Global Small Arms Market

Market Size in USD Billion

CAGR :

%

USD

6.23 Billion

USD

7.47 Billion

2025

2033

USD

6.23 Billion

USD

7.47 Billion

2025

2033

| 2026 –2033 | |

| USD 6.23 Billion | |

| USD 7.47 Billion | |

|

|

|

|

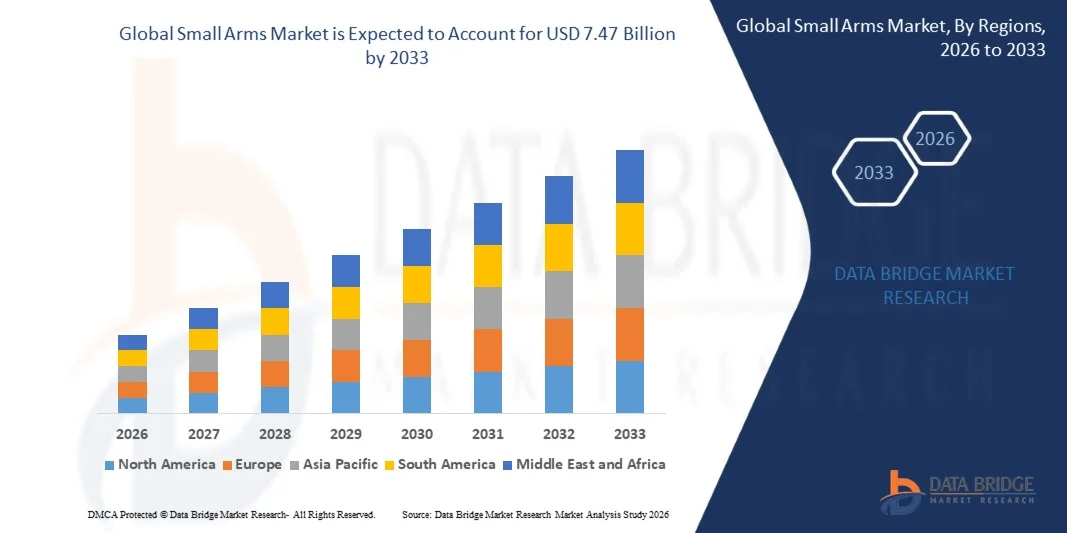

What is the Global Small Arms Market Size and Growth Rate?

- The global small arms market size was valued at USD 6.23 billion in 2025 and is expected to reach USD 7.47 billion by 2033, at a CAGR of 2.30% during the forecast period

- This growth is driven by factors such as increasing geopolitical tensions, modernization of armed forces, rising civilian interest in shooting sports, and supportive government policies for domestic arms manufacturing

What are the Major Takeaways of Small Arms Market?

- Small Arms are essential for ensuring the security and safety of maritime vessels, playing a critical role in protecting ships and their crews from piracy, theft, and other threats in high-risk maritime environments

- The market’s growth is significantly driven by factors such as increasing piracy incidents, the need for enhanced vessel security, and the adoption of advanced technologies such as surveillance systems, AI, and automated defense systems

- North America dominated the Small Arms market with a 36.13% revenue share in 2025, driven by high civilian firearm ownership, strong defense procurement programs, and continuous modernization of military equipment across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 8.45% from 2026 to 2033, driven by rising defense budgets, increasing cross-border security concerns, and military modernization programs across China, India, Japan, South Korea, and Southeast Asia

- The Defense segment dominated the market with a 52.6% share in 2025, driven by continuous military modernization programs, rising cross-border tensions, counter-terrorism operations, and increasing defense budgets globally

Report Scope and Small Arms Market Segmentation

|

Attributes |

Small Arms Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Small Arms Market?

“Increased Adoption of Smart Technology and Digital Integration in Firearms”

- One prominent trend in the global small arms market is the growing adoption of smart technology and digital integration

- These advancements enhance precision, safety, and efficiency by enabling real-time diagnostics and integration with digital systems for improved maintenance and usage tracking

- For instance, On January 7, 2022, LodeStar Works unveiled its LS9, a 9mm smart handgun, to shareholders and investors in Idaho. The firearm features advanced personalization, ensuring it can only be fired by verified users. It includes a fingerprint reader, a PIN pad, and a mobile app connection for enhanced security and user authentication .

