Global Sixth Nerve Palsy Treatment Market

Market Size in USD Billion

CAGR :

%

USD

432.00 Billion

USD

595.78 Billion

2025

2033

USD

432.00 Billion

USD

595.78 Billion

2025

2033

| 2026 –2033 | |

| USD 432.00 Billion | |

| USD 595.78 Billion | |

|

|

|

|

Sixth Nerve Palsy Treatment Market Size

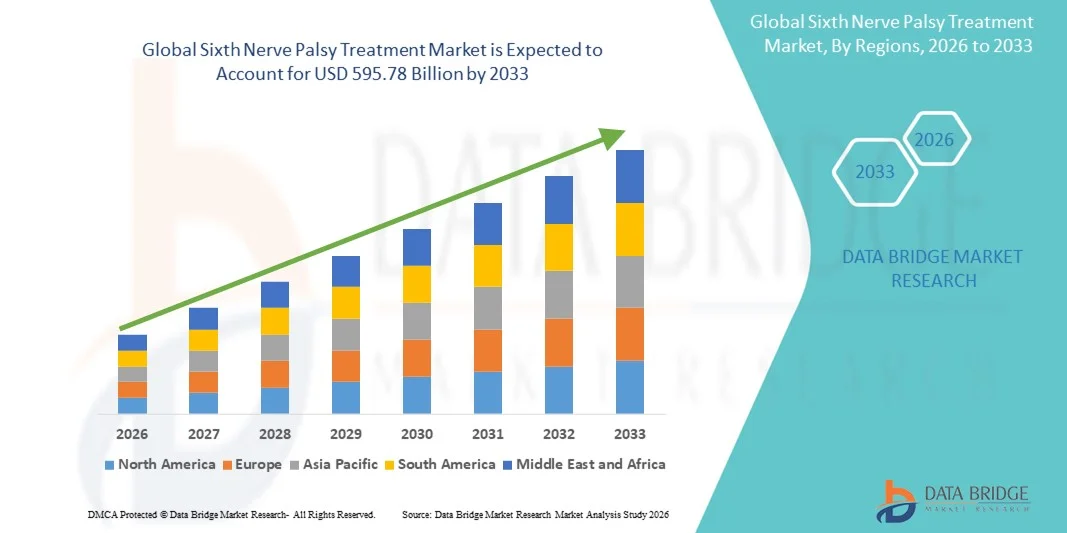

- The global sixth nerve palsy treatment market size was valued at USD 432.00 billion in 2025 and is expected to reach USD 595.78 billion by 2033, at a CAGR of 4.10% during the forecast period

- The market growth is largely fueled by the increasing prevalence of neurological disorders, rising awareness of eye movement disorders, and advancements in diagnostic and treatment technologies, leading to improved patient outcomes and greater adoption of specialized therapies

- Furthermore, growing investments in healthcare infrastructure, increasing access to ophthalmology and neurology specialists, and the expansion of treatment centers are driving the uptake of Sixth Nerve Palsy Treatment solutions, thereby significantly boosting the industry’s growth

Sixth Nerve Palsy Treatment Market Analysis

- Sixth Nerve Palsy Treatment, encompassing surgical, pharmacological, and rehabilitative interventions, is becoming increasingly vital in the management of ocular motor disorders due to its ability to restore eye movement, alleviate diplopia, and improve patient quality of life

- The escalating demand for sixth nerve palsy treatment is primarily fueled by rising awareness of neurological and ocular disorders, advancements in diagnostic and treatment technologies, and growing access to specialized ophthalmology and neurology care

- North America dominated the sixth nerve palsy treatment market with the largest revenue share of 41.2% in 2025, supported by a well-established healthcare infrastructure, high awareness of ocular and neurological disorders, access to advanced treatment modalities, and the presence of leading research institutions. The U.S. is witnessing substantial growth in the adoption of sixth nerve palsy treatment, particularly in specialized ophthalmology and pediatric care centers, driven by clinical research programs and government funding initiatives

- Asia-Pacific is expected to be the fastest-growing region in the sixth nerve palsy treatment market during the forecast period, projected to register a CAGR driven by increasing healthcare investments, improving access to advanced diagnostic tools, rising awareness of rare neurological disorders, and expanding availability of specialized treatment facilities across developing countries such as China and India

- The Injection segment dominated with the largest revenue share of 51.2% in 2025, primarily due to its role in corticosteroid and botulinum toxin therapy

Report Scope and Sixth Nerve Palsy Treatment Market Segmentation

|

Attributes |

Sixth Nerve Palsy Treatment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Sixth Nerve Palsy Treatment Market Trends

