Global Small Kitchen Appliances Market

Market Size in USD Billion

CAGR :

%

USD

31.20 Billion

USD

42.37 Billion

2025

2033

USD

31.20 Billion

USD

42.37 Billion

2025

2033

| 2026 –2033 | |

| USD 31.20 Billion | |

| USD 42.37 Billion | |

|

|

|

|

Small Kitchen Appliances Market Size

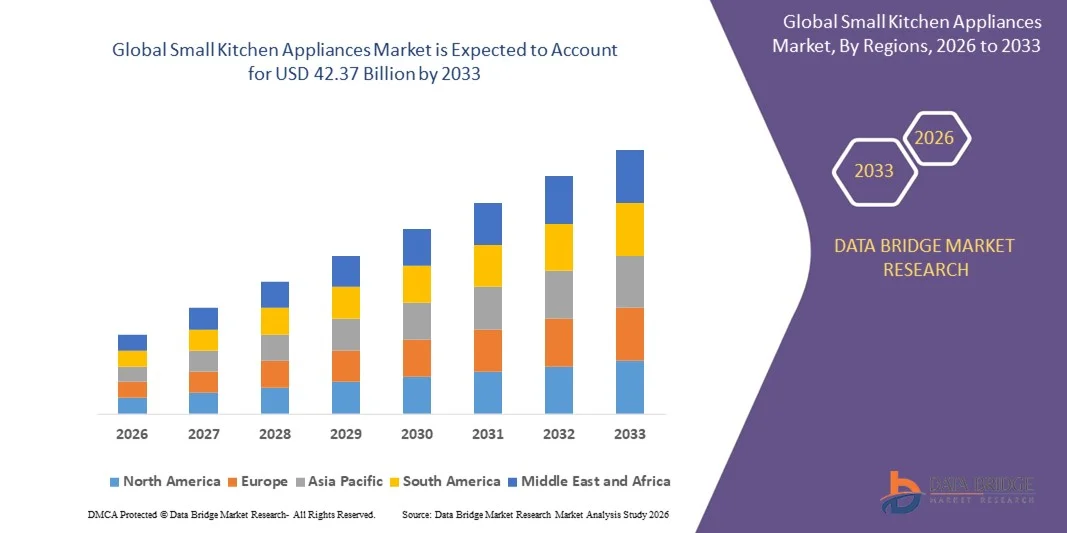

- The global small kitchen appliances market size was valued at USD 31.20 billion in 2025 and is expected to reach USD 42.37 billion by 2033, at a CAGR of 3.9% during the forecast period

- The market growth is largely fueled by changing consumer lifestyles and the rising preference for convenient, time-saving cooking solutions, driven by increasing urbanization and the growing number of nuclear and dual-income households

- Furthermore, continuous product innovation, energy-efficient designs, and rising awareness of healthy cooking practices are accelerating adoption across residential users, thereby significantly boosting the overall market growth

Small Kitchen Appliances Market Analysis

- Small kitchen appliances, designed to support everyday cooking, food preparation, and beverage needs, have become essential household products due to their ease of use, compact size, and ability to enhance cooking efficiency in modern kitchens

- The growing demand for small kitchen appliances is primarily driven by increasing home cooking trends, expanding middle-class populations, and rising penetration of multifunctional and smart appliances that align with evolving consumer preferences

- Asia-Pacific dominated small kitchen appliances market with a share of 45.14% in 2025, due to rapid urbanization, rising disposable income, and increasing adoption of modern cooking appliances across households

- North America is expected to be the fastest growing region in the small kitchen appliances market during the forecast period due to high demand for smart, connected, and multifunctional kitchen appliances

- Mixers and blenders segment dominated the market with a market share of 39.1% in 2025, due to their essential role in daily food preparation across households. Rising consumption of smoothies, batters, sauces, and ready-to-cook meals has increased reliance on these appliances for speed and consistency. Their broad price availability, frequent product upgrades, and strong penetration in both urban and semi-urban homes further support dominance. Manufacturers continue to enhance motor efficiency, durability, and multifunctionality, reinforcing sustained demand

