Global Sleep Gummy Market

Market Size in USD Billion

CAGR :

%

USD

619.40 Billion

USD

901.28 Billion

2024

2032

USD

619.40 Billion

USD

901.28 Billion

2024

2032

| 2025 –2032 | |

| USD 619.40 Billion | |

| USD 901.28 Billion | |

|

|

|

|

What is the Global Sleep Gummy Market Size and Growth Rate?

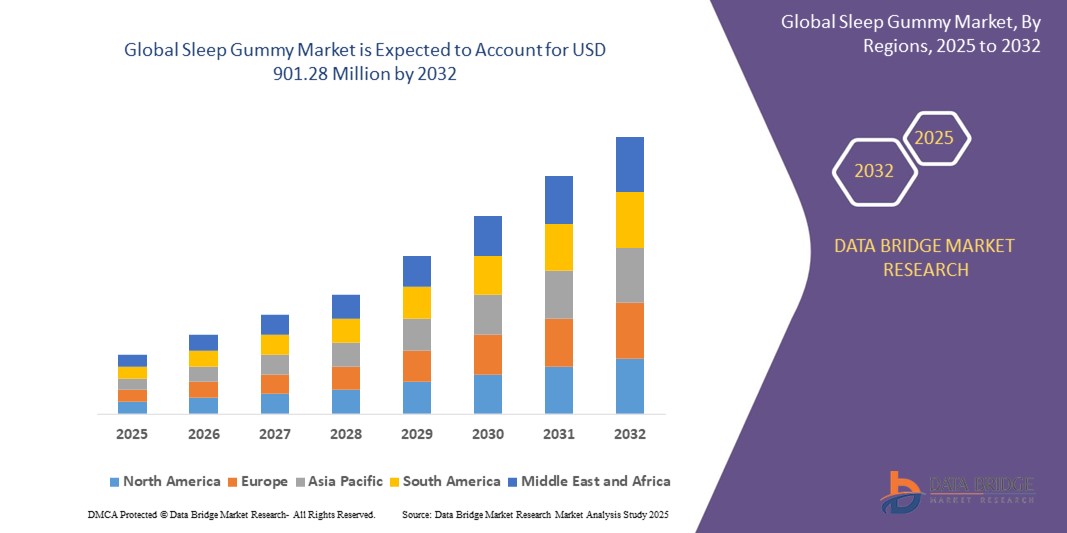

- The global sleep gummy market size was valued at USD 619.40 Million in 2024 and is expected to reach USD 901.28 Million by 2032, at a CAGR of 4.80% during the forecast period

- Market expansion is primarily driven by increasing awareness of sleep health, rising cases of insomnia and stress-related disorders, and the growing demand for convenient, non-prescription sleep aids

- In addition, the trend toward natural and plant-based ingredients in nutraceuticals, along with consumer preference for flavored, easy-to-consume formats, is further accelerating the adoption of sleep gummies globally

What are the Major Takeaways of Sleep Gummy Market?

- Sleep Gummies, infused with ingredients such as melatonin, CBD, valerian root, and chamomile, are gaining traction as natural alternatives to synthetic sleep medications, appealing to health-conscious consumers

- Rising awareness about the importance of quality sleep, particularly among millennials and working professionals, is significantly contributing to the market’s sustained growth

- The availability of sleep gummies through both online and retail channels, combined with attractive branding and evolving flavors, continues to enhance consumer reach and brand loyalty

- North America dominated the sleep gummy market with the largest revenue share of 38.44% in 2024, driven by heightened health awareness, rising incidences of sleep disorders, and the growing preference for non-prescription wellness products

- Asia-Pacific is the fastest-growing region in the sleep gummy market, expected to register a CAGR of 11.12% from 2025 to 2032, fueled by increasing disposable incomes, health awareness, and Western lifestyle influences

- The Melatonin segment dominated the sleep gummy market with the largest revenue share of 48.6% in 2024, owing to its well-established role in regulating sleep-wake cycles and its strong consumer awareness.

Report Scope and Sleep Gummy Market Segmentation

|

Attributes |

Sleep Gummy Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Sleep Gummy Market?