Advancements in Targeted Therapies and Diagnostic Approaches

- A key trend in the global sixth nerve palsy treatment market is the increasing adoption of targeted therapeutic approaches, including pharmacological interventions aimed at managing ocular misalignment, alleviating diplopia, and supporting nerve regeneration

- For instance, in 2024, a leading neurology center in the U.S. implemented an early MRI-based diagnostic protocol for Sixth Nerve Palsy patients, resulting in faster treatment initiation and improved recovery outcomes, highlighting the trend toward more precise and timely care

- Emerging treatment options, such as botulinum toxin therapy, prism glasses, and eye muscle surgery techniques, are being optimized for faster recovery and improved patient outcomes

- In addition, there is a growing focus on early and precise diagnosis using advanced imaging technologies and neuro-ophthalmological assessments, enabling clinicians to identify underlying causes more accurately and personalize treatment plans

- Integration of multidisciplinary care, involving ophthalmologists, neurologists, and physiotherapists, is enhancing the effectiveness of interventions and improving long-term prognosis

- Research into minimally invasive procedures and novel pharmacological agents is accelerating, with several clinical trials underway to evaluate efficacy and safety, which is expected to drive innovation in the market

Sixth Nerve Palsy Treatment Market Dynamics

Driver

Rising Prevalence of Sixth Nerve Palsy and Increased Awareness Among Clinicians

- The growing incidence of Sixth Nerve Palsy, particularly due to vascular disorders, trauma, infections, and tumor-related causes, is a significant driver of market growth

- Increasing awareness among healthcare professionals about the importance of early diagnosis and intervention is leading to higher treatment adoption rates

- For instance, hospitals and specialty neurology and ophthalmology centers are increasingly implementing standardized treatment protocols, including pharmacological and surgical options, to manage complex cases efficiently

- Advancements in diagnostic imaging, such as MRI and CT scans, support early detection of cranial nerve pathologies and help guide personalized treatment strategies

- Government and non-government initiatives promoting rare neurological disorder awareness, coupled with funding for research in ophthalmic and neurological care, are further boosting the market

- Rising patient awareness about treatment options and potential outcomes is also encouraging timely clinical consultation, contributing to increased demand for therapeutic interventions

Restraint/Challenge

Limited Patient Pool, High Treatment Costs, and Access to Specialized Care

- The relatively low prevalence of Sixth Nerve Palsy and its classification as a rare neurological disorder limit the size of the patient pool, creating challenges for widespread adoption of certain therapies.

- The high cost of advanced surgical procedures and specialized pharmacological treatments can pose a barrier for patients, particularly in developing regions or in healthcare systems with limited insurance coverage

- Accessibility to highly trained ophthalmologists, neuro-ophthalmology centers, and specialized hospitals is uneven across regions, which can delay treatment and affect outcomes

- Variability in treatment protocols and lack of standardized care guidelines in some regions contribute to inconsistent patient management

- For instance, in 2023, a hospital in India had to defer several corrective eye muscle surgeries due to limited availability of trained ophthalmic surgeons, underscoring access and capacity challenges, which exemplifies the restraint on market growth

- Ongoing need for post-treatment rehabilitation, such as prism therapy or eye exercises, adds additional costs and may affect patient adherence to treatment plans

- Overcoming these challenges requires increased investment in healthcare infrastructure, training programs for specialists, patient education, and efforts to make therapies more affordable and widely accessible

Sixth Nerve Palsy Treatment Market Scope

The market is segmented on the basis of Treatment, Diagnosis, Dosage, Route of Administration, End-Users, and Distribution Channel.

- By Treatment

On the basis of treatment, the Sixth Nerve Palsy Treatment market is segmented into Antibiotics, Corticosteroids, Surgery, Botulinum Toxin, and Others. The Corticosteroids segment dominated the market with the largest revenue share of 38.7% in 2025, driven by its established clinical effectiveness in reducing inflammation and improving nerve function. Corticosteroids are widely preferred by hospitals and specialty neurology clinics as first-line therapy due to their rapid onset and well-established safety profile. They are commonly administered in both adult and pediatric populations, supporting broad adoption. The segment benefits from high physician familiarity, extensive clinical evidence, and availability in multiple formulations. Favorable reimbursement policies in developed regions such as North America and Europe further enhance adoption. Increasing awareness of early intervention benefits among clinicians drives usage. Research initiatives to reduce side effects and improve adherence are ongoing. Easy integration into treatment protocols and hospital workflows supports dominance. Patient compliance is generally high due to visible improvement in symptoms. Expansion in hospital and outpatient settings contributes to growth. Clinical guidelines and standardized protocols strengthen segment leadership.