- Digital integration enables seamless connectivity between firearms and mobile devices, ensuring data collection and analysis for optimizing shooting accuracy and operational readiness

- This trend is transforming the small arms market by improving diagnostics, reducing errors, and increasing the demand for digital solutions in military, law enforcement, and civilian sectors

What are the Key Drivers of Small Arms Market?

- The small arms market is experiencing a significant technological shift, driven by innovations in materials, design, and manufacturing processes that allow for improved weapon performance, durability, and safety

- Advanced technologies such as computer-aided design (CAD), additive manufacturing, and precision machining are enabling manufacturers to create highly efficient and reliable firearms, which are critical in both military and civilian markets

- As new technologies continue to emerge, they offer manufacturers the opportunity to streamline production, reduce costs, and provide custom solutions, thereby increasing the overall appeal and competitiveness of small arms in the global market

- For instance, On August 6, 2024, Colorado-based startup Biofire shipped its first Smart Guns—biometric-enabled 9mm pistols featuring fingerprint and facial recognition. Designed to prevent unauthorized use and unintentional shootings, the gun locks when released and unlocks for registered users. With a rechargeable battery, built-in laser, and offline data storage, Biofire's innovation marks a milestone in smart firearm technology.

- The ongoing technological advancements are transforming the small arms market by not only enhancing product quality but also enabling manufacturers to meet evolving consumer demands for higher performance, customization, and cost-efficiency

Which Factor is Challenging the Growth of the Small Arms Market?

- The small arms market faces substantial regulatory challenges due to strict international arms trade agreements, export controls, and compliance with national laws governing firearms manufacturing, distribution, and sales

- Compliance with regulations such as the U.S. ITAR (International Traffic in Arms Regulations) and the EU’s arms trade controls can limit market access, create delays, and increase operational costs for manufacturers looking to expand globally

- In addition, evolving arms policies and trade restrictions in politically unstable regions complicate market dynamics, reducing manufacturers' flexibility and slowing growth prospects in certain areas. These regulatory barriers increase the complexity and cost of business operations

- For instance, On September 4, 2024, the Delhi High Court criticized the Indian government's arms industry regulations, citing "confusion and lack of clarity." It dismissed the Ministry of Home Affairs' appeal against Syndicate Innovations, stating the regulatory framework is arbitrary and inconsistent. The court emphasized the need for clear rules, especially under the 'Make in India' initiative

- The ongoing regulatory hurdles in the small arms market underscore the need for manufacturers to adopt comprehensive compliance strategies. These strategies will be crucial in navigating the complex legal landscape and mitigating the risks of operational disruptions, thereby ensuring long-term sustainability and market competitiveness

How is the Small Arms Market Segmented?

The market is segmented on the basis of end use sector, type, calibre, technology, cutting type, firing systems and action.

• By End Use Sector

On the basis of end use sector, the small arms market is segmented into Defense, Civil, and Commercial. The Defense segment dominated the market with a 52.6% share in 2025, driven by continuous military modernization programs, rising cross-border tensions, counter-terrorism operations, and increasing defense budgets globally. Armed forces prioritize advanced rifles, machine guns, and modular weapon systems to enhance combat readiness and soldier lethality. Procurement contracts, replacement of aging inventories, and adoption of lightweight polymer-based weapons further strengthen demand in this segment.

The Civil segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by increasing civilian firearm ownership for self-defense, shooting sports, and recreational activities in countries with supportive firearm regulations. Rising participation in competitive shooting events and expanding personal security concerns are also fueling growth.

• By Type

On the basis of type, the small arms market is segmented into Pistol, Revolver, Rifle, Machine Gun, and Shotgun. The Rifle segment dominated the market with a 34.8% share in 2025, owing to its widespread adoption across military and law enforcement agencies. Rifles offer superior range, accuracy, modularity, and compatibility with optical sights and tactical accessories, making them the primary infantry weapon. Increasing procurement of assault rifles and designated marksman rifles contributes significantly to revenue generation.

The Pistol segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising demand for compact personal defense weapons among civilians and law enforcement personnel. Lightweight polymer-frame pistols, improved ergonomics, and enhanced magazine capacity are accelerating adoption.

