MARKETED DRUG ANALYSIS

10.1 DRUG

10.1.1 BRAND NAME

10.1.2 GENERICS NAME

10.2 PHARACOLOGICAL CLASS OF THE DRUG

10.3 DRUG PRIMARY INDICATION

10.4 MARKET STATUS

10.5 MEDICATION TYPE

10.6 DRUG DOSAGES FORM

10.7 DOSAGES AVAILABILITY

10.8 PACKAGING TYPE

10.9 DRUG ROUTE OF ADMINISTRATION

10.1 DOSING FREQUENCY

10.11 DRUG INSIGHT

10.12 AN OVERVIEW OF THE DRUG DEVELOPMENT ACTIVITIES SUCH AS REGULATORY MILSTONE, SAFETY DATA AND EFFICACY DATA, MARKET EXCLUSIVITY DATA.

10.12.1 FORECAST MARKET OUTLOOK

10.12.2 CROSS COMPETITION

10.12.3 THERAPEUTIC PORTFOLIO

10.12.4 CURRENT DEVELOPMENT SCENARIO

11 MARKET ACCESS

11.1 10-YEAR MARKET FORECAST

11.2 CLINICAL TRIAL RECENT UPDATES

11.3 ANNUAL NEW FDA APPROVED DRUGS

11.4 DRUGS MANUFACTURER AND DEALS

11.5 MAJOR DRUG UPTAKE

11.6 CURRENT TREATMENT PRACTICES

11.7 IMPACT OF UPCOMING THERAPY

12 R & D ANALYSIS

12.1 COMPARATIVE ANALYSIS

12.2 DRUG DEVELOPMENTAL LANDSCAPE

12.3 IN-DEPTH INSIGHTS ON REGULATORY MILESTONES

12.4 THERAPEUTIC ASSESSMENT

12.5 ASSET-BASED COLLABORATIONS AND PARTNERSHIPS

13 MARKET OVERVIEW

13.1 DRIVERS

13.2 RESTRAINTS

13.3 OPPORTUNITIES

13.4 CHALLENGES

14 GLOBAL SIROLIMUS MARKET , SWOT AND DBMR ANALYSIS

15 GLOBAL SIROLIMUS MARKET, BY STRENGTH

15.1 OVERVIRE

15.2 0.5 MG

15.3 1MG

15.4 2MG

15.5 5 MG

15.6 OTHERS

16 GLOBAL SIROLIMUS MARKET, BY DRUG TYPE

16.1 OVERVIEW

16.2 BRANDED

16.2.1 RAPAMUNE

16.2.2 FYARRO

16.2.3 HYFTOR

16.2.4 OTHERS

16.3 GENERIC

17 GLOBAL SIROLIMUS MARKET, BY DOSAGE FORM

17.1 OVERVIEW

17.2 TABLETS

17.3 INJECTIONS

17.4 GEL

17.5 POWDER

17.6 OTHERS

18 GLOBAL SIROLIMUS MARKET, BY METHOD OF ADMINISTRATION

18.1 OVERVIEW

18.2 INTRAVENOUS

18.3 ORAL

18.4 TOPICAL

18.5 OTHERS

19 GLOBAL SIROLIMUS MARKET, BY APPLICATION

19.1 OVERVIEW

19.2 ORGAN TRANSPLANT REJECTIONS

19.2.1 LOW- TO MODERATE-IMMUNOLOGIC RISK

19.2.2 HIGH-IMMUNOLOGIC RISK

19.3 TUMOR/CANCER

19.3.1 UNRESECTABLE OR METASTATIC MALIGNANT PERIVASCULAR EPITHELIOID CELL TUMOR (PECOMA)

19.3.2 LYMPHANGIOLEIOMYOMATOSIS

19.3.3 OTHERS

19.4 SIROLIMUS CATHETER DEVICE

19.5 SIROLIMUS COATED BALLOONS

19.6 FACIAL ANGIOFIBROMA IN TUBEROUS SCLEROSIS COMPLEX (TSC)

19.7 OTHERS

