Global Small Molecule Sterile Injectable Drug Market

Market Size in USD Billion

CAGR :

%

USD

168.06 Billion

USD

293.10 Billion

2024

2032

USD

168.06 Billion

USD

293.10 Billion

2024

2032

| 2025 –2032 | |

| USD 168.06 Billion | |

| USD 293.10 Billion | |

|

|

|

|

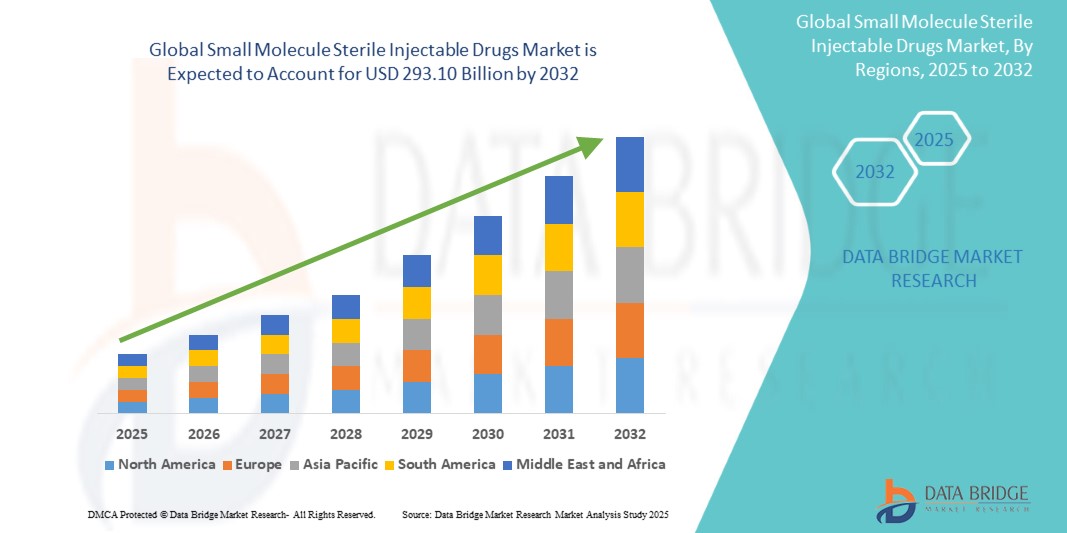

What is the Global Small Molecule Sterile Injectable Drugs Market Size and Growth Rate?

- The global small molecule sterile injectable drugs market size was valued at USD 168.06 billion in 2024 and is expected to reach USD 293.10 billion by 2032, at a CAGR of 7.20% during the forecast period

- Small molecule sterile injectable drugs are vital for delivering medications directly into the bloodstream, ensuring rapid and precise therapeutic effects. Widely used in hospitals and clinics, these drugs treat various conditions such as infections, pain management, and critical care, offering life-saving interventions in emergency and clinical settings

What are the Major Takeaways of Small Molecule Sterile Injectable Drugs Market?

- The escalating burden of chronic diseases, including diabetes, cardiovascular ailments, and cancer, highlights the need for effective treatments. Small molecule sterile injectable drugs are in high demand as they offer targeted therapy, driving their utilization for managing these conditions and addressing the growing healthcare challenges associated with chronic illnesses

- Technological innovations in biotechnology drive the development of novel small molecule injectables, enhancing efficacy, safety, and targeted delivery. These advancements expand treatment options, fueling market growth by meeting diverse therapeutic needs with more effective and precise pharmaceutical solutions

- North America dominated the small molecule sterile injectable drugs market with the largest revenue share of 36.25% in 2024, driven by the growing prevalence of chronic diseases, increasing demand for oncology treatments, and the strong presence of leading pharmaceutical manufacturers

- Asia-Pacific small molecule sterile injectable drugs market is poised to grow at the fastest CAGR of 14.32% during the forecast period of 2025 to 2032, driven by expanding healthcare access, increasing government investments in healthcare infrastructure, and a rising prevalence of chronic diseases across China, Japan, and India

- The Vial Filling segment dominated the small molecule sterile injectable drugs market with the largest market revenue share of 38.4% in 2024, driven by its versatility, high-volume storage capability, and suitability for hospital and clinical use

Report Scope and Small Molecule Sterile Injectable Drugs Market Segmentation

|

Attributes |

Small Molecule Sterile Injectable Drugs Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Small Molecule Sterile Injectable Drugs Market?

