Global Sludge Treatment Chemicals Market

Market Size in USD Billion

CAGR :

%

USD

7.54 Billion

USD

11.27 Billion

2024

2032

USD

7.54 Billion

USD

11.27 Billion

2024

2032

| 2025 –2032 | |

| USD 7.54 Billion | |

| USD 11.27 Billion | |

|

|

|

|

Sludge Treatment Chemicals Market Size

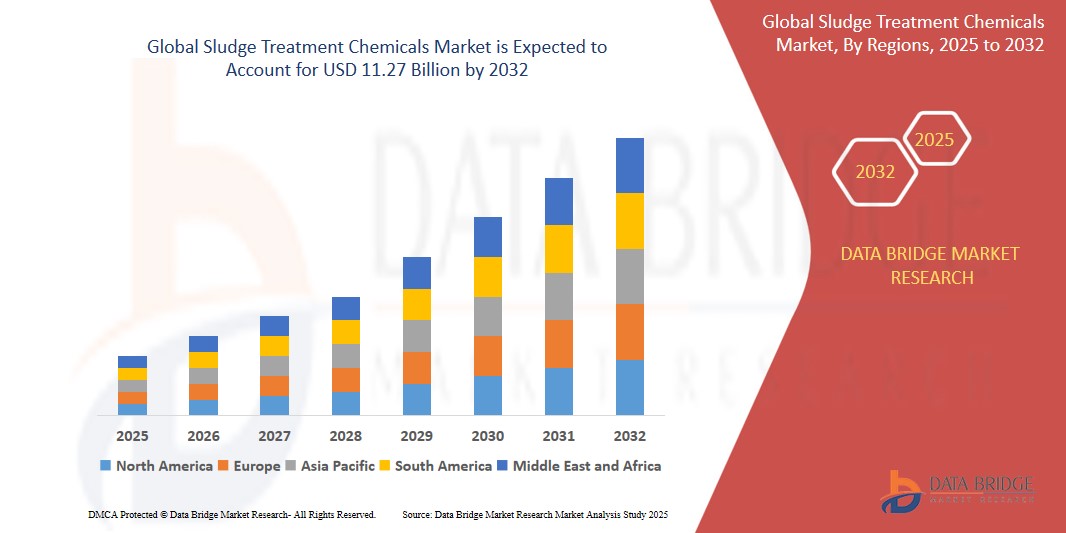

- The Global Sludge Treatment Chemicals Market size was valued at USD 7.54 billion in 2024 and is expected to reach USD 11.27 billion by 2032, at a CAGR of 5.2 % during the forecast period

- This growth is driven by factors such as Stringent Environmental Regulations and Rapid Industrialization and Urbanization.

Sludge Treatment Chemicals Market Analysis

- The Global Sludge Treatment Chemicals Market is witnessing growth due to the increasing need for efficient wastewater management and stringent environmental regulations. Chemicals like coagulants, flocculants, and disinfectants are essential for stabilizing, dewatering, and disposing of sludge safely, ensuring compliance with environmental standards.

- The Asia-Pacific region dominates the market, driven by rapid industrialization and urbanization, particularly in countries like China and India. These nations have a high demand for sludge treatment chemicals due to expanding industrial sectors such as textiles, chemicals, and food processing, which generate large volumes of sludge that require advanced treatment.

- Technological advancements, such as AI-based dosing systems and membrane bioreactors, are improving treatment efficiency and reducing operational costs. These innovations are gaining traction in developed regions like North America and Europe, where there is a stronger focus on sustainability and advanced wastewater management technologies.

- Despite this, concerns over the environmental impact of synthetic chemicals are encouraging the shift toward bio-based alternatives, with growing demand in regions with strict environmental regulations.

Report Scope and Sludge Treatment Chemicals Market Segmentation

|

Attributes |

Sludge Treatment Chemicals Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Sludge Treatment Chemicals Market Trends

“Increasing need for efficient and sustainable waste management solutions”

-

The Sludge Treatment Chemicals Market is evolving rapidly due to the increasing need for efficient and sustainable waste management solutions. Growing urbanization and industrialization across emerging economies are driving higher sludge generation, necessitating advanced chemical treatment solutions. Industries are seeking ways to comply with strict discharge norms and minimize environmental impacts.

