Global Skin Patch Dna Biosensors Market

Market Size in USD Million

CAGR :

%

USD

94.05 Million

USD

334.79 Million

2025

2033

USD

94.05 Million

USD

334.79 Million

2025

2033

| 2026 –2033 | |

| USD 94.05 Million | |

| USD 334.79 Million | |

|

|

|

|

Skin-Patch DNA Biosensors Market Size

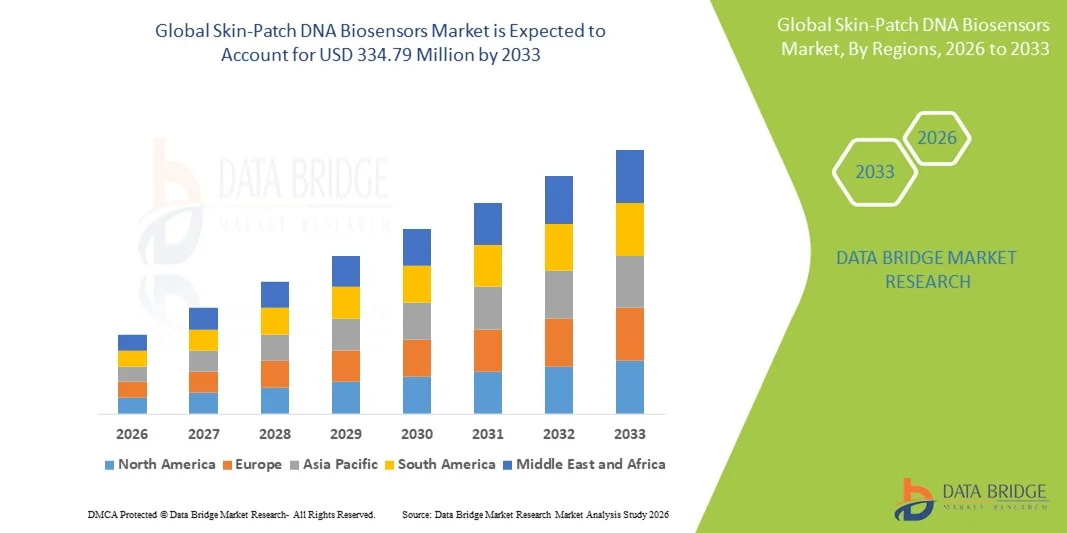

- The global skin-patch DNA biosensors market size was valued at USD 94.05 Million in 2025 and is expected to reach USD 334.79 Million by 2033, at a CAGR of17.20% during the forecast period

- The market growth is largely fueled by the growing adoption and technological advancements in wearable health monitoring devices and point-of-care diagnostics, leading to increased integration of Skin-Patch DNA Biosensors in clinical and home settings

- Furthermore, rising consumer demand for rapid, non-invasive, and accurate DNA-based testing solutions is driving the adoption of Skin-Patch DNA Biosensors, thereby significantly boosting the market’s expansion

Skin-Patch DNA Biosensors Market Analysis

- Skin-Patch DNA Biosensors, offering non-invasive and continuous monitoring of genetic markers, are increasingly vital components of modern healthcare, research, and diagnostic applications due to their enhanced accuracy, ease of use, and integration with digital health platforms

- The escalating demand for skin-patch DNA biosensors is primarily fueled by the growing adoption of wearable diagnostics, rising awareness of personalized medicine, and an increasing preference for real-time, patient-friendly monitoring solutions

- North America dominated the skin-patch DNA biosensors market with the largest revenue share of approximately 46.5% in 2025, supported by advanced healthcare infrastructure, high adoption of wearable diagnostics, strong research funding, and the presence of leading biotechnology and diagnostics companies. The U.S. accounted for the majority of regional demand due to increasing use of skin-patch biosensors in personalized medicine, early disease detection, and continuous health monitoring applications

- Asia-Pacific is expected to be the fastest-growing region in the skin-patch DNA biosensors market during the forecast period, registering a CAGR, driven by rising healthcare expenditure, expanding biotechnology sectors, growing awareness of wearable diagnostics, and supportive government initiatives in countries such as China, India, and Japan

- The Electrochemical Biosensors segment dominated the largest market revenue share of 41.8% in 2025, driven by its high sensitivity, rapid response, and cost-effectiveness.