“Surge in Demand for Targeted and Rapid-Acting Therapies”

- A significant and accelerating trend in the global small molecule sterile injectable drugs market is the rising demand for rapid-acting, targeted therapies to treat chronic diseases, cancer, and infectious disorders. The injectable route offers faster onset of action and higher bioavailability, making these drugs critical for acute care settings and life-threatening conditions

- For instance, oncology treatments such as immune checkpoint inhibitors and chemotherapy agents in injectable forms are increasingly preferred due to their efficiency in delivering precise doses directly into the bloodstream. Likewise, injectable anti-infectives, such as antibiotics for sepsis or respiratory infections, are widely used in hospitals for their fast-acting nature

- The development of pre-filled syringes, auto-injectors, and ready-to-administer formulations is enhancing convenience, reducing dosing errors, and improving patient compliance, especially in homecare settings. These innovations enable self-administration while maintaining sterility and dosage precision

- Pharmaceutical companies are focusing on the formulation of complex biologics and combination therapies as sterile injectables to address unmet medical needs. The integration of advanced manufacturing technologies ensures product stability and reduces contamination risks

- This trend is fundamentally reshaping patient care by promoting faster recovery times, improving treatment accessibility, and reducing hospitalization rates. Consequently, leading players such as Pfizer, Sanofi, and Amgen are investing heavily in expanding their sterile injectable portfolios to cater to the growing global demand

- The expanding use of small molecule sterile injectable drugs across oncology, cardiovascular, autoimmune, and infectious disease treatments is expected to accelerate market growth, as healthcare systems worldwide prioritize efficient, reliable, and patient-friendly therapeutic solutions

What are the Key Drivers of Small Molecule Sterile Injectable Drugs Market?

- The rising incidence of chronic and life-threatening diseases, combined with advancements in drug delivery technologies, is a primary driver fueling the demand for small molecule sterile injectable drugs

- For instance, in February 2024, Gilead Sciences announced new clinical data supporting the effectiveness of its injectable antiviral treatments for resistant infectious diseases, reinforcing the critical role of sterile injectables in modern healthcare

- The need for rapid therapeutic action in emergency and critical care scenarios, such as in ICUs, oncology centers, and surgical settings, significantly boosts the demand for injectable drug formulations. Their high bioavailability and immediate systemic absorption make them indispensable for time-sensitive treatments

- Additionally, the growing elderly population, rising healthcare expenditure, and the preference for homecare and self-administration are driving the development of user-friendly, pre-filled syringes and pen injectors for chronic disease management, including diabetes and rheumatoid arthritis

- Furthermore, stringent regulatory standards promoting drug sterility, safety, and efficacy are pushing pharmaceutical manufacturers to enhance production capabilities and invest in sterile injectable lines, which is expected to further support market expansion

Which Factor is challenging the Growth of the Small Molecule Sterile Injectable Drugs Market?

- The complex and costly manufacturing processes required for small molecule sterile injectable drugs pose a significant challenge to wider market penetration. The stringent sterility requirements, regulatory compliance, and facility infrastructure demands increase production expenses

- For example, regulatory recalls and supply chain disruptions due to contamination risks have impacted injectable drug availability, making healthcare providers and patients cautious about certain product categories

- The high production costs translate to premium pricing, which can restrict access to these drugs, particularly in low- and middle-income countries, where healthcare budgets and patient affordability remain constrained

- Furthermore, the dependency on specialized cold chain logistics for temperature-sensitive injectables adds complexity to distribution, often leading to supply bottlenecks or wastage, especially in remote regions

- While companies are striving to overcome these challenges through investments in advanced manufacturing technologies and process automation, the need for substantial capital expenditure and skilled workforce remains a hurdle for new market entrants

- Addressing these barriers by improving production scalability, enhancing regulatory compliance, and developing cost-effective formulations will be essential for ensuring sustainable market growth and broader accessibility to life-saving injectable therapies

How is the Small Molecule Sterile Injectable Drugs Market Segmented?

The market is segmented on the basis of type, communication protocol, unlocking mechanism, and application.

• By Product

On the basis of product, the small molecule sterile injectable drugs market is segmented into Vial Filling, Syringe Filling, Cartridge Filling, Small Molecule Antibiotics, Chemotherapy Agents, Local and General Anaesthetics, Skeletal Muscle Relaxants, Analgesics, Anticoagulants, Anticonvulsants, Antivirals, Anti-histamines/Anti-allergy, and Others. The Vial Filling segment dominated the small molecule sterile injectable drugs market with the largest market revenue share of 38.4% in 2024, driven by its versatility, high-volume storage capability, and suitability for hospital and clinical use. Vials remain the preferred format for injectable antibiotics, anesthetics, and chemotherapy agents, ensuring sterility, dosage accuracy, and ease of use in healthcare facilities.

The Syringe Filling segment is anticipated to witness the fastest growth rate of 20.5% from 2025 to 2032, owing to increasing demand for ready-to-use prefilled syringes for vaccines, chronic disease therapies, and emergency medications. Prefilled syringes enhance convenience, reduce contamination risks, and support self-administration in home care settings, driving their widespread adoption.