“Rising Demand for Natural, Non-Habit-Forming Sleep Solutions”

- A significant trend shaping the global sleep gummy market is the increasing consumer shift towards natural, plant-based, and non-habit-forming sleep aids as alternatives to prescription medications. Consumers are actively seeking products with ingredients such as melatonin, CBD, chamomile, valerian root, and L-theanine, driven by the growing interest in wellness and holistic health

- For instance, in January 2024, Olly introduced its new Extra Strength Sleep Gummy featuring higher melatonin content and botanical blends, catering to consumers looking for stronger yet natural support for restful sleep

- In addition, brands are emphasizing clean labels, vegan-friendly formulations, and sugar-free options to appeal to health-conscious buyers. Product innovations also include flavored gummies, combining functionality with taste to improve consumer experience

- The trend also aligns with the growing popularity of functional foods and supplements, particularly among millennials and Gen Z, who prioritize mental well-being and convenient dosage formats

- As a result, companies such as Natrol, ZzzQuil, and CBDfx are expanding their product lines to include natural sleep-enhancing ingredients, tapping into the rising demand for safe and effective nighttime support

- This movement toward naturally derived, accessible sleep solutions is expected to remain a key force driving market innovation and consumer adoption in the coming years

What are the Key Drivers of Sleep Gummy Market?

- Rising cases of insomnia, stress, and lifestyle-induced sleep disorders are significantly contributing to the increased demand for sleep support products, with Sleep Gummies emerging as a preferred choice due to their convenience, palatability, and portability

- For instance, in April 2024, Nature’s Bounty reported a spike in sleep gummy sales, citing growing awareness around sleep health and mental well-being post-pandemic, especially among working professionals and students

- The market is further propelled by the increasing preference for non-prescription, over-the-counter sleep aids, as consumers seek safer, more natural options without dependency risks

- The surge in e-commerce platforms and digital wellness marketing has expanded product accessibility and brand visibility, helping drive sales globally. Influencer endorsements and online health communities are playing an important role in raising product awareness

- Furthermore, the rise of functional nutrition trends, personalized wellness, and preventive healthcare is encouraging more consumers to incorporate sleep support into their daily routines. This shift is making Sleep Gummies a staple in health regimens for individuals across age groups and geographies

Which Factor is challenging the Growth of the Sleep Gummy Market?

- One of the primary challenges in the sleep gummy market is regulatory uncertainty and lack of uniform standards across regions for ingredients such as melatonin and CBD, limiting global expansion and product consistency

- For instance, European markets maintain stricter controls on melatonin content compared to U.S. regulations, restricting brand entry and availability of high-potency products

- Moreover, consumer skepticism around product efficacy and the growing number of unverified or unregulated brands in the market have raised concerns about quality and dosage accuracy, impacting consumer trust

- The risk of overconsumption, especially among children, and the absence of clear medical guidance for long-term use further complicate the scenario. Education on safe consumption and proper labeling is crucial

- In addition, the crowded and highly competitive nature of the nutraceuticals market, with low entry barriers, makes it challenging for new or small players to establish trust and differentiate. Established brands need to continually invest in clinical research, transparency, and third-party certifications to sustain consumer confidence

- Overcoming these hurdles through regulatory alignment, public education, and scientifically backed formulations will be key to ensuring long-term market stability and growth

How is the Sleep Gummy Market Segmented?

The market is segmented on the basis of primary ingredient, customer orientation, pack size, sales channel, and application.

• By Primary Ingredient

On the basis of primary ingredient, the sleep gummy market is segmented into Melatonin, Herbal Extracts, Magnesium, L-theanine, Vitamins and Minerals, Dietary Fiber, Prebiotics and Probiotics, and Polyunsaturated and Fatty Acids. The Melatonin segment dominated the Sleep Gummy market with the largest revenue share of 48.6% in 2024, owing to its well-established role in regulating sleep-wake cycles and its strong consumer awareness. Melatonin-based gummies are widely regarded as effective, fast-acting, and generally safe, making them the go-to choice for individuals dealing with occasional insomnia or jet lag.

