Global Smart Cameras Market

Market Size in USD Billion

CAGR :

%

USD

7.54 Billion

USD

16.41 Billion

2024

2032

USD

7.54 Billion

USD

16.41 Billion

2024

2032

| 2025 –2032 | |

| USD 7.54 Billion | |

| USD 16.41 Billion | |

|

|

|

|

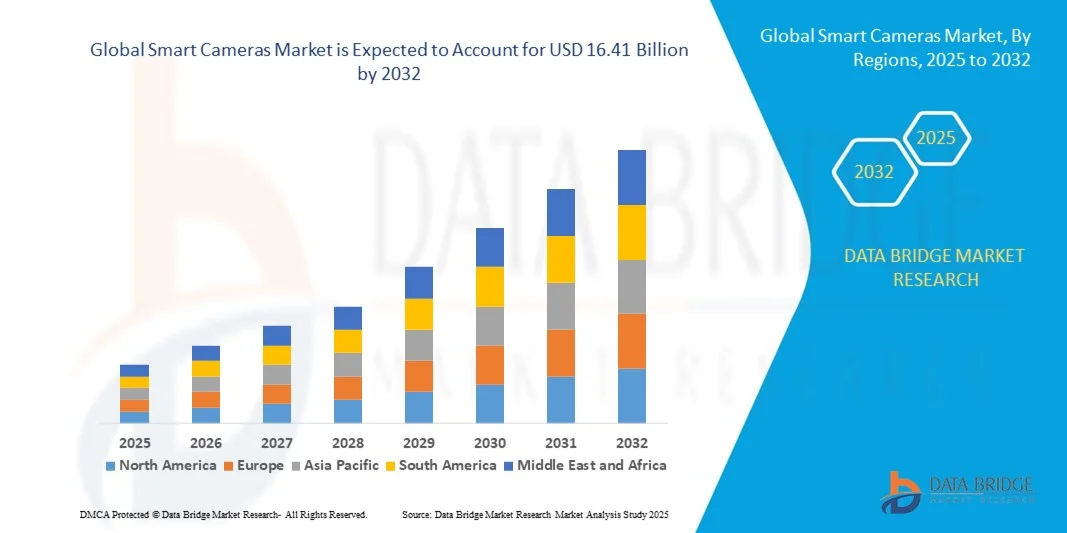

What is the Global Smart Cameras Market Size and Growth Rate?

- The global smart cameras market size was valued at USD 7.54 billion in 2024 and is expected to reach USD 16.41 billion by 2032, at a CAGR of 10.20% during the forecast period

- Growth and expansion of security and surveillance industry, rise in the demand for digital cameras along with the features resembling smartphone, and increasing application of smart cameras by a wide range of end use applications such as video surveillance, consumer electronics, industrial, transportation, automobile, medical and others are the major factors attributable to the growth of smart cameras market

What are the Major Takeaways of Smart Cameras Market?

- Rising focus on the adoption of better security solutions will emerge as the major market growth driving factor. Growing digitization of emerging economies such as India and China and rising research and development proficiencies for the development and advancement of technology involved will further aggravate the market value

- Growing adoption of automated technologies by the industries and growth and expansion of semiconductors industry especially in the emerging economies will further carve the way for the growth of the market

- North America dominated the smart cameras market with the largest revenue share of 39.5% in 2024, supported by the strong adoption of smart home ecosystems, increasing consumer awareness about security, and the widespread use of connected devices

- The Asia-Pacific smart cameras market is projected to grow at the fastest CAGR of 7.35% from 2025 to 2032, fueled by rapid urbanization, rising disposable incomes, and the proliferation of smart devices

- The Network-Based Smart Cameras segment dominated the market with a 46.5% revenue share in 2024, driven by its ability to connect directly to IP networks, enabling remote access, real-time monitoring, and integration with cloud platforms

Report Scope and Smart Cameras Market Segmentation

|

Attributes |

Smart Cameras Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Smart Cameras Market?