For instance,

- In January 2024, the U.S. Environmental Protection Agency (EPA) announced a $2 billion investment under the Clean Water State Revolving Fund to support sustainable wastewater infrastructure projects. This funding prioritizes advanced sludge treatment technologies, highlighting the growing need for efficient and eco-friendly waste management across municipalities and industries.

- A notable trend is the shift toward bio-based and eco-friendly chemicals. Companies are investing in green formulations to meet sustainability goals and reduce dependency on petroleum-based inputs. This is gaining traction especially in Europe and North America, where regulatory frameworks strongly favor low-carbon and biodegradable solutions.

- Technological innovation is also reshaping the market. Smart dosing systems, AI-integrated monitoring, and membrane bioreactors are improving process efficiency and reducing chemical consumption. These advancements are making sludge treatment more cost-effective and environmentally responsible.

- Additionally, strategic partnerships and acquisitions are increasing. Major players are expanding their portfolios and global presence through collaborations, mergers, and regional expansions to stay competitive and serve growing demand.

Sludge Treatment Chemicals Market Dynamics

Driver

“Growing Demand from the Construction Industry”

- Governments and regulatory bodies worldwide are implementing strict environmental norms to control water pollution. These regulations mandate effective sludge treatment to reduce contaminants before wastewater is discharged.

- Industries such as chemicals, pharmaceuticals, and food processing are under increasing pressure to comply with these standards, necessitating the use of advanced treatment chemicals.

- Failure to meet such standards often results in heavy fines, penalties, and operational shutdowns, which encourages compliance through investment in reliable sludge management.

- Consequently, the demand for efficient and compliant sludge treatment chemicals is rising, driving steady growth in the global market, especially in regions with progressive environmental policies like North America and Europe.

For Instance,

- In October, 2022, the European Commission proposed a revision to the Urban Wastewater Treatment Directive, aiming for full nutrient removal (nitrogen and phosphorus) in larger treatment plants by 2040. This proposed update significantly tightens discharge standards, compelling industries and municipalities to adopt advanced sludge treatment chemicals to comply with future legal requirements.

Opportunity

“Emergence of Bio-Based and Green Chemicals”

- The rising demand for environmentally responsible solutions has opened the door for bio-based sludge treatment chemicals derived from renewable sources like starch, cellulose, and chitosan.

- These green alternatives are gaining traction due to their low toxicity, biodegradability, and ability to align with environmental regulations and sustainability goals. As governments and companies increasingly prioritize ESG performance, demand for green chemicals is accelerating.

- Investments in R&D and government incentives are fueling innovation in natural coagulants, enzymatic digesters, and other eco-friendly agents. These products are particularly attractive in ecologically sensitive or protected regions, where traditional chemicals may be banned or discouraged.

- Additionally, green chemicals present opportunities for value-added branding and premium pricing strategies. Early adopters can benefit from certifications such as Green Seal or EcoLabel, which enhance credibility and marketability.

Restraint/Challenge

“High Operational and Maintenance Costs”

- Sludge treatment involves not just the initial capital investment but also substantial operational and maintenance expenses over time. This includes the continuous purchase of treatment chemicals, electricity, skilled labor, and system upkeep.

- Energy-intensive treatment processes such as thermal drying or chemical oxidation can significantly raise utility bills, particularly when fuel costs are high. Moreover, advanced systems often require frequent recalibration and troubleshooting, which demands skilled technicians and spare parts.

- These recurring costs make full-scale sludge treatment unaffordable for small municipalities, startups, and businesses in developing economies. In many such cases, operators cut corners by underdosing or using lower-quality chemicals, undermining treatment effectiveness.

- Additionally, the costs of waste disposal and environmental compliance reporting further compound operational expenses. This total cost of ownership discourages many stakeholders from upgrading or adopting new treatment technologies.

Sludge Treatment Chemicals Market Scope

The market is segmented on the basis of type, treatment and end- user.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Treatment |

|

|

By End User |

|

In 2025, the Flocculants is projected to dominate the market with a largest share in Type segment

Flocculants dominate the market due to their essential role in sludge dewatering, broad industrial usage, cost efficiency, and effectiveness in meeting stringent environmental regulations across municipal and industrial wastewater sectors.

