Global Smart Dental Polishing Products Market

Market Size in USD Billion

CAGR :

%

USD

316.80 Billion

USD

664.41 Billion

2024

2032

USD

316.80 Billion

USD

664.41 Billion

2024

2032

| 2025 –2032 | |

| USD 316.80 Billion | |

| USD 664.41 Billion | |

|

|

|

|

Smart Dental Polishing Products Market Size

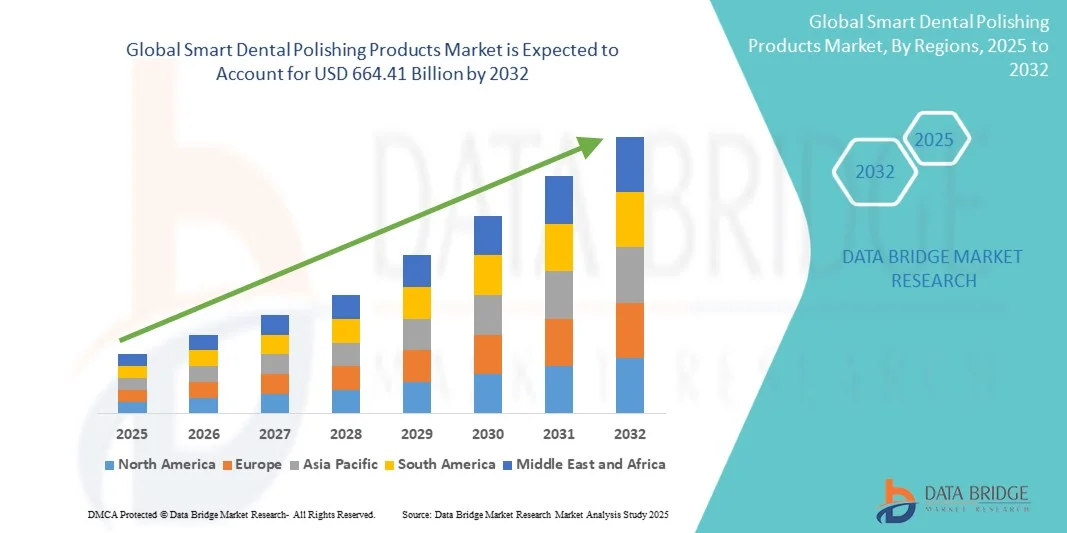

- The global smart dental polishing products market size was valued at USD 316.8 billion in 2024 and is expected to reach USD 664.41 billion by 2032, at a CAGR of 9.70% during the forecast period

- The market growth is largely fueled by the growing adoption of advanced dental technologies and continuous innovation in preventive and cosmetic dentistry, leading to improved oral hygiene awareness among patients and professionals

- Furthermore, rising demand for efficient, user-friendly, and ergonomic polishing systems in dental practices is establishing smart dental polishing products as a preferred choice for achieving enhanced cleaning precision and patient comfort. These converging factors are accelerating the uptake of Smart Dental Polishing Products solutions, thereby significantly boosting the industry's growth

Smart Dental Polishing Products Market Analysis

- Smart dental polishing products, offering advanced precision, automation, and improved ergonomics, are becoming essential components in modern dental clinics and laboratories due to their ability to enhance cleaning efficiency, reduce procedure time, and ensure consistent polishing results

- The escalating demand for smart dental polishing products is primarily fueled by the growing adoption of digital dentistry, increased awareness of oral hygiene, and the rising preference for minimally invasive and patient-friendly dental procedures

- North America dominated the smart dental polishing products market with the largest revenue share of 39% in 2024, driven by a high number of dental professionals, strong technological adoption, and well-established healthcare infrastructure. The U.S. has witnessed significant growth due to continuous product innovations, integration of AI-based polishing systems, and growing investments in cosmetic dentistry

- Asia-Pacific is expected to be the fastest-growing region in the smart dental polishing products market during the forecast period, with an anticipated CAGR fueled by increasing dental tourism, rising disposable incomes, and government initiatives promoting oral health awareness