• By Calibre

On the basis of calibre, the small arms market is segmented into 5.56MM, 7.62MM, 9MM, 12.7MM, 14.5MM, and Others. The 5.56MM segment dominated the market with a 29.7% share in 2025, as it is widely used in modern assault rifles due to its lighter weight, manageable recoil, and higher ammunition carrying capacity for soldiers. Its standardization across several NATO-aligned defense forces further strengthens its global demand.

The 7.62MM segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by increasing preference for higher stopping power and extended range in military and paramilitary operations. Rising demand for battle rifles and designated marksman systems is contributing to segment expansion.

• By Technology

On the basis of technology, the small arms market is segmented into Guided and Unguided. The Unguided segment dominated the market with a 91.3% share in 2025, as conventional small arms primarily rely on manual targeting and ballistic trajectory without electronic guidance systems. Their simplicity, cost-effectiveness, reliability, and ease of maintenance make them highly preferred across military, law enforcement, and civilian users.

The Guided segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by technological advancements in smart weapon systems, fire-control integration, and precision-guided small-caliber solutions. Increasing investments in digital optics, laser guidance modules, and network-enabled soldier systems are supporting this growth trajectory.

• By Cutting Type

On the basis of cutting type, the small arms market is segmented into Smooth Bore and Threaded/Rifled. The Threaded/Rifled segment dominated the market with a 63.5% share in 2025, owing to its superior accuracy, improved bullet stabilization, and enhanced range performance. Rifled barrels are extensively used in rifles and many pistols to ensure consistent projectile spin and improved ballistic efficiency.

The Smooth Bore segment is expected to grow at the fastest CAGR from 2026 to 2033, primarily driven by rising demand for shotguns in tactical, law enforcement, and civilian sporting applications. Smooth bore firearms are preferred for close-range engagements and less-lethal ammunition applications.

• By Firing Systems

On the basis of firing systems, the small arms market is segmented into Gas-operated, Recoil-operated, and Manual. The Gas-operated segment dominated the market with a 46.2% share in 2025, supported by its widespread use in modern assault rifles and automatic weapons. Gas-operated systems offer reliable cycling, reduced recoil impact, and improved firing consistency, making them ideal for military combat environments.

The Recoil-operated segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing adoption in pistols and lightweight automatic firearms. Its simpler mechanical design and compact configuration make it suitable for personal defense and law enforcement use.

• By Action

On the basis of action, the small arms market is segmented into Semi-automatic and Automatic. The Semi-automatic segment dominated the market with a 58.4% share in 2025, due to its extensive deployment in civilian markets, law enforcement agencies, and certain military applications. Semi-automatic firearms provide controlled firing, improved ammunition efficiency, and enhanced safety compared to fully automatic weapons.

The Automatic segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by increasing defense modernization programs and demand for high-rate-of-fire weapons in specialized military units. Rising geopolitical tensions and modernization of infantry weapon systems are further accelerating segment expansion.

Which Region Holds the Largest Share of the Small Arms Market?

- North America dominated the Small Arms market with a 36.13% revenue share in 2025, driven by high civilian firearm ownership, strong defense procurement programs, and continuous modernization of military equipment across the U.S. and Canada. Rising investments in advanced assault rifles, modular weapon systems, and lightweight firearms significantly contribute to regional revenue growth

- Leading manufacturers in North America focus on product innovation, including polymer-frame pistols, improved recoil management systems, enhanced optics compatibility, and smart fire-control integrations. Strong distribution networks, established regulatory frameworks, and consistent demand from law enforcement agencies further reinforce market leadership

- High defense spending, technological advancements in weapon manufacturing, and a well-developed commercial firearms ecosystem continue to strengthen North America's dominant position in the global market

U.S. Small Arms Market Insight

The U.S. is the largest contributor within North America, supported by substantial defense budgets, active law enforcement procurement, and strong civilian demand for self-defense and recreational shooting. Continuous modernization of infantry weapons, replacement of aging arsenals, and development of next-generation small arms platforms drive sustained growth. The presence of major firearms manufacturers, advanced R&D facilities, and large-scale ammunition production capabilities further accelerates market expansion. Growing interest in tactical firearms, sport shooting, and personal protection solutions also contributes significantly to domestic revenue generation.

