Global Smart Air Purifier Market

Market Size in USD Billion

CAGR :

%

USD

16.58 Billion

USD

45.98 Billion

2024

2032

USD

16.58 Billion

USD

45.98 Billion

2024

2032

| 2025 –2032 | |

| USD 16.58 Billion | |

| USD 45.98 Billion | |

|

|

|

|

Global Smart Air Purifier Market Size

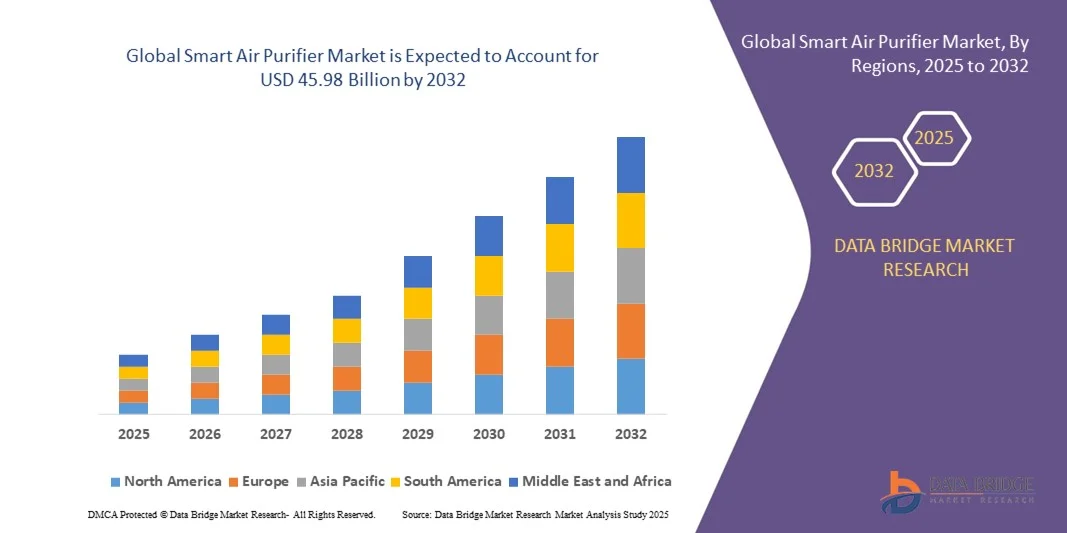

- The global Smart Air Purifier Market size was valued at USD 16.58 billion in 2024 and is projected to reach USD 45.98 billion by 2032, growing at a CAGR of 13.60% during the forecast period.

- Market expansion is being driven by increased awareness of indoor air quality, coupled with a rise in respiratory ailments and pollution levels, prompting consumers to invest in intelligent purification solutions.

- Additionally, the integration of IoT, AI, and voice assistant compatibility in smart air purifiers is aligning with evolving consumer preferences for automated, energy-efficient, and connected home environments, fueling sustained market demand.

Global Smart Air Purifier Market Analysis

- Smart air purifiers, equipped with advanced sensors, filters, and connectivity features, are becoming essential components of modern indoor environments in both residential and commercial spaces due to their ability to monitor and improve air quality in real time while seamlessly integrating with smart home systems.

- The growing demand for smart air purifiers is primarily driven by rising health awareness, increasing pollution levels, and consumer preference for automated, energy-efficient air quality management solutions.

- Asia-Pacific North America dominated the Global Smart Air Purifier Market with the largest revenue share of 32.9% in 2024, supported by early adoption of smart technologies, high environmental awareness, and a strong presence of major manufacturers, with the U.S. experiencing significant growth in installations across homes, offices, and healthcare facilities.

- North America is expected to be the fastest growing region in the Global Smart Air Purifier Market during the forecast period due to rapid urbanization, rising disposable incomes, and increasing government initiatives addressing indoor air pollution.

- The portable air purifiers segment dominated the market with the largest revenue share of 56.4% in 2024, driven by their flexibility, affordability, and ease of use across urban households and small commercial spaces.

