Global Smart Agriculture Market

Market Size in USD Billion

CAGR :

%

USD

9.30 Billion

USD

14.93 Billion

2024

2032

USD

9.30 Billion

USD

14.93 Billion

2024

2032

| 2025 –2032 | |

| USD 9.30 Billion | |

| USD 14.93 Billion | |

|

|

|

|

Smart Agriculture Market Size

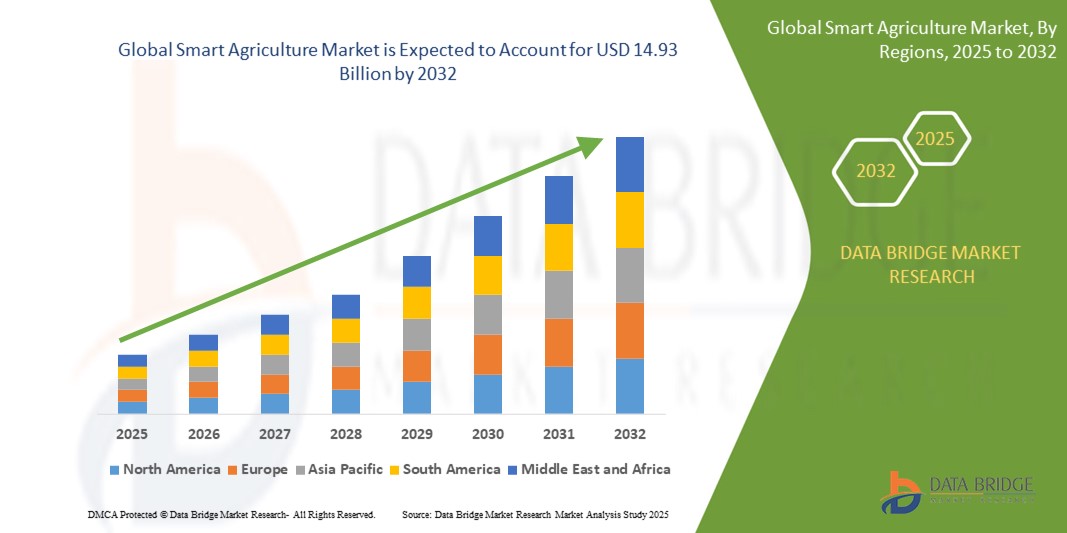

- The global smart agriculture market was valued at USD 9.30 billion in 2024 and is expected to reach USD 14.93 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 6.10%, primarily driven by limited arable land

- This growth is driven by factors such as maximizing crop yield and efficient resource management

Smart Agriculture Market Analysis

- Smart agriculture refers to the integration of advanced technologies such as IoT, AI, sensors, and big data into farming practices to enhance productivity, optimize resource use, and promote sustainable agricultural operations across various segments including crop cultivation, livestock monitoring, and aquaculture

- Market growth is driven by the increasing need for efficient food production due to limited arable land, rising global population, growing adoption of precision farming techniques, and the demand for sustainable agricultural solutions

- The market is evolving with advancements in connected devices, automation, and data analytics, which enable real-time monitoring, predictive insights, and decision support systems for enhanced farm management and output

- For instance, companies such as John Deere and Trimble are incorporating AI and machine learning in their equipment and software platforms to support precision planting, autonomous machinery, and data-driven farm operations

- The smart agriculture market is expected to witness robust growth, supported by expanding government initiatives, increased investment in agri-tech startups, and the rising incorporation of smartphones and mobile applications for on-field data access and control

Report Scope and Smart Agriculture Market Segmentation

|

Attributes |

Smart Agriculture Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Smart Agriculture Market Trends

“Increasing Adoption of IoT-Enabled Devices and Sensors”

- One prominent trend in the global smart agriculture market is the increasing adoption of IoT-enabled devices and sensors

- This trend is driven by the need for real-time monitoring, data-driven decision-making, improved resource utilization, and enhanced precision in crop and livestock management

- For instance, companies such as AGCO and CropX are deploying IoT-based soil sensors and connected machinery to monitor moisture levels, track equipment performance, and automate irrigation, resulting in optimized yields and reduced operational costs