• By Route of Administration

On the basis of route of administration, the market is segmented into Intravenous (IV), Intramuscular (IM), and Subcutaneous (SC). The Intravenous (IV) segment held the largest market revenue share in 2024, attributed to the rapid onset of action, high bioavailability, and suitability for critical care, oncology, and infectious disease treatments. IV administration remains the gold standard for delivering life-saving drugs in hospital environments.

The Subcutaneous (SC) segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by its growing use in chronic disease management, including diabetes, autoimmune disorders, and oncology. SC administration enables self-injection, reduces hospital visits, and enhances patient compliance, making it a preferred route for biologics and sterile injectables.

• By Application

On the basis of application, the market is segmented into Oncology, Infectious Diseases, Cardiovascular Diseases, Metabolic Diseases, Neurology, Dermatology, Urology, Autoimmune Diseases, Respiratory Disorders, Infectious Diseases, CNS Diseases, Blood Disorders, Musculoskeletal Disorders, and Others. The Oncology segment accounted for the largest market revenue share in 2024, driven by the rising cancer prevalence and growing reliance on sterile injectable chemotherapy agents, targeted therapies, and supportive care drugs. The need for fast-acting, accurate, and sterile drug delivery in cancer treatments significantly boosts demand.

The Infectious Diseases segment is expected to witness the fastest CAGR from 2025 to 2032, owing to the increasing burden of antimicrobial resistance, pandemics, and hospital-acquired infections. Sterile injectable antibiotics, antivirals, and antifungals are essential for treating severe infections, especially in intensive care units.

• By End-Users

On the basis of end-users, the market is segmented into Hospitals, Specialty Clinics, Home Care Settings, and Others. The Hospitals segment dominated the Small Molecule Sterile Injectable Drugs market with the largest revenue share in 2024, driven by the high demand for injectable therapies in emergency departments, surgical centers, oncology wards, and ICUs. Hospitals remain the primary setting for administering sterile injectable drugs due to their complexity and need for professional oversight.

The Home Care Settings segment is projected to register the fastest growth from 2025 to 2032, supported by advancements in prefilled syringes, auto-injectors, and patient-friendly formulations that enable at-home administration of chronic therapies, reducing healthcare costs and enhancing convenience.

• By Distribution Channels

On the basis of distribution channels, the market is segmented into Direct Tender, Retail Pharmacy, Online Pharmacy, and Others. The Direct Tender segment accounted for the largest market revenue share in 2024, as bulk procurement by hospitals, government institutions, and large healthcare providers ensures stable supply, cost efficiency, and regulatory compliance for high-volume injectable drugs.

The Online Pharmacy segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the rising trend of digital health platforms, telemedicine, and e-commerce, enabling patients to conveniently order injectable medications and home-use devices, particularly for chronic disease management.

Which Region Holds the Largest Share of the Small Molecule Sterile Injectable Drugs Maret?

- North America dominated the small molecule sterile injectable drugs market with the largest revenue share of 36.25% in 2024, driven by the growing prevalence of chronic diseases, increasing demand for oncology treatments, and the strong presence of leading pharmaceutical manufacturers

- The region benefits from advanced healthcare infrastructure, favorable reimbursement policies, and significant investment in sterile injectable drug development, particularly for oncology, infectious diseases, and cardiovascular conditions

- Additionally, the demand for ready-to-use, high-quality injectable formulations continues to grow, particularly in hospitals and specialty clinics, reinforcing North America's leading position in the market

U.S. Small Molecule Sterile Injectable Drugs Market Insight

U.S. small molecule sterile injectable drugs market captured the largest revenue share in 2024 within North America, fueled by rising cancer incidence rates, expanding hospital infrastructure, and increased preference for injectable therapies due to their rapid efficacy and precise dosage control. The growing trend of outpatient care, alongside strong regulatory oversight from the FDA for drug safety and quality, further accelerates the adoption of sterile injectables in the country.

Europe Small Molecule Sterile Injectable Drugs Market Insight

The Europe small molecule sterile injectable drugs market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by a strong pharmaceutical manufacturing base, rising geriatric population, and the growing burden of chronic and infectious diseases. Europe sees significant demand for sterile injectable antibiotics, oncology agents, and cardiovascular drugs, supported by stringent regulatory standards ensuring drug quality. The increasing focus on healthcare modernization and expansion of specialty clinics further boosts the regional market.

U.K. Small Molecule Sterile Injectable Drugs Market Insight

The U.K. small molecule sterile injectable drugs market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising healthcare expenditure, government initiatives promoting advanced treatment options, and increasing prevalence of cancer and metabolic disorders. The country's emphasis on early disease detection and patient-centric care supports the rising demand for ready-to-administer injectable drugs across hospitals and specialty clinics.