- The Dental Clinics segment dominated the largest market revenue share of 52.7% in 2024, driven by the high volume of routine prophylaxis, cosmetic polishing, and implant hygiene procedures performed in private and group practice settings

Report Scope and Smart Dental Polishing Products Market Segmentation

|

Attributes |

Smart Dental Polishing Products Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Smart Dental Polishing Products Market Trends

“Enhanced Efficiency and Personalization Through AI and Smart Integration”

- A significant and accelerating trend in the global smart dental polishing products market is the integration of artificial intelligence (AI) and smart connectivity technologies to improve efficiency, precision, and patient outcomes in dental care. These advancements are revolutionizing dental hygiene practices by enabling personalized treatment and automated performance optimization

- For instance, leading manufacturers have begun incorporating AI-driven feedback systems into dental polishing devices, allowing professionals to monitor polishing speed, pressure, and duration in real-time. Such systems help ensure optimal results while reducing the risk of enamel damage

- Similarly, integration with smart platforms and mobile applications enables dentists and dental hygienists to track polishing performance data, device usage, and maintenance schedules, improving workflow efficiency and preventive maintenance planning

- Furthermore, AI-enabled polishing systems can analyze tooth surface conditions and automatically adjust operational parameters such as rotational speed and pressure based on the patient’s enamel sensitivity or plaque buildup levels

- The integration of voice and app-based controls in some advanced dental polishing products allows for seamless, hands-free operation, enhancing hygiene and convenience during clinical procedures

- This trend toward intelligent, adaptive, and digitally connected dental care equipment is reshaping how dental professionals approach oral polishing and hygiene management. Consequently, companies are focusing on developing AI-powered, user-friendly, and ergonomically designed polishing devices that combine automation with precision to enhance clinical efficiency

- The demand for such next-generation smart dental polishing systems is rapidly growing in both clinical and home-use segments, driven by the global emphasis on advanced oral care, real-time performance tracking, and connected healthcare ecosystems

Smart Dental Polishing Products Market Dynamics

Driver

“Rising Oral Health Awareness and Technological Advancements in Dental Care Devices”

- The increasing prevalence of dental disorders such as plaque accumulation, tooth discoloration, and periodontal diseases, combined with the growing awareness of oral hygiene, is a key driver fueling the demand for Smart Dental Polishing Products

- Technological advancements such as the integration of AI-based sensors, wireless connectivity, and pressure-control mechanisms have significantly enhanced product performance and safety. These innovations enable precise polishing while minimizing tooth and gum irritation

- For instance, in April 2024, a leading dental technology manufacturer introduced an IoT-enabled dental polishing system that automatically adjusts rotational speeds based on tooth surface texture and provides real-time feedback to practitioners via a connected application. Such innovations are accelerating the adoption of smart dental devices globally

- Moreover, the growing preference for minimally invasive dental treatments and cosmetic dentistry is creating a strong demand for efficient and technologically advanced polishing tools that deliver faster and more comfortable results

- High adoption rates among dental clinics, hospitals, and home users can also be attributed to the ease of use, enhanced precision, and time-saving benefits offered by smart dental polishing systems

- In addition, the expansion of dental healthcare infrastructure, rising disposable incomes, and increased dental insurance coverage in developed regions are contributing to market growth. As dental professionals seek improved efficiency and patient satisfaction, the demand for intelligent, automated polishing devices continues to rise steadily

Restraint/Challenge

“High Product Costs and Data Security Concerns in Smart Devices”

- Despite the rapid adoption of advanced dental technologies, high initial costs associated with smart dental polishing products remain a major challenge, particularly in price-sensitive and developing markets. The integration of AI, sensors, and connectivity features increases production and retail costs, making these devices less accessible to small dental clinics and individual practitioners

- Moreover, as these smart systems often rely on cloud connectivity and data analytics, there are rising concerns about data privacy and security. Patient treatment data and operational performance metrics stored on connected platforms could be susceptible to cyber threats or unauthorized access if not properly encrypted

- To address these issues, leading manufacturers are focusing on robust encryption methods, secure data storage, and compliance with healthcare data protection standards such as HIPAA and GDPR

- In addition, while technological sophistication attracts professionals, the need for regular software updates and device calibration adds to maintenance costs, which may deter smaller clinics from adoption

- The lack of adequate training and awareness regarding smart dental technologies, especially in emerging economies, further limits large-scale deployment

- Overcoming these challenges will require a focus on cost-effective innovation, training programs for dental professionals, and consumer education on the benefits of smart systems. Enhanced data protection mechanisms and declining technology costs are expected to mitigate these barriers and drive sustainable growth in the global Smart Dental Polishing Products market

Smart Dental Polishing Products Market Scope

The market is segmented on the basis of product type, application, and end user.