- The growing availability of affordable, durable IoT devices, combined with advancements in wireless connectivity, cloud computing, and mobile integration, is accelerating their adoption in both large-scale and smallholder farms

- As agriculture continues to modernize, IoT-enabled solutions are expected to play a central role in enabling smart farming, increasing efficiency, and supporting sustainable practices amid climate challenges and rising global food demand

Smart Agriculture Market Dynamics

Driver

“Growing Global Population”

- The rising global population is a key driver of growth in the smart agriculture market, as the demand for food continues to surge, placing immense pressure on agricultural systems to boost productivity and efficiency

- This demand is especially significant in developing regions, where rapid urbanization and population growth are outpacing traditional farming capacities, creating an urgent need for technology-driven, high-yield agricultural solutions

- With finite arable land and increasing resource constraints, farmers and governments are adopting smart agriculture technologies to meet food security goals while ensuring sustainable farming practices

- These technologies, including precision farming, real-time monitoring systems, and automated equipment, help maximize crop yields, reduce waste, and improve decision-making across the agricultural value chain.

- Industry players are leveraging data analytics, IoT, and AI to address the growing food demand and develop scalable solutions tailored to diverse geographic and climatic conditions

For instance,

- John Deere offers precision farming equipment integrated with GPS and AI, allowing for real-time field data analysis and autonomous tractor operations.

- Trimble provides solutions that enable farmers to optimize planting and fertilization processes, helping maximize output per acre

- As the global population continues to grow, the adoption of smart agriculture solutions is expected to play a vital role in transforming food production systems and ensuring long-term food sustainability

Opportunity

“Incorporation of Smartphones in Agricultural Hardware and Software”

- The incorporation of smartphones into agricultural hardware and software presents a significant opportunity for the smart agriculture market. Mobile technology is reshaping farming operations by offering accessible, user-friendly platforms for real-time monitoring, control, and data analysis

- With widespread smartphone penetration, especially in rural and developing regions, farmers can now access advanced agricultural solutions at their fingertips, supporting decisions on irrigation, fertilization, pest control, and crop health through intuitive mobile apps

- This integration enhances farm management by allowing remote access to sensor data, machinery, and weather updates, facilitating timely interventions and improved resource allocation

For instance,

- Smartphone-compatible applications such as John Deere Operations Center Mobile and Trimble Ag Software allow farmers to monitor field conditions, track equipment, and adjust settings on the go

- FarmERP and KisanHub offer end-to-end farm management solutions via mobile platforms, including supply chain tracking, yield forecasting, and compliance reporting

- As smartphones continue to evolve with better connectivity, AI capabilities, and affordability, their integration with agricultural systems is expected to unlock new efficiencies, expand digital access for smallholder farmers, and accelerate the digital transformation of global agriculture

Restraint/Challenge

“Lack of Technical Expertise”

- A significant challenge in the smart agriculture market is the lack of technical expertise among farmers and agricultural workers. As the industry embraces advanced technologies such as IoT, AI, drones, and data analytics, many end-users face difficulties in understanding and operating these systems effectively

- The adoption of smart agriculture solutions often requires specialized knowledge in software handling, sensor calibration, data interpretation, and system integration—skills that are not widely available in rural farming communities, particularly in developing regions

- Moreover, training programs and technical support infrastructures are often limited, creating a gap between the availability of advanced technologies and their practical, effective implementation on the ground

For instance,

- Farmers adopting precision agriculture tools from companies such as Trimble or Ag Leader may struggle to utilize full system capabilities without adequate training or ongoing support

- Without significant investment in training, knowledge transfer, and user-friendly system designs, the widespread deployment of smart agriculture technologies could be hindered, particularly in regions where agriculture remains a primary livelihood but access to digital education is limited

Smart Agriculture Market Scope

The market is segmented on the basis of agriculture type, solution, offering, and application.

|

Segmentation |

Sub-Segmentation |

|

By Agriculture Type |

|

|

By Solution |

|

|

By Offering |

|

|

By Application

|

|

Smart Agriculture Market Regional Analysis

“North America is the Dominant Region in the Smart Agriculture Market”