Germany Small Molecule Sterile Injectable Drugs Market Insight

The Germany small molecule sterile injectable drugs market is expected to expand at a considerable CAGR during the forecast period, supported by its world-class healthcare infrastructure, robust pharmaceutical R&D ecosystem, and a growing patient population requiring injectable therapies for oncology, neurology, and infectious diseases. The country's focus on innovation, drug safety, and efficiency continues to fuel demand for sterile injectable drugs, particularly in both hospital and outpatient settings.

Which Region is the Fastest Growing Region in the Small Molecule Sterile Injectable Drugs Market?

Asia-Pacific small molecule sterile injectable drugs market is poised to grow at the fastest CAGR of 14.32% during the forecast period of 2025 to 2032, driven by expanding healthcare access, increasing government investments in healthcare infrastructure, and a rising prevalence of chronic diseases across China, Japan, and India. The region's strong pharmaceutical manufacturing base, along with a shift towards high-quality injectable treatments for oncology, infectious diseases, and metabolic conditions, is propelling market growth.

Japan Small Molecule Sterile Injectable Drugs Market Insight

The Japan small molecule sterile injectable drugs market is gaining momentum, attributed to the country's aging population, increased incidence of cancer and cardiovascular diseases, and strong demand for convenient, effective treatment options. Japan's technologically advanced healthcare system and preference for precision medicine are driving the growth of sterile injectable formulations, particularly for oncology and chronic disease management.

China Small Molecule Sterile Injectable Drugs Market Insight

China small molecule sterile injectable drugs market accounted for the largest market revenue share in Asia-Pacific in 2024, fueled by rapid urbanization, rising healthcare awareness, and a growing middle-class population demanding high-quality healthcare. China remains a major hub for pharmaceutical manufacturing, with increasing domestic production of sterile injectables for oncology, infectious diseases, and metabolic conditions. The country's push towards healthcare modernization, coupled with government initiatives promoting drug quality and accessibility, continues to support strong market expansion.

Which are the Top Companies in Small Molecule Sterile Injectable Drugs Market?

The small molecule sterile injectable drugs industry is primarily led by well-established companies, including:

- Gilead Sciences, Inc. (U.S.)

- BioCryst Pharmaceuticals, Inc. (U.S.)

- AstraZeneca (U.K.)

- Genentech, Inc. (U.S.)

- Merck KGaA (Germany)

- Hikma Pharmaceuticals PLC (U.K.)

- AbbVie Inc. (U.S.)

- American Regent, Inc. (U.S.)

- Amgen Inc. (U.S.)

- Bristol-Myers Squibb Company (U.S.)

- Teligent (U.S.)

- Eisai Co., Ltd. (Japan)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Neuren Pharmaceuticals (Australia)

- Noxopharm (Australia)

- Amomed Pharma GmbH (Austria)

- Sanofi (France)

- Exelixis, Inc. (U.S.)

- Fresenius Kabi USA (U.S.)

- Pfizer Inc. (U.S.)

What are the Recent Developments in Global Small Molecule Sterile Injectable Drugs Market?

- In December 2022, Gilead Sciences, Inc. received approval from the U.S. Food and Drug Administration (FDA) for Sunlenca, to be used alongside other antiretroviral therapies for treating HIV-1 infections in heavily treatment-experienced adults with multi-drug resistant HIV-1. This regulatory approval introduced a novel therapeutic option in the HIV treatment space, enabling the company to expand its existing infectious disease portfolio and strengthen its competitive position

- In May 2022, Eli Lilly received U.S. FDA approval for Mounjaro (tirzepatide) injection, a once-weekly dual GIP and GLP-1 receptor agonist, designed to improve glycemic control in adults with type 2 diabetes. This approval marked a significant advancement in diabetes management, providing patients with an innovative, convenient, and effective treatment option to regulate blood sugar levels and broadening Eli Lilly’s product portfolio

- In February 2021, BioCryst Pharmaceuticals, Inc. secured FDA approval for a supplemental new drug application, expanding eligibility for RAPIVAB, its antiviral treatment for influenza. This approval allowed the company to serve a broader patient population and reinforced its commitment to offering novel antiviral therapies in the infectious disease space

- In July 2021, Novartis announced that branaplam, an oral small molecule, had advanced to Phase 2 clinical trials for the treatment of spinal muscular atrophy (SMA). This milestone marked a crucial development in exploring potential treatments for this severe genetic disorder, highlighting Novartis’s focus on innovation in neurological diseases

- In January 2020, Sanofi S.A. completed the acquisition of Syntrox to enhance its capabilities in developing biotechnological treatments for cancer and autoimmune disorders. This strategic acquisition is expected to accelerate Sanofi’s pipeline expansion and contribute to advancements in therapeutic solutions, thereby supporting growth opportunities within the small molecule sterile injectable drugs market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.