Global Skin And Skin Structure Infections Treatment Market

Market Size in USD Billion

CAGR :

%

USD

13.03 Billion

USD

25.02 Billion

2025

2033

USD

13.03 Billion

USD

25.02 Billion

2025

2033

| 2026 –2033 | |

| USD 13.03 Billion | |

| USD 25.02 Billion | |

|

|

|

|

Skin and Skin Structure Infections (SSSI) (Infectious Disease) Treatment Market Size

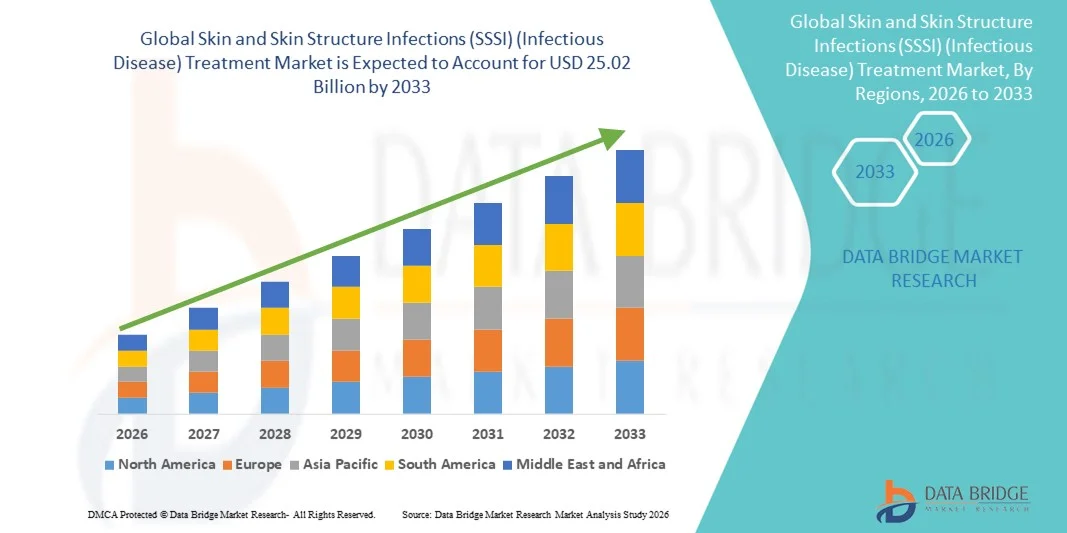

- The global Skin and Skin Structure Infections (SSSI) (Infectious Disease) Treatment market size was valued at USD 13.03 billion in 2025 and is expected to reach USD 25.02 billion by 2033, at a CAGR of 8.50% during the forecast period

- The market growth is largely fueled by the increasing prevalence of bacterial skin infections, rising cases of hospital-acquired infections, and the growing burden of chronic wounds such as diabetic foot ulcers and pressure ulcers, which require effective and timely treatment solutions

- Furthermore, rapid advancements in antibiotic therapies, improved diagnostic techniques, and increasing awareness regarding early treatment and prevention of skin infections are accelerating the adoption of Skin and Skin Structure Infections (SSSI) treatment solutions, thereby significantly boosting the overall market growth

Skin and Skin Structure Infections (SSSI) (Infectious Disease) Treatment Market Analysis

- Skin and Skin Structure Infections (SSSI), including cellulitis, abscesses, surgical site infections, and chronic wound infections, are becoming increasingly prevalent in both hospital and community settings, creating a growing demand for effective and targeted treatment solutions

- The escalating demand for skin and skin structure infections (SSSI) treatment is primarily driven by the rising number of surgical procedures, increasing prevalence of diabetes and immunocompromised conditions, growing antibiotic resistance, and a higher incidence of hospital-acquired and community-acquired infections worldwide

- North America dominated the skin and skin structure infections (SSSI) (Infectious Disease) treatment market with a revenue share of approximately 45.6% in 2025, supported by its advanced healthcare infrastructure, high awareness levels, early diagnosis rates, and strong presence of major pharmaceutical and biotechnology companies