- North America dominates the smart agriculture market, driven by the region’s high adoption of advanced technologies such as IoT, AI, drones, and precision farming tools in agricultural practices

- U.S. holds a significant share due to its large-scale commercial farming operations, high digital literacy among farmers, and widespread use of data-driven solutions to enhance productivity, optimize input usage, and ensure sustainable farming

- Key players in the region, such as John Deere, Trimble, and AGCO, are continuously innovating and expanding their smart agriculture offerings, including autonomous machinery, real-time crop monitoring systems, and integrated farm management platforms

- With its strong technological infrastructure, rising focus on sustainable agriculture, and ongoing R&D activities, North America is expected to remain the largest and most influential market for smart agriculture from 2025 to 2032

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific is expected to witness the highest growth rate in the smart agriculture market, driven by increasing food demand, limited arable land, and growing awareness of the benefits of smart farming technologies

- Countries such as China, India, and Japan are at the forefront, with increasing government initiatives, investments in agri-tech startups, and pilot programs aimed at promoting digital transformation in agriculture

- China's push toward food security and agricultural modernization, along with India’s focus on improving farmer income and digital access, is expected to significantly accelerate the adoption of smart farming solutions, including mobile-based farm management apps, precision irrigation, and drone-assisted crop monitoring.

- With rapid urbanization, rising population, and growing adoption of mobile and cloud-based farming tools, Asia-Pacific is poised to emerge as the fastest-growing region in the global smart agriculture market over the forecast period of 2025 to 2032

Smart Agriculture Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Ag Leader Technology (U.S.)

- AGCO Corporation (U.S.)

- CNH INDUSTRIAL N.V. (U.K.)

- Climate LLC (U.S.)

- Raven Industries, Inc. (U.S.)

- Precision Planting (U.S.)

- Semios (Canada)

- LexisNexis Risk Solutions (Georgia)

- Topcon (Japan)

- Trimble Inc. (U.S.)

- CropZilla Inc. (U.S.)

- Certhon (Netherlands)

- DeLaval (Sweden)

- AgEagle Aerial Systems Inc. (U.S.)

- AgriData Incorporated (U.S.)

- Deere & Company (U.S.)

- Grownetics (U.S.)

Latest Developments in Global Smart Agriculture Market

- In November 2020, Ag Leader Technology upgraded its InCommand displays and added built-in-house SteerCommand Z2 and SteadySteer to its SteerCommand product portfolio. These products provide end-users with a single user interface that steers and controls all farming equipment

- In January 2020, CropMetrics was acquired by CropX, a leading soil and agricultural analytics company, to expand into the U.S. market. This acquisition was intended to leverage CropMetrics’s vast dealer network, service model, user-friendly platform, and Variable Rate Irrigation System to serve product offerings in major regions of the U.S.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL SMART AGRICULTURE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL SMART AGRICULTURE MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 STANDARDS OF MEASUREMENT

2.2.9 VENDOR SHARE ANALYSIS

2.2.10 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.11 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL SMART AGRICULTURE MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHT

