Global Smart Antimicrobial Healthcare Coatings And Surfaces Market

Market Size in USD Billion

CAGR :

%

USD

13.19 Billion

USD

37.62 Billion

2024

2032

USD

13.19 Billion

USD

37.62 Billion

2024

2032

| 2025 –2032 | |

| USD 13.19 Billion | |

| USD 37.62 Billion | |

|

|

|

|

Smart Antimicrobial Healthcare Coatings and Surfaces Market Size

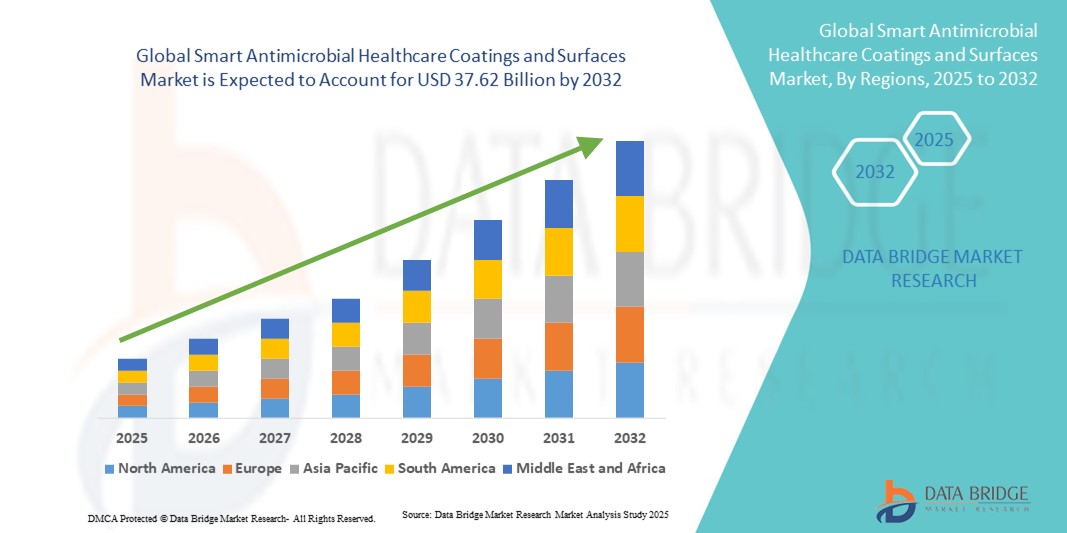

- The global smart antimicrobial healthcare coatings and surfaces market size was valued at USD 13.19 billion in 2024 and is expected to reach USD 37.62 billion by 2032, at a CAGR of 14.00% during the forecast period

- The market growth is largely fueled by the increasing demand for infection control in healthcare settings, rising prevalence of healthcare-associated infections (HAIs), and heightened awareness of hygiene, driving the adoption of advanced antimicrobial coatings and surfaces across hospitals, clinics, and laboratories

- Furthermore, ongoing technological advancements in materials science, including nanotechnology-enabled coatings, and rising consumer and institutional demand for safer, infection-resistant surfaces are establishing smart antimicrobial solutions as the preferred choice in healthcare environments. These converging factors are accelerating the uptake of smart antimicrobial coatings and surfaces, thereby significantly boosting the industry's growth

Smart Antimicrobial Healthcare Coatings and Surfaces Market Analysis

- Smart antimicrobial coatings and surfaces, providing infection-resistant and hygienic solutions for healthcare facilities, medical devices, and laboratory environments, are increasingly vital components in North American healthcare settings due to their ability to inhibit microbial growth, enhance patient safety, and support regulatory compliance

- The escalating demand for smart antimicrobial coatings in North America is primarily fueled by the rising prevalence of healthcare-associated infections (HAIs), growing awareness of hygiene standards, and increasing focus on patient safety in hospitals and clinics across the U.S. and Canada