- Asia-Pacific is expected to be the fastest growing region in the skin and skin structure infections (SSSI) (Infectious Disease) treatment market during the forecast period due to increasing healthcare expenditure, growing population, rising prevalence of infectious diseases, and improving access to advanced medical treatments

- The antibiotics segment dominated the largest market revenue share of 61.8% in 2025, driven by its proven clinical effectiveness in treating moderate to severe bacterial skin infections

Report Scope and Skin and Skin Structure Infections (SSSI) (Infectious Disease) Treatment Market Segmentation

|

Attributes |

Skin and Skin Structure Infections (SSSI) (Infectious Disease) Treatment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Skin and Skin Structure Infections (SSSI) (Infectious Disease) Treatment Market Trends

Enhanced Diagnostic Precision and Rapid Point-of-Care Testing

- A significant and accelerating trend in the global skin and skin structure infections (SSSI) treatment market is the widespread adoption of rapid molecular diagnostics, point-of-care (POC) testing, and advanced imaging to enable faster, more accurate identification of causative pathogens and resistance markers. This shift from empirical therapy toward targeted treatment is improving clinical outcomes and shortening time to effective therapy

- For instance, multiplex PCR panels and POC antigen tests now allow clinicians to distinguish bacterial from non-bacterial skin infections and to rapidly detect resistant organisms such as MRSA at the bedside, enabling immediate escalation or de-escalation of therapy. Likewise, bedside ultrasound and dermatologic imaging help clinicians differentiate abscesses that require incision and drainage from cellulitis that can be managed medically

- Advances in rapid susceptibility testing permit early tailoring of antibiotic choice (e.g., switching from broad-spectrum empiric drugs to narrow-spectrum agents), reducing unnecessary exposure to broad antimicrobials and lowering the risk of adverse events. In many emergency departments and outpatient clinics, these diagnostics are already shortening hospital stays and reducing readmission rates for complicated skin infections

- The integration of POC diagnostics with antimicrobial stewardship programs facilitates real-time decision support for prescribers, improving guideline adherence and optimizing antibiotic use. As diagnostic accuracy improves, clinicians can more confidently select topical versus systemic therapy, choose appropriate duration of therapy, and avoid unnecessary surgical interventions

- The trend toward faster, more precise diagnostics is reshaping clinical pathways for SSSI management: earlier definitive therapy, fewer broad-spectrum antibiotic days, and a reduction in downstream complications. Consequently, companies and health systems are investing in rapid assay development, POC platforms, and clinician training to capitalize on these benefits

- Demand for diagnostics that deliver quick, actionable results at the site of care is growing rapidly across inpatient and outpatient settings, driven by payers’ interest in cost containment and clinicians’ need to reduce treatment failures and antimicrobial overuse

Skin and Skin Structure Infections (SSSI) (Infectious Disease) Treatment Market Dynamics

Driver

Growing Need Due to Rising Infection Burden and Antimicrobial Resistance

- The increasing incidence of complicated skin and soft-tissue infections — driven by aging populations, rising rates of diabetes and obesity, and more invasive procedures — is a major driver for the SSSI treatment market. These comorbidities increase susceptibility to infections such as diabetic foot infections, surgical site infections, and recurrent cellulitis

- For instance, higher prevalence of chronic wounds and diabetic foot ulcers in many regions has expanded demand for both systemic therapies and advanced local treatments (e.g., wound dressings with antimicrobial properties and topical agents), making SSSI a growing area of clinical and commercial focus

- The rise of antimicrobial resistance (AMR), including resistant gram-positive organisms like MRSA and emerging resistant gram-negatives involved in skin infections, is pushing demand for novel antibiotics, long-acting agents, and combination therapies that can reliably treat resistant pathogens. This is prompting increased R&D investment from pharmaceutical firms and biotech startups

- In parallel, expanding outpatient parenteral antimicrobial therapy (OPAT) programs and novel long-acting injectable antibiotics are enabling earlier hospital discharge and ambulatory management of serious SSSI cases — a structural shift that increases market uptake of certain agents and delivery systems

- Growing awareness among clinicians and patients about appropriate wound care, early intervention, and infection prevention (e.g., perioperative bundles, diabetic foot clinics) is also driving market demand for diagnostics, topical antimicrobials, advanced dressings, and education services that reduce infection progression