Report Scope and Skin-Patch DNA Biosensors Market Segmentation

|

Attributes |

Skin-Patch DNA Biosensors Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Roche Diagnostics (Switzerland) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Skin-Patch DNA Biosensors Market Trends

Rising Demand Due to Point-of-Care Diagnostics and Personalized Healthcare

- The growing emphasis on personalized medicine and rapid point-of-care diagnostics is a key driver for the global Skin-Patch DNA Biosensors market. These biosensors allow non-invasive, continuous monitoring of genetic markers and health indicators, enabling tailored treatment and early disease detection

- For instance, in March 2024, GSK announced the development of a skin-patch biosensor for continuous glucose and genetic biomarker monitoring in metabolic disorders, highlighting industry momentum toward integrated diagnostics

- Patients and clinicians are increasingly favoring minimally invasive technologies over traditional blood tests due to convenience, comfort, and reduced infection risks. The trend of home-based monitoring and telehealth services supports the adoption of wearable DNA biosensors, which provide real-time data for personalized interventions

- Growing prevalence of chronic diseases, including diabetes, cardiovascular disorders, and genetic conditions, is encouraging adoption. Integration with mobile applications and cloud platforms for data analysis and remote monitoring enhances clinical utility

- Research institutions and pharmaceutical companies are investing in biosensor R&D to improve sensitivity, specificity, and ease of use. The availability of multiplexed biosensors capable of detecting multiple markers simultaneously strengthens demand

- Patient awareness campaigns and government health programs promoting preventive care further boost market adoption. The rising trend of wearable health devices and fitness monitoring also complements DNA biosensor uptake

- Partnerships between tech companies and healthcare providers are accelerating commercialization. The overall shift toward precision medicine and proactive health management ensures long-term market growth

Skin-Patch DNA Biosensors Market Dynamics

Driver

Technological Advancements and Integration with Health Monitoring Platforms

- The market is witnessing rapid technological innovations, including miniaturization, enhanced sensitivity, and multiplexing capabilities of skin-patch DNA biosensors

- For instance, in January 2025, Abbott Laboratories launched a next-generation wearable DNA biosensor capable of continuous genetic and epigenetic monitoring for at-risk populations

- Advances in microfluidics, nanomaterials, and flexible electronics have made skin-patch biosensors more reliable, durable, and suitable for long-term monitoring

- The integration of biosensors with cloud-based health analytics platforms allows real-time tracking of patient data and predictive health insights. Increased demand for early disease detection, especially for genetic disorders and infectious diseases, is driving innovation

- Research collaborations between academic institutions and biotech companies are accelerating product development. The focus on user-friendly designs encourages broader adoption across hospitals, clinics, and home settings. Continuous improvements in detection accuracy, lower detection limits, and rapid readouts enhance clinical confidence

- Healthcare providers are leveraging biosensor data for remote patient management and telemedicine services. Regulatory approvals for advanced biosensors are facilitating market entry in key regions

- Growing awareness about genetic testing and preventive healthcare fuels end-user demand. Investment in R&D for multifunctional skin-patch biosensors continues to be a major trend shaping the industry

Restraint/Challenge

High Costs and Regulatory Hurdles

- The relatively high development and manufacturing costs of skin-patch DNA biosensors pose a barrier to adoption, particularly in price-sensitive markets

- For instance, in June 2023, a market report highlighted that premium wearable biosensors for genetic monitoring remain largely limited to affluent regions due to their high price points

- Complex regulatory pathways for approval, including clinical validation and safety testing, slow product launch timelines. Varying regulations across regions create challenges for global market expansion

- Some end users exhibit hesitation due to concerns over data privacy and the accuracy of continuous genetic monitoring. Addressing these concerns requires robust validation studies, user education, and transparent data handling protocols

- Limited insurance reimbursement for advanced biosensor-based diagnostics in certain regions also restricts adoption. While technological advancements reduce long-term costs, initial capital investment remains high

- Smaller healthcare facilities may be reluctant to invest without clear evidence of clinical and cost-effectiveness. Manufacturers must balance innovation with affordability to penetrate emerging markets

- Public awareness and demonstration of tangible health outcomes are critical to overcoming adoption barriers. Collaboration with regulatory agencies, healthcare providers, and payers is necessary to streamline approvals and reduce market entry challenges

Skin-Patch DNA Biosensors Market Scope

The market is segmented on the basis of type and application.

- By Type

On the basis of type, the Skin-Patch DNA Biosensors market is segmented into Electrochemical Biosensors, Optical Biosensors, Piezoelectric Biosensors, Thermal Biosensors, and Others. The Electrochemical Biosensors segment dominated the largest market revenue share of 41.8% in 2025, driven by its high sensitivity, rapid response, and cost-effectiveness. These biosensors are widely used for detecting biomarkers in genetic testing and metabolic monitoring, and their simple design allows easy integration into wearable patches. The compatibility of electrochemical biosensors with continuous monitoring systems further enhances their adoption in clinical and home-based settings. Increasing investments in R&D for enhancing detection accuracy and miniaturization are strengthening their market position. In addition, the ability to provide real-time monitoring of analytes such as glucose, lactate, and nucleic acids drives preference among hospitals, diagnostic centers, and personalized healthcare providers. The segment’s reliability, reproducibility, and adaptability across multiple applications make it a preferred choice for healthcare providers globally. Rising awareness about non-invasive monitoring and the need for rapid point-of-care diagnostics further boosts demand. Partnerships between biosensor manufacturers and healthcare providers are accelerating commercialization. The integration of electrochemical biosensors with mobile apps for data tracking enhances patient engagement and personalized care. Favorable regulatory approvals and the increasing adoption of precision medicine further consolidate the segment’s dominance.