- North America dominated the smart antimicrobial healthcare coatings and surfaces market with the largest revenue share of 42.5% in 2024, characterized by advanced healthcare infrastructure, strict regulatory standards, and a strong presence of key market players, with the U.S. witnessing substantial adoption of antimicrobial coatings in hospitals and laboratories due to innovations in nanotechnology-based surface treatments

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, due to rising healthcare investments, expanding medical facilities, and increasing awareness of infection control in countries such as China and India

- Silver and nanosilver segment dominated the smart antimicrobial healthcare coatings and surfaces market with a share of 45.5% in 2024, driven by its broad-spectrum antimicrobial properties, long-lasting efficacy, and suitability across healthcare facilities and medical implants

Report Scope and Smart Antimicrobial Healthcare Coatings and Surfaces Market Segmentation

|

Attributes |

Smart Antimicrobial Healthcare Coatings and Surfaces Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Smart Antimicrobial Healthcare Coatings and Surfaces Market Trends

Rise of Nanotechnology-Enabled Antimicrobial Surfaces

- A significant and accelerating trend in the global smart antimicrobial healthcare coatings and surfaces market is the increasing adoption of nanotechnology-enabled coatings, which enhance antimicrobial efficacy and durability on medical and hospital surfaces

- For instance, silver nanoparticle coatings applied to surgical instruments or hospital bed rails can provide long-lasting antimicrobial activity, reducing microbial contamination and potential infections

- Advanced coatings now integrate smart functionalities such as responsive surfaces that release antimicrobial agents when microbial load is detected, allowing hospitals and laboratories to maintain higher hygiene standards automatically

- The integration of smart antimicrobial coatings with IoT-enabled hospital systems facilitates real-time monitoring of surface cleanliness and microbial activity, enabling proactive maintenance and enhanced infection control protocols

- This trend towards intelligent, self-sanitizing, and high-durability surfaces is fundamentally reshaping hygiene expectations in healthcare facilities. Consequently, companies such as P2i and BioCote are developing nanotechnology-based coatings with extended antimicrobial protection and compatibility across various medical surfaces

- The demand for antimicrobial coatings that combine nanotechnology with smart monitoring capabilities is growing rapidly across both hospitals and laboratories, as healthcare institutions increasingly prioritize patient safety and regulatory compliance

Smart Antimicrobial Healthcare Coatings and Surfaces Market Dynamics

Driver

Increasing Need for Infection Control and Patient Safety

- The rising prevalence of healthcare-associated infections (HAIs) and the strict regulatory standards for hygiene in hospitals and laboratories is a significant driver for the heightened demand for smart antimicrobial coatings

- For instance, in March 2024, BioCote launched a silver-based antimicrobial surface treatment for high-touch hospital areas, aiming to enhance infection prevention measures in healthcare facilities

- Healthcare institutions seeking advanced solutions to minimize microbial contamination are adopting coatings that provide continuous antimicrobial protection on beds, surgical tools, and laboratory equipment

- Furthermore, increasing patient safety awareness and stringent hygiene protocols in North America and Europe are making smart antimicrobial coatings a critical component in modern healthcare settings, ensuring compliance with health regulations

- The versatility of coatings for various applications, including medical implants, surgical instruments, and laboratory surfaces, along with cost-effective maintenance, is propelling adoption across hospitals, clinics, and laboratories

Restraint/Challenge

High Costs and Regulatory Hurdles

- The relatively high cost of advanced antimicrobial coatings, especially those utilizing silver nanoparticles or nanotechnology, poses a significant challenge for broader market penetration, particularly in smaller hospitals or budget-constrained facilities

- For instance, the implementation of silver-based coatings on all high-touch surfaces in a hospital can involve substantial upfront expenditure, limiting adoption in developing regions

- In addition, meeting stringent regulatory approvals for new antimicrobial formulations, including EPA and FDA compliance, can delay product launches and increase time-to-market for innovative solutions

- While technological advancements improve efficacy and durability, the perceived high price for nanotechnology-based antimicrobial coatings may hinder adoption among cost-sensitive healthcare providers

- Overcoming these challenges through cost optimization, regulatory guidance support, and demonstration of long-term infection reduction benefits will be vital for sustained market growth

Smart Antimicrobial Healthcare Coatings and Surfaces Market Scope

The market is segmented on the basis of type and application.