- The combined effects of demographic trends, chronic disease burden, and AMR are therefore expanding the addressable market for both established antibiotics and innovative SSSI solutions across hospitals, specialty clinics, and outpatient settings

Restraint/Challenge

Antimicrobial Resistance, Access Constraints, and Regulatory Hurdles

- Antimicrobial resistance remains the single greatest clinical and commercial challenge for the SSSI treatment market. The emergence and spread of multidrug-resistant organisms complicate therapy, limit effective oral options, and increase reliance on costly intravenous agents, which can impede broad adoption in resource-limited settings

- For instance, increasing reports of Methicillin-resistant Staphylococcus aureus (MRSA) in hospital- and community-acquired skin infections have reduced the effectiveness of commonly prescribed beta-lactam antibiotics, forcing clinicians to use more expensive and last-resort therapies such as vancomycin, daptomycin, or linezolid, thereby increasing treatment costs and hospitalization duration

- In addition, access to advanced diagnostics, specialist wound care, and newer antimicrobial agents is uneven across geographies — creating disparities in treatment outcomes. In low- and middle-income regions, limited laboratory capacity and constrained formularies restrict clinicians to older, sometimes less effective antibiotics

- Economic and regulatory barriers also slow the entry and uptake of novel therapies: high development costs, complex clinical trial requirements (to demonstrate benefit over standard care), and conservative reimbursement pathways can delay launches and limit commercial viability for smaller developers

- Concerns about side effects and stewardship — for instance, reluctance to use newer broad-spectrum agents unless clearly indicated — can restrict prescribing, especially where local guidelines emphasize conservation of last-line antibiotics. Clinician inertia and lack of awareness about novel formulations or delivery systems may further delay adoption

- Overcoming these challenges requires coordinated efforts: stronger global surveillance of resistance patterns, investment in diagnostic capacity, stewardship programs that balance access with conservation, and payer strategies that support adoption of high-value diagnostics and therapeutics. Without these measures, AMR and inequitable access will continue to constrain the SSSI market’s potential despite growing clinical need

Skin and Skin Structure Infections (SSSI) (Infectious Disease) Treatment Market Scope

The market is segmented on the basis of treatment, dosage, route of administration, end-users, and distribution channel.

- By Treatment

On the basis of treatment, the Skin and Skin Structure Infections (SSSI) (Infectious Disease) Treatment market is segmented into antibiotics, topical solutions, surgery, and others. The antibiotics segment dominated the largest market revenue share of 61.8% in 2025, driven by its proven clinical effectiveness in treating moderate to severe bacterial skin infections. Broad-spectrum and targeted antibiotics are widely prescribed by physicians as the first-line therapy for conditions such as cellulitis, impetigo, and necrotizing infections. Increasing prevalence of bacterial infections in both developed and developing regions further strengthens this segment. Hospitals and clinics continue to rely heavily on systemic antibiotics for rapid infection control. High physician confidence and availability of both branded and generic antibiotics support demand. Rising cases of antibiotic-resistant strains also encourage the use of advanced antibiotics under close supervision. Strong presence of well-established pharmaceutical manufacturers contributes to sustained dominance. Government-supported antimicrobial treatment programs further boost uptake. The consistent clinical success rate of antibiotic therapy reinforces its leadership position in the market.

The topical solutions segment is expected to witness the fastest CAGR of 18.6% from 2026 to 2033, driven by the rising preference for non-invasive and localized treatment options. Patients increasingly favor creams, gels, and ointments due to their ease of application and lower risk of systemic side effects. Growing awareness about early-stage infection management using topical antimicrobials fuels demand. Topical solutions are widely used in outpatient settings and for mild to moderate infections. Innovations in formulation technology such as sustained-release and combination products support faster market penetration. Increasing self-medication and over-the-counter availability also contribute to growth. Dermatology clinics are increasingly recommending advanced topical therapies. E-commerce platforms improve accessibility to a wide range of topical products. Rising popularity of home-based wound care further accelerates adoption.