5.1 PORTERS FIVE FORCES

5.2 REGULATORY STANDARDS

5.3 TECHNOLOGICAL TRENDS

5.4 CASE STUDY ANALYSIS

5.5 VALUE CHAIN ANALYSIS

5.6 COMPANY COMPERATIVE ANALYSIS

6 GLOBAL SMART AGRICULTURE MARKET, BY OFFERING

6.1 OVERVIEW

6.2 HARDWARE

6.2.1 AUTOMATION & CONTROL SYSTEMS

6.2.1.1. DRONES/UAVS

6.2.1.2. CAMERCA SYSTEMS

6.2.1.3. CONTROL SYSTEMS

6.2.1.4. GUIDANCE SYSTEMS

6.2.1.4.1. GPS

6.2.1.4.2. GIS

6.2.1.5. REMOTE SENSING

6.2.1.5.1. HANDHELD

6.2.1.5.2. SATELLITE SENSING

6.2.1.6. WIRELESS MODULES

6.2.1.6.1. BLUETOOTH

6.2.1.6.2. WI-FI

6.2.1.6.3. ZIGBEE

6.2.1.6.4. OTHERS

6.2.1.7. OTHERS

6.2.2 SENSING DEVICES

6.2.2.1. SOIL SENSORS

6.2.2.1.1. NUTRIENT SENSORS

6.2.2.1.2. MOISTURE SENSORS

6.2.2.1.3. TEMPERATURE SENSORS

6.2.2.2. WATER SENSORS

6.2.2.3. CLIMATE SENSORS

6.2.2.4. OTHERS

6.2.3 HVAC SYSTEMS

6.2.4 LED GROW LIGHT

6.2.5 RFID TAGS & READERS

6.2.6 VALVES & PUMPS

6.2.7 OTHERS

6.3 SOFTWARE

6.3.1 BY DEPLOYMENT MODE

6.3.1.1. ON-PREMISE

6.3.1.2. CLOUD-BASED

6.3.2 BY TYPE

6.3.2.1. AI & DATA ANALYTICS

6.3.2.2. FARM MANAGEMENT SOFTWARE

6.3.2.3. OTHERS

6.4 SERVICES

6.4.1 MANAGED SERVICES

6.4.1.1. FARM OPERATION SERVICES

6.4.1.2. DATA SERVICES

6.4.1.3. ANALYTICS SERVICES

6.4.2 CONNECTIVITY SERVICES

6.4.3 ASSISTED PROFESSIONAL SERVICES

6.4.3.1. SUPPLY CHAIN MANAGEMENT SERVICES

6.4.3.2. CLIMATE INFORMATION SERVICES

6.4.4 SUPPORT & MAINTENANCE SERVICES

7 GLOBAL SMART AGRICULTURE MARKET, BY FARM SIZE

7.1 OVERVIEW

7.2 SMALL FARMS

7.3 MEDIUM FARMS

7.4 LARGE FARMS

8 GLOBAL SMART AGRICULTURE MARKET, BY AGRICULTURE TYPE

8.1 OVERVIEW

8.2 LIVESTOCK MONITORING

8.2.1 MILK HARVESTING MANAGEMENT

8.2.2 FEEDING MANAGEMENT

8.2.3 BREEDING MANAGEMENT

8.2.4 HEAT STRESS MANAGEMENT

8.2.5 ANIMAL COMFORT MANAGEMENT

8.2.6 OTHERS

8.3 PRECISION FARMING

8.3.1 FIELD MAPPING

8.3.1.1. BOUNDARY MAPPING

8.3.1.2. DRAINAGE MAPPING

8.3.2 CROP SCOUTING

8.3.3 INVENTORY MANAGEMENT

8.3.4 IRRIGATION MANAGEMENT

8.3.5 FARM LABOR MANAGEMENT

8.3.6 YIELD MONITORING

8.3.6.1. ON-FARM YIELD MONITORING

8.3.6.2. OFF-FORM YIELD MONITORING

8.3.7 WEATHER TRACKING & FORECASTING

8.3.8 OTHERS

8.4 SMART GREENHOUSE

8.4.1 HVAC MANAGEMENT

8.4.2 WATER & FERTILIZER MANAGEMENT

8.4.3 YIELD MONITORING AND HARVESTING

8.4.4 OTHERS

8.5 PRECISION FORESTRY

8.5.1 GENETICS & NURSERIES

8.5.2 HARVESTING MANAGEMENT

8.5.3 SIVICULTURE AND FIRE MANAGEMENT

8.5.4 OTHERS

8.6 PRECISION AQUACULTURE

8.6.1 FEEDING MANAGEMENT

8.6.2 MONITORING, CONTROL & SURVEILLANCE

8.6.3 OTHERS

8.7 OTHERS