• By Product Type

On the basis of product type, the Smart Dental Polishing Products market is segmented into Air Polishing Devices, Prophy Angles, Prophy Pastes, Rubber Cups, and Others. The Air Polishing Devices segment dominated the largest market revenue share of 38.5% in 2024, driven by its broad adoption in preventive and cosmetic dentistry for stain and biofilm removal. Air polishers deliver fast, minimally invasive cleaning with less tooth structure abrasion, which increases clinician preference for routine hygiene appointments. Their compatibility with a range of powders and tips makes them versatile across adult and pediatric practices. Growing emphasis on aerosol management and improved water/air control systems has further boosted clinician confidence in these devices. The availability of portable and ergonomically designed units has encouraged uptake in both single-practitioner and multi-chair clinics. Product launches with improved ergonomics and quieter operation have expanded use in patient-facing settings. Continuing education and manufacturer training programs for dentists support safe and effective adoption. Reimbursement patterns that favor preventive care also sustain equipment purchase cycles. As a result, air polishing devices remain the single largest revenue contributor in this product group.

The Prophy Pastes segment is projected to witness the fastest CAGR of 11.2% from 2025 to 2032, fueled by rising demand for specialized paste formulations targeting sensitivity, whitening, and biofilm control. Manufacturers are developing a wider range of low-abrasivity, flavored, and medicated pastes to meet patient comfort and clinical efficacy needs. The shift toward patient-centric care has increased requests for esthetic outcomes during routine prophylaxis, boosting premium paste sales. Growth is also supported by expanding adoption of single-use paste delivery systems that improve infection control and workflow efficiency. Emerging markets are showing higher per-capita consumption as dental service access improves. Regulatory approvals for novel active ingredients and claims (anti-sensitivity, remineralization) expand clinical applications. Dental OEM partnerships and bundled equipment-consumable offerings accelerate product penetration in clinic purchasing. Continued marketing to hygienists and dentists about paste differentiation drives repeat purchase behavior. As clinics prioritize turnkey polishing solutions, prophy paste demand rises faster than many hardware categories.

• By Application

On the basis of application, the Smart Dental Polishing Products market is segmented into Dental Clinics, Hospitals, and Dental Laboratories. The Dental Clinics segment dominated the largest market revenue share of 52.7% in 2024, driven by the high volume of routine prophylaxis, cosmetic polishing, and implant hygiene procedures performed in private and group practice settings. Clinics are the primary point of preventive care where polishing products and devices are used day-to-day by dentists and hygienists. The bulk purchasing power of multi-clinic chains and franchise groups supports larger equipment deployments and standardized consumable selection. Patient demand for cosmetic dentistry and whitening boosts consumable turnover and premium device acquisition. Clinic investment in chairside technology—aimed at reducing chair time and improving throughput—favors adoption of smart polishing systems. Training programs and service contracts from device manufacturers make clinics the preferred channel for upgrades and maintenance. The convenience and revenue generation from recall and hygiene programs further cement clinics’ share. As clinics expand in urban and suburban areas, their dominance in application value increases.

The Hospitals application segment is expected to see the fastest CAGR of 9.4% from 2025 to 2032, supported by growing integration of dental departments within hospital systems and increased emphasis on oral health in medically complex patient care. Hospitals are investing in higher-end polishing units for peri-operative mouth care, oncology and transplant patient protocols, and special-care dentistry for medically compromised patients. Cross-disciplinary teams require devices that meet strict infection control and documentation standards, creating demand for integrated, smart polishing platforms. Consolidation of dental services into hospital outpatient clinics increases institutional purchasing of consumables and equipment. Public health initiatives linking oral health with systemic outcomes drive more hospital-based dental screenings and prophylaxis. Growing hospital dental residency programs and specialist clinics also raise demand for advanced polishing technologies. These structural shifts underlie faster growth for the hospital application segment.