Canada Small Arms Market Insight

Canada contributes steadily to regional growth, supported by defense modernization initiatives and regulated civilian firearm ownership. The Canadian Armed Forces continue to invest in upgraded rifles and support weapons to enhance operational efficiency. Law enforcement demand and hunting applications further drive market activity. Government defense allocations, stable regulatory oversight, and modernization of tactical equipment sustain market development across the country.

Asia-Pacific Small Arms Market

Asia-Pacific is projected to register the fastest CAGR of 8.45% from 2026 to 2033, driven by rising defense budgets, increasing cross-border security concerns, and military modernization programs across China, India, Japan, South Korea, and Southeast Asia. Expanding domestic manufacturing capabilities and technology transfer agreements are strengthening regional production. Growing paramilitary forces, internal security operations, and procurement of advanced assault rifles and machine guns further accelerate market demand across the region.

China Small Arms Market Insight

China is a major contributor in Asia-Pacific due to extensive defense investments and large-scale domestic weapon manufacturing capabilities. Ongoing military modernization and focus on advanced infantry weapon systems support sustained demand. Government-backed defense enterprises and export-oriented production further strengthen market expansion.

Japan Small Arms Market Insight

Japan demonstrates steady growth supported by defense capability enhancement programs and modernization of Self-Defense Forces equipment. Although civilian ownership is highly regulated, defense procurement remains a key growth driver. Technological focus on precision and reliability supports stable market development.

India Small Arms Market Insight

India is emerging as a high-growth market driven by defense modernization, border security requirements, and government initiatives promoting domestic arms manufacturing. Increasing procurement of assault rifles and light machine guns under modernization programs supports strong future demand.

South Korea Small Arms Market Insight

South Korea contributes significantly due to sustained military readiness programs and strong domestic arms production. Investments in advanced infantry weapons and export-oriented defense manufacturing continue to drive long-term market growth in the country.

Which are the Top Companies in Small Arms Market?

The Small Arms industry is primarily led by well-established companies, including:

- Colt’s Manufacturing Company, LLC (U.S.)

- SIG SAUER (Germany)

- STEYR ARMS USA (U.S.)

- Remington Outdoor Company (U.S.)

- Smith & Wesson (U.S.)

- Daniel Defense LLC (U.S.)

- Sturm, Ruger & Co., Inc. (U.S.)

- IWI (Israel Weapon Industries) (Israel)

- Heckler & Koch GmbH (Germany)

- GLOCK Ges.m.b.H. (Austria)

- Kalashnikov Group (Russia)

- Česká zbrojovka a.s. (CZ Group) (Czech Republic)

- Accuracy International (U.K.)

- American Outdoor Brands Inc. (U.S.)

- Fabbrica d'Armi Pietro Beretta S.p.A. (Italy)

- FN HERSTAL (Belgium)

- Lockheed Martin Corporation (U.S.)

- Northrop Grumman (U.S.)

- Thales Group (France)

- General Dynamics Corporation (U.S.)

What are the Recent Developments in Global Small Arms Market?

- In June 2024, Daniel Defense unveiled its purpose-built PCC SBR, redefining the pistol caliber carbine category. Featuring an 8.3-inch cold hammer forged barrel, 1:10 twist, and hydraulic buffer, it weighs just 6.1 pounds. Despite AR-style aesthetics, it’s a unique, recoil-operated system with no gas or piston. Designed for duty use, the SBR version offers compact performance with top-tier build quality and compatibility with standard 9mm muzzle devices

- In June 2024, True Velocity and FN America announced a global manufacturing partnership for the .338 Norma Lightweight Medium Machine Gun. FN America will serve as the primary producer of the recoil-mitigated weapon, which offers .50-caliber performance in a lighter, M240-such as profile. This strategic alliance aims to equip U.S. and Allied forces with advanced firepower, marking a major step forward in battlefield capability and military small arms innovation

- In May 2020, Colt Canada, a subsidiary of Colt’s Manufacturing Company LLC, was awarded a contract by the Canadian Department of National Defense for the supply of 272 of the new C20 semi-automatic rifle, which is described as an Intermediate Sniper Weapon with an 18-inch barrel

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.