- By Dosage

On the basis of dosage, the Skin and Skin Structure Infections (SSSI) Treatment market is segmented into tablet, injection, and others. The injection segment dominated with a market share of 55.4% in 2025, driven by its rapid onset of action and high bioavailability. Injectable antibiotics are preferred for severe and life-threatening skin infections requiring immediate medical intervention. Hospitals primarily administer injectable dosages for inpatient care, especially in ICU and emergency departments. The increasing number of hospitalized patients due to chronic diseases and weakened immunity further supports demand. Injectable therapies are also widely used in post-surgical wound infections. Strong clinical reliability makes this the first choice for critical cases. Availability of advanced IV delivery systems enhances treatment efficiency. High physician trust and standardized hospital protocols reinforce market leadership. Continuous product improvement in injectable formulations supports long-term dominance.

The tablet segment is expected to grow at the fastest CAGR of 17.3% from 2026 to 2033, due to rising preference for oral, self-administered therapy. Tablets offer convenience, portability, and cost-effectiveness, making them highly suitable for outpatient and homecare settings. Increasing shift toward ambulatory care and early hospital discharge programs boosts the use of oral medications. Improved drug absorption technologies enhance effectiveness, encouraging prescription rates. The expanding geriatric population with a high incidence of skin infections supports segment growth. Growing accessibility in retail and online pharmacies also contributes. Global initiatives to reduce hospital burden accelerate oral treatment adoption. Patient compliance is higher with tablet dosage forms. Pharmaceutical companies are launching more combination oral therapies to meet rising demand.

- By Route of Administration

On the basis of route of administration, the market is segmented into oral, topical, intravenous, and others. The intravenous segment dominated the market with a revenue share of 49.6% in 2025, due to its critical role in treating severe and rapidly progressing skin infections. IV administration ensures immediate drug delivery into the bloodstream, making it ideal for emergency situations. Hospitals rely on IV therapy for complex, multi-drug resistant infections. Growing hospital admissions for bacterial and fungal infections enhance this segment’s value. IV treatment remains standard protocol in critical care units. The presence of skilled healthcare professionals enhances safe administration. Rising surgical procedures also increase the need for IV antibiotics. Strong infrastructure in developed economies contributes to high adoption. Continuous advancements in IV drug delivery systems reinforce dominance.

The topical route is expected to witness the fastest CAGR of 19.1% from 2026 to 2033, supported by its localized effect and minimal systemic exposure. It is widely used for superficial skin infections and wound healing. Increased awareness of early infection treatment contributes to growing demand. Patients prefer topical applications for ease of use and reduced pain. Innovation in bio-adhesive and antimicrobial formulations enhances effectiveness. Growth of homecare treatment trends supports expansion. Increasing recommendation by dermatologists strengthens market momentum. OTC product availability expands consumer access. Emerging markets show rapid adoption due to affordability.

- By End-Users

On the basis of end-users, the market is segmented into clinic, hospital, and others. The hospital segment dominated with a market share of 64.9% in 2025, owing to the high admission of patients suffering from severe skin infections. Hospitals possess advanced diagnostic facilities, specialized infectious disease departments, and intensive care units required for treatment. The presence of trained healthcare professionals enables proper management of complicated cases. Rising number of surgical procedures increases infection risk and treatment demand. Strong government investments in hospital infrastructure support growth. Hospitals also serve as major centers for antibiotic and injectable therapy. Large-scale procurement of drugs strengthens this segment. Growing population and urbanization increase hospital footfall. Continuous advancements in hospital-based treatment protocols enhance dominance.

The clinic segment is expected to grow at the fastest CAGR of 16.5% from 2026 to 2033, driven by increasing demand for outpatient skin infection management. Clinics provide faster, cost-effective, and accessible treatment options. Growing number of dermatology and specialty clinics boosts market expansion. Patients mostly prefer clinics for early-stage infections. Rising awareness about the importance of prompt treatment supports this trend. Clinics are increasingly adopting advanced diagnostic methods. Expansion in rural and suburban areas contributes to rapid adoption. Reduced waiting time makes clinics a preferred option. Growing investment in private clinics strengthens the segment.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into hospital pharmacy, retail pharmacy, and online pharmacy. The hospital pharmacy segment dominated with a share of 58.7% in 2025, as most injectable and advanced antibiotics are dispensed during inpatient treatment. Hospitals maintain an in-house pharmacy to ensure immediate availability of critical medications. Bulk procurement and government supply contracts support high volume distribution. Strict prescription control ensures regulated medicine usage. Increased hospitalization rates for SSSI enhance demand through this channel. Presence of skilled pharmacists enhances safe drug dispensation. Emergency treatment protocols further drive hospital dependency. Advanced inventory management systems support efficiency. Strong ties between pharmaceutical companies and hospital networks contribute to dominance.