The Herbal Extracts segment is expected to register the fastest CAGR from 2025 to 2032, driven by increasing consumer preference for natural and plant-based ingredients. Herbs such as chamomile, valerian root, and ashwagandha are gaining popularity due to their calming effects, minimal side effects, and alignment with the clean-label trend in nutraceuticals.

• By Customer Orientation

On the basis of customer orientation, the market is segmented into Sleep Support, Relaxation, Sleep Cycle Regulation, and Skin Repair. The Sleep Support segment held the largest market share in 2024, driven by widespread consumer focus on combating stress, anxiety, and insomnia-related issues. Sleep support gummies typically feature fast-acting formulations and are marketed as daily supplements for overall wellness.

The Relaxation segment is expected to witness the fastest CAGR during the forecast period, fueled by growing awareness about mental well-being and the rise of adaptogen-infused formulations aimed at reducing stress and promoting calmness before sleep.

• By Pack Size

On the basis of pack size, the sleep gummy market is categorized into 30-Count, 60-Count, 90-Count, and 120-Count or Higher. The 60-Count segment dominated the market with the largest revenue share in 2024, due to its optimal balance of cost-effectiveness and duration of supply for consumers using sleep supplements regularly. This size is widely preferred in retail and online channels as it offers a one-month supply for two users or a two-month supply for one.

Meanwhile, the 90-Count segment is projected to record the highest growth rate from 2025 to 2032, particularly driven by bulk-buying preferences and subscription-based models via e-commerce platforms, offering better value and convenience.

• By Sales Channel

On the basis of sales channel, the market is segmented into Prescription-based, Over the Counter, Modern Trade, Hospital Pharmacies, Retail Pharmacies, Drug Stores, and Online Pharmacies. The Over the Counter (OTC) segment led the market in 2024, holding the largest revenue share, driven by the easy availability of Sleep Gummies through pharmacies, supermarkets, and wellness stores without the need for prescriptions.

The Online Pharmacies segment is expected to witness the fastest CAGR due to the rising popularity of e-commerce, home delivery convenience, product variety, and discreet purchasing experience. Consumers increasingly prefer buying health supplements online due to access to reviews, bundled discounts, and auto-refill options.

• By Product Claim

On the basis of product claim, the sleep gummy market is segmented into Organic, Vegan, All Natural, and Regular. The All Natural segment accounted for the largest market share in 2024, driven by consumer demand for clean-label supplements with minimal additives and synthetic ingredients. Products with all-natural claims appeal to a broad base of health-conscious buyers who prioritize ingredient transparency and holistic wellness.

The Vegan segment is projected to grow at the fastest CAGR during the forecast period, supported by increasing global adoption of plant-based diets, allergen sensitivity concerns, and ethical consumption habits. Major brands are launching pectin-based vegan formulations to meet this surging demand.

Which Region Holds the Largest Share of the Sleep Gummy Market?

- North America dominated the sleep gummy market with the largest revenue share of 38.44% in 2024, driven by heightened health awareness, rising incidences of sleep disorders, and the growing preference for non-prescription wellness products

- Consumers in this region increasingly favor convenient, flavorful supplement formats such as gummies to manage sleep issues without resorting to traditional pills

- A well-established nutraceutical industry, coupled with the strong presence of major players and proactive marketing campaigns, supports widespread adoption across both adult and pediatric demographics

U.S. Sleep Gummy Market Insight

U.S. sleep gummy market dominated the North American revenue share in 2024, supported by escalating consumer focus on mental well-being and natural sleep aids. The availability of melatonin and herbal-based formulations over-the-counter, along with a robust online retail infrastructure, drives significant traction. Increased innovation in vegan, sugar-free, and organic variants, and strategic endorsements by wellness influencers, continue to fuel product demand nationwide.

Europe Sleep Gummy Market Insight

Europe sleep gummy market is projected to grow at a strong CAGR during 2025–2032, supported by rising consumer preference for clean-label supplements and expanding distribution networks. Health-conscious European consumers are increasingly opting for plant-based, allergen-free sleep aids as part of their holistic wellness routines. The region benefits from favorable regulations around nutraceuticals and a growing inclination toward preventive health and stress management.