Report Scope and Global Smart Air Purifier Market Segmentation

|

Attributes |

Smart Air Purifier Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Smart Air Purifier Market Trends

Enhanced Convenience Through AI and Voice Integration

- A significant and accelerating trend in the global Smart Air Purifier Market is the growing integration with artificial intelligence (AI) and voice-controlled ecosystems such as Amazon Alexa, Google Assistant, and Apple HomeKit. This technological convergence is enhancing user experience through smarter, hands-free air quality management.

- For Instance, Dyson’s smart purifiers can be voice-controlled via Alexa and Siri, enabling users to adjust fan speed, check air quality, or schedule purification with simple commands. Similarly, Xiaomi’s smart air purifiers integrate seamlessly with Google Assistant and Alexa, offering real-time monitoring and control.

- AI integration allows smart air purifiers to learn user preferences, adapt settings based on real-time air quality data, and even optimize energy consumption. Brands like Coway and Blueair are leveraging AI to automatically adjust filtration levels depending on pollution levels, usage patterns, and even weather data.

- Voice control features offer hands-free convenience, particularly in homes with integrated smart ecosystems. Users can activate purification, change modes, or receive air quality updates without needing a smartphone or physical interaction—ideal for multi-tasking or accessibility needs.

- The ability to integrate air purifiers into broader smart home platforms enables centralized control alongside lighting, thermostats, and security devices. Through unified interfaces like mobile apps or smart displays, users gain comprehensive visibility and control over their indoor environment.

- This trend toward intelligent, user-adaptive, and interconnected air purification systems is redefining expectations for home wellness technologies. As a result, companies like LG, Philips, and Panasonic are actively developing AI-powered air purifiers with smart scheduling, voice control, and predictive maintenance alerts to meet the growing demand across residential and commercial sectors.

Global Smart Air Purifier Market Dynamics

Driver

Growing Need Due to Health Concerns and Smart Home Adoption

-

The increasing awareness of indoor air pollution and its impact on health, combined with the rapid adoption of smart home technologies, is a major driver for the growing demand for smart air purifiers.

- For instance, in March 2024, Xiaomi launched its latest smart air purifier featuring real-time PM2.5 monitoring and AI-powered auto-adjustment, designed to integrate seamlessly with its broader smart ecosystem. Innovations like these from key players are accelerating market growth.

- As consumers become more conscious of respiratory conditions, allergies, and pollution exposure, smart air purifiers offer a powerful solution with features like real-time air quality monitoring, automated filtration adjustments, and remote access via mobile apps—providing a significant upgrade over traditional purifiers.

- Furthermore, the integration of air purifiers with voice assistants and other smart home devices enables automated and connected living experiences, positioning them as essential components of modern wellness-oriented homes.

- The ability to remotely control purification settings, schedule operations, and receive maintenance alerts enhances user convenience and makes smart air purifiers especially appealing in both urban households and commercial indoor environments. The trend toward smart home DIY setups and greater awareness of air quality in shared spaces such as offices and schools is also fueling adoption.

Restraint/Challenge

Concerns Regarding Data Privacy and High Initial Costs

- Privacy and data security concerns related to smart, connected devices, including smart air purifiers, remain significant challenges to widespread adoption. Since these devices often collect and transmit environmental and usage data via networks, users are increasingly wary of potential data misuse or privacy breaches.

- For instance, consumer skepticism has grown due to incidents involving smart home devices transmitting personal information without consent, prompting greater scrutiny over data privacy standards.

- Addressing these concerns requires manufacturers to implement strong data encryption, transparent data policies, and regular firmware updates. Brands like Philips and Coway are emphasizing secure data handling and privacy-focused design to strengthen consumer confidence.

- Additionally, the relatively high upfront cost of smart air purifiers—especially those with advanced features like AI, multi-layer filtration, or voice assistant compatibility—can deter price-sensitive consumers. This is particularly relevant in developing economies or among users who view smart features as non-essential.