- By Type

On the basis of type, the smart antimicrobial healthcare coatings and surfaces market is segmented into silver and nanosilver, hydrogels, chitosan, silanes, sulfates, graphene, and carbon nanotubes. The Silver and Nanosilver segment dominated the market with the largest market revenue share of 45.5% in 2024, driven by its broad-spectrum antimicrobial properties and long-lasting efficacy. Silver-based coatings are widely applied to high-touch surfaces in hospitals, such as bed rails, surgical instruments, and door handles, due to their proven ability to inhibit bacterial and viral growth. Healthcare facilities prefer this type because of its compatibility with existing cleaning protocols and regulatory compliance. In addition, silver and nanosilver coatings are cost-effective in the long run because they reduce infection rates and associated treatment costs. The market also benefits from extensive research and development efforts aimed at enhancing the durability and antimicrobial efficiency of silver-based coatings. Manufacturers such as BioCote and P2i are actively developing advanced silver coatings tailored for diverse medical applications, reinforcing the dominance of this segment.

The Hydrogels segment is anticipated to witness the fastest growth rate of 16.5% from 2025 to 2032, fueled by its biocompatibility and moisture-retentive properties that make it ideal for wound care and implantable medical devices. Hydrogels can be functionalized with antimicrobial agents to create coatings that actively prevent microbial colonization on surgical instruments, implants, and laboratory surfaces. The growing adoption of hydrogel coatings is driven by their ability to enhance patient recovery and reduce hospital-acquired infections (HAIs). Furthermore, ongoing innovations in hydrogel technology, such as smart hydrogels that respond to environmental triggers, are expanding their applications in hospitals and laboratories. Their versatility across multiple healthcare equipment types and increasing regulatory approvals for medical applications are key factors driving their rapid adoption.

- By Application

On the basis of application, the smart antimicrobial healthcare coatings and surfaces market is segmented into healthcare facilities, medical implants, surgical equipment, veterinary, and laboratory equipment. The healthcare facilities segment dominated the market with a share of 46% in 2024, owing to the critical need for infection prevention in hospitals and clinics. Hospitals and clinics implement antimicrobial coatings on high-touch surfaces, including bed rails, tables, door handles, and surgical trays, to reduce HAIs and comply with strict hygiene regulations. This segment benefits from increased awareness among healthcare providers about the costs associated with infections and regulatory requirements for patient safety. The adoption is further supported by government initiatives promoting hospital sanitation and infection control. Key manufacturers are focusing on providing turnkey solutions that integrate antimicrobial coatings into facility management, making healthcare facilities the largest application segment. The durability, ease of cleaning, and proven antimicrobial effectiveness of these coatings reinforce their continued dominance in hospitals and clinics.

The medical implants segment is expected to witness the fastest CAGR of 18% from 2025 to 2032, driven by the rising demand for infection-resistant coatings on prosthetics, orthopedic implants, and cardiovascular devices. Implantable devices are particularly vulnerable to microbial colonization, which can lead to severe post-surgical infections. Smart antimicrobial coatings on implants help prevent bacterial biofilm formation, improving patient outcomes and reducing hospital readmissions. Technological advancements in nanocoatings and biocompatible materials are enhancing the adoption of these coatings in implantable devices. In addition, increasing investments in minimally invasive surgeries and advanced medical procedures create a growing market for coated implants. The combination of regulatory approvals, improved biocompatibility, and demonstrable reduction in infection rates positions medical implants as the fastest-growing application segment.

