Global Smart Distribution For Residential Application Market

Market Size in USD Billion

CAGR :

%

USD

2.48 Billion

USD

7.64 Billion

2024

2032

USD

2.48 Billion

USD

7.64 Billion

2024

2032

| 2025 –2032 | |

| USD 2.48 Billion | |

| USD 7.64 Billion | |

|

|

|

|

Smart Distribution for Residential Application Market Size

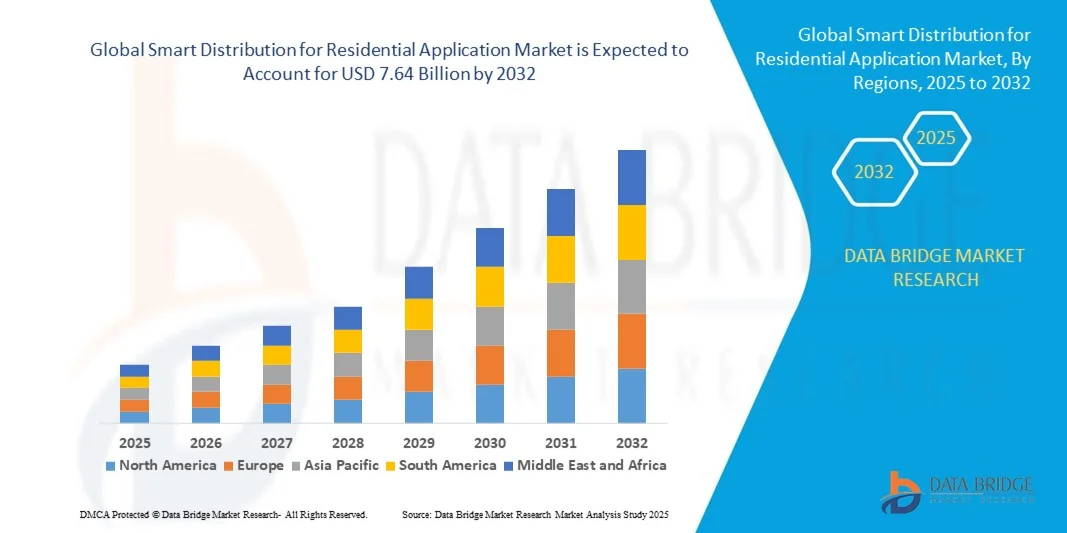

- The global smart distribution for residential application market size was valued at USD 2.48 billion in 2024 and is expected to reach USD 7.64 billion by 2032, at a CAGR of 15.12% during the forecast period

- The market growth is largely fueled by the increasing adoption of smart grids, IoT-enabled energy management systems, and digital residential distribution technologies, driving greater efficiency, reliability, and automation in power delivery for homes

- Furthermore, rising consumer and regulatory demand for energy-efficient, secure, and easily manageable residential power systems is establishing smart distribution solutions as essential components of modern home infrastructure. These converging factors are accelerating the implementation of intelligent switchgear, distribution automation terminals, and low-voltage electrical equipment, thereby significantly boosting the industry’s growth

Smart Distribution for Residential Application Market Analysis

- Smart distribution systems, enabling real-time monitoring, fault detection, and automated energy management, are increasingly critical in residential applications to ensure reliable power supply, optimize consumption, and integrate renewable energy sources

- The escalating demand for smart distribution solutions is primarily fueled by urbanization, growing deployment of connected home technologies, increasing awareness of energy efficiency, and government initiatives promoting smart grids and residential automation

- North America dominated the smart distribution for residential application market with a share of 41.03% in 2024, due to widespread adoption of smart grid infrastructure and advanced energy management technologies

- Asia-Pacific is expected to be the fastest growing region in the smart distribution for residential application market during the forecast period due to rapid urbanization, rising electricity demand, and expansion of smart city initiatives

- Complete set of low voltage electrical equipment segment dominated the market with a market share of 48.1% in 2024, due to its extensive deployment in residential power systems for efficient energy management and safety assurance. Its ability to provide stable power distribution, protect against overloads, and support integration with smart meters and home energy management systems has strengthened its market position. In addition, rising adoption of smart grids and IoT-enabled low-voltage systems across modern households is contributing to the continued dominance of this segment

Report Scope and Smart Distribution for Residential Application Market Segmentation

|

Attributes |

Smart Distribution for Residential Application Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Smart Distribution for Residential Application Market Trends

