Global Smart Dishwasher Market

Market Size in USD Billion

CAGR :

%

USD

5.13 Billion

USD

11.08 Billion

2024

2032

USD

5.13 Billion

USD

11.08 Billion

2024

2032

| 2025 –2032 | |

| USD 5.13 Billion | |

| USD 11.08 Billion | |

|

|

|

|

Smart Dishwasher Market Size

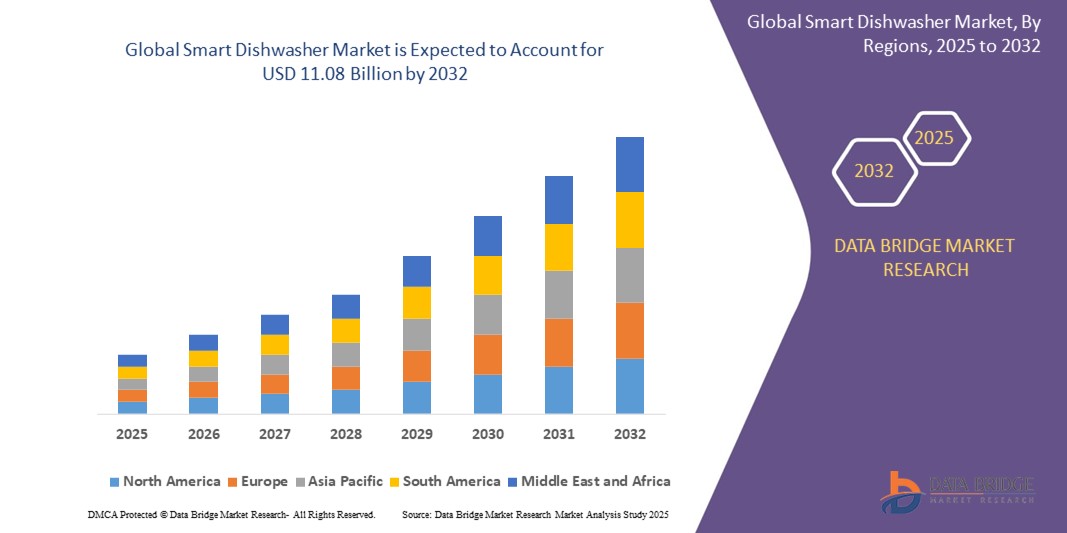

- The global smart dishwasher market size was valued at USD 5.13 billion in 2024 and is expected to reach USD 11.08 billion by 2032, at a CAGR of 10.1% during the forecast period

- The market growth is primarily driven by the increasing adoption of smart home appliances, advancements in IoT and connectivity technologies, and growing consumer preference for energy-efficient and convenient kitchen solutions

- Rising demand for automated, user-friendly appliances in both residential and commercial settings, coupled with the integration of smart dishwashers with home automation systems, is significantly boosting market expansion

Smart Dishwasher Market Analysis

- Smart dishwashers, equipped with advanced features such as Wi-Fi connectivity, voice control, and app-based operation, are becoming essential components of modern kitchen ecosystems, offering enhanced convenience, energy efficiency, and seamless integration with smart home platforms

- The surge in demand is fueled by growing consumer awareness of smart home technologies, increasing focus on sustainability, and the need for time-saving appliances in busy households and commercial kitchens

- Asia-Pacific dominated the smart dishwasher market with the largest revenue share of 42.5% in 2024, driven by rapid urbanization, rising disposable incomes, and strong demand for premium home appliances in countries like China, Japan, and South Korea

- North America is expected to be the fastest-growing region during the forecast period, propelled by high adoption rates of smart home technologies, increasing consumer spending on luxury appliances, and innovations from key industry players focusing on AI and voice-activated features

- The Built-In Dishwasher segment dominated the largest market revenue share of 65% in 2024, driven by its seamless integration into modern kitchen designs and space-saving appeal, particularly in urban households

Report Scope and Smart Dishwasher Market Segmentation

|

Attributes |

Smart Dishwasher Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Smart Dishwasher Market Trends

“Increasing Integration of IoT and AI Technologies”

- The global smart dishwasher market is experiencing a significant trend toward integrating Internet of Things (IoT) and Artificial Intelligence (AI) technologies

- These technologies enable advanced functionalities such as remote control via smartphone apps, automated detergent dispensing, and predictive maintenance to optimize performance and efficiency

- AI-driven platforms analyze user patterns to provide customized wash cycles, energy-saving recommendations, and notifications for maintenance needs, reducing water and energy consumption

- For instance, companies like Samsung and LG are developing smart dishwashers with AI features that adjust wash settings based on load size and soil level, enhancing user convenience and sustainability

- This trend is increasing the appeal of smart dishwashers for tech-savvy consumers and commercial operators, driving market growth by offering seamless integration with smart home ecosystems

- IoT connectivity allows real-time monitoring and diagnostics, enabling proactive issue resolution to prevent costly repairs or downtime