20 GLOBAL SIROLIMUS MARKET , BY AGE GROUP

20.1 OVERVIEW

20.2 ADULT

20.3 PEDIATRIC

20.4 GERIARTIC

21 GLOBAL SIROLIMUS MARKET , BY GENDER

21.1 OVERVIEW

21.2 MALE

21.3 FEMALE

22 GLOBAL SIROLIMUS MARKET , BY END USER

22.1 OVERVIEW

22.2 HOSPITALS

22.2.1 PUBLIC

22.2.1.1. TIER I

22.2.1.2. TIER II

22.2.1.3. TIER III

22.2.2 PRIVATE

22.2.2.1. TIER I

22.2.2.2. TIER II

22.2.2.3. TIER III

22.3 SPECIALITY CLINICS

22.4 HOMECARE SETTING

22.5 AMBULATORY CARE CENTERS

22.6 CATH LABS

22.7 OTHERS

23 GLOBAL SIROLIMUS MARKET , BY DISTRIBUTION CHANNEL

23.1 OVERVIEW

23.2 DIRECT TENDER

23.3 RETAIL SALES

23.3.1 HOSPITAL PHARMACY

23.3.2 DRUG STORES

23.3.3 E-PHARMACY

23.3.4 OTHERS

23.4 OTHERS

24 GLOBAL SIROLIMUS MARKET , COMPANY LANDSCAPE

24.1 COMPANY SHARE ANALYSIS: GLOBAL

24.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

24.3 COMPANY SHARE ANALYSIS: EUROPE

24.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

24.5 MERGERS & ACQUISITIONS

24.6 NEW PRODUCT DEVELOPMENT & APPROVALS

24.7 EXPANSIONS

24.8 REGULATORY CHANGES

24.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

25 GLOBAL SIROLIMUS MARKET , BY REGION

GLOBAL SIROLIMUS MARKET , (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

25.1 NORTH AMERICA

25.1.1 U.S.

25.1.2 CANADA

25.1.3 MEXICO

25.2 EUROPE

25.2.1 GERMANY

25.2.2 U.K.

25.2.3 ITALY

25.2.4 FRANCE

25.2.5 SPAIN

25.2.6 RUSSIA

25.2.7 SWITZERLAND

25.2.8 TURKEY

25.2.9 BELGIUM

25.2.10 NETHERLANDS

25.2.11 DENMARK

25.2.12 SWEDEN

25.2.13 POLAND

25.2.14 NORWAY

25.2.15 FINLAND

25.2.16 REST OF EUROPE

25.3 ASIA-PACIFIC

25.3.1 JAPAN

25.3.2 CHINA

25.3.3 SOUTH KOREA

25.3.4 INDIA

25.3.5 SINGAPORE

25.3.6 THAILAND

25.3.7 INDONESIA

25.3.8 MALAYSIA

25.3.9 PHILIPPINES

25.3.10 AUSTRALIA

25.3.11 NEW ZEALAND

25.3.12 VIETNAM

25.3.13 TAIWAN

25.3.14 REST OF ASIA-PACIFIC

25.4 SOUTH AMERICA

25.4.1 BRAZIL

25.4.2 ARGENTINA

25.4.3 REST OF SOUTH AMERICA

25.5 MIDDLE EAST AND AFRICA

25.5.1 SOUTH AFRICA

25.5.2 EGYPT

25.5.3 BAHRAIN

25.5.4 UNITED ARAB EMIRATES

25.5.5 KUWAIT

25.5.6 OMAN

25.5.7 QATAR

25.5.8 SAUDI ARABIA

25.5.9 REST OF MEA

25.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

