Global Smart Air Conditioner Market

Market Size in USD Billion

CAGR :

%

USD

20.02 Billion

USD

51.38 Billion

2024

2032

USD

20.02 Billion

USD

51.38 Billion

2024

2032

| 2025 –2032 | |

| USD 20.02 Billion | |

| USD 51.38 Billion | |

|

|

|

|

Smart Air Conditioner Market Size

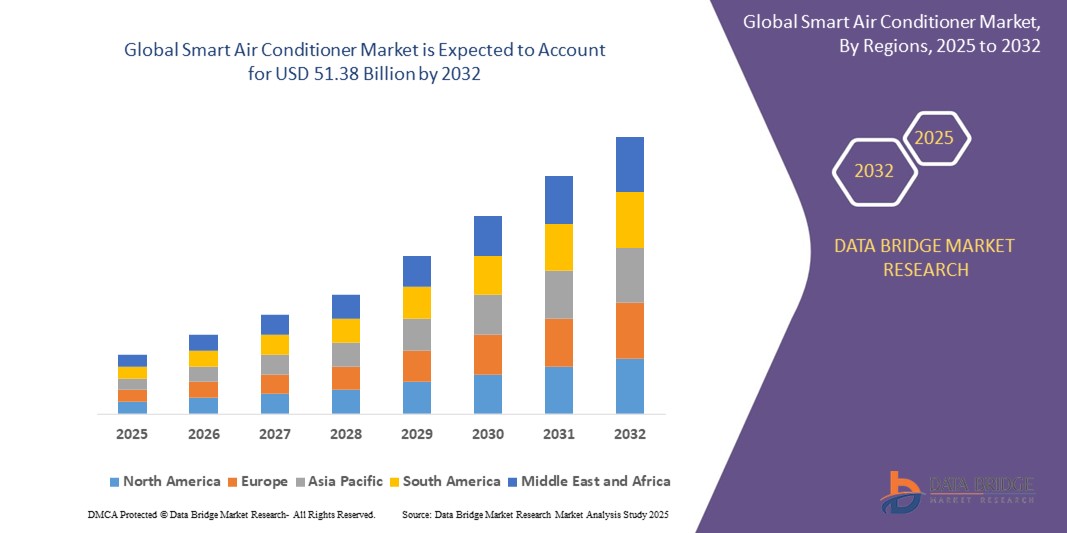

- The global smart air conditioner market size was valued at USD 20.02 billion in 2024 and is expected to reach USD 51.38 billion by 2032, at a CAGR of 12.50% during the forecast period

- The market growth is driven by the increasing adoption of smart home technologies, rising demand for energy-efficient cooling solutions, and advancements in IoT and AI integration for enhanced user control and convenience

- Growing consumer preference for connected, eco-friendly, and remotely controllable air conditioning systems is positioning smart air conditioners as a key component of modern climate control solutions, significantly contributing to market expansion

Smart Air Conditioner Market Analysis

- Smart air conditioners, equipped with advanced features such as remote control, energy monitoring, and integration with smart home ecosystems, are becoming essential for efficient climate management in residential, commercial, and industrial settings

- The surge in demand is fueled by rising global temperatures, increasing urbanization, and a growing focus on energy efficiency and sustainability

- Asia-Pacific dominated the smart air conditioner market with the largest revenue share of 42.5% in 2024, driven by rapid urbanization, high demand for energy-efficient appliances, and a strong presence of key manufacturers, particularly in countries such as China, Japan, and South Korea

- North America is expected to be the fastest-growing region during the forecast period, propelled by increasing adoption of smart home technologies, high disposable incomes, and innovations in AI-driven climate control systems

- The split and multi-split AC segment dominated the largest market revenue share of 71.2% in 2024, driven by its widespread adoption in residential and commercial settings due to energy efficiency, compact design, and advanced features such as inverter technology