Growing Adoption of IoT-Based Residential Energy Management Systems

- The smart distribution market for residential applications is experiencing strong growth driven by the accelerating adoption of IoT-based energy management systems. These systems enable homeowners to monitor, control, and optimize electricity usage in real time, improving energy efficiency and supporting sustainable living environments

- For instance, Schneider Electric’s Wiser Energy System and Siemens’ Smart Infrastructure solutions provide IoT-enabled platforms that integrate with smart meters and connected appliances to manage power consumption intelligently. These systems use real-time data analytics to adjust loads dynamically, enhancing both efficiency and safety in residential power distribution

- IoT-based residential energy management enhances transparency and user control by enabling smart grids, mobile monitoring, and automated response systems. Homeowners can remotely monitor energy patterns, detect faults, and automate operations such as lighting or HVAC management through centralized mobile applications or voice-activated assistants

- The integration of AI algorithms with IoT sensors is advancing adaptive energy management, allowing systems to learn household usage patterns and automatically adjust consumption. This reduces electricity costs and also contributes to environmental sustainability through reduced energy wastage and peak demand balancing

- Smart distribution systems with IoT connectivity support the integration of renewable energy sources, such as rooftop solar and home battery storage, into residential grids. This drives self-sufficiency and encourages net-zero energy behavior through efficient management of distributed generation and storage assets

- The growing adoption of IoT-based residential energy management systems is transforming power distribution into a responsive, automated ecosystem. By combining convenience with efficiency, these technologies are redefining the modern smart home, ensuring both sustainability and consumer empowerment in energy usage

Smart Distribution for Residential Application Market Dynamics

Driver

Rising Demand for Efficient, Secure, and Automated Home Power Distribution

- The increasing demand for energy-efficient and secure home power distribution systems is a major driver shaping the smart distribution market for residential applications. Consumers are seeking greater control and automation over household power systems to enhance comfort, security, and sustainability

- For instance, ABB Ltd and Legrand SA have introduced smart power distribution solutions for homes that enable automatic fault detection, energy usage insights, and remote control of connected devices. These systems empower residents to manage home energy with higher reliability and lower risk of electrical faults

- Automated power distribution ensures that loads are balanced intelligently across networks, reducing energy consumption and optimizing the performance of connected devices. In addition, integrated monitoring enhances safety by identifying abnormal currents or voltage fluctuations before failures occur

- The trend toward home automation and smart living is accelerating the need for integrated systems that merge connectivity, real-time monitoring, and AI-based optimization. Smart distribution enables this transformation by providing the infrastructure foundation for smart appliances, EV charging, and renewable energy integration

- With consumers prioritizing energy efficiency, safety, and digital convenience, demand for intelligent home power distribution systems is expected to rise continuously. This broad adoption supports sustainability goals while driving advancements in residential energy technologies worldwide

Restraint/Challenge

High Installation Costs in Existing Residential Buildings

- The high installation cost of smart distribution systems remains a major challenge, particularly in retrofitting existing residential buildings. Implementing smart grids and IoT-enabled wiring networks requires extensive modifications that can increase both project complexity and cost

- For instance, installing advanced systems such as Schneider Electric’s Wiser Home or Honeywell’s smart energy solutions in older buildings often demands rewiring, additional sensors, and compatibility adjustments with outdated infrastructure. This leads to higher upfront investments compared to installations in newly constructed smart homes

- Labor-intensive retrofitting and integration of new technologies into older electrical systems require specialized technicians, adding to installation and configuration expenses. Limited interoperability among legacy devices can further raise costs due to the need for adapters or replacement of entire components

- Homeowners also face additional financial burdens due to ongoing maintenance, software upgrades, and cybersecurity requirements for IoT-linked power management systems. These extended costs often act as deterrents for middle-income homeowners or multi-unit residential complexes

- Reducing installation complexity through modular retrofit kits, wireless IoT sensors, and flexible financing models could significantly improve adoption rates. Addressing these cost-related challenges remains critical for expanding smart distribution penetration across existing residential infrastructure globally

Smart Distribution for Residential Application Market Scope

The market is segmented on the basis of product type and end-use.