The Botulinum Toxin segment is projected to witness the fastest CAGR of 21.3% during 2026–2033, driven by growing demand for minimally invasive therapies to manage ocular misalignment and diplopia. Adoption is increasing in specialized neurology and ophthalmology centers, supported by clinical studies highlighting efficacy and safety. Non-surgical administration reduces patient recovery time and procedural risks. Rising physician training programs and awareness campaigns are expanding the patient base. Insurance coverage improvements in key markets facilitate accessibility. Regulatory approvals in developed and emerging markets enhance adoption. Integration with outpatient care protocols and follow-up assessments supports utilization. Growing preference in Asia-Pacific for non-invasive therapy accelerates growth. Cost reductions and technological refinements in injection techniques further boost adoption. The segment benefits from increasing clinical evidence and physician confidence. Patient convenience and minimal downtime contribute to rapid uptake. Expansion of botulinum toxin availability in hospital and clinic settings strengthens forecast growth.

- By Diagnosis

On the basis of diagnosis, the Sixth Nerve Palsy Treatment market is segmented into Blood Tests, CT Scan, MRI, Laboratory Tests, and Others. The MRI segment dominated with the largest revenue share of 45.6% in 2025, attributed to its superior accuracy in detecting cranial nerve lesions, tumors, and vascular anomalies. Hospitals and specialty clinics rely on MRI for precise treatment planning and follow-up monitoring. MRI is non-invasive and provides detailed imaging, enabling better clinical outcomes. The segment benefits from technological advancements such as high-resolution and functional imaging. Widespread availability in developed regions and integration with hospital digital systems strengthen adoption. Physician confidence and guideline recommendations support consistent utilization. MRI is widely applied across adult and pediatric populations. Awareness campaigns emphasizing early diagnosis drive referrals. Insurance coverage in developed markets enhances access. Clinical workflow integration improves efficiency. Expansion of MRI centers in urban areas supports segment dominance. Rising patient awareness and demand for accurate diagnostics contribute to continued growth.

The Laboratory Tests segment is projected to witness the fastest CAGR of 18.9% during 2026–2033, fueled by increasing reliance on blood panels and biomarker analysis to identify systemic or infectious causes of Sixth Nerve Palsy. Adoption is growing in outpatient and community clinics. Integration with telemedicine and electronic health records enables timely diagnosis. Rising physician awareness and adoption of standardized testing protocols drive growth. Laboratory tests are cost-effective for initial screening compared to advanced imaging. Government-supported diagnostic initiatives in emerging markets enhance access. Expansion of lab infrastructure in Asia-Pacific contributes to rapid uptake. Growing demand for follow-up monitoring and treatment optimization supports adoption. Rising patient preference for less invasive diagnostic options further boosts growth. Clinical evidence demonstrating test reliability encourages physician confidence. Partnerships between hospitals and labs improve accessibility. The segment benefits from increasing urbanization and healthcare awareness.

- By Dosage

On the basis of dosage, the Sixth Nerve Palsy Treatment market is segmented into Tablet, Injection, and Others. The Injection segment dominated with the largest revenue share of 51.2% in 2025, primarily due to its role in corticosteroid and botulinum toxin therapy. Injection allows direct delivery to target areas, ensuring rapid therapeutic effects and high efficacy in acute cases. Hospitals and specialty clinics prefer injections for controlled dosing and patient monitoring. Use in inpatient and emergency care settings strengthens adoption. Clinical protocols and training programs improve safety and consistency. Availability in multiple healthcare settings enhances accessibility. Favorable insurance coverage and reimbursement in developed markets support adoption. High patient compliance is driven by visible clinical improvement. Integration with hospital workflows ensures efficient administration. The segment is preferred for severe or complex cases requiring immediate intervention. Physician familiarity and guideline support reinforce segment dominance.

The Tablet segment is projected to witness the fastest CAGR of 19.6% during 2026–2033, driven by outpatient and home-based administration convenience. Tablets are widely used for corticosteroids and supportive medications, enhancing patient adherence. Growing patient preference for oral therapy supports segment growth. Expansion of hospital and retail pharmacy networks improves accessibility. Clinical studies demonstrating efficacy and safety encourage physician adoption. Cost-effectiveness and insurance coverage improvements further drive adoption. Patient education programs improve adherence in home-based care. Tablet usage is increasing in developing regions due to easier distribution. Long-term therapy benefits enhance segment potential. Integration into outpatient treatment protocols supports adoption. Marketing and awareness campaigns further promote usage. Growing demand in emerging markets accelerates growth.