• By End User

On the basis of end user, the Smart Dental Polishing Products market is segmented into Dentists, Dental Hygienists, and Others. The Dentists segment dominated the largest market revenue share of 60.1% in 2024, reflecting dentists’ central role in purchasing decisions for both devices and premium consumables and their performance of a substantial portion of polishing and cosmetic procedures. Dentists lead clinic technology adoption, determine workflow, and specify consumable brands, concentrating value on their segment. High-margin cosmetic and restorative practices that bundle polishing services contribute heavily to device and paste revenues. Dentist-led training and clinical research also promote evidence-based product uptake. The involvement of dentists in multi-disciplinary esthetic case planning increases use of specialized pastes and air polishing for final polishing steps. Practice owners’ capital expenditure cycles typically drive larger purchases such as integrated polishing systems. As a result, dentists account for the majority of market value across devices and high-end consumables.

The Dental Hygienists segment is projected to record the fastest CAGR of 10.6% from 2025 to 2032, as hygienists increasingly lead preventive care programs and chairside polishing in many markets. Expanding scopes of practice and delegation of routine prophylaxis to hygienists increase per-practitioner consumable consumption. Hygienists’ preferences heavily influence paste selection, tool ergonomics, and single-use accessory adoption. Professional associations and continuing-education courses that target hygienists promote best practices and new product trials, accelerating uptake. Growth in public-health hygiene initiatives and employer-sponsored dental programs also raises demand for hygienist-driven services. As dental teams optimize recall intervals and hygiene throughput, hygienists become the fastest-growing end-user group for polishing products and accessories.

Smart Dental Polishing Products Market Regional Analysis

- North America dominated the smart dental polishing products market with the largest revenue share of 39% in 2024

- Driven by a high number of dental professionals, strong technological adoption, and well-established healthcare infrastructure

- The market has witnessed significant growth due to continuous product innovations, integration of AI-based polishing systems, and growing investments in cosmetic dentistry

U.S. Smart Dental Polishing Products Market Insight

The U.S. smart dental polishing products market captured the largest revenue share in 2024 within North America, supported by a strong base of dental professionals and rapid integration of digital technologies in dental care. The increasing adoption of AI-driven polishing tools and portable devices for home dental care is propelling market expansion. Growing awareness regarding oral aesthetics and the rising popularity of cosmetic dentistry procedures further strengthen the U.S. market. In addition, collaborations between dental clinics and technology developers are fostering innovation and improving accessibility to advanced polishing systems.

Europe Smart Dental Polishing Products Market Insight

The Europe smart dental polishing products market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the region’s advanced healthcare infrastructure and growing emphasis on dental hygiene. Countries across Europe are experiencing an increasing shift towards preventive dental care and minimally invasive aesthetic procedures. Furthermore, technological advancements and favorable reimbursement policies are promoting the integration of smart polishing devices in clinical practice. The rise of digital dentistry and demand for precision-based polishing systems are key factors supporting market growth across the region.

U.K. Smart Dental Polishing Products Market Insight

The U.K. smart dental polishing products market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising awareness of oral aesthetics and continuous advancements in dental technology. The expansion of private dental clinics, coupled with increased spending on cosmetic procedures, is stimulating market growth. The country’s focus on adopting AI-integrated and ergonomic polishing devices for both clinical and home applications is further boosting adoption. In addition, favorable government initiatives promoting oral hygiene are expected to support consistent market development.

Germany Smart Dental Polishing Products Market Insight

The Germany smart dental polishing products market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s robust dental equipment manufacturing base and increasing preference for smart, eco-friendly devices. Germany’s emphasis on innovation, precision engineering, and sustainability continues to enhance product quality and adoption rates. Integration of digital polishing tools with CAD/CAM systems and intraoral scanners is improving procedural efficiency across dental clinics. Moreover, the growing focus on personalized dental care and automation in clinics supports steady market growth.