Enhanced Convenience Through AI and Voice Integration

- A defining trend in the global smart cameras market is the integration of artificial intelligence (AI) and voice-controlled platforms such as Amazon Alexa, Google Assistant, and Apple HomeKit. This combination is significantly enhancing user convenience and the overall smart home experience

- For instance, Arlo’s AI-powered smart cameras integrate seamlessly with Google Assistant and Alexa, allowing users to control live feeds, receive activity-based alerts, and automate functions through voice commands. Similarly, Nest Cam (Google) uses AI to differentiate between people, animals, and objects, reducing false alarms

- AI-driven smart cameras enable advanced features such as facial recognition, intelligent motion detection, and behavior pattern analysis, ensuring more accurate alerts and higher personalization. Voice control adds another layer of ease, enabling users to monitor spaces or retrieve footage with simple verbal commands

- The convergence of AI and voice integration is transforming smart cameras into central hubs for security and automation, where users can monitor and control connected home devices

- Companies such as Ring (Amazon) and TP-Link Kasa are actively developing AI-enabled cameras with voice assistant compatibility to meet rising demand for convenience, automation, and real-time intelligent monitoring

- This trend is redefining consumer expectations, with residential and commercial users increasingly favoring cameras that combine smart analytics, voice compatibility, and seamless ecosystem integration

What are the Key Drivers of Smart Cameras Market?

- The growing demand for advanced security among households and enterprises, coupled with the rising adoption of smart home solutions, is a major driver for the smart cameras market

- For instance, in March 2024, Ring (Amazon) launched upgraded AI-based video doorbells and smart cameras with improved real-time monitoring, strengthening its connected home security portfolio

- Consumers are increasingly aware of security risks and seek comprehensive protection with features such as remote access, real-time notifications, and cloud storage, making smart cameras an attractive upgrade over conventional CCTV systems

- The surge in smart home device adoption and the preference for interconnected living environments have positioned smart cameras as integral components of broader ecosystems. Their compatibility with smart locks, lights, and alarms enhances user value

- In addition, benefits such as remote viewing via smartphone apps, two-way communication, and ease of installation are boosting adoption across both residential and commercial sectors. The rise of DIY-friendly devices and cost-effective models is further accelerating penetration

Which Factor is Challenging the Growth of the Smart Cameras Market?

- Cybersecurity vulnerabilities remain a critical concern, posing barriers to wider adoption. Since smart cameras rely on internet connectivity and cloud services, they are prone to hacking and unauthorized data access

- For instance, in recent years, reports of IoT camera hacks raised alarms, leading to consumer hesitancy around data privacy and surveillance risks in connected devices

- Addressing these issues requires robust data encryption, secure authentication, and regular firmware updates. Leading players such as Arlo and Wyze emphasize cybersecurity in their product design and marketing to build trust

- Another challenge is the higher cost of premium smart cameras, particularly those with advanced AI features and integrated storage. While basic models are becoming more affordable, the price gap compared to traditional surveillance still hinders adoption in price-sensitive regions

- Educating consumers on safe device usage, enhancing built-in security measures, and offering cost-effective yet feature-rich options will be critical for overcoming these challenges and driving sustained market growth

How is the Smart Cameras Market Segmented?

The market is segmented on the basis of type, component, technology, application, and connectivity.

- By Type

On the basis of type, the smart cameras market is segmented into Stand-Alone Smart Cameras, Single-Chip Smart Cameras, Embedded Systems Smart Cameras and PC, and Network-Based Smart Cameras. The Network-Based Smart Cameras segment dominated the market with a 46.5% revenue share in 2024, driven by its ability to connect directly to IP networks, enabling remote access, real-time monitoring, and integration with cloud platforms. These cameras are highly favored in security and surveillance due to their scalability and compatibility with smart home and enterprise ecosystems.

Meanwhile, the Embedded Systems Smart Cameras segment is projected to witness the fastest CAGR of 20.3% from 2025 to 2032, fueled by growing adoption in industrial automation, machine vision, and robotics applications. Their built-in processing capability eliminates the need for external hardware, making them cost-efficient and versatile. This segmentation highlights a growing shift toward intelligent, connected, and application-specific smart camera systems.

- By Component

On the basis of component, the smart cameras market is segmented into Display, Image Sensors, Processors, Lens, and Others. The Image Sensors segment accounted for the largest share of 38.7% in 2024, as high-resolution imaging and low-light performance remain crucial in security, automotive, and consumer applications. Continuous innovations in CMOS and CCD sensors have expanded their use in high-definition surveillance, medical imaging, and smart mobility solutions.

The Processors segment is expected to register the fastest growth at a CAGR of 19.8% during 2025–2032, driven by the integration of AI accelerators and edge computing capabilities, which enable advanced analytics such as facial recognition, object detection, and predictive monitoring directly on the device. Lens systems and displays also play a significant role, but the trend toward intelligent imaging is positioning processors and sensors as core enablers of the smart cameras ecosystem.