- By Route of Administration

On the basis of route of administration, the market is segmented into Oral, Intravenous, and Others. The Intravenous segment dominated with a revenue share of 47.8% in 2025, owing to rapid onset of action and precise dosing in corticosteroid and botulinum toxin therapies. It is preferred in hospital inpatient and critical care settings for severe or acute cases. Direct systemic delivery ensures immediate therapeutic effects. Adoption is highest in developed regions with advanced hospital infrastructure. Clinical guidelines recommend intravenous administration for complex cases. Integration with standard hospital protocols ensures safety and consistency. Insurance coverage supports affordability in key markets. High physician confidence in efficacy maintains segment dominance. Multidisciplinary care adoption further strengthens utilization. Availability in hospitals ensures patient access. Rapid response in emergencies reinforces segment preference.

The Oral segment is projected to witness the fastest CAGR of 20.3% during 2026–2033, due to ease of self-administration and suitability for outpatient and home-based therapy. Tablets and oral corticosteroid formulations support long-term management. Patient convenience and adherence drive adoption. Expansion of retail pharmacies in emerging markets enhances accessibility. Awareness campaigns encourage self-managed treatment. Cost-effectiveness compared to injections promotes growth. Outpatient care protocols support oral therapy uptake. Increased patient preference for non-invasive routes contributes to rapid growth. Growing adoption in Asia-Pacific further accelerates expansion. Insurance coverage improvements improve affordability.

- By End-Users

On the basis of end-users, the market is segmented into Clinic, Hospital, and Others. The Hospital segment dominated with the largest revenue share of 62.4% in 2025, supported by specialized neurology and ophthalmology departments, advanced diagnostic tools, and inpatient care facilities. Hospitals provide integrated treatment combining diagnostics, surgery, and pharmacological therapy. Adoption is highest due to structured protocols and multidisciplinary teams. Investments in rare neurological disorder programs enhance growth. Insurance coverage facilitates patient access. Hospital pharmacies ensure availability of required medications. Physician expertise ensures treatment quality. Standardized care and monitoring improve outcomes. Hospital-based clinical research strengthens adoption. Accessibility in urban centers supports segment dominance. Patient preference for comprehensive care reinforces uptake.

The Clinic segment is projected to witness the fastest CAGR of 22.1% during 2026–2033, driven by expansion of outpatient neurology and ophthalmology services. Clinics provide convenient access for routine management, follow-ups, and minimally invasive therapies. Telemedicine integration enhances service delivery. Cost-effectiveness and shorter waiting times promote adoption. Patient education and awareness improve adherence. Urban and semi-urban expansion increases accessibility. Partnerships with diagnostic centers support growth. Convenience for home-based patients accelerates adoption. Rising patient preference for outpatient care enhances market potential.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into Hospital Pharmacy, Retail Pharmacy, and Online Pharmacy. The Hospital Pharmacy segment dominated with the largest revenue share of 53.5% in 2025, due to direct availability of advanced therapies and integration with inpatient and outpatient care. Hospital pharmacies provide reliable access to specialized formulations and medications. Clinical workflow integration ensures timely treatment. Insurance coverage in key markets supports affordability. Physician preference for hospital-based dispensing strengthens dominance.

The Online Pharmacy segment is projected to witness the fastest CAGR of 25.4% during 2026–2033, driven by digital adoption and convenience for remote patients. Online pharmacies facilitate access to medications in urban and rural areas. Telemedicine integration allows seamless delivery. Regulatory support and patient education improve adoption. Rising e-commerce penetration in Asia-Pacific accelerates growth. Online channels provide convenience, privacy, and cost-effectiveness, enhancing uptake. Expansion of reliable courier and logistics services ensures timely delivery of medicines. Increasing partnerships between online pharmacies and hospitals or clinics further drive market penetration.

Sixth Nerve Palsy Treatment Market Regional Analysis

- North America dominated the sixth nerve palsy treatment market with the largest revenue share of 41.2% in 2025

- Supported by a well-established healthcare infrastructure, high awareness of ocular and neurological disorders

- Access to advanced treatment modalities, and the presence of leading research institutions

U.S. Sixth Nerve Palsy Treatment Market Insight

The U.S. sixth nerve palsy treatment market captured the largest revenue share within North America in 2025, fueled by the presence of specialized ophthalmology and pediatric care centers, government funding initiatives, and ongoing clinical research programs. The adoption of advanced therapeutic approaches and surgical interventions is significantly increasing, supported by high awareness among medical professionals and patient populations.