Report Scope and Small Kitchen Appliances Market Segmentation

|

Attributes |

Small Kitchen Appliances Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Small Kitchen Appliances Market Trends

Rising Adoption of Smart and Multifunctional Small Kitchen Appliances

- A major trend in the small kitchen appliances market is the growing adoption of smart and multifunctional products that enhance convenience and efficiency in everyday cooking tasks. Consumers are increasingly favoring appliances that combine multiple functions, reduce manual effort, and align with fast-paced urban lifestyles

- For instance, companies such as Koninklijke Philips N.V. and TTK Prestige Ltd. are introducing smart air fryers and multifunctional cookers with advanced airflow technology and programmable settings. These innovations improve cooking consistency, support healthier food preparation, and strengthen user control

- The integration of digital controls, preset cooking modes, and sensor-based automation is gaining traction as it simplifies operation and minimizes cooking errors. This is particularly appealing to younger consumers and working professionals seeking intuitive kitchen solutions

- Growing interest in connected and app-enabled appliances is further shaping this trend, as users value remote monitoring, customization, and seamless usability. These features enhance user experience and elevate the functional value of small kitchen appliances

- Manufacturers are also focusing on compact and space-saving designs to suit modern kitchens with limited space availability. This emphasis on design efficiency supports wider adoption across urban households

- Overall, the shift toward smart, multifunctional, and user-centric appliances is reinforcing the transition toward modernized kitchens and driving sustained innovation across the small kitchen appliances market

Small Kitchen Appliances Market Dynamics

Driver

Increasing Demand for Time-Saving and Convenient Cooking Solutions

- The rising demand for time-saving and convenient cooking solutions is a key driver supporting growth in the small kitchen appliances market. Busy lifestyles, longer working hours, and the increasing number of dual-income households are encouraging consumers to adopt appliances that reduce cooking time and effort

- For instance, brands such as Midea Group and Samsung offer quick-cooking appliances including air fryers, blenders, and multicookers that streamline food preparation. These products enable faster meal preparation while maintaining consistency and quality

- Growing urbanization and the expansion of nuclear families are reinforcing reliance on appliances that support efficient daily cooking routines. Small kitchen appliances help users manage multiple tasks simultaneously, improving overall household productivity

- The rising popularity of home cooking and experimentation with diverse cuisines is further boosting appliance demand. Consumers are investing in products that offer versatility and ease of use without requiring advanced cooking skills

- Improved affordability and availability across online and offline channels are also strengthening this driver. As convenience becomes a priority, demand for practical and efficient kitchen appliances continues to accelerate market growth

Restraint/Challenge

High Price Sensitivity and Intense Market Competition

- The small kitchen appliances market faces challenges due to high price sensitivity among consumers, particularly in developing regions. Many buyers remain cost-conscious, limiting the adoption of premium or technologically advanced appliances

- For instance, intense competition among brands such as LG Electronics, Whirlpool Corporation, and regional manufacturers places pressure on pricing strategies. Companies must balance innovation with affordability to maintain market share

- Frequent product launches and aggressive discounting intensify competition, reducing profit margins for manufacturers. This environment makes it challenging to sustain differentiation based solely on features

- The presence of unorganized and low-cost local players further increases competitive pressure, especially in price-driven markets. These alternatives can restrict the penetration of branded appliances

- Overall, maintaining profitability while meeting consumer expectations for quality, innovation, and affordability remains a persistent challenge. This restraint continues to influence strategic pricing, product positioning, and market expansion decisions across the industry

Small Kitchen Appliances Market Scope

The market is segmented on the basis of product type and distribution channel.