The Optical Biosensors segment is expected to witness the fastest CAGR of 19.6% from 2026 to 2033, propelled by advances in photonic and nanomaterial technologies that enhance detection sensitivity and specificity. Optical biosensors allow label-free detection of DNA, RNA, and protein biomarkers, making them highly suitable for point-of-care diagnostics and real-time monitoring. Continuous miniaturization and integration into wearable patches enable remote and home-based monitoring, expanding their market reach. Increasing use in personalized medicine and continuous health monitoring drives adoption in both clinical and consumer healthcare settings. The growing prevalence of chronic diseases and the need for early detection support rapid market expansion. Optical biosensors are increasingly being incorporated into multi-analyte detection platforms, allowing simultaneous monitoring of multiple biomarkers. Technological improvements such as surface plasmon resonance (SPR) and fluorescence-based detection enhance performance and reliability. Collaborative research initiatives with academic and medical institutions are accelerating product development and adoption. Rising funding for innovative biosensor technologies and favorable healthcare policies in key regions further boost growth. The versatility, accuracy, and ability to deliver rapid results make optical biosensors a preferred choice among healthcare providers. Increasing consumer interest in wearable and non-invasive diagnostics is expected to sustain high growth through the forecast period.

- By Application

On the basis of application, the Skin-Patch DNA Biosensors market is segmented into Clinical Diagnostics, Point-of-Care Testing, Personalized Medicine, Wearable Health Monitoring, and Others. The Clinical Diagnostics segment accounted for the largest market revenue share of 39.5% in 2025, driven by the widespread adoption of biosensors in hospitals, laboratories, and diagnostic centers. This segment benefits from increasing demand for rapid and accurate diagnostic solutions for infectious diseases, genetic disorders, and chronic conditions. Clinical diagnostics applications prioritize biosensors that are highly reliable, reproducible, and compatible with existing laboratory workflows. Hospitals and diagnostic laboratories favor biosensors that enable real-time, non-invasive testing and minimize patient discomfort. Regulatory approvals, hospital partnerships, and integration with electronic health records enhance adoption in clinical settings. Advancements in biosensor technologies and growing emphasis on early disease detection drive sustained demand. Increasing prevalence of chronic and genetic diseases globally also strengthens the segment’s dominance. Furthermore, the growing trend of personalized medicine encourages adoption of biosensors for targeted monitoring. The availability of biosensors with rapid response times and high sensitivity ensures preference for clinical applications. Strategic collaborations between biosensor manufacturers and healthcare providers accelerate product deployment. Rising awareness among clinicians about point-of-care and minimally invasive diagnostics supports consistent market expansion.

The Wearable Health Monitoring segment is expected to witness the fastest CAGR of 21.2% from 2026 to 2033, fueled by rising consumer demand for non-invasive, continuous health monitoring solutions. Wearable biosensors provide real-time insights into genetic, metabolic, and physiological markers, enabling personalized health management. Integration with mobile devices and cloud-based platforms allows remote monitoring and data-driven decision-making. Increasing interest in home-based healthcare, telemedicine, and fitness monitoring drives adoption. The segment benefits from technological advances in flexible electronics, microfluidics, and low-power biosensor design. Growing awareness of preventive healthcare and lifestyle monitoring supports rapid market penetration. Wearable biosensors also enable early detection of disease onset, empowering users to take timely action. Partnerships with digital health companies and app developers enhance user engagement and market reach. Rising investment in R&D for user-friendly, multifunctional wearable devices further accelerates growth. The versatility of wearable biosensors across clinical, fitness, and consumer applications makes this segment highly attractive. Increasing global prevalence of chronic diseases and genetic disorders adds to market momentum. Consumer preference for non-invasive, comfortable, and portable monitoring solutions ensures sustained CAGR growth throughout the forecast period.

Skin-Patch DNA Biosensors Market Regional Analysis

- North America dominated the skin-patch DNA biosensors market with the largest revenue share of approximately 46.5% in 2025

- Supported by advanced healthcare infrastructure, high adoption of wearable diagnostics, strong research funding, and the presence of leading biotechnology and diagnostics companies

- The market accounted for the majority of regional demand due to increasing use of skin-patch biosensors in personalized medicine, early disease detection, and continuous health monitoring applications

U.S. Skin-Patch DNA Biosensors Market Insight

The U.S. skin-patch DNA biosensors market captured the largest revenue share within North America, fueled by the growing adoption of wearable diagnostic devices and the integration of biosensors in healthcare and research applications. Rising awareness of personalized medicine and preventive healthcare is driving demand. Moreover, increasing investments in biotech startups and advanced diagnostic technologies are significantly contributing to market expansion.

