Global Smart Card In Government Market

Market Size in USD Billion

CAGR :

%

USD

22.06 Billion

USD

42.37 Billion

2025

2033

USD

22.06 Billion

USD

42.37 Billion

2025

2033

| 2026 –2033 | |

| USD 22.06 Billion | |

| USD 42.37 Billion | |

|

|

|

|

What is the Global Smart Card in Government Market Size and Growth Rate?

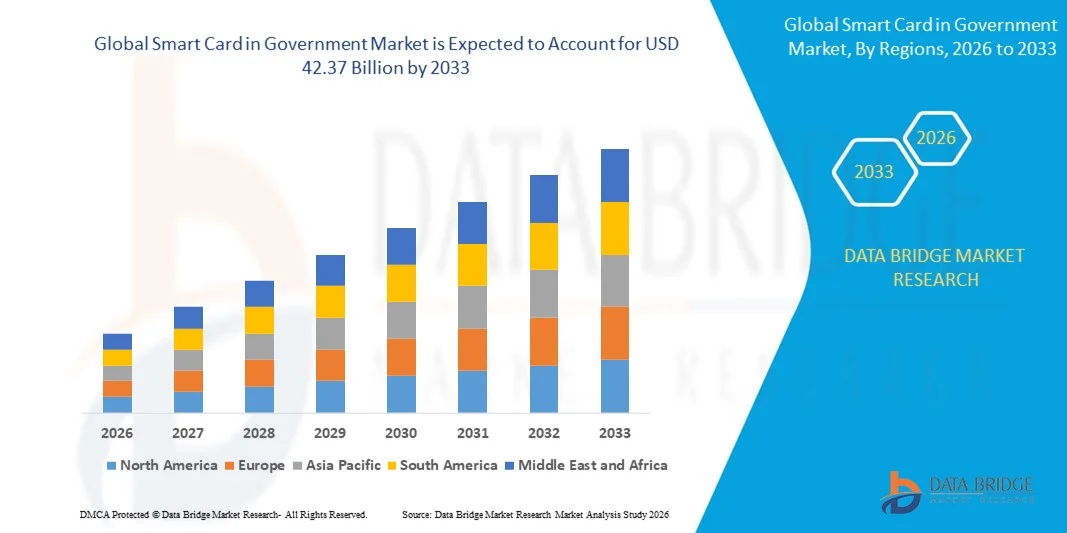

- The global smart card in government market size was valued at USD 22.06 billion in 2025 and is expected to reach USD 42.37 billion by 2033, at a CAGR of8.50% during the forecast period

- Increasing demand for identification cards to avail government facilities, increasing adoption of e-passports and smart cards in banking systems, availability of the contactless interfaces, surging levels of investment for the development of improved IT infrastructure, help governments and transport services collect the travel data of commuters

What are the Major Takeaways of Smart Card in Government Market?

- Advent of multifunction cards has made it convenient to manage the network system access and store valuable and other data are some of the major as well as vital factors which will such asly to augment the growth of the smart card in government market

- On the other hand, increasing adoption of blockchain technology which enhance security features along with growing number of technological advancements which will further contribute by generating massive opportunities that will lead to the growth of the smart card in government market

- North America dominated the smart card in government market with a 36.36% revenue share in 2025, driven by strong adoption of national ID programs, e-passports, secure citizen authentication, and digital government services across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 7.24% from 2026 to 2033, fueled by rapid government digitalization, growing national ID adoption, and rising demand for secure citizen authentication solutions across China, India, Japan, South Korea, and Southeast Asia

- The Contactless Smart Cards segment dominated the market with a 45.2% share in 2025, driven by their convenience, faster transaction speed, and growing adoption in e-governance, public transport, border control, and national ID programs

Report Scope and Smart Card in Government Market Segmentation

|

Attributes |

Smart Card in Government Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Smart Card in Government Market?

Increasing Adoption of Advanced, Secure, and Multi-Application Smart Card Solutions in Governments

- The smart card in government market is witnessing strong adoption of high-security, contactless, and multi-application smart cards designed for citizen ID, e-governance, border control, and digital payment applications

- Manufacturers are introducing enhanced cryptography, biometric integration, and NFC/RFID-enabled cards that improve security, interoperability, and ease of use across government programs

- Growing demand for cost-effective, durable, and scalable smart card solutions is driving deployment across national ID programs, social security, healthcare, and transportation sectors

- For instance, companies such as Thales, IDEMIA, Infineon Technologies, NXP Semiconductors, and HID Global have upgraded smart card offerings with embedded security features, multi-application support, and cloud-enabled identity management systems

- Increasing need for secure digital identification, authentication, and efficient government service delivery is accelerating the shift toward advanced smart card adoption

- As governments increasingly digitize citizen services and public infrastructure, Smart Cards in Government will remain critical for secure identity management, fraud prevention, and streamlined administrative processes

What are the Key Drivers of Smart Card in Government Market?