9 GLOBAL SMART AGRICULTURE MARKET, BY GEOGRAPHY

GLOBAL SMART AGRICULTURE MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

9.1 NORTH AMERICA

9.1.1 U.S.

9.1.2 CANADA

9.1.3 MEXICO

9.2 EUROPE

9.2.1 GERMANY

9.2.2 FRANCE

9.2.3 U.K.

9.2.4 ITALY

9.2.5 SPAIN

9.2.6 RUSSIA

9.2.7 TURKEY

9.2.8 BELGIUM

9.2.9 NETHERLANDS

9.2.10 NORWAY

9.2.11 FINLAND

9.2.12 SWITZERLAND

9.2.13 DENMARK

9.2.14 SWEDEN

9.2.15 POLAND

9.2.16 REST OF EUROPE

9.3 ASIA PACIFIC

9.3.1 JAPAN

9.3.2 CHINA

9.3.3 SOUTH KOREA

9.3.4 INDIA

9.3.5 AUSTRALIA

9.3.6 NEW ZEALAND

9.3.7 SINGAPORE

9.3.8 THAILAND

9.3.9 MALAYSIA

9.3.10 INDONESIA

9.3.11 PHILIPPINES

9.3.12 TAIWAN

9.3.13 VIETNAM

9.3.14 REST OF ASIA PACIFIC

9.4 SOUTH AMERICA

9.4.1 BRAZIL

9.4.2 ARGENTINA

9.4.3 REST OF SOUTH AMERICA

9.5 MIDDLE EAST AND AFRICA

9.5.1 SOUTH AFRICA

9.5.2 EGYPT

9.5.3 SAUDI ARABIA

9.5.4 U.A.E

9.5.5 OMAN

9.5.6 BAHRAIN

9.5.7 ISRAEL

9.5.8 KUWAIT

9.5.9 QATAR

9.5.10 REST OF MIDDLE EAST AND AFRICA

9.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

10 GLOBAL SMART AGRICULTURE MARKET,COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: GLOBAL

10.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

10.3 COMPANY SHARE ANALYSIS: EUROPE

10.4 COMPANY SHARE ANALYSIS: ASIA PACIFIC

11 GLOBAL SMART AGRICULTURE MARKET, SWOT & DBMR ANALYSIS

12 GLOBAL SMART AGRICULTURE MARKET, COMPANY PROFILE

12.1 AG LEADER TECHNOLOGY

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 PRODUCT PORTFOLIO

12.1.4 RECENT DEVELOPMENT

12.2 AGCO CORPORATION

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 PRODUCT PORTFOLIO

12.2.4 RECENT DEVELOPMENT

12.3 DEERE & COMPANY

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT DEVELOPMENT

12.4 BAYER AG

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 PRODUCT PORTFOLIO

12.4.4 RECENT DEVELOPMENT

12.5 KUBOTA CORPORATION

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 RECENT DEVELOPMENT

12.6 ARGUS CONTROL SYSTEMS LIMITED

12.6.1 COMPANY SNAPSHOT

12.6.2 REVENUE ANALYSIS

12.6.3 PRODUCT PORTFOLIO

12.6.4 RECENT DEVELOPMENT

12.7 AGJUNCTION LLC

12.7.1 COMPANY SNAPSHOT

12.7.2 REVENUE ANALYSIS

12.7.3 PRODUCT PORTFOLIO

12.7.4 RECENT DEVELOPMENT

12.8 CROPZILLA INC.

12.8.1 COMPANY SNAPSHOT

12.8.2 REVENUE ANALYSIS

12.8.3 PRODUCT PORTFOLIO

12.8.4 RECENT DEVELOPMENT

12.9 DICKEY-JOHN

12.9.1 COMPANY SNAPSHOT

12.9.2 REVENUE ANALYSIS

12.9.3 PRODUCT PORTFOLIO

12.9.4 RECENT DEVELOPMENT

12.1 DRONEDEPLOY

12.10.1 COMPANY SNAPSHOT

12.10.2 REVENUE ANALYSIS

12.10.3 PRODUCT PORTFOLIO