The Activated Carbon is expected to account for the largest CAGR during the forecast period in Type segment

In 2025, The Activated Carbon segment is projected to witness the highest CAGR due to increasing demand for advanced odor control, toxin removal, and eco-friendly sludge treatment solutions across both municipal and industrial wastewater applications.

Sludge Treatment Chemicals Market Regional Analysis

“Asia-Pacific Holds the Largest Share in the Sludge Treatment Chemicals Market”

-

Asia-Pacific is the dominant region due to its large industrial base, particularly in countries like China, India, and Japan, which produce significant amounts of wastewater and sludge requiring chemical treatment.

- China is the largest market for sludge treatment chemicals due to its extensive industrial activities. With industries such as textiles, chemicals, and food processing generating significant sludge, the need for efficient chemical treatment is high.

- Strict environmental regulations, especially in countries like China and India, demand advanced wastewater treatment solutions. These regulations drive the need for efficient sludge treatment chemicals in industrial and municipal sectors.

- The fast-growing urbanization in countries like China is leading to higher wastewater generation in cities. With increased sludge production, there’s a growing demand for treatment chemicals to ensure safe waste disposal and compliance with environmental standards.

“Middle East & Africa is Projected to Register the Highest CAGR in the Sludge Treatment Chemicals Market”

-

The Middle East & Africa region is experiencing rapid growth in wastewater treatment due to substantial investments in infrastructure, particularly in countries like Saudi Arabia, UAE, and South Africa. These investments are boosting the demand for sludge treatment chemicals.

- Water Scarcity and Reuse: The region faces severe water scarcity issues, which is driving initiatives for water recycling and reuse. Efficient sludge treatment is essential to clean and process wastewater for reuse, fueling the demand for treatment chemicals.

- Industrial Growth: Expanding industries such as oil & gas, mining, and manufacturing in the Middle East & Africa generate large volumes of sludge, requiring advanced treatment chemicals to ensure proper disposal and compliance with environmental standards.

Sludge Treatment Chemicals Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Dow (U.S.)

- Akzo Nobel N.V. (Netherlands)

- Lonza (Switzerland)

- BASF SE (Germany)

- GENERAL ELECTRIC COMPANY (U.S.)

- Ashland (U.S.)

- Mitsubishi Chemical Corporation (Japan)

- GN Decanter Centrifuge Manufacturer (China)

- Xian KOSUN Environmental Engineering Co., Ltd. (China)

- Aqseptence Group (Germany)

- Ecolab (U.S.)

- Kemira (Finland)

- AMCON INC. (U.S.)

- Beckart Environmental, Inc. (U.S.)

- Ovivo (Canada)

- Hubbard-Hall (U.S.)

- Accepta The Water Treatment Products Company (UK)

- Kurita Water Industries Ltd. (Japan)

- Thames Water Utilities Limited (UK)

- Italmatch AWS (Italy)

Latest Developments in Global Sludge Treatment Chemicals Market

- In November 2024, BASF completed the sale of its flocculant mining business, including brands like Magnafloc® and Rheomax®, to Solenis. This strategic move allows BASF to focus on flotation reagents and solvent extraction, while Solenis expands its mining solutions portfolio.

- In February 2025, BASF launched HySorb® B 6610 ZeroPCF, a polyacrylate-based superabsorbent polymer for the hygiene industry with a product carbon footprint of zero. The product uses renewable energy and raw materials, supporting customers' sustainability targets without compromising performance.

- In September 2021, Kemira inaugurated a 2,400 m² R&D center in Pujiang Town, Shanghai, China. The facility focuses on developing renewable, biodegradable, and recyclable products, enhancing Kemira's capabilities in serving the rapidly growing Asia-Pacific market.

- In April 2024, BASF expanded its EcoBalanced portfolio, offering more than 60 products with sustainability attributes like low and zero product carbon footprints. This expansion supports customers in achieving sustainability goals without sacrificing product performance.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Sludge Treatment Chemicals Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Sludge Treatment Chemicals Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Sludge Treatment Chemicals Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.