Europe Sixth Nerve Palsy Treatment Market Insight

The Europe sixth nerve palsy treatment market is projected to expand at a substantial CAGR during the forecast period, driven by increasing awareness of neurological disorders, advanced healthcare infrastructure, and rising adoption of both pharmacological and surgical treatments. Countries like Germany, France, and Italy are seeing higher demand for specialized treatments in hospitals and clinics, particularly in pediatric and ophthalmology-focused centers.

U.K. Sixth Nerve Palsy Treatment Market Insight

The U.K. sixth nerve palsy treatment market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising patient awareness, increasing healthcare investments, and a focus on early diagnosis and treatment. Hospitals and clinics are increasingly adopting comprehensive diagnostic tools and treatment protocols to improve patient outcomes.

Germany Sixth Nerve Palsy Treatment Market Insight

The Germany sixth nerve palsy treatment market is expected to expand at a considerable CAGR during the forecast period, supported by advanced medical infrastructure, research-driven treatment development, and growing awareness of ocular motor disorders. Hospitals and specialty clinics are increasingly focusing on effective treatment interventions and rehabilitation programs.

Asia-Pacific Sixth Nerve Palsy Treatment Market Insight

The Asia-Pacific sixth nerve palsy treatment market is poised to grow at the fastest CAGR during the forecast period, driven by increasing healthcare investments, expanding hospital infrastructure, improving access to diagnostics, and growing awareness of rare neurological disorders in countries such as China, India, and Japan. The rising number of specialized treatment facilities and adoption of advanced therapies is contributing significantly to market growth.

Japan Sixth Nerve Palsy Treatment Market Insight

The Japan sixth nerve palsy treatment market is gaining momentum due to the country’s advanced healthcare system, focus on ophthalmology and pediatric care, and growing awareness of neurological disorders. Adoption of specialized treatment interventions and early diagnosis programs is driving market expansion.

China Sixth Nerve Palsy Treatment Market Insight

The China sixth nerve palsy treatment market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to increasing healthcare infrastructure, government initiatives to improve access to specialized care, rising awareness of rare neurological disorders, and growing adoption of advanced treatment modalities in urban and semi-urban hospitals and clinics.

Sixth Nerve Palsy Treatment Market Share

The Sixth Nerve Palsy Treatment industry is primarily led by well-established companies, including:

• Fresenius Kabi (Germany)

• Roche (Switzerland)

• Novartis (Switzerland)

• Sanofi (France)

• Pfizer (U.S.)

• GlaxoSmithKline (U.K.)

• Cipla (India)

• Sun Pharmaceutical (India)

• Aurobindo Pharma (India)

• Baxter International (U.S.)

• AbbVie (U.S.)

• Boehringer Ingelheim (Germany)

• Takeda Pharmaceutical (Japan)

• Johnson & Johnson (U.S.)

• Teva Pharmaceuticals (Israel)

• Hikma Pharmaceuticals (U.K.)

• Amgen (U.S.)

• Biocon (India)

• Shire (Ireland)

Latest Developments in Global Sixth Nerve Palsy Treatment Market

- In October 2023, a study published preliminary results for a new modification of vertical muscle transposition surgery aimed at enhancing abducting force in patients with sixth‑nerve palsy. This surgical variation—intended to better restore eye movement in longstanding palsy—showed promising early outcomes in restoring lateral rectus function

- In July 2024, a retrospective study from India involving 82 patients with isolated sixth‑nerve palsy found that ~87% achieved complete recovery (spontaneously or with conservative management) over 6 months follow‑up, reinforcing that many cases still benefit from non‑surgical/observation‑first approaches before invasive intervention

- In August 2024, a case was reported of isolated sixth‑nerve palsy occurring after infection with COVID-19; the patient responded to a course of corticosteroids, with comparatively rapid recovery — highlighting evolving recognition of inflammatory or post‑viral etiologies and steroid responsiveness in some not‑previously considered cases

- In October 2025, a case report described bilateral sixth‑nerve palsy developing after intravitreal injection of Ranibizumab, a commonly used anti‑VEGF agent. The palsy was attributed to microvascular disturbances; notably, the patient’s lateral‑rectus function improved over three months — drawing attention to rare iatrogenic risks and informing risk‑benefit considerations in ophthalmic drug use

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.