Report Scope and Smart Air Conditioner Market Segmentation

|

Attributes |

Smart Air Conditioner Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Smart Air Conditioner Market Trends

“Increasing Integration of AI and IoT Technologies”

- The global smart air conditioner market is experiencing a significant trend toward integrating Artificial Intelligence (AI) and Internet of Things (IoT) technologies

- These technologies enable advanced data processing, real-time monitoring, and predictive maintenance, providing insights into system performance, energy usage, and environmental conditions

- AI-powered smart air conditioners can proactively identify maintenance needs, optimize cooling based on occupancy patterns, and integrate with smart home ecosystems for enhanced user control

- For instance, companies such as Daikin and LG are developing AI-driven platforms that adjust temperature and humidity based on user preferences, weather data, or room occupancy, improving energy efficiency and comfort

- This trend enhances the appeal of smart air conditioners for residential, commercial, and industrial users by offering personalized climate control and reducing operational costs

- IoT-enabled features, such as remote control via smartphone apps or voice assistants such as Alexa and Google Assistant, allow users to monitor and adjust settings in real-time, further driving market adoption

Smart Air Conditioner Market Dynamics

Driver

“Rising Demand for Energy-Efficient and Connected Climate Solutions”

- Increasing consumer demand for energy-efficient and smart home-integrated air conditioning systems, such as those offering remote control, energy monitoring, and automation, is a key driver for the global smart air conditioner market

- Smart air conditioners enhance indoor comfort with features such as precise temperature regulation, humidity control, and air quality management, meeting modern consumer expectations for convenience and sustainability

- Government regulations, particularly in regions such as Asia-Pacific with energy efficiency standards are promoting the adoption of smart air conditioners

- The proliferation of 5G technology and IoT advancements enables faster data transmission and seamless connectivity, supporting sophisticated applications such as zoned climate control and integration with smart building systems

- Manufacturers are increasingly offering factory-fitted smart air conditioning systems as standard or optional features in residential, commercial, and industrial applications to meet market demands and enhance product value

Restraint/Challenge

“High Initial Costs and Data Privacy Concerns”

- The high initial investment required for smart air conditioner hardware, software, and integration into existing systems poses a significant barrier to adoption, particularly in cost-sensitive emerging markets

- Retrofitting older buildings with smart air conditioning systems can be complex and expensive, requiring infrastructure upgrades and professional installation

- Data security and privacy concerns are major challenges, as smart air conditioners collect and transmit sensitive data, such as user preferences and occupancy patterns, raising risks of breaches or misuse

- The lack of standardized communication protocols across brands and regions complicates integration with other smart home or building management systems, potentially limiting interoperability

- These factors can deter adoption in regions with high cost sensitivity or strong data privacy awareness, slowing market growth despite the technological advantages of smart air conditioners

Smart Air Conditioner market Scope

The market is segmented on the basis of type, product, technology, application, and distribution channel.

- By Type

On the basis of type, the global smart air conditioner market is segmented into Window AC, Split and Multi-Split AC, Packaged AC, Variable Refrigerant Flow (VRF), Central AC, and Others. The Split and Multi-Split AC segment dominated the largest market revenue share of 71.2% in 2024, driven by its widespread adoption in residential and commercial settings due to energy efficiency, compact design, and advanced features such as inverter technology.

The Variable Refrigerant Flow (VRF) segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing demand for flexible and energy-efficient cooling systems in commercial and residential applications, particularly in urban areas with diverse zoning needs.

- By Product

On the basis of product, the global smart air conditioner market is segmented into Temperature Control, Humidity Control, Ventilation Control, and Integrated Control. The Temperature Control segment dominated the market with a revenue share of 63.2% in 2023, driven by consumer demand for precise and energy-efficient climate control solutions integrated with IoT-enabled devices and smart thermostats.