- By Technology

On the basis of technology, the smart cameras market is segmented into Sensors and Scanning. The Sensors segment dominated the market with a revenue share of 61.2% in 2024, primarily driven by advancements in CMOS and infrared sensors, which enhance image quality, accuracy, and performance in various lighting conditions. Smart cameras embedded with advanced sensor technologies are increasingly deployed in security, automotive driver assistance, and industrial inspection systems.

The Scanning segment is anticipated to witness the fastest CAGR of 17.9% from 2025 to 2032, propelled by applications in barcode scanning, medical imaging, and logistics automation. With AI integration, scanning-enabled smart cameras are providing more precise results in quality assurance and supply chain management. This segmentation underscores the reliance on sensor-driven innovation while highlighting the growing role of scanning solutions in specialized industrial and healthcare markets.

- By Application

On the basis of application, the smart cameras market is segmented into Video Surveillance, Consumer Electronics, Industrial, Transportation, Automobile, Medical, and Others. The Video Surveillance segment led the market with a 49.6% revenue share in 2024, driven by increasing demand for residential and commercial security solutions, government safety initiatives, and smart city projects. High-resolution imaging, remote monitoring, and AI-powered analytics make smart cameras indispensable for surveillance applications.

The Automobile segment is projected to grow at the fastest CAGR of 22.1% from 2025 to 2032, supported by rising adoption in advanced driver-assistance systems (ADAS), autonomous driving, and in-vehicle monitoring. Smart cameras in transportation and industrial automation are also gaining traction, but video surveillance remains the largest contributor due to its critical role in public safety, corporate security, and urban infrastructure management worldwide.

- By Connectivity

On the basis of connectivity, the smart cameras market is segmented into Wi-Fi, Bluetooth, Wireless HART, and Others. The Wi-Fi segment dominated the market with the largest revenue share of 44.9% in 2024, attributed to widespread home Wi-Fi penetration, seamless internet access, and compatibility with cloud platforms and mobile applications. Wi-Fi-enabled smart cameras are particularly popular among residential consumers for their ability to provide remote access, live streaming, and integration with voice assistants.

The Bluetooth segment is expected to expand at the fastest CAGR of 18.7% from 2025 to 2032, driven by its low power consumption, localized connectivity, and affordability. Bluetooth-enabled smart cameras are increasingly adopted in consumer electronics and portable devices where direct smartphone pairing is crucial. Wireless HART and other emerging standards are also gaining momentum in industrial IoT applications, but Wi-Fi continues to dominate the overall smart cameras ecosystem.

Which Region Holds the Largest Share of the Smart Cameras Market?

- North America dominated the smart cameras market with the largest revenue share of 39.5% in 2024, supported by the strong adoption of smart home ecosystems, increasing consumer awareness about security, and the widespread use of connected devices

- Consumers in the region favor smart cameras for their ability to provide remote monitoring, AI-enabled alerts, and seamless integration with digital assistants such as Alexa and Google Assistant

- High disposable incomes, advanced infrastructure, and the rapid expansion of smart city projects are further boosting the market, positioning smart cameras as a key element of residential and commercial safety systems

U.S. Smart Cameras Market Insight

The U.S. smart cameras market dominated North America’s revenue share in 2024, driven by the rapid penetration of home automation systems and strong consumer demand for AI-powered surveillance. DIY-friendly smart cameras, along with features such as voice integration and mobile app access, are gaining popularity. The presence of leading players such as Ring, Arlo, and Google Nest further supports the U.S. as a global hub for innovation and adoption in smart security solutions.

Europe Smart Cameras Market Insight

The Europe smart cameras market is projected to expand steadily during 2025–2032, supported by strict security norms, growing urbanization, and increased reliance on smart devices in residential and business spaces. Consumers value the energy efficiency, data security, and convenience offered by smart cameras. Adoption is strong across both new constructions and retrofitting projects, with surveillance solutions becoming standard in multi-family housing, offices, and retail establishments.

U.K. Smart Cameras Market Insight

The U.K. market is expected to grow at a notable CAGR throughout the forecast period, fueled by rising burglary concerns and the push for smart home adoption. British consumers are increasingly investing in connected devices that provide real-time monitoring and voice-enabled control. Robust e-commerce and retail channels further aid product availability, ensuring continued growth momentum in both the residential and commercial segments.