U.K. Sleep Gummy Market Insight

The U.K. sleep gummy market is expected to grow at a noteworthy pace, backed by increasing stress levels, sleep-related issues, and heightened focus on mental wellness. Consumers are drawn to sleep gummies as a non-addictive, easily consumable option for addressing mild insomnia and poor sleep hygiene. The U.K.’s flourishing e-commerce platforms and strong demand for natural, vegan products contribute significantly to this upward trend.

Germany Sleep Gummy Market Insight

The Germany sleep gummy market is poised to grow at a healthy CAGR, driven by strong consumer interest in botanical and melatonin-based supplements. With rising healthcare awareness and a preference for functional wellness products, German consumers are turning to gummies for better sleep and relaxation. Increased product availability in pharmacies and organic stores, along with innovation in sugar-free and eco-conscious formulations, is supporting this market’s momentum.

Which Region is the Fastest Growing in the Sleep Gummy Market?

Asia-Pacific is the fastest-growing region in the sleep gummy market, expected to register a CAGR of 11.12% from 2025 to 2032, fueled by increasing disposable incomes, health awareness, and Western lifestyle influences. Urban populations in countries such as China, India, and Japan are seeking natural sleep solutions, which are readily available through expanding e-commerce and retail networks. The region’s youthful demographic and rapid digitization of wellness consumption patterns are further catalyzing demand for innovative, accessible sleep supplements.

Japan Sleep Gummy Market Insight

The Japan sleep gummy market is growing rapidly, supported by its aging population, urban lifestyles, and a strong inclination towards functional foods. Japanese consumers value subtle, effective solutions such as gummies for managing sleep quality without pharmaceutical intervention. The integration of sleep health into daily wellness routines and a preference for clean, efficient formulations drive consistent market gains.

China Sleep Gummy Market Insight

China held the largest market share in Asia-Pacific for sleep gummies in 2024, owing to the country’s expanding middle class and increasing sleep-related health concerns. Widespread acceptance of functional nutrition and aggressive online marketing have made gummies a preferred format for young and working populations. Domestic manufacturers are accelerating innovation, offering affordable, flavor-rich sleep aid products, contributing to robust market expansion across urban and semi-urban regions.

Which are the Top Companies in Sleep Gummy Market?

The sleep gummy industry is primarily led by well-established companies, including:

- HARIBO GmbH & Co. KG (Germany)

- Ferrara Candy Company (U.S.)

- The Hershey Company (U.S.)

- Perfetti Van Melle (Netherlands)

- Nestle (Switzerland)

- Mondelez International, Inc (U.S.)

- Mars Food Services (U.K.)

- meiji holdings co ltd (Japan)

- LOTTE WELLFOOD CO., LTD. (South Korea)

- Hero Nutritionals, Inc. (Switzerland)

- Shenzhen Jinduoduo Food Co., Ltd. (China)

- The Candy Plus Sweet Factory s.r.o (Czech Republic)

- Nature's Way Brands, LLC (U.S.)

- Damel Group SL (Spain)

- Vitabiotics Ltd. (U.K.)

- STARPOWA UK (U.K.)

- Sambucol (U.K.)

What are the Recent Developments in Global Sleep Gummy Market?

- In March 2023, 3Z Brands completed its acquisition of Leesa Sleep, a strategic move aimed at reinforcing its presence in the sleep wellness market, including the sleep gummy segment. This acquisition expands 3Z Brands’ product portfolio with a stronger focus on natural sleep aids, enhancing its competitiveness in meeting rising consumer demand. This move is expected to accelerate innovation and product diversification in the sleep gummy category

- In January 2023, Vicks introduced its ZzzQuil Natura gummies, marking its entry into the sleep supplement space with a consumer-friendly gummy format. This launch highlights the growing trend of major healthcare brands tapping into the booming sleep aid market. Such entries from trusted names further validate and boost the credibility of the sleep gummy segment

- In April 2022, Nature's Truth launched a range of adult vitamin gummies in response to increasing consumer preference for supplement formats that are both functional and enjoyable. This product expansion reflects the broader shift toward gummy-based wellness solutions. The move also reinforces market confidence in gummies as a mainstream delivery form for health and sleep support

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.