Smart Antimicrobial Healthcare Coatings and Surfaces Market Regional Analysis

- North America dominated the smart antimicrobial healthcare coatings and surfaces market with the largest revenue share of 42.5% in 2024, characterized by advanced healthcare infrastructure, strict regulatory standards, and a strong presence of key market players

- Healthcare facilities and laboratories in the region prioritize the adoption of advanced antimicrobial coatings due to their proven effectiveness in reducing microbial contamination on high-touch surfaces such as bed rails, surgical instruments, and laboratory equipment

- This widespread adoption is further supported by advanced healthcare infrastructure, high awareness of patient safety, and strong presence of key industry players actively innovating nanotechnology-based coatings, establishing smart antimicrobial surfaces as a preferred solution in hospitals, clinics, and laboratories across the region

U.S. Smart Antimicrobial Healthcare Coatings and Surfaces Market Insight

The U.S. smart antimicrobial healthcare coatings and surfaces market captured the largest revenue share of 38% in 2024 within North America, fueled by increasing investments in hospital hygiene and rising prevalence of healthcare-associated infections (HAIs). Healthcare providers are prioritizing advanced antimicrobial coatings for high-touch surfaces, surgical instruments, and laboratory equipment to enhance patient safety. The growing adoption of nanotechnology-based coatings and smart antimicrobial surfaces integrated with monitoring systems is further propelling market growth. Moreover, government regulations and accreditation standards for infection control are encouraging widespread adoption across hospitals and clinics.

Europe Smart Antimicrobial Healthcare Coatings and Surfaces Market Insight

The Europe smart antimicrobial healthcare coatings and surfaces market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent healthcare regulations and increasing awareness of infection control. The rise in hospital infrastructure modernization and adoption of connected medical devices is fostering the use of antimicrobial coatings. European healthcare facilities are increasingly deploying antimicrobial surfaces to comply with hygiene standards and reduce healthcare-associated infections. The market growth is supported by research initiatives and innovation in nanomaterial coatings that provide durable and long-lasting antimicrobial protection.

U.K. Smart Antimicrobial Healthcare Coatings and Surfaces Market Insight

The U.K. smart antimicrobial healthcare coatings and surfaces market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising concerns over HAIs and increasing adoption of infection-resistant surfaces in hospitals and clinics. Hospitals and laboratories are integrating antimicrobial coatings into high-contact areas and surgical tools to ensure compliance with regulatory guidelines. The growing focus on patient safety, combined with increasing investments in hospital modernization projects, is stimulating market growth. In addition, awareness campaigns and professional healthcare standards are promoting the adoption of advanced antimicrobial technologies across the U.K.

Germany Smart Antimicrobial Healthcare Coatings and Surfaces Market Insight

The Germany smart antimicrobial healthcare coatings and surfaces market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of infection control and a focus on technologically advanced, sustainable healthcare solutions. German hospitals are adopting durable antimicrobial coatings for medical equipment, surgical instruments, and patient contact surfaces to reduce HAIs. The country’s emphasis on innovation and eco-conscious materials promotes the uptake of nanotechnology-based coatings. Integration with smart monitoring systems is becoming increasingly common, aligning with Germany’s strong regulatory standards and consumer preference for safe healthcare environments.

Asia-Pacific Smart Antimicrobial Healthcare Coatings and Surfaces Market Insight

The Asia-Pacific smart antimicrobial healthcare coatings and surfaces market is poised to grow at the fastest CAGR of 17% during the forecast period of 2025 to 2032, driven by increasing healthcare infrastructure investments, rapid urbanization, and rising awareness of hygiene and infection prevention in countries such as China, Japan, and India. Government initiatives promoting healthcare modernization and infection control are accelerating adoption. In addition, growing demand for cost-effective antimicrobial coatings in hospitals, clinics, and laboratories is supporting market expansion. The region is also benefiting from domestic manufacturers and the availability of innovative antimicrobial solutions at competitive pricing.