Smart Dishwasher Market Dynamics

Driver

“Rising Demand for Smart Home Appliances and Energy Efficiency”

- Growing consumer demand for smart home appliances, including features like Wi-Fi connectivity, voice control, and mobile app integration, is a key driver for the global smart dishwasher market

- Smart dishwashers enhance user convenience with features such as remote cycle monitoring, eco-wash cycles, and integration with virtual assistants like Amazon Alexa and Google Assistant

- Government regulations promoting energy and water conservation, particularly in regions like Europe and North America, are encouraging the adoption of energy-efficient smart dishwashers

- The advancement of 5G technology and the proliferation of IoT are enabling faster data transmission and more reliable connectivity, supporting sophisticated features like real-time usage tracking and automation

- Manufacturers are increasingly offering smart dishwashers as standard or optional features in premium models to meet consumer expectations for modern, connected kitchens

Restraint/Challenge

“High Initial Costs and Data Privacy Concerns”

- The high upfront costs of smart dishwasher hardware, software, and integration into kitchen setups can be a significant barrier, particularly for cost-sensitive consumers in emerging markets

- Retrofitting existing kitchens with smart dishwashers often requires additional installation expenses, limiting adoption in some regions

- Data security and privacy concerns are a major challenge, as smart dishwashers collect and transmit sensitive user data, such as usage patterns and preferences, raising risks of breaches or misuse

- Compliance with diverse data protection regulations, such as GDPR in Europe, adds complexity for manufacturers and service providers operating across multiple regions

- These factors can hinder market growth, especially in regions with high awareness of data privacy or where economic constraints limit consumer spending on premium appliances

Smart Dishwasher market Scope

The market is segmented on the basis of product, application, and distribution channel.

- By Product

On the basis of product, the global smart dishwasher market is segmented into Free Standing Dishwasher, Built-In Dishwasher, and Semi-Integrated Dishwasher. The Built-In Dishwasher segment dominated the largest market revenue share of 65% in 2024, driven by its seamless integration into modern kitchen designs and space-saving appeal, particularly in urban households. These dishwashers are favored for their aesthetic compatibility with modular kitchens and advanced features like Wi-Fi connectivity and sensor-based automation.

The Free Standing Dishwasher segment is anticipated to witness the fastest growth rate of 10.5% from 2025 to 2032, fueled by its flexibility in placement, making it ideal for rental properties and temporary living arrangements. The rising demand for portable and versatile appliances in smaller households further accelerates adoption.

- By Application

On the basis of application, the global smart dishwasher market is segmented into Households and Commercial. The Household segment dominated the market with a revenue share of 82.1% in 2024, attributed to the increasing penetration of smart home technologies and consumer preference for convenient, time-saving appliances. Features like remote control via smartphone apps and voice assistant integration enhance user experience and drive adoption.

The Commercial segment is expected to experience robust growth from 2025 to 2032, with a projected CAGR of 8.0%. The rapid expansion of the hospitality sector, including hotels, cafes, and restaurants, drives demand for smart dishwashers that offer efficient cleaning, reduced water consumption, and compliance with stringent hygiene standards.

- By Distribution Channel

On the basis of distribution channel, the global smart dishwasher market is segmented into Offline and Online. The Offline segment held the largest market revenue share of 55% in 2024, driven by consumer preference for physical retail experiences in hypermarkets, supermarkets, and specialty stores, where a wide range of products can be evaluated in person.

The Online segment is anticipated to witness the fastest growth rate of 12% from 2025 to 2032, propelled by the growing popularity of e-commerce platforms like Amazon, eBay, and Walmart. Increasing internet penetration, ease of access, and the convenience of home delivery are key factors boosting online sales of smart dishwashers.

Smart Dishwasher Market Regional Analysis

- Asia-Pacific dominated the smart dishwasher market with the largest revenue share of 42.5% in 2024, driven by rapid urbanization, rising disposable incomes, and strong demand for premium home appliances in countries like China, Japan, and South Korea

- Consumers prioritize smart dishwashers for their convenience, energy efficiency, and advanced features such as Wi-Fi connectivity, remote control via smartphone apps, and automated cleaning cycles, particularly in regions with busy lifestyles and growing smart home trends

- Growth is supported by advancements in technology, including IoT integration, AI-driven cycle optimization, and energy-efficient designs, alongside rising adoption in both household and commercial segments

Japan Smart Dishwasher Market Insight

Japan’s smart dishwasher market is expected to witness rapid growth due to strong consumer preference for high-quality, technologically advanced appliances that enhance convenience and hygiene. The presence of major manufacturers and the integration of smart dishwashers in OEM vehicles accelerate market penetration. Rising interest in aftermarket smart home solutions also contributes to growth.