- Although prices are gradually becoming more competitive, the perception of smart purifiers as a premium product category may continue to limit adoption. Bridging this gap through more affordable models, consumer education on long-term health benefits, and incentives such as government subsidies or rebates will be critical to ensuring sustained market growth.

Global Smart Air Purifier Market Scope

The smart air purifier market is segmented on the basis of type, component, function, technique, end user and distribution channel.

- By Type

On the basis of type, the Global Smart Air Purifier Market is segmented into Whole-House Air Cleaners, Whole-House Air Filters, and Portable Air Purifiers. The portable air purifiers segment dominated the market with the largest revenue share of 56.4% in 2024, driven by their flexibility, affordability, and ease of use across urban households and small commercial spaces. Consumers prefer portable units due to their ability to purify specific rooms, easy installation, and compatibility with smart home systems.

The whole-house air cleaners segment is expected to witness the fastest CAGR of 22.1% from 2025 to 2032, as demand rises for comprehensive air purification integrated with HVAC systems in new residential and commercial buildings. These systems offer centralized purification, making them highly efficient for large spaces and health-conscious consumers seeking uninterrupted air quality management. Increasing urbanization and smart building initiatives contribute significantly to this segment’s growth.

- By Component

On the basis of component, The Global Smart Air Purifier Market is segmented into Solution and Services based on components. The solution segment held the largest market revenue share of 72.7% in 2024, fueled by the demand for smart air purifier devices equipped with advanced filtration, sensors, and connectivity features. Consumers are increasingly opting for complete purification systems that provide real-time air quality data and mobile app control, creating strong hardware sales.

The services segment is projected to witness the fastest CAGR of 24.3% during the forecast period, driven by the need for filter replacements, maintenance, software upgrades, and installation services. Subscription models for filter replacement and smart system updates are becoming popular, particularly in commercial and institutional settings, further boosting service segment growth.

- By Function

on the basis of function, the market is segmented into Dust Collecting, Fume and Smoke Collectors, and Others. The dust collecting segment dominated the market with a revenue share of 49.6% in 2024, primarily driven by urban consumers’ demand for effective removal of dust, pollen, and particulate matter, which are common indoor pollutants affecting health. Portable units with dust filtration are especially popular among allergy sufferers and households with pets.

The fume and smoke collectors segment is expected to register the fastest CAGR of 21.9% from 2025 to 2032, fueled by increasing air pollution concerns, especially wildfire smoke and industrial fumes. Commercial kitchens, offices, and urban homes are adopting these purifiers to tackle odors, smoke, and chemical pollutants. Enhanced filtration technologies and smart sensors are boosting the adoption of this segment.

- By Technique

On the basis of technique, the Global Smart Air Purifier Market is segmented into HEPA, TSS (Thermodynamic Sterilization System), UV, Ionizer Purifiers, Activated Carbon Filtration, and Others. The HEPA segment led the market with a revenue share of 43.5% in 2024, favored for its proven efficacy in capturing fine particulate matter, allergens, and pollutants. HEPA filters are widely recommended by health professionals and have become the industry standard in both residential and commercial purifiers.

The UV segment is projected to witness the fastest CAGR of 23.4%, driven by rising demand for microbial disinfection in the wake of heightened awareness of airborne viruses and bacteria. UV purification technology is gaining traction in healthcare, hospitality, and educational facilities due to its germicidal properties, supporting strong growth prospects for this segment.

- By End User

On the basis of end user, The Global Smart Air Purifier Market is segmented into Residential, Commercial, and Others. The residential segment dominated with a market revenue share of 59.1% in 2024, propelled by increasing health consciousness, rising pollution levels in urban areas, and rapid adoption of smart home technologies. Homeowners are prioritizing indoor air quality, especially in regions prone to allergies and pollution.

The commercial segment is expected to witness the fastest CAGR of 22.8% from 2025 to 2032, due to growing awareness about workplace health and safety standards. Businesses, educational institutions, and healthcare facilities are adopting smart air purifiers to ensure cleaner indoor air, improve occupant wellbeing, and comply with regulations, driving robust growth.