The Integrated Control segment is anticipated to experience the fastest growth rate from 2025 to 2032, driven by the rising adoption of smart home ecosystems, enabling seamless control of multiple environmental parameters such as temperature, humidity, and air quality through unified platforms.

- By Technology

On the basis of technology, the global smart air conditioner market is segmented into Inverter and Non-Inverter. The Inverter technology segment held the largest market revenue share of 69.2% in 2024, owing to its energy efficiency, quieter operation, and ability to maintain consistent temperatures by adjusting compressor speed. The Non-Inverter segment is expected to witness steady growth from 2025 to 2032, particularly in cost-sensitive markets, where lower upfront costs drive adoption despite higher long-term energy consumption.

- By Application

On the basis of application, the global smart air conditioner market is segmented into Residential Buildings, Industrial Buildings, and Commercial Buildings. The Commercial Buildings segment accounted for the largest market revenue share of 63.2% in 2023, driven by the need for centralized control, energy efficiency, and compliance with stringent building regulations in offices, retail spaces, and hospitality venues.

The Residential Buildings segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing consumer demand for smart home integration, energy savings, and enhanced comfort through features such as remote control and AI-based cooling adjustments.

- By Distribution Channel

On the basis of distribution channel, the global smart air conditioner market is segmented into Multi-Brand Stores, Exclusive Stores, and Online Stores. The Online Stores segment held the largest market revenue share of 40.5% in 2024, driven by the convenience of e-commerce platforms, competitive pricing, and growing consumer preference for online purchasing.

The Exclusive Stores segment is expected to witness significant growth from 2025 to 2032, as manufacturers focus on brand-specific outlets to showcase advanced features, provide hands-on experiences, and build consumer trust in premium smart air conditioning solutions.

Smart Air Conditioner Market Regional Analysis

- Asia-Pacific dominated the smart air conditioner market with the largest revenue share of 42.5% in 2024, driven by rapid urbanization, high demand for energy-efficient appliances, and a strong presence of key manufacturers, particularly in countries such as China, Japan, and South Korea

- Consumers prioritize smart air conditioners for enhancing indoor comfort, reducing energy costs, and integrating with smart home ecosystems, particularly in regions with hot and humid climates

- Growth is supported by advancements in technology, including IoT connectivity, AI-driven algorithms, and inverter technology, alongside rising adoption in both residential and commercial segments

Japan Smart Air Conditioner Market Insight

Japan’s smart air conditioner market is expected to witness rapid growth due to strong consumer preference for high-quality, technologically advanced systems that enhance comfort and energy efficiency. The presence of major manufacturers such as Daikin and Mitsubishi Electric, along with the integration of smart air conditioners in OEM installations, accelerates market penetration. Rising interest in aftermarket smart controllers also contributes to growth.

China Smart Air Conditioner Market Insight

China holds the largest share of the Asia-Pacific smart air conditioner market, propelled by rapid urbanization, increasing residential and commercial construction, and growing demand for energy-efficient cooling solutions. The country’s expanding middle class and focus on smart home technologies support the adoption of advanced systems. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

U.S. Smart Air Conditioner Market Insight

The U.S. smart air conditioner is expected to witness significant growth, fueled by strong consumer demand for energy-efficient and connected cooling solutions. Growing awareness of energy savings and UV protection benefits, coupled with the trend toward smart home integration, boosts market expansion. The increasing adoption of inverter-based systems and stringent energy efficiency regulations further complement both OEM and aftermarket sales.

Europe Smart Air Conditioner Market Insight

The Europe smart air conditioner market is expected to witness significant growth, supported by regulatory emphasis on energy efficiency and consumer demand for enhanced indoor comfort. Consumers seek systems that offer precise temperature control and seamless integration with smart home platforms. Growth is prominent in both new installations and retrofit projects, with countries such as Germany and France showing significant uptake due to rising environmental concerns and urban density.