- By Product Type

On the basis of product type, the small kitchen appliances market is segmented into mixers and blenders, coffee and tea makers, refrigerators, grinders and processors, toasters and juicers, and others. The mixers and blenders segment dominated the market with the largest revenue share of 39.1% in 2025, driven by their essential role in daily food preparation across households. Rising consumption of smoothies, batters, sauces, and ready-to-cook meals has increased reliance on these appliances for speed and consistency. Their broad price availability, frequent product upgrades, and strong penetration in both urban and semi-urban homes further support dominance. Manufacturers continue to enhance motor efficiency, durability, and multifunctionality, reinforcing sustained demand.

The coffee and tea makers segment is expected to register the fastest growth rate from 2026 to 2033, supported by increasing at-home beverage consumption and premium café-style experiences. Changing lifestyles, work-from-home culture, and growing preference for customized brews are accelerating adoption. Technological advancements such as programmable settings, compact designs, and energy-efficient systems are improving usability. Rising disposable income and expanding coffee culture in emerging markets further strengthen growth momentum.

- By Distribution Channel

On the basis of distribution channel, the small kitchen appliances market is segmented into online channel and offline channel. The offline channel accounted for the largest market revenue share in 2025, driven by consumer preference for physical product evaluation before purchase. Retail stores enable hands-on demonstrations, immediate product availability, and direct comparison of features, which builds buyer confidence. Strong presence of brand outlets, specialty appliance stores, and organized retail chains supports high sales volumes. After-sales services, warranties, and in-store assistance further reinforce offline channel dominance.

The online channel is projected to witness the fastest growth rate from 2026 to 2033, driven by expanding e-commerce penetration and increasing digital adoption. Online platforms offer wider product assortments, competitive pricing, and detailed customer reviews, influencing informed purchase decisions. Convenience of home delivery, flexible payment options, and seasonal discounts enhance attractiveness. Growing smartphone usage and improved logistics infrastructure continue to accelerate online channel expansion.

Small Kitchen Appliances Market Regional Analysis

- Asia-Pacific dominated the small kitchen appliances market with the largest revenue share of 45.14% in 2025, driven by rapid urbanization, rising disposable income, and increasing adoption of modern cooking appliances across households

- Strong growth in residential construction, expanding middle-class population, and rising preference for time-saving and energy-efficient appliances are accelerating regional market expansion

- The presence of large manufacturing hubs, competitive pricing, and increasing penetration of organized retail and e-commerce platforms are contributing to higher consumption of small kitchen appliances across the region

China Small Kitchen Appliances Market Insight

China held the largest share in the Asia-Pacific small kitchen appliances market in 2025, owing to its strong domestic manufacturing base and high household penetration of kitchen appliances. The country benefits from large-scale production capabilities, continuous product innovation, and wide availability across online and offline channels. Rising urban households, growing demand for smart and multifunctional appliances, and export-oriented manufacturing further support market leadership.

India Small Kitchen Appliances Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by increasing urbanization, rising disposable income, and changing cooking habits. Growing demand for mixers, grinders, and other daily-use appliances is supported by expanding nuclear families and busy lifestyles. Government initiatives supporting domestic manufacturing and rapid growth of e-commerce platforms are further strengthening market expansion.

Europe Small Kitchen Appliances Market Insight

The Europe small kitchen appliances market is growing steadily, supported by high consumer preference for premium, energy-efficient, and aesthetically designed appliances. Strong awareness of sustainability, product quality, and safety standards drives replacement demand across households. The region’s focus on compact appliances suitable for modern kitchens continues to support stable growth.

Germany Small Kitchen Appliances Market Insight

Germany’s market is driven by high demand for technologically advanced, durable, and energy-efficient kitchen appliances. Strong consumer purchasing power, preference for premium products, and emphasis on product reliability support consistent demand. The presence of leading appliance manufacturers and strong retail infrastructure further enhances market performance.