- By Distribution Channel

On the basis of distribution channel, the Global Smart Air Purifier Market is segmented into Aftermarket and OEM. The OEM segment held the largest revenue share of 65.3% in 2024, driven by partnerships between purifier manufacturers and original equipment manufacturers that supply integrated solutions with HVAC and smart home systems. These products cater to high-end residential and commercial markets demanding seamless connectivity and advanced features.

The aftermarket segment is projected to register the fastest CAGR of 21.6% during the forecast period, fueled by rising consumer preference for standalone purifier units, replacement filters, and upgrades through online and retail channels. The surge in e-commerce, combined with increasing awareness about filter replacement cycles and product maintenance, supports aftermarket growth.

Global Smart Air Purifier Market Regional Analysis

- Asia-Pacific dominated the Global Smart Air Purifier Market with the largest revenue share of 32.9% in 2024, driven by increasing concerns about air quality, growing health awareness, and widespread adoption of smart home technologies.

- Consumers in the region prioritize advanced purification features, real-time air quality monitoring, and seamless integration with other smart home devices such as HVAC systems and voice assistants.

- This strong market presence is further supported by high disposable incomes, technological readiness, and stringent government regulations aimed at improving indoor air quality, positioning North America as a key market for smart air purifiers across residential and sectors.

U.S. Smart commercial Air Purifier Market Insight

The U.S. smart air purifier market captured the largest revenue share of 81% in North America in 2024, driven by rising awareness of indoor air quality and health concerns related to pollution and allergens. Consumers are increasingly investing in advanced air purification systems equipped with smart features like real-time air quality monitoring, remote control via mobile apps, and integration with voice assistants such as Alexa and Google Assistant. The growing trend of smart home ecosystems and government initiatives promoting healthier indoor environments further propel market growth. Additionally, the demand for portable and whole-house air purifiers is surging, supported by high disposable incomes and technological readiness among U.S. consumers.

Europe Smart Air Purifier Market Insight

The Europe smart air purifier market is projected to grow steadily at a significant CAGR during the forecast period, primarily due to stringent environmental regulations and rising public awareness about air pollution and respiratory health. Urbanization and increasing demand for smart, energy-efficient appliances are encouraging adoption in both residential and commercial sectors. The market is also driven by the integration of air purifiers with smart home ecosystems, offering consumers enhanced convenience and control. Countries like Germany, France, and the U.K. are witnessing substantial investments in smart air purification technology for both new buildings and retrofit applications.

U.K. Smart Air Purifier Market Insight

The U.K. smart air purifier market is expected to experience strong growth at a notable CAGR through the forecast period, fueled by increasing concerns about air pollution and its impact on health. Rising adoption of home automation technologies and smart appliances is driving demand for connected air purifiers that provide real-time air quality updates and automated control features. The country’s strong e-commerce presence and government incentives for improving indoor environmental quality are also contributing to market expansion. Additionally, the growing prevalence of respiratory conditions is encouraging both residential and commercial users to invest in smart air purification solutions.

Germany Smart Air Purifier Market Insight

The Germany smart air purifier market is anticipated to expand at a considerable CAGR during the forecast period, driven by increasing environmental consciousness, strict air quality regulations, and a focus on sustainability. The country’s advanced technological infrastructure supports the integration of smart air purifiers with broader smart home systems. Demand is strong across residential, commercial, and industrial sectors, with consumers favoring energy-efficient, high-performance purification technologies such as HEPA and activated carbon filters. Germany’s emphasis on innovation and eco-friendly solutions positions it as a key market within Europe for smart air purification.

Asia-Pacific Smart Air Purifier Market Insight

The Asia-Pacific smart air purifier market is poised to grow at the fastest CAGR of approximately 24% from 2025 to 2032, fueled by rapid urbanization, increasing pollution levels, and rising disposable incomes in countries such as China, Japan, India, and South Korea. Government initiatives promoting smart cities and healthier living environments are further boosting demand. The region is also a manufacturing hub for smart air purifier components, contributing to improved affordability and accessibility. Growing awareness about health impacts of poor air quality and expanding smart home adoption are driving rapid market penetration, particularly in urban centers.