- By Product Type

On the basis of product type, the smart distribution for residential application market is segmented into distribution automation terminal, intelligent medium voltage switchgear, and complete set of low voltage electrical equipment. The complete set of low voltage electrical equipment segment dominated the market in 2024 with the largest revenue share of 48.1%, driven by its extensive deployment in residential power systems for efficient energy management and safety assurance. Its ability to provide stable power distribution, protect against overloads, and support integration with smart meters and home energy management systems has strengthened its market position. In addition, rising adoption of smart grids and IoT-enabled low-voltage systems across modern households is contributing to the continued dominance of this segment.

The distribution automation terminal segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing implementation of automation technologies and digital monitoring in residential energy systems. These terminals enable real-time fault detection, remote control, and energy optimization, significantly enhancing operational reliability and reducing downtime. Growing investments in grid modernization, coupled with the demand for intelligent fault management and efficient power restoration systems, are driving the rapid growth of this segment across smart residential infrastructures.

- By End-Use

On the basis of end-use, the market is segmented into power systems, intelligent building, petrochemical, medical, metallurgy, traffic, and others. The intelligent building segment dominated the market in 2024 with the largest revenue share, primarily due to the widespread integration of smart distribution systems within smart homes and residential complexes. These systems enable centralized energy control, improved load balancing, and enhanced energy efficiency through automation and connectivity. Rising urbanization, growing demand for sustainable housing, and increased consumer awareness of energy optimization are propelling the adoption of smart distribution technologies in intelligent building setups.

The power systems segment is expected to register the fastest growth rate from 2025 to 2032, driven by the need for reliable, efficient, and automated residential energy networks. Integration of smart distribution solutions in power systems supports real-time monitoring, grid resilience, and reduced transmission losses. The segment’s growth is further supported by increasing investments in distributed energy resources, renewable power integration, and government initiatives promoting energy-efficient infrastructure within residential sectors.

Smart Distribution for Residential Application Market Regional Analysis

- North America dominated the smart distribution for residential application market with the largest revenue share of 41.03% in 2024, driven by widespread adoption of smart grid infrastructure and advanced energy management technologies

- The region’s emphasis on efficient power distribution, automation, and integration of renewable energy systems is fueling demand

- Strong presence of key players, supportive government initiatives for energy optimization, and increasing consumer focus on home automation systems further enhance market growth, positioning North America as a leader in smart residential distribution adoption

U.S. Smart Distribution for Residential Application Market Insight

The U.S. smart distribution for residential application market captured the largest share within North America in 2024, supported by the rapid implementation of smart grid projects and IoT-based energy management systems. Growing investment in home electrification, coupled with demand for real-time power monitoring and outage management, drives market expansion. The increasing number of smart home installations, integration with AI-driven analytics, and emphasis on energy sustainability strengthen the U.S. market’s position in the global landscape.

Europe Smart Distribution for Residential Application Market Insight

The Europe smart distribution for residential application market is projected to grow at a substantial CAGR during the forecast period, driven by the region’s commitment to renewable energy integration and advanced building automation. Stringent government regulations promoting energy efficiency and carbon reduction are accelerating adoption. The market is witnessing increasing deployment of intelligent low-voltage systems in residential complexes and smart cities, reflecting Europe’s focus on sustainability and digital transformation in power distribution networks.

U.K. Smart Distribution for Residential Application Market Insight

The U.K. market is anticipated to grow at a noteworthy CAGR, propelled by rising smart housing projects and nationwide efforts toward achieving net-zero emissions. Adoption of intelligent energy systems in new and retrofit residential buildings is increasing as consumers seek efficient, connected, and low-carbon solutions. Government-backed programs supporting smart metering and home electrification are further stimulating market growth in the U.K.

Germany Smart Distribution for Residential Application Market Insight

The Germany market is expected to expand at a considerable CAGR, driven by its advanced infrastructure and emphasis on smart energy management. Increasing adoption of intelligent low-voltage and medium-voltage systems in residential areas aligns with Germany’s focus on renewable integration and digital grid transformation. High awareness of energy efficiency and sustainability standards continues to propel market demand across residential sectors.

Asia-Pacific Smart Distribution for Residential Application Market Insight

The Asia-Pacific region is expected to register the fastest CAGR during 2025–2032, supported by rapid urbanization, rising electricity demand, and expansion of smart city initiatives. Governments in China, Japan, and India are heavily investing in digital grid modernization and smart metering infrastructure, driving strong adoption. Growing consumer awareness of energy efficiency and the presence of cost-effective manufacturing capabilities are strengthening the region’s market growth.

