Global Slotted Boxes Market

Market Size in USD Billion

CAGR :

%

USD

20.00 Billion

USD

28.22 Billion

2024

2032

USD

20.00 Billion

USD

28.22 Billion

2024

2032

| 2025 –2032 | |

| USD 20.00 Billion | |

| USD 28.22 Billion | |

|

|

|

|

Slotted Boxes Market Size

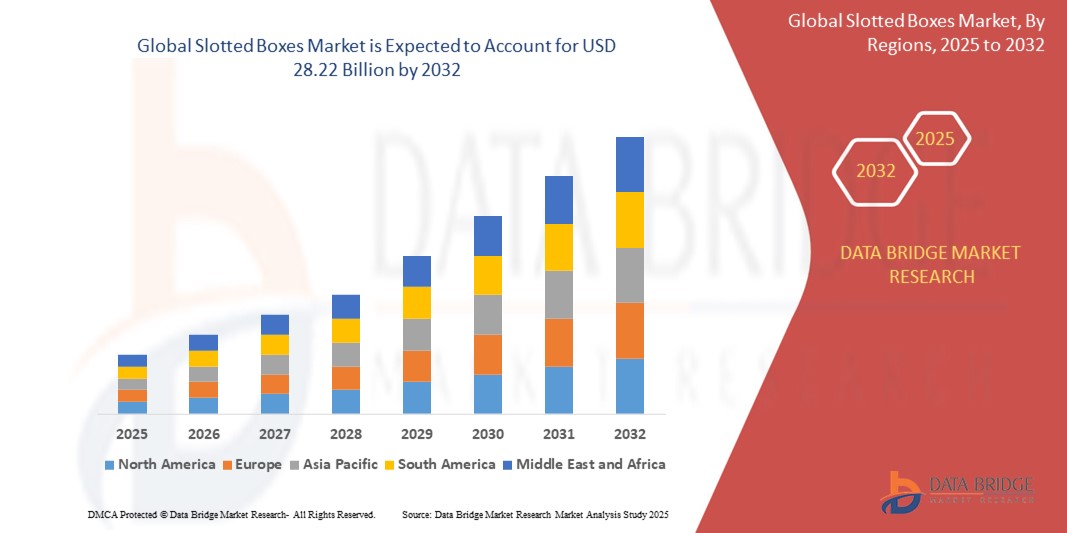

- The global slotted boxes market size was valued at USD 20.00 billion in 2024 and is expected to reach USD 28.22 billion by 2032, at a CAGR of 4.4% during the forecast period

- The market growth is largely driven by the rising demand for sustainable and recyclable packaging across industries such as food, e-commerce, electronics, and pharmaceuticals, aligning with global efforts to reduce plastic usage and environmental impact

- Furthermore, the rapid expansion of online retail and growing need for durable, lightweight, and cost-effective packaging solutions are positioning slotted boxes as a preferred choice for both manufacturers and consumers. These converging factors are accelerating the adoption of slotted box packaging, thereby significantly boosting the market's growth

Slotted Boxes Market Analysis

- Slotted boxes are a type of packaging box characterized by flaps and slots that interlock to form the box structure. These boxes are commonly used for shipping and storing various goods and products. The slots allow for easy assembly and closure of the box, providing a secure and protective enclosure for the contents. Slotted boxes are available in different sizes and configurations to suit different packaging needs

- The escalating demand for slotted boxes is primarily driven by the growth of e-commerce, increased emphasis on sustainable and recyclable materials, and the need for customizable packaging options that cater to various product dimensions and handling requirements

- Asia-Pacific dominated the slotted boxes market with a share of in 2024, due to robust manufacturing activity, expanding e-commerce, and rising demand for sustainable packaging across key industries such as food, electronics, and retail

- Europe is expected to be the fastest growing region in the slotted boxes market during the forecast period due to stringent environmental regulations, a rising preference for recyclable packaging, and increased investment in automation across the packaging industry

- Corrugated slotted boxes segment dominated the market with a market share of 64% in 2024, due to their superior strength-to-weight ratio and protective cushioning properties. Industries favor corrugated boxes for their durability and shock absorption in handling sensitive or high-value goods. Their compatibility with printing and branding also boosts demand from retail and consumer goods sectors

Report Scope and Slotted Boxes Market Segmentation

|

Attributes |

Slotted Boxes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Slotted Boxes Market Trends

“Growing Shift Toward Recyclable and Sustainable Packaging”

- A major and accelerating trend in the global slotted boxes market is the transition toward eco-friendly, recyclable packaging solutions, driven by regulatory pressures and consumer preference for sustainability

- For instance, SPAR Hungary launched eco-friendly reusable fruit and vegetable transport boxes in February 2024 to reduce waste and enhance recyclability across its supply chain

- This shift is also supported by advancements in printing and customization technologies, which allow manufacturers to maintain aesthetic appeal and branding on sustainable packaging without compromising functionality