Japan Smart Air Purifier Market Insight

The Japan smart air purifier market is gaining momentum due to the country’s advanced technological culture, growing urban population, and heightened focus on health and wellness. The adoption of smart air purifiers is driven by demand for integrated smart home systems that provide real-time air quality monitoring and automated purification. Japan’s aging population is also influencing demand for user-friendly and efficient air purification solutions in both residential and healthcare settings. Increasing concerns about allergens and seasonal pollution further support market growth.

China Smart Air Purifier Market Insight

The China smart air purifier market accounted for the largest revenue share in the Asia-Pacific region in 2024, fueled by rapid urbanization, rising middle-class incomes, and increased awareness of air pollution’s health effects. China is one of the largest markets for smart home appliances, and smart air purifiers are becoming standard in residential, commercial, and public spaces. Government programs aimed at improving air quality and developing smart cities, along with strong domestic manufacturing capabilities, contribute significantly to market expansion. Affordability and availability of a wide range of smart purifier options continue to encourage widespread adoption across the country.

Global Smart Air Purifier Market Share

The Smart Air Purifier industry is primarily led by well-established companies, including:

• Dyson Ltd (Singapore/U.K.)

• LG Electronics Inc. (South Korea)

• Philips N.V. (Netherlands)

• Honeywell International Inc. (U.S.)

• Sharp Corporation (Japan)

• Blueair (Sweden)

• Panasonic Corporation (Japan)

• Xiaomi Corporation (China)

• Coway Co., Ltd. (South Korea)

• Daikin Industries, Ltd. (Japan)

• Whirlpool Corporation (U.S.)

• Winix Inc. (South Korea)

• Electrolux AB (Sweden)

• Fellowes Brands (U.S.)

What are the Recent Developments in Global Smart Air Purifier Market?

- In April 2023, Dyson, a global leader in home appliances and air purification technology, launched a strategic initiative in South Africa to expand its smart air purifier offerings tailored for residential and commercial spaces. This move underscores Dyson’s commitment to providing advanced air quality solutions that address the specific pollution challenges of the region. By leveraging its innovative filtration technologies and smart features, Dyson aims to strengthen its market presence while promoting healthier indoor environments in rapidly urbanizing areas.

- In March 2023, LG Electronics introduced an upgraded version of its smart air purifier specifically designed for educational institutions and commercial buildings. The new model incorporates enhanced sensors and AI-driven air quality management, ensuring optimized performance in high-occupancy environments. This innovation highlights LG’s dedication to creating smart solutions that improve safety and comfort in public spaces, catering to growing demand for reliable and efficient air purification.

- In March 2023, Honeywell International Inc. successfully implemented the Bengaluru Clean Air Project, deploying advanced smart air purifiers across key urban centers to combat air pollution and improve public health. The initiative integrates real-time air quality monitoring with connected purification systems, showcasing Honeywell’s expertise in delivering scalable smart environmental solutions. This project emphasizes the rising importance of smart air purifiers in creating sustainable and healthier urban living environments.

- In February 2023, Philips announced a strategic partnership with major real estate developers in the U.S. to integrate smart air purification systems into new residential and commercial buildings. This collaboration aims to enhance indoor air quality and promote occupant wellness through cutting-edge purification technologies and seamless smart home integration. The initiative reflects Philips’ focus on innovation and improving quality of life by embedding health-focused solutions into building design.

- In January 2023, Sharp Corporation unveiled the Sharp Plasmacluster Smart Air Purifier at the CES 2023, featuring enhanced Wi-Fi connectivity and AI-powered air quality optimization. This device allows users to remotely monitor and control indoor air quality via smartphone apps, offering convenience and improved health protection. The launch reinforces Sharp’s commitment to advancing smart home technologies and delivering effective air purification solutions that combine innovation with ease of use.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.