China Smart Distribution for Residential Application Market Insight

China accounted for the largest market share in Asia-Pacific in 2024, driven by rapid development of smart grid infrastructure and extensive government support for residential energy automation. The country’s push toward smart city projects and widespread deployment of IoT-enabled energy systems are major contributors to growth. Strong domestic manufacturing of smart distribution components also enhances scalability and affordability in the residential sector.

Japan Smart Distribution for Residential Application Market Insight

Japan’s market is gaining traction with increasing adoption of smart home energy systems and grid-interactive technologies. The nation’s focus on efficient energy utilization, coupled with its strong technological ecosystem, is propelling demand. Integration of smart meters, intelligent switchgear, and automation systems within residential settings reflects Japan’s commitment to sustainable and secure energy distribution solutions.

Smart Distribution for Residential Application Market Share

The smart distribution for residential application industry is primarily led by well-established companies, including:

- ABB (Switzerland)

- Siemens (Germany)

- Schneider Electric (France)

- Emerson Electric Co. (U.S.)

- Rockwell Automation, Inc. (U.S.)

- Danaher (U.S.)

- Honeywell International Inc. (U.S.)

- Wipro Limited (India)

- General Electric Company (U.S.)

- Hitachi, Ltd. (Japan)

- Eaton (Ireland)

- OMRON Corporation (Japan)

- Itron Inc. (U.S.)

- Landis+Gyr (Switzerland)

- Aclara Technologies LLC (U.S.)

- Yokogawa India Ltd. (India)

- Mitsubishi Electric Corporation (Japan)

- Cisco (U.S.)

- Open Systems International, Inc. (U.S.)

- IBM Corporation (U.S.)

- Oracle (U.S.)

- S&C Electric Company (U.S.)

- Kamstrup A/S (Denmark)

- Trilliant Holdings Inc. (U.S.)

- Globema (Poland)

Latest Developments in Global Smart Distribution for Residential Application Market

- In September 2025, Hitachi Energy was recognized by ARC Advisory Group as the global leader in grid automation in its “Grid Automation Global Market Study 2024–2029.” This recognition highlights the company’s strong influence in advancing smart grid and residential distribution systems worldwide. The acknowledgment reinforces Hitachi Energy’s expertise in integrating automation, control, and real-time monitoring technologies across low- and medium-voltage networks, which directly supports the growth of intelligent residential power distribution solutions by promoting higher reliability and operational efficiency in smart homes

- In July 2025, Tata Power partnered with AutoGrid to expand an AI-enabled Smart Energy Management System in Mumbai, India. This collaboration aims to enhance demand response capabilities and improve energy efficiency across residential areas by integrating smart plugs, meters, and real-time energy analytics. The initiative is expected to significantly reduce peak load and enable homeowners to better manage power consumption, accelerating India’s transition toward smarter and more sustainable residential energy systems, thereby strengthening the regional smart distribution market

- In May 2025, Tata Power Delhi Distribution Ltd (TPDDL) signed an MoU with Enel Group’s Gridspertise to implement pilot projects for smart metering and automation of distribution networks. This partnership introduces hybrid communication technologies combining PLC and RF for improved connectivity and reliability in residential networks. The collaboration marks a major step toward digitalizing India’s power distribution infrastructure, laying the foundation for highly efficient, automated residential grids that enhance system resilience and energy optimization

- In March 2025, ABB entered into a strategic partnership with Wieland Electric to develop prefabricated electrical installation systems for modular and smart residential buildings. This plug-and-play solution integrates ABB’s smart distribution components with Wieland’s connector technology, reducing installation time by up to 70% and costs by about 30%. The partnership is driving innovation in residential smart distribution by simplifying deployment, boosting scalability, and making smart electrical systems more accessible and cost-effective in new housing projects

- In January 2025, Schneider Electric launched its “Bring Home the Smart” campaign alongside an expanded smart home and electrical product portfolio in India. The product line includes Miluz Zeta switches with air quality indicators, motion-sensing lighting, and enhanced Wiser home automation features. These innovations are enhancing user engagement in residential energy management, fostering greater adoption of smart distribution solutions, and solidifying Schneider Electric’s presence in the growing residential automation and smart grid segment

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Smart Distribution For Residential Application Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Smart Distribution For Residential Application Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Smart Distribution For Residential Application Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.