- Food, e-commerce, and electronics sectors are rapidly adopting recyclable slotted boxes to align with corporate sustainability goals and reduce carbon footprints across their supply chains

- Furthermore, governments in several regions are implementing stricter regulations on single-use plastics, encouraging widespread adoption of corrugated slotted packaging as a compliant alternative

- This trend is redefining packaging standards across industries and prompting innovation in material sourcing and design to ensure slotted boxes meet both ecological and commercial requirements

Slotted Boxes Market Dynamics

Driver

“Increasing E-commerce and Retail Logistics Demand”

- The explosive growth of e-commerce and retail logistics is a primary driver for the slotted boxes market, as these sectors require cost-efficient, sturdy, and scalable packaging solutions for secure product delivery

- For instance, leading online platforms such as Amazon and Flipkart use slotted corrugated boxes extensively due to their customizable size, strength, and ability to withstand long-distance shipping

- With global online retail sales projected to continue rising, demand for protective and lightweight packaging that ensures safe transit is growing rapidly

- Slotted boxes meet this need effectively, offering flexible design options and high stacking strength while minimizing waste and shipping costs. In addition, the ease of automation in packing and sealing processes for regular slotted cartons supports large-scale, efficient distribution operations

- This surge in online shopping and product shipments has made slotted boxes a packaging staple, fueling continuous investment and innovation in the sector

Restraint/Challenge

“Price Volatility and Availability of Raw Materials”

- A major challenge facing the slotted boxes market is the fluctuating cost and inconsistent availability of raw materials such as kraft paper and recycled board, which directly impacts production pricing and margins

- For instance, global disruptions in pulp and paper supply chains have led to increased input costs and shortages, especially in regions dependent on imports

- This volatility affects manufacturers’ ability to maintain stable pricing, often resulting in delayed orders or reduced profit margins for both producers and end-users

- Moreover, rising demand from multiple industries intensifies competition for raw material procurement, further straining supply chains and causing delays in production schedules. Small and mid-sized manufacturers are particularly vulnerable to these price fluctuations, as they often lack long-term supply contracts or diversified sourcing strategies

- Mitigating this challenge requires strategic partnerships, investment in recycled material processing, and efforts to localize supply chains to ensure cost stability and operational resilience

Slotted Boxes Market Scope

The market is segmented on the basis of application, slot type, product type, and material.

• By Application

On the basis of application, the slotted boxes market is segmented into shipping boxes, electronic packaging, retail packaging, office and stationary packaging, food and beverage packaging, pharmaceutical packaging, chemicals, paints & lubricants, automotive, and others. The shipping boxes segment accounts for the largest market revenue share in 2024, primarily due to the exponential rise in e-commerce and global logistics activities. Businesses across industries prefer slotted boxes for shipping because of their durability, cost-effectiveness, and ability to protect goods during transit. Their stackability and easy customizability further enhance utility for large-scale transportation and warehouse operations.

The food and beverage packaging segment is expected to register the fastest growth rate from 2025 to 2032, propelled by the growing demand for sustainable and recyclable packaging in the food service and grocery delivery sectors. Slotted boxes are increasingly being adopted by food manufacturers and delivery companies due to their biodegradable nature and structural integrity, which helps maintain product freshness and reduce environmental impact.

• By Slot Type

On the basis of slot type, the slotted boxes market is segmented into regular slotted boxes, half slotted boxes, overlap slotted boxes, full overlap slotted boxes, center special slotted boxes, center special overlap slotted boxes, and center special full overlap slotted boxes. The regular slotted boxes segment dominates the market in 2024 due to its standardized design, which ensures material efficiency and cost savings during production. Their versatility in packaging a wide range of goods—from industrial parts to retail products—makes them the go-to solution for many businesses. The simplicity of folding and sealing also enables faster packing operations.

The full overlap slotted boxes segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by increasing demand for high-strength packaging in heavy-duty and fragile item transportation. These boxes provide extra padding and edge protection, making them suitable for sectors such as electronics, automotive parts, and bulk materials. Their overlapping flaps enhance load-bearing capacity, which is vital for supply chain resilience.

• By Product Type

On the basis of product type, the slotted boxes market is segmented into plain slotted boxes and corrugated slotted boxes. Corrugated slotted boxes held the largest market share of 64% in 2024, supported by their superior strength-to-weight ratio and protective cushioning properties. Industries favor corrugated boxes for their durability and shock absorption in handling sensitive or high-value goods. Their compatibility with printing and branding also boosts demand from retail and consumer goods sectors.

The plain slotted boxes segment is projected to grow at the highest CAGR from 2025 to 2032, fueled by demand from small and medium enterprises seeking budget-friendly and easy-to-use packaging. These boxes are particularly popular in local markets and small-scale logistics where simplicity, quick assembly, and low cost are prioritized over advanced protective features.