Japan Smart Antimicrobial Healthcare Coatings and Surfaces Market Insight

The Japan smart antimicrobial healthcare coatings and surfaces market is gaining momentum due to the country’s advanced healthcare infrastructure, high patient safety standards, and technological innovations in nanocoatings. Hospitals and laboratories are adopting antimicrobial coatings for surgical instruments, implants, and high-touch surfaces to reduce microbial contamination. Integration with smart monitoring systems and IoT-enabled hospital management solutions is driving growth. In addition, Japan’s aging population is creating higher demand for infection-resistant medical environments in both residential healthcare and clinical settings.

India Smart Antimicrobial Healthcare Coatings and Surfaces Market Insight

The India smart antimicrobial healthcare coatings and surfaces market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to rapid expansion of hospitals, increasing healthcare investments, and growing awareness of infection prevention. The country is witnessing rising adoption of antimicrobial coatings in surgical instruments, medical implants, and high-touch surfaces within healthcare facilities. Government initiatives for modernizing hospitals and promoting infection control, coupled with the availability of cost-effective antimicrobial solutions, are driving market growth. Domestic manufacturers and local innovation in nanotechnology-based coatings are further strengthening India’s position as a key market in the region.

Smart Antimicrobial Healthcare Coatings and Surfaces Market Share

The smart antimicrobial healthcare coatings and surfaces industry is primarily led by well-established companies, including:

- Akzo Nobel N.V. (Netherlands)

- BASF (Germany)

- PPG Industries, Inc. (U.S.)

- Nippon Paint Holdings Co., Ltd. (Japan)

- RPM International Inc. (U.S.)

- The Sherwin-Williams Company (U.S.)

- dsm-firmenich. (Netherlands)

- Lonza (Switzerland)

- Diamond Vogel (U.S.)

- Arxada (U.S.)

- DuPont de Nemours, Inc. (U.S.)

- Microban International (U.S.)

- ArmorThane (U.S.)

- Specialty Coating Systems, Inc. (U.S.)

- Spartha Medical (France)

- Evonik Industries AG (Germany)

- Biocoat, Inc. (U.S.)

- Advanced Deposition & Coating Technologies, Inc. (U.S.)

- Milliken & Company (U.S.)

What are the Recent Developments in Global Smart Antimicrobial Healthcare Coatings and Surfaces Market?

- In July 2025, EU-Funded RELIANCE Project Develops Sustainable Antimicrobial Coatings. The EU-funded RELIANCE project developed new biocidal additives based on silica mesoporous nanoparticles and non-toxic bioactives to create durable and sustainable antimicrobial coatings. These coatings are designed for use in healthcare environments, aiming to reduce the spread of infections while being environmentally friendly

- In June 2024, NEI Corporation announced the launch of its new coating, NANOMYTE AM-100EC, which provides both antimicrobial and easy-to-clean properties. This micron-thick coating is designed for high-touch surfaces in healthcare, food service, and public transportation. Tested to ISO 22196 standards, it demonstrated a 99.99% reduction in E. coli after 24 hours. The coating is also highly repellent to water and oils, simplifying cleaning and maintenance

- In February 2025, Nottingham Trent University develops copper nanoparticle coating for implants. Researchers at Nottingham Trent University have developed a coating using copper oxide nanoparticles that can be applied to implanted medical devices such as catheters and orthopedic implants. This innovation aims to reduce the risk of post-operative infections, which are a major concern for patients with medical devices

- In January 2025, Hydromer's Antimicrobial Coatings Enhance Infection Control. Hydromer introduced antimicrobial coatings that prevent germs from adhering to surfaces and forming biofilms. These coatings are applied to medical devices and hospital surfaces to improve infection control, enhance patient outcomes, and reduce healthcare-associated infections (HAIs)

- In April 2022, BioInteractions, a UK-based biomaterial technology company, announced the launch of its new coating technology, TridAnt, for medical devices. The company describes it as a paradigm shift in infection prevention and protection against a broad range of pathogens. TridAnt is a non-leaching coating that uses both active and passive components to provide infection resistance and reduce biofilm formation without using toxic materials

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.