The online pharmacy segment is projected to grow at the fastest CAGR of 20.4% from 2026 to 2033, due to rapid digitalization in healthcare. Increasing use of smartphones and internet access expands online medication purchasing. Home delivery convenience boosts patient preference. Growing chronic skin conditions drive repeat purchases. Competitive pricing and subscription models enhance affordability. Expanding telemedicine services link prescriptions with e-pharmacies. Rising trust in certified online platforms strengthens growth. Increased rural reach supports market penetration. Post-pandemic behavioral shifts further reinforce e-commerce adoption.

Skin and Skin Structure Infections (SSSI) (Infectious Disease) Treatment Market Regional Analysis

- North America dominated the skin and skin structure infections (SSSI) (infectious disease) treatment market with a revenue share of approximately 45.6% in 2025, supported by its advanced healthcare infrastructure, high awareness levels, early diagnosis rates, and strong presence of major pharmaceutical and biotechnology companies actively developing and commercializing effective treatment options

- The region benefits from widespread access to hospitals, specialty clinics, and well-established reimbursement systems, which support the higher adoption of advanced antibiotics, combination therapies, and novel treatment regimens for both acute and chronic SSSI cases

- Strong investments in infectious disease research, increasing hospital admissions due to complicated skin infections, and the growing prevalence of antibiotic-resistant pathogens further contribute to market expansion in North America

U.S. Skin and Skin Structure Infections (SSSI) (Infectious Disease) Treatment Market Insight

The U.S. skin and skin structure infections (SSSI) (infectious disease) treatment market captured the largest revenue share within North America in 2025, driven by a high incidence of bacterial skin infections, rising cases of hospital-acquired infections, and the presence of leading pharmaceutical manufacturers. Increased healthcare spending, advanced diagnostic capabilities, and heightened awareness regarding early treatment of skin infections are major factors boosting demand for SSSI therapies in the country.

Europe Skin and Skin Structure Infections (SSSI) (Infectious Disease) Treatment Market Insight

The Europe skin and skin structure infections (SSSI) (infectious disease) treatment market is projected to expand at a substantial CAGR throughout the forecast period, supported by increasing prevalence of infectious diseases, an aging population, and rising hospital admissions related to chronic wounds and post-surgical infections. Strong government support for healthcare innovation and the increasing adoption of advanced antimicrobial therapies are contributing to market growth across the region.

U.K. Skin and Skin Structure Infections (SSSI) (Infectious Disease) Treatment Market Insight

The U.K. skin and skin structure infections (SSSI) (infectious disease) treatment market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing awareness of early infection management, rising cases of diabetes-related skin complications, and improved access to healthcare services. Government initiatives focused on reducing hospital-acquired infections and improving antibiotic stewardship programs are also positively influencing market demand.

Germany Skin and Skin Structure Infections (SSSI) (Infectious Disease) Treatment Market Insight

The Germany skin and skin structure infections (SSSI) (infectious disease) treatment market is expected to expand at a considerable CAGR, supported by a strong healthcare system, high adoption of innovative treatment methods, and increasing investments in pharmaceutical research. The growing prevalence of chronic wounds among the elderly population and improved hospital infrastructure are further driving the market in Germany.

Asia-Pacific Skin and Skin Structure Infections (SSSI) (Infectious Disease) Treatment Market Insight

The Asia-Pacific skin and skin structure infections (SSSI) (infectious disease) treatment market is expected to be the fastest growing region during the forecast period, due to increasing healthcare expenditure, a rapidly growing population, rising prevalence of infectious and chronic diseases, improved access to medical facilities, and expanding awareness of the importance of early infection treatment.