• By Material

On the basis of material, the slotted boxes market is segmented into kraft paper and paperboard. The kraft paper segment accounted for the largest revenue share in 2024 due to its strength, tear resistance, and biodegradability. Kraft-based slotted boxes are extensively used across sectors such as agriculture, food, and pharmaceuticals, where strong, sustainable, and safe packaging is essential. Their eco-friendly profile aligns well with global sustainability mandates.

The paperboard segment is expected to grow at the fastest rate from 2025 to 2032, driven by its lighter weight and print-friendly surface, making it ideal for high-volume retail and consumer packaging. Brands increasingly opt for paperboard slotted boxes to achieve a balance of functionality, cost-efficiency, and premium visual appeal in point-of-sale displays and promotional packaging.

Slotted Boxes Market Regional Analysis

- Asia-Pacific dominated the slotted boxes market with the largest revenue share of 40.01% in 2024, driven by robust manufacturing activity, expanding e-commerce, and rising demand for sustainable packaging across key industries such as food, electronics, and retail

- The region benefits from high-volume packaging consumption across China, India, Japan, and Southeast Asian countries, supported by population growth and industrialization

- Government initiatives promoting eco-friendly materials and rapid infrastructure development for logistics and exports have further bolstered the adoption of slotted boxes in the region

China Slotted Boxes Market Insight

The China slotted boxes market accounted for the largest share in Asia-Pacific in 2024, supported by its strong manufacturing base, booming online retail sector, and increased focus on recyclable and cost-effective packaging. China’s dominance in global exports and its extensive logistics network have amplified the need for durable and customizable slotted boxes. Continuous investment in automated packaging solutions and rising demand for corrugated packaging in food and consumer electronics sectors are further driving growth.

Europe Slotted Boxes Market Insight

The Europe slotted boxes market is projected to grow at the fastest CAGR during the forecast period of 2025 to 2032, owing to stringent environmental regulations, a rising preference for recyclable packaging, and increased investment in automation across the packaging industry. With a focus on reducing plastic use, European manufacturers are actively shifting to paper-based packaging alternatives such as slotted boxes, especially for food, cosmetics, and pharmaceuticals. The demand is further supported by the expansion of e-commerce and the rising need for lightweight, efficient packaging for cross-border deliveries.

Germany Slotted Boxes Market Insight

The Germany slotted boxes market is anticipated to expand significantly, backed by the country’s leadership in industrial production and its strong push toward sustainable packaging. Demand is particularly high in the automotive, chemicals, and machinery sectors, where robust, custom-fit packaging is critical. Germany’s emphasis on recyclability, coupled with technological innovation in packaging design and materials, supports the widespread adoption of advanced slotted box formats.

U.K. Slotted Boxes Market Insight

The U.K. slotted boxes market is set to grow steadily, driven by strong e-commerce penetration and increasing consumer awareness of environmental impact. Online retailers and SMEs are turning to slotted boxes for flexible, branded, and eco-conscious packaging solutions. The post-Brexit focus on domestic manufacturing and localized supply chains is also creating new demand for reliable and cost-effective packaging formats across retail and logistics sectors.

Slotted Boxes Market Share

The slotted boxes industry is primarily led by well-established companies, including:

- Corpak Packaging Pvt Ltd., (India)

- Green Bay Packaging Inc. (U.S.)

- Bel-Art Products (U.S.)

- Cascades Inc. (Canada)

- Packaging Corporation of America (U.S.)

- Corrugated Concepts and Packaging, Inc. (U.S.)

- Greenpack Industries (Singapore)

- Mondi (Austria)

- WestRock Company (U.S.)

- DS Smith (U.K.)

- Smurfit Kappa (Ireland)

- Rengo Co., Ltd. (Japan)

- Georgia-Pacific LLC (U.S.)

Latest Developments in Global Slotted Boxes Market

- In June 2024, Green Bay Packaging Inc. (GBP) announced the successful acquisition of SMC Packaging Group, headquartered in Springfield, MO. Renowned for its exemplary customer service and product quality, SMC boasts a robust leadership team committed to principles of Safety, Quality, and Service, alongside fostering a culture of respect and dignity for its employees. This acquisition marks a strategic expansion of GBP's geographical footprint, aligning seamlessly with its corporate culture. GBP eagerly anticipates collaborating with SMC to drive mutual business growth

- In February 2024, SPAR Hungary introduced eco-friendly, reusable fruit and vegetable transport boxes to reduce waste and promote recycling, reinforcing the growing market trend toward sustainable packaging solutions. This initiative is expected to influence other retailers and logistics providers to adopt similar practices, boosting demand for durable and recyclable slotted box alternatives

- In October 2021, Smurfit Kappa Group completed the acquisition of Verzuolo, following the 2019 conversion of its PM9 machine into a high-capacity recycled containerboard production unit with an annual output of 661,387 tons. Strategically located near the port of Savona, this development enhances the company’s supply capabilities and supports the market’s shift toward recycled materials, strengthening the availability and cost-efficiency of slotted boxes made from sustainable inputs

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Slotted Boxes Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Slotted Boxes Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Slotted Boxes Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.