12.10.4 RECENT DEVELOPMENT

12.11 FARMERS EDGE INC.

12.11.1 COMPANY SNAPSHOT

12.11.2 REVENUE ANALYSIS

12.11.3 PRODUCT PORTFOLIO

12.11.4 RECENT DEVELOPMENT

12.12 RAVEN INDUSTRIES, INC.

12.12.1 COMPANY SNAPSHOT

12.12.2 REVENUE ANALYSIS

12.12.3 PRODUCT PORTFOLIO

12.12.4 RECENT DEVELOPMENT

12.13 TRIMBLE INC.

12.13.1 COMPANY SNAPSHOT

12.13.2 REVENUE ANALYSIS

12.13.3 PRODUCT PORTFOLIO

12.13.4 RECENT DEVELOPMENT

12.14 TOPCON

12.14.1 COMPANY SNAPSHOT

12.14.2 REVENUE ANALYSIS

12.14.3 PRODUCT PORTFOLIO

12.14.4 RECENT DEVELOPMENT

12.15 HELIOSPECTRA AB

12.15.1 COMPANY SNAPSHOT

12.15.2 REVENUE ANALYSIS

12.15.3 PRODUCT PORTFOLIO

12.15.4 RECENT DEVELOPMENT

12.16 NEDAP LIVESTOCK MANAGEMEN

12.16.1 COMPANY SNAPSHOT

12.16.2 REVENUE ANALYSIS

12.16.3 PRODUCT PORTFOLIO

12.16.4 RECENT DEVELOPMENT

12.17 AGEAGLE AERIAL SYSTEMS INC

12.17.1 COMPANY SNAPSHOT

12.17.2 REVENUE ANALYSIS

12.17.3 PRODUCT PORTFOLIO

12.17.4 RECENT DEVELOPMENT

12.18 CROPIN TECHNOLOGY SOLUTIONS PRIVATE LIMITED

12.18.1 COMPANY SNAPSHOT

12.18.2 REVENUE ANALYSIS

12.18.3 PRODUCT PORTFOLIO

12.18.4 RECENT DEVELOPMENT

12.19 FANCOM BV

12.19.1 COMPANY SNAPSHOT

12.19.2 REVENUE ANALYSIS

12.19.3 PRODUCT PORTFOLIO

12.19.4 RECENT DEVELOPMENT

12.2 ABACO S.P.A.

12.20.1 COMPANY SNAPSHOT

12.20.2 REVENUE ANALYSIS

12.20.3 PRODUCT PORTFOLIO

12.20.4 RECENT DEVELOPMENT

12.21 DELAVAL

12.21.1 COMPANY SNAPSHOT

12.21.2 REVENUE ANALYSIS

12.21.3 PRODUCT PORTFOLIO

12.21.4 RECENT DEVELOPMENT

12.22 INNOVASEA SYSTEMS INC.

12.22.1 COMPANY SNAPSHOT

12.22.2 REVENUE ANALYSIS

12.22.3 PRODUCT PORTFOLIO

12.22.4 RECENT DEVELOPMENT

12.23 MERCK & CO., INC.

12.23.1 COMPANY SNAPSHOT

12.23.2 REVENUE ANALYSIS

12.23.3 PRODUCT PORTFOLIO

12.23.4 RECENT DEVELOPMENT

12.24 CONSERVIS

12.24.1 COMPANY SNAPSHOT

12.24.2 REVENUE ANALYSIS

12.24.3 PRODUCT PORTFOLIO

12.24.4 RECENT DEVELOPMENT

12.25 AGRIDATA

12.25.1 COMPANY SNAPSHOT

12.25.2 REVENUE ANALYSIS

12.25.3 PRODUCT PORTFOLIO

12.25.4 RECENT DEVELOPMENT

12.26 CLIMATE LLC.

12.26.1 COMPANY SNAPSHOT

12.26.2 REVENUE ANALYSIS

12.26.3 PRODUCT PORTFOLIO

12.26.4 RECENT DEVELOPMENT

12.27 CROPX INC.

12.27.1 COMPANY SNAPSHOT

12.27.2 REVENUE ANALYSIS

12.27.3 PRODUCT PORTFOLIO

12.27.4 RECENT DEVELOPMENT

12.28 TEEJET TECHNOLOGIES

12.28.1 COMPANY SNAPSHOT

12.28.2 REVENUE ANALYSIS

12.28.3 PRODUCT PORTFOLIO

12.28.4 RECENT DEVELOPMENT

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

13 CONCLUSION

14 QUESTIONNAIRE

15 RELATED REPORTS

16 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.