Japan Skin and Skin Structure Infections (SSSI) (Infectious Disease) Treatment Market Insight

The Japan skin and skin structure infections (SSSI) (infectious disease) treatment market is gaining steady growth due to an aging population, advanced healthcare infrastructure, and increased focus on managing post-surgical and chronic skin infections. Strong investment in clinical research and improved access to modern treatment solutions are supporting market expansion in the country.

China Skin and Skin Structure Infections (SSSI) (Infectious Disease) Treatment Market Insight

The China Skin and skin and skin structure infections (SSSI) (infectious disease) treatment market accounted for the largest revenue share in Asia Pacific in 2025, driven by a large patient population, rising prevalence of infections, improving healthcare infrastructure, and increasing government support for disease prevention and treatment programs. The expansion of local pharmaceutical manufacturing and improved access to affordable medications are further strengthening the market in China.

Skin and Skin Structure Infections (SSSI) (Infectious Disease) Treatment Market Share

The Skin and Skin Structure Infections (SSSI) (Infectious Disease) Treatment industry is primarily led by well-established companies, including:

• Pfizer (U.S.)

• GlaxoSmithKline (U.K.)

• Novartis (Switzerland)

• Merck & Co. (U.S.)

• Johnson & Johnson (U.S.)

• Sanofi (France)

• Teva Pharmaceuticals (Israel)

• Bayer (Germany)

• AstraZeneca (Sweden)

• Bristol-Myers Squibb (U.S.)

• AbbVie (U.S.)

• Gilead Sciences (U.S.)

• Boehringer Ingelheim (Germany)

• Allergan (U.S.)

• Sandoz (Switzerland)

• Hikma Pharmaceuticals (Jordan)

• Lupin (India)

• Cipla (India)

Latest Developments in Global Skin and Skin Structure Infections (SSSI) (Infectious Disease) Treatment Market

- In March 2021, the U.S. FDA approved Kimyrsa (oritavancin) developed by Melinta Therapeutics for the treatment of acute bacterial skin and skin structure infections (ABSSSI). Kimyrsa introduced a faster administration time compared to traditional oritavancin infusions, requiring only a one-hour infusion. This advancement improved treatment efficiency for healthcare facilities and increased patient convenience, supporting broader outpatient use for SSSI conditions

- In July 2021, Melinta Therapeutics officially launched KIMYRSA® (oritavancin) in the U.S. market as a single-dose, long-acting intravenous therapy for ABSSSI. The product was positioned as a convenient alternative to multiple-dose antibiotic regimens, helping to reduce hospital stay duration and lowering overall treatment costs. Its launch significantly strengthened Melinta’s position in the infectious disease segment

- In January 2022, Paladin Labs, a subsidiary of Endo International, launched Xydalba (dalbavancin) in Canada for the treatment of ABSSSI in both adults and pediatric patients aged three months and above. This launch expanded treatment accessibility for skin infections in North America and highlighted the growing focus on long-acting, once-weekly antibiotic treatments designed to improve patient adherence

- In June 2022, the U.S. FDA expanded approval for Sivextro (tedizolid phosphate) for the treatment of acute bacterial skin and skin structure infections caused by susceptible Gram-positive pathogens. This approval strengthened the drug’s market presence as a potent alternative to linezolid, offering a shorter treatment course and reducing adverse side effects, which increased its demand in hospital and outpatient care settings

- In April 2024, the U.S. FDA approved ceftobiprole, developed by Basilea Pharmaceutica, for the treatment of acute bacterial skin and skin structure infections, including those caused by methicillin-resistant Staphylococcus aureus (MRSA). This marked an important milestone in the fight against antibiotic-resistant infections. The approval significantly expanded the company’s presence in the U.S. antibiotic market and provided clinicians with a powerful new treatment option for complicated SSSI cases

- In February 2025, several leading pharmaceutical companies accelerated clinical development of next-generation antibiotics and combination therapies targeting drug-resistant skin and soft tissue pathogens. Increased government funding and public-private partnerships supported R&D activities, especially for treatments effective against multidrug-resistant organisms. These advancements indicate a strong innovation focus within the global SSSI treatment market and are expected to shape future product pipelines

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.