26 GLOBAL SIROLIMUS MARKET , COMPANY PROFILE

26.1 PFIZER INC.

26.1.1 COMPANY OVERVIEW

26.1.2 REVENUE ANALYSIS

26.1.3 GEOGRAPHIC PRESENCE

26.1.4 PRODUCT PORTFOLIO

26.1.5 RECENT DEVELOPMENTS

26.2 ZYDUS

26.2.1 COMPANY OVERVIEW

26.2.2 REVENUE ANALYSIS

26.2.3 GEOGRAPHIC PRESENCE

26.2.4 PRODUCT PORTFOLIO

26.2.5 RECENT DEVELOPMENTS

26.3 NOBELPHARMA AMERICA, LLC

26.3.1 COMPANY OVERVIEW

26.3.2 REVENUE ANALYSIS

26.3.3 GEOGRAPHIC PRESENCE

26.3.4 PRODUCT PORTFOLIO

26.3.5 RECENT DEVELOPMENTS

26.4 AADI BIOSCIENCE, INC.

26.4.1 COMPANY OVERVIEW

26.4.2 REVENUE ANALYSIS

26.4.3 GEOGRAPHIC PRESENCE

26.4.4 PRODUCT PORTFOLIO

26.4.5 RECENT DEVELOPMENTS

26.5 AMNEAL PHARMACEUTICALS NY LLC

26.5.1 COMPANY OVERVIEW

26.5.2 REVENUE ANALYSIS

26.5.3 GEOGRAPHIC PRESENCE

26.5.4 PRODUCT PORTFOLIO

26.5.5 RECENT DEVELOPMENTS

26.6 APOTEX CORP

26.6.1 COMPANY OVERVIEW

26.6.2 REVENUE ANALYSIS

26.6.3 GEOGRAPHIC PRESENCE

26.6.4 PRODUCT PORTFOLIO

26.6.5 RECENT DEVELOPMENTS

26.7 DR. REDDY'S LABORATORIES LTD.

26.7.1 COMPANY OVERVIEW

26.7.2 REVENUE ANALYSIS

26.7.3 GEOGRAPHIC PRESENCE

26.7.4 PRODUCT PORTFOLIO

26.7.5 RECENT DEVELOPMENTS

26.8 TORRENT PHARMACEUTICALS LTD.

26.8.1 COMPANY OVERVIEW

26.8.2 REVENUE ANALYSIS

26.8.3 GEOGRAPHIC PRESENCE

26.8.4 PRODUCT PORTFOLIO

26.8.5 RECENT DEVELOPMENTS

26.9 BIOCON

26.9.1 COMPANY OVERVIEW

26.9.2 REVENUE ANALYSIS

26.9.3 GEOGRAPHIC PRESENCE

26.9.4 PRODUCT PORTFOLIO

26.9.5 RECENT DEVELOPMENTS

26.1 INTAS PHARMACEUTICALS LTD

26.10.1 COMPANY OVERVIEW

26.10.2 REVENUE ANALYSIS

26.10.3 GEOGRAPHIC PRESENCE

26.10.4 PRODUCT PORTFOLIO

26.10.5 RECENT DEVELOPMENTS

26.11 CONCORD BIOTECH

26.11.1 COMPANY OVERVIEW

26.11.2 REVENUE ANALYSIS

26.11.3 GEOGRAPHIC PRESENCE

26.11.4 PRODUCT PORTFOLIO

26.11.5 RECENT DEVELOPMENTS

26.12 VIATRIS INC.

26.12.1 COMPANY OVERVIEW

26.12.2 REVENUE ANALYSIS

26.12.3 GEOGRAPHIC PRESENCE

26.12.4 PRODUCT PORTFOLIO

26.12.5 RECENT DEVELOPMENTS

26.13 NOVADOZ PHARMACEUTICALS.

26.13.1 COMPANY OVERVIEW

26.13.2 REVENUE ANALYSIS

26.13.3 GEOGRAPHIC PRESENCE

26.13.4 PRODUCT PORTFOLIO

26.13.5 RECENT DEVELOPMENTS

26.14 PHARMACEUTICAL ASSOCIATES, INC.

26.14.1 COMPANY OVERVIEW