U.K. Smart Air Conditioner Market Insight

The U.K. market for smart air conditioners is expected to witness rapid growth, driven by demand for improved energy efficiency and comfort in urban and suburban settings. Increased interest in smart home ecosystems and rising awareness of energy cost savings encourage adoption. Evolving regulations promoting sustainable cooling solutions influence consumer choices, balancing performance with compliance.

Germany Smart Air Conditioner Market Insight

Germany is expected to witness rapid growth in the smart air conditioner market, attributed to its advanced technological infrastructure and high consumer focus on energy efficiency and indoor air quality. German consumers prefer technologically advanced systems, such as those with inverter technology and IoT connectivity that reduce energy consumption and enhance comfort. The integration of these systems in premium residential and commercial buildings supports sustained market growth.

Smart Air Conditioner Market Share

The smart air conditioner industry is primarily led by well-established companies, including:

- DAIKIN INDUSTRIES, Ltd. (Japan)

- Electrolux (Sweden)

- Carrier (U.S.)

- Hitachi, Ltd. (Japan)

- Mitsubishi Electric Corporation(Japan)

- Panasonic Corporation (Japan)

- Voltas Ltd. (India)

- Johnson Controls (U.S.)

- TOSHIBA CORPORATION (Japan)

- FUJITSU GENERAL (Japan)

- LG Electronics (South Korea)

What are the Recent Developments in Global Smart Air Conditioner Market?

- In September 2024, Midea Group, China’s top home appliance manufacturer, completed a successful IPO on the Hong Kong Stock Exchange, raising city’s largest listing in over three years. Trading under stock code 0300.HK, the offering attracted major cornerstone investors such as Cosco Shipping Holdings and UBS Asset Management Singapore. The proceeds are expected to accelerate Midea’s global expansion and innovation in smart technologies, including smart air conditioners, robotics, and industrial automation. This strategic move also reinforces Hong Kong’s position as a key capital market for Chinese enterprises

- In June 2024, Mitsubishi Electric launched a new series of smart air conditioners equipped with advanced Indoor Air Quality (IAQ) monitoring capabilities. These models reflect a growing industry trend toward integrating health and wellness features into smart home appliances. The IAQ sensors track pollutants, humidity, and temperature in real time, helping users maintain a healthier indoor environment. Combined with energy-efficient inverter technology and smart connectivity, the new lineup supports voice control, app-based management, and adaptive cooling based on air quality data

- In May 2023, LG Electronics introduced its latest ThinQ-powered air conditioners, featuring enhanced voice control and air purification technologies. These smart ACs integrate AI-driven cooling with support for Google Assistant and Amazon Alexa, allowing users to adjust settings hands-free. The built-in HD filters with anti-virus protection and auto-clean functions help maintain a healthier indoor environment. With AI+ Dual Inverter technology, the units also optimize energy efficiency and cooling performance based on usage patterns and ambient conditions

- In January 2022, Daikin launched a new series of AI-powered air conditioners designed to optimize energy consumption by learning user preferences and adapting cooling patterns accordingly. These smart units feature Hepta Sense technology, which utilizes seven sensors to monitor ambient conditions and adjust performance in real time. The lineup also includes Triple Display, Dew Clean Technology, and PM 2.5 filters for enhanced air purification and maintenance efficiency. This innovation reflects the industry’s growing focus on intelligent, energy-efficient cooling solutions tailored for modern homes

- In August 2021, Samsung introduced its SmartThings-enabled air conditioner lineup, reinforcing its vision for a connected smart home ecosystem. These air conditioners feature Wi-Fi connectivity, voice control via Alexa, Google Assistant, and Bixby, and seamless integration with other SmartThings-compatible devices such as smart fans and switches. The launch emphasized intelligent automation, allowing users to schedule cooling, monitor energy usage, and personalize comfort settings remotely through the SmartThings app. This move positioned Samsung as a leader in smart climate control, offering enhanced convenience, energy efficiency, and interoperability across its appliance portfolio

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.