U.K. Small Kitchen Appliances Market Insight

The U.K. market is supported by rising adoption of convenience-oriented appliances and growing preference for compact kitchen solutions. Increasing penetration of online retail, demand for coffee and tea makers, and changing lifestyle patterns are key growth drivers. Focus on design, energy efficiency, and smart features continues to shape purchasing decisions.

North America Small Kitchen Appliances Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by high demand for smart, connected, and multifunctional kitchen appliances. Strong replacement cycles, rising interest in home cooking, and premium product adoption are boosting market growth. Expansion of e-commerce and subscription-based appliance services further supports regional momentum.

U.S. Small Kitchen Appliances Market Insight

The U.S. accounted for the largest share in the North America market in 2025, supported by high household appliance penetration and strong consumer spending. Demand for innovative, smart, and energy-efficient products remains high, particularly for mixers, blenders, and coffee machines. A mature retail ecosystem and presence of major brands reinforce the country’s dominant regional position.

Small Kitchen Appliances Market Share

The small kitchen appliances industry is primarily led by well-established companies, including:

- LG Electronics (South Korea)

- Whirlpool Corporation (U.S.)

- Morphy Richards India (India)

- SAMSUNG (South Korea)

- Koninklijke Philips N.V. (Netherlands)

- Robert Bosch GmbH (Germany)

- Electrolux AB (Sweden)

- GE Appliances (U.S.)

- Toshiba Lifestyle Products and Services Corporation (Japan)

- Havells India Ltd. (India)

- Panasonic Corporation (Japan)

- BSH Home Appliances Group (Germany)

- Hitachi Appliances, Inc. (Japan)

- mabe international (Mexico)

- Midea Group (China)

- Miele India Pvt. Ltd. (Germany)

- Daewoo Electricals (South Korea)

- Behmor, Inc. (U.S.)

- Rallison Appliances (India)

- Hangzhou Robam Electric Co. (China)

Latest Developments in Global Small Kitchen Appliances Market

- In October 2024, Daewoo, a prominent Korean brand operating in 110 countries, announced plans to launch over 100 consumer appliance products in India, significantly intensifying competition in the small kitchen appliances market. The move targets the rapidly growing base of nuclear families and dual-income households seeking convenient and time-saving appliances. By expanding its local portfolio, Daewoo is expected to improve product accessibility, strengthen brand visibility, and accelerate market penetration across urban and semi-urban regions

- In June 2024, TTK Prestige Ltd. introduced the Prestige 4.5-liter Nutrifry air fryer, further strengthening its presence in the health-focused cooking appliance segment. The smart airflow 360-degree warm air circulation technology enhances cooking efficiency while delivering crisp textures with reduced oil usage. This launch aligns with rising consumer awareness of healthy eating and reinforces Prestige’s competitive positioning in the premium small kitchen appliances category

- In April 2024, Koninklijke Philips N.V. expanded its signature series by launching a new air fryer equipped with seven-layer fast air technology and a large 7.3-liter capacity. The product caters to increasing demand for high-capacity and high-performance appliances suited for family consumption. This development supports Philips’ strategy of expanding its premium offerings while driving growth in the air fryer segment through advanced cooking technology

- In March 2024, KitchenAid unveiled its innovative Grain and Rice Cooker, introducing sensor-based automation to simplify everyday cooking. The appliance’s ability to detect grain quantity and dispense precise water levels ensures consistent results and minimizes user effort. This innovation strengthens KitchenAid’s positioning in smart kitchen solutions and reflects growing consumer demand for intuitive, precision-driven appliances

- In March 2024, Midea presented its latest range of small appliances at the Inspired Home Show 2024 in Chicago, emphasizing its focus on innovation and portfolio diversification. Showcased products, including the Double Decker Dual-Zone Air Fryer, Barista Brew Smart Coffee Maker, and Easy Sauté Multicooker, address evolving consumer preferences for multifunctional and smart appliances. These launches enhance Midea’s global competitiveness and contribute to faster innovation cycles within the small kitchen appliances market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.