- Rising demand for secure, reliable, and multifunctional smart cards to support digital identity, e-governance, and financial inclusion initiatives

- For instance, in 2025, leading providers such as Thales, NXP Semiconductors, and IDEMIA launched upgraded card platforms featuring enhanced encryption, biometric authentication, and contactless interfaces for government programs

- Growing adoption of e-passports, citizen ID cards, health insurance cards, and transit payment systems is boosting demand across North America, Europe, and Asia-Pacific

- Advancements in card chip technology, biometric sensors, encryption algorithms, and cloud-based identity management have strengthened card performance, reliability, and security

- Rising implementation of digital government services, secure citizen identification programs, and smart urban infrastructure is creating strong demand for multi-functional, high-security cards

- Supported by sustained government initiatives, public-private partnerships, and technology investments, the Smart Card in Government market is expected to witness strong long-term growth

Which Factor is Challenging the Growth of the Smart Card in Government Market?

- High costs associated with premium secure cards, biometric modules, and multi-application integration restrict adoption among smaller municipalities and emerging economies

- For instance, during 2024–2025, fluctuations in semiconductor chip prices, global supply chain disruptions, and higher security compliance requirements increased deployment costs for several vendors

- Complexity in implementing multi-layered security, interoperability with legacy systems, and large-scale citizen enrollment increases demand for skilled technical support and training

- Limited awareness in developing regions regarding digital identity solutions, smart card standards, and security benefits slows adoption

- Competition from mobile digital ID solutions, biometric apps, and cloud-based identity platforms creates pricing and technology pressure for traditional smart cards

- To address these challenges, companies are focusing on cost-optimized card solutions, scalable deployment models, training programs, and software-enabled identity management to increase global adoption of smart cards in government

How is the Smart Card in Government Market Segmented?

The market is segmented on the basis of communication, component, application, and access.

- By Communication

On the basis of communication, the market is segmented into Contact Smart Cards, Contactless Smart Cards, Microprocessor-Based Smart Cards, and Memory-Based Smart Cards. The Contactless Smart Cards segment dominated the market with a 45.2% share in 2025, driven by their convenience, faster transaction speed, and growing adoption in e-governance, public transport, border control, and national ID programs. Contactless cards are widely used for secure, touchless interactions, offering better durability and compatibility with NFC-enabled readers.

The Microprocessor-Based Smart Cards segment is expected to grow at the fastest CAGR from 2026 to 2033, fueled by increasing demand for high-security applications, multi-application government services, and integration with biometric authentication. Their ability to store encrypted data and perform secure processing makes them essential for advanced identity and authentication programs.

- By Component

On the basis of component, the market is segmented into Hardware, Software, and Services. The Hardware segment dominated the market with a 48.7% share in 2025, as secure card chips, embedded readers, and card issuance terminals form the backbone of government smart card programs. High adoption is driven by national ID initiatives, e-passports, and social security card projects that require durable, tamper-resistant hardware.

The Services segment is projected to grow at the fastest CAGR from 2026 to 2033, supported by the increasing need for card personalization, enrollment services, system integration, and ongoing management of citizen ID and authentication programs. Outsourced services enhance scalability, security, and efficiency in government deployments.

- By Application

On the basis of application, the market is segmented into Identification and Authentication, Entrance and Exit, and Other. The Identification and Authentication segment dominated the market with a 52.3% share in 2025, owing to growing implementation of national ID cards, e-passports, digital voting systems, and secure citizen authentication platforms. Smart cards ensure accurate identity verification, reduce fraud, and streamline service delivery.

The Entrance and Exit segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by increasing use of access control in government offices, secure facilities, transportation hubs, and defense installations. Integration with biometric and NFC technologies accelerates adoption across high-security environments.

- By Access

On the basis of access, the market is segmented into Physical and Logical. The Physical access segment dominated the market with a 49.1% share in 2025, fueled by demand for secure building entry, facility access, and controlled movement of personnel in government institutions. Smart card-based access systems enhance safety, accountability, and operational efficiency.

The Logical access segment is projected to grow at the fastest CAGR from 2026 to 2033, supported by rising implementation of secure network logins, online citizen services, cloud-based government platforms, and digital identity management. Increasing cyber-security requirements and integration with multi-factor authentication solutions drive growth in this segment.

Which Region Holds the Largest Share of the Smart Card in Government Market?

- North America dominated the smart card in government market with a 36.36% revenue share in 2025, driven by strong adoption of national ID programs, e-passports, secure citizen authentication, and digital government services across the U.S. and Canada. High investment in secure electronics manufacturing, advanced card personalization, and government-led digital ID initiatives continues to fuel demand for smart card solutions in federal, state, and municipal projects

- Leading companies in North America are deploying advanced smart card platforms with multi-application support, biometric integration, NFC/contactless features, and cloud-based identity management, reinforcing the region’s technological leadership. Continuous focus on secure identity solutions, public-private partnerships, and government digitalization programs drives long-term market expansion

- Strong innovation ecosystems, skilled workforce, and government-backed technology initiatives further strengthen North America’s market dominance

U.S. Smart Card in Government Market Insight

The U.S. is the largest contributor in North America, supported by extensive federal and state-level ID initiatives, e-passport adoption, and secure digital authentication programs. Rising implementation of citizen-centric services, secure voting, and access management drives demand for multi-application, biometric-enabled smart cards. Presence of major card manufacturers, technology startups, and digital identity solution providers accelerates market growth.