China Smart Dishwasher Market Insight

China holds the largest share of the Asia-Pacific smart dishwasher market, propelled by rapid urbanization, rising vehicle ownership, and increasing demand for energy-efficient and connected appliances. The country’s growing middle class and focus on smart home ecosystems support the adoption of advanced smart dishwashers. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

U.S. Smart Dishwasher Market Insight

The U.S. smart dishwasher market is expected to witness significant growth, fueled by strong consumer demand for connected home appliances and increasing awareness of energy and water conservation benefits. The trend toward smart home ecosystems and the integration of dishwashers with voice assistants like Amazon Alexa and Google Assistant further boost market expansion. Both OEM and aftermarket segments contribute to a robust product ecosystem.

Europe Smart Dishwasher Market Insight

The Europe smart dishwasher market is expected to witness significant growth, supported by a strong emphasis on energy efficiency and consumer preference for smart home appliances. Consumers seek dishwashers that offer remote monitoring, water conservation, and seamless integration with smart home systems. Growth is prominent in both new installations and retrofit projects, with countries such as Germany and France showing notable uptake due to increasing environmental concerns and urban lifestyles.

U.K. Smart Dishwasher Market Insight

The U.K. market for smart dishwashers is expected to witness rapid growth, driven by demand for enhanced convenience and energy-efficient appliances in urban and suburban settings. Increased interest in smart home technology and rising awareness of water-saving benefits encourage adoption. Evolving regulations promoting energy efficiency influence consumer choices, balancing advanced features with compliance.

Germany Smart Dishwasher Market Insight

Germany is expected to witness rapid growth in the smart dishwasher market, attributed to its advanced manufacturing sector and high consumer focus on energy efficiency and convenience. German consumers prefer technologically advanced dishwashers that optimize water and energy usage while integrating with smart home ecosystems. The adoption of these appliances in premium households and commercial settings supports sustained market growth.

Smart Dishwasher Market Share

The smart dishwasher industry is primarily led by well-established companies, including:

- Robert Bosch GmbH (Germany)

- LG Electronics (South Korea)

- SAMSUNG (South Korea)

- Haier Group (China)

- Electrolux AB (Sweden)

- Whirlpool of India (India)

- Miele India Pvt. Ltd (India)

- Panasonic Corporation (Japan)

- Arçelik (Turkey)

- SMEG S.p.A (Italy)

- ASKO APPLIANCES (Sweden)

- Dacor, Inc. (U.S.)

- GENERAL ELECTRIC (U.S.)

- Transform SR Brands, LLC (U.S.)

- BSH Hausgeräte GmbH (Germany)

- Home Connect GmbH (Germany)

What are the Recent Developments in Global Smart Dishwasher Market?

- In July 2025, Whirlpool Corporation introduced the Spin&Load Rack, a breakthrough dishwasher accessory designed to improve accessibility for users with restricted mobility. This 360-degree spinning lower rack allows effortless access to all areas of the dishwasher, eliminating the need to reach or reposition while loading and unloading. Developed in collaboration with the United Spinal Association, the rack was tested by individuals with disabilities to ensure comfort and usability. It fits all 24-inch Whirlpool dishwashers manufactured after 2018—including brands such as Amana, JennAir, KitchenAid, and Maytag—and retails

- In July 2024, Elista expanded its dishwasher lineup in India with three new models—EDC12P, EDC12SS, and EDC12SP—engineered specifically for Indian kitchens. These A++ energy-rated dishwashers are designed to tackle sticky, ghee-laden utensils, offering a specialized Intensive Kadhai Wash at 65°C and removing up to 99.9% of germs. Each unit includes six wash programs, user-friendly LED controls, and child safety locks, ensuring convenience and peace of mind for families. With features such as Eco Silence Drive, Glass Care System, and Half Load options, Elista’s launch reflects a strong commitment to regional needs and sustainable innovation

- In August 2023, Samsung Electronics and LG Corporation announced a landmark collaboration to create a seamless smart home ecosystem built on the Home Connectivity Alliance (HCA) standard. This partnership aims to ensure interoperability between smart appliances—such as dishwashers, refrigerators, and washing machines—regardless of brand, allowing users to control and monitor devices from different manufacturers through a unified interface

- In June 2023, LG Electronics introduced a smart dishwasher equipped with voice-activated control, further advancing its integration into connected home ecosystems. Compatible with Amazon Alexa and Google Assistant, users can start, stop, or monitor wash cycles using simple voice commands. The dishwasher also supports remote management via the LG ThinQ app, allowing users to download new wash programs, receive maintenance alerts, and optimize energy usage. This launch reflects LG’s commitment to smart appliance innovation, combining convenience, performance, and seamless connectivity

- In April 2023, Xiaomi Corporation unveiled the Mijia N1 Smart Dishwasher, a dual-purpose appliance engineered for enhanced dishwashing efficiency. With a 116-piece capacity, it supports 11 versatile wash programs and features a triple rapid drying system combining PTC hot air, automatic door operation, and residual heat condensation. The smart door opens during drying to improve airflow and closes afterward to prevent contamination. Its 75°C sterilization cycle achieves a 99.999% sterilization rate, underscoring Xiaomi’s commitment to smart home innovation and energy-efficient design. This launch reflects the brand’s ongoing push toward intelligent, user-friendly kitchen solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.