Asia-Pacific Smart Dental Polishing Products Market Insight

The Asia-Pacific smart dental polishing products market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by increasing dental tourism, rising disposable incomes, and improving healthcare infrastructure in countries such as China, Japan, and India. Growing awareness regarding oral health and the rising popularity of advanced cosmetic procedures are major factors accelerating demand. Government initiatives promoting oral care programs, combined with technological collaborations among regional manufacturers, are expanding accessibility to affordable smart polishing devices.

Japan Smart Dental Polishing Products Market Insight

The Japan smart dental polishing products market is gaining momentum due to the country’s technological sophistication, strong dental care culture, and emphasis on aesthetics. The increasing integration of smart polishing systems in clinics, supported by AI and robotics, is elevating procedural precision and efficiency. Rising demand for portable and ergonomic devices for elderly patients is also driving growth. Moreover, Japan’s innovation-driven healthcare system continues to promote early adoption of digital dental technologies, strengthening its market position within Asia-Pacific.

China Smart Dental Polishing Products Market Insight

The China smart dental polishing products market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, growing dental awareness, and increasing demand for cosmetic and preventive dentistry. China’s expanding dental tourism sector, alongside strong domestic manufacturing capabilities, is supporting affordability and large-scale adoption of smart polishing systems. The country’s government-led oral health initiatives and rising investments by key players in AI-integrated and portable polishing tools are major factors driving sustained growth.

Smart Dental Polishing Products Market Share

The Smart Dental Polishing Products industry is primarily led by well-established companies, including:

- Dentsply Sirona (U.S.)

- 3M (U.S.)

- KaVo Kerr (Germany)

- Hu-Friedy (U.S.)

- Young Innovations, Inc. (U.S.)

- Coltene Holding AG (Switzerland)

- Ultradent Products, Inc. (U.S.)

- GC Corporation (Japan)

- Ivoclar Vivadent AG (Liechtenstein)

- Premier Dental Products Company (U.S.)

- Shofu Inc. (Japan)

- Henry Schein, Inc. (U.S.)

- Patterson Dental (U.S.)

- VOCO GmbH (Germany)

- ACTEON Group (France)

- Microcopy Dental (U.S.)

- DÜRR Dental SE (Germany)

- DenMat Holdings, LLC (U.S.)

- DMG America (U.S.)

- NSK Nakanishi Inc. (Japan)

Latest Developments in Global Smart Dental Polishing Products Market

- In April 2022, a major dental-equipment manufacturer launched a next-generation air-polishing device embedded with built-in digital sensors that monitor powder flow and water/air ratios in real-time, enabling clinicians to maintain optimal polishing conditions while reducing enamel loss and splash dispersal. This innovation marked a significant shift toward “smart” polishing systems designed for both aesthetic and preventive dental workflows

- In August 2023, a global oral-health company introduced a single-use, color-coded prophy-angle system compatible with smart-handpiece connectivity. The design allows hygienists to track usage data via a cloud-linked platform, enabling inventory management, patient usage metrics, and enhanced infection-control traceability within large hygiene chains and multi-chair dental practices

- In January 2024, a dental-device OEM announced the rollout of a smartphone-app-connected polishing unit specifically tailored for teledentistry and hygiene outreach programs. The device offers remote monitoring of polishing cycles, digital pre- and post-treatment imaging, and integration with patient-mobile apps for home-care follow-up—expanding smart polishing solutions beyond the clinic

- In November 2024, a major national dental association updated its clinical guidelines to encourage the use of “smart polishing” protocols incorporating devices with built-in feedback systems (such as pressure sensors and particle control alerts), stating that such technologies may reduce occupational exposure and improve treatment consistency. This institutional recommendation spurred higher adoption in clinics and hygiene department

- In February 2025, a pediatric-dentistry network piloted a compact, low-noise smart polishing system outfitted with LED-guided targeting and voice-prompt feedback for children with dental anxiety. The device’s success in reducing turnaround time, improving patient comfort and yielding higher recall-visit compliance has attracted broader attention from general-practice clinics seeking patient-friendly equipment upgrades

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.