Canada Smart Card in Government Market Insight

Canada contributes significantly to regional growth, driven by expanding digital ID programs, government e-services, and secure access solutions for defense and public sectors. Adoption of biometric-enabled cards, NFC-based payment integration, and cloud-managed identity systems strengthens government initiatives. Skilled workforce availability and government-supported innovation programs support widespread adoption across federal and provincial institutions.

Asia-Pacific Smart Card in Government Market

Asia-Pacific is projected to register the fastest CAGR of 7.24% from 2026 to 2033, fueled by rapid government digitalization, growing national ID adoption, and rising demand for secure citizen authentication solutions across China, India, Japan, South Korea, and Southeast Asia. Expansion of e-governance, transportation access control, and healthcare identification systems drives large-scale deployment.

China Smart Card in Government Market Insight

China is the largest contributor in Asia-Pacific due to massive government investments in national ID programs, digital e-passports, and large-scale citizen authentication systems. Growing adoption of contactless, microprocessor-based, and multi-application smart cards supports secure service delivery, while local manufacturing and competitive pricing drive both domestic and export market growth.

India Smart Card in Government Market Insight

India is emerging as a key growth hub, driven by government-backed digital identity programs, rapid expansion of e-governance services, and growing adoption of smart health, transport, and education cards. Investments in infrastructure, enrollment centers, and secure card issuance accelerate market penetration.

Japan Smart Card in Government Market Insight

Japan shows steady growth supported by advanced telecom infrastructure, secure e-government services, and modernization of citizen identification systems. Focus on high-quality, reliable smart card solutions and integration with low-latency, multi-application systems ensures long-term adoption.

South Korea Smart Card in Government Market Insight

South Korea contributes significantly due to strong demand for secure government ID cards, biometric-enabled citizen authentication, and contactless smart card solutions. High adoption of e-governance, transportation access, and public service cards drives growth, supported by advanced card manufacturing capabilities and innovative digital identity platforms.

Which are the Top Companies in Smart Card in Government Market?

The smart card in government industry is primarily led by well-established companies, including:

- Thales (France)

- IDEMIA (France)

- Infineon Technologies AG (Germany)

- NXP Semiconductors (Netherlands)

- SAMSUNG (South Korea)

- Giesecke+Devrient GmbH (Germany)

- HID Global Corporation / ASSA ABLOY AB (U.S./Sweden)

- STMicroelectronics (Switzerland)

- Ingenico (France)

- Watchdata Co., Ltd. (China)

- Rambus (U.S.)

- CPI Card Group Inc. (U.S.)

- Identiv, Inc. (U.S.)

- Kona (South Korea)

- Fingerprint Cards AB (Sweden)

- Newland Payment Technology (China)

- PAX Global Technology Limited (China)

- CardLogix Corporation (U.S.)

- Zwipe AS (Norway)

- Versasec AB (Sweden)

What are the Recent Developments in Global Smart Card in Government Market?

- In April 2025, the MENA Fintech Association (MFTA), a Dubai-based non-profit registered with the Abu Dhabi Global Market (ADGM), partnered with International Smart Card (ISC), also known as Qi, Iraq’s leading provider of digital payments, fintech solutions, and digital identity services, to foster innovation, accelerate digital payments adoption, and promote inclusive financial transformation throughout the MENA region, strengthening regional fintech infrastructure

- In November 2024, QiCard, an international smart card company, acquired Miswag, Iraq’s e-commerce platform, in a confidential transaction valued in the seven-figure range, aiming to integrate digital payments and online retail ecosystems, thereby enhancing Iraq’s fintech and e-commerce growth

- In November 2024, GlobalFoundries collaborated with IDEMIA Secure Transactions (IST), a division of IDEMIA Group, to manufacture IST’s smart card integrated circuit using GlobalFoundries’ 28ESF3 process technology, creating a fully European value chain and providing secure, next-generation smart card solutions, advancing technological innovation in smart card manufacturing

- In May 2022, IDEMIA and Telefónica España improved the security of 5G SIM technology using ground-breaking methods to safeguard user communications, ensuring enhanced privacy and reliability in mobile networks

- In May 2022, IDEX Biometrics partnered with payment software provider Verisoft to market biometric payment solutions across EMEA and beyond, enabling more than 100 banks in 32 countries to access comprehensive smart card issuance solutions, personalization software, and online payment options, expanding biometric card adoption globally

- In April 2022, IDEX Biometrics ASA established a partnership with E-kart to commercialize biometric payment solutions in Eastern Europe, providing Turkish banks and payment card users with cost-effective, high-performance biometric smart cards, accelerating regional adoption of secure payment technologies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Smart Card In Government Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Smart Card In Government Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Smart Card In Government Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.