26.14.2 REVENUE ANALYSIS

26.14.3 GEOGRAPHIC PRESENCE

26.14.4 PRODUCT PORTFOLIO

26.14.5 RECENT DEVELOPMENTS

26.15 ALKEM LABORATORIES LTD.,

26.15.1 COMPANY OVERVIEW

26.15.2 REVENUE ANALYSIS

26.15.3 GEOGRAPHIC PRESENCE

26.15.4 PRODUCT PORTFOLIO

26.15.5 RECENT DEVELOPMENTS

26.16 NOVITIUM PHARMA LLC

26.16.1 COMPANY OVERVIEW

26.16.2 REVENUE ANALYSIS

26.16.3 GEOGRAPHIC PRESENCE

26.16.4 PRODUCT PORTFOLIO

26.16.5 RECENT DEVELOPMENTS

26.17 AMNEAL PHARMACEUTICALS, INC.

26.17.1 COMPANY OVERVIEW

26.17.2 REVENUE ANALYSIS

26.17.3 GEOGRAPHIC PRESENCE

26.17.4 PRODUCT PORTFOLIO

26.17.5 RECENT DEVELOPMENTS

26.18 ACTIZA PHARMACEUTICAL PRIVATE LIMITED

26.18.1 COMPANY OVERVIEW

26.18.2 REVENUE ANALYSIS

26.18.3 GEOGRAPHIC PRESENCE

26.18.4 PRODUCT PORTFOLIO

26.18.5 RECENT DEVELOPMENTS

26.19 MSN LABORATORIES PRIVATE LIMITED

26.19.1 COMPANY OVERVIEW

26.19.2 REVENUE ANALYSIS

26.19.3 GEOGRAPHIC PRESENCE

26.19.4 PRODUCT PORTFOLIO

26.19.5 RECENT DEVELOPMENTS

26.2 GLENMARK PHARMS LTD

26.20.1 COMPANY OVERVIEW

26.20.2 REVENUE ANALYSIS

26.20.3 GEOGRAPHIC PRESENCE

26.20.4 PRODUCT PORTFOLIO

26.20.5 RECENT DEVELOPMENTS

26.21 MIDAS PHARMA GMBH

26.21.1 COMPANY OVERVIEW

26.21.2 REVENUE ANALYSIS

26.21.3 GEOGRAPHIC PRESENCE

26.21.4 PRODUCT PORTFOLIO

26.21.5 RECENT DEVELOPMENTS

26.22 TAJ PHARMA GROUP

26.22.1 COMPANY OVERVIEW

26.22.2 REVENUE ANALYSIS

26.22.3 GEOGRAPHIC PRESENCE

26.22.4 PRODUCT PORTFOLIO

26.22.5 RECENT DEVELOPMENTS

26.23 IVASCULAR S.L.U

26.23.1 COMPANY OVERVIEW

26.23.2 REVENUE ANALYSIS

26.23.3 GEOGRAPHIC PRESENCE

26.23.4 PRODUCT PORTFOLIO

26.23.5 RECENT DEVELOPMENTS

26.24 ALVIMEDICA

26.24.1 COMPANY OVERVIEW

26.24.2 REVENUE ANALYSIS

26.24.3 GEOGRAPHIC PRESENCE

26.24.4 PRODUCT PORTFOLIO

26.24.5 RECENT DEVELOPMENTS

26.25 CORDIS

26.25.1 COMPANY OVERVIEW

26.25.2 REVENUE ANALYSIS

26.25.3 GEOGRAPHIC PRESENCE

26.25.4 PRODUCT PORTFOLIO

26.25.5 RECENT DEVELOPMENTS

26.26 CONCEPT MEDICAL

26.26.1 COMPANY OVERVIEW

26.26.2 REVENUE ANALYSIS

26.26.3 GEOGRAPHIC PRESENCE

26.26.4 PRODUCT PORTFOLIO

26.26.5 RECENT DEVELOPMENTS

27 RELATED REPORTS

28 CONCLUSION

29 QUESTIONNAIRE

30 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.