Germany Smart Cameras Market Insight

The Germany smart cameras market is set for consistent expansion, driven by rising awareness of cybersecure smart solutions and demand for high-quality surveillance in both homes and enterprises. With strong infrastructure and an emphasis on sustainable technology, Germany favors privacy-focused and eco-conscious smart camera solutions. Integration with broader home automation systems is also gaining traction, particularly in urban households and commercial buildings.

Which Region is the Fastest Growing in the Smart Cameras Market?

The Asia-Pacific smart cameras market is projected to grow at the fastest CAGR of 7.35% from 2025 to 2032, fueled by rapid urbanization, rising disposable incomes, and the proliferation of smart devices. Government initiatives encouraging digitalization and the development of smart cities in China, India, and Japan are significantly driving adoption. The presence of local manufacturers and cost-effective products also makes smart cameras more accessible across the region.

Japan Smart Cameras Market Insight

The Japan market is witnessing strong growth, supported by the country’s technological advancement and aging population, which is increasing demand for user-friendly, secure monitoring solutions. Integration with IoT systems in homes and commercial facilities is pushing adoption, while Japan’s culture of innovation ensures continuous upgrades in AI and automation features in smart cameras.

China Smart Cameras Market Insight

The China smart cameras market held the largest share in Asia-Pacific in 2024, propelled by the country’s expanding middle class, large-scale urban development, and aggressive smart city initiatives. With strong domestic players and affordability of devices, China leads in both production and consumption of smart cameras. Adoption spans residential, commercial, and industrial applications, making it the single largest contributor to APAC growth.

Which are the Top Companies in Smart Cameras Market?

The smart cameras industry is primarily led by well-established companies, including:

- SAMSUNG (South Korea)

- Sony Corporation (Japan)

- FLIR Systems, Inc. (U.S.)

- Panasonic Corporation (Japan)

- Raptor Photonics (U.K.)

- Olympus Corporation (Japan)

- Bosch Sicherheitssysteme GmbH (Germany)

- Koninklijke Philips N.V. (Netherlands)

- Hamamatsu Photonics K.K. (Japan)

- Danaher (U.S.)

- Canon Inc. (Japan)

- Nikon Corporation (Japan)

- PLR Ecommerce, LLC. (U.S.)

- WATEC CAMERAS (Japan)

- IntelliVision (U.S.)

- VIVOTEK Inc. (Taiwan)

- VMukti Solutions Pvt. Ltd. (India)

- Axis Communications AB (Sweden)

- Zmodo (U.S.)

- Basler AG (Germany)

What are the Recent Developments in Global Smart Cameras Market?

- In November 2024, Sensormatic Solutions, a global retail leader under Johnson Controls, collaborated with Thruvision, a pioneer in walk-through security screening technology, to strengthen people screening in retail spaces. This partnership integrates advanced passive terahertz camera technology with Sensormatic's loss-prevention solutions, enabling the detection of concealed weapons and stolen items from up to seven meters away without radiation exposure or privacy concerns. This initiative marks a significant step toward enhancing safe and secure retail environments

- In October 2024, Ring LLC introduced 24/7 recording functionality in its security cameras, allowing devices to record continuously instead of only when motion is detected, which was the traditional feature of Ring’s cameras and video doorbells. This advancement enhances surveillance reliability and provides users with comprehensive video coverage at all times

- In May 2024, Eufy launched the Eufy S330, a fully autonomous LTE-powered surveillance camera equipped with a 360-degree field of vision and a solar panel for uninterrupted operation. Featuring AI-driven tracking, the device can independently monitor wide areas while delivering superior image quality. This innovation redefines home security by combining autonomy, efficiency, and advanced imaging technology

- In July 2022, Nikon unveiled the LuFact ultra-compact machine vision camera designed to accelerate digital transformation at manufacturing facilities. Derived from “Luminous Factory Camera,” the product improves production capabilities by illuminating details that were previously undetectable. This release highlights Nikon’s commitment to advancing industrial automation and precision manufacturing

- In July 2022, Canon introduced its first intelligent camera, the Canon PowerShot Pick, developed as a smart photography companion. The device automatically captures memorable moments without requiring manual effort, enabling users to focus on experiencing events. This launch demonstrates Canon’s push toward blending smart automation with personal imaging solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Smart Cameras Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Smart Cameras Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Smart Cameras Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.