Europe Skin-Patch DNA Biosensors Market Insight

The Europe skin-patch DNA biosensors market is projected to expand at a substantial CAGR during the forecast period, driven by rising investments in healthcare technology, growing adoption of wearable diagnostic devices, and increasing focus on preventive medicine. The region is witnessing robust growth across hospitals, diagnostic centers, and research institutions integrating skin-patch DNA biosensors for continuous health monitoring and genomic diagnostics.

U.K. Skin-Patch DNA Biosensors Market Insight

The U.K. skin-patch DNA biosensors market is expected to grow at a noteworthy CAGR due to increasing awareness of personalized medicine, adoption of wearable biosensors, and supportive healthcare initiatives. Expansion of diagnostic laboratories and rising emphasis on early disease detection are also fueling market growth.

Germany Skin-Patch DNA Biosensors Market Insight

The Germany skin-patch DNA biosensors market is anticipated to expand significantly during the forecast period, driven by strong biotechnology infrastructure, increasing healthcare expenditure, and rising adoption of wearable diagnostics for clinical and research applications. Government support for innovation and digital health integration is further enhancing market growth.

Asia-Pacific Skin-Patch DNA Biosensors Market Insight

The Asia-Pacific skin-patch DNA biosensors market is poised to grow at the fastest CAGR during the forecast period, driven by rising healthcare expenditure, expanding biotechnology sectors, growing awareness of wearable diagnostics, and supportive government initiatives in countries such as China, India, and Japan. Increasing investments in healthcare infrastructure and rising demand for early detection and continuous monitoring solutions are propelling the regional market.

Japan Skin-Patch DNA Biosensors Market Insight

The Japan skin-patch DNA biosensors market is witnessing rapid adoption due to a high-tech healthcare ecosystem, growing interest in personalized medicine, and demand for continuous health monitoring. Integration of skin-patch biosensors in clinical research and preventive healthcare programs is supporting market expansion.

China Skin-Patch DNA Biosensors Market Insight

The China skin-patch DNA biosensors market accounted for a significant revenue share in the Asia-Pacific region in 2025, driven by rapid urbanization, rising healthcare expenditure, expanding biotechnology industry, and high adoption of wearable diagnostics. Government initiatives promoting digital health and preventive care, along with the presence of strong domestic manufacturers, are key factors fueling market growth.

Skin-Patch DNA Biosensors Market Share

The Skin-Patch DNA Biosensors industry is primarily led by well-established companies, including:

• Roche Diagnostics (Switzerland)

• Abbott (U.S.)

• Siemens Healthineers (Germany)

• Thermo Fisher Scientific (U.S.)

• Illumina (U.S.)

• Agilent Technologies (U.S.)

• Bio-Rad Laboratories (U.S.)

• PerkinElmer (U.S.)

• Merck KGaA (Germany)

• Honeywell Life Sciences (U.S.)

• BD Biosciences (U.S.)

• Genalyte (U.S.)

• Circulogene (U.S.)

• OpGen (U.S.)

• Oxford Nanopore Technologies (U.K.)

• Samsung Biologics (South Korea)

• GE Healthcare Life Sciences (U.S.)

• Tecan Group (Switzerland)

• Becton Dickinson (U.S.)

Latest Developments in Global Skin-Patch DNA Biosensors Market

- In January 2023, researchers at National Institute of Standards and Technology (NIST), in collaboration with other institutes, unveiled a new modular DNA biosensor that can detect biomarkers (DNA sequences) with high sensitivity and low cost. The design relies on binding kinetics measured by a field-effect transistor (FET), making it suitable for inexpensive, portable diagnostic devices

- In December 2023, scientists developed a flexible photonic‑hydrogel patch capable of sweat‑based sensing for metabolites such as lactate, glucose, and urea. The design uses liquid crystal microdroplet resonators embedded in a hydrogel that adheres to skin, enabling non‑invasive metabolite monitoring — demonstrating potential for wearable biosensors beyond just electrical detection

- In December 2024, a research group published a demonstration of a wearable non‑enzymatic sensor patch based on a novel nanostructure (Black Phosphorus / Graphitic Carbon Nitride heterostructure). The patch enables real-time monitoring of glucose via sweat, showing improved sensitivity and stability — reflecting growing maturity in skin‑patch biosensors for metabolic / health monitoring.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.